Wondering how to avoid using home address for LLC? While it’s legal in many states, putting your home address on the public record can create privacy concerns, security concerns, and weaken your business image. The cleaner business formation setup: use a registered agent service with an in-state real street address for service of process, and a commercial address or virtual business address for your principal address, mailing address, and official business lines. This approach offers entrepreneurs the advantages of stronger privacy and security, compliance with zoning laws, and a more professional image when you register your business.

This guide shows how to make the switch, what each address for your LLC is used for, and how to keep your business operations compliant without exposing your personal address.

Why you should Avoid Using your Home Address for your LLC

Using your home address for LLC registration might seem convenient, but it can expose your privacy and security while introducing legal and professional risks. Here’s why business owners should explore alternatives for a safer and more professional image, and why it’s often best to avoid using home address for llc.

Can I Use my Home Address for LLC?

A residential address can legally be used as an address for an llc (many limited liability companies do this), but it becomes part of the public record, searchable through most Secretary of State portals and often surfaced by the filing process, whether you’re in york city or running a digital operation.

This transparency offers few advantages to business owners or entrepreneurs, and real privacy concerns do exist; it can create complications if clients or vendors show up at your home address uninvited, blurring boundaries between your business and personal life.

Risks of Using Your Home Address

Using your home address for LLC registration comes with multiple challenges that can affect both your personal and professional life. Below, we explore key risks, from compromised privacy to potential legal exposure and reputational costs.

Privacy

Registering your LLC with a home address exposes it publicly, which can lead to data misuse, unsolicited visitors, or other safety issues. For business owners, this lack of privacy blurs the boundary between personal and professional life. (No one wants a knock at the door during family dinner.)

Zoning Laws and HOA Restrictions

Some residential zones prohibit business activities or impose restrictions under Homeowners’ Association rules, potentially creating compliance hurdles. Non-compliance can result in fines or the need to relocate operations, so always confirm zoning laws before you file.

Liability

Using a home address does not, by itself, jeopardize limited liability. What matters is maintaining the entity’s separateness, observe formalities, avoid commingling, and keep separate business records. Failing those can weaken the corporate veil and expose personal assets to claims tied to your business.

Impact on Business Image

Displaying a personal address on your business documents or marketing materials can undercut professional image. Prospective clients may question credibility or perceive instability — especially when reliability and client trust matter most.

In contrast, opting for a professional mailing solution can upgrade brand perception, reinforce credibility, and help your business stand out in competitive markets. A small change in address can feel like a big step up to your customers.

Protect Your Privacy with Northwest

Get a professional address and stay compliant effortlessly.

Best Alternatives to your Home Address for your LLC

When registering your LLC, choosing the right address to register is crucial for privacy, professionalism, and compliance. Whether you run a fully remote company or a growing team, these options help you present a commercial address without exposing your home.

1. P.O. Box

A practical way to keep home details off public filings is a P.O. Box at a USPS facility. It offers mail security and flexible pickup, but remember: most states require a physical street address for the registered agent, so a P.O. Box alone won’t satisfy that rule. Use it as your mailing address and keep a separate street address for filings when required (some states explicitly say “no P.O. Box” for certain fields). This also reduces basic security concerns tied to publishing your home.

2. Virtual Mailbox Service

A virtual mailbox service provides a street address plus online mail management, letting you scan, view, and forward items from anywhere, handy for a modern, digital workflow. Most providers operate as CMRAs, which means USPS requires PS Form 1583 (ID verification) before handling your mail. It’s a strong mailbox solution, but you’ll still need a separate registered agent address where required.

3. Commercial Mail Receiving Agency (CMRA)

Also called mailbox-rental or mail-forwarding services, a CMRA gives you a legitimate street address while it receives and forwards mail on your behalf. Many will scan envelopes so you can decide what to open or forward. Compare service levels, scan speeds, and fees—and confirm the provider is properly registered with USPS. This is a clean way to keep a consistent commercial address across platforms.

4. Virtual Office Services

A virtual office bundles a business address, mail handling, and optional perks like meeting rooms and receptionist service. It helps you appear established without leasing space. Just note: a virtual office address doesn’t automatically cover registered agent obligations — most states still require an in-state RA at a real office. Evaluate the pros and cons versus your budget and client expectations.

5. Renting or Leasing Commercial Space

If you have team members, storage needs, or client visits, leasing commercial space can project credibility and simplify compliance. You’ll operate at a true business location, often with signage and parking. Balance costs carefully and confirm local zoning rules before signing a lease — especially if you’re transitioning from home-based operations.

6. Using a Partner’s or Collaborator’s Address

When a partner works from a professional site, their address can serve as your business address, with written consent and state compliance. Align on mail handling and who receives official business documents to avoid mix-ups. This is budget-friendly for early-stage teams, but set expectations in writing.

7. Coworking Spaces

Coworking gives you a professional address, access to workspace, and a built-in community. Many locations accept business mail; however, service of process usually still goes to your registered agent, not the front desk—so plan accordingly. If clients visit, book meeting rooms to keep your brand experience consistent.

8. Business Domiciliation Services

“Domiciliation” providers package a virtual office address, mail management, and add-ons like meeting space. It’s ideal for the time-pressed entrepreneur who wants a professional footprint without a long-term lease. Verify what’s included (mail scanning, forwarding speeds, visitor policies) and confirm it pairs well with your registered agent setup.

| Solution | Cost | Privacy Level | Legal Compliance | Best For |

|---|---|---|---|---|

| P.O. Box | Low (USPS fees) | Moderate | Limited (not valid for service of process) | Basic correspondence for very small businesses. |

| Virtual Mailbox Service | Medium (monthly fees) | High | Valid for most business needs | Remote businesses needing mail management and street address. |

| CMRA | Medium to high | High | Generally valid | Entrepreneurs needing mail forwarding and a physical address. |

| Virtual Office | High (location-dependent) | High | Valid for LLC registration | Businesses requiring professional image and administrative services. |

| Commercial Space | High (rent or lease) | Very High | Fully compliant | Teams with employees, physical storage, or client-facing businesses. |

| Partner’s/Collaborator’s Address | Minimal (or shared costs) | Moderate | Valid with consent and state rules | Startups or partnerships with limited budgets. |

| Coworking Spaces | Medium (membership fees) | High | Generally valid | Networking-focused businesses seeking flexible workspaces. |

| Business Domiciliation | Medium to high | Very High | Fully compliant | Entrepreneurs requiring a polished image and meeting facilities. |

What are the Legal Requirements for LLC address?

Selecting the right address for your LLC is critical to meeting tax and compliance obligations. A registered agent service helps you stay on top of official notices, while your chosen address must satisfy state rules to avoid legal issues. For the IRS, you’ll list a mailing address and a separate street address for your business location on EIN paperwork.

Coordinating your EIN registered agent details properly can help streamline compliance and filing processes.

Registered Agent Address Requirements

A registered agent service is essential for receiving official documents like tax notices, legal correspondence, and other important filings. It’s crucial to understand the distinction between a registered agent address vs business address when structuring your LLC. The agent acts as your LLC’s point of contact for these matters, ensuring you stay informed about any legal or tax-related issues. Every LLC is required to designate an agent with a physical address in the state where the business is registered.

The registered agent’s address cannot be a P.O. box; it must be a physical location accessible during normal business hours to handle service of process and other legal correspondence. If you’re considering a P.O. box for LLC, ensure it complies with your state’s legal requirements for business filings. For additional details, you can consult state-specific regulations through the Small Business Administration’s guide to LLC requirements. Ensuring compliance with these requirements helps maintain your LLC’s good standing.

IRS and State Requirements

The IRS and state agencies use different forms with different address lines. IRS Form SS-4 requires a street address (no P.O. box) for your principal place of business, while states may allow more flexibility for mailing fields on formation articles or annual reports. Keep addresses aligned across filings to prevent delays, notices going to the wrong place, or avoidable legal issues.

Simplify LLC Setup with ZenBusiness

Start strong with expert guidance and flexible solutions.

Virtual Address: A Modern Solution

A virtual address has become a popular choice for business entities, providing privacy, professionalism, and flexibility. It’s a convenient way to avoid using your home address in LLC registration while maintaining a credible business presence.

What Is a Virtual Address?

A virtual business address gives your LLC a professional image without leasing physical office space. It serves as a centralized hub for mail handling, ensuring important documents are processed efficiently. Most providers operate as CMRAs (registered with USPS) and will scan and provide mail forwarding so you can manage it online via a digital dashboard.

Remember, a virtual address for LLC is great for your mailing address, public listings (and sometimes the public record), but it does not replace your registered agent service, you still need an in-state physical address (a real street address) for service of process. Using a virtual address for LLC not only enhances privacy but also ensures your business maintains a credible presence.

Benefits of Using a Virtual Address

- Privacy: A virtual address keeps personal details off public records, reducing security risks and keeping your home address out of view. (Your future self will thank you.)

- Professionalism: A professional address signals credibility and trustworthiness, helping you show up polished to clients and partners.

- Convenience: Providers offer online mail management, scanning and forwarding, and secure storage, saving time and effort while you focus on growth. Key advantages include easier multi-location presence without extra leases.

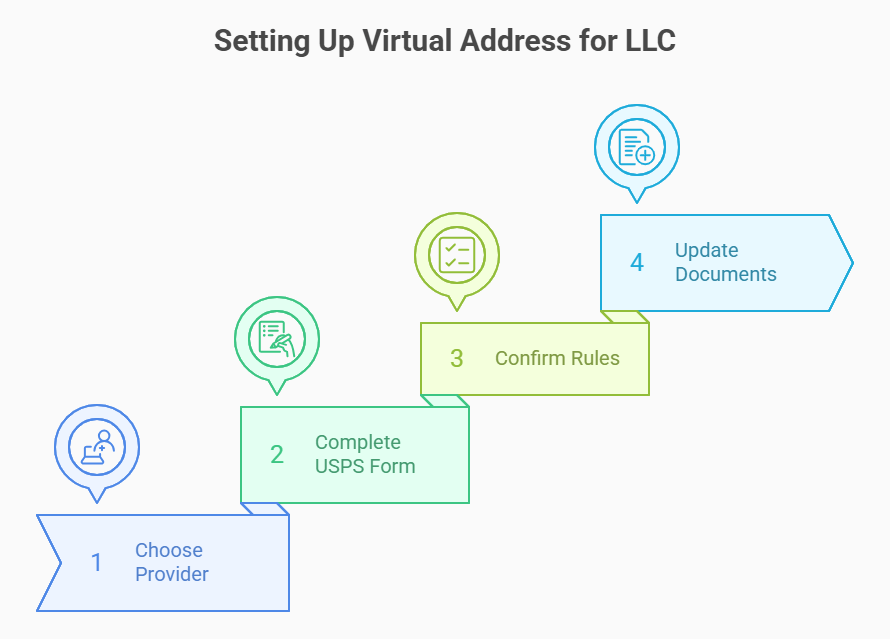

Step-by-Step Guide: Registering Your LLC with a Virtual Address

Setting up a virtual address for your LLC is straightforward and can significantly enhance privacy and professionalism. Follow these steps to ensure your business meets all legal and operational requirements effectively:

- Pick a reputable provider for mail forwarding, scanning, and document management. If you also need a registered agent, verify the provider offers that service—or hire a separate registered agent to stay compliant.

- Complete USPS PS Form 1583 (with ID verification/notarization) so the CMRA can legally receive mail on your behalf; this is mandatory.

- Confirm state and IRS rules: Use a street address (no P.O. box) where required (for example, IRS SS-4; many CA filings). Then update official documents (operating agreement, annual report) to keep records consistent.

By following these steps, you’ll transition smoothly to a virtual address — protecting your personal information, keeping filings consistent, and reinforcing your LLC’s professional image.

Keep Your Home Address Off Public Records

Want to keep your home address off the public record without breaking compliance? Pair a registered agent service for all “RA” fields with a virtual mailbox (street-address CMRA — a virtual business address) for your principal address and mailing address. This combo preserves privacy and security while staying square with state rules that require an in-state, real street address for service of process during business hours (no post office boxes). It offers entrepreneurs the advantages of a more professional image and a cleaner compliance process.

Pro tactics (quick plan):

- Use a registered agent service for “RA” fields. Your RA’s physical address appears on state records and receives service of process during business hours; a P.O. box (i.e., post office) isn’t acceptable in many states.

- Use a virtual mailbox for principal/mailing. Choose a CMRA with a real street address and complete USPS PS Form 1583 so they can handle mail handling and mail forwarding. (This doesn’t replace your RA.)

If your home address was used before (clean-up checklist):

- File a state amendment or update on your annual report to change principal address/mailing address (examples: Florida online update; California Statement of Information).

- Notify the IRS with Form 8822-B (business address/responsible party change) so postal mail for tax purposes routes correctly.

- Update licenses, bank, and vendors so official business correspondence goes to your new address.

- Scrub your domain and data-broker listings: enable WHOIS privacy/proxy at your registrar and opt out of people-search sites.

- Re-verify your Google Business Profile after an address change; Google may require re-verification.

A quick swap to professional addresses helps you stay compliant, look polished, and feel safer—without inviting business mail (or service of process) to your front door.

Mistakes That Leak Your Home Address

Small oversights can put your home address on public records fast. Avoid these common traps so your filings stay consistent, compliant, and private.

- Putting your home in RA fields. Your registered agent address must be a physical street address in the state and available during business hours for service of process—a home address here goes straight to searchable state databases. Most states explicitly say no P.O. Box for the RA (e.g., Florida).

- Mixing addresses across agencies (state, IRS, bank). If your state filing shows one address but the IRS/SS-4 or bank shows another, mail and notices can misroute—and your old home address may linger online. File IRS Form 8822-B for changes and use a street address (no P.O. Box) where required on SS-4; keep state records (e.g., CA Statement of Information) aligned.

- Assuming a P.O. Box solves RA (it doesn’t). A P.O. Box can work for mailing, but it cannot be used for the registered agent address. States require an in-state street address for the RA (example: Florida). Use a registered agent service plus a virtual mailbox for principal/mailing fields.

- Printing your home address on permits, invoices, or your site’s footer/privacy policy. Anything customer-facing can be copied, cached, or scraped by people-search sites. Use a business address consistently across receipts, policies, and contact pages to prevent unnecessary exposure.

Conclusion: Choosing the Right Business Address

Selecting the right address for your company goes beyond compliance; it’s about protecting your privacy, projecting professionalism, and setting the stage for future growth. Whether you’re running a small startup or a growing corporation, your choice can significantly impact your business image.

For many owners, virtual addresses and coworking spaces strike the perfect balance between cost-efficiency and practicality. Those looking for a more established presence might consider renting or forming partnerships to secure a physical business address. The key is to evaluate your unique needs and goals before deciding.

If you’re planning an address change or want to avoid using your home address, take the time to seek advice from professionals who specialize in business formation. By doing so, you’ll ensure your decision aligns with long-term success, compliance, and operational ease.

No matter your budget or scale, carefully selecting your LLC’s address is a foundational step in forming a business you can confidently grow. Whether it’s for mail handling, branding, or client interactions, the right choice makes it easier to manage your operations effectively—without unnecessary rent or privacy risks.

Frequently Asked Questions: Setting Up Your Business Address

Curious about how to manage your company's address effectively? Here are the most common questions answered to guide you through setup, changes, and ensuring compliance for your growing venture.

Do I need to have a physical office to register my business?

No, having a dedicated office isn’t mandatory for registration. However, you must list a valid address to meet requirements. This can include using authorized services such as a virtual address or shared spaces for flexibility.

How can I change the business address for my LLC?

Start by notifying your state’s secretary through the appropriate forms, often available online. Update the address across all official documents, including tax records, contracts, and your operating agreement, to ensure compliance and avoid delays.

Does the IRS accept virtual business addresses?

Yes, virtual addresses are typically acceptable for federal purposes. However, they cannot be used as the location for IRS visits or inspections. Always check with authorized counsel to confirm your address meets the necessary standards.

Do you need a business location for an LLC?

Not necessarily. While a physical base isn’t required, you do need a valid address for records and correspondence. Many LLC owners opt for rental options or virtual addresses to meet their needs without committing to a fixed location.

Can my LLC have multiple addresses?

Yes, multiple addresses can be used for various purposes. For instance, one address may be designated for mail, while another is used for operational records. Ensure all addresses are updated accurately in your LLC formation documents.

- IRS: About Form 8822-B, Change of Address or Responsible Party — Business

- IRS: Form 8822-B (PDF)

- USPS: PS Form 1583 (PDF) — Application for Delivery of Mail Through Agent

- USPS: PS Form 1583-A (PDF) — Application to Act as a CMRA

- USPS Postal Explorer: DMM 508 — Recipient Services (CMRA requirements)

- U.S. Small Business Administration: Pick your business location (zoning & compliance)

- ICANN: Registration Data (WHOIS/RDDS) Lookup

- ICANN: WHOIS and Registration Data Directory Services

Compliance Made Easy with Harbor

Manage your address and legal requirements seamlessly.