Choosing the right professional employer organization (PEO) can save your business time, reduce compliance risks, and unlock access to better employee benefits. Engage PEO stands out in this space with attorney-led compliance oversight, IRS certification, and personalized HR support. In this review, we’ll break down Engage’s features, pricing, pros and cons, and compare it against competitors like Justworks and ADP TotalSource to see if it’s the right fit for your business in 2025.

Engage PEO: Is It Worth It for Your Business?

As a leading professional employer organization in the U.S. PEO industry, Engage PEO offers a tailored blend of compliance, payroll, and HR services designed to help any business achieve a measurable competitive advantage. This organization stands out for combining attorney-led oversight with scalable, client-focused solutions.

Core HR Outsourcing and Co‑Employment Model

Engage PEO operates under a co-employment structure, where it shares employer responsibilities with client businesses while providing full-scale human resources and compliance support. Through human resources outsourcing, Engage PEO serves as employer of record with regard to payroll, benefits, and tax filings. This frees companies to spend more time growing their business while Engage PEO manages the admin and controls risk. This process,often referred to as employee leasing, is central to how PEO services work and how they deliver efficiency and consistency across HR functions. For a practical overview from a major industry provider, see ADP’s What is a PEO and How Can It Help Your Business?.

IRS-Certified (CPEO), ESAC & SOC1 Accreditations

Engage PEO is an IRS-certified professional employer organization (CPEO), recognized by the national association of professional employer groups for meeting the highest industry standards. These credentials signal strong financial stability, rigorous compliance practices, and trustworthy employer services. In the PEO industry, holding ESAC and SOC1 accreditations assures clients that payroll, tax, and benefits are managed with precision under federal oversight.

Our Verdict: Best-in-Class Compliance and Legal HR Support

For businesses that prioritize strict compliance and legal safeguards, Engage PEO offers a unique advantage. Founded and led by attorneys, this employer services provider blends employment law knowledge with proactive HR management, ensuring policies and procedures meet both state and federal standards.

Our expert review finds Engage particularly strong in risk management and compliance assistance, thanks to its dedicated in-house legal team and deep legal expertise. While it may not have the most advanced tech tools in the market, the organization’s legal depth and personalized support make it a compelling choice for companies facing complex workforce regulations.

| Evaluation Criteria | Engage PEO Performance |

|---|---|

| Overall Customer Rating | 4.4/5 (Glassdoor – 70+ reviews) 4.5/5 (G2 – Limited data) |

| Employee Satisfaction | 89% recommend working at Engage PEO Strong internal culture and client focus |

| Business Accreditation | BBB A+ Rating Accredited and IRS certified PEO |

| Service Coverage | Small to medium-sized businesses HR, payroll, benefits administration |

| Technology Platform | Standard features Mobile app and basic HR tools |

| Market Presence | Limited online reviews Growing company in PEO industry |

| Transparency | Moderate Limited pricing information publicly available |

| Customer Support | Dedicated account management HR compliance counseling praised by clients |

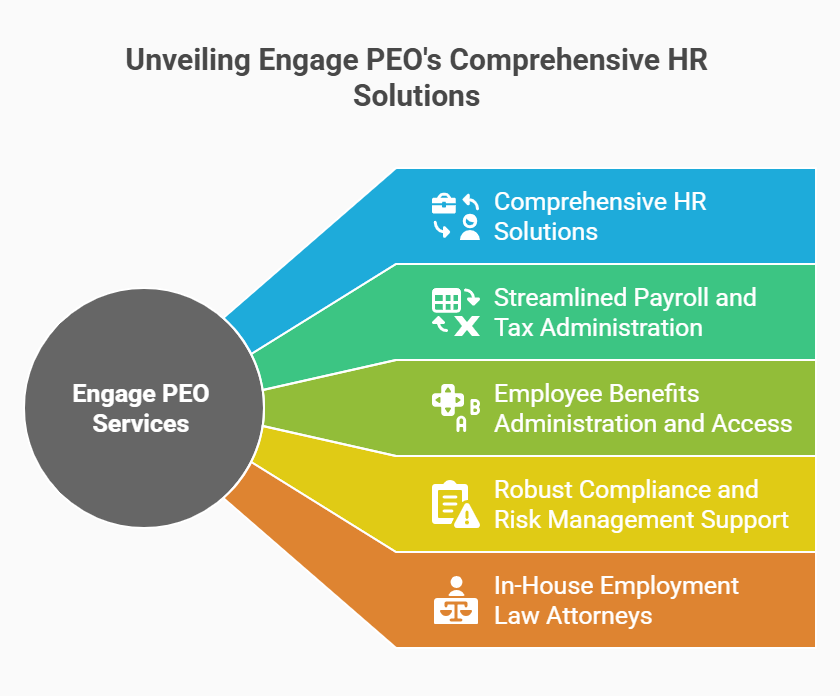

Key Features and Services Offered by Engage PEO

Engage PEO delivers comprehensive HR solutions that help companies streamline employee administration, payroll, and compliance through expert management practices. Their broad range of HR services supports diverse clients, offering scalable solutions designed to boost efficiency, accuracy, and long-term performance management for growing businesses.

Comprehensive HR Solutions for Small and Mid-Sized Businesses

Engage PEO support small and mid-sized business clients with strategic human resources solutions, providing them with the tools and expertise necessary to streamline daily operations. Some of the scalable solutions provided by them improve the satisfaction of your employees, compliance and help you in offering competitive, retractable employee benefits to improve retention and employee engagement. If you’re an independent consultant, getting to know how to start a consulting business LLC may be your first step toward sustainable growth. Service-based entrepreneurs, such as those in landscaping, can also benefit after following this guide to starting a landscaping business to establish a solid operational foundation.

Core HR Services Include:

- Payroll administration and tax filing

- Employee benefits design and enrollment support

- Onboarding and new hire processing

- Compliance tracking and policy development

- Performance evaluation and employee engagement programs

- Training resources and HR documentation management

Streamlined Payroll and Tax Administration

Engage PEO streamlines payroll processing, ensuring speed, accuracy, and compliance with all federal and state regulations. In a series of automated processes, the system will compute the wages, deductions pay and issue digital pay stubs to employees. Clients benefit from integrated management tools that handle payroll tax filings to ensure deadlines are met and mistakes are minimised. By removing manual work and the chances of expensive mistakes, streamlining this administration provides comfort to businesses that the payroll and tax obligations are taken care of.

Employee Benefits Administration and Access

Engage PEO simplifies benefits administration by giving employers access to competitive advantage employee benefits packages typically reserved for larger organizations. From health insurance and retirement plans to wellness programs, the service is designed to attract and retain top talent while reducing administrative burdens on HR services management teams.

Through an intuitive online portal, employees can easily review, enroll in, and manage their benefits. This self-service access empowers team members to make informed decisions, track their coverage, and stay employee engagement with their total rewards. The result is a smoother experience for both the employee and the employer.

Robust Compliance and Risk Management Support

Engage PEO provides more than just an efficient HR services platform; it proactively assists employers in complying with employment law in an industry that is constantly changing. Their in-house experts systematically monitor changes in legislation and modify company policies and oversee training activities to help ensure a workplace that is safe, equitable and lawful.

Apart from legal adherence, the team emphasizes risk management strategies to safeguard both employee and employer. Engage PEO takes care of risk mitigation to ensure continuity of effective operations ranging from potential human resources to workplace safety and data security risk management workforces. For business owners thinking long-term, incorporating a solid business succession plan can further safeguard leadership continuity and organizational stability during transitions.

The Advantage of In-House Employment Law Attorneys

Engage PEO’s in-house team of employment law attorneys is one of its highest value assets. The way the organization is structured, it allows you to quickly go to them for legal expertise for workplace policies, dispute resolution and regulatory challenges. Employers can strengthen these policies by following an employee handbook creation guide to clearly define expectations, outline benefits, and maintain legal compliance. When an employer places legal expertise directly into HR services management, the employer benefits from quicker, comfier decisions with greater consistency and more resistant claim defence in today’s world.

Engage PEO: Pricing Structure & Value

Engage PEO structures its pricing to deliver measurable value for every business, balancing service quality with long-term cost efficiency. While the company doesn’t publish exact costs, its approach is designed to create a competitive advantage through tailored solutions that align with each client’s size, needs, and industry.

Per‑Employee Model with Tax Filing Authority

Engage PEO operates on a pricing per employee to maintain transparency as your employee base grows. Smart Bundle includes payroll processing along with benefits administration and compliance for a predictable rate but will also take the authority of the payroll tax filing. Engage PEO handles the whole process, even the payment of salaries and remit to federal and state, all the hassle of administration so there is low risk of penalty and businesses can emphasize growth.

Cost vs. Competitors and ROI Potential

When business leaders compare Engage PEO to other competitors in the market, the company often delivers strong ROI through bundled services and risk reduction. While actual costs vary by client size and needs, Engage’s value proposition is enhanced by legal expertise, compliance support, and tailored HR solutions.

Key Cost Comparison Factors:

- Scope of included services vs. à la carte pricing

- Extent of compliance and legal support offered

- Technology platform capabilities and integrations

- Transparency and flexibility in contract terms

Potential Hidden Costs and What to Ask

While Engage PEO is transparent in its core pricing, every business should investigate possible add-on fees for services like onboarding, insurance policy changes, or off-cycle payroll runs. The specifics of these extras will differ by company and contract terms. So always check the fine print.

Before you commit, request details of all service charges, and ask for examples of situations that may incur extra costs. By understanding how invoicing and dispute resolution works, you can ensure there are no surprises and your partnership stays cost-efficient.

What Do User and Employee Reviews Say About Engage PEO?

Available user reviews and employee reviews for Engage PEO offer valuable insight into service quality, workplace culture, and client satisfaction. While public reviews are limited, aggregated feedback from platforms like Glassdoor and G2 provides a balanced perspective for this engage peo reviews analysis.

Considering Engage PEO? Compare with Justworks

Justworks offers a modern, intuitive PEO experience—covering payroll, benefits, and HR compliance with transparent pricing and top-rated support.

Glassdoor Employee Ratings and Feedback

Engage PEO receives high ratings on Glassdoor when it comes to employee satisfaction thanks to its leadership, management, and workplace culture. More than 80% would advise a friend to join employer, mainly due to opportunities for professional growth, and life balance. Some of the employee reviews noted that technology tools can be improved. However, the general vibe of the internal environment seems positive and in alignment with the client focus.

Customer Satisfaction and G2 Reviews

Engage PEO has favorable user reviews on G2 because of its personalized service and compliance expertise. The ability of the company to adapt to changing needs while keeping payroll processing and HR services accurate is highlighted by customers.

While the sample size may be smaller than that of larger providers, the employee satisfaction levels generally remain high. A number of clients have reported improved operational efficiencies and fewer compliance headaches working with a dedicated account manager at Engage PEO.

Common Praise and Complaints

Across public feedback channels, employee and client sentiment toward the company is largely positive, with clear pros and cons emerging. Most would recommend Engage PEO for its legal expertise and client focus, though some note areas for operational improvement.

Frequently Mentioned Points:

| Pros: | Cons: |

|---|---|

| – Strong compliance and legal support | – Limited technology features compared to larger competitors |

| – Responsive, knowledgeable account managers | – Pricing transparency could be improved |

| – Comprehensive HR and payroll services |

If you’d like to see how Engage PEO’s reputation compares to other providers, our PEO reviews index compiles user ratings and expert evaluations for top U.S. PEOs.

How Does Engage PEO Compare to Other PEO Alternatives?

To help businesses compare options, this section examines how Engage PEO stacks up against top PEO alternatives. Each company is evaluated on pricing, service scope, technology, and customer satisfaction, providing a clear framework for decision-making in a competitive HR outsourcing market. For an even wider perspective, see our 2025 rankings of the best PEO services, which reviews the top providers for small businesses before diving into these head-to-head comparisons.

Engage PEO vs. ADP TotalSource

When you compare Engage PEO vs ADP TotalSource, the differences usually come down to scale and specialty. As one of the largest competition in the PEO industry, ADP has large HR services technology tools and broader national coverage. Engage PEO, on the other hand, provides personalized compliance support with attorney’s guidance tailored for small and mid-sized businesses. With both of the providers pricing transparency is still a more limited affair. However, due to Engage PEO’s more boutique approach, it may be a better fit for companies looking for high-touch support over the kind of enterprise-level automation.

Engage PEO vs. Justworks

Both Engage PEO and Justworks are targeted towards the same business size but have different strengths. For readers new to the PEO model, Insperity’s What is a PEO? guide offers a straightforward explanation of how this arrangement works in practice. Justworks is known for its modern HR services technology platform, intuitive mobile app and transparent pricing – all of which appeal to fastest growing companies in search of ease. Engage PEO puts the focus on attorney-led compliance, personalized guidance, and a boutique service model.

Both Justworks and ADP TotalSource provide core PEO services, such as payroll processing, employee benefits, and compliance support. However, Justworks often stands out for its ease of use, flat-rate transparency, and strong onboarding tools. While Engage PEO provides a legal expertise advantage, Justworks may be more suitable for businesses focused on scalability and digital-first workflows.

Key Comparison Table:

| Criteria | Engage PEO | Justworks |

|---|---|---|

| Compliance Support | Attorney-led, high-touch | Standard HR compliance |

| Pricing Model | Custom per-employee rates | Transparent flat monthly rates |

| Technology Platform | Standard HR tools | Modern platform + mobile app |

| Customer Support | Dedicated account manager | 24/7 support channels |

| Market Position | Compliance-focused boutique provider | Tech-driven, scalable PEO |

Engage PEO vs. Paychex HR

Engage PEO and Paychex HR share a focus on serving small to mid-sized business clients but differ in scope and approach. Paychex offers a broader range of payroll and HR services, supported by extensive technology integrations, while Engage centers on attorney-led compliance and tailored client relationships.

Both providers offer competitive HR packages, yet Paychex’s scale can feel less personal for companies seeking dedicated support. For businesses wanting modern tools with transparent pricing and strong onboarding – areas where Justworks excels – it may be worth exploring alternatives beyond these two providers.

You can also check our full comparison of the best PEO companies for 2025 to evaluate pricing, services, and benefits across multiple top providers before making your final choice.

Conclusion

Engage PEO stands out for its attorney-led compliance, personalized client relationships, and strong track record in supporting small to mid-sized businesses. Its customized strategies for HR services, payroll processing, and risk management make it a trusted platform for companies with critical compliance needs.

However, companies that value transparent pricing, modern HR services technology and smooth onboarding may find providers such as Justworks beneficial. Assessing the priorities of your business, whether you want legal expertise depth or digital-first efficacy, will ensure you pick the professional employer organization best suited to your growth.

Frequently Asked Questions About Engage PEO Reviews

This section serves as a quick guide for businesses exploring Engage PEO, addressing the most common questions about its services, certifications, and client experience. From compliance credentials to contact details, these concise answers help you assess whether Engage is the right fit for your business.

Is Engage a Certified PEO?

Yes. Engage PEO is an IRS-recognized certified professional employer organization (CPEO). This designation confirms the company meets strict federal standards for financial stability, tax compliance, and reporting accuracy, giving clients added assurance when outsourcing payroll, benefits, and HR functions through a trusted and regulated PEO partner.

Who Is the Owner of Engage PEO?

Engage PEO is privately held and led by CEO Jay Starkman, who founded the company in 2011. Under his leadership, the firm has grown into a nationally recognized PEO, combining legal expertise with a client-focused service model to support small and mid-sized businesses across the U.S.

What Industries Does Engage PEO Serve?

Engage PEO serves clients across a wide range of industries, including professional services, healthcare, manufacturing, and non-profits. Its tailored HR solutions are designed for small to mid-sized businesses seeking compliance expertise, payroll accuracy, and employee benefit programs that help their business attract and retain top talent in competitive markets.

Business owners seeking localized guidance can explore our Rhode Island PEO service comparison, New Hampshire PEO provider directory, and Wisconsin PEO solutions guide for state-specific options.

What Is the Phone Number for Engage PEO?

You can reach Engage PEO by calling the company’s main contact line at (888) 780-8807. This toll-free number connects you directly with their client services team, who can assist with sales inquiries, support requests, or general questions about Engage’s HR, payroll, and compliance solutions.

What Types of Businesses Benefit Most from Engage PEO?

Engage PEO is a strong fit for small to midsize business clients who require attorney-led compliance, full-service HR services, and scalable payroll processing solutions. The company’s tailored plans work best for organizations in regulated industries where risk management, employee benefits, and legal oversight are essential to sustaining growth. If you’d like to explore a broader range of providers, our PEO company database lists 45 top U.S. PEOs with key details to help you compare options.

- Engage PEO: Our Services

- IRS: CPEO Public Listings

- IRS: List of CPEOs (PDF)

- ESAC: Find a PEO

- ESAC: Accreditation Certificate (PDF)

- Forbes Advisor: Engage PEO Review

- IRS: Certified Professional Employer Organization (CPEO)

- NAPEO: PEO Industry Overview

- SHRM: PEO Advantages & Disadvantages

Need More from Your PEO? Try ADP TotalSource

With enterprise-level HR tools, compliance, and employee benefits, ADP TotalSource is built for businesses that demand more from their PEO.