Starting an LLC in Wisconsin in 2025 is straightforward if you know the right steps. The process involves filing your Articles of Organization online, choosing a Wisconsin registered agent, and following an eight-step checklist to stay compliant. You’ll also need to budget for state fees, taxes, and annual reports. This guide explains the costs, process, and compliance rules so you can form and maintain your Wisconsin LLC with confidence.

Why Form an LLC in Wisconsin (Benefits & Fit)

Forming an LLC in Wisconsin gives owners liability protection while keeping taxes simple. In most cases, profits and losses pass through to your personal return (no entity-level income tax by default), and you can later elect a different tax status if it fits your numbers. That blend—asset protection plus flexible taxation, is the core of Wisconsin LLC benefits.

Compared with a sole proprietorship (no liability shield) or a traditional corporation (more formalities), a Wisconsin limited liability company balances credibility, simple compliance, and room to grow—ideal for freelancers, side hustles, and small teams testing or scaling a business model. To see how significant small businesses are in the state, check out Wisconsin small business statistics that highlight their role in jobs and economic growth.

Real Limited Liability (What Wisconsin Law Actually Protects)

Forming an LLC in Wisconsin creates a legal shield between your business obligations and your personal assets. Under Wisconsin’s LLC statute, a company’s debts and liabilities are solely the company’s, and members/managers aren’t personally liable just because they own or run the LLC—subject to narrow exceptions (e.g., their own wrongful acts). Courts in Wisconsin reaffirm this separation: the LLC is a distinct legal person, and liability doesn’t “flow” to owners merely due to membership. Keep your books clean and follow formalities to preserve this protection.

Pass-through Taxes by Default, with Options Later

By default, a single-member LLC is disregarded for federal income tax (it files on the owner’s return), and a multi-member LLC defaults to partnership tax treatment. You can later elect corporate or S corporation status if that’s better for your margins and payroll mix (via IRS Form 2553 for S corp). Wisconsin generally conforms to federal classification and recognizes S-corp treatment (with a separate “opt-out” available in limited cases). If you want to see how these rules compare at a national level, here’s a breakdown of LLC tax benefits that explains pass-through status, deductions, and flexibility in more detail. This flexibility lets you start simple and optimize as you grow.

Flexible Management: Member-managed by Default, Manager-managed if You Prefer

Wisconsin’s LLC law lets you choose how decisions get made. By default, an LLC is member-managed; you can switch to manager-managed in your operating agreement if you want a board-style setup or outside managers. The revised Chapter 183 (effective 2023) modernized authority rules and clarifies duties of loyalty/care while letting a written operating agreement fine-tune them within statutory limits. Translation: you get structure without corporate red tape.

Who an LLC Fits(and When to Consider Something Else)

If you want liability protection plus simple, flexible taxation, a Wisconsin LLC fits freelancers, side-hustlers, consultants, and small teams. Compared with a sole proprietorship, you gain a liability shield and credibility; compared with a C-corp, you avoid double taxation and heavy formalities. If you’re chasing venture capital or planning complex equity incentives, a corporation may fit better. Either way, choose based on risk, tax goals, and growth plans.

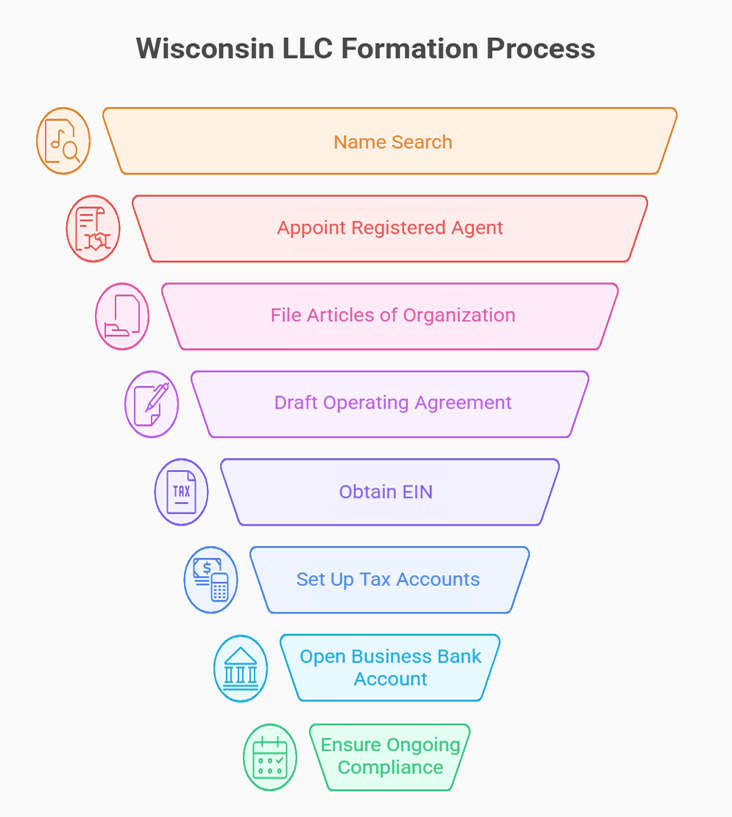

Steps to Form a Wisconsin LLC

Here’s exactly how to start an LLC in Wisconsin in 2025: the process runs entirely online through the state portal. In short, you’ll (1) run a name search, (2) choose a Wisconsin registered agent, (3) file Articles of Organization, (4) draft an operating agreement, (5) get your EIN, (6) set up state tax accounts and any local licenses, (7) open a business bank account, and (8) calendar your ongoing compliance. This is the same workflow you’ll follow to form an LLC in Wisconsin or when registering an LLC in Wisconsin — and in the step-by-step below I’ll show where to click, what each form asks, current fees, and timing so you can file cleanly and avoid rejections.

Step 1: Name Search & Rules (+ Optional Reservation)

Start with a Wisconsin DFI database check: use Search Corporate Records (broad lookup) and the Name Availability tool to confirm your idea is distinguishable. You can also run a quick lookup with this Wisconsin business search guide to better understand how the process works and what results to expect. Search the root words and ignore endings like “LLC” or “Corp.” — designators don’t create uniqueness.

Your LLC’s legal name must include a designator: “limited liability company” (or “limited company”) or the abbreviations “LLC” or “LC.” Variations in capitalization or punctuation are fine.

The name must be distinguishable on DFI’s records, can’t imply an unlawful or impermissible purpose, and can’t conflict with an existing entity. Certain regulated words may require extra approval under other laws.

If you’re not ready to file Articles, you can reserve the name for 120 days by submitting the Name Reservation Application (Form CORP-1). For LLCs, the current form lists a $15 fee. Reserve only if you need extra time—otherwise, the name is “locked” when you file your Articles.

Step 2: Appoint a Registered Agent

Every Wisconsin LLC must list a Wisconsin registered agent with a Wisconsin street address (no P.O. boxes) who is available during normal business hours to receive lawsuits and state mail. The agent can be you (a Wisconsin resident) or a company authorized to do business in the state. Under §183.0115, the agent must maintain a business office at the registered office and have an email address on file—this is central to LLC in Wisconsin requirements and appears on your Articles.

You can serve as your own agent—free, but public—since your address goes on record and you must stay reachable at that location. A registered agent service adds privacy, consistent availability, and mail scanning/logging with reminders—useful if you travel or work from home. Many owners prefer a Wisconsin registered agent provider to keep legal mail centralized for their LLC in Wisconsin. If you’re unsure whether you actually need a registered agent, check out this guide on registered agent requirements in Wisconsin for a simple breakdown.

You can switch agents anytime by filing a Statement of Change with DFI: $10 online (paper $25), with an optional +$25 expedite for paper submissions. Updates take effect once processed; the DFI online portal is the quickest route when changing your Wisconsin registered agent.

If you’re comparing providers, here’s a list of the best registered agent services in Wisconsin with reviews and pricing to help you decide.

Get a Trusted Wisconsin Registered Agent with Northwest

Northwest ensures your Wisconsin business stays protected and compliant—backed by their renowned privacy-first Registered Agent service.

Step 3: File Articles of Organization

Here’s how to file for LLC in Wisconsin without hiccups. Go to the DFI Business Entity File Online portal, choose Create a Corporation or LLC, then select Form 502 — Articles of Organization to file LLC in Wisconsin. The system asks for a contact email and, in most cases, accepts your filing upon receipt and emails confirmation immediately.

What you’ll enter (required fields):

- LLC name (must meet designator and distinguishability rules).

- Registered agent name and agent email, plus a registered office street address in Wisconsin (no P.O. boxes).

- Principal office street/mailing address (can be outside Wisconsin).

- Organizer(s) with complete addresses and signature.

- (Optional) Management statement, other provisions, and a delayed effective date (up to 90 days).

Common rejection triggers to avoid:

- Name not distinguishable on DFI records or missing an allowed designator.

- Listing the LLC itself as its own registered agent, or using a P.O. box for the registered office.

- Missing organizer signature or drafter name (if executed in Wisconsin).

Processing time — how long does it take to register LLC in Wisconsin?

Online submissions are “accepted upon receipt” in most cases, with immediate email notice. Paper filings can add time, but you may request expedited, next-business-day processing for an extra $25 on paper forms (check the “expedite” box). If you want more detail on approval timelines and common delays, check this guide on how long it takes to get a Wisconsin LLC approved. After formation, DFI communicates by email for online filings, so watch your inbox for proof.

If you prefer paper, download Wisconsin LLC Articles of Organization (Form 502) from DFI’s Business Entity Forms page; instructions mirror the online flow. For most founders, though, the Wisconsin LLC filing online is faster and cleaner.

Step 4: Draft an Operating Agreement (Internal)

Your operating agreement is an internal contract, not filed with the state, that sets how the LLC actually runs. Under Wisconsin’s updated Chapter 183, an “operating agreement” can be written, oral, implied, or any mix, which is exactly why putting it in writing prevents confusion. Use it to define member vs. manager management, who has authority to sign, and how decisions get made.

Cover the essentials: ownership percentages, voting thresholds, and distributions (timing, tax reserves). Spell out contributions, admission/exit rules, and buy–sell triggers to reduce deadlock and owner disputes. Wisconsin’s statute lets the operating agreement govern relations among members/managers and tweak certain default duties within limits—so tailor it to your risk and growth plans.

Finally, banks and investors often ask for the operating agreement to verify authority and roles when opening accounts or funding you. A clean, signed copy speeds compliance, lending, and diligence.

Step 5: Get an EIN (Free via IRS)

Apply for your Employer Identification Number directly with the IRS. Use the online EIN application (fastest) and you’ll get the number immediately when the system is open (Mon–Fri, 7:00 a.m.–10:00 p.m. ET). If the portal’s closed, file Form SS-4 by fax or mail. Ignore paid “rush” services — the IRS never charges a fee for an EIN.

Single-member LLC (SMLLC): If you have no employees and no excise taxes, the IRS doesn’t require an EIN for federal tax filing—though banks and payroll providers usually do.

Multi-member LLC (MMLLC): Get an EIN to file as a partnership and to open business banking and payroll. Either way, securing the EIN early speeds banking, merchant accounts, and state tax registrations.

Step 6: Set Up State Tax Accounts & Local Licenses

After formation, register tax accounts with the Wisconsin Department of Revenue (DOR) via Business Tax Registration (BTR-101) and manage everything in My Tax Account. This is the path most people mean by “how to start a business in Wisconsin” beyond filing, especially if you’ll sell taxable goods/services or run payroll. It’s also how you’ll open LLC Wisconsin tax accounts without third-party markups.

Sales & Use Tax (seller’s permit): apply through BTR-101. The initial registration fee is $20 and renewals are $10 every two years; you’ll file and pay in My Tax Account. Use DOR’s rate tools for address-level lookups and note the City of Milwaukee 2% and Milwaukee County 0.9% add-ons effective Jan 1, 2024 (total 7.9% in the city).

For payroll, add employer withholding during BTR-101—returns and payments live in My Tax Account alongside sales/use. This keeps registration, filing, and payments under one login. If you’d rather not manage payroll and HR on your own, you can explore the top Wisconsin PEO companies that specialize in handling payroll, compliance, and benefits for small and mid-sized businesses.

Local/industry licenses: Wisconsin has no statewide general business license; requirements are local permits (city/county) and industry licenses. Common examples include food/health permits, alcohol licenses, construction trades, and professional credentials. Check your municipality and the relevant state agency for specifics.

City example — Milwaukee (quick checklist):

- Confirm if your activity needs a city license (Milwaukee issues no general business license—only activity-specific licenses).

- If selling taxable goods/services in Milwaukee, register for the state seller’s permit and collect the combined rate (use DOR lookup).

- Keep copies of state tax registrations (seller’s permit/withholding) in your records for inspections or lease due diligence.

Step 7: Open Business Banking & Set Records

Open a dedicated business checking in the LLC’s name to keep personal and company money separate, this supports your liability shield and simplifies taxes. Bring core documents (formation approval) and your EIN; SBA’s guide to opening a business bank account outlines the basics.

Decide who’s authorized to sign. Most banks will ask for your operating agreement and may require a short banking resolution listing authorized signers and their powers. Call ahead to confirm the checklist.

Set a simple records system: retain account agreements, monthly statements, check images/deposit slips, invoices/receipts, payroll, and tax filings. The IRS says keep records long enough to substantiate income/deductions (often 3–7 years depending on the document). Store digital copies with backups.

Step 8: Keep Info Current (Amendments, RA/Name/Address/Members)

Use the DFI Business Entity File Online system to update your LLC’s public record. File Articles of Amendment (Form 504) when you change the LLC name, principal office, or other provisions (e.g., management statement). Fee $40; paper filings may add +$25 expedite.

For registered agent or registered office updates, file a Statement of Change (Form 13) — $10 online (paper $25). The registered office must be a Wisconsin street address and the agent’s business office. Keep the agent’s email current so you don’t miss legal notices.

Member changes are typically handled internally (operating agreement, resolutions). If your Articles include management language and it changes, amend with Form 504 so public records match your governance.

Start Your Wisconsin LLC with ZenBusiness

ZenBusiness makes forming your Wisconsin LLC simple, affordable, and fast—covering everything from filing to compliance in one streamlined platform.

Wisconsin LLC Costs (One-time & Ongoing)

If you’re asking how much is an LLC in Wisconsin, budget two buckets: a one-time formation fee (most founders file online) and small ongoing fees to keep your company active. Online Articles of Organization cost $130; paper filings are $170 and can be expedited for +$25. Each year, you’ll file an annual report—$25 online (or $40 by paper). Optional items (e.g., name reservation, certificate of status, certified copies) add only a few dollars when you need them. State tax registration is separate through DOR (BTR: $20 initial, $10 every two years). Your EIN is free at IRS.gov.

| Cost item | State fee | When it applies |

|---|---|---|

| Articles of Organization (online) | $130 | Standard online filing to create your LLC. |

| Articles of Organization (paper, Form 502) | $170 | Mail/in-person filing instead of online. |

| Expedited handling (paper filings) | +$25 | Optional; acted on by close of next business day. |

| Annual report (online) | $25 | Due once per year in your anniversary quarter. |

| Annual report (paper) | $40 | Paper alternative (slower and more expensive). |

| Statement of Change—registered agent/office (online) | $10 | Update agent or registered office. |

| Articles of Amendment—LLC (Form 504) | $40 | Change name/management provisions in Articles. |

| Name reservation (optional) | $15 | Hold a name up to 120 days if you’re not ready to file. |

| Certificate of Status (“good standing”) | $10 | Banks/partners sometimes request. |

| Certified copy (per document) | $10 | Certified copy of filed records. |

| Business Tax Registration (DOR) | $20 initial / $10 renewal (q2y) | Seller’s permit/withholding setup and renewal. |

For a deeper breakdown of state filing fees and recurring costs, see our detailed guide on Wisconsin LLC costs

Maintaining your Wisconsin LLC (Compliance & Taxes)

If you’re searching state of wisconsin llc renewal, you’re really looking for three things: your Wisconsin LLC annual report cadence, your ongoing LLC taxes (Wisconsin + federal), and how to update public records when something changes. In Wisconsin, you’ll file one annual report each year in the calendar quarter of your formation anniversary, keep state tax accounts current (sales/use and employer withholding if applicable), and update your registered agent, address, or governance when needed. I’ll show where to file, what info you’ll need, and quick links so you stay compliant without overpaying.

Annual Report (What/When/Where)

Domestic LLCs file once per year in the anniversary quarter (Jan–Mar due Mar 31; Apr–Jun Jun 30; Jul–Sep Sep 30; Oct–Dec Dec 31). Online filing is $25; paper adds a $15 surcharge (i.e., $40). Missed filings can trigger administrative dissolution. File online via DFI/One Stop; it’s faster and cheaper than paper.

What you’ll need (LLC):

- Entity name; state of formation (“Wisconsin” for domestic).

- Registered agent name & email and registered office street address (no P.O. boxes).

- Principal office address.

- At least one member or manager name (depending on management).

How to file (quick):

- Open the File Your Annual Report page → look up your entity.

- Confirm/edit registered agent, addresses, and management name.

- Pay the $25 online fee and submit; save the receipt.

Taxes (Default Treatment & Common State Accounts)

By default, a single-member LLC is disregarded for federal income tax; a multi-member LLC defaults to a partnership. You can elect corporate or S-corp later if it fits (Wisconsin generally follows your federal classification, with an S-corp “opt-out” mechanism for corporations).

Most Wisconsin LLCs only need state tax accounts if activity requires them:

- Sales & use tax (seller’s permit) — register via BTR-101; initial fee $20 (renewal $10 every two years); manage returns in My Tax Account.

- Employer withholding — add during BTR if you’ll have employees; returns/payments are also in My Tax Account.

Owners of pass-through LLCs typically make quarterly estimated tax payments at the federal level (Form 1040-ES), and Wisconsin individuals may also owe state estimated payments. A short consult with a CPA is smart in year one.

Changes & Amendments

Use DFI’s online system for updates:

- Registered agent/registered office → Statement of Change (Form 13); the registered office must be a Wisconsin street address and the agent’s business office. (Online filing available.)

- Name, principal office, or management provisions → Articles of Amendment (Form 504); $40 filing fee; optional +$25 expedite.

- Member changes are usually handled internally via operating-agreement amendments/resolutions; update Articles only if your public management statement changes.

Records & Banking Hygiene

Keep a separate business bank account and preserve clean, searchable records: bank statements, contracts/invoices, payroll, tax returns, and annual-report receipts. The IRS generally suggests keeping records at least 3 years (longer for certain items); digital backups help during audits or financing. Consistent minutes/resolutions for major decisions also strengthen your liability shield.

Names, DBAs, Licenses & Foreign Registration

If you’re exploring a wisconsin llc dba, here’s the lay of the land in one place. Your LLC’s legal name lives at DFI; “DBA” (trade name) protection is handled by Wisconsin’s Chapter 132 trademark/trade-name system. You’ll also handle state tax registrations (seller’s permit, withholding) and check city/county licenses as needed. Finally, if you’re expanding into Wisconsin from another state, you’ll foreign-register your LLC (or corporation) with a Wisconsin registered agent and meet annual report obligations. Quick, accurate steps below with official sources.

Business Names & DBA (Trade Name)

Your LLC’s legal name appears on DFI records; a DBA (trade name) is the brand you use publicly—handy for bank signage, websites, or running multiple brands under one LLC. If you’re new to the concept, here’s a simple guide that explains what a DBA is and how it works in plain English. In Wisconsin, DBAs are recorded by registering a trade name/trademark under Chapter 132 with DFI’s Trademark unit (not by amending your Articles). The state explicitly notes you should file a Trademark/Trade Name application for “Doing Business As.” Fee is $15 per name/design; registration lasts 10 years and can be renewed.

How to file a Wisconsin trade name:

- Make sure the name isn’t confusingly similar to existing marks/brands.

- File online via DFI Trademark File Online (one application per name/design; $15).

- Save the certificate; update bank/website/contracts to use the DBA. (You don’t change your Articles.)

Adding a DBA post-formation:

Just file the trade name with the Wisconsin DFI; many banks will also ask for a short member/manager resolution authorizing use of the DBA. You can register multiple DBAs if needed, and each must be renewed every 10 years. Statutory background: Wis. Stat. ch. 132 governs trade names and marks.

If you’re weighing whether a DBA is enough or if you should form an LLC, this LLC vs DBA comparison breaks down the key differences.

Licenses & local permits

There’s no statewide general business license. Most LLCs only need state tax accounts (seller’s permit for sales/use; employer withholding if you hire) and any industry-specific or local licenses. You register tax accounts via Business Tax Registration (BTR-101) and manage returns in My Tax Account.

Milwaukee example, quick checks:

- The City of Milwaukee does not issue a general business license; it licenses specific activities (e.g., food dealer, alcohol). Start at the License Division page and the activity list.

- If selling taxable goods/services, secure your seller’s permit via BTR-101 and collect the correct rate; keep the BTR certificate in your records.

Foreign LLCs & Out-of-state Entities

Doing business in Wisconsin? Register your out-of-state LLC by filing DFI’s Foreign Registration Statement (Form 521) ($100; optional +$25 expedite). You’ll list a Wisconsin registered agent with a street address and keep that info current. If your true name isn’t available in Wisconsin, you may adopt a fictitious name for use here (built into the LLC instructions; related corporate form 21B is for corporations). After approval, you’ll file annual reports as a foreign entity, DFI indicates foreign entities file in the first calendar quarter each year following the year of registration.

Note for corporations (e.g., a Delaware C-corp operating in WI). Corporations apply for a Certificate of Authority (Form 21) and must attach a recent certificate of status from the home state; fees can include a capital-based component. If the corporate name isn’t available in WI, file Form 21B to adopt a fictitious name.

Alternatives: LLC vs Corporation vs Sole Proprietorship

If you’re weighing structures, and googling how to incorporate in wisconsin — match the entity to your goals: liability protection, taxes, and investor expectations. An LLC keeps liability separate and taxes simple by default; a corporation adds stock/board formalities that venture investors expect; a sole proprietorship is the lightest lift but offers no liability shield. If you do choose to incorporate in Wisconsin, you’ll file Articles of Incorporation (Form 2) under Ch. 180 with the Department of Financial Institutions (online filing available).

LLC: Pros/Cons

An LLC in Wisconsin is the go-to choice for many small business owners because it balances liability protection with simplicity. The structure keeps your personal assets separate, avoids double taxation by default, and requires less ongoing paperwork than a corporation. Still, an LLC isn’t perfect, some investors prefer corporate stock, and equity incentives can be more cumbersome. Here’s a clear breakdown:

| Pros | Cons |

|---|---|

| Limited liability protection keeps personal assets separate from business debts. | Some investors prefer corporate stock, making corporations more attractive for fundraising. |

| Pass-through taxation by default, avoiding double taxation. | Equity incentive plans like stock options are harder to structure. |

| Flexible management — member- or manager-managed. | Venture capital and institutional investors may avoid LLC structures. |

| Light paperwork and predictable compliance. | Not ideal for complex ownership or rapid scaling. |

| Works well for freelancers, consultants, agencies, and small teams. | — |

Corporation (C-Corp) Overview

A Wisconsin business corporation is formed by filing Articles of Incorporation (Form 2, Ch. 180). You’ll maintain a board, officers, bylaws, shareholder meetings, and stock records—formalities that match what venture funds expect. Drawbacks: classic double taxation (corporation pays tax on profits; shareholders pay tax on dividends). It makes sense when you plan to raise outside capital, issue preferred stock, or scale with repeat fundraising. DFI’s portal lists the corporation forms; fees for incorporation are set by the state. For a deeper comparison, see our guide to LLCs vs C-Corporations to weigh the structural and tax differences.

Sole Proprietorship Trade-offs

Simplest to start and run, but no liability separation—your personal assets remain on the hook for business debts and lawsuits. You can operate under a trade name (DBA) but you don’t issue stock and fundraising is harder. Many founders start here for a tiny, low-risk side hustle, then migrate to an LLC or corporation as revenue and risk rise. (SBA’s structure guide is clear about the liability and financing limits of sole props.)

S-Corp Election Basics (For LLC/Corp)

“S-corp” is a tax election, not a legal entity type. A qualifying domestic corporation, or an LLC that elects S-corp status, files IRS Form 2553 and meets eligibility rules (≤100 shareholders, one class of stock, only allowable shareholders). S-corps pass income/losses to owners, avoiding corporate-level income tax, but owners who work in the business must take reasonable compensation (payroll) before taking distributions. This can lower self-employment taxes when profits are steady, worth modeling with a CPA.

Conclusion

Ready to start a Wisconsin LLC the right way? Follow the simple rhythm: file your Articles online → organize with an operating agreement, EIN, and bank account → identify the right state tax accounts and any local licenses → comply with your annual report and keep your registered agent/address current. If you want speed and privacy, you can check our ranking of the 10 best Wisconsin LLC services to compare trusted providers. DIY folks can use the step-by-step checklist above. For branding or expansion, see the sections on DBAs and foreign registration so you can operate statewide (and beyond) with confidence.

Frequently Asked Questions About Starting an LLC in Wisconsin

Quick Wisconsin LLC FAQ: here are crisp, source-backed answers to the questions founders ask most, costs, timing, licenses, annual reports, registered agents, DBAs, and who can form. Use these to validate decisions fast and avoid common filing mistakes.

How much does it cost to start an LLC in Wisconsin?

Online Articles of Organization cost $130; paper costs $170. The annual report is $25 online (or $40 by paper). Optional extras include name reservation $15, certificate of status $10, and expedite $25 (for paper services). Taxes/permits (e.g., seller’s permit via DOR) are separate. These are state-set fees; formation services may add their own charges.

How long does approval take?

Wisconsin’s portal says that, in most cases, online filings are accepted upon receipt and you’ll receive notice immediately. Paper filings can be expedited for +$25 and are acted on by close of business the next business day; standard mail processing varies. If you’re on a deadline, file online or add expedite to paper.

Do I need a business license for a Wisconsin LLC?

There’s no statewide “general” business license. You’ll register tax accounts with the DOR (seller’s permit, withholding) if applicable, and then check local/industry rules. For example, Milwaukee does not issue a general business license, only activity-specific licenses (e.g., food/alcohol). Other cities/counties may require permits depending on your activity.

Do Wisconsin LLCs file an annual report?

Yes, once per year in the calendar quarter of your formation anniversary (due Mar 31, Jun 30, Sep 30, or Dec 31). File online for $25 (paper $40). The filing updates your registered agent, addresses, and management info. Missed reports can lead to penalties or administrative dissolution, so calendar it.

Can I be my own registered agent in Wisconsin?

Yes, The agent can be an individual (including you) or a company, but the registered office must be a Wisconsin street address (no P.O. boxes), and the agent should be available during business hours to receive service of process. Keep agent details current to avoid missed notices.

Is there a way to get a “free LLC” in Wisconsin?

Not truly, You must pay state filing fees (e.g., $130 to form online). Some services advertise “$0” packages but still pass through state fees and upsell add-ons. The EIN is always free directly from the IRS—avoid paid EIN “assist” sites.

How do I add a DBA to my Wisconsin LLC?

Wisconsin handles DBAs as trade names/trademarks under Chapter 132 (separate from your LLC’s Articles). File a Trademark/Trade Name application with DFI’s Trademark unit; the fee is $15 per name/design and registration lasts 10 years (renewable). After approval, update banking, invoices, and your website to use the DBA.

Can non-residents form a Wisconsin LLC?

Yes, The statute allows “one or more persons” to act as organizers—there’s no residency requirement. You will, however, need a Wisconsin registered agent with a street address. Non-U.S. owners can obtain an EIN via IRS processes (including options for international applicants).

- Wisconsin DFI: Name Availability Search

- Wisconsin DFI (PDF): Articles of Organization – Form 502

- Wisconsin DFI (PDF): Annual Report Instructions & Due-Date Table

- Wisconsin DFI (PDF): Change of Registered Agent/Office – Form 13

- Wisconsin DFI: Trade Name / Trademark (DBA) – General Info

- Wisconsin DOR: Business Tax Registration (BTR-101) & Fees

- Wisconsin DOR: Sales & Use Tax – Overview & Rate Lookup

- IRS: Get an EIN (Free)

Looking for an overview? See Wisconsin LLC Services

Simplify Your Wisconsin LLC Setup with Harbor Compliance

Harbor Compliance handles every detail of forming your Wisconsin LLC—perfect for entrepreneurs who want full-service, no-hassle setup in 2025.