Think moving your business means just switching zip codes? Not quite. Shifting your LLC across state lines can impact everything from your federal income tax to whether you're still legally allowed to conduct business. One wrong assumption, and the whole structure of your current LLC might unravel. Registered agent obligations alone can complicate the process more than expected.

To transfer your LLC to another state in 2025, it’s essential to either file for foreign qualification or legally domesticate your LLC—depending on each state’s rules. Over 70% of business owners miscalculate the cost of compliance, risking delays, penalties, or even the loss of their certificate of good standing.

Between keeping your old LLC active or forming a new one entirely, there’s no one-size-fits-all solution. Whether managing a Florida LLC, navigating franchise tax in your original state, or adjusting your annual report filings, the decisions carry legal and financial weight. From business address updates to new EIN requests with the Internal Revenue Service, even routine steps must align. Transferring an LLC is less like forwarding mail and more like rewiring your legal foundation—every cable needs to connect cleanly, or the whole system shorts.

Can I keep my LLC in my original state after moving?

Contrary to popular belief, relocating personally doesn't automatically require moving your LLC. The answer depends on two crucial considerations: whether your business operations are changing locations and the specific regulations of your current state and destination. For clarity on your business entity, you might want to review What Does LLC Mean for a comprehensive explanation.

Understanding state registration requirements

When considering relocation, you must first understand what legally constitutes “doing business” in a state. Most jurisdictions have specific thresholds that determine when a company must register locally, with physical presence being the primary trigger.

- Maintaining a physical office or retail location

- Having employees working in the state

- Regularly meeting clients in-person within the state

- Storing inventory or maintaining equipment

- Generating significant portion of revenue from in-state activities

Your current LLC may need to register in your new location if your physical operations are moving too, as most states require businesses to register as a foreign entity when they conduct business across state lines.

When should you consider moving your LLC?

Keeping your business entity registered in your old state while living elsewhere can create several complications. You'll still need a registered agent with a physical address in your original jurisdiction, adding an ongoing expense to your operations. If you're wondering whether Is an LLC Necessary for your business strategy, further analysis may be required.

The tax situation often becomes the deciding factor. You may face dual income tax obligations if your LLC to another state move isn't properly structured. Some states impose higher franchise tax rates on non-resident businesses, making a complete transition more economically sensible for smaller operations.

When licensing requirements or industry regulations differ significantly between states, the benefits of properly domesticate your LLC or form a new one outweigh the administrative costs of maintaining status quo.

Easily Move or Register Your LLC

ZenBusiness helps you file a foreign qualification or start fresh in your new state—without the confusion.

What are my options for relocating my LLC?

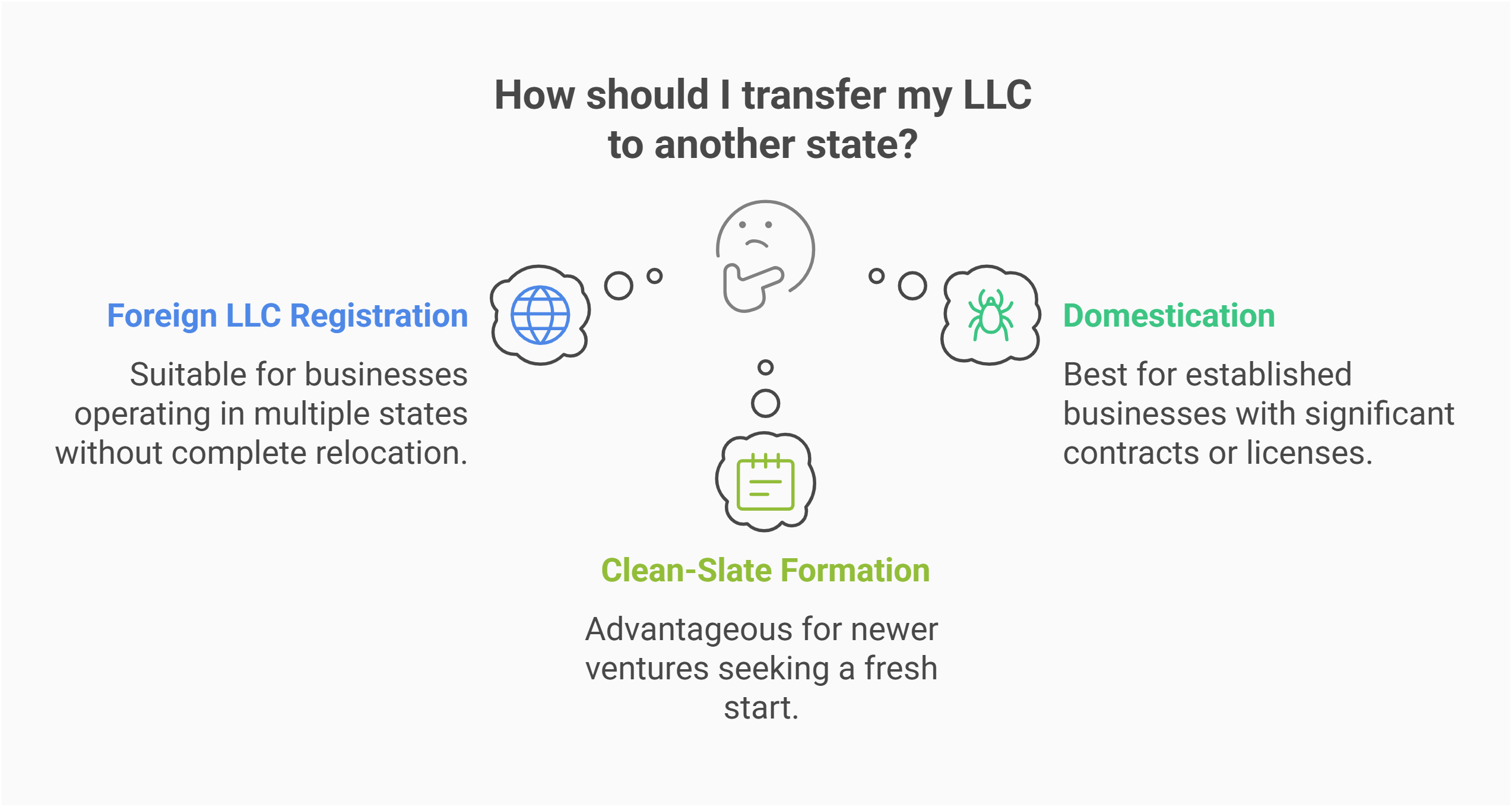

Statistics show nearly 13% of businesses relocate annually and face this exact decision. Business owners contemplating an interstate move have three primary options: foreign qualification, domestication/conversion, or complete dissolution and reformation in the new jurisdiction.

Registering as a foreign LLC

Foreign qualification allows your business to legally operate in multiple states simultaneously. This process involves filing specific paperwork with the Secretary of State in your new location while maintaining your original registration. Moreover, learning How to Acquire an LLC can guide you through the required procedures.

This approach offers significant advantages including maintaining your business history, existing contracts, and credit profile. However, drawbacks include paying filing fee requirements in both states, submitting duplicate annual report filings, and navigating two sets of compliance regulations that could potentially conflict.

LLC domestication (conversion)

LLC domestication refers to the formal process of changing your company's home state while maintaining the same legal entity. Not all jurisdictions permit this process—approximately 35 states currently allow some form of conversion mechanism. For entrepreneurs targeting regional support, exploring LLC in Florida can offer tailored insights for a smooth transition.

The primary benefit of domestication is continuity; you maintain your EIN, bank accounts, and contracts while changing your home jurisdiction.

| State | Allows Conversion | Special Requirements |

|---|---|---|

| Delaware | Yes | Simple process, minimal requirements |

| Wyoming | Yes | Must file Plan of Conversion |

| Florida LLC | Yes | Requires Articles of Domestication |

| California | Yes | More complex process with higher fees |

| New York | Yes | Requires certified copy of formation documents |

| Texas | Yes | Requires tax clearance certificate |

Domestication typically requires significantly less paperwork than dissolving and reforming your business and prevents any gaps in your liability protection.

Dissolving and forming a new LLC

The most comprehensive approach involves formally closing your old LLC and establishing a completely new entity in your destination state. This process requires filing dissolution papers with your state of formation, settling any outstanding tax obligations, fulfilling creditor notification requirements, transferring assets and contracts, and then registering a fresh LLC in the new location. While more complex, this option provides a clean break that may benefit businesses facing significant regulatory differences between states. For new entrepreneurs, open an LLC Without a Business Plan might be a flexible option for starting afresh.

What are the legal and tax implications of moving an LLC?

Consider the case of James, who moved his online consulting business address from California to Texas but failed to properly structure his business transition. He was shocked to receive a $5,800 tax bill from California despite not living there for months. Both legal and tax considerations require careful evaluation when moving your business. For professionals weighing their options, comparing PLLC vs LLC Texas can help determine the optimal structure.

State taxation and franchise fees

State income tax rates vary dramatically across the country, from zero in states like Wyoming and Nevada to over 12% in California. Moving your LLC can significantly impact your tax obligations depending on where income is earned and whether you maintain physical presence in multiple jurisdictions.

Many entrepreneurs are surprised to discover that each state has its own approach to franchise tax and annual fees. Delaware charges a modest $300 annual LLC tax, while California imposes a minimum $800 yearly fee regardless of whether your business generates profit. For service businesses with minimal physical assets, properly transferring your LLC to a tax-friendly state can produce substantial savings, though nexus rules still apply if you operate across state lines.

Compliance requirements in a new state

Ongoing reporting obligations vary significantly between jurisdictions. Some states require detailed annual report filings with financial disclosures, while others maintain minimal paperwork requirements for LLCs, particularly member-managed entities.

Licensing requirements present another significant consideration when moving an LLC. Professional service providers, food service businesses, contractors, and real estate brokers often face entirely different qualification standards, continuing education requirements, and renewal processes. Consulting a business attorney familiar with both jurisdictions can prevent costly compliance oversights.s in Georgia can benefit from learning How to Start Your Own LLC in GA to streamline their formation process.

Relocate Your LLC Without Mistakes

Northwest walks you through LLC domestication, registered agent changes, and state-by-state compliance.

Do you need a new EIN when moving your LLC?

Generally, you won't need a new EIN when relocating your LLC across state lines if you maintain the same business structure. The Internal Revenue Service considers your employer identification number permanent unless your entity undergoes fundamental changes like switching from a sole proprietorship to a corporation or LLC, changing ownership structure, or being acquired.

However, if you dissolve your original entity and form a completely new one, you'll need to apply for a new identifier with the IRS, as the federal income tracking number is tied to the specific legal entity rather than just the business name or ownership.

How to transfer an LLC to another state step by step

Wondering if you need to navigate a bureaucratic maze to do I need to move my LLC? While the process requires attention to detail, following a systematic approach can save time and prevent legal complications down the road.

Determining the best relocation option

Start by evaluating whether your business needs physical presence in both locations. If maintaining operations across state lines, foreign LLC registration may be your simplest path. For complete relocations, compare domestication availability and requirements between your current state and destination.

Consider business continuity requirements carefully. Established businesses with significant contracts, licenses, or industry certifications should prioritize domestication when available, while newer ventures might find clean-slate formation more advantageous. Companies holding specialized permits, professional licenses, or government contracts should consult a tax professional about potential transfer restrictions. Additionally, reviewing Which State Is Best to Form an LLC can help you evaluate regional benefits.

Filing necessary documents in the new state

Begin by obtaining a certificate of good standing from your current jurisdiction, as most states require this documentation to process domestication or foreign qualification. This certificate verifies your company is compliant with all requirements in your original location.

Contact the state agency responsible for business registrations in your destination to obtain the correct forms. Most states require Articles of Domestication or similar documentation that references your original formation information and confirms your intent to transfer registration. For example, Setting Up an LLC in Florida provides a clear roadmap for meeting local requirements.

Timing considerations can significantly impact your transition success. Plan for processing delays that may extend from 2-3 weeks in business-friendly states to 2-3 months in more bureaucratic jurisdictions. Maintaining dual registrations during this interim period ensures continuous legal operation. For instance, understanding Florida LLC Filing Time may help you plan your move effectively.

Updating business licenses and permits

Identify which operational credentials must be updated, including general business licenses, professional certifications, sales tax permits, health department authorizations, and industry-specific requirements. Some credentials may transfer easily while others require complete reapplication.

Operating with outdated credentials after relocating can trigger significant penalties, including fines that often scale with duration of non-compliance, potential business closure orders, and even personal liability for corporate income tax in extreme cases. Specialized industries like healthcare, financial services, and food service face particularly stringent enforcement of proper licensing.

Notifying stakeholders of your LLC move

Develop a comprehensive notification plan for clients, vendors, financial institutions, insurance providers, government agencies, and business partners. Your LLC operating agreement may even specify required procedures for location changes. Beyond legal requirements, clear communication prevents disruption to business relationships, ensures uninterrupted service delivery, maintains proper insurance coverage, and allows time for stakeholders to update their systems with your new information, preventing payment delays and lost correspondence.

Managing multi-state LLC operations

Historically, multi-state operations were primarily the domain of large corporations, but today's digital commerce landscape has made interstate business common even for small business entity owners. Proper management across state lines requires careful attention to registration requirements, tax obligations, and ongoing compliance.

How foreign qualification works

Foreign qualification is the process of registering your LLC to do business in states beyond your formation jurisdiction. This registration acknowledges your company's out-of-state origin while authorizing operations in the new location.

- Opening a physical office or store

- Hiring employees based in the state

- Applying for business licenses specific to that jurisdiction

- Regular in-person meetings with clients

- Storing inventory or equipment in the state

- Generating significant revenue from in-state activities

The application process typically involves filing a Certificate of Authority or similar documentation with the Secretary of State office in your new jurisdiction, providing a copy of your formation documents, and designating a local registered agent to accept legal documents. Before finalizing your new registration, consider using an LLC Name Generator to inspire a distinctive business identity.

Costs of maintaining presence in multiple states

Initial registration costs for file for foreign qualification typically range from $50-$500 depending on the state, with California and Illinois among the most expensive. These are one-time expenses, but ongoing compliance generates perpetual costs including annual or biennial report filings ($10-$800), maintaining registered agent services ($100-$300 annually per state), and jurisdiction-specific fees.

The financial consequences of non-compliance can dwarf these expenses. Unregistered businesses operating across state lines may face fines ($100-$5,000 per year), back taxes with penalties, contract enforcement problems, and even being barred from using state courts to pursue payment from clients. For businesses generating significant revenue in multiple states, proper registration is invariably less expensive than potential penalties.

Streamlining compliance across state lines

Implementing a centralized compliance calendar with automated reminders for all jurisdictional deadlines prevents costly oversights. Many businesses benefit from digital document management systems that organize requirements by state with clear ownership assignments.

Professional registered agent services offering multi-state coverage provide significant advantages for businesses operating across jurisdictions. These services ensure proper handling of official notices and can often provide compliance monitoring. For complex operations, specialized compliance software can track changing requirements and upcoming deadlines across all your business locations. For advanced asset management, LLC Holding can provide effective solutions.

FAQs about moving an LLC to another state

Navigating LLC relocation is like traveling unfamiliar terrain—you need reliable directions. Here are the most common questions business owners ask when contemplating transferring an LLC across state borders.

Properly executed LLC relocations maintain your liability protection throughout the transition. However, gaps can occur if you dissolve your original entity before completing new state formation, or if you continue operating in a state after formally withdrawing registration. Maintaining thorough documentation of all transfer your LLC procedures, including asset transfers between entities, helps defend against any “alter ego” claims that might attempt to pierce the liability veil.

Timeframes vary significantly by method and jurisdiction. Foreign qualification typically processes fastest (1-3 weeks), while LLC to a new state domestication averages 4-8 weeks from submission to completion. The dissolution and reformation approach typically takes longest (6-12 weeks) due to the sequential nature of the process. States like Delaware, Wyoming, and Nevada offer expedited processing for additional fees.

For domesticated LLCs maintaining the same EIN, many banks allow you to update your address without opening new accounts, though documentation requirements vary by institution. If forming a new entity, you'll need to open fresh accounts with your updated EIN and transfer assets from your old state accounts. During transition, maintain clear separation between personal and business finances to preserve liability protection, and notify payment processors, merchant services, and automatic billing systems.

Wyoming, Nevada, and Delaware frequently top lists of tax-friendly jurisdictions with no state corporate income tax, low or no franchise fees, and strong privacy protections. However, physical presence in any state typically creates tax nexus regardless of where your LLC is registered. The truly “best” state depends on your specific business model, industry regulations, and personal circumstances. Consulting with a tax professional before transferring an LLC for tax purposes ensures you understand the actual benefits for your situation. In some cases, business owners might also consider Change LLC to S Corp as a means to optimize tax efficiency.

Moving an LLC internationally involves more complex considerations than interstate relocations. Most approaches require dissolving your U.S. entity and forming a new company under foreign law, though some jurisdictions offer conversion options. Popular international destinations include the United Kingdom, Singapore, and Canada, each offering different advantages regarding taxation, regulatory frameworks, and international business protections, though all require careful consideration of U.S. Internal Revenue Service reporting requirements that continue to apply to U.S. citizens operating businesses abroad. Alternatively, Starting a Corporation might be a viable option for those seeking a different business structure.

Handle Multi-State Compliance Smoothly

Harbor Compliance ensures your LLC transition meets all legal requirements—no gaps, no missed filings.