Looking to verify a business in Oregon or check if your desired LLC name is available? The Oregon LLC search tool makes that process fast, reliable, and completely free. Whether you're forming a company, researching competitors, or reviewing public business records, the Oregon business registry gives you real-time access in just a few clicks.

To check if a name is available, visit the Oregon Secretary of State’s Business Registry Search page, select the “Limited Liability Company” option, then enter your desired name. The system displays all exact or similar business entities—active listings block your filing, while inactive or expired records don’t; if no conflict appears, you can reserve the name for 120 days using a $100 name reservation form.

In this guide, you’ll learn how to use Oregon’s business entity search portal step-by-step. We’ll cover everything from filtering by entity type, confirming legal status, reserving your name, and downloading official business registration documents.

Understanding the Oregon Business Registry & SOS Biz Services

The Oregon Secretary of State’s Corporation Division runs the oregon business registry, a centralized, online hub where you can look up info on Oregon LLCs, corporations, nonprofits, and assumed business names.

Here’s what you can do with it:

- Run a business entity search to check names, statuses, and filings.

- View detailed business records like formation date, registered agent, and current status.

- Order official documents or make updates through your business registration account.

This whole system is part of the Oregon Department’s BizCenter portal and updates in real time. It’s a go-to tool for entrepreneurs, attorneys, and CPAs who need to verify legal status, file updates, or stay compliant. Oregon alone supports over 600,000 small businesses—see more in this report on Oregon’s small business landscape.

Best part? It’s completely free and open to the public. Whether you’re doing competitor research, checking if a limited liability company really exists, or getting ready for llc formation, this transparent registry database should be your first stop.

How to Search for an Oregon LLC in 7 Steps

Need to verify a company, investigate a competitor, or check if your desired LLC name is available? The Oregon Secretary of the State offers a free and powerful online business name search through its SOS Biz Services portal. This public service connects directly to the Oregon business registry, granting you access to accurate and real-time information on all business entities registered in Oregon. When preparing for LLC formation, a company’s legal status validation, and ownership records review, follow the steps below for a successful first-click-to-report assessment.

This guide gives you not just a high-level overview of what a business entity search is. You will also see how to filter your results, what the results mean and what to do next. You will learn how to print documents and request notifications. This is perfect for entrepreneurs, CPAs and attorneys, or anybody else with a need to reliable Oregon registry database.

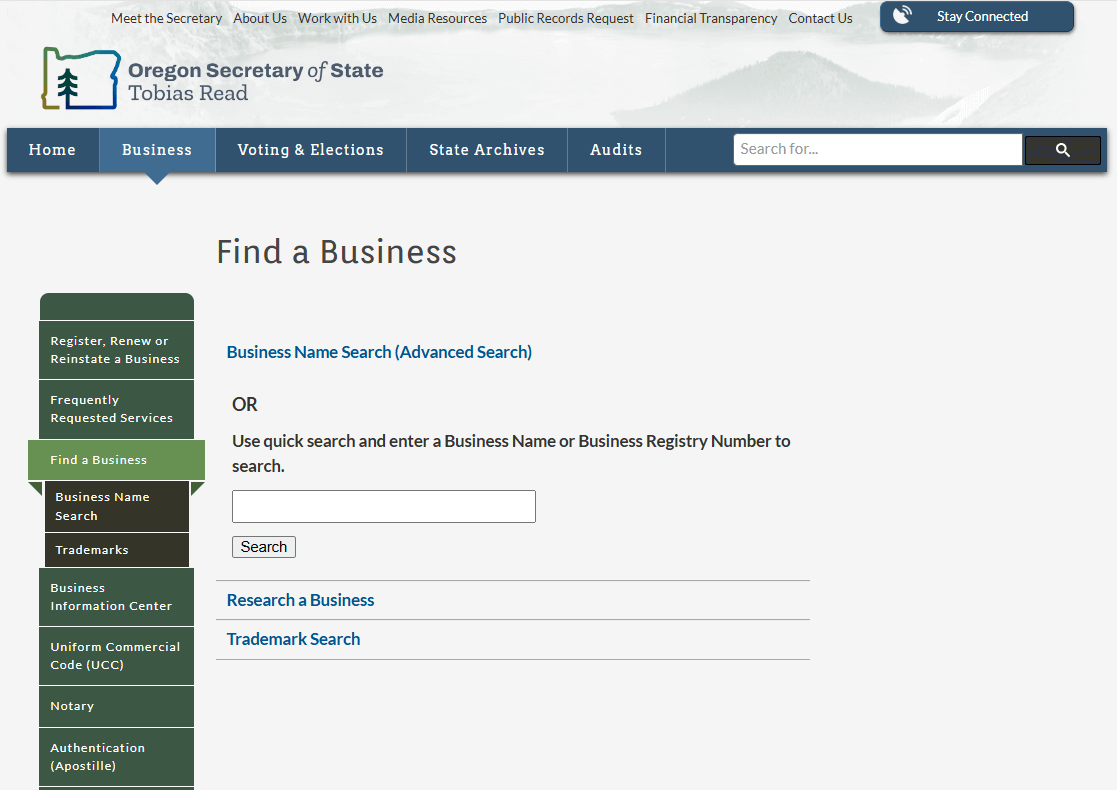

Step 1: Visit the Oregon SOS Biz Services “Search Records” Page

Begin by visiting the official Oregon Secretary of State Find a Business page. This is Oregon’s state-maintained registry for all business filings – including LLCs, corporations, assumed business names, and nonprofits.

The interface is clean and self-service friendly. You don’t need an account or login, and searching is free.

On this page, you can search by:

- Business Name – ideal for checking name availability or researching a company

- Business Registry Number – useful if you already have an Oregon LLC or corporation's unique ID

Simply type into the main search box and click Search.

Below the search bar, you’ll also find links to:

- Advanced Search (for more detailed filters)

- Trademark Search

- Research a Business (for deeper insights on business filings and compliance)

Bookmark this tool – it's the fastest, most reliable way to access real-time business records in Oregon.

For additional guidance across all states, here’s a useful resource on how to perform a multistate business entity search.

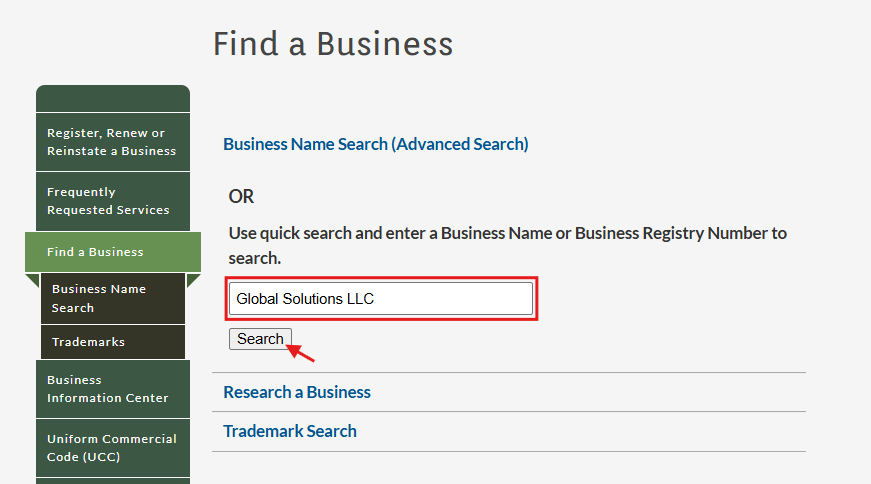

Step 2: Search by Name or Registry Number

Once you’re on the Oregon “Find a Business” page, use the main search box to either:

- Enter a Business Name

Example: “Global Solutions LLC” - Enter a Business Registry Number

Format: a 7- or 8-digit ID like12345678

Then click the Search button.

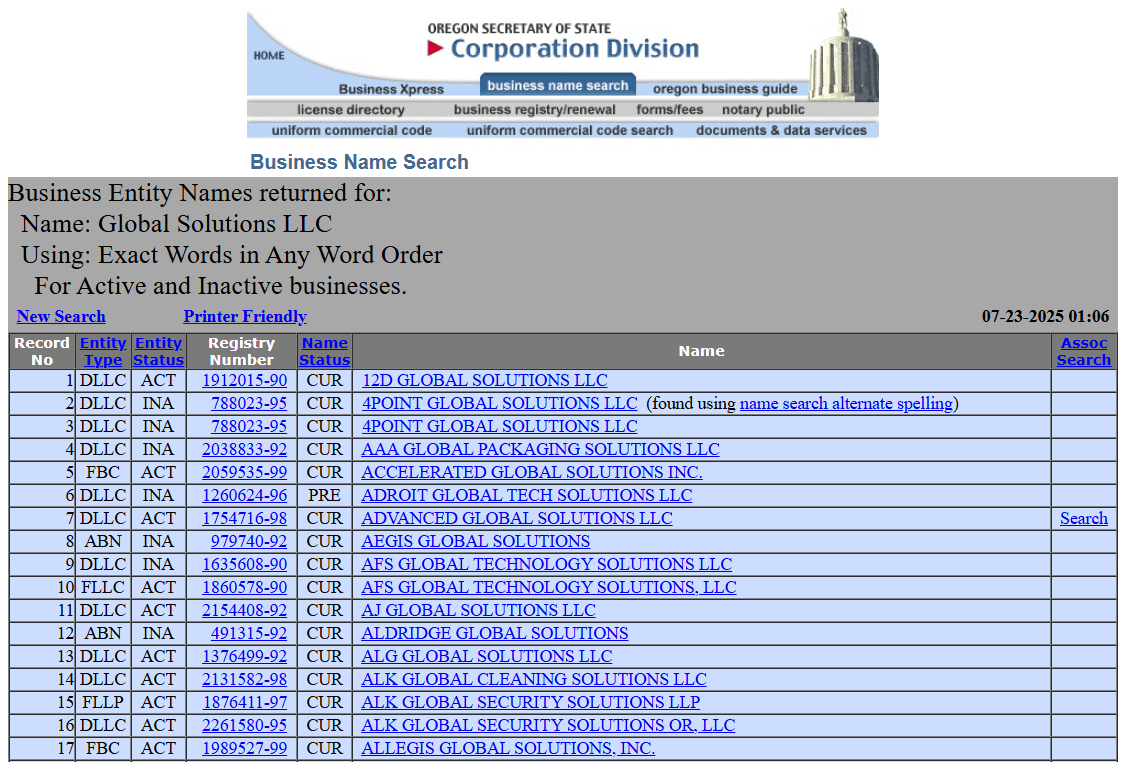

Step 3: Review the Search Results List

After entering your business name (e.g., Global Solutions LLC) into the Oregon Business Name Search and clicking Search, you'll land on a results page showing all entities that contain those words in any order.

You’ll see a table with:

- Entity Type (e.g., DLLC = Domestic LLC, FBC = Foreign Business Corporation)

- Entity Status (ACT = Active, INA = Inactive, PRE = Reserved)

- Registry Number (a clickable 7- or 8-digit ID)

- Name Status (CUR = Current, indicating the name is in use)

- Business Name (clickable to view full details)

Here’s how to interpret the results:

- Active names (like “12D AJ GLOBAL SOLUTIONS LLC”) will block your filing, even if they’re not an exact match. The Oregon Secretary of State considers confusingly similar names grounds for rejection.

- Inactive names (like “AAA GLOBAL PACKAGING SOLUTIONS LLC”) no longer offer name protection but may still raise red flags if they’re too similar.

- Similar names with only minor changes (e.g., “ALK GLOBAL SECURITY SOLUTIONS OR, LLC”) can still lead to rejection due to perceived similarity or brand confusion.

Tip: If the business status shows anything other than Active, be cautious. Entities marked Inactive, Dissolved, or Revoked are not currently in good standing.

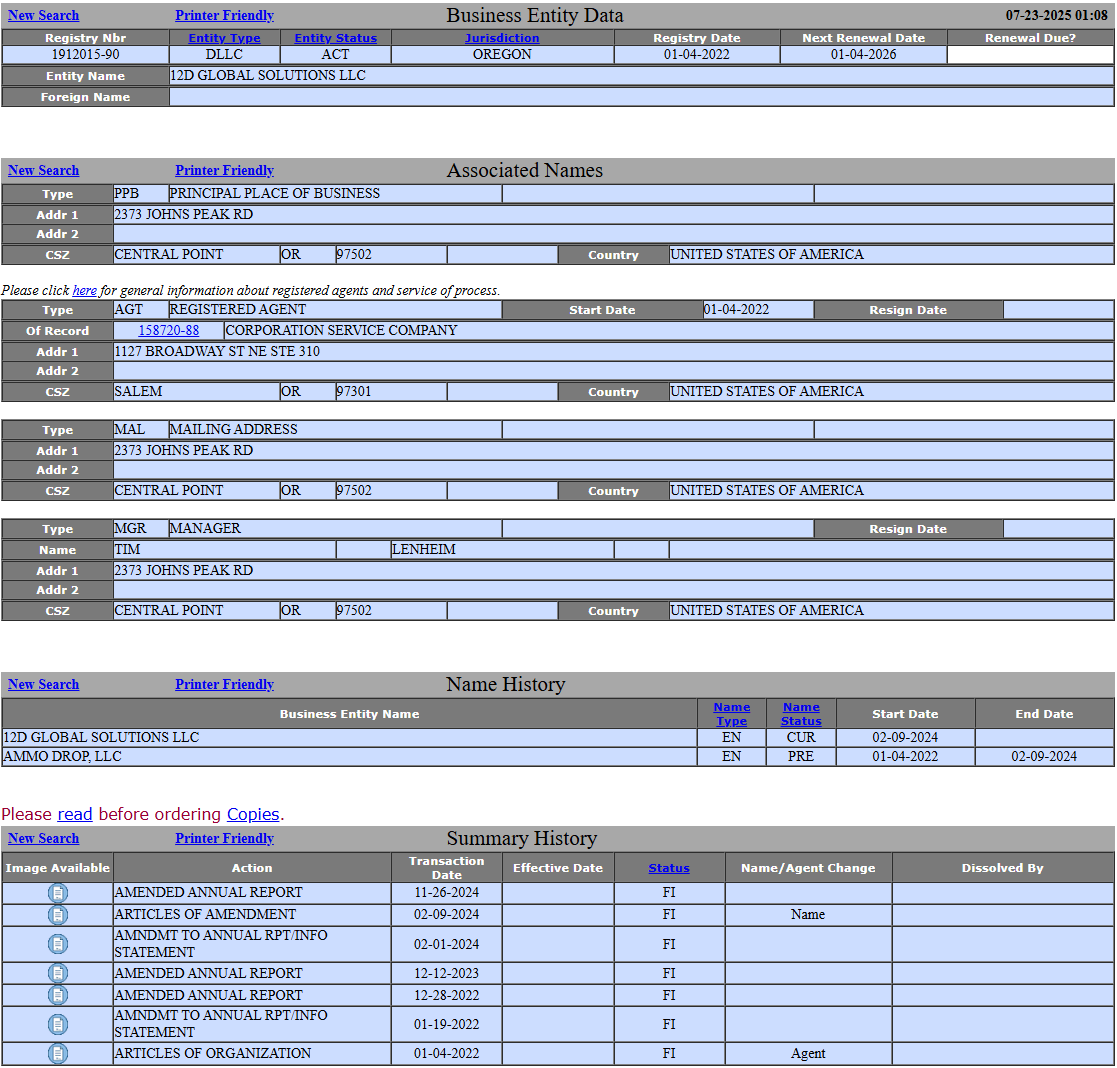

Step 4: Review the Full Business Record

After selecting a result like “12D GLOBAL SOLUTIONS LLC”, you’ll land on the business entity profile page. This record is hosted by the Oregon Secretary of State and confirms the company’s legal registration.

Here’s what to look for:

- Entity Name: 12D GLOBAL SOLUTIONS LLC

- Status: Active (ACT) — this means it’s currently operating and will block your name filing

- Registry Number: 1912015-90

- Date of Registration: January 4, 2022

- Next Renewal Date: January 4, 2026

- Principal Place of Business: 2373 Johns Peak Rd, Central Point, OR 97502

- Registered Agent: Corporation Service Company, Salem, OR

- Manager on Record: Tim Lenheim

- Mailing Address: Same as business address

- Name History: This business used to operate under “AMMO DROP, LLC” until February 2024

Scroll further to view filing history, including annual reports, amendments, and the original Articles of Organization.

Tip: If this business is active and the name is close to your proposed LLC name (e.g., Global Solutions LLC), your filing will likely be rejected. Always document this screen (screenshot or PDF) if you need evidence for appeal or clarification.

Step 5: Save or Print the Business Record for Your Files

Once you’ve reviewed the full business profile, it’s a good idea to save or print a copy for your records. You can:

- Click the “Printer Friendly” link at the top of each section to generate a clean printable version.

- Save the page as a PDF using your browser (File > Print > Save as PDF).

- Take a screenshot for internal reference or due diligence documentation.

This is especially useful if you're evaluating competitors, checking vendor legitimacy, or documenting a name availability check for future filings.

Your Oregon LLC, Done Right with ZenBusiness

Skip the legal maze – ZenBusiness takes your idea and turns it into a fully-formed Oregon LLC, with zero stress and max support.

Checking & Reserving Your Oregon LLC Name

Always check to see if the desired LLC name you wish to use for registration is available. In Oregon, your business name must be distinguishable from the names already in the registry database. In other words, no other active entity can have the same or deceptively similar name as yours. This protects consumers, prevents brand confusion and ensures legal clarity.

You may conduct a preliminary check with Oregon’s business name search tool. If your name or something similar appears in the results, you will probably need to change it. Oregon has strict rules of their own concerning abbreviations, punctuation, and certain restricted words (i.e. “bank,” “trust,” or “insurance”). So, it is recommended to check out their naming rules.

Once you’re sure you have the name you want, it’s smart to reserve the name, particularly if you are not ready to file yet. It stops anyone else from taking it while you finish your paperwork or business plan.

Conduct a Preliminary Name Availability Search & Trademark Check

To test if your desired LLC name is available, start with Oregon's Business Name Search. Type the name exactly how you want it to appear in your account. You will be shown present entities, expired names, and assumed business listing that can block your filing in the system.

Not appearing on a name does not guarantee approval. Under Oregon law, your name has to be meaningfully distinguishable from the names of all others in the system. In other words, a little thing like exchanging “&” for “and” or putting “LLC” at the end will not help you. For more detailed strategies and best practices, see this complete post on how to check LLC names effectively. The Oregon Secretary of State rejects of names that are too similar in wording, sound, or appearance.

You should also do a basic trademark search at USPTO.gov to check for federal conflicts. Even if the name is approved in Oregon, a registered trademark holder could challenge you. If you are serious about branding, you cannot skip this step.

File a Name Reservation Request—$100 for 120-Day Hold

If you’re not quite ready to form your LLC but want to lock down your desired name, Oregon gives you the option to reserve it for 120 days. That way, no one else can swoop in and register it while you’re still getting your paperwork in order, lining up your registered agent, or handling your EIN and banking setup.

To hold your desired llc name, you’ll need to file the Name Reservation– New form with the Oregon Secretary Of State. You can do this online via the business registry portal or send in a paper form by mail using the official name reservation form. There’s a $100 fee, and heads-up—it’s nonrefundable, even if you decide not to use the name in the end.

Once reserved, your desired name will show up in the registry database as unavailable to others for that full 120-day stretch. Just a heads-up: you can’t renew or extend it. It’s a one-time deal, so make sure you’re ready to move before that window closes.

Verifying Your LLC’s Status & Ordering Certificates

Once your Oregon LLC is up and running, it’s smart to check every now and then that it’s still in good standing with the Oregon Secretary of State. This matters more than you might think, whether you’re applying for a business loan, signing a contract, or just getting ready to file your annual report, confirming your LLC’s status is a smart step. If you’re also wondering how Oregon compares to other states when it comes to recurring costs, here’s a useful breakdown of annual LLC maintenance fees by state.

The easiest way to do that? Run a quick business entity search using your company name in the state’s online registry. You’ll see info like your registration date, business structure, registered agent, and whether your status is Active, Inactive, or administratively dissolved. These records update in real time and are officially recognized by banks, agencies, and licensing authorities.

Need something official? From the entity profile page, you can request:

- A Certificate of Existence (also called a Certificate of Good Standing)

- A certified copy of your Articles of Organization or other filings

- A status history or filing log

Most certificates are available for online download in PDF format within minutes. If you’re unsure which form you need, the Corporation Division provides helpful descriptions for each document type.

Finding Oregon Business Licenses & Permits

Even after forming your Oregon LLC, you’re not totally in the clear to start running your business just yet. You still need to make sure you’ve got the right licenses and permits in place. And here’s the thing, business license rules in Oregon can vary a lot depending on your industry, what you actually do, and where you're located. Skipping this part? That could mean fines or even being forced to shut down.

The upside? The oregon department offers a centralized tool to help you figure out exactly what you need. Whether you’re opening a restaurant, doing some consulting, or handling contract work, it’s important to check every license requirement, whether it’s local, state, or federal – that applies to your business type.

Scroll through the sections below to figure out what licenses you’ll need, find direct application links, and steer clear of the common compliance slip-ups that catch many new businesses off guard.

No Fluff. Just Your Oregon LLC—Powered by Northwest

Want to launch quietly and professionally? Northwest forms your Oregon LLC while keeping your personal details under wraps.

Using the Business Xpress License Directory

Oregon Business Xpress License Directory is the best place to start your licensing search. The state provides this tool to help you find any business license, permit or registration that may apply to your business based on your industry, location and business activities.

Here’s how it works :

- Enter keywords related to your business (e.g., “construction,” “salon,” or “food service”).

- Choose your business type and location.

- The tool will display a list of licenses required at the city, county, and state levels—plus direct links to forms, fees, and renewal rules.

Starting an Oregon LLC or growing existing business? Make sure you don’t miss out on crucial permits by using this guide. It gets updates regularly and links to other official pages like the DEQ, OLCC, and Oregon Health Authority.

Major State Permits: Sales Tax, Liquor Licensing & Professional Trades

In Oregon, most general businesses do not pay sales tax, but that does not mean you are off the hook as far as permits are concerned. Your LLC in Oregon might require licenses or certifications state level depending on the type of business.

Here are some of the most common :

- Liquor Licensing – Required for bars, restaurants, or retailers that serve or sell alcohol. Apply through the Oregon Liquor and Cannabis Commission (OLCC).

- Contractor Licensing – Construction and remodeling businesses must register with the Oregon Construction Contractors Board (CCB).

- Health & Cosmetology Licensing – Required for salons, spas, and similar services. Overseen by the Oregon Health Licensing Office.

- Environmental & Safety Permits – Manufacturing or waste-related industries may need permits from DEQ or OSHA.

Every license has a different agency, application forms, and renewal cycles. If you miss out any one, there can be heavy fines or your business license may be revoked. So, do confirm your industry-specific requirements before the launch.

Local Permit & Zoning Requirements by County

Beyond state-level licensing, each Oregon county and city may have its own rules for zoning, signage, inspections, and assumed business names. If you’re opening a physical location or working in residential areas (like a home-based business), local regulations can be just as important as state compliance.

To find your local permit requirements:

- Visit your county clerk’s office or city planning department website.

- Ask whether your business location is zoned for your activity.

- Inquire about occupancy inspections, signage rules, and business license applications.

- Some jurisdictions may require a home occupation permit even for solo operations.

Here’s a quick overview of county-by-county permit links to help you start:

| County | Local Permit Portal URL |

|---|---|

| Multnomah | Portland Business License |

| Washington | Washington County Business Services |

| Lane | Lane County Planning |

| Marion | Marion County Permits |

| Jackson | Jackson County Development Services |

Accessing Oregon Business Data & API for Bulk Lookups

If you need to analyze large volumes of entity data—whether for compliance, legal research, or competitive analysis—the Oregon Secretary of State offers public access to its business registration database through a downloadable CSV file and developer-accessible API.

This data includes all active and inactive business entities registered in Oregon, including LLCs, corporations, and assumed business names. Fields include entity name, registry number, formation date, status, and registered agent details.

For manual users:

You can download the full Oregon business entity file from the Corporation Division's Open Data portal. It’s updated weekly and free to access.

For developers:

Oregon provides an API interface that lets you query real-time records for integration with CRMs, compliance tools, or enterprise systems. The API documentation and access credentials are available by request through the Corporation Division’s contact center.

As an illustration, check out how Maine’s system allows business entity searches and downloads via its Secretary of State portal, here’s a guide on how to lookup business entities in Maine (Similar CSV/API access and data fields apply)

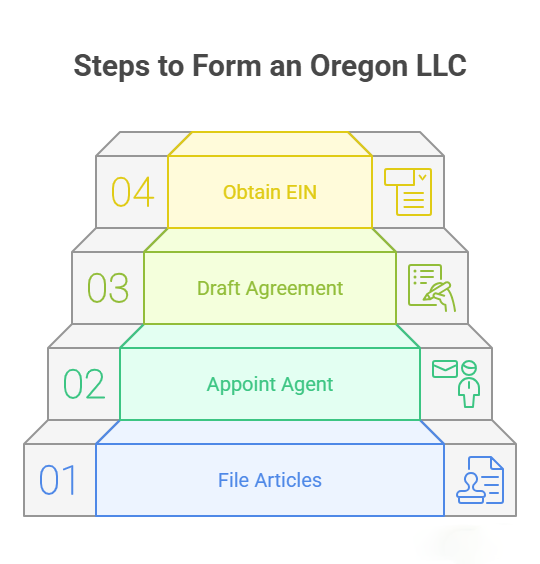

Quick Guide to Registering a New LLC in Oregon

Ready to turn your business idea into a legal entity? Forming an Oregon LLC is straightforward—but only if you follow the right steps. To get a clear sense of timing and plan accordingly, check out this helpful overview of Oregon LLC formation timelines. For a more comprehensive walkthrough beyond just filing, explore this detailed guide on launching a limited liability company in Oregon. It covers everything from naming tips and paperwork to registered agents and compliance. This quick guide will show you how to file, appoint a registered agent, and meet IRS and state requirements without confusion.

We’ll walk you through the entire LLC formation process: from submitting your Articles of Organization to getting an EIN and writing an Operating Agreement. Whether you're handling it solo or hiring help, this guide ensures you cover every legal and logistical step to launch your business the right way.

File Articles of Organization—$100 Filing Fee

To officially form your Oregon LLC, your first legal step is filing the Articles of Organization with the Oregon Secretary of State. This document establishes your business as a recognized limited liability company in Oregon and enters it into the state’s registry database. For a deeper dive into how this founding document works and why it's essential, check out this plain-English guide on understanding your LLC formation certificate.

You can file online through Oregon’s Business Registry portal or submit a paper form by mail. The filing fee is $100 and is nonrefundable.

The Articles form will ask for basic but critical information:

- Your LLC’s legal name

- Principal office address

- Duration (perpetual or specific term)

- Appointed registered agent

- Organizer details and signature

Once approved, your business will receive a registry number and be searchable in the Oregon business entity system. This step is what officially “forms” your LLC—no other part of the process matters unless this is filed first.

Appoint & Consent a Registered Agent

Every Oregon LLC must have a registered agent—an individual or business entity responsible for receiving legal documents, notices, and government mail on behalf of the company. Oregon law requires the agent to be physically located in the state and available during standard business hours (typically Monday–Friday, 9 a.m. to 5 p.m.).

Your Articles of Organization must list the name and Oregon street address of your agent. If you're using a professional registered agent service, make sure they’re authorized to do business in Oregon and have provided written consent. To simplify the selection process, here’s a hand-picked guide to the top-rated Oregon registered agent companies. If you're appointing yourself or a team member, understand that the address becomes part of the public record in the registry database.

The Secretary of State doesn’t require a separate consent form, but you should still obtain signed consent before listing someone. This protects both parties and helps prevent future compliance issues.

Choosing a reliable agent ensures you never miss a court summons, state renewal notice, or tax deadline.

Draft an Operating Agreement & Obtain an EIN

While not legally required in Oregon, drafting an Operating Agreement is one of the smartest steps you can take when forming an Oregon LLC. This internal document outlines the ownership structure, member duties, voting rights, profit sharing, and exit rules for your company. It protects your limited liability status and minimizes internal disputes by clarifying what happens if members disagree or if someone leaves.

Even single-member LLCs should have one—it proves your company is distinct from you personally, which can help during audits, lawsuits, or banking procedures.

Next, apply for an EIN (Employer Identification Number) through the IRS.gov EIN portal. This number is free and required if you plan to hire employees, open a business bank account, or file taxes as anything other than a sole proprietor. To learn more about efficient EIN retrieval methods (including how to find one for another business), see this detailed walkthrough on how to find a company EIN quickly.

Your EIN becomes your LLC’s federal tax ID and can usually be issued online within minutes. Keep a copy of your confirmation letter for your records.

Frequently Asked Questions: Oregon LLC Search & Registration

Whether you're starting a new business or researching an existing one, it's normal to have questions about Oregon’s LLC tools, requirements, and processes. Below are answers to the most commonly searched topics – written to help you move forward with clarity and confidence.

How do I perform an Oregon LLC search online?

You can perform an Oregon LLC search by visiting the Oregon Business Registry Search portal. Enter a business name, registry number, or registered agent to view filings, formation dates, and legal status. Be sure to select “Limited Liability Company” under Entity Type to filter your results. This search is free and provides real-time data directly from the Oregon Secretary of State.

What is the Oregon business registry & SOS “Search Records”?

The Oregon business registry is the official state database of all registered business entities, managed by the Oregon Secretary of State. The “Search Records” tool allows users to find business names, check entity status, verify formation dates, and view public filings. It includes data for LLCs, corporations, nonprofits, and assumed business names. This free tool helps business owners, attorneys, and the public ensure compliance and track entity information with real-time updates.

How can I check and reserve an LLC name in Oregon?

To check if your desired LLC name is available, use the Oregon Business Name Search tool. It lets you see existing entities and assumed business names to avoid conflicts. Once confirmed as available, you can reserve the name for 120 days by filing a Name Reservation form with the Oregon Secretary of State. The fee is $100, and it holds your name while you prepare for LLC formation.

Where do I find and apply for Oregon business licenses?

You can find and apply for required Oregon business licenses using the Business Xpress License Directory. This tool helps identify state, county, and city-level permits based on your business type and location. Just enter keywords related to your industry to view required licenses, fees, and application links. Some businesses may also need additional approvals from agencies like OLCC, DEQ, or the Health Authority, depending on the service or product offered.

How do I access bulk business data or use the API?

You can access Oregon business data in bulk through the Corporation Division’s Open Data portal. It offers downloadable CSV files updated weekly with business names, registry numbers, statuses, and agent information. For real-time integration, developers can request access to Oregon’s business registration API. This allows programmatic lookups and database syncing for high-volume users like CRMs, compliance teams, or research firms.

Resources for Oregon Business Owners

If you need more help than what the Oregon business registry provides, these trusted tools and agencies can guide you through every step of LLC formation, compliance, and licensing.

- Oregon Business Registry (sos.oregon.gov): The official site to search business entities, file formation documents, update registered agents, and track business status.

- Oregon Business Xpress License Directory (licenseinfo.oregon.gov): Find all required state, county, and city permits for your business based on location and industry.

- Oregon SBDC Network (oregonsbdc.org): Offers free business advising, startup guidance, and educational workshops through statewide centers.

- IRS EIN Application Portal (irs.gov): Get your Employer Identification Number for free online, required for taxes and bank accounts.

- U.S. SBA Oregon District Office (sba.gov): Provides funding guidance, small business certifications, and free consultations with SCORE and SBDC partners.

Use these official resources to stay compliant, informed, and ready to grow—whether you're just starting out or managing an existing Oregon LLC.

Looking for an overview? See Oregon LLC Services

Harbor Compliance Gets Your Oregon LLC Up and Running

Cut through the red tape—Harbor Compliance handles every form and deadline so your Oregon LLC starts strong from day one.