Are you looking to protect your personal assets by forming an LLC in North Carolina? Want to know exactly which steps and fees are involved so you can budget accurately? Curious how simple the process can be when you follow the state’s requirements?

To start an LLC in North Carolina, file the Articles of Organization (Form L-01) online or by mail and pay the $125 state filing fee, appoint a registered agent with a physical North Carolina address, and draft an internal operating agreement for clarity (though not legally required). Each year by April 15, you’ll submit an annual report for $203 online (or $200 by mail) to maintain good standing. Optional actions—like reserving your LLC name for $10 or registering a DBA for $26 per county—help secure branding and streamline operations.

In this guide, you’ll discover:

- Key formation requirements and naming guidelines

- A clear breakdown of one-time and recurring costs

- Step-by-step filing instructions for Articles and annual reports

- Strategies to minimize expenses and avoid compliance pitfalls

Ready to get started? Let’s dive right in and explore how to launch your North Carolina LLC!

Launch Your North Carolina LLC with Northwest

Northwest offers fast, secure LLC formation in North Carolina—privacy-focused and backed by expert support.

Why Start an LLC in North Carolina?

Launching a limited liability company in North Carolina gives entrepreneurs the best of both worlds: solid personal-asset protection, wallet-friendly state fees, and a pro-business culture that stretches from Charlotte’s fintech corridor to the coastal tourism hubs. The state’s GDP grows faster than the national average, yet regulatory red tape remains thin, letting founders focus on product-market fit instead of legal gymnastics.

- Liability shield keeps personal cars and savings out of business lawsuits

- Straightforward $125 filing and online processing in under 24 hours

- No franchise or gross-receipts tax on pass-through profits

- Diverse talent pipeline fed by Research Triangle universities

- Affordable real estate outside major metros lowers startup burn rate

Add in responsive county economic-development teams, competitive electricity rates, and predictable regulatory timelines, and north carolina quietly outshines splashier startup states. If you’re comparing options, see our ranking of the best state to launch an LLC for detailed fees and timelines. Whether you’re bootstrapping in Asheville or courting venture capital in the Triangle, forming an NC LLC sets a stable legal foundation while preserving flexibility for future conversions, capital raises, or multi-state expansions.

North Carolina LLC Requirements (What You Need to Know)

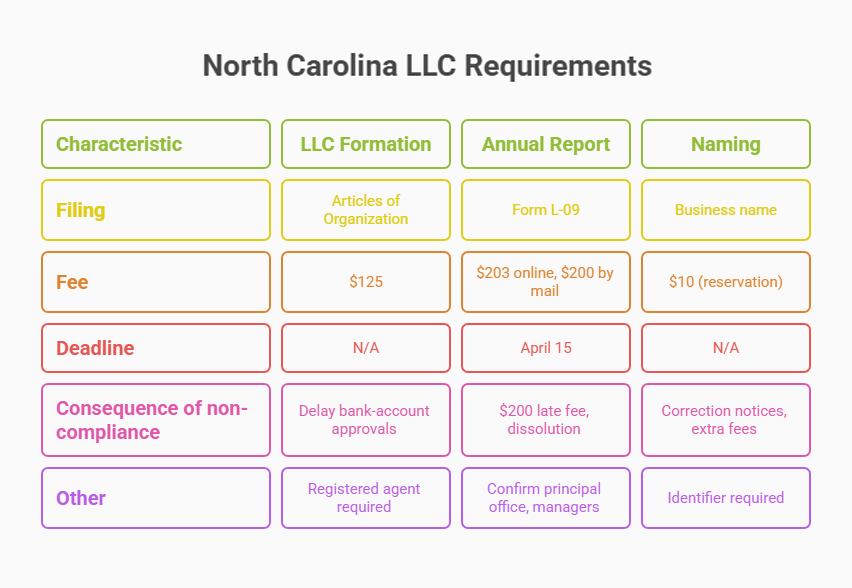

Before you file anything, understand the legal bones of an NC LLC. The state asks for little more than contact info, a llc formation fee, and an agent on call during business hours, yet skipping small details can stall bank-account approvals or derail compliance. The overview below distills statutes into plain English so you can move from idea to registration in one afternoon.

Minimum Formation Requirements Under State Law

North Carolina keeps startup red tape short. You’ll file articles of organization (Form L-01) with the Secretary of State and pay $125 online or by mail. For a complete walkthrough of every step, check our guide on how to form an LLC. The form lists the LLC name, principal office, mailing address, and a registered agent who maintains a street address in the state. Member names are optional, but many banks want them on record for KYC checks, so include at least one manager if you need speedy financing. Domestic LLCs can delay their effective date up to 90 days without extra cost, a handy option when you’re timing launch around leases or investor closings. Foreign members? No problem—North Carolina has no residency requirement. Just be sure the organizer signs electronically and that your name includes “LLC” or its variants to pass the first technical review. Once approved, you’ll receive a PDF stamped with your entity number, and you’re legally alive.

Annual Filing and Compliance Obligations

The ongoing obligation boils down to a single annual report due every April 15 after your first year. Learn more about the LLC annual report in North Carolina and how to file on time. File online for $203 or mail Form L-09 for $200; the extra $3 covers credit-card processing. The report confirms your principal office, managers, and registered-agent data—no revenue or ownership percentages. Miss the deadline and the state marks the LLC “Delinquent,” assessing a $200 late fee and starting a 60-day countdown to administrative dissolution. Because lenders check standing before funding, savvy owners calendar reminders and let their registered agent double-check filings. If dissolved, reinstatement requires every back report, the $200 fee, plus a $100 reactivation charge, so punctuality pays.

North Carolina LLC Naming Guidelines

Picking a name that wins instant approval saves you from correction notices and extra fees. The north carolina secretary of State rejects any label that duplicates an existing domestic or foreign entity, differs only by punctuation, or implies a banking or insurance charter without licenses. Include an identifier—“LLC,” “L.L.C.,” or “Ltd. Liability Co.”—and steer clear of words like “University” unless you submit agency approvals. Names may use foreign characters, but the system transliterates them, so verify spelling in the Latin alphabet before paying the fee. To vet availability statewide, use our guide to the business search in North Carolina. Adding commas or ampersands won’t distinguish your name from a competitor’s, but unique adjectives or geographic markers usually do. Finally, deceptive words such as “government” or “FBI” trigger automatic denial, and the $10 reservation fee is non-refundable, so search thoroughly first.

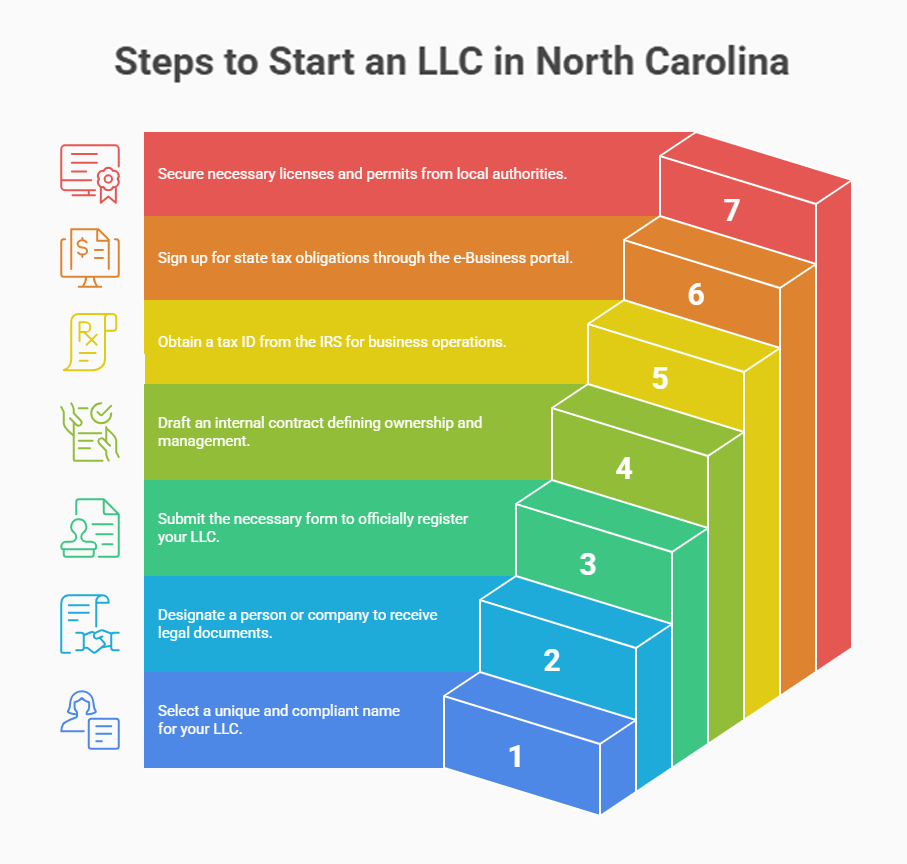

Step 1 – Choose a Business Name for Your NC LLC

Choosing a standout brand is your first public move. A strong name makes it easier to start an llc that customers remember, while a sloppy search invites lawsuit headaches. This step walks you through state tools, reservation rules, and DBA nuances so you can lock in a compliant, market-ready identity before printing business cards or signing that first lease.

How to Perform a North Carolina LLC Name Search

The fastest way to vet options is the Secretary of State’s business registration search. Enter keywords, avoid punctuation, and set the filter to “Starting With” to catch near matches. If no active or administratively dissolved record appears, run the identical search in trademark and domain databases to avoid overlap beyond state borders. Finally, scan county assumed-name registries for legacy DBAs that don’t show up in the state index. Take screenshots of clear searches—lenders sometimes ask for evidence—then move immediately to reservation or filing before a competing entrepreneur snaps it up.

Rules for Name Availability and Reservation

North Carolina applies “distinguishable on record” standards: swapping articles or punctuation won’t cut it. Your proposed name must differ by more than a corporate ending, and it can’t mislead consumers into thinking you’re a bank or agency. After clearing the search, you may reserve the name for 120 days by filing Form BE-03 and paying a filing fee of $10. The reservation is optional but smart if your operating agreement or funding won’t be ready for a few weeks.

Filing a DBA (Doing Business As) in North Carolina

Operating under a different brand? File an Assumed Business Name Certificate with the register of deeds in the county where you’ll transact—wake county forms cost $26 per name. Unlike many states, North Carolina centralizes DBA listings in a statewide database, so you only record once per county even if you grow regionally. Banks and payment processors require a certified copy before opening merchant accounts, making this minor fee worth every penny.

Name Reservation Fee and Duration

If you need extra runway before filing Articles, a 120-day hold buys peace of mind. Submit Form BE-03 online or by mail, pay the $10, and the state emails confirmation within one business day. Because this small charge is fixed in the SOS fee schedule, there’s no surcharge for multiple classes or expedited processing. You can renew once by filing a brand-new reservation, but successive holds are frowned upon and can be challenged by competitors claiming bad faith. Use the time to finish branding assets, draft contracts, and line up domain and social handles.

Step 2 – Appoint a Registered Agent in North Carolina

Appointing a registered agent is North Carolina’s way of ensuring your LLC never misses a lawsuit or tax notice. The agent’s street address becomes the public point of contact, so choose carefully: it shapes privacy, compliance, and even first impressions with investors. Here’s what every founder should know before naming that crucial liaison.

Who Can Be a Registered Agent in NC?

State law lets any adult resident or qualifying business entity with a physical North Carolina address serve as an agent. That includes you, a trusted employee, or a commercial provider. The agent must be available during normal business hours to accept service of process and certified mail; P.O. boxes and virtual offices fail the test and trigger immediate rejection. If you travel often, naming yourself could risk missing a sheriff’s knock—an oversight that can lead to default judgments. Foreign entities must appoint a North Carolina agent before the Secretary of State will approve their authority filing.

Free vs Paid Registered Agent Services

Using your office address costs nothing, but a professional service—around $99 – $149 a year—offers far more than a mailbox. Besides shielding your home address from public databases, providers time-stamp every delivery, scan documents the day they arrive, and email secure PDFs—features that speed response times and bank account verifications. Most firms maintain redundant servers, so even natural-disaster closures won’t interrupt service of process. For a side-by-side comparison, see the best registered agent in North Carolina. They also push calendar alerts for annual reports, local tax renewals, and zoning rechecks, effectively acting as a compliance co-pilot. If you operate in multiple states, the same provider can serve everywhere, simplifying fee budgeting and giving you a single login for address changes. For location-independent founders or digital nomads, that peace of mind usually justifies the subscription.

Changing Your Registered Agent in the Future

Switching agents is simple for any llc in north carolina. File the Statement of Change of Registered Office or Agent (Form BE-06) online, pay $5, and the update posts instantly. Notify the outgoing agent to avoid service gaps, then update lenders, insurers, and your website footer so legal mail routes correctly. Because the new agent’s consent is embedded in the form, you skip the signature chase other states require. Most businesses complete the entire swap in under ten minutes, and there’s no limit on how often you can change—handy if a co-founder relocates or your company graduates from DIY to commercial service.

Step 3 – File Articles of Organization with the Secretary of State

Now it’s time to create the LLC’s legal backbone: filing Form L-01 with the Secretary of State. Submission is entirely digital, costs $125, and approval emails land within 24 hours. Curious about total turnaround? Find out how long it takes to form an LLC in North Carolina. Before you click “Submit,” gather the company name, principal office, organizer details, and your chosen registered agent. Listing all members up front isn’t mandatory, but it smooths customer-identification checks at banks and prevents delays opening vendor credit lines.

- Upload PDF attachments only if you need custom provisions

- Select an effective date up to 90 days in the future for timing flexibility

- Double-check spellings; corrections cost another filing

- Pay by card or ACH—no mailed checks accepted

Once the form clears, the state emails a stamped certificate with your entity number—proof the domestic llc exists. Print it for leases and keep the PDF in cloud storage. Congratulations: your North Carolina company is officially alive.

Let ZenBusiness File Your North Carolina LLC for You

Avoid paperwork errors and get fast approval. We’ll prepare and file your Articles of Organization, appoint your registered agent, and deliver your formation certificate within 24 hours.

Step 4 – Draft an LLC Operating Agreement (Optional but Recommended)

An operating agreement isn’t required by statute, yet savvy founders draft one anyway. This internal contract clarifies ownership, voting rights, and profit splits, preventing friendship-ending disputes once money starts flowing. Even single-member LLCs benefit: the document proves separation between you and the business if creditors ever challenge your liability shield.

Legal Importance of an Operating Agreement in NC

Courts treat the agreement as the LLC’s governing constitution. Without it, state default rules decide everything from management votes to dissolution payouts—often the opposite of what partners expect. Banks, investors, and some landlords insist on reviewing the signed document before extending credit. A well-crafted contract also outlines procedures for admitting new members, issuing units, and handling member deaths or divorces, giving the company stability that statutes alone can’t match. It can even override the state rule that profits follow capital percentages, letting teams reward sweat equity instead. Finally, documenting dispute-resolution venues cuts legal fees by steering disagreements to mediation before court. That foresight keeps the business focused on growth instead of draining cash on franchise tax audits triggered by messy ownership records.

What to Include in Your Agreement

Your template should cover capital contributions, management powers, profit allocations, buyout triggers, and dispute-resolution venues. Add indemnification clauses that protect managers acting in good faith and a records policy specifying how and when owners can inspect books. If your LLC elects S-corp tax treatment, include language authorizing distributions to cover member tax bills at the prevailing tax rate. Spell out meeting quorums, electronic-vote rules, and the process for amending the agreement. Finally, attach signature blocks for every member and store the signed PDF in both local and cloud backups—lenders and auditors may request it years later.

Step 5 – Apply for an EIN for Free with the IRS

Every North Carolina LLC needs a federal tax ID, and most business owners secure it minutes after filing Articles. An EIN unlocks payroll, wholesale accounts, and business credit lines, so waiting until revenue rolls in is a costly delay. Fortunately, the IRS issues numbers at no charge, and you can finish the entire process on a coffee break.

Why Your North Carolina LLC Needs an EIN

The internal revenue service treats an LLC without employees as a “disregarded entity,” yet banks, vendors, and state tax portals still demand an EIN to prove legal existence. This nine-digit number separates personal and company finances, a key factor in piercing-veil lawsuits. You’ll also need it to opt into S-corp taxation, hire staff, or issue 1099s to contractors. Not sure if LLC status or a corporation fits best? Read our comparison of LLC vs corporation. Applying early prevents bottlenecks when you open a merchant account, onboard your first hire, or register for state sales tax. Because the IRS database syncs nightly with many fintech platforms, approvals flow faster once the EIN is live.

Step-by-Step EIN Application Process

First, gather the LLC’s legal name, trade name, member SSN or ITIN, and principal address—no online fee required.

- Visit IRS.gov and choose “Apply for an Employer Identification Number.”

- Select “Limited Liability Company” and note member count.

- Enter contact details and responsible party information.

- Choose the tax classification (default partnership or request S-corp later).

- Review, submit, and download the confirmation letter (CP 575).

The CP 575 PDF arrives instantly; print one copy for your records and save another to cloud storage. If you’re a foreign llc with no U.S. SSN, complete Form SS-4 by fax instead—approval usually returns within two business days. Guard the EIN carefully; phishing scams thrive on new-entity filings.

Step 6 – Understand State Tax and Regulatory Obligations

North Carolina keeps state-level levies predictable, yet missing a registration can still hurt. From collecting sales tax at the point of purchase to remitting employee withholdings, founders must align cash-flow forecasts with statutory deadlines. The quick guides below show where, when, and how to sign up. For an in-depth cost breakdown, see our full guide to LLC cost.

Register for North Carolina State Taxes

Start at the north carolina department of Revenue’s e-Business portal. A single application registers your LLC for income, withholding, sales, and machinery taxes—no separate forms. Pass-through entities skip entity-level income but file an informational return if they withhold non-resident distributions. C-corp-elected LLCs face the 2.5 percent corporate income tax on net income sourced to the state, payable by the fifteenth day of the fourth month after year-end. Approval emails generally arrive within 48 hours, and the confirmation letter doubles as proof for wholesalers who need your tax ID before extending trade credit.

Sales and Use Tax Permit (If Applicable)

Any LLC selling tangible goods or certain digital products must secure a seller’s permit before its first transaction. Registration is free online, and the state publishes a clear fee schedule for late filings—$50 per missed return plus interest that compounds monthly. Marketplace facilitators remit on your behalf, but your own storefront or point-of-sale device must program the base 4.75 percent rate plus local add-ons that reach 7.5 percent in some counties. Update product tax codes annually; the state reclassifies streaming content and SaaS services regularly, catching many first-year founders off guard.

NC Franchise and Privilege License Taxes

Unlike some states, North Carolina imposes no LLC-level franchise tax on standard pass-throughs, yet specific industries—electric co-ops, insurance carriers, and lending institutions—owe privilege taxes at varying percentages. If your LLC elects C-corp status, the flat corporate income tax already noted applies, plus a minimum franchise base of $200. Always confirm NAICS codes when you file to avoid erroneous billing notices.

Withholding Tax for Employers

Hiring even one W-2 employee triggers withholding registration. Factor these additional costs into payroll quotes: you’ll remit withheld amounts monthly or quarterly, depending on liability, and file the annual reconciliation on or before January 31. Penalties start at 10 percent of unpaid tax, so automate deposits through your payroll provider.

Step 7 – Business Licenses and Permits in North Carolina

Licensing varies wildly by sector and zip code. If you need payroll and HR support, compare the best PEO in North Carolina. A contractor in Raleigh needs more paperwork than a boutique Airbnb host in the mountains, while a real estate brokerage faces an entirely different board. Use the roadmap below to check every level—state, county, and municipality—before opening your doors.

Statewide Licensing Requirements by Industry

Professions affecting health, safety, or finances require state oversight. Foreign entities like out-of-state construction firms must secure a Certificate of Authority plus trade-specific credentials. Expect application fees of $100 – $375 and mandatory exams for architects, CPAs, and cosmetologists. Regulated industries often tie license renewals to continuing-education credits, so budget both time and tuition. Submit applications through the appropriate board’s online portal; many now integrate with the Secretary of State’s database, speeding cross-checks and reducing redundant notarizations.

County and City-Level Business Licenses

Most North Carolina counties scrapped general privilege licenses in 2024, but larger municipalities still impose sector fees—Durham charges food trucks $100 annually, while Greensboro requires a $50 short-term-rental decal. A series llc operating multiple locations must hold separate permits when city ordinances demand location-specific inspections. Verify zoning compliance simultaneously; a coffee roaster may need air-quality clearance even if the city licence seems generic.

How to Check Local License Requirements

Begin with your county economic-development website, then call the city clerk for district-specific checklists. Search the state’s Occupational License Database, filtering by NAICS code, to catch obscure filings for alcohol, fireworks, or pest control. Finally, email the fire marshal to confirm occupancy limits if your llc operating space welcomes customers—many founders forget this free step and face costly retrofits after a surprise inspection. Keep PDF copies of every approval in a single compliance folder; renewal reminders often arrive by mail, not email.

Annual Compliance and Ongoing Requirements

North Carolina’s compliance rhythm is simple but relentless: one form, one fee, one deadline. Even if a service handles the paperwork, you’re the one the state holds liable, so lock the dates into a compliance calendar now and sidestep penalties that can dissolve your LLC or freeze financing.

- April 15: File the Annual Report ($203 online, $200 mail)

- 30 days after ownership change: Amend Articles if managers or address shift

- Within 60 days: Renew any expiring city permits or zoning certificates

- Every Q1: Confirm sales-tax rates if you collect at point of sale

- Ongoing: Keep EIN and bank signers current to pass lender audits

Miss a filing and state penalties escalate fast—$200 late fee, then administrative dissolution 60 days later. A dissolved entity also loses its name, giving competitors an opening to claim it, so punctual paperwork is cheaper than emergency clean-up.

North Carolina LLC Costs (2025 Breakdown)

Here’s your 2025 snapshot of core llc costs. To see how these fees compare to other states, check our article on LLC cost in North Carolina. Numbers come straight from the Secretary of State and county fee schedules, so you can build a launch budget without guessing—and decide where splurging on convenience beats DIY frugality. Remember that local permits and niche professional licenses can quietly double your year-one spend if you overlook them, so treat this table as a living checklist, not mere trivia.

| Cost item | Amount | Frequency | Notes |

|---|---|---|---|

| Articles of Organization | $125 one-time | Formation | Online or mail |

| Name Reservation (opt.) | $10 | One-time | 120-day hold |

| Assumed Business Name (DBA) | $26 per county | One-time | Filed with Register of Deeds |

| Registered Agent (pro) | $99 – $149 | Annual | Privacy & scanning |

| Annual Report | $203 online ($200 mail) | Annual (Apr 15) | Mandatory |

| Change Registered Agent | $5 | As needed | Form BE-06 |

| Dissolution | $30 | As needed | Online filing |

| EIN | Free | One-time | IRS.gov |

Frequently Asked Questions About North Carolina LLCs

Still have questions? This hit-list tackles the most-searched concerns about north carolina llc paperwork, prices, and timelines. Each answer is laser-focused, so you get facts you can act on—not filler. Bookmark this section and share it with co-founders; it condenses statute books and fee charts into quick, practical guidance for entrepreneurs who would rather build products than decipher legal codes.

How long does it take to form an LLC in North Carolina?

Online filings typically clear within 24 hours, while mailed documents take three to five business days once received. Add another day if the name search flags minor corrections. Expedited service isn’t offered, so filing online is the fastest route.

What is the total cost of starting an LLC in NC?

Forming an LLC costs $125 for Articles and $203 for the first Annual Report, bringing the statutory launch price to $328. Add $26 if you need a DBA and roughly $120 if you hire a pro agent. Include $50–$150 for local permits, and most single-member startups land between $328 and $624. That sum covers every mandatory state fee, making the total cost lower than neighboring Virginia and Georgia, where franchise and registration taxes kick in immediately.

Can I use my home address for the LLC in NC?

Yes. North Carolina lets you list a residential home address for both principal office and registered agent, provided someone is available during business hours. Be aware the address becomes part of the public record, searchable by vendors and competitors. Many founders start with their home and later switch to a commercial agent for $5 when privacy, growth, or relocation concerns arise. If you rent, confirm the lease permits business mail; some landlords forbid it.

Do I need a business license to operate in North Carolina?

There is no blanket statewide license, but many cities and specialized industries require one. Check county and municipal rules plus state occupational boards (e.g., contractors, cosmetology) before opening for business.

Can I be my own registered agent in NC?

Absolutely. Any adult with a physical North Carolina address can serve. The trade-off is privacy and availability: your address goes public, and you must be on-site during business hours. Many owners start as their own agent, then switch to a commercial provider as the business grows.

Looking for an overview? See North Carolina LLC Services

Use Harbor Compliance as Your North Carolina Registered Agent

Harbor Compliance provides reliable Registered Agent services in North Carolina to keep your business compliant.