Doing a California business entity search is straightforward when you use the state’s official tools and read the results like an examiner. Go to bizfile California → Business Search, look up the company by Entity Name or Entity Number, then open the record to see Status (Active, SOS/FTB Suspended), the registered agent, addresses, and Statement of Information filings. For banking, licensing, or due-diligence proof, order a Certificate of Status or certified copies via bizfileOnline. Note that DBAs (FBNs) and trademarks are outside the SOS database, check county FBN records and the California/USPTO trademark databases separately.

How to Perform a California Business Entity Search

If you need to verify a company’s legal standing, confirm a name is available, or pull official records before you file, the California Secretary of State’s bizfile California “Business Search” is the source of truth. Below is a precise, field-tested workflow with pro tips, examples, and the caveats that trip up most filers.

Open California Business Search

Start at bizfile California → Search. Keep Entity Information Search selected for entities. If you’re checking public-company filings, switch the toggle to Publicly Traded Disclosure Search. (Tip: Advanced Search is required for filtering by status or running a publicly traded query.)

Search by Name or File Number and use Advanced filters

Begin broad, then narrow.

- By Name: enter core words only. Example: type Coffee Break.

- By File Number: paste the Entity Number (older corps: C-#######; LLC/LP: 12-digit; some newer records show a B-ID).

- Click Advanced to refine: Contains or Starts with, Entity Type (Corp/LLC/LP), Status (Active, etc.), and Initial Filing Date range. If results feel noisy, add “Starts with” or set dates.

Review your results list and refine

After you search Coffee Break, the results grid shows mixed statuses and types, e.g., AMERICAN COFFEE BREAK, INC. (Suspended–FTB), BREAKROOM COFFEE AND FOOD, INC. (Active), BREAKERS COFFEE COMPANY LLC (Terminated), Coffee Break Cafe LLC (Active). Use this page to separate true conflicts (live LLCs/corps) from noise (terminated/merged-out) and then iterate your query.

How to tighten the list (filters → iterate):

- Filter to real competition.

Set Entity Type = LLC and Status = Active to surface live LLCs (e.g., Coffee Break Cafe LLC, Celebrity Coffee Break LLC). - Flip match mode.

Try Contains to catch descriptors around your stem (e.g., Breakroom Coffee and Food), then Starts with for exact-beginning matches. - Add a specific variant.

Test Coffee Break Cafe, Coffee Break Roasters, Coffee-Break, Coffee Breaks. You’ll see cosmetic tweaks don’t meaningfully reduce conflicts. - Open the exact record.

Click the blue chevron ▸ to read Status, Standing (SOS/FTB), Agent, addresses, and Statement of Info Due Date; use View History for changes.

Will it pass? (apply California’s name rules):

| Candidate name | Verdict | Why / How to fix |

|---|---|---|

| Coffee Break LLC | ❌ Likely flagged | Same core as multiple results; add a new lead word. |

| Coffee-Break LLC | ❌ Cosmetic | Hyphen/spacing/punctuation don’t distinguish. |

| The Coffee Break LLC / Coffee Break Co., LLC | ❌ Cosmetic | “The,” “Co./Company” and endings don’t help. |

| Coffee Break of CA LLC / Coffee Break California LLC | ❌ Too generic | Geographic add-ons rarely create a new name. |

| Harborline Coffee Break LLC | ✅ Often works | New distinctive lead (“Harborline”) + descriptor. |

| Redwood Coffee Break Kitchen LLC | ✅ Often works | Multi-word, specific descriptor, clearly different stem. |

| Sierra Vista Coffee Break LLC | ✅ Often works | Distinct locale + core; different overall impression. |

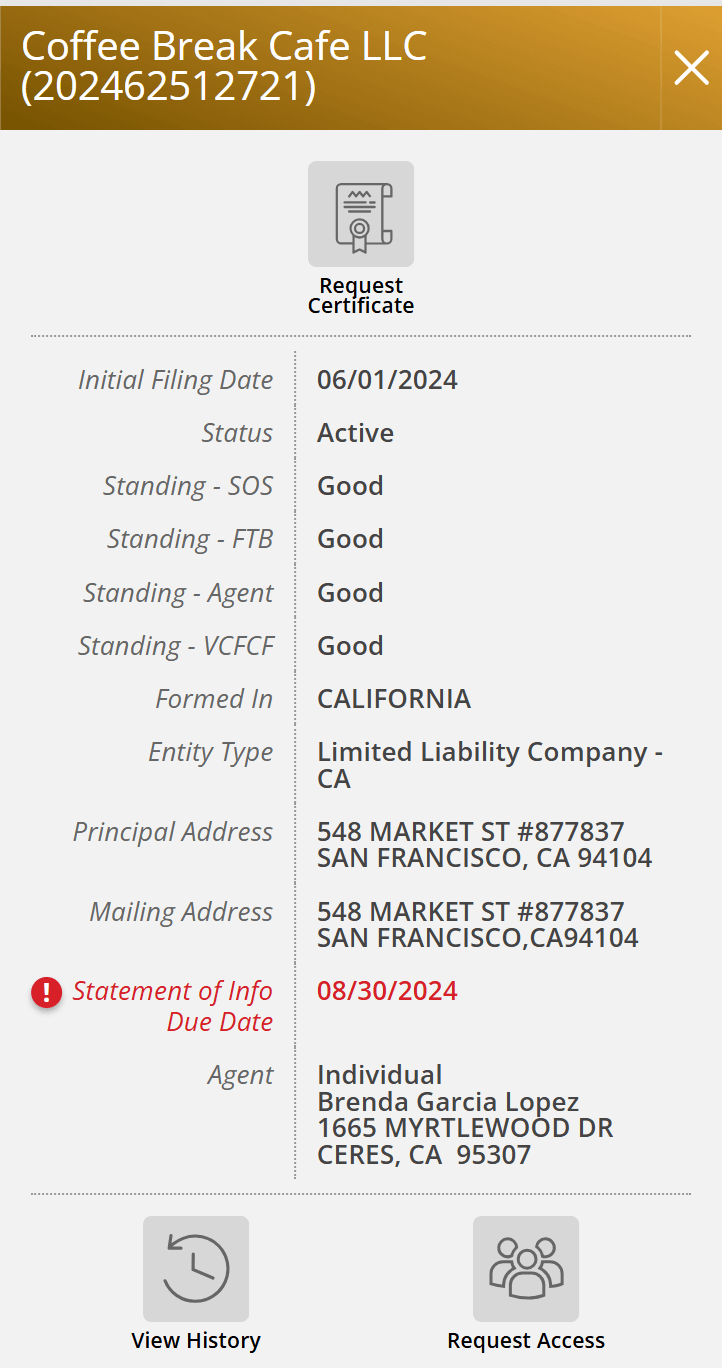

Open the entity drawer & read key fields

Click the blue chevron (▸) on the right row. A detail drawer opens with everything you need to decide what to do next. Read it top-to-bottom, then act.

- Header & Entity Number.

Copy this exact number from the header (e.g., 202462512721) for orders and filings. - Status & Standing lines.

Look for Status plus Standing – SOS / FTB / Agent / VCFCF.- Active / Good → you can usually proceed; order proof if needed.

- Suspended – FTB or Standing – FTB: Not Good → taxes; follow revivor steps.

- SOS issues → file/bring current the Statement of Information.

- Formed In & Entity Type.

Confirms domestic vs. foreign and whether you’re viewing a corporation, LLC, or LP – important for name conflicts and form choice. - Principal vs. Mailing Address.

Use principal for executive location; mailing for correspondence. Mismatches can explain bank/KYC questions. - Statement of Info Due Date.

Red text = due/overdue. File an updated SI now; don’t wait for a window. - Agent for Service of Process.

Note individual vs. 1505 corporate agent and the listed address. If you need privacy/reliability, switch agents in your next SI. - Actions.

- Request Certificate → order Certificate of Status or certified copies.

- View History → opens prior filings to confirm changes.

- Request Access → link your SOS online account if you manage this entity.

Example:

Coffee Break Cafe LLC (202462512721) shows Status: Active and Standing – SOS/FTB/Agent/VCFCF: Good – great. The Statement of Info Due Date = 08/30/2024 (red) signals a due/overdue filing; submit an LLC-12 update online, then order a Certificate of Status if a bank or vendor needs proof. The agent is an individual (Brenda Garcia Lopez) at a California street address, fine for service, but switch to a registered corporate agent if you want privacy.

Download filings & order official proof

Download any imaged PDFs (Articles, Statement of Information) from the record. For banks/licensing, click Request Certificate to order a Certificate of Status or certified copies, use the exact Entity Number displayed in the drawer.

If It’s Not Here, Know Where to Look

Not every record sits inside the SOS Business Search. When something’s missing, pivot to the right system so you don’t spin your wheels.

- DBAs/FBNs: Check the county clerk/recorder where the business operates (e.g., Los Angeles County FBN). These never appear in the SOS index.

- Property tax: Use the county tax collector/assessor portals for parcel lookups and payment history.

- LLP/GP records: If a partnership doesn’t show up, submit a Business Entities Records Request to the SOS for copies or a status report.

Register Your Business Name in California

ZenBusiness helps you check name availability and register your LLC quickly, ensuring compliance with California’s regulations.

Read California Results Correctly

When you click into an entity on bizfile California → Business Search, you’re looking at an official abstract of the Secretary of State record. Read it like an examiner: every field has a specific meaning, and small details (status codes, the agent type, missing filings) can change what you do next. Below is a practical decoder with examples and quick fixes.

Decode Every Field

Read the listing like an examiner, each line tells you something actionable about the entity and how to proceed.

- Entity Number.

Corporations use a 7-digit number beginning with “C”; LLCs/LPs use a 12-digit numeric ID. Use this ID for all orders and filings to avoid near-match errors. - Registration Date & Jurisdiction.

Tells you when the entity registered in California and where it was organized (e.g., Delaware). Foreign (out-of-state) entities can be active in CA even if formed elsewhere. - Status.

Don’t stop at “Active” vs. “Suspended”, California distinguishes SOS actions from FTB (tax) actions. See the status table below. - Agent for Service of Process.

Either a California resident individual (street address required) or a registered corporate agent qualified under Corporations Code §1505. If a corporate agent is listed, you may need a Status Report to view the agent’s address. - Addresses & LLC Management.

“Entity Address” is the executive office; “Mailing Address” is for mail; LLCs also show whether they’re member-managed or manager-managed. - Statements of Information (SI).

- SI-COMPLETE = last fully completed SI on file.

- SI-NO CHANGE = no changes since last SI-COMPLETE.

If the SI image isn’t online, you can still order copies.

What the statuses actually mean

Status tells you whether you can transact and which agency you must satisfy to fix problems.

| Status (as shown) | What it means | What you should do |

|---|---|---|

| Active | On file and authorized (subject to other laws). | Need proof? Order a Certificate of Status online. |

| SOS Suspended / SOS Forfeited | Secretary of State action, most often for missing a required Statement of Information. | File the overdue SI (online is fastest); order a Status Report if you need details. |

| FTB Suspended / FTB Forfeited | Franchise Tax Board action for tax non-compliance. Entity loses rights/powers to do business. | Follow FTB’s revivor path: file past-due returns, pay balances, submit revivor request. |

| SOS/FTB Suspended or Forfeited | Both agencies have acted. | Address both: file SI and complete FTB revivor steps. |

| Dissolved / Canceled / Surrendered / Merged Out / Converted-Out | Entity ended, left CA, or changed type/jurisdiction. | Order copies if needed; name reuse still must meet naming rules. |

What’s Not in Business Search

The database covers corporations, LLCs, and LPs. It does not include general partnerships, LLPs, or DBAs/Fictitious Business Names, DBAs are filed with the county clerk, not the SOS.

How to get official documents (banking, licensing, deals):

- Certificates of Status & Certified Copies:

Order online in minutes via bizfileOnline, or use the Sacramento drop-off window for special-handling. - Status Reports / Non-imaged SIs:

Use Business Entities Records Request; drop-off special-handling fees are separate from copy/certificate fees.

Confirm Business Name in California

Choosing a name is a legal check, not just branding. California applies two tests at filing: your name must be distinguishable in the records and not likely to mislead the public, and the state ignores cosmetic tweaks (punctuation, spacing, endings). Use the quick workflow below to stay compliant and avoid rework.

What “distinguishable in the records” really means

Start by knowing what doesn’t make a new name. California treats formatting changes as the same name, so focus on changing real letters or words, not cosmetics.

- Does not create a new name: changing case or fonts, adding/removing punctuation or symbols (including “&” vs “and”), adding/removing entity endings (Inc./LLC/LP).

- State examples: “Goodtime Rest Home, LLC” ≠ “Goodtime Rest Home LLC”; “A B C Corp.,” “AB C Corp.,” “A-B-C Corp.” are still the same for approval purposes.

- Rule of thumb: If the only difference is entity identifier, case/spacing, punctuation/symbols, or “and” vs “&,” expect a rejection.

Required words & restricted words

Before you fall in love with a name, check the must-haves and no-go terms. This avoids instant rejections at filing.

- LLC requirements: Include “Limited Liability Company,” “LLC,” or “L.L.C.” (you may abbreviate “Limited” as Ltd. and “Company” as Co.).

- LLC restrictions: Don’t use bank, trust, trustee, incorporated/inc./corporation/corp., insurer/insurance company or wording that implies you issue insurance.

- Corporations: Must also be distinguishable and not misleading under the same framework (restricted words may require regulator sign-off).

- Tip for an LLC in California: If you truly need regulated terms (e.g., “bank”/“trust”), secure the agency’s no-objection/approval first.

What California checks, and what it doesn’t

Set the right expectations so you don’t assume approval where none exists.

- Checked: Your proposed name against like entities only (corp vs corp, LLC vs LLC, LP vs LP) in the state’s records.

- Not checked: County DBAs/Fictitious Business Names and trademarks (state or federal). Run those searches separately (USPTO + California trademark search).

A safe 6-step name-clearance workflow

Give yourself a clean path from idea to approval with this short, repeatable process.

- Screen in Business Search.

Run exact and close variants; open likely matches, don’t rely only on the result list. This is preliminary. - Apply the distinguishability rules.

If the only change is “&/and,” spacing, or the entity ending, pick a new core word. - Clear federal trademarks.

Search for identical and similar marks (spelling/phonetic). - Check California state trademarks.

Some owners register in-state, screen those too. - Reserve the name (optional).

Hold it for 60 days via bizfileOnline; renewals allowed but not consecutive (leave a 1-day gap). In-person submissions add a special-handling fee. - File and adapt.

The real test is at filing. If rejected, change the core wording and resubmit.

Registered Agent in California

California uses the term agent for service of process (not “registered agent”). Every corporation, LLC, LP, and LLP must designate one (and keep that information current), to receive lawsuits and official state mail. You can view the current agent on any entity’s listing in bizfile Online, new to this requirement and wondering do you need a registered agent in California?

Who Can Serve as Your Agent

A quick primer before you choose:

- California resident individual.

Must provide a California street address (no P.O. Boxes). The name and street address become public record. - Registered corporate agent (Corp. Code §1505).

A corporation authorized with the Secretary of State to act as agent for many businesses. When you designate one, you list only the agent company’s legal name, its address is maintained on the 1505 record. (Get the agent’s advance approval first.)

Address rules & privacy

Before you file, note these address standards:

- No P.O. Boxes for individuals.

If your agent is an individual, the form requires a California street address; P.O. Boxes are rejected. - Corporate agents list name only.

If your agent is a registered corporate agent, you enter just the agent’s name (not an address) on your Statement of Information. Many owners pick a corporate agent or a registered agent service for privacy and reliability.

Appoint or change your agent

Use your Statement of Information to add or update the agent, online is fastest via bizfileOnline. For timing: LLCs file the initial SI within 90 days of registration, then every two years (and whenever details change). Stock corporations file the initial SI within 90 days, then annually (file an updated SI whenever details change). If you’re comparing providers, here’s a short guide to the best registered agent in California to help you choose.

If Your Agent Resigns

Resignations happen, here’s how to avoid mail going astray:

- The agent files Form RA-100.

There’s no filing fee to resign as agent for service of process. - You must appoint a new agent promptly.

File an updated Statement of Information to name the replacement; until you do, filings can be rejected or notices missed.

What is a registered corporate agent (1505)?

A company can qualify with the SOS to serve as a registered corporate agent by filing Form 1505; the filing fee is $30. These agents keep an address of record with the SOS and can be appointed by many entities, on your SI, you’ll list only the agent’s name.

Individual vs. 1505 corporate agent (quick comparison)

| Option | Pros | Cons | Best for |

|---|---|---|---|

| Individual (owner/manager) | $0 cost; simple | Home/office address becomes public; must be available during business hours | Solo owners okay with a public address |

| 1505 corporate agent | Professional handling; privacy; statewide coverage | Annual fee to the agent | Anyone wanting privacy/compliance support |

Secure your California Registered Agent with Northwest

Northwest is known for premium registered agent services that protect your personal info and ensure you never miss an important state notice.

Trade Names and State Trademarks

You’ll often use a trade name (DBA/FBN) for branding and a trademark to protect that brand. They’re different systems, handled by different offices. Here’s the tight, California-specific version, just what you need, nothing extra.

Trade Name (DBA/FBN)

A trade name (also called a DBA or Fictitious Business Name) is a county-level public notice, not a state registration. It lets the public identify who’s behind a business name.

What to know (and do):

- Where to file:

With the county clerk/recorder where your principal place of business is located. (DBAs are not filed with the Secretary of State.) - Publish the notice:

After filing, publish the FBN statement once a week for 4 consecutive weeks in a newspaper of general circulation. The first publication must appear within 45 days of filing, and you must file the affidavit of publication within 45 days after completion. If you have no place of business in California, publish in Sacramento County. - What it is / isn’t:

A DBA is public notice only, it doesn’t create ownership rights or block others the way a trademark can. Keep using your entity’s true legal name for contracts, and list the DBA where forms ask for it. (For an LLC in California, the DBA doesn’t change the legal entity name.)

State Trademarks

A California state trademark helps protect a mark used in California commerce (names, logos, slogans) within the state. It’s separate from DBAs and separate from federal (USPTO) protection.

How it works:

- Search first: Use the California Trademark Search to review existing marks and view filings; also screen the USPTO database for federal conflicts.

- File the application: Apply online via bizfile California using Form TM-100. The filing fee is $70 per class. You must already be using the mark in commerce and include a specimen.

- Term & renewal: A California registration is active for 5 years from the filing date and can be renewed every 5 years (file within the six-month window before expiry) as long as use continues.

When to go federal: If you sell or plan to sell beyond California, file federally with the USPTO for broader protection and stronger enforcement tools. Keep (or add) a state registration if in-state coverage is useful.

Annual Reports and Compliance

In California, your “annual report” is the Statement of Information (SI). Corporations file annually; LLCs file biennially; all must also file an initial SI within 90 days of registration and whenever information changes (agent, addresses, officers/managers). You can file everything online via bizfileOnline. If you’ll be hiring staff, a California PEO (professional employer organization) can streamline payroll tax filings, workers’ comp, and day-to-day HR compliance.

What California counts as your “annual report”

Use this quick table to know exactly what to file and when.

| Entity | Initial due | Ongoing frequency | Form (typical) | Filing fee |

|---|---|---|---|---|

| Stock corporation | Within 90 days of registration | Annually | SI-550 (or online SI) | $25 |

| Nonprofit corporation | Within 90 days | Every 2 years | SI-100 (or online SI) | $20 |

| LLC | Within 90 days | Every 2 years | LLC-12 (or online SI) | $20 |

Notes: California uses a statutory 6-month filing window tied to your anniversary month; filing any time inside that window is on time.

File it online

Before you click “Submit,” gather the fields the state expects so you don’t bounce back.

- Where to file: bizfileOnline → “File Statement of Information.”

- Include: principal and mailing addresses, agent for service of process, officers/directors (corp) or managers/members (LLC).

- Timing: after your initial SI, use the 6-month window that starts the first day of your anniversary month and runs for six full months.

Late filings & status problems

If you miss the due date, the SOS sends a delinquency notice and gives you 60 days to file. After that, the SOS certifies a penalty to the FTB, generally $250 (nonprofits $50), and your entity can be suspended/forfeited by SOS and/or FTB. To fix an FTB suspension, you must file past-due returns, pay balances, and submit a Certificate of Revivor application.

Taxes You Still Owe

The SI is not a tax filing. Plan for these recurring payments so you don’t trigger FTB action.

- LLCs: $800 annual tax due by the 15th day of the 4th month of your tax year (use FTB 3522). If CA-source revenue is ≥ $250k, pay the LLC fee by the 15th day of the 6th month (estimate with FTB 3536). For a concise breakdown of rates, due dates, and examples, see California LLC taxes.

- Corporations (C & S): $800 minimum franchise tax each year (first-year exemption applies to newly incorporated/qualified corporations).

Verifying Business Name Availability in California

California approves names that are distinguishable in the records and not likely to mislead the public. Treat the Business Search as a preliminary screen, the binding call happens during filing review. Below is the lean, California-specific process that aligns with current SOS regulations.

Apply California’s rule (distinguishable, not misleading)

Before you compare results, anchor on what doesn’t create a new name. California requires a plainly recognizable difference in letters or numerals; formatting tweaks don’t count.

- Ignored differences: entity endings (Inc./LLC/LP), case, punctuation/symbols/spaces, and “and” vs “&.”

State examples: A B C Corp., A.B.C. Corp., A-B-C Corp. → not distinguishable; Good Time Rest Home, LLC vs Goodtime Rest Home LLC → not distinguishable. - Rare exception: A space that creates a new word/meaning (e.g., Got Ham vs Gotham) may pass.

- Misleading terms (e.g., implying governmental status or insurance underwriting) can be rejected even if otherwise unique.

Do the essential checks (fast, in order)

Use this mini-workflow to avoid avoidable rejections and delays.

- Screen the official index.

Search exact + close variants in bizfile California → Business Search. Remember, the SOS compares like entities only (corp vs corp, LLC vs LLC, LP vs LP). - Apply LLC naming rules.

LLC names must include “Limited Liability Company,” “LLC,” or “L.L.C.” and may not contain bank, trust, trustee, incorporated/inc./corporation/corp., insurer/insurance company (or anything implying you issue insurance). - Handle regulated words.

If you truly need bank or trust, obtain a DFPI Letter of No-Objection before filing. - Know what the SOS doesn’t check.

County DBAs and trademarks aren’t part of name approval, run those separately if brand risk matters.

Reserve the name (60 days)

If you need time to finalize filings, hold one name for 60 days. Reservations are not consecutive (leave at least one day between), cost $10, and in-person requests add $10 special handling. Reservations and staff opinions are advisory; final acceptability is decided at filing. File online via bizfileOnline for speed. For budgeting beyond reservation fees, see our complete list of California LLC fees.

Accessing Public Business Records in California

California’s official gateway is bizfile California. From the Business Search, you can pull a free snapshot of corporations, LLCs, and LPs, view many imaged filings, and order Certificates of Status or certified copies online. Some datasets live in separate tools (e.g., Publicly Traded Disclosures), and certain info (like DBAs and property taxes) is handled outside the Secretary of State. The guide below shows where to get each item fast.

What you can (and can’t) get online from the state

Here’s a quick map so you know exactly where to look before you start clicking around.

| Need | Where to find it | Notes |

|---|---|---|

| Entity snapshot (name, Entity Number, registration date, status, agent for service of process, principal/mailing addresses) | Business Search | Free abstracts for corporations, LLCs, and LPs; many filings are imaged as PDFs. |

| Certificates of Status (“good standing”) & certified copies | Order Online (bizfileOnline) | Most orders can be completed online from the entity’s record. |

| Latest Statements of Information & amendments | Business Search (imaged documents) | If a PDF isn’t posted, you can still order it. |

| Is the company publicly traded? (SI-PT) | Publicly Traded Disclosure Search | Separate database, this disclosure won’t show in the standard results list. |

| LLP and general partnership records | Business Entities Records Request | LLP/GP filings aren’t fully indexed in the Business Search. |

| DBAs/Fictitious Business Names | County clerk/recorder (e.g., Los Angeles County) | DBAs aren’t filed with SOS; check the county’s system. |

| Property tax payment/parcel history | County portals (e.g., LA County Property Tax) | County function, outside SOS databases. |

Formed an LLC in California? Your listing shows the agent for service of process and the latest Statement of Information; for banks or licensing, order a Certificate of Status via Order Online. If you need a step-by-step on setup and ongoing requirements, here’s our California LLC guide.

How to obtain compliance documents and filings

A short, repeatable workflow keeps your requests clean the first time.

- Open the entity in Business Search.

Scan the Document Image list for what you need (Articles, latest SI, amendments) and download any posted PDFs. - Order official proof.

From Order Online, pick Certificate of Status or Certified Copies and enter the Entity Number shown on the listing (note: older corporations may display a C-number; newly registered entities use a 12-character ID starting with “B”). - Can’t find an image?

Submit a Business Entities Records Request to get status reports and certified/plain copies. - Need the agent’s details?

The agent for service of process is on the listing; if it’s a registered corporate agent, the agent’s address is maintained on the SOS’s 1505 record (not always displayed on the entity page).

Registering a Business in California

Registering a business in california is straightforward yet requires attention to detail. First, confirm that your chosen name is available by performing a thorough business name search. Next, prepare the necessary paperwork, including articles of organization for an LLC or the appropriate forms for a corporation. For a broader launch plan (licenses, taxes, banking, marketing), see how to start a small business in California.

Follow these recommended steps:

- Choose an Entity Type: Decide if you’ll form a limited liability company, corporation, or another structure like a limited partnership. Not ready to operate yet? You can still form an LLC without a business to secure the name and set up compliance early.

- Complete Formation Documents: Draft the required forms, such as the articles, specifying directors or members.

- File With the Secretary of State: Submit your paperwork online or by mail; filing fees vary depending on the entity type. If you’re planning your launch date, check how long approval typically takes in California (including available expedite options).

- Appoint a Registered Agent: Ensure a reliable agent receives lawsuits, notices, and official correspondence.

- Obtain Any Licenses: Check local or state rules for a valid business license or tax permits. If you're selling online, you might wonder, do you need a business license to sell on Etsy in California? Check local or state rules to confirm.

- Address County Requirements: For certain matters like property taxes or local registration, coordinate with the county clerk’s office.

- Maintain Good Standing: Regularly update your records, pay applicable fees, and follow the california code.

Staying compliant may also involve tasks like paying the franchise tax board for annual taxes, verifying that your naming rules remain consistent, or ensuring all formalities for liability companies and limited entities are met. Thorough planning sets you on a successful path in one of the country’s most vibrant commercial landscapes.

Common Mistakes to Avoid in California Business Searches

Even experienced teams slip up with bizfile California. Keep it tight and official: the state search is the source of truth, county DBAs live outside it, and some disclosures sit in separate tools. Use the essentials below to avoid rework.

Avoid these errors

A quick primer so you don’t chase bad data.

- Using non-official sites.

Third-party databases can be stale, always confirm in the Business Search and order records from Order Online. - Looking for “publicly traded” info in the wrong place.

That’s in the Publicly Traded Disclosure Search, not the entity listing. - Mixing up SOS vs. FTB status.

“Suspended/Forfeited” can be an SOS filing lapse or an FTB tax issue, the fix path is different. - Expecting DBAs/FBNs to appear.

DBAs are county filings (e.g., Los Angeles County FBN), not SOS records. - Relying on punctuation or “Inc./LLC” to clear a name.

California ignores punctuation, spacing, “and/&,” and entity endings for distinguishability. - Searching the wrong index.

Corporations are indexed separately from LLC/LP records, screen both when checking conflicts.

Verify and document

Short steps that make banks, partners, and compliance teams happy.

- Pull the listing in Business Search and download any imaged filings (Articles, latest SI). If not posted, order copies.

- Cross-check the right systems: public companies → Publicly Traded Disclosure; DBAs → county clerk/recorder.

- Match status with the cure: SOS lapses → file the Statement of Information; FTB issues → follow revivor (returns + payments).

- Prove it: order a Certificate of Status (and certified copies if needed) from Order Online.

Fast name-search tips

Keep searches focused and conflict-aware.

- Search core words, not punctuation.

The state ignores punctuation/symbols and “and/&.” - Open the filings.

Don’t rely on the list view, read the Statement of Information for officers/managers and the agent for service of process. - Reserve only when clean.

After screening and trademark checks, hold the name for 60 days via bizfileOnline (reservation is separate from formation).

Frequently Asked Questions (FAQ) About California Business Searches

Below is a concise FAQ addressing the most common queries about performing a California business search. These answers help clarify essential points quickly.ll help you quickly understand the process and make informed decisions.

Is the California Business Search official and free?

Yes, It’s the Secretary of State’s official index for corporations, LLCs, and LPs, free to use. You can view an entity snapshot (status, agent for service of process, addresses) and many imaged filings. It’s a preliminary screen: final name approval happens during filing. It does not include county DBAs or trademarks, which you must check separately (county clerk for DBAs; USPTO/California for trademarks).

How do I perform a Business Entity Search in California?

Use bizfile California → Business Search. Choose Entity Name (start broad, then refine) or Entity Number (fastest if you have it). Open the exact record to verify status, agent, addresses, and imaged filings (Articles, Statements of Information). Download PDFs as needed and use Order Online for Certificates of Status or certified copies. Remember: publicly traded disclosures and county DBAs live in separate systems.

What Types of Business Entities Can I Search For in California?

The public Business Search covers corporations, LLCs, and limited partnerships (LPs), both domestic and foreign entities registered in California. You’ll see status, agent for service of process, addresses, and many imaged filings. Not included: county DBAs/FBNs, trademarks, and most LLP/general partnership records (request those from the SOS or the county). Public-company disclosures appear in a separate Publicly Traded Disclosure Search, not on the standard entity listing.

How do I get proof of good standing?

Order a Certificate of Status online. Open the entity in Business Search, confirm the exact Entity Number, then use the “Order Online” option to request a Certificate of Status (and certified copies if needed). Banks, vendors, and licensing boards commonly require this document. Download the PDF for your records and share it with counterparties; it’s the cleanest, most widely accepted proof.

Do DBAs or trademarks appear in the state search?

No, The Business Search shows entities, not DBAs or trademarks. DBAs/Fictitious Business Names are filed with the county clerk/recorder where you operate (e.g., Los Angeles County FBN). Trademarks are separate: search USPTO for federal marks and the California Trademark Search for state registrations. Always run these checks alongside the entity search to avoid brand conflicts and rebranding costs.

What naming differences are ignored for availability?

Cosmetic changes don’t count. California ignores punctuation, symbols, spacing, case, “and” vs “&,” and entity endings (Inc./LLC/LP) when judging distinguishability. You need a plainly recognizable difference in letters or numerals, often a new core word. Screen exact and close variants, then apply this rule before reserving a name. If your only change is formatting or the ending, expect a rejection at filing.

- California Office of the Small Business Advocate (CalOSBA): Fictitious Business Name (DBA) overview

- California Secretary of State: Statements of Information – Filing Windows & Tips

- California Franchise Tax Board: LLC Annual Tax $800 & LLC Fee (FTB 3522 / 3536)

- California Franchise Tax Board: FTB 3522 – LLC Tax Voucher ($800) Instructions (PDF)

- California Secretary of State: Resignation of Agent for Service of Process – Form RA-100 (PDF)

- California Secretary of State: Certificate Pursuant to Corporations Code §1505 (Registered Corporate Agent) (PDF)

Looking for an overview? See California LLC Services

Ensure Full Compliance for Your California Business

Harbor Compliance simplifies business registration, name verification, and compliance tracking so you can operate with confidence.