Looking to form a business in South Carolina? Starting a legal company structure like an LLC can unlock tax advantages, legal protections, and flexible management—all in a few simple steps.

To start an LLC in South Carolina, file Articles of Organization with the Secretary of State ($110 online or by mail), appoint a registered agent with a South Carolina address (free or $49–$150/year), and apply for a free EIN from the IRS. Optional fees may include a $25 name reservation and $10–$20 for a DBA. Overall, expect to spend $110–$250 upfront to form your LLC, with minimal to no annual fees unless you elect corporate tax treatment.

This guide to South Carolina LLC Formation breaks down the exact process, legal requirements, costs, and key benefits of starting an LLC in the Palmetto State. Whether you're building a side hustle or a full-scale company, we'll show you how to do it right—and save time and money along the way.

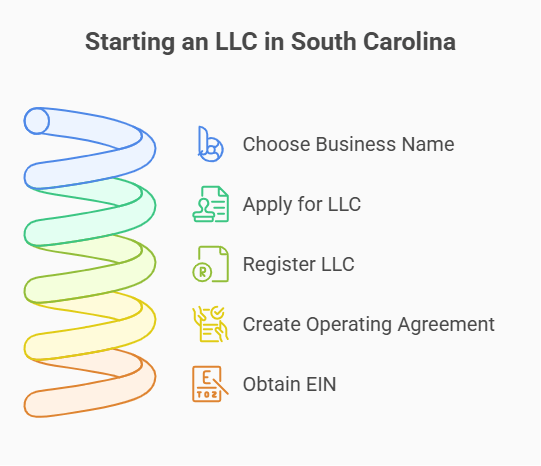

How to Start an LLC in South Carolina (Step-by-Step Guide)

Forming a business in South Carolina is straightforward when you know what to expect. This section outlines the five key steps to launching a limited liability company in the state. Whether you’re setting up shop online or opening a local office, this process works for all types of entrepreneurs.

Step 1: Start LLC South Carolina by Choosing Your Business Name

Your business name is the first impression you make—and South Carolina has specific rules you must follow. The name should not be similar to the names of other registered entities. Moreover, it must contain a designation such as “LLC” or “Limited Liability Company”. Also, stay away from misleading terms. Anything suggesting association with a state or federal government agency will not do. The name you select must also be legally allowed to be used in your state.

Before you register, check if your desired name meets all state requirements and can serve your branding goals. You may also want to reserve your name temporarily and secure a matching domain. If you're not ready to form your LLC right away, you can file an optional Name Reservation with the Secretary of State. This reserves your chosen name for 120 days and costs $25.A strong name sets the tone for how your business in South Carolina is perceived and remembered.

South Carolina naming rules checklist:

- Must include “LLC” or “Limited Liability Company”

- Must be distinguishable from existing names in SC

- Cannot imply connection with government agencies

- Cannot use restricted terms (e.g., Bank, Insurance) without approval

- Must be available for registration in South Carolina

- Check domain availability for online branding

Step 2: Apply for LLC in SC Online or by Mail

To complete the formation of your South Carolina LLC, you’ll need to submit your Articles of Organization with the South Carolina Secretary of State. You can apply online or by mail in either way. When you file it online, it’s faster and is processed within 24 hours. South Carolina does not offer expedited filing because online applications are already handled quickly at no extra cost. For mailed applications, the department usually takes up to 2-3 business days to process the application once they receive it. Both methods require a filing fee of $110.

Online applications can be submitted through the South Carolina Business Filings portal, which guides you through each section of the form. For mail filings, download the form from the same site (then print it), and send it to the Secretary of State’s physical street address. Make sure all documents are signed and complete to avoid delays.. To see how costs compare in other states, check out this guide on the cost to start an LLC in California.

Step 3: Register an LLC in South Carolina

Once your articles of organization are submitted and approved, your LLC in South Carolina becomes officially recognized by the state. You’ll receive a stamped copy as confirmation and can move forward with your operations. To complete this step, you’ll need to appoint a registered agent service—a legal requirement for handling the service of process on behalf of your company. Visit the SC Business One Stop portal to complete your registration and review compliance guidelines.

Step 4: Create a South Carolina LLC Operating Agreement

Although the state law does not require it, drafting an operating agreement will be one of the smartest things you can do for your LLC. Limited liability company agreements specify how it is managed and how major decisions are made. Doing this to reduce arguments, make roles clear, and back up the organization’s separation from the owner’s assets legally.

An operating agreement describes essential internal rules, like what members do, how they vote, how they split profits, who can join the LLC and how the LLC shuts down. Also, decide here if you’ll run a manager managed or member managed company. Even if you’re the only one involved, a contract can help back you up legally or financially.

Step 5: Get an EIN for Your South Carolina LLC

An EIN or Employer Identification Number is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify your limited liability company and used for federal tax purposes. Think of it as a Social Security number for your business. You’ll need an EIN to open a business bank account, hire employees, and file income tax returns.

You can apply for an EIN online for free through the IRS website. In just a couple of minutes, you apply and your number will be ready right away. You can also submit Form SS-4 by fax or mail if you choose, but it takes longer to process.

Start a South Carolina LLC with ZenBusiness

ZenBusiness makes LLC formation in South Carolina smooth and affordable, with compliance reminders built in.

South Carolina LLC Filing Requirements Explained

To create an LLC in South Carolina LLC, you need to follow specific legal steps and submit documents. The state requires transparency and proper structure of every business entity whose owners must ensure required filings. This part explains exactly what papers to have, when to file them, and how to be in compliance from day one. The U.S. is available to help you. If you want extra help, the U.S. Small Business Administration's South Carolina page is a solid resource.

What Are the Required LLC Documents in South Carolina?

To establish an LLC in South Carolina, you’ll need to submit a set of formation documents that formally creates your business entity under state law. The documents which state the intent to form a limited liability company contain the LLC’s name, principal address, management structure, and registered agent. All documents must be filed with and signed by the South Carolina Secretary of State. These are the primary documents for LLC registration.

All submissions must be properly signed and filed with the South Carolina Secretary of State office, either online or by mail. These are the primary documents for LLC registration:

- Articles of Organization

- Operating Agreement

- Registered Agent Consent Form

- Name Reservation Form (if applicable)

- Federal EIN Confirmation Letter (for IRS purposes)

If your LLC will operate under a different name than the one registered, you must file a DBA (Doing Business As) or fictitious name at the county level. Fees typically range from $10 to $20 depending on the jurisdiction.

If you have organized and correct documents, the speed of filing process will be faster and delays will be avoided. To make the LLC in South Carolina approval process smoother, many business owners like to prepare everything online or by mail before submitting their forms.

South Carolina LLC Filing Process: What to Expect

The online filing process for an LLC in South Carolina is quick and structured. Once you have gathered your documents, you can submit them online or via post. If you file your application online, it will get processed within 24 hours, but if you file it by mail, it may take 2-3 business days (how long it takes). You must pay the filing fee of the state, and once approved you will receive confirmation. Ensure that your documents are complete so the state can accept them without rejection or delay.

Maintaining Your South Carolina LLC in Good Standing

Once your LLC is formed, ongoing compliance means continuing your responsibilities. South Carolina LLCs are not required to file an annual report, unless the LLC is taxed as a corporation. In that case, you must file Form CL-1 and pay a $25 fee to the Department of Revenue. In addition, your business address, management information, and registered agent particulars must be updated with the state. If you fail to do this, you might end up paying a penalty or even losing good standing or even have to undergo administrative dissolution.

It is important to keep proper records, update your EIN if necessary, and pay any required state tax beyond these forms. Every LLC in South Carolina is mandated to enroll at the South Carolina Department of Revenue (SC DOR) for tax identification purposes. Having your business registered allows you to meet your obligations for sales taxes, business personal property taxes, or employer withholding.

Depending on what businesses you are running, you may have to also apply for local business licenses or permits. The city or county in which you operate issues business licenses, which are generally necessary for regulated industries, including construction, food service, or healthcare. Some of these include state registration fees or filing fee renewals (see our guide on LLC annual fees by state). Staying current ensures your business entity retains its legal protections and maintains access to banking, financing, and government contracts.

You can request a Certificate of Good Standing from the South Carolina Secretary of State to prove your LLC is active and in good standing. The document costs $10, and it’s usually required for business loans, contracts, and opening an account with a financial institution. You can also request certified copies of your formation documents at an extra fee.

Appoint Northwest as Your South Carolina Registered Agent

With Northwest, you’ll never miss a notice or filing—trusted by thousands of SC businesses.

LLC in South Carolina: Benefits and Legal Protections

Forming an LLC in South Carolina comes with powerful perks. From flexible tax treatment to strong legal protections, this structure offers simplicity and security for both entrepreneurs and small businesses – even as they hire or scale. Whether you’re protecting assets or seeking growth-friendly rules, South Carolina’s pro-business environment delivers key business entity benefits tailored to both new and established ventures.

Why Form a South Carolina LLC?

The choice of having a limited liability company in South Carolina can give your business great flexibility, protection, and growth potential. This type of business entity will separate your personal liability from business liability, allow for easy taxation and make it easier to hire and scale with you as you grow.

Top 7 benefits of a South Carolina LLC:

- Personal liability protection

- Pass-through taxation

- Fewer formalities than corporations

- Flexible management structure

- Lower LLC training requirements

- Strong reputation for real estate and small business support

- Legal recognition across all U.S. states

This list highlights why many entrepreneurs choose South Carolina for its LLC advantages.

Personal Asset Protection for South Carolina LLC Owners

One of the key benefits of forming an LLC in South Carolina is the protection of your personal assets. Being a limited liability company means that your personal bank accounts, vehicles, and property are separate from your business. If your business is sued or is in debt, your assets are protected under the LLC structure.

For example, if a customer sued your LLC, they could only go after business assets, not your house or savings. This clear separation enhances your financial privacy andprovides assurance and that you will not lose your house because of the LLC.

How Do South Carolina LLCs Pay Taxes?

In South Carolina, most LLCs will have pass-through taxation, meaning the profits and losses of a business report on the owners’ taxes directly. This avoids the double taxation that corporations face. Nonetheless, LLCs have the option to select the corporate tax structure in accordance with their financial goals. South Carolina also allows LLCs to make a PTE-level (Pass-Through Entity) tax election, which enables the LLC to pay state income tax at the entity level at a flat 3% rate. This election can be advantageous for owners looking to maximize their federal SALT (State and Local Tax) deduction. You will still have to pay applicable state and federal income tax and possibly sales tax, depending on your operations.

South Carolina LLC: Key Questions Before You Apply or Manage Your LLC

Before forming or managing your LLC in South Carolina, it’s good to clear up common questions. These include startup costs, search tools, and whether you can operate as a foreign LLC. We answer the questions that are asked most frequently below so that you can move forward confidently.

How Do You Perform a South Carolina LLC Search?

To search a South Carolina LLC, simply access SC Business Filings Search page. Enter the name of the business or the entity ID to access public information like business status, registration date, and registered agent information. Use this free tool to check availability or verify an existing LLC before formation. This free tool helps verify availability or check existing entities before you start an LLC.

How to Dissolve a South Carolina LLC

To dissolve your LLC, file Articles of Termination with the South Carolina Secretary of State. You must also pay any final taxes and close your business license or permits. Visit the SCBOS closing portal for instructions and forms. This step ensures your business entity is formally closed and avoids future fees or legal obligations.

Can You Operate a Foreign LLC in South Carolina?

Yes. To operate a foreign LLC in South Carolina, you must apply for a certificate of authority through the Secretary of State. This allows an out-of-state limited liability company to legally conduct business in South Carolina. You’ll also need to maintain a local registered agent and comply with ongoing reporting requirements.

How Does the LLC Process in South Carolina Compare to Other States?

South Carolina is best known for speedy filing process, inexpensive training costs, and minimal paperwork. Compared to other states like North Carolina or California, South Carolina offers:

– Online approval within 24 hours

– No annual franchise tax for most LLCs

– Flat $110 filing fee

– Fewer legal requirements

– Clear instructions from the South Carolina Department

This makes it one of the most affordable and business-friendly states to launch an LLC.

How Much Is an LLC in South Carolina?

The total South Carolina LLC cost starts at $110, which covers the state’s one-time filing fee for submitting your articles of organization. Additional expenses may include name reservation, business license or permit fees, and optional registered agent service. While not all fees are mandatory, budgeting around $150–$250 gives most owners a realistic startup estimate.

Can You Start a Free LLC in SC?

No, you can’t form an LLC in South Carolina completely free. The state charges a mandatory $110 filing fee for your articles of organization. While you can reduce costs by filing yourself and avoiding paid services, there’s no way to legally bypass the official state fees to start an LLC.

Looking for an overview? See South Carolina LLC Services

Create Your South Carolina LLC with Harbor Compliance

Harbor Compliance handles all the legal setup so you can focus on launching your business with confidence.