Idaho’s SOSBiz is the Secretary of State’s free search to check business-name availability and pull official records. Search by name or file number, open the entity drawer to confirm status, registered agent, addresses, and filings, and use Advanced filters to find true conflicts. Idaho’s ‘distinguishable on the records’ rule and required LLC/corporation designators apply; if needed, reserve a name online for 120 days. When ready, order $10 certificates or certified copies right from the entity panel.

How to Search Idaho Businesses Online (use SOSBiz)

Idaho’s SOSBiz is the official, free database run by the Idaho secretary. You can run a business name search, open the profile panel to see status/addresses/registered agent, download filings, and use Advanced Search Options to narrow results. You can search by name or file number, and the right-side panel shows “information and actions” you can take for that entity.

Experience tip: When you type a name during filing, SOSBiz shows a preliminary green-check if the name looks available, but staff make the final call, so always run a full business entity search first.

Step 1: Open SOSBiz and choose Business Search

On the “Online Business Services” home, look to the dark-blue left rail and click Search, then choose Business. The page loads a single field labeled “Search by name or file number” with a magnifying-glass button. No login is needed to run a business name search.

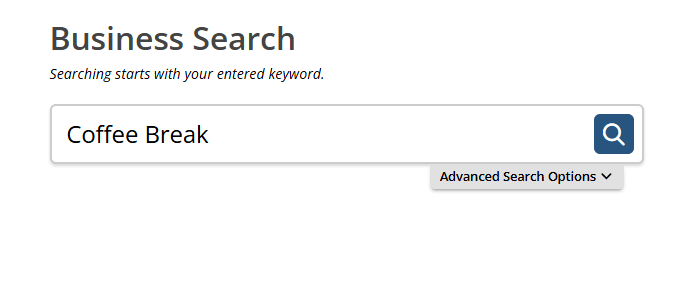

Step 2: Search by Name or File Number and use Advanced filters

Type a broad term first, enter (for example) Coffee Break (leave off “LLC/Inc.”), and click the magnifying glass or press Enter.

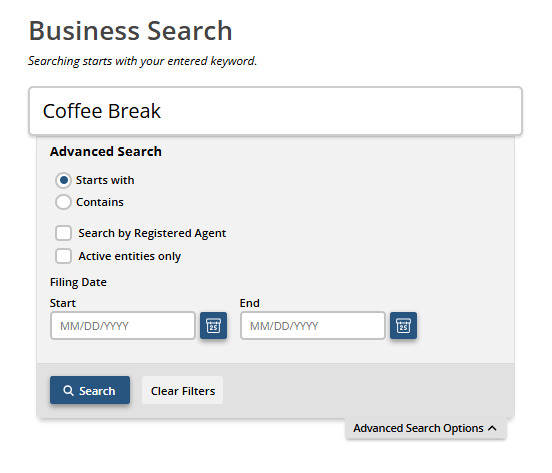

To narrow your search results, click Advanced Search Options (small caret under the field) to reveal:

- Starts with / Contains (radio buttons)

- Search by Registered Agent (checkbox)

- Active entities only (checkbox)

- Filing Date range with Start/End date pickers and Clear Filters

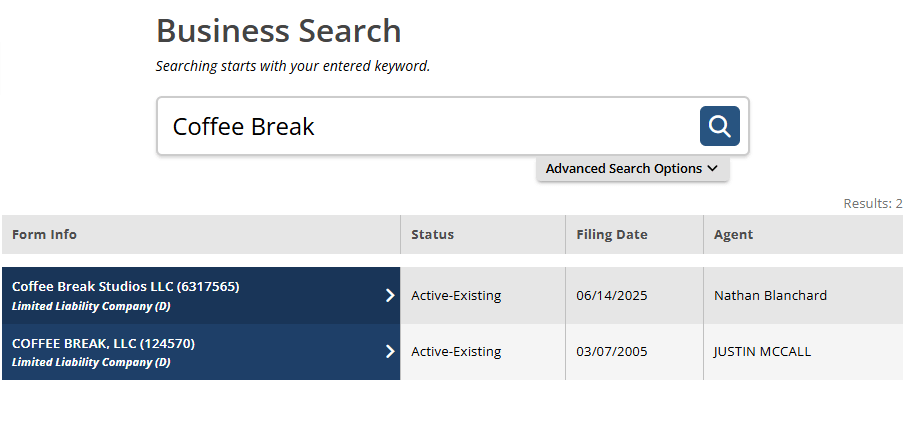

Step 3: Review your results list

After click the search button, a results grid appears under the bar with columns Form Info, Status, Filing Date, and Agent. For Coffee Break, you’ll see:

- Coffee Break Studios LLC (6317565) – Active-Existing – Agent: Nathan Blanchard

- COFFEE BREAK, LLC (124570) – Active-Existing – Agent: JUSTIN MCCALL

This is your first filter for name conflicts and for picking the right record. “Active-Existing” means a live claim to a confusingly similar name, critical for availability decisions and for diligence.

What to do now (quick checklist):

- Scan Status: prioritize Active-Existing hits.

- Compare names: is your proposed name distinguishable?

- Note file number of the record you’ll open next.

- Too many results? Go back and use Advanced (Active-only, Contains, or Registered Agent).

Works / Doesn’t work (embedded, using our example)

- Works:

- Coffee Break Roasters LLC – adds “Roasters,” usually distinguishable from COFFEE BREAK, LLC and Coffee Break Studios LLC.

- Coffee Break Collective LLC – distinctive second word; valid limited liability designator.

- Doesn’t work (fix it):

- Coffee Break LLC – exact conflict with COFFEE BREAK, LLC.

- Coffee-Break LLC / The Coffee Break LLC – punctuation/articles only; generally not enough to distinguish.

(Final acceptance is by filing staff. After this grid looks clean, you’ll still run a state trademark search.)

Step 4: Open the entity drawer & read key fields

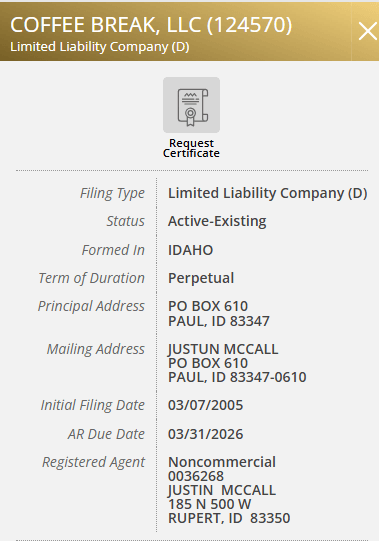

Click a row to open the details panel. For COFFEE BREAK, LLC (124570) you’ll see:

- Filing Type: Limited Liability Company (D)

- Status: Active-Existing

- Formed in: IDAHO

- Term: Perpetual

- Principal/Mailing Address: PO BOX 610, PAUL, ID 83347

- Initial Filing Date: 03/07/2005 • AR Due Date: 03/31/2026

- Registered Agent: JUSTIN MCCALL, 185 N 500 W, RUPERT, ID 83350 (physical Idaho street address)

Top of the panel: Request Certificate (order proof).

The drawer confirms whether this record actually blocks your business name search and whether the company is in good standing. It also gives you the registered agent and addresses you need for contracts, notices, banking, or service of process.

How to use each field (quick map):

- Status → Availability & risk (Active vs. dissolved).

- Formed in / Filing Type → Whether it’s domestic or foreign; entity type that might still conflict.

- AR Due Date → Compliance timing; missed dates signal risk.

- Registered Agent + street address → Must be an Idaho physical address; use for notices.

- Request Certificate → Order a $10 certificate when proof is required; save PDFs of filings for your deal folder.

Next action: If this record is too close, adjust your name (see Step 3’s “Works/Doesn’t work”). If it’s unrelated, continue to the trademark search and proceed.

Step 5: Confirm name clearance with the State Trademark Search

Entity availability isn’t brand clearance. After your idaho business entity search looks clean, run the SOS trademark search to catch identical or confusingly similar marks the entity database won’t show. Do this before finalizing logos or social media handles.

Step 6: Decide next steps: order certificates or save filings

If everything checks out, order a Certificate of Existence/Authorization directly from the panel (typical fee $10). For certified copies, expect a certification fee plus per-page charges. Not ready to file today? Reserve the name for 120 days online to hold it while you finish prep, online filing avoids manual paper surcharges with the secretary of state business.

Reserve Your Idaho Business Name with ZenBusiness

Don’t let someone else grab your name. ZenBusiness helps you lock it in and move forward with confidence in Idaho.

Read Idaho Search Results

When your business entity search returns a match, open the record in SOSBiz to review the core fields. You’ll see the legal name, file number, entity type, status, principal and mailing addresses, registered agent information, and links to filings/certificates. Use this to verify identity and decide next steps (file, reserve, or order proof).

Status and good standing indicators

Confirm whether the entity is shown as Active (or similar) versus terms like Administratively Dissolved or Revoked. Status appears at the top of the profile and should be consistent with recent filings in the history list. (Annual reports and other updates are filed through SOSBiz.)

Domestic vs foreign and authority date

“Domestic” indicates the entity was formed in Idaho; “Foreign” means it was formed in another state and is registered to transact business in Idaho. The profile also shows an “Authority/Registration” date for foreign entities, useful for confirming when Idaho authorization began.

Registered agent and registered office details

Idaho requires a registered agent with an in-state physical street address where someone is available during normal business hours to receive service of process. PO Boxes or commercial mailboxes aren’t acceptable for the registered office. If the agent or address is outdated, file a change promptly.

Filings to open first for due diligence

Open the formation filing (Articles/Certificate), amendments, and the most recent annual report for a quick compliance read. When a bank, licensor, or counterparty asks for proof, order a Certificate of Existence/Good Standing from the state, $10 per certificate, and request certified copies if needed (certification $10 plus $0.25/page). Idaho has warned about third-party mailers that charge much more; you can order directly from the Secretary of State.

Name Rules and Reservation

Before you file or reserve a name in Idaho, confirm two things: that your business names are distinguishable on the records and that the correct designator is included for your structure. The secretary of state business database enforces these rules at filing and when you submit a reservation.

Idaho distinguishability and required designators

Idaho law requires names to be distinguishable on the idaho secretary’s records. Corporations must include “corporation,” “incorporated,” “company,” or “limited,” or an accepted abbreviation; LLCs must include a limited liability designator such as “Limited Liability Company,” “Limited Company,” or “LLC/L.L.C./LC/L.C.” (see Idaho Code §§ 30-21-301, 30-21-302).

Reserve a business name for 120 days online for $20

You can reserve a legal entity name for four months (120 days). The form shows $20 base fee; paper filings add a $20 manual processing fee (avoid this by filing online). See “Application for Reservation of Legal Entity Name” and the state “Business Forms” index.

When to reserve vs file immediately

Reservation is useful if you need time for internal approvals, branding, or licensing prep. If you’re ready to form now and your business entity search is clear (and you’ve done a quick trademark search), filing immediately skips an extra step. Idaho provides both the SOSBiz entity search and the statewide trademark search in the same ecosystem.

Assumed Business Names (DBA)

If you’ll operate under a name that’s different from your legal name, Idaho uses Assumed Business Name (ABN) filings (often called “DBA”). ABNs are notice filings only, they make the name public on the Idaho secretary records but do not grant exclusive rights to the name or replace forming legal entities like LLCs or corporations.

When an ABN is required (and when it isn’t)

Idaho requires an ABN before you begin transacting business in idaho under an assumed name. Formally organized business entities (LLC, corporation, LP/LLP) must file an ABN if they conduct business under a name other than their true legal name. A sole proprietor using their own first and last name within the business name generally doesn’t need an ABN. If you’re weighing structure vs trade name, see LLC vs DBA.

How to search existing ABNs

ABNs are included in the SOSBiz public business entity search. Use the same search screen to look up business names and ABNs, then open the record to view owners, addresses, and filing history.

File, amend, or cancel (current fees and where to do it)

Idaho encourages online filing through SOSBiz; paper forms usually add a manual processing surcharge. Key fees from the official forms:

- New ABN (Certificate of Assumed Business Name): $25 online; paper adds $20 manual processing ($45 total), with optional expedite +$40 or same-day +$100 for manual entries.

- Amend or Cancel an ABN: Base amendment filing $10; paper submissions add $20 manual processing (total $30). For a cancellation (or mailing-address-only change), the state’s FAQ notes no fee; if you submit a paper cancellation, you’ll still pay the $20 manual entry fee. File online in SOSBiz to avoid the manual charge.

- Paper/manual surcharge rule: Idaho’s Business Forms index confirms most paper filings incur an additional $20 manual processing fee and are rejected if that fee isn’t included.

Quick facts (read before you file):

- ABN names must be distinguishable from names of Idaho filing entities and registered/ reserved names in the commercial register. Don’t add “LLC/Inc.” to an ABN, those designators imply a different entity type.

- ABNs are public records; use a business mailing address, not a home address, on forms.

- ABNs don’t file annual reports (that requirement applies to certain entities, not ABNs). Watch for third-party “mailers” that try to sell unnecessary filings or overpriced certificates.

Registered Agents in Idaho

Every filing entity that does business in idaho must maintain a registered agent and a registered office in Idaho. The agent must be available during normal business hours to accept service of process and official notices at a physical street address (not a PO Box). You may appoint an individual Idaho resident or another legal business (but not your own entity) with an in-state street address.

Not sure what’s required for your situation? Start with do I need a registered agent in Idaho.

Trust Northwest as Your Idaho Registered Agent

Northwest offers local expertise and strong legal protection as your Idaho Registered Agent—ideal for keeping your business in good standing.

Idaho requirements and physical address rule

Idaho follows Title 30, Chapter 21 rules for registered agents. Practically speaking, this means: keep an Idaho street address on file, ensure someone is available at that address during business hours, and update the idaho secretary’s records promptly if anything changes. PO Boxes and commercial mailboxes don’t satisfy the registered office requirement.

Before you file, here’s a quick checklist to review (and yes, read this intro first, then the list):

- Confirm the registered agent has an Idaho street address (no PO Boxes).

- Make sure business-hours availability is feasible at that registered office.

- Decide whether to appoint an individual or a third-party service (Idaho no longer publishes a statewide agent list).

Find or change a registered agent in SOSBiz

You can view the current registered agent from your entity’s SOSBiz profile and update it online. Online changes are $0; if you use the paper Statement of Change of Registered Agent/Registered Office, Idaho assesses a $20 manual processing fee (paper filings without that fee are rejected). Optional expedite services are available: + $40 (expedite) or + $100 (same-day). Filing online avoids the manual surcharge.

Where this lives: SOSBiz is the state’s online commercial register for business entities; it’s also where you’ll manage registered-agent changes alongside other updates.

If you’re choosing a commercial provider, compare Idaho registered agents.

Records and Certificates

Once your idaho business entity search confirms the exact legal name, you can download filings from the SOSBiz profile and order official proof from the state. Idaho offers multiple certificate types and certified copies directly from the secretary of state business office, so you don’t need a third party.

What You Can Order

Banks, licensors, and counterparties commonly ask for:

- Certificate of Existence/Good Standing (proves the entity exists and is in good standing) – $10 each.

- Certificate of Authorization/Registration (often labeled “Existence/Goodstanding” for foreign companies) – $10.

- Other certificates available on the state form: Merger, Name Change, Certificate of Filing ABN, and No Record – $10 each.

Quick reminder: before ordering proof, run a final business name search in SOSBiz to make sure you’re selecting the correct record.

Certified Copies vs. Plain Copies

If you need official copies of formation/authority filings (e.g., Articles, amendments, latest annual report):

- Certified copies: $10 certification + $0.25/page (includes the original filing and all amendments).

- Plain copies: $0.25/page via public-records copy rates. (Useful when certification isn’t required.)

How to Order (Online vs. Form)

You can download many filings straight from the entity’s SOSBiz profile. For official certificates/certified copies:

- Use the state Certificate Request form (mail/pickup). It lists available certificate types, fees, and the certified-copy rate.

- Filing paper requests/forms? Idaho adds a $20 manual processing fee to most paper submissions; online options avoid that surcharge.

Avoid Overpaying (Official vs. Third Parties)

The Idaho Attorney General has warned about misleading mailers that upcharge for “good standing” or “certificate” services. Order directly from the state using SOSBiz or the official form.

Licenses and Permits

After your business entity search confirms the name and record, the next step is making sure your business in idaho has the right tax accounts and any required state/local permits. Idaho doesn’t issue a single, statewide “general business license,” so you’ll piece together exactly what you need based on what you sell, where you operate, and your industry.

State Tax Accounts

Start with the Idaho Business Registration (IBR) to open state tax permits, most commonly a regular seller’s permit (sales tax) and employer withholding if you’ll have employees. After your accounts are created, set up your TAP login to file and pay online.

- IBR overview & how it works (Idaho State Tax Commission).

- Regular seller’s permit (who needs one, basics).

- TAP (Taxpayer Access Point) registration/overview for online filing.

Employer Unemployment Insurance

If you’ll hire employees, open an unemployment insurance (UI) account with the Idaho Department of Labor. Use the iUS Employer Portal to register and manage your UI tax.

- iUS Employer Portal (create/manage UI account).

- UI portal FAQ and account details.

Professional & Occupational Licenses

Some lines of work require a professional license (for example: contractors, health professions, cosmetology, real estate). Idaho’s Division of Occupational and Professional Licenses (DOPL) provides application and renewal portals, board pages, and license lookup.

Health & Safety Permits

Food trucks, restaurants, caterers, and similar operations must obtain permits through their local public health district; plan review and a pre-opening inspection are standard before operating.

City/county Licenses

Idaho has no statewide “business license,” but many cities issue activity-specific licenses (e.g., alcohol service, mobile vendors, transportation, etc.). Always check your city/county after you register with the state.

If you’re unsure how licensing interacts with your entity type, start with do LLCs need a business license?

Register a New Business in Idaho

Getting on the record in Idaho is a three-part flow: confirm your name, complete the state filing in SOSBiz, then open your tax and employer accounts. The same business entity search hub you used earlier also links to trademark search, filings, and certificates, so you can move from check → file → proof in one place. (If you’ll form an LLC, follow our step-by-step Idaho LLC guide).

1) Choose a structure and clear the name

Start by verifying that your business names are distinguishable in SOSBiz, then scan Idaho’s trademark search for conflicts. If you’re not ready to form, reserve the name for 120 days: online $20; paper adds the $20 manual processing surcharge; optional expedite +$40 or same-day +$100 (for manual/paper entries). For broader brand protection, check federal marks via USPTO.

If you’re weighing tax treatment as part of the decision, skim our overview of LLC tax benefits.

2) File formation or foreign registration in SOSBiz

Create/Log in to SOSBiz and file the right form for your structure:

- LLC : Certificate of Organization (base $100 online; paper adds $20 manual processing → $120).

- Corporation : Articles of Incorporation (base $100; paper adds $20 manual processing).

What you’ll need on the form: exact legal name with a limited liability designator (for LLCs), principal/mailing address, Idaho registered agent with an in-state physical street address (no PO Boxes), and other structure-specific details. Idaho confirms a $20 surcharge for filings requiring manual data entry; the FAQ also notes optional expedited handling (“within 8 working hours”). If you’d rather compare providers before filing, see our Idaho LLC service reviews.

For average approval timelines, see our Idaho LLC processing time guide.

3) Set Up Taxes and Employer Accounts

After the secretary of state business filing posts, open your tax accounts and payroll IDs:

- EIN (IRS) – Free, instant online directly from IRS (never pay a third party).

- Idaho Business Registration (IBR) – Register for sales tax/withholding, then manage in TAP.

- Unemployment Insurance (UI) – Create your employer account in Idaho Labor’s iUS Employer Portal.

When the dust settles, calendar your first annual report in SOSBiz so you maintain good standing and can order proof (e.g., Certificates of Existence) any time.

If you prefer to outsource payroll, HR, and compliance, explore Idaho PEO options.

Keep an Idaho Business Compliant

Stay in good standing by calendaring your annual report in SOSBiz and keeping your registered agent and addresses current. Idaho links good standing to simple, recurring actions. Use SOSBiz to file the annual report, confirm principals and mailing/principal addresses, and update your registered agent when anything changes. If you slip, miss a report or lose agent coverage, the state can administratively dissolve the company, but you can cure issues and request reinstatement. The steps below show exactly what to file, when, and how to recover

File the annual report on time in SOSBiz

File the annual report each year by the last day of your anniversary month in SOSBiz (first due one year after formation/registration). Use it to confirm principals, principal/mailing addresses, and if needed, update the registered agent; RA/address changes in the report operate as a valid statement of change under Idaho law. No state fee applies to most entities.

Update information, reinstate if needed, and maintain good standing

Keep a continuous registered agent and deliver the report on time. Idaho may administratively dissolve an entity for missing the report, lacking an RA for 60 days, or failing to report an RA change/resignation within 60 days; you’ll get notice and have 60 days to cure. Reinstatement is available for 10 years and relates back to the dissolution date.

Frequently Asked Questions About Idaho Business Entity Search

This FAQ covers the essentials of Idaho’s business entity search: running a clean business name search, checking the state trademark search, locating ABNs, filtering by registered agent, and how quickly new filings appear. Each answer is concise and action-oriented so you can move from search → decision → filing with confidence.

How to confirm a name is available in Idaho

Search SOSBiz, then ensure the name is legally distinguishable. Run the Business Search by name (leave off “LLC/Inc.”), open close matches, and check status/addresses. Idaho applies “distinguishable on the records” rules; if you’re not filing today, you may reserve the name (120 days). Final acceptance happens during staff review.

Where to run a state trademark search

Use Idaho’s SOSBiz Trademark Search. After clearing the entity name, search the state trademark database for identical or confusingly similar marks. This catches brand conflicts the entity database won’t show. If you plan broader protection, review federal options separately.

Are ABNs included in SOSBiz results

Yes, ABN/“DBA” filings appear in the same public search. Use SOSBiz to find Assumed Business Names, then open the record to view owners and addresses. ABNs are public records and searchable alongside LLCs and corporations, simplifying checks for conflicting trade names.

Can I search by registered agent

Yes, open Advanced in SOSBiz and apply filters. Idaho’s SOSBiz Help notes advanced filters are available; you can also access the “List of commercial registered agents” from the Lists section. Use these tools to locate entities tied to a specific agent or to narrow crowded results.

How quickly new filings appear in SOSBiz

After approval; standard review is 7–10 days, or expedited within 8 working hours. Processing time depends on filing method and whether you pay for expedite. Once the Secretary of State approves the filing, the record appears in SOSBiz and you can download proof or order certificates.

- Idaho Secretary of State: Assumed Business Name (DBA) Application (PDF)

- Idaho Secretary of State: Registered Agent Information

- Idaho State Tax Commission: Getting Tax Permits (Idaho Business Registration, IBR)

- Idaho State Tax Commission: Taxpayer Access Point (TAP) Overview & Registration

- Idaho Industrial Commission: Employer Workers’ Compensation Information

- Idaho Department of Health & Welfare: Food Safety (Health District Permits)

- FindLaw: Idaho Code § 30-21-302 (Name requirements/designators)

- Justia: Idaho Code § 30-21-804 (Assumed Business Names)

Looking for an overview? See Idaho LLC Services

Stay on Top of Your Idaho Business Records with Harbor Compliance

Harbor Compliance offers tools to track, manage, and stay compliant with your Idaho business filings, so nothing falls through the cracks.