Buying an LLC offers entrepreneurs a unique opportunity to fast-track their business goals by acquiring an existing structure with potential brand equity, a customer base, and pre-established compliance. Unlike starting from scratch, this strategy can deliver immediate benefits—provided the due diligence is done right.

By purchasing an LLC, you can gain access to a ready-made business with revenue streams, built-in goodwill, and operational efficiency, all while minimizing the risks associated with the startup phase.

In this guide, we’ll explore:

- The benefits of buying an LLC over forming a new one.

- Key steps in the purchase process to ensure a seamless transition.

- Legal, financial, and operational considerations to secure your investment.

Let’s dive into everything you need to know to confidently acquire and manage an LLC in 2025!

Understanding What It Means to Buy an LLC

You might wonder why you’d buy an LLC rather than create one from scratch. After all, it’s easy enough to start your llc by filing the necessary papers. But purchasing an existing llc can offer immediate brand recognition, established business credit, and a built-in customer base. But purchasing an existing LLC can offer immediate brand recognition, established business credit, and a built-in customer base. If you're considering alternatives, can I open an LLC without a business might be an option. Below, we’ll explain what an LLC is and why acquiring one can be a strategic, cost-effective shortcut.

What Is an LLC and Why Buy One Instead of Starting from Scratch?

A Limited Liability Company—often referred to as limited liability companies—combines some advantages of corporations and partnerships. It protects personal assets by creating a corporate veil between you and the business’s debts or lawsuits. Normally, you’d form an LLC by filing articles of organization in your state. But if you’d like a jump on existing revenue or brand equity, buying an existing llc might be appealing. This way, you’re not forced to build from the ground up in areas like marketing or business licenses. For inspiration on naming, explore our best LLC names examples 2025.

The Key Benefits of Purchasing an Existing LLC

Taking over an already-formed LLC can save you both time and money. Here are a few standouts:

- Immediate Revenue: An LLC with existing contracts or accounts can generate cash flow quickly.

- Faster Market Entry: Skip the early stages of business growth that can be risky.

- Established Reputation: If the prior owner had a positive track record, you inherit that goodwill.

- Pre-set Structure: The LLC’s tax implications and business structure are already in place, simplifying transitions.

Additionally, an existing LLC might have previously handled regulatory concerns, making it easier to keep operations going right away.

Common Scenarios: When Buying an LLC Makes Sense

Not every buyer is an aspiring founder. Some are business owners seeking expansions or entrepreneurs wanting to pivot quickly. Maybe you find a specialized field interesting—like real estate—where building from scratch is cumbersome. In such cases, acquiring an LLC that already has local know-how and necessary business law compliance could help you launch new projects seamlessly. People with capital to invest but limited time might also appreciate a done-for-you structure.

Risks and Challenges of Acquiring an Existing LLC

While you gain many perks—like brand equity and possibly strong business credit—you also inherit potential pitfalls. The LLC might have hidden debts, pending lawsuits, or outdated tax returns. A negative reputation can also hamper future growth. Knowing these issues, you must carefully evaluate every aspect, from outstanding tax purposes to intangible factors like staff morale or prior management mishaps. Proper due diligence is key to ensuring you buy a strong foundation rather than a sinking ship.

Buy an LLC Seamlessly

Streamline your purchase with Northwest Registered Agent. Get expert guidance to secure your LLC and ensure a smooth transition.

The Step-by-Step Process to Buy an LLC

Below is a six-part roadmap to guide you in buying a business structured as an LLC. Each step addresses specific tasks, ensuring a smooth handoff of ownership and a well-documented transaction. Whether you’re a seasoned pro or a first-time buyer, following this sequence can help you maintain liability protection and pave the way for success.

Step 1: Identifying the Right LLC for Purchase

First, figure out which sectors or states interest you. Browse businesses for sale listings, consult brokers, or check local networks. Potential sellers might be business owners looking to retire or pivot. When you spot a promising candidate, confirm that its legal entity status is in good standing. Additionally, how to check LLC names can help ensure there are no naming conflicts. Look at whether the LLC’s registered agent is up to date, and see if they consistently filed their articles of organization amendments. This ensures the company is legit and properly formed.

Step 2: Conducting a Comprehensive Due Diligence

Once a target emerges, it’s time for thorough due diligence. Request financial statements, tax returns, and proof of current business licenses. Investigate any change in ownership that might have happened previously—did they follow legal steps? Don’t forget intangible assets like intellectual property or brand recognition. Also, confirm whether the LLC faces any open lawsuits or pending term sheet negotiations. The aim is to uncover red flags early, so you know exactly what you’re getting.

Step 3: Negotiating the Terms of Purchase

At this point, you and the seller should discuss the purchase price, payment methods, and other conditions. If the LLC is a single-member operation, negotiations might be simpler, but multi-member setups can be trickier. This is also where business structure adjustments come up—for example, if you want to keep the current corporate veil intact. You might sign a preliminary sell agreement or term sheet that outlines major points: price, timeline, included assets, and so forth.

Step 4: Drafting and Signing the Buyout Agreement

After hammering out details, formalize everything with a buyout agreement or purchase agreement. The document clarifies how transfer of ownership occurs—like if you’re buying all shares or just partial interest—and addresses how any personal assets remain shielded. Ideally, a lawyer with business law experience should help finalize it. Ensure clauses exist for potential change in ownership disputes, future liabilities, and tax implications. This stage cements your legal right to operate the entire llc.

Step 5: Filing the Transfer and Updating State Records

When the contract is signed, you typically need to update state offices that track limited liability companies. Each jurisdiction might have a form or procedure for indicating new membership or ownership changes. This step ensures your name is on record if future legal or tax purposes issues arise. At times, you also have to revise the articles of organization to reflect changes. Meanwhile, you might need to reappoint the best registered agent in Florida, especially if the prior one was the former owner.

Step 6: Transitioning Ownership and Operational Control

Finally, shift daily operations. This could mean informing customers, suppliers, and staff that the LLC has a new boss. Update bank account signatories and reflect buying an existing llc in official logs. If you’re rebranding or making management changes, do it gradually to keep the customer base loyal. Schedule a meet-and-greet with employees, or set up new vendor accounts if necessary. Once you’ve claimed the keys and integrated yourself, you can start steering the LLC toward your strategic goals.

Research sectors or states of interest, verify the LLC’s legal standing, and confirm up-to-date filings.

Review financial records, tax filings, licenses, and check for potential lawsuits or liabilities.

Finalize price, payment methods, and conditions while discussing business structure adjustments.

Create a buyout agreement to detail ownership transfer, liability protections, and operational responsibilities.

Update state records, amend articles of organization, and appoint a new registered agent if necessary.

Inform stakeholders, update bank accounts, and gradually implement rebranding or management changes.

Key Legal Considerations When Buying an LLC

Even if you have a robust buyout plan, certain legalities must be addressed to protect yourself fully. Below, we’ll look at important documents, regulatory rules, and the best times to obtain professional legal advice. Skipping these steps may create liability gaps or hamper your ability to manage the company post-sale.

What Is a Buyout Agreement and Why It Matters

The buyout agreement is a contract explaining how purchase price and membership interests are handed over. If there’s confusion about who holds voting rights or how the purchase agreement is structured, disputes can arise fast. By spelling out each party’s duties and clarifying next steps, the buyout agreement becomes your safety net. It also ensures that each departing or staying member understands the tax implications of transferring ownership. It also ensures that each departing or staying member understands the tax implications of transferring ownership. Additionally, defining the business purpose for LLC can clarify operational goals and strategies.

Managing Member Consent for LLC Ownership Transfers

In multi-member LLCs, an ownership transfer typically demands everyone’s approval. The buyout agreement might require a supermajority vote or unanimous consent. If you’re dealing with fractional ownership, ensure the LLC’s operating documents don’t forbid or heavily restrict new members. Any change in ownership must align with these guidelines to avoid internal lawsuits or conflicts that could disrupt the transition.

State-Specific Regulations You Must Follow

While start your llc guidelines are fairly standard, ownership transfers can vary from state to state. Some require you to publish a notice or update the business licenses. Others might ask for a newly amended annual report. If your newly purchased LLC operates across borders, you may need multiple state updates, especially if it’s a “foreign” LLC in different jurisdictions. Failing to adhere to these local rules might jeopardize your liability protection.

When to Consult a Lawyer: Legal Advice for Buyers

A qualified attorney with business law experience can be essential. They’ll check for hidden liabilities, ensure your articles of organization can be amended properly, and draft a bulletproof purchase agreement. If disputes surface, the lawyer ensures you’re not stuck with unexpected burdens. The cost of seeking counsel often pales compared to the potential meltdown from skipping thorough legal advice, especially if the LLC has complicated finances or intangible assets.

Financial and Tax Implications of Buying an LLC

Buying an LLC isn’t just about stepping into a functioning enterprise—it also involves tax burdens, potential income tax breaks, and other financial considerations. Often, how you structure the purchase can influence your final bill to the IRS or your state’s revenue department. Understanding these nuances now can save you from surprises later.

Many business owners weigh the pros and cons of an asset purchase (buying the LLC’s holdings outright) versus a membership interest purchase (acquiring the entire legal entity). Each route affects tax returns differently. For asset deals, you’d revalue items like equipment or intellectual property. Meanwhile, membership interest deals might let you keep older tax positions but could inherit undisclosed liabilities.

If the LLC was a single member llc, its taxes likely flowed through to one individual’s return, simplifying some transition aspects. In multi-member scenarios, verifying the entity’s pass-through structure or tax purposes classification is crucial, especially if the LLC elected S-corp or C-corp status. Documenting the purchase price allocation among tangible and intangible assets can also be critical for depreciation and tax implications.

Finally, the manner in which you pay for the LLC can influence your cost basis. Are you using cash, stock swaps, or a note? Each method might impact your future deductions or how quickly you recoup your investment. It’s wise to consult an accountant to finalize the approach that yields the best tax outcome.

Financial and Tax Impact Table

Here’s an overview comparing scenarios based on different approaches:

Remember, whichever route you choose, thorough due diligence ensures you’re not saddled with unforeseen tax bills or hidden costs.

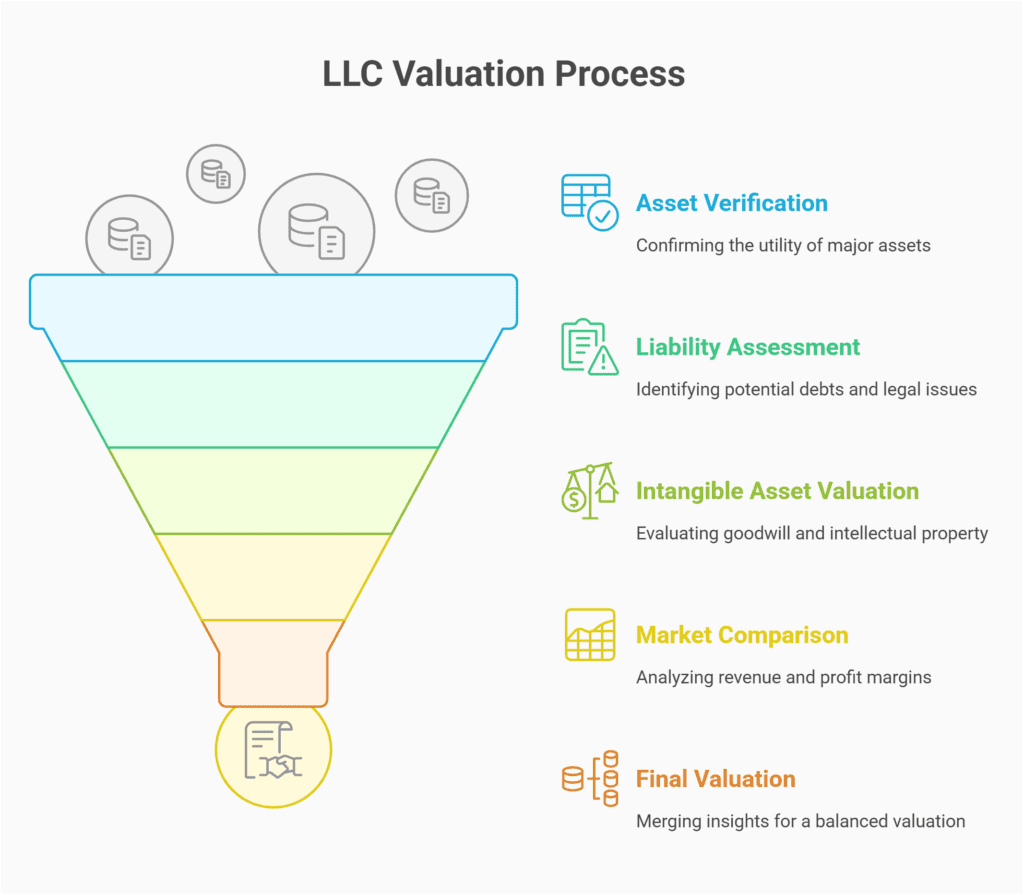

Evaluating and Valuing the LLC

Before committing to any purchase price, you need an honest assessment of the LLC’s worth. That goes beyond a quick glance at the financial statements. You’ll want to weigh intangible assets, such as brand recognition or specialized intellectual property. Below, we’ll outline a few strategies for sizing up an LLC’s overall health so you can confidently finalize your offer.

How to Assess an LLC’s Market Value

Valuing an LLC often involves comparing revenue, profit margins, and even local market conditions. Some owners use multiples of net earnings or revenue as a shortcut. But while helpful, it might ignore intangible elements like brand loyalty or unique technology. Another approach is the discounted cash flow method, which projects future earnings. A balanced perspective often merges these tactics, ensuring you don’t overpay or miss hidden value.

Analyzing Assets, Liabilities, and Financial Health

Request multiple years of tax returns, plus complete financial statements. Confirm each major asset—real estate, equipment, or intellectual property—still has utility and isn’t outdated. Also look for liabilities, from short-term debts to potential lawsuits. If the LLC has lines of credit or vendor relationships, see whether they remain valid after a transfer of ownership. The risk of your credit lines being re-evaluated under your leadership is real.

Valuing Goodwill and Intellectual Property

Sometimes, intangible factors define an LLC’s success. If it owns exclusive product patents or trademark rights, that intangible property can drastically boost the bottom line. Goodwill arises from loyal customers, brand esteem, or location benefits if it’s a storefront. While quantifying goodwill can be tricky, ignoring it could lead to undervaluation. On the flip side, paying too much for intangible assets that aren’t easily monetized can hamper returns.

Tools and Resources to Help You Appraise an LLC

You can hire professional business appraisers or rely on specialized software. Advisors factor in term sheet negotiations, local competition, and even intangible brand equity. Some CPAs or attorneys also partner with you to interpret the data. Ultimately, the goal is to create a purchase agreement aligning your perceived value with the seller’s, ensuring both parties walk away satisfied.

Financing Options for Purchasing an LLC

Unless you’re paying in cash, you might need financing to seal the deal. From personal savings to SBA loans, multiple avenues exist to fund the acquisition. Below, we’ll map out typical sources, highlight pros and cons, and offer strategic tips so you can secure capital at favorable terms.

Using Personal Savings vs Business Loans

Some buyers tap personal funds to expedite the transaction and skip lender red tape. This route can simplify negotiations but risk personal finances if things falter. Meanwhile, a business loan—often from a traditional bank—offers structured repayment, freeing up personal reserves. You’ll likely need a solid credit score, a thorough business plan, and robust financial statements from the LLC to reassure lenders of viability.

SBA Loans: A Guide to Financing Small Business Acquisitions

The Small Business Administration (SBA) might guarantee part of your loan for buying a business, letting banks lend with less risk. You can get competitive rates and extended terms. Expect detailed documentation, including business tax returns and due diligence on the LLC’s finances. Though the process can be lengthy, SBA loans often deliver more favorable interest rates and better-lenient structures than conventional loans.

Structuring Payment Terms for LLC Acquisitions

Not all deals are 100% cash upfront. You could craft creative terms—like partial down payment, plus an installment plan. A purchase price might also be contingent on certain performance milestones post-sale, known as “earnouts.” This approach can protect you from inflated valuations if the LLC’s future revenue doesn’t meet seller claims. Just ensure your purchase agreement clearly spells out how to measure and disburse these amounts.

Partnering with Investors to Fund Your Purchase

If you lack capital or can’t meet bank criteria, consider bringing on one or more investors. They might provide financing in exchange for partial membership interests. This approach can lighten your personal financial burden, but it also means sharing control and profits. In some setups, the investor remains a silent partner; in others, they expect an active role in management decisions.

Industry-Specific Insights: Tailoring the LLC Purchase

Different sectors carry unique concerns, from regulatory constraints to operational nuances. When you’re acquiring an LLC in real estate, e-commerce, or franchising, knowing the details is crucial to avoid missteps. Below is a handy table comparing some top industries to see where to focus your due diligence efforts, plus sub-sections offering deeper guidance.

Acquiring an LLC for Real Estate Investments

Real estate LLCs often hold property assets and rental contracts. Double-check each lease for transfer of ownership clauses to ensure tenants can’t terminate or renegotiate. Also examine local zoning if you plan expansions or conversions. If your target LLC relies heavily on a single prime property, confirm there’s no hidden lien or pending condemnation threat.

Buying an LLC in the E-Commerce Sector

E-commerce can skip certain overhead—like physical storefront rent—but you’ll want to confirm the site’s domain ownership, social media accounts, and brand reputation. In reviewing the financials, see if the brand has consistent sales or if it soared from short-term marketing stunts. If a big portion of revenue hinges on an Amazon store, confirm it’s stable, as changing marketplace policies can greatly affect income.

Purchasing a Franchise LLC: What Makes It Unique

When you buy a franchised LLC, you’re not just inheriting the local operation but the franchisor’s overarching rules. The purchase agreement must address transfer fees or brand compliance. Some franchisors insist you pay a new franchise fee even if the prior owner had already covered it. Additionally, they might require training or on-site inspections before approving your purchase. Communication with the franchisor is vital to avoid post-sale friction.

Specialized Considerations for Service-Based LLCs

Service-based enterprises—like consultancies or marketing agencies—thrive on reputation and personal networks. If top employees or the founder is leaving, the LLC might risk losing clients. Make sure any sell agreement includes non-compete clauses or ensures key staff remain post-sale. Confirm the relevant professional licenses remain valid after a change in ownership. Otherwise, you might need re-licensing or additional credentials to serve existing clients.

Simplify LLC Transfers with ZenBusiness

ZenBusiness helps you navigate buying an LLC with confidence. Gain immediate access to revenue and a strong foundation.

What to Do After Buying an LLC

Congratulations—you’re now the proud owner of a new (to you) LLC! But your journey doesn’t end here. Transitioning smoothly requires tying up loose ends, updating official records, and building on the LLC’s existing momentum. This final phase of purchasing an existing llc is about ensuring day-to-day operations remain stable while you add your personal stamp on the business.

First, reevaluate your business structure to confirm whether the LLC’s previous classification still suits your future plans. If you want to tweak tax purposes, speak with an accountant to see if an S-Corp election benefits you. Additionally, update any vendor contracts that reference the old ownership. Some suppliers might require a new credit check or fresh signature. In certain states, you’ll need revised business licenses or updated local permits to reflect the new management team.

It’s also key to reaffirm liability protection—are the company’s finances and personal finances separated, preserving the corporate veil? Check each bank account name, ensuring they reflect your name as the controlling manager. Communicate with employees, explaining the change in ownership and your vision going forward. This fosters trust and continuity, especially if you plan to expand or pivot. Lastly, keep lines of communication open with the old owner, in case you need clarifications on operational quirks or tax implications that might surface in the first few months.

Common Mistakes to Avoid When Buying an LLC

Missteps in an LLC purchase can sabotage your fresh start and saddle you with hidden headaches. Here’s how to dodge typical pitfalls and uphold a smooth transfer. By being proactive, you keep the path clear for growth and success.

- Skipping Thorough Due Diligence: Overlooked debts, lawsuits, or incomplete financial statements can haunt you.

- Failing to Clarify Transfer Protocol: If the LLC’s membership rules require unanimous consent, ignoring these steps can invalidate the sale.

- Not Updating State Records Promptly: Delays in official updates can cause confusion with tax or legal authorities.

- Forgetting Intangible Assets: Don’t forget intellectual property or brand goodwill that might need separate documentation.

- Neglecting Post-Sale License Renewals: Missing new or renewed permits can lead to forced shutdowns.

Staying vigilant about each step ensures you keep the entire llc structure intact and ready to thrive.

Benefits of Buying an LLC vs Starting a New One

Some prospective entrepreneurs wonder if it’s cheaper or simpler to just form a brand-new LLC. Indeed, launching from scratch might seem easy: you fill out articles of organization, pay a filing fee, and start your llc. Yet purchasing can fast-track your launch. Below are top reasons:

- Existing Customer Base: You don’t need to build from zero—there’s an established business owner history and audience.

- Immediate business credit: A well-aged LLC can have credit lines or vendor relationships you can use.

- Shortened Ramp-Up: You skip the time-consuming launch phase, diving straight into revenue generation.

- Potential Bargains: If the seller is motivated—due to retirement or urgent liquidity needs—you might land a favorable purchase price.

However, keep in mind that adopting prior owners’ baggage might lead to new challenges. Always weigh the pros and cons thoroughly. If you’re comfortable with official forms and process to start the LLC, a DIY approach might save you $50 to $300 in service fees. However, utilizing a best LLC service can streamline the process and reduce potential errors.

Frequently Asked Questions About Buying an LLC

Below are concise answers to the most pressing questions about buying a business structured as an LLC. Each is optimized to rank highly for quick insights, perfect for entrepreneurs eyeing an efficient path to purchasing an existing llc.

While not legally mandated in every scenario, consulting an attorney specializing in business law is highly advisable. They’ll verify that the purchase agreement covers liabilities, tax implications, and transfer of ownership details clearly. Additionally, a lawyer helps ensure you’re not inheriting undisclosed debts or legal claims. If you’re skipping professional oversight, you risk signing a term sheet that fails to protect your personal assets, especially if lawsuits arise after the handover. In short, while it’s possible to handle the transaction solo, legal advice often proves invaluable to safeguard your interests.

Costs vary, but expect to budget for due diligence, legal document prep, and the purchase price. The latter might be a flat amount or an earnout if future performance matters. Attorney fees range from $1,000 to $5,000 or more, depending on complexity. You might also pay extra for specialized audits of financial statements, tax returns, or intellectual property. If the LLC uses a paid registered agent, transferring that service may add minor fees. Overall, factoring in these one-time and ongoing costs helps you finalize a realistic acquisition budget.

Time frames vary. A straightforward transaction might close in 30–60 days, especially if the existing business has pristine books and a willing seller. Complex deals—like those requiring multiple approvals from members—could stretch to a few months. Steps like due diligence, drafting a buyout agreement, and waiting on state-level processing can add delays. Additionally, if you’re seeking external financing (e.g., SBA loans), expect added weeks for application reviews. So while it’s possible to wrap up quickly with all parties aligned, factor in extra time for unexpected snags.

Yes, partially. You can find businesses for sale on online marketplaces, then conduct early negotiations virtually. E-signatures can finalize documents, and some states let you handle change in ownership filings through e-portals. However, you still need real-world tasks like verifying personal assets or physically inspecting assets if you’re cautious. And while “online” can speed up the process, certain steps—like verifying business licenses—often require direct contact with state agencies. Ultimately, an online approach is feasible for many aspects, but remain diligent to avoid missing critical offline details.

When you buy membership interests, you generally inherit the LLC’s obligations—unpaid invoices, potential lawsuits, or unfiled taxes. The corporate veil can protect your personal holdings, but the entire llc remains on the hook for prior liabilities. Thorough due diligence helps you find out if there are claims or outstanding liens. If you suspect risks, consider structuring the deal as an asset purchase so you exclude certain debts. Clarify all these details in your purchase agreement to ensure any liabilities discovered post-sale remain the seller’s responsibility, if that’s your intent.

Protect Your LLC Investment

Harbor Compliance offers due diligence services for LLC acquisitions. Secure your business with trusted professionals.