Starting an LLC in Missouri is one of the most frequently asked questions of entrepreneurs who are interested in starting a business in the Show-Me State. In 2025, the process is faster and less expensive than many places in the U.S. Missouri has one of the cheapest state filing fee, no annual report requirement, and easy online filing. This is perfect for small business owners who want liability protection and don’t want to pay too much to comply.

To form an LLC in Missouri, you’ll pay just $50 to file your Articles of Organization online with the Missouri Secretary of State. While this is the only mandatory fee, other potential costs include $50–$150/year for a registered agent, $0–$100 for EIN or legal services, and $25 if you reserve your business name in advance. Total startup costs typically range from $50 to $300, making Missouri one of the most cost-effective states to register a limited liability company.

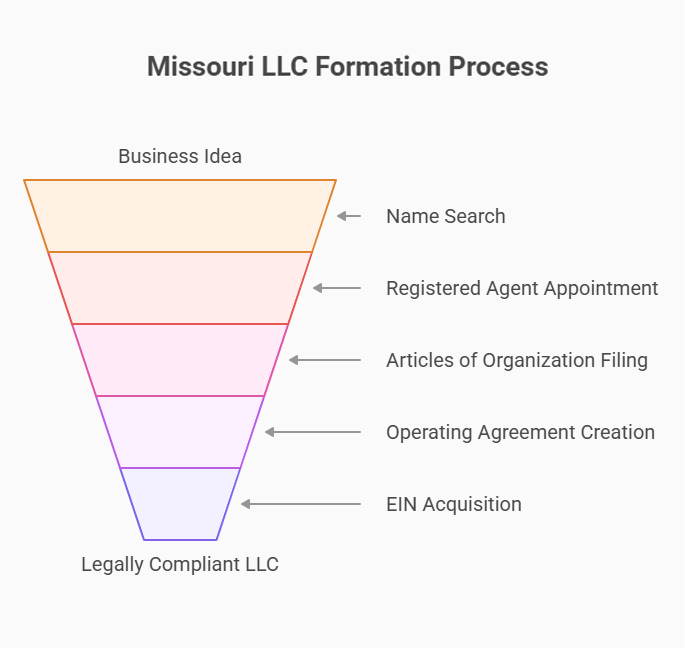

This step-by-step guide walks you through the entire Missouri LLC formation process — from choosing a name and appointing a registered agent to filing documents and staying compliant after formation. Whether you're forming a single-member LLC or something more complex, this 2025 guide covers everything you need to start strong.

Key Considerations Before You Form a Missouri LLC

An LLC is a statutory entity, which means it’s protections and powers are defined and enforced under missouri law. It’s important to choose the right business structure, comply with Missouri law and evaluate your future. Whatever the case may be, protecting your personal liability or needing an official way to do business in missouri, considering all this early can make or break your success. Some entrepreneurs even choose to form an LLC before having a full business plan and adjust as they grow. Read carefully your options and understand your compliance obligations before you decide to form your LLC in Missouri.

Why Choose an LLC in Missouri?

Starting a limited liability company in Missouri is affordable and easy. Missouri is an entrepreneur-friendly state with a low filing fee, no required annual report, and one of the most pro-business climates in the United States. To understand what drives this reputation, explore these key small business stats from Missouri for insights into GDP, per capita income, and the state’s top-performing industries. In Missouri, unlike in many other states, you can set up your LLC fully online and finish the process in a few business days. When it comes to liability protection without lots of red tape, Missouri is a good option. If you are still unsure, then compare it with the most popular states to form an LLC for further insight.

Who Can Form an LLC in Missouri?

In Missouri, anyone can set up an LLC including individuals, partnerships, foreign entities, and other entities. You do not need to live in the U.S. or the bordering state to start a limited liability company here since there’s no residency requirement. This makes Missouri particularly attractive for remote founders, out-of-state investors, or those getting started with a trusted partner. Out of all the options available, owing a corporation or a limited liability partnership is possible but the LLC is the most flexible and used ones.

Certain professional services (like legal, medical, or architectural firms) may need special licensing or approval to form an LLC in Missouri Missouri restricts nonprofit activity under a standard LLC, thus if you want tax-exempt status, you should use a different business structure.

Start Your Missouri LLC Easily with ZenBusiness

ZenBusiness streamlines your Indiana LLC formation from name search to filing. With intuitive forms, expert support, and fast processing, you’ll be up and running in no time.

Mandatory Operating Agreement Requirement

Missouri is one of the few states that legally requires a written operating agreement when forming a limited liability company. While this document isn’t filed with the secretary, it must be maintained with your internal records. All LLCs in Missouri are bound to this rule (single-member LLCs included). To clarify how the owners or managers will operate the business and to lessen the potential for legal ambiguities, your agreement will set out the duties, functions and responsibilities of each owner or manager.

Step-by-Step: How to File for Your LLC in Missouri

Starting your llc in missouri is simple when you follow the state’s four-step process. Everything can be handled online through the missouri secretary of state’s platform. This section breaks down each step clearly—so you can form an llc quickly, affordably, and with full legal compliance.

Step 1: Perform a Missouri LLC Name Search and Select a Name

Your business name should be unique and distinguishable from the names of other business entities to register an llc in Missouri. Start with the Missouri Secretary of State's Business Entity Search tool to check availability. If the name is not taken then you can continue or reserve for a period of 60 days. You can also follow this guide on using the Missouri LLC name search tool effectively.

Your name must include “Limited Liability Company” or an acceptable abbreviation such as “LLC” or “L.L.C.” According to the law in Missouri, one cannot use any word or phrase in a business name that indicates a connection with a government agency or the necessity of business or professional licensing.

Step 2: Appoint a Missouri Registered Agent

Every llc in missouri must appoint a registered agent—a person or service responsible for receiving legal and government documents on behalf of your limited liability company. Your agent must have a physical address in Missouri and be available during normal business hours. You can serve as your own agent, but many owners prefer a professional registered agent service to ensure privacy and reliability. Also consider the legal risks of acting as your own registered agent before making that decision.

Step 3: File Missouri Articles of Organization Online

To Create an LLC in Missouri, you have to submit or file the articles of organization with the Missouri Secretary of State. The quickest and cheapest option is to file online through the Missouri Secretary of State’s business portal. You’ll provide basic info like the name and address of your registered agent, the duration of your LLC, and the names of its members or managers.

Typical Filing Timelines in Missouri

| Filing Method | Processing Time | Cost | Notes |

|---|---|---|---|

| Online | 1–3 business days | $50 | Fastest method |

| 5–10 business days | $105 | Includes $5 handling fee | |

| In-Person | 1–2 business days | $105 | May require appointment |

| Fax | 3–5 business days | $105 | Payment by credit card form only |

Once approved, you’ll receive a stamped copy confirming your LLC creation has been legally filed with the secretary. Save this document for your records—you’ll need it to open a business bank account and register for tax IDs.

If you aren’t sure what this document includes, here’s a breakdown of what a certificate of organization includes and how to ensure it’s complete.

Step 4: Create Your LLC Operating Agreement and Obtain an EIN

Missouri law requires a written LLC operating agreement, although it is not filed with the state, and must be in place. This document outlines your LLC’s responsibilities, duties, and ownership. This also enhances your liability protection because, in the eyes of the law, your personal and business affairs remain separate – a big plus for the single member LLCs.

The IRS will issue you an employer identification number (EIN) next. If you apply online for IRS Form SS-4, you can get an E.I.N. for free, and its approval is mostly quick. To open business bank accounts, hire employees and handle federal tax filinf, you will need the EIN. You can apply using the IRS EIN online application — processing is immediate and free of charge.

What Is the Cost to Start an LLC in Missouri?

Missouri is one of the most affordable states for llc formation, offering low state filing fees and minimal ongoing costs. In this section, we’ll break down what you must pay to legally operate your limited liability company—and which expenses are optional but still worth considering.

The Mandatory State Filing Fee

To officially start your llc in missouri, you must pay a state filing fee of $50 if you file online. This is one of To officially start your llc in missouri, you’ll need to pay a one-time state filing fee of $50 when submitting your articles of organization. This low-cost fee applies if you file online, which is the fastest and most efficient method. Payment is made via the Missouri Secretary of State’s secure portal using a credit or debit card. Once processed, you’ll receive a digital confirmation showing that your limited liability company has been approved and entered into the state database.

Other Potential Business Formation Expenses

Besides the required state filing fee, there are certain optional services and compliance items that may increase your overall cost to form an LLC. Even though not all of them are required under missouri law, they can always help to make sure that your limited liability company is properly protected, documented as well as ready to run. Whether you're hiring a professional registered agent service or filing for a business license, budgeting for these extras up front will make your launch smoother and legally compliant from day one.

- Registered agent service: $50–$150 per year

- Operating agreement drafting: $0–$200

- Name reservation (optional): $25

- Certificate of Good Standing: $10

- Business license registration: Varies by locality

- EIN filing via third-party service: $0–$100

Curious how Missouri compares to other states? Check this guide on typical how much it costs to form an LLC nationwide nationwide to plan more effectively.

Form Your Missouri LLC with Northwest – No Hidden Fees

Northwest guides you through Indiana LLC setup with clear instructions, reliable support, and lifetime privacy by default.

Post‑Formation Compliance and Maintenance

After your llc in missouri is officially established, staying compliant under missouri law is crucial. Thankfully, ongoing maintenance is minimal compared to other states. This section outlines what your limited liability company must do to remain active, legal, and in good standing with both state and federal authorities. To see how Missouri stacks up nationally, review this breakdown of LLC annual costs across all states.

Does Missouri Require an Annual Report for LLCs?

Missouri stands out for its low-maintenance requirements. Unlike many states, it does not require limited liability companies to file an annual report each year. This means fewer deadlines and reduced administrative burden for business owners. However, your llc in missouri is still responsible for keeping its business address, registered agent, and ownership records current with the missouri secretary of state to remain in good standing.

Opening a Business Bank Account for Your LLC

Every LLC in Missouri must open a separate business bank account for their business. Establishing your LLC as a separate legal entity is essential for your liability protection and makes preparing your taxes easier. Personal use of your business funds – like those for shopping or the grocery store – could potentially expose you to personal liability, especially if you are sued or audited by the IRS. In general, banks ask for a number of standard documents to open an account. So, have everything ready beforehand for when you visit a branch or apply online.

Documents Typically Required:

- A copy of your articles of organization

- Your operating agreement

- IRS-issued employer identification number (EIN)

- A valid government-issued photo ID

- Proof of business address

Staying Compliant with Taxes and Licenses

Once you set up your LLC in Missouri, you will incur taxes and license fees at the state and federal levels. Although LLCs features pass-through taxation, you must register with the Missouri Department of Revenue if your limited liability company is engaged in taxable activities like hiring workers, selling products, or collecting sales tax. You must also decide if your city or the county (the big ones including kansas city or jefferson city) will require you to obtain a business license to operate. Sometimes, your LLC can choose federal tax treatment such as S corporation status based on the manner in which the profits are distributed.

At a state level, Missouri does not require a business license, however, several municipalities mandate one. Make sure you prepare complete and timely filings so that you do not pay penalties or delay operations.

Common Tax and License Obligations:

- Register with the Missouri Department of Revenue

- Apply for a local business license

- File federal taxes with the Internal Revenue Service

- Submit employer tax forms if you have staff

When and How to File Amendments or DBAs (h3)

Filing an amendment to the Missouri Secretary of State is necessary if your LLC in Missouri changes its name, business purpose, or member information. A DBA, doing business as, may also require a separate registration and local approval. These updates help keep your limited liability company in compliance with state rules and ensure your business records stay accurate and current. If ownership is changing hands, here’s how to transfer LLC ownership while staying legally compliant.

How to Obtain a Certificate of Good Standing

You can use a Certificate of Good Standing of your LLC to prove compliance with Missouri law. This document shows that your limited liability company is authorized to do business in Missouri. You might require it when you apply for loans, open a business bank account, or register as a foreign LLC in another state. If your LLC does business only in Missouri, it is called domestic. Opening locations in other states will call for a foreign corporation registration as well as multiple certificates or license filing.

You can order this document through the Missouri Secretary of State’s website. The request is processed by the Business Services Division, which maintains official records and filing statuses. Most certificates are delivered within 1–2 business days, with options for digital or mailed copies. Legal documents provide proof of your legal status in the public record, and are frequently requested by banks, lenders and licensing agencies.

The Missouri Series LLC: An Advanced Option for Investors

A series LLC is a special type of limited liability company available under missouri law. It allows you to create multiple “series” or sub-entities within a single parent LLC, each with its own liability protection, assets, and members. This setup is especially appealing for real estate investors or business owners with distinct operations or assets to manage separately.

While a series LLC offers structural flexibility and cost savings, it also comes with complexity. Each series must maintain clear records, and legal recognition of series entities can vary outside Missouri. Consult an attorney before choosing this business structure, especially if you operate in multiple states.

Missouri LLC Formation: Frequently Asked Questions

We’ve compiled answers to the most common questions about starting and maintaining an llc in missouri. This section clarifies legal, tax, and filing concerns to help you make informed decisions throughout the llc formation process and keep your limited liability company in compliance.

How Long Does It Take for You to Form an LLC in Missouri?

If you file online, forming an llc in missouri typically takes 1 to 3 business days. Mail or in-person submissions can take up to 10 days. Expedited processing is not available, so filing digitally through the missouri secretary is the fastest option for most entrepreneurs.

Is Missouri a Good State for You to Start an LLC?

Yes—Missouri is perfect if you want to start an llc affordably and with minimal red tape. This state has no annual report requirement, has low filing fees, and has an easy online system. It’s especially appealing for business owners seeking ease of compliance and low startup costs.

How Much Tax Does an LLC Pay in Missouri?

A limited liability company in Missouri is treated as a pass-through entity, so profits are reported on each member’s personal income tax return. This structure helps avoid double taxation, which occurs in C corporations and sometimes in a sole proprietorship depending on how income is reported. While Missouri has no franchise tax, your LLC may owe state income tax, sales tax, or employment-related taxes depending on your business structure and revenue activity.

Can You File for a Free LLC in Missouri?

No—while you can handle the paperwork yourself, Missouri still requires a $50 filing fee to officially form an llc. However, there are no hidden charges if you file online. Hiring a service provider is optional and may add costs, but DIY filing is fully allowed and affordable.

Can Non‑US Residents Form a Missouri LLC?

Yes—non-US residents can legally form an llc in Missouri. There are no citizenship or residency restrictions under missouri law. However, you’ll still need a U.S.-based registered agent, a valid business address, and may need to apply for an employer identification number from the Internal Revenue Service.

Can You Change Your Missouri LLC Name Later?

Yes, you can change your llc in missouri name by filing an amendment to your articles of organization with the missouri secretary of state. A filing fee applies, and the new name must meet state naming requirements. Once approved, update your business license and bank records accordingly.

Resources for Starting a Missouri LLC

Ready to take the leap into Missouri entrepreneurship? Whether you're filing your Articles of Organization or navigating state tax rules, these key resources have you covered from start to finish:

- Missouri Secretary of State – LLC Registration & Forms (sos.mo.gov)

Find and download essential filings—including LLC‑1 Articles of Organization and name reservation forms. This is your go‑to for official state paperwork and fee schedules. - Step‑By‑Step Online Filing Guide – Missouri SOS (sos.mo.gov)

Detailed PDFs and resources walking you through creating an account, filing your LLC, and submitting online correctly. Perfect for first‑timers. - Starting a Business in Missouri – Official Guide (sos.mo.gov)

Covers entity types, name requirements, online filing tips, and where to find further SOS resources. - Northwest Registered Agent – Missouri LLC Overview (northwestregisteredagent.com)

Offers practical advice on filing methods, fees ($52 online vs. $105 by mail), registered agents, and the absence of annual reports for Missouri LLCs. - Harbor Compliance – Missouri LLC Formation Guide (harborcompliance.com)

Covers steps from name selection to tax registration and EIN application, including military fee waivers and optional services. - DIY Missouri LLC Guide – Bizee (bizee.com)

A hands-on walkthrough featuring Missouri-specific filing fees, name rules, registered agent requirements, and additional business support resources.

Launching your Missouri LLC just got easier, these resources guide you through filings, name checks, agent setup, and compliance like a pro. Whenever you're ready to begin, let these tools light the way!

Looking for an overview? See Missouri LLC Services

Create your Missouri LLC with Harbor Compliance

Enterprise-grade service with compliance tracking and full document prep. Ideal for serious founders.