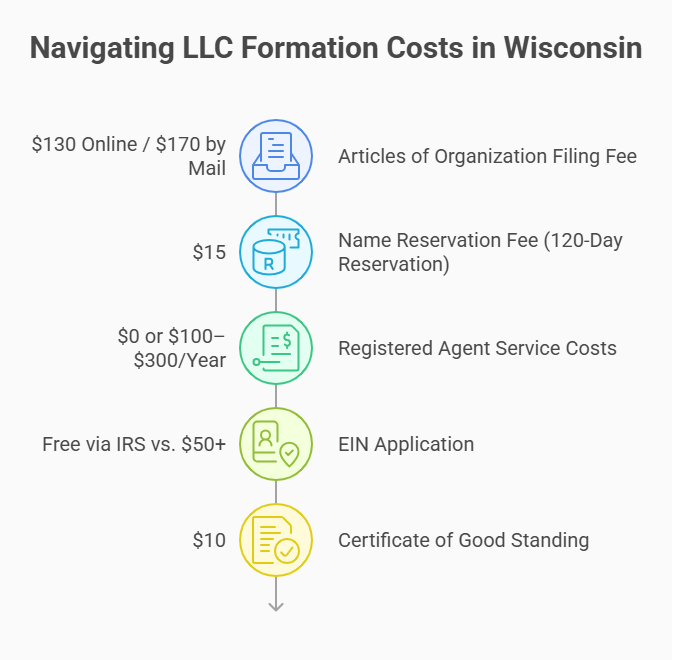

Starting a Wisconsin LLC costs $130 online (or $170 by mail) for the Articles of Organization, with most founders also grabbing an EIN for $0 directly from the IRS. After formation, your only mandatory recurring state fee is the $25 online annual report (paper totals $40 because of a $15 surcharge) due by the end of your anniversary quarter. Optional costs, like a registered agent service (~$99–$300/yr), trade name/DBA ($15 for 10 years), or expedited processing (+$25) – depend on your privacy, timing, and branding needs. Below you’ll find a source-backed breakdown of startup and ongoing costs.

Wisconsin LLC Cost Summary (Start-up & Ongoing Fees)

Below is a quick-reference summary of what you’ll pay to form your llc and keep it compliant in business in wisconsin. Amounts are current per state sources and major agencies; notes after the table link to the official pages.

| Cost Item | Amount | When it’s Due | Notes |

|---|---|---|---|

| Wisconsin Articles of Organization | $130 (filed online) / $170 (mail) | One time at formation | Creates your business entity with the department of financial institutions. |

| Expedited handling (optional) | +$25 | Add-on | Speeds processing by the next business day. |

| Name reservation (optional) | $15 | Before filing (holds for 120 days) | Useful if you aren’t ready to form your llc yet. |

| DBA / Trade name (optional) | $15 | As needed | State “trade name” (DBA) via DFI’s Trademark program (10-year term). |

| Wisconsin registered agent (you or a registered agent service) | $0 if you/your team; ~$99–$300/yr if hired | Ongoing | Must list a physical address in WI and be available during business hours. |

| EIN (IRS) | $0 | At formation or soon after | Apply directly with the internal revenue service. |

| Operating Agreement | $0–$50 | At/after formation | Internal document; not filed with the state (llc operating agreement). |

| Certificate of Status (optional) | $10 | As needed | Banks or partners may request it. |

| Annual report fee | $25 (online) | Every year | Due by the end of your anniversary quarter (file an annual report). Paper filings add a $15 surcharge. |

| Change Registered Agent/Office (if needed) | $10 online / $25 paper | As needed | File a statement of change. |

| Sales tax permit (business license equivalent for sellers) | $20 BTR (seller’s permit) | At registration; renew $10 every 2 years | Register with the wisconsin department of revenue. |

| Foreign LLC in Wisconsin (if expanding from another state) | $100 | One time | File a Certificate of Registration (Form 521). |

Helpful tax context: Wisconsin doesn’t charge an LLC-specific franchise tax. By default, most limited liability companies are pass-throughs; however, if your LLC elects corporate taxation (C-corp or S-corp), Wisconsin imposes the corporate franchise/income tax (7.9%) at the entity level. Talk with an accountant about tax treatment before you file your tax return.

Initial Formation Costs Unique to Wisconsin

At formation, Wisconsin keeps state fees fairly low, especially if you file online and handle simple tasks yourself. Still, many new owners forget small-but-common add-ons like reserving a name or ordering a Certificate of Status. To avoid surprises, budget for the items below.

Before you file, use the Wisconsin business search to confirm your LLC name is available.

How do I form an LLC in Wisconsin?

Quick steps:

1. Choose an available name.

2. File Articles online and list your registered agent.

3. Get your EIN (free at IRS).

4. Create your operating agreement (DIY or attorney).

5. Open a bank account and register tax accounts if required.

For the full checklist with screenshots and pro tips, see our Wisconsin LLC formation guide.

Articles of Organization Filing Fee – $130 Online / $170 by Mail

To establish an LLC in Wisconsin, you must file your articles of organization with the Wisconsin Department of Financial Institutions. Filing online through the state’s One Stop Business Portal costs $130, while filing by mail costs $170. It is quicker to file on the internet with a $1 penalty for having a portal.

Regardless of whether you're forming a single member llc or a multi-member llc, a non-refundable, one-time filing fee is required. Your articles must have important details like your business address, registered agent, and limited liability company purpose.

How long does it take to get a Wisconsin LLC?

Online filings are usually approved the same day (often within minutes or a few hours); mail filings take several business days after DFI receives them, plus postal time. If timing matters, add the $25 expedite to ensure next-business-day handling after receipt. Banks, merchant accounts, or local permits can extend your “open for business” timeline.

For a step-by-step timeline and common delay fixes, see our Wisconsin LLC processing time guide.

Pro tip: Double-check spelling of your legal name before you pay the filing fee, a typo means another filing (and another fee).

Name Reservation Fee – $15 (120-Day Reservation)

Not ready to file yet, but found the perfect name? You can reserve it for 120 days for $15. Helpful when you’re still finalizing partners, an operating budget, or branding. If you’re ready to file now, skip this, your name is locked in when the Articles are approved. If you’re still sketching things out, you can form an LLC without a business plan.

DBA (“Trade Name”) filing (optional)

Want to market under a brand that’s different from your LLC’s legal name? Register a Trade Name (DBA) through DFI’s trademark/ tradename program:

- Cost: $15 per name/design

- Term: 10 years (renewable)

- Use cases: E-commerce storefront name, product line, or a shorter public name

- Reminder: A DBA does not create a new business entity; it simply lets your LLC operate under another public-facing name.

Registered Agent Service Costs – $0 (Self-Service) or $100–$300/Year (Professional)

Wisconsin requires every LLC to keep a registered agent with a physical address in the state (no P.O. Boxes) who’s available during normal business hours to receive lawsuits and government mail.

- Cost options:

- $0 if you (or a member/manager) serve at a Wisconsin street address you control.

- $99–$300/year for a professional registered agent service (privacy, statewide presence, and mail forwarding).

- Changing agents later: Online filing of a Statement of Change is typically $10 (paper changes cost more).

Which should you choose? Hire a service if you want privacy, plan to move offices, or can’t guarantee daytime availability. If you’d like to compare providers and pricing, see best registered agent services in Wisconsin.

EIN Application – Free via IRS vs. $50+ through Service Providers

An EIN, or Employer Identification Number, acts as an ID number for your business entity, just like a Social Security Number does for you. You will need one if you plan to hire employees, set up a business bank account or operate as more than a single member llc. The quickest and least expensive method to obtain an IRS EIN is from the IRS itself, where it is free.

However, some LLC formation firms charge $50 to $100 to get it for you during setup. It is convenient to use a third-party service, but most business owners can fill out the EIN application themselves in minutes through the IRS online portal.

Simply fill out Form SS-4, and you will instantly get your EIN as soon as you submit online. Before applying, you must have your articles of organization and a U.S. mailing address. If you have a single-member LLC, it is taxed as a disregarded entity and the income must be reported on your tax return. Discover everything you need to know about this classification and its consequences in our complete guide to disregarded entity status.

Operating Agreement – Free to $1,200+

An operating agreement sets ownership, voting, profit splits, and rules. It’s internal (not filed with DFI), but banks and partners often ask for it.

- DIY cost: $0–$50 using a reputable template you tailor to your structure.

- Attorney-drafted: Commonly $300–$1,200+ depending on complexity (multi-member, buy-sell terms, investor rights).

- Minimums to include: ownership percentages, capital contributions, manager/member powers, tax treatment selection, dispute/resignation process, and signature blocks.

Even single-member limited liability companies should keep a written LLC operating agreement to reinforce liability protection.

If you are wondering whether legal help is worth it then read this detailed LLC attorney fees article. It covers average prices, what you get for the price, when a lawyer is worth it.

Certified Copies & Certificate of Status

Banks, vendors, or investors may ask you to prove “good standing” or provide stamped copies. Wisconsin offers:

| Item | State fee | Why you might need it |

|---|---|---|

| Certificate of Status (Good Standing) | $10 | Bank account verification, out-of-state registration, or due diligence |

| Certified copy (Articles or other filing) | $10 | Lender, landlord, or grant documentation |

| Expedite add-on | +$25 per item | Speeds delivery for time-sensitive closings |

Delivery is typically by email; mail and pick-up options are also available.

Form Your Wisconsin LLC with Budget in Mind

ZenBusiness makes forming an LLC in Wisconsin affordable and hassle-free, with clear pricing, fast filing, and everything done online.

Annual Report & Ongoing Costs

You’ve launched, nice. Now keep your business entity compliant and predictable with this quick, scannable view of what repeats each year (or two). We’ll start with the must-do state filing, then cover renewals you’ll likely see as you operate and grow.

Snapshot: recurring costs at a glance

| Item | Typical amount | How often | Where / how |

|---|---|---|---|

| Annual report fee | $25 online ($40 if you file on paper) | Every year | Online filing with Wisconsin DFI; paper has a $15 surcharge per DFI-CCS 10.01(6). |

| Registered agent service (if hired) | ~$99–$300/yr | Every year | Private providers (ex: Northwest $125/yr; InCorp $129/yr; ZenBusiness $199/yr renewal). |

| Seller’s permit via Business Tax Registration (BTR) | $20 initial; $10 renewal | Every 2 years | Wisconsin Department of Revenue (DOR). |

| Professional licenses (if applicable) | Varies by credential | Varies | Renew through DSPS LicensE. |

| Local licenses/permits (city/county) | Varies | Varies | Check your municipality (e.g., Milwaukee renewals). |

| Business insurance (typical small biz) | ~$44–$100+/mo | Ongoing | Compare options; WI averages from Insureon & state guide. |

Annual Report: fee, due date, how to file

What it is: The yearly update that keeps your Wisconsin LLC in good standing. You’ll confirm or update your registered agent, principal office address, and contacts, then file an annual report with DFI.

Cost & method: The annual report fee is $25 when you use online filing (DFI portal). Paper filings add a $15 surcharge under DFI rules, so paper totals $40.

Due date: Wisconsin uses a quarter-based system tied to your formation anniversary. Your report is due by the last day of the quarter that contains your LLC’s anniversary date (e.g., approvals in Jan–Mar → due Mar 31; Apr–Jun → Jun 30; Jul–Sep → Sep 30; Oct–Dec → Dec 31). This applies each year after the calendar year you organized.

How to file (5 quick steps):

- Go to DFI’s File Online page (or Wisconsin One Stop). Look up your company.

- Open the Annual Report, verify your registered agent name and physical address.

- Update your principal office address and email.

- Review officers/managers (if any) and submit.

- Pay $25 by card (or file by mail at $40 total).

Registered Agent Renewal Costs

Wisconsin requires every LLC to maintain a registered agent with a Wisconsin physical address during normal business hours. If you hire a registered agent service, plan on ~$99–$199 per year. Representative current pricing: Northwest $125/yr, InCorp $129/yr (multi-year discounts), ZenBusiness $199/yr renewal (often promo $99 first year). If you need to switch agents later, DFI’s Statement of Change is $10 when filed online.

DIY option: You (or a member/manager) can serve as agent at a street address you control to save cash, just be reliably available 9–5 for legal mail.

Registered Agent for Wisconsin LLCs with Privacy Built In

Northwest provides secure, dependable registered agent services to meet state requirements and protect your personal info.

Licenses & Permits that renew (state & local)

There’s no single statewide “general business license.” Instead, renew the credentials that apply to your activity:

- Seller’s permit (sales/use tax): Issued through DOR’s Business Tax Registration. $20 initial (covers two years), then $10 every two years. You’ll handle filings in My Tax Account.

- Professional/occupational licenses (DSPS): Health, trades, and other regulated fields renew on cycles set by statute/board. Track and renew in LicensE.

- Local operating licenses: Cities/counties can require renewals for activities (e.g., alcohol, food service, mobile vending). Check your local clerk’s page, Milwaukee posts forms and annual renewal schedules online.

- Reference hubs: Wisconsin One Stop and the SBA’s Wisconsin district page point you to the right agencies for your business type and location.

Keep a one-page “renewal sheet” in your operating agreement binder with logins, account numbers, and due dates – handy if an owner takes leave or you hire staff.

Other Recurring Tools (domain, website, bookkeeping, insurance)

Not state fees, but they show up on every founder’s budget. Plan for:

- Domain + website: Domain (often $10–$20/yr) and hosting ($5–$25/mo for starter plans). Add a basic site builder or lightweight CMS if you’re not hiring a developer.

- Bookkeeping & payroll: Cloud bookkeeping ($25–$60/mo for starter tiers) scales with users and add-ons; payroll quotes start near $40–$50/mo + per-employee. If you want benefits and HR compliance bundled with payroll, compare the best Wisconsin PEO companies.

- Payments: Card processors commonly take 2.6%–3.5% + 10–30¢ per transaction; negotiate as volume grows.

- Business insurance: Budget for general liability (WI averages around $44/mo) and add what your risk profile demands (E&O, cyber, workers’ comp). Use the state’s consumer guide to understand coverages before you buy.

- Banking: Many online banks offer $0 monthly bank account plans; watch transaction and cash-deposit limits.

Pro move: Put renewals on a single card with alerts set 30/14/7 days out, and store PDFs (policies, invoices, state receipts) in one “Compliance” folder.

Taxes & Licenses for Wisconsin LLCs

Running a business in Wisconsin means two ongoing compliance lanes: (1) how your LLC is taxed and (2) which licenses/permits you must keep current. Below is a crisp, source-backed guide you can act on today.

Wisconsin LLC Taxes (Pass-Through, S-/C-Corp, Sales & Employer)

TL;DR: Default pass-through (members pay on their personal tax return). Optional S-corp can reduce self-employment taxes if payroll makes sense. C-corp pays WI entity tax (7.9%). If you sell taxable items, collect sales tax; employers must open withholding + unemployment accounts.

Your tax options at a glance

| Choice | Who pays WI tax | Key WI filing | When it helps |

|---|---|---|---|

| Default pass-through | Members (individual income taxes) | Individual returns | Simple setup; best for many new LLCs. |

| S-corp election | Mostly owners via payroll + pass-through | Form 5S (+ possible WI entity-level tax) | When profits justify payroll savings. |

| C-corp election | The LLC as a corporation (7.9%) | Corporate return | Useful for reinvestment or specific planning. |

Sales & use tax: State rate 5%; some counties/cities add local surtaxes (e.g., City of Milwaukee 2%). Always check DOR’s rate lookup before invoicing to charge the right total.

Register & file: If you collect sales tax, register through the Business Tax Registration and file in My Tax Account. Most IDs issue within 1–2 business days.

Employer taxes:

- Withholding tax: Register with the wisconsin department of revenue and file in My Tax Account.

- Unemployment insurance: Register with DWD Unemployment Insurance online.

- New-hire reporting: Report new/rehired employees within 20 days.

Quick win: Model S-corp payroll vs. default pass-through with your CPA so the savings exceed payroll and compliance costs.

Licenses & Permits (statewide and local; how to verify requirements)

There isn’t a single statewide “general business license.” Instead, you’ll register tax accounts and then pick up any activity-specific licenses your line of business needs.

State-level checkpoints:

- Seller’s Permit / BTR: Required for most sellers of taxable products/services. Start here if you’ll collect sales tax.

- Professional/occupational licenses: Health/trades/other regulated fields renew via DSPS License; use the credential lookup and renewal portal to confirm your exact license and cycle.

- One-Stop portal: Wisconsin’s One-Stop walks you through registration across DFI, DOR, and DWD and links to permits you may need.

Local permits (examples & how to check):

- City of Milwaukee: License Division centralizes business licenses (food dealer, public passenger vehicle, etc.) and renewals. Start at the city’s licensing pages or the renewal portal.

- City of Madison: No generic license; you only license what’s regulated (e.g., restaurants, pools). Check the Clerk’s licensing list before you open.

5-minute verification flow:

- Search your NAICS on DOR’s site to confirm sales/use obligations; then open My Tax Account if required.

- Check DSPS LicensE for any professional credential and renewal cadence.

- Check your city/county licensing page (Milwaukee or Madison examples above) for local permits.

- Add renewal dates to your compliance calendar and store PDFs (permits and receipts) in a shared “Licenses” folder.

Penalties & Late Fees

Skipping a small filing can snowball. Here’s exactly what happens in Wisconsin if you miss an annual report, let your registered agent lapse, or need to get reinstated, plus the real fees you’ll pay and how to fix issues fast.

Missed annual report (late fees & status impact)

Good news: Wisconsin does not assess a monetary late fee if you miss your LLC’s annual report deadline. Instead, the state escalates toward administrative dissolution if you don’t file for several years. When DFI starts that process, your company appears on a Notice of Administrative Dissolution; if you still don’t file, DFI issues a Certificate of Administrative Dissolution about 60 days later. There are no late fees or penalties, but you lose good standing and the state can dissolve the entity.

Practical risks of missing reports

- Loss of “good standing” (banks/partners often require it).

- Inability to register in other states or update filings.

- If administratively dissolved, you may not carry on business except to wind up; your name protection can lapse.

Action to take: File the overdue annual report online right away. Domestic LLCs pay $25 online (paper totals $40 with the $15 paper surcharge).

Failure to maintain registered agent (risks & notices)

Wisconsin law requires every LLC (domestic and foreign) to designate and maintain a registered agent at a physical address in the state (no P.O. Boxes). If your agent resigns or becomes invalid and you don’t appoint a replacement, DFI can initiate administrative dissolution for noncompliance.

How notices work? DFI first addresses written notice to your registered agent. If undeliverable, DFI re-sends to your principal office; if that also fails, DFI posts public notice on its website. You have 60 days to cure after the notice takes effect.

Why it matters? During dissolution proceedings, you can still be served via your last registered agent of record; lawsuits and state mail won’t wait.

Quick fix: File a Statement of Change online to appoint a new agent ($10 online). A professional registered agent service prevents lapses and keeps your business in wisconsin reachable during business hours.

Stay compliant in Wisconsin with Bizee's Registered Agent Service

Don’t risk dissolution, Bizee ensures your Wisconsin LLC always has a reliable registered agent on file, so you never miss legal notices or state mail.

Reinstatement after administrative dissolution (steps & costs)

If your LLC is administratively dissolved, you can come back into compliance. Expect these costs and a simple fix.

Costs at a glance:

- Reinstatement application: $100

- Past-due annual reports: $25 each (domestic) / $80 each (foreign)

- Registered agent change (if needed): $10 online

What to do?

Request the reinstatement packet from DFI, fix the cause (e.g., file an annual report or appoint a valid agent), submit the application, and pay.

Effect:

Once approved, status is retroactive to the dissolution date, treated as if the company was never dissolved.

Foreign LLC note:

If revoked for missing the March 31 report, you generally have 6 months to reinstate; file overdue reports and request reinstatement within that window.

Quick reference:

| Situation | State late fee | What happens | Fix |

|---|---|---|---|

| Missed domestic annual report | $0 | Notice → if ignored, administrative dissolution | File online ($25) or reinstate |

| No valid registered agent | $0 | Noncompliance can trigger dissolution | Appoint new agent ($10 online) |

| Reinstatement | $100 | Must also clear past-due reports | Request packet + submit + pay |

Cost Comparison: Wisconsin LLC vs. Other Business Structures

The business entity you choose has an impact on your startup costs and ongoing costs along with your legal protection. Forming an llc in Wisconsin is relatively inexpensive compared to a corporation. However, both have pros and cons in terms of filing fees, tax treatment and management requirements. This section compares real costs of an LLC with a sole proprietor, corporation, and partnership respectively. It helps you choose the right structure according to your goal and budget.

Ever wonder how Wisconsin compares to other states for starting a business? Find out the best states to start an LLC, which breaks down filing fees, tax perks and other startup friendly regulations: ideal for entrepreneurs eyeing multi-state operations or selective locations.

LLC vs. Sole Proprietorship – $130 vs. No State Filing Fee

The simplest way to run a business in Wisconsin is to operate as a sole proprietorship. There is no state registration or filing fee. However, your assets are not protected in any way. If your business is sued, your personal assets might be at risk.

Whereas, to form an llc in Wisconsin, you must file articles of organization, paying a $130 online filing fee. In return, you will gain a separate legal identity. Also, with that you will gain the benefits of a limited liability company. And these benefits are: tax flexibility, as well as asset protection.

Although it may be less expensive to form a sole proprietorship, an LLC provides better credibility, protects your personal finances, and is often better suited for business owners who plan to grow their business or hire employees.

LLC vs. Wisconsin Corporation – $130 vs. $100 Filing Fee

To incorporate your corporation in Wisconsin, you must file articles of incorporation with the Department of Financial Institutions, which has a $100 online filing fee. Establishing an LLC in Wisconsin requires somewhat of a higher cost to file the articles of organization, $130 online.

However, costs alone don’t tell the full story. Corporations are required to maintain very strict formalities. They must issue stock, and hold shareholders’ meetings each annual and filing annual reports which entails more paperwork. An LLC offers flexible management, less complicated compliance, and strong liability protection for the business owner.

Most small to mid-sized businesses will benefit from an LLC. It mainly balances better control, ease, and costs. On the other hand, a corporation suits those wanting outside investment or going public.

LLC vs. Partnership – Reporting & Licensing Differences

While a partnership is easy to start in Wisconsin with no formal filing fee, it doesn’t provide the legal separation or liability protection of an llc. In Wisconsin, two or more people who run a business and don’t register as a specific business entity may inadvertently form a partnership.

In contrast to a corporation that must submit articles of incorporation to the state, an llc must submit articles of organization to the state and pay the $130 online filing fee. The llc provides far greater flexibility, particularly with respect to the llc operating agreement. Partnerships do not have the continuity and formality of an LLC that deals with ownership changes, taxes, or disputes.

If your business is going to be long term, take on risk, or involve property, setting up an LLC is a better and safer choice for any business owner in Wisconsin.

Frequently Asked Questions About Wisconsin LLC Costs

Navigating the costs of starting and maintaining an LLC in Wisconsin can be confusing, especially with optional services, state fees, and recurring compliance obligations. This FAQ answers the most common cost-related questions about forming and running a limited liability company in Wisconsin, helping you avoid surprises and stay on budget.

What is the total cost to form an LLC in Wisconsin in 2025?

The total cost to form an LLC in Wisconsin in 2025 is typically $130 if you file online, or $170 if you file by mail. This includes the articles of organization filing fee, which is mandatory. If you also use a professional registered agent service, expect to pay an additional $100–$300 per year. Optional costs include name reservation ($15), EIN service ($50+ if not filed directly with the IRS), and licenses depending on your business type.

Not sure whether you even need an LLC to start a business? This guide breaks down when forming an LLC is necessary, what benefits it offers, and why some businesses choose to stay unregistered or operate as sole proprietorships instead.

What’s the annual cost to maintain a Wisconsin LLC?

$25 per year when you file an annual report online ($40 on paper). If you hire a registered agent service, expect roughly $100–$200/year (self-appointing is $0). Some businesses also renew a seller’s permit through the Business Tax Registration, $10 every two years (averages $5/year). Put the report due date on your calendar to keep good standing.

Do I need a registered agent and how much does it cost?

Yes, every LLC must maintain a registered agent with a Wisconsin physical street address (no P.O. Boxes). You can serve yourself for $0, but many hire a registered agent service for privacy and reliability, typical pricing is $99–$300/year. If your agent changes, you can file a Statement of Change online.

Which Wisconsin licenses add the most to startup expenses?

In Wisconsin, the most expensive startup licenses typically apply to regulated industries such as alcohol sales, construction, food service, and healthcare. For example, a liquor license can cost over $1,000, depending on the municipality, while certain contractor and restaurant permits may require state registration fees, inspections, and renewals. These costs are in addition to your LLC’s formation and business license requirements. To avoid delays or fines, check with your local government and the Wisconsin Department of Revenue or Department of Safety and Professional Services.

How much does it cost to register a foreign LLC in Wisconsin?

$100 to file the Foreign Registration (Form 521). Optional expedite is +$25. After approval, you’ll owe a foreign annual report each year, $65 online / $80 paper, due by March 31. A Wisconsin registered agent with a physical street address is required. Budget these items alongside your home-state costs.

Is a DBA required and what does it cost?

No, Wisconsin doesn’t require a DBA. If you want to operate under a brand different from your legal LLC name, you can register a state Trade Name/Trademark for $15, valid 10 years (renewable for $15). Many small businesses skip this unless they need public notice of a specific name or logo.

- Wisconsin DFI: Business Entity Fees

- Wisconsin DFI: Annual Report Instructions (Form CORP5i)

- Wisconsin DFI: Administrative Dissolutions

- Wisconsin DFI: Trademarks / Tradename Info

- Wisconsin DSPS: Professions A–Z

- Wisconsin DWD: Unemployment Insurance – New Employer Registration

- City of Milwaukee: License Renewal Portal

- Wisconsin Statutes: §183.0115 – Registered agent & office

- Wisconsin Statutes: §183.0709 – Reinstatement after administrative dissolution

Looking for an overview? See Wisconsin LLC Services

Get Your Wisconsin LLC Filed and Compliant

Harbor Compliance takes care of the full formation process so your Wisconsin LLC is legally set up and ready to operate.