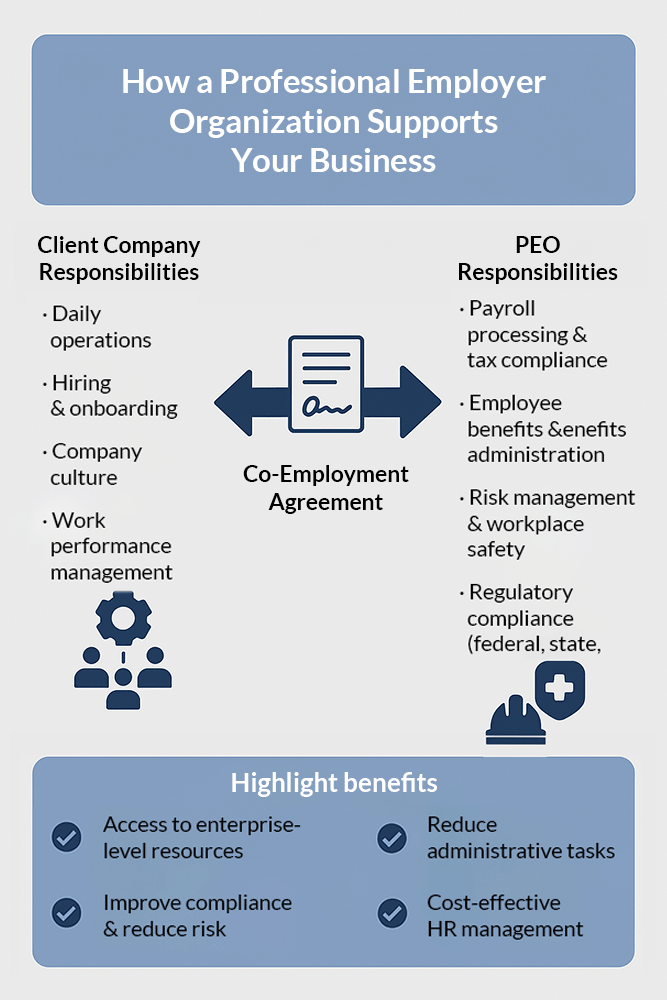

A PEO, or Professional Employer Organization, is a type of HR outsourcing provider that enters into a co-employment arrangement with a client company. The PEO becomes the employer of record, handling payroll taxes, employee benefits, workers’ compensation, and employment law compliance, while the client company keeps operational control. This structure allows businesses to reduce administrative burdens, lower risks, and access better employee benefits without building a full in-house HR team.

With these basics in mind, let’s take a closer look at how PEOs work, why businesses use them, and how they differ from staffing companies.

Understanding Professional Employer Organizations

A professional employer organization (PEO) is a company that joins with a client company to provide essential human resource functions under a co-employment model. A PEO helps businesses to handle payroll processing , employee benefits and regulatory compliance , which helps to reduce administrative tasks. To learn more, see Professional Employer Organization on Wikipedia .

What Does PEO Stand For?

PEO stands for professional employer organization . It's a type of HR outsourcing provider that partners with a client company through a co-employment arrangement. The PEO handles all HR functions including payroll, employee benefits and regulatory compliance . So, it allows small businesses to have access to enterprise-level resources, without incurring charges for maintaining a full in-house HR department.

How PEOs Work Through Co-Employment

In co-employment, the professional employer organization (PEO) takes over as the employer of record for tax and benefits purposes, while the client company retains control over business operations and management of work performance. The PEO can take on regulatory compliance and administrative tasks through this structure.

The client company conducts recruiting and hiring workers, trains and supervises them while PEO looks after the payroll, employee benefits , workers compensation, and employment laws compliance. When the employer responsibilities are divided in this way, a small business can reduce its administrative responsibilities and ensure compliance with legal requirements without relinquishing operational control.

What Services Do PEOs Provide?

A professional employer organization offers complete portfolios of PEO services that help business owners manage critical HR functions. These are payroll processing , benefits administration, risk management , and regulatory compliance which lessen administrative tasks and support long-term business growth .

Payroll Processing and Tax Administration

Dealing with payroll processing and payroll tax management is time-consuming and leads to expensive mistakes. According to the US Small Business Administration, human resources and payroll outsourcing can free up a small business ‘ resources. A professional employer organization can take care of these processes with the help of dedicated systems to ensure accuracy, timing and tax compliance while reducing the administrative load on the client company .

Key payroll and tax administration services include:

- Calculating gross and net pay for all employees.

- Managing the holdings and filing of payroll taxes.

- Preparing and delivering pay stubs

- Handling the filing of W-2s and 1099s at year-end.

- Managing garnishments and deductions.

- Ensuring compliance with federal and state tax laws

Employee Benefits and Workers' Compensation

A professional employer organization allows small businesses and medium-sized companies access to competitive benefits packages designed for large companies. These can include health insurance, dental and vision plans, retirement programs, and wellness initiatives – helping employers attract and retain top talent.

PEOs manage workers' compensation programs, liability, claims management, and compliance with relevant regulations. By centralizing benefits administration and safety measures, the client company lessens employer responsibilities while safeguarding its people and ensuring compliance with employment laws .

HR Support, Risk Management, and Compliance

A professional employer organization provides ongoing HR support for hiring, onboarding, and employee relations, while implementing proactive risk management strategies to insulate your business. This may include ensuring regulatory compliance with employment laws , overseeing workplace safety programs, or guiding the client company through complex legal requirements, all of which mitigate liability and help maintain a positive and compliant workplace.

Technology and Employee Self-Service Tools

Professional employer organizations that use new technology help improve efficiency and streamline their administrative tasks . These solutions combine payroll calculations, benefit tracking, time management, and other compliances into a single secure system.

With employee self-service tools, employees can view pay stubs, change personal information, sign up for employee benefits and monitor paid time off. This digital accessibility eases the burden on HR of the client company . It increases workforce transparency and satisfaction.

Simplify HR and Payroll with Justworks PEO

Justworks makes it easy to manage payroll, benefits, and compliance—all in one streamlined platform designed for growing businesses.

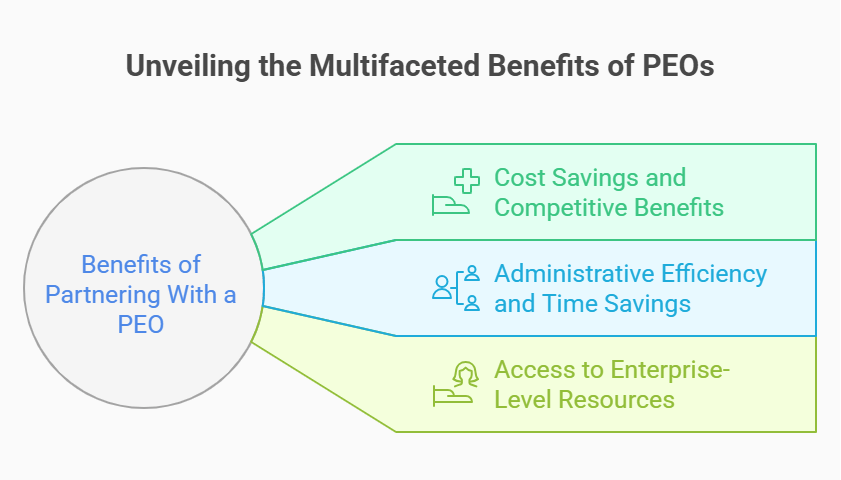

Key Benefits of Partnering With a PEO

Business owners become more cost-effective, receive more competitive benefits , and have fewer administrative tasks when using a professional employer organization . When small businesses and medium-sized companies work with a PEO, they can improve regulatory compliance , enhance HR efficiency and gain enterprise-level resources without the cost of keeping a full in-house human resources department. Check out our detailed guide for a complete list of top PEO providers for small businesses to help business owners make the right choice.

Cost Savings and Competitive Benefits

A PEO or professional employer organization helps small businesses and medium-sized companies lower their HR related costs by pooling employees, allowing them to benefit from large company rates. Affordable health insurance , retirement plans, and other benefit packages . Through cutting costs and enhancing employee offerings, a PEO helps the client company to attract and keep talent while remaining compliant with employment laws .

Administrative Efficiency and Time Savings

Outsourcing HR to a professional employer organization allows business owners to take on fewer administrative responsibilities and give them time to plan strategically. According to the Harvard Business Review, work/life support programs have unexpected benefits that can help boost productivity and reduce employee turnover . PEOs manage complex processes accurately and consistently, allowing the client company to focus on business growth and core operations.

Top time-saving benefits include:

- Payroll processing and tax compliance handled by experts

- Centralized benefits administration

- Simplified onboarding and hiring processes

- Proactive risk management and regulatory updates

- Streamlined human resources communication and documentation

Access to Enterprise-Level Resources

A professional employer organization gives small businesses and medium-sized companies access to many resources that large companies have. We provide expert compliance guidance, competitive benefits packages , and advanced human resources technology.

A client company can improve employee benefits , training programs, and HR management best practices by taking advantage of the PEO model ’s scale and expertise. Tools at the enterprise level help businesses manage competition and grow sustainably.

PEO vs Other HR Solutions

When looking at a professional employer organization and other HR outsourcing models, business owners need to consider services, pricing and compliance support. By knowing these differences, a client company will be able to choose the best option suited to size, need, and business. To explore detailed comparisons of the best PEO companies for 2025 and browse a comprehensive list of PEO companies with trusted providers, visit our resources.

PEO vs. Administrative Services Organization (ASO)

Unlike ASOs, which simply handle HR but don't take on any additional employer responsibilities , PEOs adopt a co-employment model that makes them the employer of record . Both do provide HR services, but in different ways.

| Feature | PEO | ASO |

|---|---|---|

| Employment Model | Co-employment arrangement | No co-employment |

| Employer of Record | Yes | No |

| Payroll taxes & Compliance | Managed by PEO | Managed by client |

| Employee Benefits Access | Large-group plans | Client's own plans |

An ASO can be a good choice for companies wanting HR assistance without changing the employment relationship , but a PEO offers broader compliance coverage and access to enterprise-level benefits.

PEO vs. Traditional HR Outsourcing

A professional employer organization provides a full suite of HR services to small businesses and medium-sized companies through a co-employment model, in which the PEO is the employer of record for the employees as far as, for instance, payroll processing , employee benefits , risk management , and regulatory compliance are concerned. The structure offers small businesses access to enterprise-level resources and large group benefit plans.

Classic or Traditional HR outsourcing does a specific human resource function such as recruiting or benefits administration . Unlike professional employer organizations (PEOs), they don't take on any employer responsibilities . Also, they do not take on any liability for compliance. Though this choice might fit businesses in search of precise assistance, it won't provide the all-in-one integration or compliance coverage offered by a PEO.

PEO vs Staffing Companies

A professional employer organization enters into a long-term co-employment relationship with the client company in which it controls payroll taxes , employee benefits and regulatory compliance but the client company maintains operational control. In contrast, staffing companies provide independent contractors and temporary workers for short-term use only. They do not provide benefits administration or any employer responsibilities . We'll look at the advantages of PEOs in detail. Generally speaking, PEO services enable businesses to benefit from HR outsourcing.

PEO vs. In-House HR Departments

A PEO provides scalable HR solutions that often cost less than maintaining an entire in-house human resource department. A PEO gives you big company capabilities without the expense of adding staff by managing payroll processing , employee benefits , risk management , and regulatory compliance .

On the other hand, in-house HR teams provide companies with direct control over their processes. But they also require a serious investment in salaries, training and technology. This model offers the flexibility to larger businesses with complex requirements. However, small businesses with a quest for flexibility, advanced tools and cost cutting would find this restrictive.

Power Your Business with Oasis PEO by Paychex

From payroll and HR to employee benefits, Oasis delivers full-service PEO support backed by Paychex’s trusted expertise.

Choosing the Right PEO for Your Business

When choosing a professional employer organization , it is important to evaluate their services, cost and experience in your industry. Making the right choice guarantees effective HR support, solid regulatory compliance and a partnership that works with your business operations and goals around growth.

Essential Factors to Evaluate

When it comes to selecting the best professional employer organization , it takes more than prices. Business owners should review what each service provider guarantees in terms of their capabilities, track record, and compliance standards. This way, they can ensure that they enter a PEO partnership that would help them grow and will not compromise their client company . You can also check a curated list of PEO reviews to learn about provider reputations and service quality. Additionally, for added assurance of compliance and reliability, consider providers certified under the IRS Certified Professional Employer Organizations (CPEO) Program .

Key evaluation criteria include:

- Range of PEO services offered

- Industry experience and human resource expertise

- Regulatory compliance record

- Payroll processing and tax handling efficiency

- Quality of employee benefits and benefits administration

- Technology tools and reporting systems

- Customer support responsiveness

- Pricing transparency and contract flexibility

Questions to Ask Potential PEO Partners

Before signing an employment agreement with a PEO, develop a series of questions for the PEO to clarify the employer's services, costs and compliance responsibilities and other important aspects. Through this, the client company will understand what's included and how it works .

Ask about their record of adhering the rules, experience with small businesses in your industry, and how they deal with payroll taxes employee benefits , and risk management . Request details on technology tools, customer support, and the process for terminating the contract if necessary.

Cost Considerations and Pricing Models

A professional employer organization usually charges a fixed administrative cost for each employee or a total payroll percentage. The pricing models affect the total cost and should be reviewed by company size, services needed and growth plans.

Business owners should also ask about any potential hidden charges, such as setup fees, technology costs, or other compliance-related billing. Knowing the total pricing structure ensures the client company can account for its PEO services to maximum value.

Is a PEO Right for Your Business?

Whether a professional employer organization is right for your business will depend on the size, industry and HR requirements of your business. By looking at goals, budget, and compliance requirements, business owners can decide if joining with a PEO will help improve efficiencies, reduce the administrative tasks, and support the long-term growth of the business.

Ideal Business Profiles That Benefit From PEOs

Some companies are particularly suited to work with a PEO. Usually, they want cost savings, compliance help and access to competitive benefits without having to build a large in-house HR team.

Many businesses expand across multiple states and require PEO providers familiar with local employment laws. Specialized PEO services are available in states like New Hampshire, Texas, Louisiana, Oregon, and Alabama, offering tailored solutions to meet regional compliance and workforce management needs.

Best candidates include:

- Small businesses that are growing fast.

- Medium-sized companies expanding into new markets

- Startups don't have human resource professional.

- Companies in highly regulated industries

- Employers with high employee turnover

- Businesses offering multi-state employee benefits

Limitations and Potential Drawbacks to Consider

While a professional employer organization has many possible advantages, it may not suit for all clients. The PEO model may not be suitable for companies wanting total control over all HR processes or those wanting to manage human resources entirely in-house.

Very small businesses that can’t afford to hire full-time payroll experts might also face costs. On top of this, some industries might require specialized compliance know-how that all providers don’t offer. By assessing these factors, business owners can make an informed decision before signing an employment agreement.

Frequently Asked Questions About PEOs

This section answers the most common questions business owners have about working with a professional employer organization . From service types and costs to compliance and impact on company culture, these FAQs provide quick, clear insights into the PEO model .

What Are the Three Types of PEO Services?

The three main types of peo services are full-service PEOs handling all HR functions, unbundled PEOs offering select human resources tasks like payroll processing , and specialized PEOs focusing on niche areas such as benefits administration or industry-specific regulatory compliance .

What Is the Main Purpose of a PEO?

The primary goal of a professional employer organization is to help business owners manage HR functions more efficiently. By overseeing payroll processing , employee benefits , and regulatory compliance , a PEO allows the client company to focus on business growth while reducing administrative tasks and mitigating risk.

Do PEOs Affect Company Culture?

Working with a professional employer organization does not change your company culture , as the client company retains control over daily operations, management style, and employee engagement. PEOs focus on human resources and compliance support, leaving cultural development entirely to the business.

How Much Does PEO Service Cost?

PEO service pricing typically ranges from $150 to $200 per employee per month or 2%–12% of total payroll . Costs vary based on company size, services included, benefits offered, and compliance needs, so business owners should request a detailed quote from each peo provider .

Can Large Companies Use PEO Services?

Yes. Large companies can benefit from PEO services by outsourcing human resources functions like payroll processing , employee benefits , and regulatory compliance . Enterprise-focused peo providers offer scalable solutions, advanced technology, and specialized expertise to support complex operations across multiple locations.

What Is a Certified PEO (CPEO) and Why Choose One?

A Certified PEO (CPEO) is a professional employer organization accredited by the IRS for meeting strict tax compliance and financial standards. Choosing a CPEO gives business owners added protection, credibility, and assurance that payroll taxes and employee benefits are managed with the highest regulatory standards.

- IRS: Certified Professional Employer Organization (CPEO)

- IRS: CPEO Public Listings

- IRS: List of CPEOs (PDF)

- IRS: Requirements for Maintaining Certification as a CPEO

- NAPEO: PEO Industry Overview

- U.S. Chamber of Commerce (CO—): Professional Employer Organization (PEO)

- Texas Statutes: Labor Code — Chapter 91: Professional Employer Organizations

- Florida Department of Revenue: Reemployment Tax — Employee Leasing Companies (ELC)

Get Full-Service PEO Support with ADP TotalSource

ADP TotalSource offers enterprise-grade HR solutions, benefits administration, and compliance support for businesses of all sizes.