For LLC owners, an Employer Identification Number (EIN) is more than just a tax ID—it’s a gateway to financial security and professional credibility.

Yes, you can get an EIN before forming an LLC. The IRS allows individuals to apply for an EIN as a sole proprietor or under another business classification, then update the entity type once the LLC is officially registered. However, if your LLC name or structure changes after EIN issuance, you may need to apply for a new EIN to align with your final business details.

In this guide, we’ll cover:

- Why an EIN is essential for LLC owners.

- How to apply for an EIN step by step.

- Common EIN mistakes and how to avoid them.

Let’s break down everything you need to know about EINs and how they impact your LLC’s operations.

What Is an EIN and Why Does It Matter for LLC Owners?

An EIN, or Employer Identification Number, is a unique digit number assigned by the IRS to identify your business for federal tax purposes. It essentially functions like a Social Security Number for companies, allowing you to file taxes, open a business bank account, and handle official documents. Without it, many banks or credit agencies might deny your requests, which complicates day-to-day operations.

When an LLC is created, the IRS typically links that EIN to the responsible party—often the LLC’s managing member. Whether you’re a multi member llc or a sole proprietor converting into an LLC, an EIN streamlines tax returns and fosters clear separation between personal and business finances. This single identifier also simplifies tasks like payroll management and building business credit, making it indispensable for serious entrepreneurs.

Get Your EIN and Start Your LLC

ZenBusiness makes it easy to form your LLC and secure an EIN hassle-free. Ensure your business is tax-ready and legally compliant from day one.

How the EIN and LLC Formation Process Work Together

Building a legitimate LLC typically involves registering the company with your state and obtaining key documentation for federal income tax and licensing. Once your LLC is recognized, you can safely apply for an EIN under that official entity name, ensuring a tight match between your IRS records and state documents. If you’re considering can I use registered agent address for EIN, it’s essential to understand the implications for your business filings. Below, we’ll examine how these steps flow in standard scenarios—and what happens if you want an EIN earlier.

Standard Steps to Register an LLC and Apply for an EIN

- Draft Organizational Paperwork: Start by preparing your articles of incorporation (or certificate of organization, depending on state terminology). This outlines the LLC’s name, address, and operating agreement details. This outlines the LLC company names, address, and operating agreement details.

- File with the State: Submit the required forms and pay associated fees. Once llc approved, you receive documentation confirming your legal entity. For budget-conscious entrepreneurs, using the cheapest LLC filing service can help reduce your initial setup costs.

- Obtain an EIN: Head to the IRS site to apply for an ein. You’ll fill out basic info such as your entity’s official name, responsible party, and contact details.

- Set Up Finances: With your EIN in hand, you can open a specialized bank account and keep finances separate from personal funds.

The entire process may only take a few business days if you file digitally. By following these steps, you ensure the irs form for your EIN correctly references your newly formed LLC, avoiding mismatches that could disrupt taxpayer identification or hamper your business structure status.

Why the IRS Links EINs to Business Structures

The IRS coordinates your EIN with your specific type of business for income tax purposes, whether that’s a disregarded entity like a single member llc, or a more complex setup. Matching these records prevents confusion about how your tax returns should be filed. The correct classification is crucial for calculating excise tax, employment taxes, and general obligations, ensuring you aren’t subject to double taxation or other administrative snags. suits novices. Check Homegrown Pet’s official site for licensing details.

Prepare LLC formation documents, including name, address, and operating details.

Submit forms and fees to legally establish your LLC.

Apply via the IRS to get a tax identification number for your business.

Open a dedicated business bank account and separate funds.

EINs ensure tax classification aligns with your LLC type, preventing administrative issues.

Can You Apply for an EIN Before Your LLC Exists?

While standard wisdom suggests forming an LLC first, some entrepreneurs file for an EIN early to expedite business finances or line up business credit. If you’re wondering can I start an LLC without a business, our guide provides insights into navigating the process effectively. The IRS does permit it in certain conditions, but you must handle potential name mismatches or rejections if your LLC isn’t ultimately recognized.

IRS Rules for Obtaining an EIN Without an LLC

Technically, you can get an ein without llc formation by applying as a sole proprietorship or other business entity type. The IRS requires you to declare a responsible party and choose an ownership classification during the ein application. For instance, you might list yourself as a sole proprietor initially. Here are some key points:

- State a valid reason for applying, such as “Starting a business.”

- Provide your social security number or tax identification.

- Keep in mind that once your LLC is formed, you might need to revise or reapply, especially if the name differs.

If you incorrectly claim an LLC status that doesn’t exist, you risk generating contradictory records that cause confusion or require additional tax returns fixes.

When It Makes Sense to Get an EIN First

Applying early can be beneficial if you need to open a business bank account immediately or hire employees before your LLC is finalized. It also allows you to start building credit lines, sign initial leases, or manage payroll. Maybe you’re waiting on your LLC paperwork to finalize but need an EIN now to secure a loan or finalize contracts. This approach can streamline your launch—just remember to update the IRS once your LLC is official, preventing inaccurate data about your taxpayer identification status. For young entrepreneurs, learning how to start a business as a teenager can be an invaluable step toward building your handyman business.

What Happens If Your LLC Application Fails?

Should your planned LLC fail to form—maybe you picked a taken name or missed state deadlines—you’ll have an EIN that references a nonexistent entity (or a default classification like a sole proprietorship). This mismatch could lead to confusion at tax time, forcing you to reclassify or apply anew. If your LLC name changes substantially, the IRS might treat it as a different legal entity, requiring fresh forms. Some entrepreneurs prefer letting the EIN expire or going through a correction process. Stay proactive: if you sense your LLC won’t proceed, contact the IRS to avoid potential identity theft flags or record errors.

Pros and Cons of Getting an EIN Before Registering Your LLC

While jumping the gun on an EIN might suit certain startups, it carries unique risks. Below, we’ll examine how applying early can accelerate your business—alongside pitfalls if your final structure doesn’t match what you initially told the IRS.

Advantages of Applying Early

Requesting an EIN prior to formal LLC approval can yield several perks:

- Immediate Access to Banking: Obtain a business bank account right away, letting you manage personal and business finances securely.

- Contracts & Hiring: Some vendors or employees might only engage with fully recognized businesses with an EIN.

- Faster Business Launch: If you’re sure your LLC name won’t conflict, an early EIN can expedite credit checks or property rentals.

You also enjoy a head start on record-keeping, ensuring you track income and expenses from day one. Additionally, some entrepreneurs prefer completing all federal tax purposes steps at once, streamlining their timeline. If you’re confident your LLC will be accepted under a final name, an initial EIN helps you pivot quickly into day-to-day operations.

Potential Drawbacks and IRS Considerations

Applying prematurely can complicate matters if your planned LLC name, business structure, or membership drastically changes. The IRS associates EIN data with the responsible party you listed, plus the entity classification. If the LLC is never approved, or if you must do a major pivot—like going from a single member llc to a multi member llc—the mismatch could create issues. You might need extra forms to correct your ein for your llc, or in some cases, fully reapply. Additionally, you risk confusion about how to file taxes if the original application doesn’t reflect your final arrangement. In short, early isn’t always better if your formation plans are still fluid.

Set Up Your LLC with an EIN

Northwest Registered Agent helps you form your LLC and obtain an EIN, so you can open a bank account and manage taxes without complications.

How to Apply for an EIN Before Forming an LLC

If you’ve decided that securing your tax ID in advance is the right move—perhaps for banking or immediate hiring—here’s how to do it properly. The IRS will classify you under your current structure until your LLC exists, so keep potential corrections in mind.

Required Information and IRS Guidelines

First, gather the party designee (the person handling the process) and responsible party details, including a social security or taxpayer identification number. On your application, you’ll specify a reason like “Started a new business” or “Hiring employees soon.” Check the IRS official site for the latest rules, especially regarding classification changes once your LLC is recognized. Key points:

- Provide a valid physical address.

- Indicate current structure (e.g., sole proprietor).

- Confirm no existing EIN covers your proposed activities.

Keep your potential LLC name on file if you’re certain of it, but be aware you might need future adjustments if the final name or membership differs.

Application Methods: Online, Fax, Mail, and Phone

The most convenient route is the IRS online portal—approval is near-instant, and you receive your confirmation letter digitally. Alternatively, you can fax or mail Form SS-4, though that may take weeks for the IRS to process. In special cases, phone applications exist, mainly for international applicants. Regardless of method, keep a copy of your applied for an ein record for future reference. The online path is typically fastest and ensures minimal data entry errors. Once done, store your EIN safely, as you’ll need it to hire employees, open accounts, or handle taxes for the new entity.

What to Do After Receiving Your EIN

Once you have the EIN, pivot to your next tasks. If you haven’t formed an LLC yet, proceed with your certificate of organization or forming an llc steps promptly, so your official name and structure match what the IRS expects. Then open a dedicated business bank account to keep finances separate, and begin any licensing or insurance processes. If the state modifies or rejects your proposed name, you may need to update the IRS with the correct one. Keep that ein application letter on file for reference, and be ready to attach it when you apply for credit lines or vendor accounts.

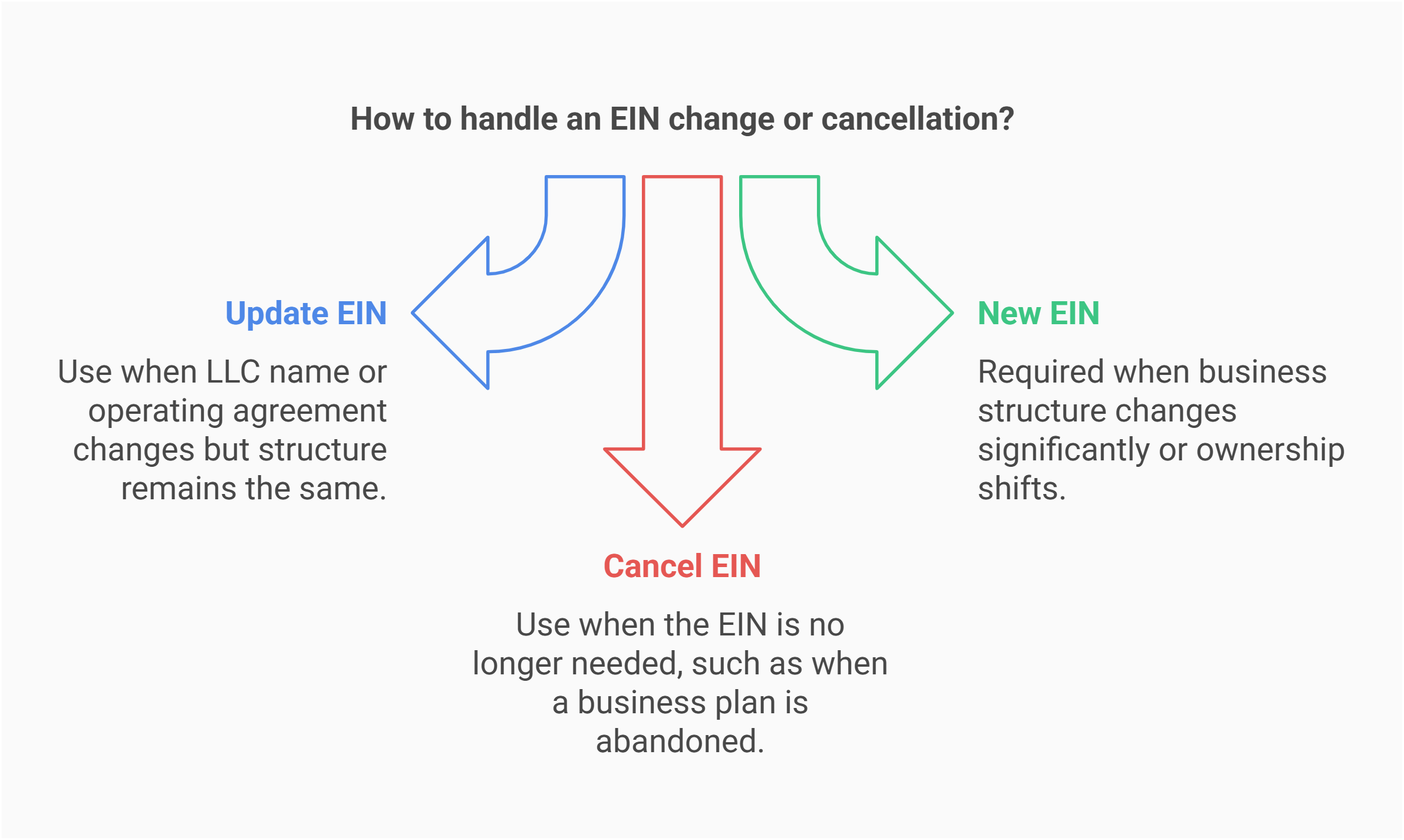

What If You Need to Change or Cancel Your EIN?

Circumstances shift—maybe you rename your LLC, or realize you no longer require that early EIN. Fortunately, the IRS provides channels for updates or cancellations, but you must follow specific procedures.

Updating Your EIN After LLC Approval

If your LLC name or operating agreement differs significantly from your original EIN info, file an update with the IRS. Typically, you can send a signed letter explaining the changes, referencing your current EIN, and including any llc approved documentation. Indicate whether the responsible party changed too. Keep a copy of that letter. Once processed, your new details sync with IRS records, safeguarding correct federal income tax handling going forward.

When You Need a New EIN Instead of Updating

Some scenarios demand an entirely fresh EIN. If your business structure changes from a sole proprietorship to a corporation or from a partnership to an LLC, the IRS may treat it as a new legal entity. Also, transferring or inheriting a business can require an additional EIN if ownership fundamentally shifts. Always consult experience as a real business manager or tax pro to confirm. If you suspect your case triggers “substantial changes,” applying for a brand-new EIN ensures clarity for tax law obligations.

How to Cancel an EIN and Notify the IRS

If you realize you no longer need the EIN—perhaps your planned business never launched—mail or fax a cancellation request to the IRS. Send a short statement (on official letterhead, if possible) with your name, EIN, address, and reason for closure. Include the initial confirmation letter if available. According to IRS guidelines, they’ll mark the number as canceled in their database, although it won’t vanish from historical records. Keep in mind that if you start another venture later, you must reapply for a fresh EIN or correct old data appropriately.les become surmountable steppingstones.

Business and Tax Implications of Getting an EIN Without an LLC

Moving forward with an EIN early has ripple effects. Below, we’ll parse how it impacts immediate tax responsibilities, your capacity to form a separate entity later, and what it means for obtaining funding or building credit.

Does Having an EIN Create Immediate Tax Obligations?

Merely holding an EIN doesn’t automatically trigger excise tax or employment taxes. If you haven’t started generating revenue or paying wages, no immediate payment is due. However, once money flows in, or you hire employees, standard federal tax purposes rules apply. Keep the IRS informed about your official business classification if your original plan changes—this ensures no confusion when filing your next tax return.

Can You Open a Business Bank Account With Just an EIN?

In many cases, yes. Banks often want proof you’re an authorized entity, so showing an EIN plus supporting ID is enough to open a small-business checking account. However, you may also need official formation documents if you claim to be an LLC or corporation. Lacking an LLC, the bank might classify your account as a sole proprietorship arrangement. That’s still beneficial for keeping personal and business finances separate. Once your LLC is official, update your account details or transfer funds to a newly labeled business bank account if needed.

How an EIN Affects Business Credit and Funding

With an EIN, lenders and vendors can track your business credit history distinctly from your personal record. Even if you remain a disregarded entity, you’ll still have a taxpayer ID for referencing financial responsibilities. Over time, consistent on-time payments or successful project completions strengthen your commercial credit file. This separation fosters trust among potential investors or creditors. Just be sure to clarify your official business structure once your LLC is formed, so your credit profile remains accurate.

When Should You Get an EIN? Expert Recommendations

Timelines vary. For some, waiting until the LLC is certain helps avoid confusion. Others see value in applying early to expedite banking or employing staff. Let’s see which approach experts and tax professionals generally advise.

Best Practices for Small Business Owners and Startups

Consider these steps:

- Confirm Your LLC Name: If the name is up in the air, hold off on the EIN.

- Evaluate Urgency: If you must pay vendors or secure a lease, an early EIN can be vital.

- Keep Records Aligned: Once your LLC is recognized, update any EIN details if needed.

- Stay Consistent: If you initially indicated a sole proprietor structure, make sure to correct it once your LLC is official.

Ultimately, you want minimal friction across your tax identification, formation documents, and business transactions. If your path is relatively straightforward and you expect quick LLC approval, experts suggest applying after form your llc. If not, applying early can help set up essential financial tools fast.

Insights From Tax Professionals and Attorneys

Experience in tax law points to waiting if you foresee changes in membership or the LLC name. On the other hand, attorneys note an EIN can help you demonstrate seriousness to investors or landlords. The IRS isn’t particularly rigid about obtaining multiple EINs over time; you just risk confusion if multiple are unused. They also emphasize the value of working with a party designee—someone authorized to handle the application on your behalf—especially if you juggle multiple responsibilities. This ensures you avoid data mistakes or incomplete submissions.

FAQs About EINs and LLC Formation

Below are concise answers to frequent queries about EIN timelines and LLC status. Each response aims to rank well in search results, clarifying typical concerns. Whether you’re new to business or revisiting your entity setup, these straightforward points can guide you through potential pitfalls.

Often, waiting ensures your EIN data perfectly matches your llc approved name and structure. That said, if you need immediate business finances for lease agreements or hiring, applying beforehand is feasible. Just note any mismatch—like a final LLC name you didn’t originally list—may prompt updates. If your experience as a real estate investor or entrepreneur demands speed, an early EIN can help. Otherwise, form your LLC first, then apply for the EIN to keep the process seamless.

No, not exactly. If your EIN was assigned while you were a sole proprietor, it’s tied to that classification. When you form an llc, the IRS recognizes a new business entity or at least a new tax status. Generally, you’ll need a fresh EIN reflecting your new structure. If you skip this and just reuse the old ID, official records might incorrectly treat your operation as a sole proprietorship. A separate EIN clarifies your LLC’s identity, ensuring proper separation between personal and business liabilities.

Your EIN still exists, but it’s now tied to a phantom or default classification—often as a sole proprietorship. If your LLC never came to life, the IRS might expect tax returns if you reported business activity. If you decide not to proceed at all, you can cancel the EIN by writing to the IRS. Alternatively, if you do form the entity under a different name or timeline, you’ll typically need to update or reapply for an EIN that reflects your final legal entity details.

There’s no direct penalty just for applying prematurely, but you could face confusion if your final business name or business structure changes. The IRS may treat your subsequent filing as a brand-new entity, forcing you to reclassify or reapply. Also, any triggered tax returns or forms remain your responsibility if revenue or payroll arises. While not punishable in isolation, ignoring mismatches can lead to errors or missed deadlines. If your plans are uncertain, many experts recommend waiting until you’re sure about your LLC details.

Mail or fax the IRS a cancellation request, referencing your EIN, name, address, and reason for closure. If possible, attach the original EIN assignment notice or letter. The IRS updates its records to mark that ID as inactive, though it won’t vanish historically. Keep proof of your request in case questions arise later. If you end up needing a fresh tax ID for a new or restructured venture, you’ll simply apply for an ein again under the correct classification.

Yes, although the process differs. Non-U.S. residents or those lacking an SSN can still apply using an Individual Taxpayer Identification Number (ITIN) or by filing IRS forms such as Form SS-4 manually. The IRS typically requests extra details to confirm identity and taxpayer identification. Applicants often rely on phone or mail/fax applications. Once approved, you’ll have your EIN for federal income tax and business usage. Just be prepared for a slightly lengthier process compared to an online submission with an SSN.

If you use that EIN while still a sole proprietorship, the IRS treats you as such until you notify them of your LLC status. So, your disregarded entity or pass-through classification might shift once the LLC is recognized. Some excise taxes or employment tax forms also hinge on official structure. As long as you update the IRS on time and file correct returns, there’s no direct penalty. The key is ensuring your final classification lines up with the ein for your llc so you avoid double or inaccurate

Simplify EIN Registration for Your LLC

Harbor Compliance streamlines LLC formation and EIN registration, helping you stay compliant and focus on growing your business.