Selecting the right tax identification number is crucial for businesses and individuals managing tax obligations. The two most common options are TIN (Taxpayer Identification Number) and EIN (Employer Identification Number), but they serve different roles based on tax status and entity type.

A TIN is a broad tax ID used by individuals and businesses for IRS reporting, while an EIN is specifically assigned to companies for payroll, banking, and tax compliance. Understanding which one you need depends on your filing status and business structure.

In this guide, we’ll explore the key differences between EIN and TIN, who needs each, and how to apply. Whether you’re a sole proprietor, LLC owner, or foreign entity, knowing the right number to use will help you meet legal and financial obligations with confidence. Let’s break it all down!

Understanding Taxpayer Identification Numbers (TIN) and Employer Identification Numbers (EIN)

Selecting the proper taxpayer identification number can be pivotal when navigating business filings and official records. Whether you need an ID for everyday transactions or for major expansions, understanding each type of tin ensures you comply with regulations while minimizing hassles.

What Is a TIN and Its Purpose?

A TIN identifies a person or entity to government agencies for types of tax reporting and financial tracking. Because these codes tie your records directly to the Internal Revenue Service, it’s simpler for officials to confirm whether each return or statement aligns with the correct account. By assigning a unique identifier, authorities reduce errors and streamline oversight.

In most cases, a TIN is issued by the irs to keep personal and business data organized. This process helps maintain clarity for everyone, from small enterprises to large corporations, and avoids confusion when verifying compliance or filing taxes. Although TINs come in several forms, they all serve the same fundamental goal: ensuring consistent, accurate identification within the U.S. tax system.

What Is an EIN and How Is It Different from a TIN?

An employer identification number ein is specific to businesses rather than individuals, though it still operates within the broader TIN category. The main difference between an ein and other identifiers is that the EIN connects payroll and financial details directly to a firm instead of an individual taxpayer. In other words, while your SSN might report personal earnings, the EIN logs corporate transactions and obligations. This distinction answers questions like are ein and tin the same, highlighting that the EIN is a specialized subset of TIN for business and payroll use, not a universal solution for all tax filers.

Types of TINs: ITIN, SSN, EIN, and Other Identifiers

Since the U.S. uses multiple types of tax identification numbers, you may wonder how to distinguish them. In general, a TIN can be a social security card number, an EIN, or even an individual taxpayer identification for those who cannot get an SSN. Each code comprises a unique nine-digit format, simplifying official recordkeeping and clarifying who must pay what.

Below are a few notable categories:

- Adoption taxpayer identification: used for children awaiting SSNs.

- Preparer taxpayer identification: an ID for tax professionals handling others’ returns.

- EIN: assigned specifically to business entities.

- SSN: the standard personal code for employees and some freelancers.

These distinctions help you apply the right number in the right scenario, preventing confusion and ensuring smooth compliance.

Get the Right Tax ID for Your Business

ZenBusiness simplifies EIN registration, ensuring your company has the proper tax identification number for compliance and growth.

EIN vs TIN: Key Differences and When to Use Them

Many people see ein vs tin debates when dealing with federal tax identification, but the simplest approach is recognizing how each code fits into the larger system. As explained by these guidelines, TINs apply broadly, while an EIN serves specific business functions. Knowing which applies to your situation saves time and prevents filing mishaps. For newcomers to business structures, it’s useful to understand what does llc stand for to better determine your identification needs.

Who Needs a TIN vs Who Needs an EIN?

A TIN generally applies to individuals or groups who must report income or interact with U.S. tax processes. That can include Americans working abroad, nonresident aliens, and certain specialized situations like managing estates and trusts. Meanwhile, who needs an ein often boils down to whether you’re a dedicated business owner with employees or if you file separate returns for commercial activity.

For instance, a foreign entity establishing operations here might be required to get an EIN for payroll and official paperwork, whereas a sole earner with straightforward personal taxes could stick to a simple TIN. Either way, verifying the correct identifier for your circumstances helps protect you from compliance problems, fees, and possible misunderstandings with federal agencies. Alternatively, if you’re aiming for a lean startup model, you might start a business without an llc to keep things simple and flexible.

When Should a Business Use an EIN Instead of a TIN?

Whenever a company has employees, files separate tax return documents for corporate revenues, or wants to open a dedicated bank account under its official name, an EIN is usually required. In contrast, freelancers or single-member structures without staff might not need a separate ID. In general, the EIN acts as the tax id for business operations, letting you distinguish corporate finances from personal assets. Whether dealing with payroll, credit, or licensing requests, the EIN helps both you and the government track relevant activities without confusion.

Can an EIN Be Used as a Tax ID Number?

Yes. EIN effectively works as your business’s official tax ID, but it’s important not to overlook personal codes if you operate a hybrid structure. An EIN can streamline financial management by keeping commercial transactions separate from individual ones, especially if you run a partnership, multi-member LLC, or even certain nonprofits. While it functions within the broader TIN framework, keep in mind that EIN doesn’t replace other personal obligations for owners or officers. You still must stay current with any state or federal rules that apply specifically to you as an individual.

EIN Registration Made Easy

Northwest Registered Agent helps you obtain an EIN quickly, so you can file taxes, open business accounts, and stay compliant.

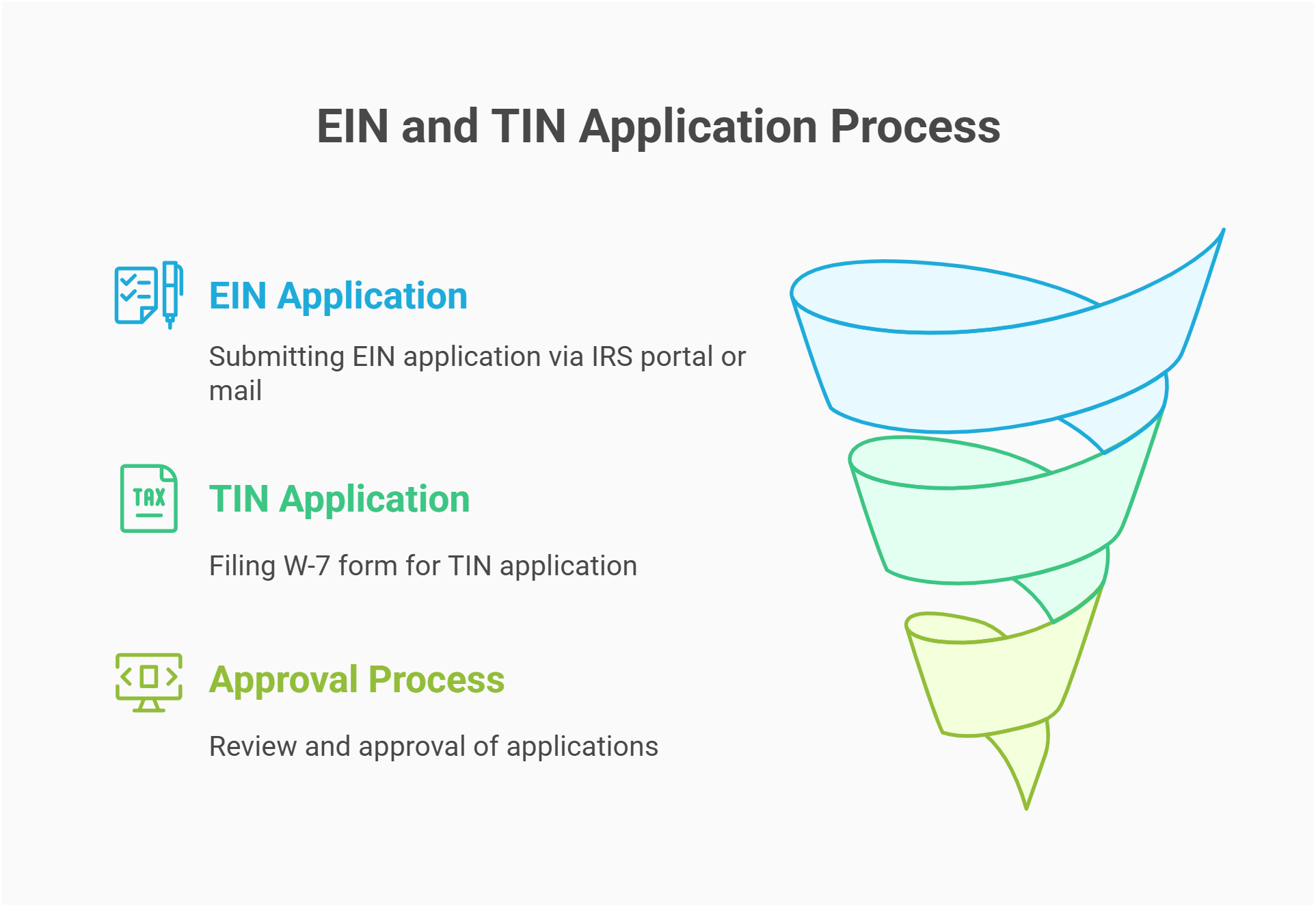

How to Apply for an EIN or TIN

Whether you plan to start a business or need an identifier for personal taxation, obtaining these codes follows a set procedure. Knowing what forms to fill out and which documentation to provide keeps you ahead of potential delays. By preparing carefully, you’ll secure the right number without unnecessary confusion or red tape.

Step-by-Step Guide to Obtaining an EIN from the IRS

Submitting an application for an EIN is relatively straightforward if you follow official guidelines. First, gather key details like your legal name, address, and business structure. Then apply for an ein using the IRS’s online portal or by mailing the appropriate paperwork. For some businesses, it’s often recommended to use registered agent as business address to maintain a professional and consistent mailing address. An EIN can be crucial for aspects such as payment processing, new hiring, and compliance reporting.

Once approved, your nine-digit identifier arrives quickly, allowing you to separate financial data for your enterprise. To ensure accuracy, double-check every entry on the form before sending it off. Mistakes in your entity classification or contact info might delay approval. If you’re unsure how to proceed, consider consulting a tax professional or acceptance agent for extra guidance. Additionally, for ongoing legal support, the best legal subscription service can provide you with continuous access to expert advice.

How to Apply for a TIN or ITIN

Obtaining a TIN, such as an ITIN, is crucial for individuals who lack a valid SSN but still need a record for income tax. In many situations, resident aliens also rely on this method if they haven’t yet secured full Social Security credentials. You can file a W-7 form and attach supporting evidence, like a passport or visa documentation, to demonstrate your identity and residency status.

Here’s what you generally need:

- Properly filled out form specifying preparer tax identification details, if a professional assists you

- Proof that your status or activities require a TIN

- Any relevant statements indicating tax exempt incomes

Visit this resource for a deeper rundown of acceptable papers and additional clarifications. Once processed, your TIN is valid for tax purposes, letting you file tax returns or claim refunds where applicable. If you’re considering formalizing your business structure further, explore how to start an LLC for guidance on establishing a robust business framework.

Tax and Business Implications of EIN and TIN

Choosing the right identifier matters for everything from opening a business bank account to fulfilling state or federal filing obligations. Each code plays a distinct role in official documents, so mixing them up can lead to unexpected fees or rejections. For businesses forming a domestic limited-liability company, it’s essential to understand the specific tax implications. By knowing their differences, you safeguard both time and resources.

How EIN and TIN Impact Tax Filing

EINs and TINs both facilitate official filings, but each resonates with different sets of tax laws. For instance, companies that hire staff or structure themselves as partnerships typically rely on an EIN, whereas smaller setups might stick to a TIN if no separate payroll is required. Understanding these distinctions simplifies annual or quarterly reporting, helping you steer clear of compliance errors.

From the perspective of the administration, each code offers clarity on who owes what. An EIN highlights organizational revenue, while a TIN may reflect individual liability or simpler business structures. This distinction influences corporate forms, payroll obligations, and whether certain provisions—like treaty benefits—apply. In California, be aware of the California business tax which can significantly affect your overall tax liability. Key facts, matching the right number to your entity ensures smooth tax handling year after year.

Do All Businesses Need an EIN?

Not all Businesses must obtain an EIN, though many find it beneficial for legitimacy and clarity. A sole proprietorship without employees can often manage with just the owner’s TIN or SSN, provided no outside staff or corporate structure is involved. However, once you hire people, shift to a partnership, or aim for complex ventures, an EIN becomes vital. Beyond that, many banks request an EIN before granting lines of credit or extended services. In essence, smaller single-person firms may forego the EIN for a while, but growth often demands a separate identifier to properly track payroll, expansions, and official tax forms. For companies planning significant expansion in the Golden State, consider how to start an llc in California to take advantage of local market opportunities.

Tax Benefits and Limitations of EIN vs TIN

An EIN offers specialized perks for larger operations, letting each business entity expand without mixing personal finances. This separation helps with record-keeping, capital investment, and banking. By contrast, a TIN might suffice for a smaller sole proprietor who wants simpler documentation. Still, an EIN can streamline tasks like merchant processing and official registrations, especially when dealing with multiple stakeholders. Moreover, be sure to review the current federal LLC tax rate to better understand the financial implications for your business.

Keep in mind that certain advanced credits or treaty benefits require an EIN if you plan to operate internationally. Although TINs can handle personal returns or single-person setups, they might not unlock every advantage. Checking the IRS site ensures you meet criteria for each federal employer identification perk, from capital allowances to special corporate incentives.

FAQ – Common Questions About EIN and TIN

People frequently ask how these codes affect daily tasks like opening a credit card or hiring staff. Below, we’ll address a few popular inquiries to clarify usage and application. By knowing these basics, you’ll feel more confident in your record-keeping and documentation throughout the year. Ultimately, deciding between forming an LLC or DBA is a crucial step in shaping your business’s legal and tax strategy.

Start by reviewing official paperwork for your sole proprietors account or scanning prior tax forms to see if an EIN was referenced. If you spot a distinct nine-digit code labeled for business use, that’s likely your EIN. Otherwise, a TIN might appear on personal returns alongside your SSN or ITIN. You can also call the IRS directly to confirm which identifier you currently hold.

Most LLCs require a unique ID for official matters, but whether that ID must be an EIN or another TIN depends on your setup. If the LLC hires employees or files separately, the administration typically mandates an EIN. Single-member LLCs that file taxes as a disregarded entity might get by with just the owner’s SSN or ITIN. However, many entrepreneurs choose an EIN anyway to keep personal and professional finances distinct and ensure easier expansions down the line. For more detailed guidance, explore whether does your llc need an ein to ensure you’re choosing the best identification method.

Although an ITIN and TIN appear similar, an ITIN is actually a specific subset of TIN assigned to individuals who can’t obtain an SSN. So while every ITIN counts as a TIN, not all TINs are ITINs. The basic principle is that each code allows the IRS to identify taxpayers, but an ITIN is strictly for nonresidents or those without Social Security eligibility.

Yes, it can, at least in certain circumstances. A sole proprietor without staff or complicated operations might handle taxes under a TIN or SSN. That said, going without an EIN can limit growth, especially when aiming for external funding or contractual deals. Once you add employees or evolve into a corporation or partnership, obtaining an EIN becomes standard procedure to keep everything organized and official. Moreover, for single-member businesses, operating as a disregarded entity LLC can offer simplified tax reporting while maintaining liability protection.

Stay Compliant with the Right Tax ID

Harbor Compliance provides expert assistance in obtaining an EIN, helping your business meet IRS requirements effortlessly.