Before you start a business in Tennessee, it’s crucial to confirm that your desired LLC or corporation name is available. The Tennessee Business Entity Search allows entrepreneurs, investors, and professionals to verify registration details, check active status, and avoid potential trademark conflicts. Skipping this step could lead to delays, rejections, or legaYou’ve taken the first step to protect your business by forming an LLC, but does that mean you’re ready to operate legally? Not necessarily. Many industries and municipalities require additional business licenses or permits, and failing to get the right documentation could lead to fines, delays, or even a shutdown. From vendor permits to occupational licenses, every location has different requirements.

Having an LLC does not mean you’re legally allowed to do business. Depending on your industry and location, you may need state, federal, or local business licenses before opening your doors.

This guide will help you determine the exact permits you need, how to register, and which government agencies handle licensing. Whether you’re opening a restaurant, professional service, retail store, or online business, we’ll cover how to check licensing rules in your city or county, avoid common mistakes, and ensure full compliance. Let’s get started!

Understanding Business Licensing for LLCs

Running a limited liability company (LLC) often requires more than just filing formation documents. You might need specific business licenses to legally operate, depending on your location and industry. Understanding these licensing obligations is vital for ensuring compliance, avoiding penalties, and setting a stable, long-term foundation for your LLC’s growth.

What is the Difference Between an LLC and a Business License?

An LLC, or limited liability company, is a legal business entity structure that shields owners from personal liability for debts, lawsuits, and other obligations. A domestic llc is formed within the state where the business operates, providing localized benefits and compliance. By filing formation documents with your state, you create a separate entity distinct from your personal assets.

A business license, on the other hand, is government authorization that allows you to operate within a particular jurisdiction or industry. While an LLC provides liability protection and distinct tax advantages, it does not automatically grant you permission to conduct business activities. That permission is typically granted through the relevant licenses or permits required by federal, state, or local agencies.

Below is a quick comparison:

| Category | LLC | Business License |

|---|---|---|

| Purpose | Forms a legal entity separate from owners | Official permit to operate commercially |

| Liability Protection | Yes | No |

| Registration | Filed with state authorities | Granted by federal, state, or local agencies |

| Renewal | Periodic state fees | Often requires renewal |

In short, forming an LLC secures liability protection and a distinct tax identity, whereas a business license grants you legal permission to engage in commercial activities. Both elements work together to keep your operations compliant and safe from unnecessary legal or financial risks. Understanding this difference is essential for meeting regulatory obligations. For more insights on managing your llc license, refer to our comprehensive guide.

Are Business Licenses Mandatory for LLCs in All States?

Business licensing rules vary considerably across the United States. Some states have no blanket license requirement for LLCs, but they may mandate specialized permits depending on the nature of your services.

In Ohio, for instance, there is no general state-level business license, yet many industries—like food service, childcare, and construction—require specific authorizations. Additionally, local governments often impose separate regulations that can include zoning permits, health department certifications, or tax purposes. Because these requirements differ from one municipality to another, it is crucial to verify the regulations applicable to your LLC’s location. If you're planning to launch a small business in California, make sure to follow the specific state guidelines.

Failing to comply can result in fines, loss of operating privileges, or penalties, or even forced closure, so it pays to research both state and local mandates in advance.

Hidden Costs of Business Licensing: What Most LLC Owners Overlook

Many entrepreneurs assume that the only expense linked to a license is the initial application fee. However, various hidden costs often emerge over time, catching LLC owners off guard. You might encounter ongoing renewal charges, surcharges for expedited processing, or additional fees when your company expands into new regions.

Certain industries, like healthcare or construction, also require background checks, inspections, or specialized training programs, each adding to your overall licensing budget. Moreover, failing to renew a license on time can lead to reinstatement penalties, which can quickly accumulate if not addressed promptly.

To help you prepare, here are some commonly overlooked expenses that could impact your bottom line:

- Late fees for missing renewal deadlines

- Additional charges for industry-specific permits

- Third-party services for compliance or legal advice

- Mandatory training programs or workshops

- Penalties for non-compliance with local regulations

By anticipating these costs, you can set aside a budget to cover potential surprises. This proactive approach not only safeguards your LLC’s overall financial health but also keeps your operations compliant, helping you avoid disruptions and maintain a solid reputation in your market.

Check Your Business License Requirements

Ensure your LLC meets all legal requirements. Use our business license search tool to verify the permits you need for compliance.

Do You Need a Business License Before or After Forming an LLC?

Determining when to apply for a business license relative to forming your LLC can influence your launch timeline and compliance strategy. Some sole proprietorship secure a license first to confirm legal viability, while others finalize the LLC before seeking licenses. Timing depends on your industry requirements.

Is a Business License Needed to Form an LLC?

Forming an LLC involves carefully filing the necessary paperwork with your state and paying associated fees. To learn how to get a llc started, follow our step-by-step guide.

In most cases, you generally do not need a business license to complete these formation steps. However, creating an LLC does not automatically grant the authority to operate in regulated fields. Whether it’s retail, construction, or professional services, you must ensure compliance with the agencies overseeing those sectors. If your chosen field demands specialized permits or licenses, factor that into your initial startup plan. To understand the specific timelines for forming an LLC in different states, such as llc California, visit our detailed resource.

On a federal level, certain types of companies may need extra documentation before they can lawfully transact. The Internal Revenue Service outlines basic steps for starting a business, which you can review here. While this resource covers topics like obtaining an Employer Identification Number (EIN), it does not entirely replace the need for state or local licensing. Ultimately, whether you need a business license prior to forming your LLC strictly depends on the regulations specific to your industry and location.

Business License or LLC? Which Comes First?

Deciding whether to obtain a business license before forming an LLC can be confusing. Each approach has its merits: securing a license first might verify that your venture is legally permissible in your area, while forming an LLC early can protect personal assets if any legal issues arise. Ultimately, the best sequence depends on your unique circumstances and the regulations governing your specific industry.

Consider the following points:

- Research local or state rules to see if licensing is mandatory before LLC formation.

- Check your industry’s liability risks and legal complexities to determine if asset protection is crucial.

- Evaluate costs and financial readiness for both license fees and LLC filing expenses.

- Confirm any deadlines that could affect your operational timeline.

- Consult professional advice when in doubt about the ideal order.

What Happens if You Operate Without a Business License?

Operating an LLC without a proper business license can result in severe penalties. Authorities may issue fines, suspend or revoke your right to operate, or even pursue legal action against you if serious infractions arise. Noncompliance can also tarnish your reputation, making it harder to secure partnerships or attract new clients. Additionally, some states and municipalities can shut down your operations until you rectify the licensing issue, causing significant downtime, added complications, and lost revenue. In extreme cases, repeated violations might lead to permanent closure or criminal charges. To avoid these risks, it’s essential to understand your jurisdiction’s requirements and maintain all required licenses and permits throughout your LLC’s lifecycle.

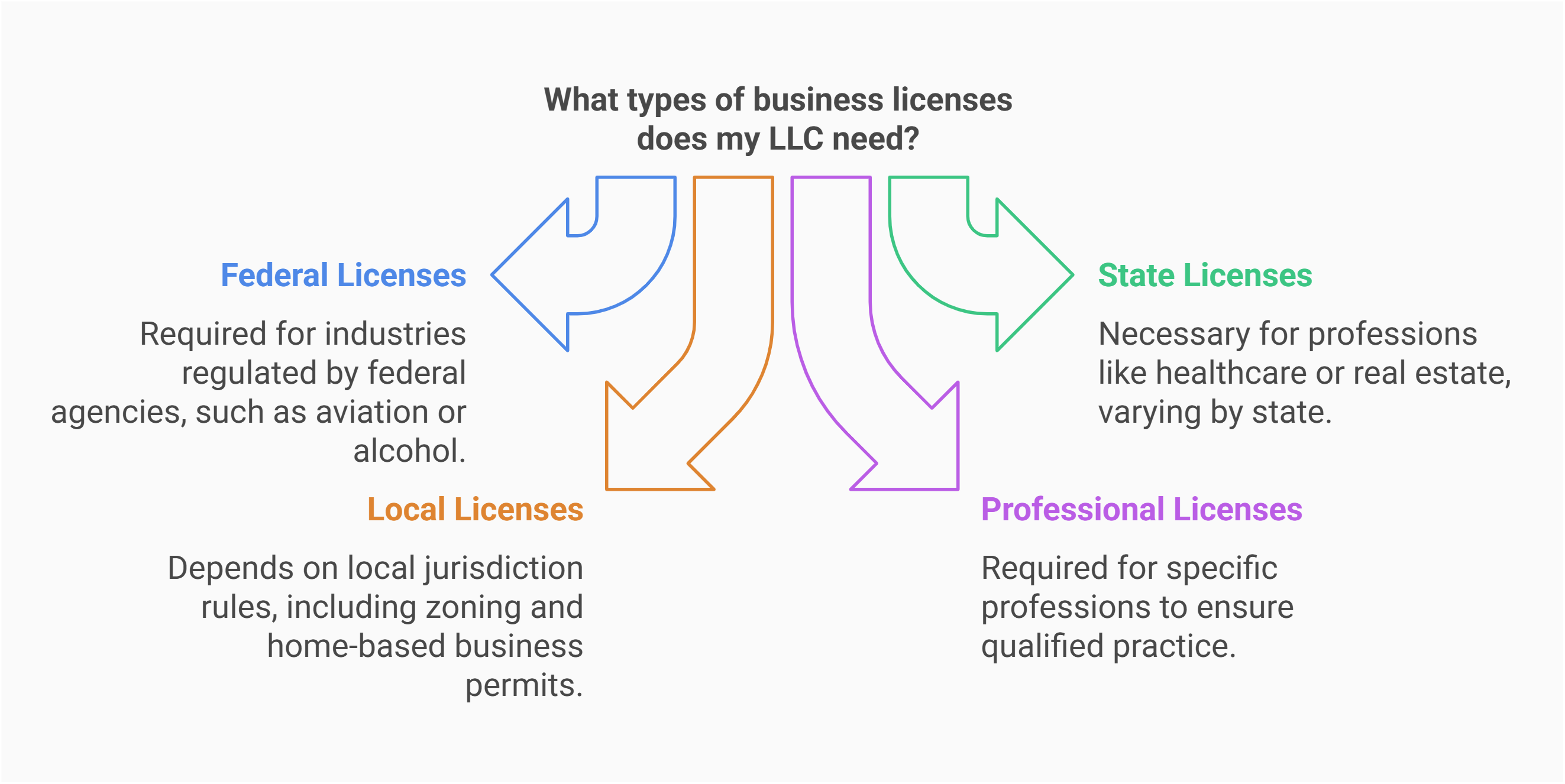

What Types of Business Licenses Does an LLC Need?

LLCs may require various licenses at the federal, state, and local levels, depending on the nature of their operations. Some industries also call for professional credentials to safeguard public safety and maintain industry standards. Below is a closer look at the different categories of licenses and exact compliance requirements that might apply to your LLC.

Federal Business Licenses: Who Needs Them?

Federal business licenses are reserved for industries that are regulated by the government. For example, businesses dealing with aviation, broadcasting, or the sale of alcohol or firearms need federal authorization to operate legally. In these sectors, federal agencies like the Federal Aviation Administration (FAA) or the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) oversee the licensing process. Failing to comply with federal regulations can result in fines or forced shutdowns.

To learn more about federal licensing requirements, visit this page from the U.S. Small Business Administration (SBA). While not every LLC will need federal licensing, those operating in regulated fields must adhere to these rules before they can legally serve customers. Even if your specific sector is not federally regulated, it’s important to double-check whether other additional federal permits, or guidelines, or certifications could apply to your unique operations.

State Business Licenses: Common Industries Requiring Them

Many states mandate business licenses for specific sectors that pose unique risks or require oversight. In general, professional services like legal counsel, healthcare providers, and real estate brokers must obtain state-issued licenses to practice. Some states also license businesses involved in cosmetology, automotive repair, and environmental services. Business license requirements vary widely from one state to another, so it’s crucial to research the regulations in your region. Below are examples of industries that often require a state-level business license.

- Healthcare (doctors, nurses, physical therapists)

- Legal profession (attorneys, notaries)

- Real estate (agents, brokers)

- Cosmetology (hair stylists, nail technicians)

- Automotive services (mechanics, body shops). Similarly, if you're interested in how to start a cleaning business, specific licenses related to sanitation and safety may be required.

- Environmental firms (waste management, water treatment). Similarly, if you're interested in how to grow a landscaping business, ensuring proper licensing is a crucial first step.

Confirm your state’s specific criteria for these and other fields to ensure you meet all licensing obligations. Failure to do so could lead to serious legal issues, financial penalties, or forced closures, complicating your LLC’s path to success.

Local Business Licenses: Do You Always Need One?

Local jurisdictions, such as cities or counties, often impose their own licensing rules in addition to federal and state requirements. Whether you need a local business license depends on factors like your business location, the type of activities you conduct, and even zoning regulations. Many municipalities also require home-based businesses to register or obtain permits, ensuring that residential neighborhoods are not disrupted by commercial operations.

Even if your state does not enforce broad licensing policies, local authorities may have stricter mandates. For instance, a restaurant operating within city limits might need a separate health inspection certificate. By proactively checking municipal guidelines, you can avoid fines, forced closures, and other setbacks. Always confirm whether your LLC’s activities, location, or industry triggers local licensing obligations before opening your doors to the public.

Professional Licenses: When Are They Required?

Professional licenses pertain to individuals who must meet specific educational, experiential, or testing standards to legally practice in their field. Common examples include attorneys, accountants, healthcare practitioners, and engineers. These licenses are issued by state boards or agencies dedicated to regulating each profession. The goal is to maintain a consistent level of expertise and protect the public from unqualified practitioners. For an LLC offering specialized services, ensuring that team members hold the proper professional credentials is just as critical as obtaining any other required business license.

For instance, if your LLC is a healthcare clinic employing nurses and physicians, each practitioner must hold a valid license from the relevant medical board. If your business falls under regulated professions, you might need to consider forming a pllc to meet industry standards.

Even if the LLC secures the necessary business licenses, non-licensed staff members cannot legally offer clinical services. In this scenario, professional licensing requirements work alongside standard business licensing to ensure public safety and regulatory compliance across the entire organization.

How to Determine Your LLC’s Licensing Requirements

Identifying the licenses your LLC needs involves analyzing your industry, business activities, and geographic location. Research both state and local regulations, and consult federal guidelines if applicable. By verifying each level of government, you minimize compliance risks and potential penalties.

How Do I Know if I Need a Business License for My LLC?

Start by reviewing your state’s business portal or contacting the state’s office to clarify licensing prerequisites. These resources often outline the industries and activities that require authorization. Next, check whether your local city or county government imposes additional requirements, such as zoning approvals or health department inspections. Pay close attention to any occupation-specific mandates, especially if you offer professional services. By gathering this information early, you can avoid costly surprises and ensure smoother business operations.

You should also consider consulting a professional, such as a business attorney or CPA, for personalized guidance. If you're looking for specific guidance, check our guide on how to start an llc in North Carolina. They can assess your specific circumstances, including multi-state operations or niche markets, to pinpoint any unique licensing rules. Remember that regulations change over time, so periodic reviews of your compliance status are essential. By staying informed and adapting to evolving laws, you’ll keep your LLC ahead of potential legal hurdles and maintain the trust of clients and partners.

Form & License Your LLC Easily

ZenBusiness helps you register your LLC and secure the necessary business licenses to operate legally in your state. Get started today.

Where to Check for State and Local Licensing Requirements?

Uncovering licensing requirements usually starts with your state’s official websites, such as the Department of Revenue or Department of Commerce. Many of these platforms offer search tools or databases to help you identify the necessary licenses and permits. You should also review local city or county portals for ordinances and zoning rules. Below are several reliable online resources that can guide you in determining your LLC’s obligations at both state and local levels.

- State Government Websites: Often labeled “Business” or “Commerce” sections for licensing details.

- Local County or City Portals: Check for zoning, health, and safety regulations.

- SBA’s Local Assistance Finder: Connects you with regional advisors who know local rules.

- Chambers of Commerce: Provide region-specific business guidance and networking opportunities.

- Industry Associations: Offer specialized regulatory updates for niche sectors.

Consult these channels to avoid oversights.

How to Get a Business License for Your LLC

Acquiring a business license for your LLC typically involves identifying the required permits, gathering essential paperwork, and submitting applications to the appropriate government entities. You’ll also need to pay any associated fees and maintain compliance through renewals. Below is a straightforward, step-by-step approach to help you navigate the application process and keep your LLC properly licensed and in good standing.

Step 1: Identify the Licenses You Need

Begin by assessing the nature of your LLC’s activities and the jurisdictions in which you plan to operate. If you’ll provide specialized services—like food preparation or financial services consulting—look up the corresponding regulations. Some professions require education certifications, which may be separate from standard business licenses. Being thorough at this stage helps you compile a list of necessary permits and prevents delays during the application process.

Check multiple sources, including your state’s business registry, professional boards, and local city ordinances. Don’t overlook county-level requirements, which can be relevant for home-based or mobile businesses. Each licensing authority may have distinct criteria and fees, so gather documentation accordingly. This upfront research ensures a well-organized approach, allowing you to submit accurate applications and reduce the likelihood of rejections or follow-up requests for additional information. If you're interested in starting a tutoring business, ensure that all educational and operational licenses are in place.

Step 2: Apply Through the Right Government Agencies

Once you’ve identified all required licenses, submit your applications to the appropriate authorities. This often means filling out both online and paper forms, depending on the agency. Some states allow combined filings for multiple permits, while others require separate submissions. Processing times can vary, so be mindful of deadlines and consider expedited services or urgent situations if time is critical. For a comprehensive overview of registration steps, visit this link.

Common agencies include:

- State Licensing Boards for professional fields

- County Clerk’s Office for local registrations

- City Zoning or Building Department for property-based approvals

- Department of Revenue for sales tax permits

- Secretary of State for general business filings

Be sure to follow each agency’s instructions precisely. Missing or incorrect forms can delay approvals and legal ramifications or incur additional fees, so double-check your information before submitting.

Step 3: Pay the Required Fees and Renew as Needed

Most agencies charge fees for initial applications and renewals. These costs vary widely by location and industry, so budget accordingly. Missing a payment can result in late fees or lapses in licensure, jeopardizing your LLC’s operations. Keep track of all due dates, and consider setting calendar reminders to stay on top of renewals. Some licenses even offer multi-year options, which may save money over time.

Every licensing body has distinct renewal intervals—ranging from annual to biennial—so clarify these timelines when applying. Staying compliant not only prevents legal complications but also preserves your credibility with clients, lenders. If you expand into new locations or services, you may need additional licenses or endorsements. Keeping your LLC’s licenses current demonstrates a commitment to professionalism and reduces the risk of unexpected obstacles to growth.

Research local, state, and federal requirements based on your business type and location to ensure full compliance.

Submit applications to state licensing boards, city zoning offices, and tax authorities as required for your industry.

Track renewal deadlines, set reminders, and maintain compliance to avoid penalties and disruptions to your business.

Common Questions About LLCs and Business Licenses

Whether you’re starting a small home-based enterprise or scaling a multi-state operation, questions about LLCs and business licenses often arise. From determining if you can legally skip a license to figuring out multi-jurisdictional obligations, getting clear answers in every step ensures you stay fully compliant and avoid costly legal complications.

It’s possible to form an LLC without immediately obtaining a business license, especially in industries or regions that do not require one at the outset. However, going without the necessary permits can cause operational and legal problems down the line.

Even if your state doesn’t mandate a general license, local municipalities or specialized boards may impose separate requirements. If you overlook these, you risk fines, forced closures, or lost revenue, or damage to your LLC’s reputation. To avoid interruptions, it’s prudent to research all relevant regulations well before you begin operating under your LLC, ensuring a smooth and lawful launch. Understanding why start an llc without a business can help you make informed decisions about your company's structure.

Having an LLC does not exempt you from local licensing obligations. For instance, if you run a café in a residential zone, your city may require a zoning permit or conditional-use authorization, even if you’ve already registered your LLC with the state. This ensures that businesses operate responsibly within the community. Neglecting local rules can lead to fines or forced closures, undermining the liability protection and stable credibility that an LLC provides. Always verify municipal regulations to keep your operations compliant and uphold goodwill with nearby neighbors and local authorities.

If your LLC only operates in one state, you’re subject to that state’s regulations. However, if you conduct business or have a presence in multiple states, each jurisdiction may impose licensing requirements. Your sales activities, service locations, and online transactions can trigger obligations. Understanding how each state defines ‘doing business’ is to avoiding penalties or have your LLC’s status revoked.

Before expanding your LLC across state lines, consult each state’s business registration office for a clear understanding of their rules. Some states have reciprocal agreements or simplified filing processes, but you’ll still need to meet local licensing standards. Ignoring these nuances can lead to fines, suspension of your operating privileges, and a damaged reputation, both with regulators and potential clients.

You can form an LLC and keep it inactive, but certain obligations remain. For example, many states require a report or franchise tax, even if the LLC conducts no business. Additionally, you may need to maintain a registered agent on file. Failing to meet these obligations could result in penalties or administrative dissolution. If you eventually plan to operate under the LLC, staying compliant helps preserve your entity’s good standing.

A Doing Business As (DBA) registration is not the same as a business license. A DBA simply lets you operate under a name different from your LLC’s legal designation. It doesn’t grant you the legal right to conduct types of activities, nor does it provide liability protection.

Business licenses, on the other hand, are government-issued permissions to operate in a particular location or industry. Even if your LLC uses a DBA, you may need the relevant licenses to stay compliant.

A business license allows you to legally operate in a specific locale or industry, while a seller’s permit grants you the authority to collect and remit sales tax on goods or services. They serve distinct purposes: one ensures general compliance with local regulations, and the other ensures tax collection from retail or wholesale transactions.

In many states, you’ll obtain a seller’s permit through the Department of Revenue, whereas a business license might come from a local city office or specialized board. If your LLC plans to sell goods, failing to secure a seller’s permit can lead to fines and audits. Conversely, lacking a business license can result in shutdowns.

An LLC provides liability protection and a business structure, while a license grants you legal permission to operate in a given field or locale. In many cases, you do need both. Your LLC status will not shield you from fines if you lack the license.

For instance, if you run a salon under an LLC, you still need cosmetology licenses for the stylists and a business license from your city. Failing to secure each required license undermines your legal standing. By obtaining both, you protect yourself financially and remain compliant. For comprehensive llc services that cater to your business needs, explore our offerings.

Yes, most LLCs in Georgia require a business license at the city or county level, depending on the business location. Local governments issue these licenses, so requirements vary. Some professions need additional state licenses. If your LLC sells taxable goods, a Georgia Sales Tax Permit from the Department of Revenue is necessary. Certain businesses also require industry-specific permits. To ensure compliance, check with your local city hall or county office. Operating without the required licenses can lead to fines or legal issues, so verify requirements early to avoid complications. Always consult a business attorney for tailored advice.

Stay Compliant with Licensing Laws

Harbor Compliance simplifies business license management, helping you track renewals and stay legally compliant. Avoid penalties and operate with confidence.