Think opening an LLC in the U.S. is out of reach for foreign-owned companies? It’s surprising how many assume that without a social security number or physical address, forming an LLC is impossible — yet LLC owners worldwide are proving that myth wrong every day. From foreign corporations to real estate investors, tapping into U.S. liability companies offers powerful advantages, if one understands the tax law landscape.

Over 60% of non-U.S. residents who start an LLC today manage to complete their business bank account setup and meet federal tax requirements within three months. With precise legal documents, a registered agent, and a taxpayer identification number, it’s easier than ever to align with U.S. tax purposes and file a proper income tax return.

Choosing the right state comparison, structuring the articles of organization, and staying ahead of annual report deadlines isn’t just regulatory compliance — it’s the art of scaling a business entity across borders. Navigating the department of the treasury feels like mastering a complex game, where only well-prepared business owners truly seize the rewards.

Can Non-U.S. Residents Open an LLC in the U.S.?

Absolutely—non-us residents can legally establish and operate limited liability companies in the United States without requiring citizenship, visas, or permanent residency status.

Legal Eligibility for Foreign Entrepreneurs

U.S. federal and state laws place no citizenship restrictions on forming an LLC, making America one of the world's most accessible jurisdictions for international entrepreneurs. The only mandatory requirement involves appointing a registered agent with a valid physical address within your chosen state. Foreign corporation owners, individuals, and other business entities can freely establish operations, though specific tax obligations and reporting requirements apply based on ownership structure and business activities conducted within American borders.

Common Myths About Non-Resident LLC Ownership

Many international entrepreneurs mistakenly believe they need social security numbers, U.S. addresses, or immigration visas to start an LLC. If you’re wondering whether you need an LLC to start a business, this resource will clarify your requirements.

These misconceptions stem from confusion between business formation requirements and tax identification procedures. In reality, non-us citizens can complete the entire LLC formation process remotely, obtain necessary employer identification numbers without SSNs, and maintain full liability protection while operating from their home countries through proper compliance procedures. Some founders weigh the choice between LLC distributions vs salary to determine the most efficient way to pay themselves.

Form your U.S. LLC easily with ZenBusiness

ZenBusiness specializes in helping non-U.S. residents create a compliant American LLC, including EIN setup and registered agent services.

Step-By-Step Guide to Starting an LLC for Non-U.S. Residents

Starting an LLC as a foreign entrepreneur follows the same fundamental process as domestic formation, with specific considerations for international compliance and banking requirements. If you need to choose the optimal structure, our comparison of corporation vs LLC breaks down the pros and cons of each entity type.

Step 1: Choose the Right U.S. State for Your LLC

Choose a state strategically based on your business needs rather than assuming you must incorporate where you plan to operate. Consider these essential criteria when making your selection:

- Annual report requirements and associated fees

- Privacy protections for LLC owners

- Tax law advantages and state-level obligations

- Court systems and legal entity precedents

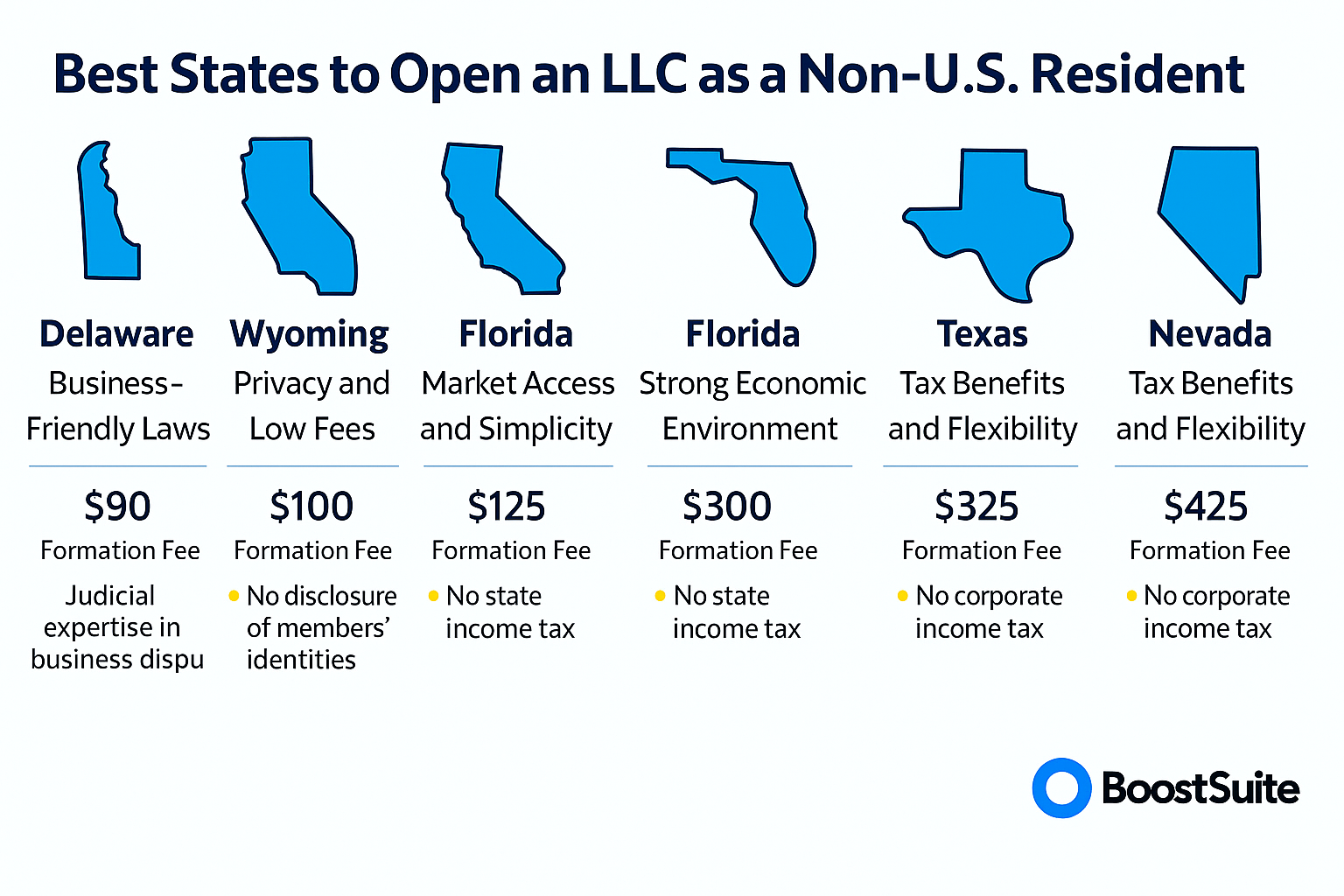

Wyoming, Delaware, Nevada, and Florida consistently rank among the most foreign-owned LLC-friendly jurisdictions, offering competitive formation costs, strong privacy protections, and simplified ongoing compliance requirements for international business owners. To identify the best state to start an LLC, check out our comparative analysis of top jurisdictions.

Step 2: Hire a Registered Agent in the U.S.

Every legal entity operating in America must maintain a registered agent with a permanent business address in your formation state. This person or service receives official legal documents, court notices, and government correspondence on your LLC's behalf, ensuring continuous compliance with local regulations. If you oversee multiple formations, our tips on a registered agent multiple states will help streamline service across jurisdictions.

Step 3: File Formation Documents and Pay Fees

Submit your articles of organization to the Secretary of State in your chosen jurisdiction, along with required filing fees ranging from $50 to $500. Most states process these documents within 3-10 business days, officially establishing your business entity and providing legal recognition.

Step 4: Apply for an EIN Without a Social Security Number

An employer identification number from the internal revenue service serves as your LLC's federal tax identification, essential for banking and compliance purposes. Non-us residents lacking SSNs can obtain EINs by submitting Form SS-4 via mail or fax, applications are usually processed in about four business days, while mail requests take roughly four-to-six weeks.

The IRS requires this identifier for all foreign owned LLCs, regardless of income levels or business activities. Complete your application accurately, entering “Foreign” in the SSN field and providing comprehensive business information. Visit IRS.gov for detailed application procedures and current processing times. If you’re looking for the easiest way to start LLC, our guide simplifies the process.

Best States to Open an LLC as a Non-U.S. Resident

State comparison reveals significant differences in costs, privacy protections, and regulatory environments that directly impact international business entities and their ongoing operations. For entrepreneurs on a budget, discover options for a cheap registered agent without sacrificing reliability.

Delaware: Business-Friendly Laws

Delaware's Court of Chancery provides specialized business entity litigation expertise, making it the preferred jurisdiction for companies seeking investor funding. The state's well-established tax law precedents and liability companies statutes offer predictable legal outcomes, though formation and annual report fees exceed most alternatives. For a detailed walkthrough of setting up Delaware LLC, follow our step-by-step guide.

Wyoming: Privacy and Low Fees

Wyoming pioneered the limited liability company structure and maintains the strongest foreign ownership privacy protections nationwide. Members' identities remain confidential in public records, while $100 formation fees and $60 minimum annual license tax (or 0.0002 × Wyoming assets, whichever is higher) costs make it extremely cost-effective for sole proprietorship conversions and small business entities.

Florida: Market Access and Simplicity

Florida offers direct access to major consumer markets without state income tax return requirements for liability companies. The state's simplified annual report process requires minimal information disclosure while maintaining reasonable compliance costs.

Real estate investors particularly favor Florida's favorable landlord laws and robust liability protection statutes for property holding entities. If you’re assessing an LLC in Florida, our detailed overview covers all the formation steps.

Texas: Strong Economic Environment

Texas provides extensive business bank account options, major metropolitan marketsand no state income tax on LLC profits; most LLCs must still file the annual Texas Franchise Tax/Public Information Report, which is $0 when revenue is at or below the $2.47 million “no-tax-due” threshold. The state's pro-business regulatory environment supports rapid growth while maintaining simplified operating agreement requirements for foreign owned entities. For strategies on the cheapest way to start an LLC in Texas, explore our cost-saving tips.

Nevada: Tax Benefits and Flexibility

Nevada eliminates state corporate income taxes and offers flexible business entity management structures. The following table compares key advantages across popular formation states:

| Feature | Nevada | Wyoming | Delaware | Texas |

|---|---|---|---|---|

| Formation Fees | $425 total (Articles of Organization $75 + Initial List $150 + Business License $200) | $100 | $90 | $300 |

| Annual Report Cost | $350 per year ($150 Annual List + $200 Business License) | $60 minimum annual license tax | $300 | $0 |

| Privacy Protection | High | Highest | Medium | Medium |

| Tax Law Benefits | No state tax | No state tax | Favorable | No state tax |

Nevada's liability companies also benefit from shortened statute of limitations on legal entity challenges, providing additional liability protection for international owners facing potential disputes.

New Mexico: Low Costs and High Privacy

New Mexico combines minimal formation costs with strong privacy protections, making it ideal for business owners prioritizing confidentiality and cost control. Visit New Mexico's business registration portal for current requirements and processing procedures. To see exactly how to start an LLC in New Mexico, consult our comprehensive tutorial.

Tax Implications and Compliance Requirements

Understanding U.S. tax obligations prevents costly penalties while optimizing your disregarded entity status for international tax efficiency and domestic compliance requirements.

Understanding U.S. Tax Obligations for Non-Resident LLC Owners

Single-member LLCs typically qualify as disregarded entity status for tax purposes, meaning the internal revenue service treats them as sole proprietorship extensions of their owners. Federal tax obligations depend primarily on income source, with U.S.-sourced revenue subject to withholding tax and reporting requirements regardless of your residency status. For clarity on terminology, learn what does disregarded entity mean and how it affects your tax reporting.

IRS Form 5472 Reporting Requirements

Foreign owned disregarded entity LLCs must file Form 5472 annually, along with a pro forma Form 1120, regardless of income levels. This requirement applies to all non-us residents owning single-member LLCs and includes:

- Complete ownership disclosure information

- All transactions between the LLC and foreign owner

- Financial records supporting reported activities

- Taxpayer identification numbers for all parties

The department of the treasury imposes $25,000 penalties for non-compliance, making professional assistance valuable for complex situations. You can learn more about how are LLC distributions taxed to plan for withholding accurately.

Key State Filings and Deadlines

Most states require annual filings maintaining your legal entity status and current business address information. Deadlines vary by jurisdiction, with some states imposing specific filing windows while others allow year-round submissions. To budget effectively, review our breakdown of how much does an LLC cost per year across different jurisdictions.

Limited liability partnership conversions and structural changes often trigger additional state-level requirements, particularly when involving private limited company ownership or complex foreign corporation structures requiring specialized compliance procedures.

Set up your foreign-owned LLC with Northwest

Northwest guides international entrepreneurs through U.S. LLC formation, ensuring privacy, compliance, and smooth IRS registration.

Opening a U.S. Business Bank Account for a Non-Resident LLC

Securing reliable banking relationships provides essential financial infrastructure for your American operations while satisfying internal revenue service documentation requirements.

Documents Required to Open a Bank Account

Opening a bank account requires comprehensive documentation proving your LLC's legitimacy and your authority to act on its behalf:

- Articles of organization filed with the Secretary of State

- Employer identification number confirmation letter

- Operating agreement establishing management authority

- Valid passport and foreign identification

- Proof of business address and contact information

Access the Treasury Department's banking guidelines for additional requirements and compliance standards affecting foreign-owned accounts.

Best Online Banks for Non-U.S. Residents

Wise (formerly TransferWise) and Relay Bank currently offer the most accessible us bank account options for international LLC owners. Wise provides multi-currency capabilities and simplified approval processes, while Relay focuses specifically on business entities with streamlined onboarding procedures.

Mercury Bank has recently tightened approval criteria for non-us citizens, making alternative providers more reliable for initial banking relationships and ongoing account maintenance.

Common Challenges and How to Overcome Them

Banks frequently request additional verification for foreign owned entities, including proof of U.S. business address and detailed business purpose explanations. Maintain comprehensive documentation, prepare for potential in-person visits, and consider establishing relationships with community banks familiar with international clients to overcome typical approval obstacles. Entrepreneurs can also review the LLC federal tax rate to anticipate their filing obligations.

Frequently Asked Questions About LLCs for Non-U.S. Residents

These common questions address the primary concerns international entrepreneurs face when considering American LLC formation and ongoing operations.

Can a Non-U.S. Resident Own 100% of a U.S. LLC?

Yes, foreign ownership of 100% is completely legal without restrictions. Non-us residents can form an LLC, maintain sole ownership, and operate their business entities independently while maintaining full liability protection benefits.

Do You Need a U.S. Visa or Address to Start an LLC?

No visa or permanent U.S. physical address is required to open an LLC. You only need a registered agent with an American address, which can be provided through professional services without requiring your personal U.S. presence.

What Are the Ongoing Compliance Requirements?

Liability companies must maintain:

1. Annual report filings with the state

2. Tax returns and IRS Form 5472 when required

3. Current registered agent information

4. Accurate business bank account records

Can You Run a U.S. LLC From Abroad?

Yes, LLC in the United States can be managed remotely from any country. Modern technology enables complete international management of American business entities without requiring U.S. residency or physical presence.

What Are the Costs Involved in Maintaining a Non-Resident LLC?

Annual costs typically range from $200-$800, including state fees, registered agent services, and basic compliance requirements. Additional federal tax preparation and real estate holdings may increase these expenses based on business complexity.

Launch your cross-border LLC with Harbor Compliance

Harbor Compliance offers expert LLC formation for foreign companies, covering legal documents, tax IDs, and multi-state compliance.