Are you preparing to launch an LLC in New Jersey and wondering what fees you’ll face? Curious which mandatory filings you can’t skip and which optional services will impact your budget? Want to ensure you maintain good standing without unexpected penalties?

Forming and keeping an LLC in New Jersey typically starts with a $125 Certificate of Formation, plus an optional $50 name reservation. You’ll pay a $75 annual report fee each year and a $150 per-member tax for multi-member LLCs. Registered-agent services run $0–$150 annually, and expedited filings add $25 per request. Beyond these core charges, expect costs for DBAs, good-standing certificates ($50–$100), and local permits—so plan approximately $300–$600 in year one and $225–$375 each following year.

In this guide, you’ll learn:

- State formation and reservation fees

- Annual report, per-member tax, and compliance penalties

- Registered-agent options and expedited processing costs

- Hidden expenses like DBAs, good-standing certificates, and local permits

Ready to get started? Let’s dive into the real cost breakdown for your New Jersey LLC!

| Cost Category | Fee | Frequency | Key Details |

|---|---|---|---|

| Certificate of Formation | $125 | One-time | Filed online; instant approval |

| Name Reservation (optional) | $50 | 120-day hold | Locks name before filing |

| Business Registration Certificate | $0 | One-time | Auto-issued after formation |

| Trade Name (DBA) | $50 | Per county | Required for each alias |

| Annual Report | $75 | Yearly | Due by formation-month end |

| Registered Agent | $0 – $150 | Yearly | Self or commercial service |

| Per-Member LLC Tax | $150 | Yearly | Multi-member entities only |

| Certificate of Good Standing | $50 e-copy / $100 paper | As needed | Banking & foreign filings |

| Expedited Processing | $25 | Per filing | Same-day acceptance |

| Reinstatement | $75 + past fees | One-time | After admin dissolution |

State Filing Fees to Start an LLC in New Jersey

Launching an LLC in New Jersey starts with state paperwork and mandatory certificates. Below you’ll find every llc formation expense you can’t avoid, plus tactics to skip optional add-ons. For a step-by-step formation walkthrough, see how to start an LLC in NJ.

Certificate of Formation – $125 One-Time Fee

The Certificate of Formation is the core filing that legally creates your company with a unique certificate of formation number. Submitted online through the Division of Revenue, the $125 payment covers indexing, stamping, and instant PDF delivery. Within minutes you receive an acknowledgment email—banks and landlords treat that file as proof you exist. Keep the download in multiple cloud folders, because replacements cost extra. The fee is flat: member count, capital contributions, or business purpose do not affect the price, and foreign filers pay the same when domesticating into the state.

Name Reservation – When It’s Needed and $50 Fee

A reservation lets you lock branding while finalizing an operating agreement or chasing investor signatures. For $50, the Division of Revenue holds your desired name for 120 days. Reserve only if you need time; filing formation automatically secures the name. Use reservations strategically for sequenced rebrands or when counsel must run trademark checks. The hold cannot be extended—you’ll forfeit the fee if paperwork isn’t filed before expiration. If you’d rather skip formal planning, learn how to launch an LLC without business plan in minutes.

Business Registration Certificate – Mandatory but Free

Every new LLC must obtain a Business Registration Certificate from the state’s division of revenue portal, but there’s no extra charge. After formation, the system generates the certificate once you answer basic tax-eligibility questions. You’ll need this free PDF to bid on public contracts, open a bank account, and claim sales-tax resale exemptions. Bookmark the file immediately; vendors may withhold payment without it.

Form your NJ LLC the easy way with ZenBusiness

Step-by-step guidance, compliance alerts, and affordable add-ons, perfect for first-time founders.

Alternate Name (DBA) Costs in New Jersey

Using a different public name can boost marketing, but each alias adds paperwork. Here’s what a business entity pays to file a DBA in the Garden State.

Trade Name Filing – $50 with County Clerk

County clerks record Trade Names—also called Alternate Names—for a flat $50. Complete a one-page form listing the LLC’s true name, desired alias, and street address, then file it in every county where you operate. Processing happens while you wait, and the clerk returns a stamped copy banks accept for DBA checking accounts. Because the county keeps no online index, scan the paper for remote vendors who question the alias.

When You Need a DBA and When You Don’t

File a DBA when storefront branding differs from the legal name or when launching a new product line. Skip it if the official name already communicates your service; regulators don’t demand DBAs merely for shortened logos. Multiple aliases are legal, but each triggers a separate report filing fee, so consolidate where possible to cut clerical costs.

Hidden DBA-Related Costs (Banking, Branding, Compliance)

Beyond the $50 filing, expect indirect expenses. Banks often charge a new-account setup fee for DBA deposits. Graphic updates inflate branding budgets, and e-commerce platforms may bill extra for additional seller accounts. Compliance-wise, you must renew local mercantile licenses under every alias and ensure the registered agent service lists each trade name on forward-mail labels. Price these hidden costs before committing to multiple monikers. For a general formation primer, check out our guide on how to start an LLC.

Annual and Recurring Fees for New Jersey LLCs

Formation is a sprint; compliance is a marathon. The fees below repeat every year you operate an llc in new jersey, and missing them can dissolve the entity.

Annual Report Filing – $75 Each Year with Deadline Overview

New Jersey requires an annual report filing for $75, due by the end of your anniversary month. The short online form confirms address, member names, and registered-agent data. Finish it in minutes to keep the public record current. The portal emails a receipt you should archive with tax documents. Miss the deadline and late fees pile on, good-standing certificates freeze, and dissolution starts at 60 days. For detailed filing instructions, see our LLC annual report for New Jersey.

Registered Agent – Free to $150/Year Depending on Choice

Using yourself as registered agent costs nothing but publishes your home address and forces business-hour availability. Commercial services run $99–$150 per year and include mail scanning, compliance alerts, and privacy shielding—worth it for remote founders or anyone expecting sensitive lawsuit papers. Either option must be on file before formation, and changes trigger a $25 amendment fee. To compare top providers, check our ranking of the best LLC service in New Jersey.

What Happens If You Miss the Filing Deadline

Skip the annual report and the portal adds a $25 late penalty plus interest. At 60 days past due, the LLC becomes “Not in Good Standing,” blocking loans and state contracts. Reach 12 months and the Division of Revenue issues administrative dissolution. Rebuilding credibility later costs more than the original report filing fee, so set automated reminders.

Reinstatement and Revival Fees After Dissolution

Once dissolved, you must file a reinstatement form, pay $75, and catch up on every skipped report and tax. The state also wants proof your business-tax account is current. Processing can take two weeks, during which vendors may freeze payments. Treat compliance fees as non-negotiable overhead to avoid this disruption. To set realistic timelines, see how long it takes to get an LLC in New Jersey.

Optional Administrative Costs and Situational Fees

Optional fees don’t appear on the Division of Revenue’s fee table, yet they surface when lenders, landlords, or marketplaces want extra paperwork. Budget for them while forming an llc so last-minute scrambles never stall a closing or product launch.

Certificate of Good Standing – $50 or $100

Banks, franchisors, and foreign states ask for proof your limited liability company is current on every report and tax. New Jersey sells a $50 PDF that downloads in minutes and a $100 embossed copy for jurisdictions that still demand paper. Both expire after ninety days, so order right before a loan signing, real-estate closing, or multi-state registration. Build the line item into every major financing checklist.

Expedited Filing Fee – $25

Standard online submissions post next day, but selecting the $25 rush option pushes your document into a one-hour queue. It’s invaluable when a purchase contract requires entity approval or when you must grab a sales tax permit before a weekend pop-up. Upload PDFs before 2 p.m. ET; filings after that revert to normal speed. Batch amendments into one order to stretch the premium. If budget is tight, learn how to form a cheap LLC without sacrificing compliance.

Certified Copies or Amendments – Variable

Certified copies cost $10 per page plus a $25 seal, yet shipping, apostilles, and notary fees inflate the total. Order certified Articles when bidding on federal contracts or registering abroad, and archive scans with every tax return so auditors and buyers can trace ownership history without fresh orders. Request an apostille at the same time to save a second courier run.

Taxes for New Jersey LLCs

New Jersey layers unique state charges atop federal duties. Knowing each income tax trigger—member fees, sales levies, and payroll withholding—keeps cash-flow forecasts honest and prevents quarter-end panic.

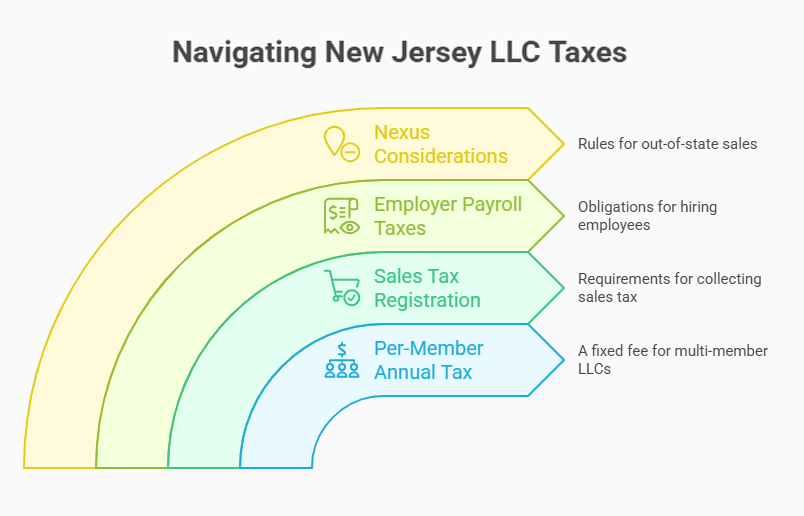

$150 Per-Member Annual Tax (Multi-Member LLCs)

Partnership-classified LLCs owe a $150 fee per member, capped at $250 K. Like a limited partnership franchise tax, it rides on Form NJ-1065 every April, even if the company breaks even. Partners can’t deduct it federally, so treat it as overhead.

When Single-Member LLCs Are Exempt

Disregarded entities escape the member fee because they’re taxed like a sole proprietorship. You’ll still file Schedule NJ-CBA and pay estimates above $10 K profit. Admit a second member mid-year and prorate the fee from the admission date.

Northwest Registered Agent – Focused on Privacy and Simplicity

Protect your personal address and get instant access to legal documents.

Sales-Tax Registration – Economic Nexus

Cross $100 K in receipts or 200 transactions and a foreign llc or domestic one must collect 6.625 %. Urban Enterprise Zones drop the rate by half. Monthly ST-51 deposits kick in once collections exceed $500, and quarterly ST-50 returns reconcile credits. To compare overall expenses, check our roundup of LLC cost.

Employer Payroll Taxes – If Hiring in New Jersey

Hiring triggers limited liability partnership-style trust-fund levies—Unemployment, Disability, Family Leave, and withholding. Register within ten days of first wages, file NJ-927 and WR-30 each quarter, and sync totals with IRS 941s to dodge audits.

Nexus Considerations for Out-of-State Sales

Warehousing a single pallet in york city or Newark creates physical nexus even below revenue thresholds. Register before inventory lands to access voluntary-disclosure interest abatements and automate jurisdiction tracking in your accounting stack.

Business License and Local Permit Costs in NJ

State approval is step one; municipal signatures for zoning, fire safety, and waste are step two. Use this private limited company checklist so no local invoice derails opening day.

City and County Licensing – Estimated Ranges

Fees jump by zip code. Salem County issues $25 mercantile licenses, while Jersey City charges a $168 base, $54 fire inspection, and $75 signage approval. Hoboken adds a $20 sidewalk-café permit; Cherry Hill bills $200 for health reviews. New Brunswick tags grease-trap certificates at $50 every six months, and Camden assesses a vacancy surcharge until code passes. Fingerprinting for pawn shops, alarm installers, and recycling surcharges on e-commerce cardboard can quietly add four figures—a surprise for joint stock investors used to Delaware simplicity. If you need a general timeline, see how long it takes to form an LLC across all states.

Regulated Industries – When Special Permits Are Needed

Highly regulated fields must form an llc and then secure vertical endorsements. Liquor licenses range from $200 processing to $15 K at auction; cannabis retailers pay $10 K up front plus 2 % of gross to the host town. Child-care centers file 16-page booklets, floor plans, and $110 fingerprints per staffer, while clinical labs need CLIA numbers and a $500 biohazard stamp. Miss one renewal and shutdown notices can wipe out a season’s profit.

Foreign LLC Fees and Obligations in New Jersey

Expanding into New Jersey doesn’t require a full reincorporation, but your out-of-state company must register before signing leases, hiring staff, or opening a bank account. The jersey division of Revenue views foreign LLCs like domestic cousins, issuing the same obligations, due dates, and late-fee triggers.

Certificate of Authorization – $125 Filing Fee

Foreign LLCs secure legal standing by filing a Certificate of Authorization and paying a $125 fee. Submit the form online, attach a current Certificate of Good Standing from your home state, and list the New Jersey registered agent. Approval arrives within 24 hours and includes a stamped PDF for utilities, payroll, and vendor onboarding. The filing lets you operate as an llc in new jersey without changing home-state articles. Because the document creates tax nexus, register employer and sales accounts the same day to avoid mismatched start dates. Keep home-state operating agreements and equity ledgers intact for investors.

Annual Report and Tax Duties for Foreign Entities

Once approved, a foreign LLC meets the identical liability partnership obligations that bind local firms. File the $75 annual report by the end of the authorization month, update any New Jersey locations, and pay the $150 partnership levy for each profit-sharing member. Sales tax, unemployment, and disability premiums follow standard schedules. New Jersey lets a foreign LLC keep its home-state suffix even if it skips “LLC,” yet most banks will ask for a county-level DBA before printing checks. Budget $50 for that trade name and log all deadlines in your existing compliance tracker to dodge double jeopardy.

Cost Comparison: Filing Yourself vs Using a Service

DIY routes look cheap until postage, notary stamps, and re-work delays stack up. A service bundles paperwork, alerts, and templates—charging for convenience. The matrix below compares cash outlay and time value so you can gauge whether an online llc filing assistant earns its fee.

| Task | Do-It-Yourself | Formation Service |

|---|---|---|

| State filing | $125 | $125 |

| Name reservation (optional) | $50 | $50 |

| Registered-agent year 1 | $0 – $150 | Included |

| Operating-agreement template | $0 – $200 | Included |

| Notary, shipping, copies | $40 | $0 |

| Compliance reminders | Manual | Included |

| First-year total | $215 – $565 | $275 – $375 |

FAQs – New Jersey LLC Costs

LLC expenses spark endless debate, so we distilled the most-asked questions into concise answers. All figures reflect June 2025 schedules and assume a baseline formation cost through the state portal. Layer city permits, payroll insurance, and industry licenses on top for a precise launch budget.

What is the total cost to form an LLC in NJ in 2025?

Forming online costs a state filing fee of $125 for the Certificate of Formation. Add an optional $50 name reservation and, if you rush, a $25 expedited charge—roughly $200 on day one. Within 30 days you must register for taxes (free), and by your first anniversary you’ll owe a $75 annual report. Plan on about $300 for year one before adding agent or city fees.

Are there any ongoing or hidden fees after registration?

Beyond published charges, watch for hidden fees such as the $150 per-member tax (multi-member only), $99–$150 agent renewals, and $50 Good-Standing certificates every time you refinance. Trade-name filings cost $50 per county, and recycling surcharges or pop-up permits can nibble at margins. Miss a deadline and penalties plus revival costs snowball quickly—calendar alerts pay for themselves.

Is the $150 tax required for all types of LLCs?

The partnership tax applies only to LLCs taxed as partnerships. Single-member entities and those electing S-corp status avoid the levy entirely. Add a partner in August and you’ll owe $150 prorated over five months; revert to solo ownership and next year’s charge disappears. New Jersey syncs the fee with your current federal classification.

What happens if I miss my annual report deadline?

Miss the deadline and the state adds a $25 late fee plus interest. After 60 days you lose good standing, blocking loans and tax clearances. At 12 months the Division administratively dissolves the company. Reinstatement demands every past report, a $75 reinstatement fee, and full penalty payment—delays that can stall real-estate closings for weeks.

Can I form a New Jersey LLC entirely by myself?

Yes. Draft the paperwork, pay the fee, appoint an agent, and download approval—often in under fifteen minutes. DIY saves money but shifts tax IDs, unemployment registration, and municipal permits onto your plate. Weigh the formation application cost against a few hours of your billable time before deciding.

Do I need a local business license for each city I operate in?

Usually. Each municipality sets its own rules, and operating across towns means separate applications, renewals, and inspections. Mobile firms need a base-city license plus temporary permits for fairs and pop-ups. Skipping a business license invites daily fines that can exceed the original fee within a month, so confirm requirements during site selection.

Resources for Launching Your New Jersey LLC

Exploring LLC formation in New Jersey? Dive into these trusted resources that walk you through filing fees, name registration, tax registration, and annual reports—made simple so you can confidently launch your business.

- New Jersey Business Gateway Services (nj.gov)

Official portal to register your LLC, check name availability, file annual reports, and manage tax accounts. - Articles of Organization – Form L-102 (nj.gov)

Download the required form to file your LLC. Filing fee is currently $125, with expedited options available. - New Jersey LLC Filing & Fee Guide – ZenBusiness (zenbusiness.com)

Breakdown of setup costs, annual report fees ($75), name reservation fees, and optional add-ons like registered agent service. - NJ Department of Treasury – Business Tax Registration (nj.gov)

Guide to registering your LLC for sales tax, employer withholding, and corporate net income tax via New Jersey’s tax portal.

These resources give you the tools you need to navigate New Jersey’s LLC formation process – from payment and compliance to optional service options, so you can get your business off the ground with clarity and peace of mind.

Looking for an overview? See New Jersey LLC Services

Create your New Jersey LLC with Harbor Compliance

Enterprise-grade service with compliance tracking and full document prep. Ideal for serious founders.