Running a small business or scaling a growing company means juggling payroll, HR compliance, and employee benefits. Partnering with a Professional Employer Organization (PEO) can ease this burden by providing cost savings, access to Fortune 500-level benefits, and streamlined compliance support. The right partner can improve employee satisfaction and free leadership to focus on growth. In this guide, we explore the most important PEO benefits and how they help companies of all sizes operate more efficiently.

Understanding Professional Employer Organizations and Their Purpose

The PEO industry has grown rapidly, with the National Association of Professional Employer Organizations (NAPEO) reporting that over 173,000 U.S. businesses, many of them small businesses, partner with a professional employer organization (PEO) for HR and benefits administration. This trend shows PEOs’ rising importance in streamlining operations, improving compliance, and driving sustainable business growth.

What Does PEO Stand for in HR?

In the world of HR, PEO stands for Professional Employer Organization, a strategic partner that shares certain employer responsibilities with client companies through a co-employment arrangement (PEO basics). A Professional Employer Organization (PEO) performs human resource functions such as payroll and employee benefits. Business owners can concentrate on their core business operations without worrying about these functions. This employment model allows small business and mid-size businesses to gain access to enterprise-level resources without spending a fortune on maintaining a large in-house HR team. To learn more about how it all works, read our complete guide on what is a PEO and how it helps your small business.

Co‑Employment Explained and Legal Implications

Co-employment is an employment model where a Professional Employer Organization shares certain employer responsibilities with a client company. In this setup, the PEO is responsible for running payroll, providing employee benefits and ensuring compliance with human resources regulations, while the client is in charge of day-to-day operations of the business. It helps the business owners to gain more benefits with lesser costs without losing control over strategy.

In legal terms, co-employment clearly defines which party handles specific obligations. The PEO takes care of employment-related legal issues such as compliance, workers compensation and unemployment insurance and risk management. The client company maintains control over hiring and firing as well as operational policies.

PEO vs EOR vs ASO: Key Differences

While PEO services focus on co-employment, an employer of record (EOR) takes full legal responsibility for employing workers, and an administrative services organization (ASO) offers HR support without sharing employer responsibilities. Choosing between them depends on your business size, goals, and desired level of control over HR functions.

| Feature / Service Scope | PEO | EOR | ASO |

|---|---|---|---|

| Service Scope | HR, payroll, benefits, compliance | Full employment & payroll | HR admin only |

| Liability | Shared with client | EOR holds all | Client retains |

| Cost Structure | Monthly fee or % payroll | Higher due to full liability | Lower, flat fee |

| Best For | SMBs wanting shared HR & compliance | Global hiring, no local entity | Companies wanting admin help only |

A professional employer organization is often ideal for SMBs that want cost savings and improved benefits without giving up operational control.

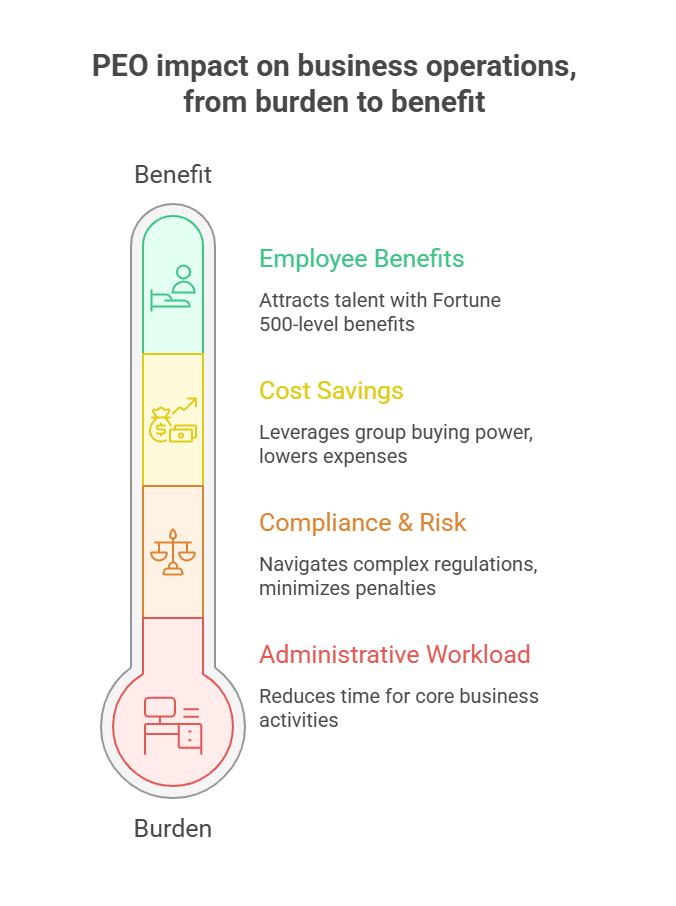

Core Advantages of Partnering With a PEO

Working with a professional employer organization delivers measurable improvements for business owners, from cost savings and stronger benefits packages to reduced administrative burden. By partnering with a PEO, small and mid-size businesses gain access to enterprise-level HR support, streamlined compliance, and resources that drive long-term business growth and employee satisfaction.

Access to Fortune 500-Level Employee Benefits

Professional Employer Organizations offer small business access to big business employee benefits. Through economies of scale, PEOs provide affordable insurance benefits as well as retirement and wellness programs to help attract and retain quality talent. This expanded benefits package improves recruitment, reduces turnover, and boosts overall employee experience.

Key benefit categories include:

- Medical insurance and health plans

- Dental and vision coverage options

- Life insurance and disability coverage

- Retirement plans such as 401(k) and MEPs

- Wellness programs and mental health support

- Employee assistance programs (EAPs)

Cost Savings Through Group Buying Power

By pooling multiple businesses under one contract, a professional employer organization leverages group buying power to negotiate lower rates for insurance plans, technology tools, and HR services. This cost savings model enables small businesses to access high-quality benefits and resources at prices typically reserved for large corporations, often reducing expenses by several percent without sacrificing coverage or service quality.

How PEOs Reduce Administrative and HR Workload

A Professional Employer Organization takes over payroll processing, benefits administration, compliance reporting and other time-consuming admin tasks. When business owners outsource these tasks, they free up important hours in their week to spend making money and planning.

When internal HR teams partner with a PEO, they get new technology and the support to outsource human resources functions. This eases repetitive tasks, streamlines workflows, and minimizes the administrative burden of managing employee benefits and employment laws. As time goes on, these efficiencies will save time and improve operational performance for client companies. To help you identify the right solution, this expert-curated guide to the best PEO services for small businesses compares top providers for 2025 based on features, pricing, and support. And for business owners located in the Mountain West, this list of the best Montana PEO companies highlights top-rated local providers who combine administrative support with regional expertise.

Enhanced Compliance and Risk Management

A Professional Employer Organization strengthens compliance by tracking employment laws, updating tracking policies and providing risk management strategies. Professional Employer Organizations support employers to manage the complexities of the ACA, COBRA, and OSHA regulations. This reduces the employer’s exposure to penalties and fines. Certain providers are even IRS-certified PEOs. That means they meet federal standards for tax compliance and reporting accuracy. By outsourcing these functions, business owners can relax knowing their company stays compliant and their liability reduced as employees are protected under consistent and up-to-date workplace standards. If you are in Oregon, check out this list of the top PEO companies in Oregon – firms that offer compliance mastery for Oregon’s unique regulatory environment.

Enhancing Employee Experience and Retention

A professional employer organization enhances the employee experience by offering competitive benefits, personalized coverage options, and opportunities for professional development. The above benefits assist businesses in increasing their rates, cutting turnover and helping the workforce. Investing in employee support helps businesses attract and retain top talent for the long run.

Offering Competitive Benefits: Health, Dental, Vision, Life

With the help of PEO services, businesses can offer competitive benefits like comprehensive health plans, dental and vision coverage and life insurance and disability insurance. By offering employees various plan design options, coverage options help to improve satisfaction and retention levels. Through the use of group insurance and expert benefits administration, business owners can offer a benefits package that rivals large corporations at a reasonable cost, attracting and retaining skilled workforce in an intense job market.

Retirement Plans via MEPs and 401(k)s

A Professional Employer Organization can provide retirement benefits through Multiple Employer Plans (MEPs) and 401(k) programs to help businesses offer employees a safe, tax-advantaged way to save. Business owners often encounter improved participation rates and diminished administrative effort with these plans.

Key advantages include:

- Lower fees through pooled resources

- Simplified enrollment and administration

- Access to diverse investment options

- Improved employee participation rates

Professional Development & Training Support

A Professional Employer Organization can enhance the skills of your workforce by providing essential access to professional development resources. This includes online learning tools and tailored training programs. Employees get the opportunity to upskill, obtain certifications, and stay ahead of trends with the help of these tools.

In addition to skill-building, performance tracking and succession planning are part of PEO services. Thus, business owners can spot high-potential talent and create growth plans. Investing in human capital doesn't just help managers engage employees during the appraisal period. It brings several other benefits as well. It helps in building a strong company culture while ensuring a long-term retention plan. The investment shows employees the clear scope for advancement. To safeguard the long-term future of your business, this complete guide will provide you with a step-by-step approach to succession planning.

Improved Recruitment and Employee Engagement

By offering full-fledged benefits packages and a strong workplace culture, a Professional Employer Organization can help businesses attract great candidates and boost employee engagement. There are two main advantages to ensuring benefits are compliant with the law. One, making sure your benefits packages are competitive and legally sound. Two, creating a positive candidate experience through streamlined HR processes. By filling jobs quicker, it also helps retain top talent to reduce turnover and foster loyalty for the long term. If you’re a business owner located in New England, this rundown of the best PEO providers in New Hampshire offers insights into companies that support strong engagement and localized HR solutions.

Unlock the Full Value of a PEO with Justworks

From payroll to benefits and compliance, Justworks simplifies your HR so you can focus on growth—with transparent pricing and trusted support.

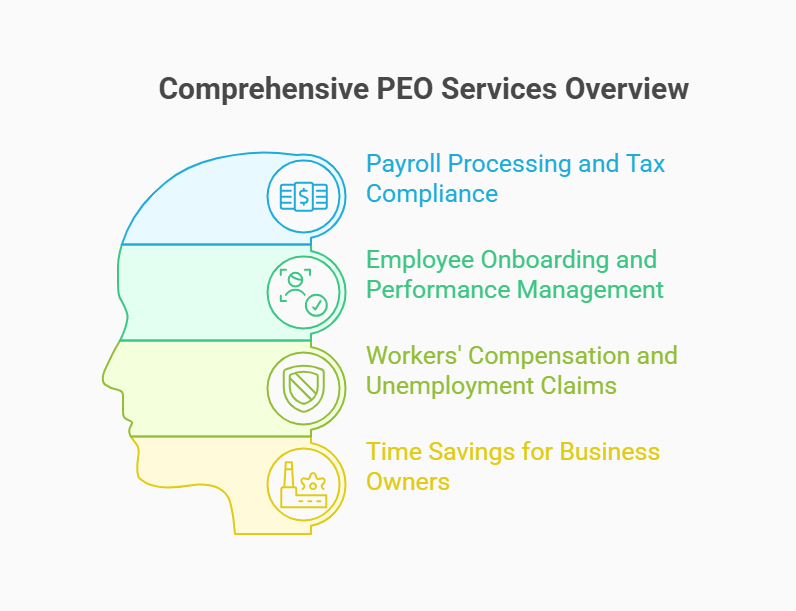

Streamlining HR and Administrative Operations

A professional employer organization simplifies business operations by centralizing human resource functions, automating payroll processing, and managing administrative tasks. This streamlined approach reduces errors, improves compliance, and speeds up onboarding, allowing business owners to achieve faster time-to-productivity for new hires while focusing on strategic goals and sustainable business growth.

Payroll Processing and Tax Compliance

A Professional Employer Organization manages payroll processing using automated systems that ensure accuracy, timeliness, and integration with the HR database. This entails making and filing payroll taxes with the IRS as well as complying with federal and state employment laws. When you outsource payroll and tax, business owners reduce mistakes, avoid penalties and save time. As a result, client companies will have enhanced financial precision, steady employee compensation, and assurance that they cover all payroll-related obligations on their behalf.

If you are a company doing business in California and you find the state’s tax and employment law landscape to be complex, our list of the best PEO companies in California will give you a good place to start. These specialized PEOs are able to help you navigate the laws of California in a professional manner.

Employee Onboarding and Performance Management

A Professional Employer Organization streamlines employee onboarding and performance management with efficient workflows, automation, and compliance oversight that is consistent. New employees gain access to vital tools, benefits packages, and training resources more quickly, making them productive in no time. These methodical strategies offer benefits to business owners, who will spend less time, keep benefit compliant, and maintain long-term employee engagement. They also enhance retention and overall business operations through a smooth on-boarding of each employee.

Key onboarding improvements include:

- Digital paperwork and faster enrollment

- Automated benefits administration

- Clear role definitions and training schedules

- Ongoing performance feedback

- Compliance with industry-specific regulations

Workers' Compensation and Unemployment Claims

A Professional Employer Organization manages workers’ compensation programs. They arrange for the necessary insurance coverage to protect your business against employee claims. They also ensure the quick processing of any claims. Their involvement also helps to reduce costs to your business through negotiated group rates. This helps businesses to protect employees while also controlling budget.

For unemployment insurance claims, the PEO handles filing, documentation, and compliance with employment laws. It decreases the chance of mistakes and prospective penalties for a business owner.

By outsourcing these functions, client companies gain access to specialized expertise, risk management strategies, and legal support, providing peace of mind while meeting all statutory obligations for workplace safety and employee protection. For employers in Hawaii, consider exploring these PEO companies with expertise in Hawaii’s labor system to ensure compliance with local insurance and employment laws.

Time Savings for Business Owners

The services of a Professional Employer Organization will free owners up to hours a week by outsourcing human resources functions. Hiring expert payroll processing services allows owners to focus on their revenue and strategic initiatives. Besides, it helps manage activities like benefitsadministration, compliance reporting and much more. Productivity is enhanced, but stress is also diminished, so that leaders can make better decisions and devote more energy to business operations that create profits and add long-term value.

Financial Impact and Measurable ROI of a PEO

By teaming up with a Professional Employer Organization, business owners can cut down on HR costs and lower insurance premiums which leads to reduced payroll taxes. According to the National Association of Professional Employer Organizations, businesses using PEOs experience a 7 – 9% increased growth over similar businesses that do not use PEOs. In addition, these companies have 10 – 14% lower employee turnover rates. Finally, they are 50% less likely to close their doors. The gains from these efficiencies often deliver a return on investment (ROI) within the first year, so that businesses can reinvest the savings into business growth and strategic initiatives that strengthen their competitiveness.

Lower Health Insurance Premiums and Employment Taxes

A PEO uses group buying power to negotiate lower health insurance premiums for businesses, providing affordable insurance coverage without sacrificing quality. When all employees are under one plan, PEOs have less employment tax as it helps in payroll tax. The business owners can now offer stronger benefits packages and maintain predictable expenses from the savings combined. As a result, employees are more satisfied, less likely to leave the company, and there are more resources to grow the business or invest competitively in the workforce.

Reduced Internal HR Costs and Technology Spend

A PEO enables a company to minimize costly HR overhead through smaller in-house groups and not excessively expensive software. Business owners can do away with multiple vendor contracts and obsolete systems through human resources outsourcing. Shifting interface turns fixed costs into service fees that are easy to measure along with some cost savings. Quality will not take a hit.

Key areas of cost reduction include:

- Salaries for HR staff

- Payroll software licenses

- Benefits administration tools

- Compliance training programs

- Recruiting platform fees

- Risk management systems

- IT support for HR processes

These efficiencies lower total cost of ownership, improve resource allocation, and free budget for business growth initiatives, allowing companies to reinvest in strategic priorities with confidence.

CoAdvantage Helps You Get More from Your PEO

With tailored HR and payroll services, CoAdvantage gives small and mid-sized businesses the tools to grow and stay compliant.

Real-World Case Studies and ROI Metrics

Many businesses partnering with a professional employer organization report ROI ranging from 25% to 35% within the first year, driven by cost savings, improved employee benefits, and reduced compliance risk. For example, client companies often save thousands every year on insurance coverage and HR technology, while boosting employee retention and satisfaction. These are very clear indications that PEO solutions can provide measurable repeatable returns in many sectors and across businesses of all size.

If your business operates in the Southwest, explore this evaluation of leading PEO companies in New Mexico to find localized support tailored to your state’s unique business environment and compliance needs.

PEO Pros and Cons: Is It the Right Fit?

Employers should consider the pros and cons of a PEO. Though PEO services can save on costs, ensure compliance, improve employee benefits etc., they can also come at a price of reduced operational control etc. This section provides a balanced framework for business owners to evaluate whether partnering with a PEO aligns with their goals and business operations.

Major Advantages That Drive Growth

A Professional Employer Organization helps businesses grow by delivering competitive benefits, advanced HR technology, and expert compliance support. These benefits are great for business owners to attract the best talent, improve retention, better run the business while saving costs. PEO partnerships provide the flexibility and efficiency necessary for sustainable business growth in competitive markets by reducing the administrative burden and facilitating access to large company resources.

Potential Disadvantages and How to Mitigate Them

The loss of control of some HR functions can be a drawback of working with a Professional Employer Organization. Some business owners may feel less direct involvement in their payroll, the selection of benefits, or decisions regarding compliance. Such a feeling can be a concern of companies whose operations may require more flexibility in these areas.

When selecting a PEO, we recommend looking for one with a clear agreement on services. If you carefully review contracts, set performance standards, and ensure alignment with your business, you can control it while getting the efficiencies and cost savings PEOs provide.

Best PEO Providers for Small Businesses

If you are a small business looking for a reliable PEO, three providers consistently earn high marks for quality, pricing, and client satisfaction. Justworks offers transparent pricing, intuitive HR technology, and strong compliance support, making it ideal for startups and growing companies. ADP TotalSource brings decades of experience to help you with payroll, benefits administration, and risk management tools. Oasis, a Paychex company, specializes in personalized service and flexible plan options for businesses of all sizes. Every provider offers cost savings and scalable solutions for business owners to concentrate on growth opportunities while ensuring workers have competitive benefits and consistent HR support.

To help simplify your comparison process, this overview of PEO provider ratings and scores presents side-by-side performance metrics across leading companies.

Conclusion and Next Steps

A Professional Employer Organization is a proven way to lower HR costs, improve employee benefits, and ensure compliance in any industry. Examining PEO services will enable a business owner to choose a partner whose culture aligns with the business. Plus, PEO services should add operational value and drive sustainable business growth. Thus, leadership will be free to focus on innovation, customer relationships and long-term profitability. To get you started, browse this PEO company database featuring 45 top providers across the U.S., including where they are located, their websites, and the date they were founded.

Frequently Asked Questions About PEO Benefits

This section answers common questions about PEO Benefits, covering financial impact, scalability, compliance processes, cultural considerations, and industry fit. By addressing these points, business owners can make informed decisions about partnering with a PEO and determine whether this employment model aligns with their long-term goals and operational needs.

What Are the Long‑Term Financial Benefits of a PEO?

Over time, partnering with a PEO can generate substantial cost savings through reduced HR overhead, lower health insurance premiums, and optimized payroll taxes. When businesses are efficient, they can free up money to spend on growth, technology and talent. Also, knowing the service fees in advance makes budgeting simpler for business owners. Further, access to competitive employee benefits improves retention. As a result, the fees create a sustainable cycle of financial and operational improvement across clients with varying business sizes and industries.

Can a PEO Serve Fast‑Growing Businesses Equally Well?

Yes, A professional employer organization adapts quickly by scaling benefits packages, HR systems, and compliance oversight as headcount grows. Flexible PEO services ensure business owners maintain efficiency, control costs, and support expansion without sacrificing employee satisfaction or operational quality.

How Do PEOs Handle Healthcare Compliance Like ACA and COBRA?

A professional employer organization manages healthcare compliance by monitoring ACA and COBRA regulations, updating benefits administration systems, and ensuring timely notices to eligible employees. PEO services coordinate with insurance carriers, maintain accurate records, and provide business owners with expert guidance to prevent penalties while supporting employee access to mandated healthcare coverage.

Will a PEO Impact Your Company Culture or Employee Autonomy?

A PEO supports existing company culture by aligning HR policies with leadership values. PEO services maintain local management authority over daily decisions while streamlining compliance and benefits delivery, ensuring business owners preserve employee autonomy, engagement, and trust throughout the outsourcing partnership.

What Should You Ask Before Signing a PEO Agreement?

Business owners should ask a Professional Employer Organization about service scope, fee structures, compliance guarantees, and benefits options. Make it clear who takes care of payroll, tax filings, and risk management. By assessing customer satisfaction ratings and asking for references, you ensure the chosen PEO services fit your operational and long-term business goals.

How Do PEO Benefits Compare to In-House HR?

Compared to in-house HR, PEO benefits often provide broader coverage, lower costs, and stronger compliance support. Business owners gain access to advanced technology and expertise without the overhead of maintaining a full internal HR department.

Which Industries Benefit Most from PEO Services?

Industries with complex compliance demands, such as: healthcare, construction, finance, and technology – gain significant advantages from PEO services. These sectors benefit from streamlined HR processes, cost-effective benefits, and risk management, enabling business owners to focus on growth while meeting stringent regulatory requirements. For business owners located in the Northeast, explore our comparison of the top-rated PEO providers in Connecticut to find options tailored to your state’s regulations and needs.

- IRS: Certified professional employer organization | Internal Revenue Service

- U.S. Department of Labor (EBSA): COBRA Continuation Coverage | U.S. Department of Labor

- OSHA: Employer Responsibilities | Occupational Safety and Health Administration

- Federal Register: Definition of “Employer” Under Section 3(5) of ERISA-Association Retirement Plans and Other Multiple-Employer Plans

- ESAC: PEO Reliability Starts Here: ESAC Accreditation

- NAPEO: Industry Overview – Napeo

- SHRM: What is a PEO? Exploring Its Role in HR Outsourcing

- U.S. Chamber of Commerce: PEO vs. EOR: Pros, Cons & Examples | CO- by US Chamber of Commerce

- U.S. Department of Labor: Workers' Compensation | U.S. Department of Labor

Maximize HR Efficiency with ADP TotalSource

ADP TotalSource brings you comprehensive PEO solutions—ideal for businesses that want deep HR support, top-tier benefits, and full compliance.