Wondering how to get a Tax ID number quickly for your business? Not sure if you need an EIN, TIN, or FEIN—and what the difference even is? Curious whether you qualify to apply online, especially if you’re a freelancer or a non-resident?

To get a Tax ID Number (EIN) fast, apply online through the IRS website—it takes about 10 to 15 minutes, and your EIN is issued immediately upon completion. You’ll need basic business details (entity type, start date, responsible party info) and a valid SSN or ITIN. If you’re a non-US applicant without these, call the IRS’s international line or fax Form SS-4. The online method is by far the fastest and most reliable way to get your EIN in 2025.

In this article, we’ll cover:

- The difference between EIN, TIN, SSN, and when to use each

- A step-by-step guide to applying online in minutes

- Special rules for non-US residents and multi-owner LLCs

- What to do after receiving your EIN to stay compliant

Ready to lock in your EIN and move forward with confidence? Let’s break down the process together.

What Is a Tax ID Number? (TIN, EIN, FEIN Explained Clearly)

A Tax ID Number in the United States identifies you or your business for tax purposes. Think of it like a social security number for companies, enabling federal and state agencies to track income, file returns, and handle compliance. You’ll encounter different acronyms—TIN, EIN, FEIN—but each refers to a unique identifier used by the federal government or state authorities. Whether you operate an LLC, partnership, or sole proprietorship, you’ll likely need a Tax ID to file tax returns, open a business bank account, or hire employees.

EIN vs TIN vs SSN: What’s the Difference?

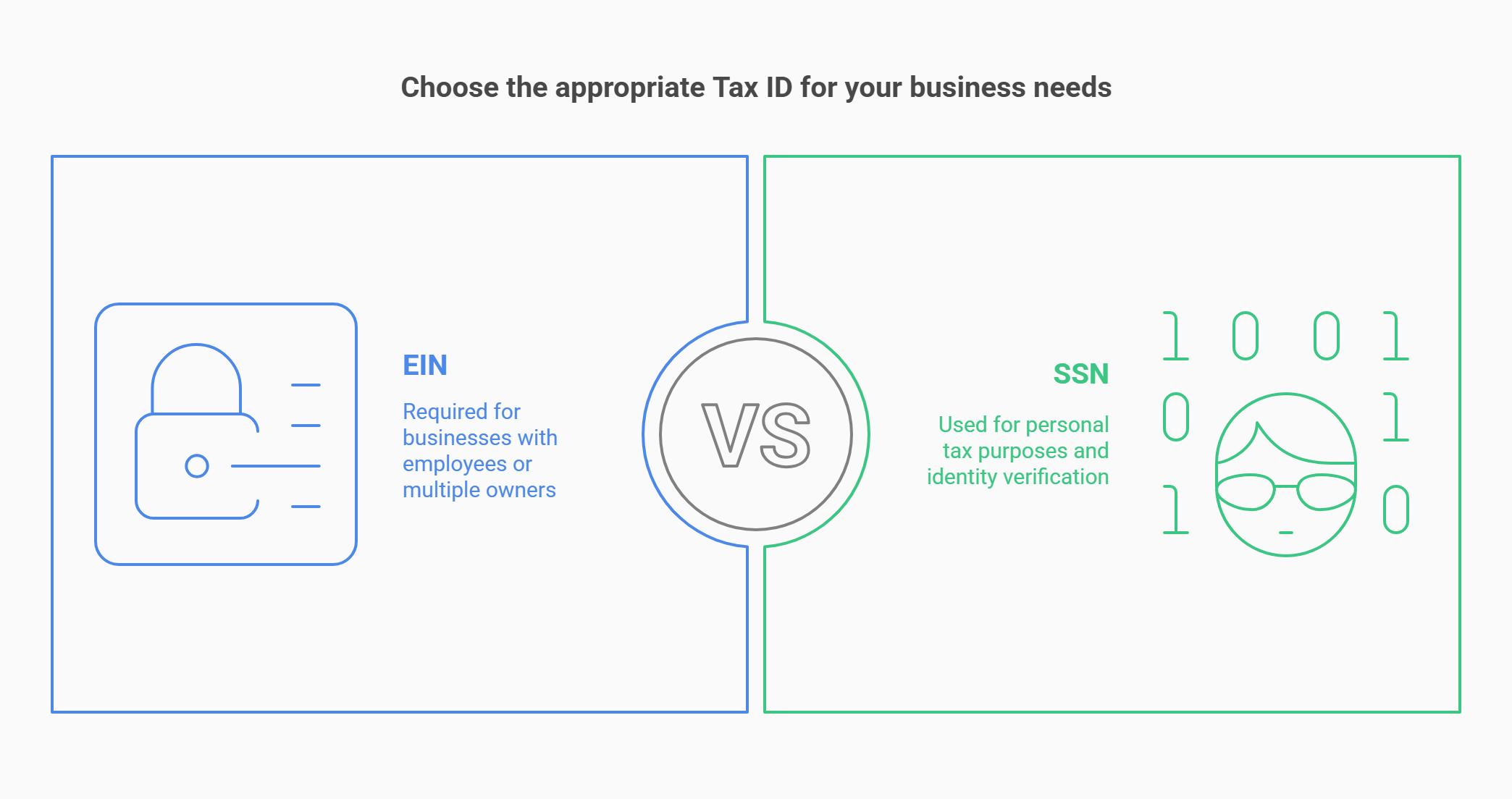

While “Tax ID” serves as an umbrella term, these codes differ in function:

- Social Security Number (SSN): Assigned by the social security administration to individuals. Used for personal income tax filing and verifying personal identity.

- Employer Identification Number (EIN): Issued by the IRS to businesses, nonprofits, trusts, and certain estates. Often called a federal tax id number.

- Taxpayer Identification Number (TIN): A broad category that also includes ITIN (for foreign individuals) and EIN. All are tax identification numbers recognized by the IRS.

As of March 2025, the IRS still uses a nine-digit number format for each. Double-check your official letter or online records to verify correctness. If you’re missing any digit, contact the IRS for support. To better understand the distinctions, here’s a helpful breakdown of the difference ein vs tin and how each applies to various business types.

Who Needs a Federal EIN — and Who Doesn’t?

Generally, businesses must have a federal tax identification number if they meet any of the following criteria:

- Multiple Owners or Partners: Partnerships, multi-member LLCs, or corporations.

- Employees on Payroll: The moment you have staff on W-2 forms.

- Certain Tax Elections: S-corporations or C-corporations require an EIN for filing.

- Nonprofit or Trust Entities: Organizations with tax exempt status or specialized structures.

- Involved in Excise Taxes: If your operation deals in alcohol, tobacco, or firearms, an EIN is typically mandatory.

However, single-owner businesses without employees (like a sole proprietor using only an SSN) don’t always need one. Still, many choose to obtain an ein for better separation between personal and business finances. Some even prefer to get EIN before forming llc so they can prepare banking and licensing applications in advance.

Why a Tax ID Is Required for Most US Businesses

By 2025, most organizations need an federal employer identification number to handle bank transactions, register with state agencies, and remain fully compliant. The IRS uses it to track your business structure, ensuring that each owner pays the correct state tax or federal levy. It also helps avoid identity theft by keeping personal SSNs off documents. If you plan to scale, apply for grants, or handle government contracts, an EIN is practically essential for smooth operations. road, helping your operation run smoothly from day one.

Do You Really Need an EIN? Here's When to Apply

Many entrepreneurs wonder if they can use a personal SSN instead. While that’s possible for some single-person ventures, most LLCs, partnerships, and corporations benefit from a dedicated Tax ID. Even if you’re a freelancer, having an EIN can streamline finances and boost credibility. Understanding the exact scenarios that require this tax identification number helps you decide if it’s time to file.

5 Business Types That Must Get an EIN

Certain organizations are legally obligated to apply for an ein right from the start:

- Corporations: Whether C-corp or S-corp, an EIN is a must for federal filing.

- Multi-Member LLCs: If you have more than one owner, you need a dedicated new ein.

- Partnerships: From general to limited, any multi-person setup requires a separate ID.

- Nonprofit Entities: Charities or foundations applying for tax exempt status must list an EIN on IRS forms.

- Estates or Trusts: If they manage business assets or generate revenue, an EIN is needed for reporting.

As of March 2025, any venture that plans to hire employees also needs an EIN to process payroll taxes, withhold Social Security, and satisfy federal requirements.

Do Freelancers, Side Hustlers, or Sole Proprietors Need One?

By law, a sole proprietorship without employees can keep using a personal SSN for tax filings. However, an EIN often offers privacy advantages and helps protect your personal information. If you accept contract work, plan to scale, or open separate business accounts, many experts recommend getting an EIN regardless. Additionally, certain states—like Minnesota—might ask for an minnesota department registration that aligns with your EIN for minnesota tax obligations. If you want to separate finances or prevent mixing personal and business liabilities, securing an EIN is a wise step. If that’s your case, here’s how to start an llc in Minnesota while staying fully compliant.

Already Have a TIN or SSN? When That’s Not Enough

Your existing tax identification number or SSN might suffice for personal or limited business filings. But the moment you alter your nature of business—like adding a partner, forming an LLC, or switching to a corporation—your existing credentials no longer apply. For instance, if you were once a single-member LLC using an SSN, converting to a multi-member entity often triggers the need for an EIN. Always confirm with the IRS or a trusted return preparer if a structural change necessitates a distinct ID.

Need an EIN fast? Let ZenBusiness handle it

ZenBusiness can help you form your LLC and obtain your EIN from the IRS—without the paperwork headaches.

Get Your Tax ID Number in 10 Minutes (Step-by-Step)

Applying for an EIN can be quick if you have everything lined up. The IRS typically issues it instantly via the online application, so you can begin operating under your new Tax ID right away. Make sure to verify your eligibility, gather essential data, and choose the right application process to avoid mistakes that slow you down.

Step 1: Check Eligibility to Apply Online (US vs Non-US)

In 2025, the IRS allows any responsible party with a valid SSN, ITIN, or existing EIN to apply online for a federal tax identification number. Non-US founders without these credentials often must file by phone or fax. Make sure your mailing address and contact details are accurate. If you plan to manage your business remotely, confirm you’re within the allowable times for the online portal. The IRS system typically processes only one EIN request per day per party, so double-check you qualify before beginning. For more guidance, here’s what you need to know about providing the correct adress for EIN when applying.

Step 2: Gather IRS-Required Info (Entity Type, Responsible Party, etc.)

Before logging on to the irs website, compile essential business registration info. You’ll specify your business structure, the date you started operations, and the principal officer or responsible party’s data. Having your personal information, like SSN or ITIN, close at hand saves time. Also note your mailing address and the exact nature of your venture (e.g., retail, consulting, etc.).

Step 3: Choose the Right Application Method

Though online is fastest, the IRS still accepts ein application by mail, fax, or phone (for foreign applicants). Decide what fits your scenario:

- Online: Near-instant results for most US-based founders.

- Fax: Takes a few business days.

- Mail: Can stretch to 4–6 weeks.

- Phone: Reserved for non-resident owners without an SSN or ITIN.

Pick one route to avoid duplicate forms that complicate your data.

Online (Recommended)

Filling out the form through the IRS portal typically takes 10–15 minutes. Submit all your contact details carefully. As soon as you finish, the system displays your EIN confirmation letter in PDF format. Save or print it—this is your official record. If the site is busy, try again during off-peak hours, but you generally get an immediate result.

Fax or Mail

If you prefer or need paper forms, download the current Form SS-4. Complete every field meticulously and send it to the listed IRS fax number or mailing address. The turnaround is roughly one week by fax and about four to six weeks by mail. Always keep copies of your forms. If you don’t hear back within a month, contact the IRS for status updates.

Phone (For Non-US Applicants)

Founders living abroad or lacking an SSN can call the IRS’s international EIN desk. You’ll verbally provide your details, such as individual taxpayer identification number if you have one. The agent issues an EIN over the phone or notifies you of any further steps. Double-check the time zones and have all relevant documents at hand to expedite the process. Once issued, you can also how to find a company with EIN using public resources for verification or due diligence.

Step 4: Submit Your Application and Get Confirmation

Once you’ve chosen a method, carefully review your data—especially your principal officer name, entity type, and responsible party ID. Even a small typo can cause rejections or mismatch with future state tax filings. After submission, the IRS either issues your EIN immediately (online or phone) or mails/faxes it back to you. If you apply online, make sure to save or print the confirmation letter. This letter proves you now have a federal employer identification number for official matters.

What Happens After Submission (And What to Watch For)

Your EIN becomes active as soon as the IRS confirms it, allowing you to open a business bank account, apply for relevant licenses, and file income tax forms. If you realize you made an error—like entering the wrong mailing address—contact the IRS to correct it. Keep an eye out for potential identity theft or fraudulent usage; never share your EIN with unverified parties. Also note that some changes, like switching from a sole proprietorship to an LLC, might require a new ein if the IRS deems it a substantial shift in ownership or structure.

Verify you have a valid SSN, ITIN, or existing EIN for online application. Non-US founders without these credentials must use alternative methods like phone or fax.

Compile business structure details, start date, responsible party data, mailing address, and business activity type before beginning the application process.

Select between online (instant), fax (days), mail (4-6 weeks), or phone (for non-residents). Online is recommended for most US-based applicants for immediate results.

Review all data carefully before submission. Save or print your confirmation letter immediately if applying online, as this is your official EIN documentation.

Your EIN becomes active immediately, allowing you to open bank accounts and apply for licenses. Contact the IRS for any corrections and protect your EIN from identity theft.

Which Documents and Information Are Required to Apply?

The IRS focuses on verifying legitimate operations and avoiding duplication, so they don’t request a mountain of paperwork. Still, you should gather basic entity data before you begin. This includes personal ID for the responsible party and details about your company’s formation.

What the IRS Will Ask (and Won’t)

In the ein application, you’ll need to provide:

- Legal Business Name: Must match your incorporation or registration documents.

- Entity Type: Sole proprietor, corporation, partnership, etc.

- Start Date: When you began or plan to start operations.

- Number of Employees: If applicable, or zero if none.

- Primary Business Activity: Retail, consulting, manufacturing, etc.

The IRS typically won’t ask for your entire ownership agreement or bank statements. However, they want enough info to confirm the taxpayer identification number request is valid and to prevent duplication across tax identification numbers.

How to Fill the Responsible Party Section

The responsible party is the main individual controlling the company, often the principal officer in a corporation or the single owner in a limited liability setup. This person’s SSN, ITIN, or existing EIN is required. If you have multiple owners, choose one primary contact to represent the entity for official IRS communications. Double-check the contact details—like phone number and mailing address—to ensure you receive vital updates. Incorrect info in this section can lead to processing delays or a mismatch with your state-level data.

Special Case: Foreign Applicants Without an SSN

If you’re a non-resident forming a US entity but lack a social security administration number, you can still get an EIN. Indicate “Foreign” in place of an SSN on your form or mention it during the phone application. Provide an individual taxpayer identification number (ITIN) if you have one, or simply submit your passport details if prompted. The IRS will process your request via phone or fax, typically within a few business days, though times can vary.

EIN for California Businesses: What You Need to Know

California’s state regulations can sometimes complicate the federal ID process. Even though EINs are issued at the federal level, the Golden State imposes unique requirements for tax filings and entity compliance. Here’s how to avoid pitfalls if you operate or plan to launch in California.

Does California Require a Separate State Tax ID?

Typically, your EIN suffices for most aspects of doing business in California. However, if you’re hiring employees in the state, you’ll also need a separate EDD account for payroll and state tax withholding. For sales tax or specialized industries, you might register a permit with the California Department of Tax and Fee Administration. Having an EIN speeds up these processes, but the state doesn’t issue its own standalone “business tax ID” for all companies—unlike some states that have a distinct separate code.

How EIN Registration Connects to the Franchise Tax Board

California’s Franchise Tax Board (FTB) administers personal and corporate taxes, but not all entities pay a dedicated franchise tax if they’re tax exempt or meet specific criteria. If you have an EIN, the FTB matches it with your LLC, corporation, or partnership data for income tax tracking. Once you file your initial California returns, the FTB stores your EIN as your primary ID. Make sure to keep your IRS records consistent with your FTB info, since any mismatch can delay refunds or trigger compliance letters.

Mistakes to Avoid When Applying in CA

Some entrepreneurs run into trouble navigating both federal and state rules. Here’s how to steer clear of common errors:

- Failing to Register: Skipping local county or city registration can lead to penalties, even if you have a federal EIN.

- Wrong Entity Name: The business name on your EIN must match your state filing documents.

- Overlooking Local Taxes: Certain counties in California impose extra fees for specialized industries.

- Forgetting the LLC Fee: If you’re an LLC, the minimum state fee of $800 typically applies, even if you have zero revenue.

By confirming each step aligns with the federal application and your California documents, you’ll maintain consistent records and avoid compounding errors.

Form your business and get your EIN in one step

Northwest includes EIN acquisition with their formation service—perfect for entrepreneurs who want speed and privacy.

EIN Mistakes That Can Cost You Time and Money

Even if getting an EIN is straightforward, a few frequent blunders can cause headaches. Double-check every detail, especially if you’re dealing with new or complex structures. Simple missteps like choosing the wrong entity type or mixing up addresses can lead to rejections, wasted time, or potential fines down the road.

Choosing the Wrong Entity Type During Filing

If you mark “partnership” but you’re actually forming an LLC, your EIN won’t reflect the correct business structure. The IRS categorizes your entity based on the application data. Down the line, this mismatch complicates your federal tax return and might invalidate certain limited liability protections. Ensure your entity type matches how you’ve registered with your state before submitting.

Submitting Conflicting or Duplicate Information

Sending multiple forms or entering different info in separate sections can confuse the IRS. For example, you might type one mailing address on your online application, then fax a second version with changes. Each submission is stored, potentially causing a duplicate record. If the system detects conflicting data, it can put your application on hold or send you an error notice.

Not Matching EIN Info With State Filings

Your business registration info at the state level—such as your official company name—must align exactly with your EIN application. Mismatches lead to confusion when you pay minnesota tax or file annual reports in other states. Inconsistent data can also stall licensing or formation processes. Keep your contact details uniform on every form.

Losing or Misrecording Your EIN

After you get your EIN, store it securely but accessibly. If you lose it or transpose digits, the IRS might treat subsequent documents as invalid. Reacquiring your EIN or verifying it with the IRS can take days or weeks, especially during peak seasons. Keep a digital copy of the confirmation letter to prevent misplacement and guard against unauthorized usage.

After You Get Your EIN: What You Must Do Next

Securing your EIN is just the beginning. The IRS and state agencies assume you’ll use this identifier for official filings, licensing, and tax payments. Failing to align your federal tax identification number with each subsequent step can lead to missed deadlines or confusion over your legal status.

- Open a Business Bank Account: Many banks require an EIN to verify your company’s legitimacy and separate personal finances from business funds.

- Update Your State Records: Confirm your new EIN with relevant agencies—like the minnesota department if you operate there—so your account numbers match up.

- Register for Any Additional Permits: Depending on your nature of operations, you may need sales, liquor, or professional licenses. Use the same EIN across all forms.

- Coordinate With Tax Return Preparers: Inform your CPA or tax return preparers about your EIN for seamless filing of tax returns or multi-state compliance.

- Secure Your EIN and Documents: To combat identity theft, store your EIN letter in a safe place and never share it with unverified third parties.

By March 2025, it’s standard practice for lenders, insurers, and partners to request EIN verification. Keeping your documentation organized ensures a smoother experience, whether you’re seeking funding, expanding to new territories, or simply staying compliant year after year. Depending on your goals, it may also help to review the best states for llc formation before locking in your registration.

Real-Life EIN Scenarios: Choose the Right Path for You

Many entrepreneurs wonder if their circumstances are unique. While the general process stays consistent, different business models or personal backgrounds can influence how you apply.

“I’m Forming a Single-Member LLC”

Even if an LLC has only one member, an EIN can help separate personal and business finances. It acts as the taxpayer identification number when you file federal forms, especially if you elect S-corp status. Single-member LLCs can often remain “disregarded entities” by default, using the owner’s SSN for returns. Yet, having an EIN streamlines payroll if you choose to hire employees in the future. If you plan to scale or open multiple branches, the structure remains flexible. Filing online is usually quickest—just double-check you click “LLC” and not “sole proprietor.” Before applying, make sure you clearly understand the llc meaning and how it affects your tax identity.

“I’m a Non-US Founder Launching a US Company”

Foreign founders usually apply by phone or fax if they lack an SSN or ITIN. The IRS still grants EINs to overseas entrepreneurs who can verify their identities with passports or corporate formation papers. Plan for a slightly longer wait—one to two weeks—though you might receive it sooner. Once assigned, the EIN helps you open a US business bank account, comply with local tax laws, and handle state tax obligations if you register in a specific jurisdiction.

“I’m Setting Up a Nonprofit or Trust”

Any nonprofit applying for 501(c)(3) or other tax exempt status must list an EIN on IRS Form 1023 or 1024. Similarly, trusts that generate or distribute income typically need an EIN to handle tax returns correctly. Confirm your mission statement or trust deed matches the data on your EIN application, preventing confusion about your “charitable” or “private” classification. Always keep the official letter from the IRS as proof for donors, accountants, or potential board members. This applies whether you're starting a nonprofit or want to start an llc in Ohio for general business purposes.

“I Already Have a TIN — Do I Still Need This?”

If your TIN is simply an SSN or ITIN, you’ll need an EIN to formalize your business for tax purposes in most multi-member or corporate structures. Some single-person contractors survive on an SSN alone, but an EIN can protect your privacy, especially if you must share your credentials with vendors or clients. Check if your legal changes—like merging into a multi-owner entity—trigger the need for a brand-new EIN. A quick call to the IRS or consultation with a pro can clarify any gray areas. If you’re unsure where to begin, here’s a complete guide on how to start an llc step by step.

FAQ: Tax ID and EIN Application Questions Answered

Many founders have last-minute concerns about EINs, SSNs, or how the application interacts with state laws. Below are concise, direct answers to the most frequent queries.

EIN stands for employer identification number, often called a federal employer identification number or FEIN. These are all synonyms for a business’s tax identification number in the US. However, “Tax ID” can also refer to other codes like SSNs or ITINs. If you see “FEIN” or “EIN,” assume it’s the nine-digit code from the IRS that identifies a business entity, nonprofit, or trust for federal filings.

Yes. Non-residents or individuals without SSNs can still receive an EIN by phone or fax. You might be asked for an individual taxpayer identification number (ITIN) if available. If you lack both, indicate “Foreign” in the SSN field and provide alternative identity documents. The process may take a bit longer than the online application route, but you’ll still get a valid EIN for your business. This also applies if you plan to form llc without business plan but still need to register for an EIN.

Yes, the IRS does not charge any fee to process your ein application. Some third-party websites or paid services might offer to handle it for you, but you can apply directly at the irs website or mail/fax Form SS-4 at no cost. If a site demands payment merely to file your EIN, consider doing it yourself to save money unless you truly need a paid professional’s assistance.

Applying online typically yields instant results—your EIN shows up right after you submit. Fax applications can take a few business days, while mailed forms might stretch to four to six weeks. Foreign applicants using phone lines often get an EIN immediately after providing contact details and verifying their identity. Regardless of method, always keep a copy of your approval notice for verification or proof of compliance.

If you never got your EIN confirmation, contact the IRS Business and Specialty Tax Line for help. They can look up your record, confirm the digit number, and resend verification. If you misplaced your original letter or suspect identity theft, call right away to secure your credentials. Don’t reapply unless the IRS instructs you to—duplicate submissions can confuse their system and cause conflicting entries on your account.

Get your EIN with expert business setup

Harbor Compliance takes care of everything, from your Tax ID to business registration, so you can start operating with confidence.