Starting an llc in indiana offers more than just low costs — it gives entrepreneurs strong legal protections, tax advantages, and a stable economic environment to grow their business. Whether you're forming a new venture or restructuring an existing one, Indiana provides a streamlined path to establish your limited liability company with clear requirements, minimal red tape, and affordable fees.

To start an LLC in Indiana, you must file your articles of organization for $95 with the indiana secretary, appoint a registered agent (free if self or $100–$125/year), and create an operating agreement, while optional extras include a $10 name reservation, $25 expedited filing fee, $31 business entity report, and $15–$30 for a certificate of existence. You can file online through the INBiz portal, and you'll also need to register for taxes, apply for permits, and get a free EIN from the IRS.

This guide walks you through every step, from name search and legal filings to taxes, permits, and ongoing compliance requirements. Whether you're just exploring options or ready to form your limited liability company, you'll learn how to launch and grow a fully compliant indiana business with the right structure and long-term liability protection.

Why Choose Indiana for Your LLC?

Owners of limited liability company (LLC) in Indiana may take advantage of low costs, flexible rules, and strong legal protections. Indiana has numerous advantages related to launching a business from simplified formation through INBiz to tax savings and scalable business incentives. This makes the state among the most affordable and efficient places to set up a limited liability company. Whether you’re beginning locally or relocating from a different state, the benefits are real and immediate. If you’re uncertain about whether your specific business model warrants an LLC, overview of when and why to form an LLC covers the key benefits and legal triggers that may assist you in your decision.

Streamlined Formation via INBiz Online Portal

Indiana makes it easy to start your limited liability company through INBiz – the official online portal managed by the Indiana Secretary of State. This platform allows entrepreneurs to file online, check name availability, appoint a registered agent, and track all steps in one place. You can create an account, submit your articles of organization, and pay your filing fee in just minutes.

Unlike many states, Indiana does not require mailing documents or hiring intermediaries to complete basic tasks. INBiz reduces paperwork, saves time, and lets you handle everything from tax registration to permit applications in a centralized dashboard. If you're forming your LLC in indiana, this digital convenience gives you a fast, clear, and modern path to launch.

No State Income Tax on LLC Pass-Through Income

One of the most appealing reasons to form an LLC in Indiana is that there is no state income tax on pass-through income. If your limited liability company (LLC) is considered a sole proprietorship, partnership or S corporation, profits pass through the owners and are only taxed at the federal level. It can mean a whole lot of tax savings compared to a state like California or New York.

Indiana’s tax structure helps small and mid-sized businesses minimize overhead and simplify tax filings. While you’ll still have to register for sales or withholding tax if applicable, there’s no additional state income tax burden upon your company’s main profit. In the U.S., no other state has a more tax-friendly climate for business owners and freelancers than Indiana, if it’s more profit you want, and red tape you want to avoid.

Strong Liability Protection & Charging Order Law

Indiana provides strong liability protection for LLC owners, shielding personal assets from business debts, lawsuits, and obligations. When you form a limited liability company, your home, savings, and personal property are typically safe from creditors seeking business-related claims — a critical layer of security for small business owners.

Even better, Indiana enforces a pro-LLC “charging order” rule, which limits a creditor’s ability to seize ownership or control of an LLC. Instead, creditors may only claim distributions (if any), leaving the business entity intact and under your full control. This legal advantage is one reason many professionals and investors choose to form an llc in indiana, especially those concerned with long-term asset protection.

Business Incentives & Growing Midwest Market

The State of Indiana offers competitive business incentives for growth at every stage. The state offers a variety of incentives including tax credits, grants and training reimbursements to lure startups, manufacturers and tech firms. Initiatives such as EDGE and the Hoosier Business Investment Tax Credit incentivize workforce hiring, capital investment and creation of jobs, perfect for launching new limited liability company or expanding small businesses.

Located in the heart of the Midwest, Indiana gives companies direct access to key markets with lower overhead costs than coastal hubs. With a lot of workers, a strong transport network, and low filing fee, it’s a great home base for any LLC. To learn more about the state’s entrepreneurial ecosystem, these Indiana small business statistics highlight growth rates, employment levels, and business density. Structuring your limited liability company in Indiana provides you with financial advantages and regional benefits if you want to grow strategically.

Indiana LLC Formation Requirements

Starting an LLC in Indiana consists of more than just filling out forms, there are several essentials every business owner must know. Establishing an LLC in Indiana requires several steps. This includes obtaining a unique name, appointing a registered agent, creating an operating agreement, and determining necessary licenses. Indiana keeps the process simple but legally sound. Each limited liability company must be in working order according to state-level requirements that are given here.

Name Availability Search & Optional Reservation – $10 + $1 Fee

Before forming an LLC in Indiana, your business name must be distinguishable from the names of other businesses registered in Indiana. You can use the INBiz portal for a free online name search to check availability, or refer to step-by-step Indiana LLC name search to get extra tips for picking the correct name and avoiding rejection. If the name is available, but you are not ready to file yet, you can reserve the name for 120 days by filing a reservation form and paying a $10 filing fee plus a $1 online processing fee.

This step isn’t mandatory but can protect your desired name while preparing your other formation documents. Be sure that your LLC name has “Limited Liability Company” or an acceptable abbreviation like “LLC” or “L.L.C.” This is required by law and confirms the legal status of your business.

Registered Agent Eligibility & Appointment Options

Every llc in indiana is legally required to appoint a registered agent, a person or service authorized to receive official documents, lawsuits, and state notices on behalf of the business. If you're unsure what a registered agent actually does or why it's required, this explanation of registered agents and their role in an LLC offers a clear breakdown. The agent must have a physical indiana address and be available during regular business hours. You can designate yourself, another member of the LLC, or hire a commercial registered agent service.

Using a professional service may cost between $100–$125 per year but ensures privacy, compliance, and consistency. Self-appointment is free but less reliable if you're often out of the office or operate in multiple states. Whichever option you choose, naming your agent correctly on the articles of organization is a non-negotiable requirement to legally form your limited liability company.

Operating Agreement Essentials: Content & Benefits

While not legally required, all Indiana LLCs should have a written operating agreement. This internal document defines your limited liability company's owner structure, management roles, member duties, and distribution of profits. Are you switching from a sole proprietorship? This guide to changing from sole proprietor to LLC explains how the operating agreement makes your transition into a much more protected business entity. It also sets out the mechanisms for resolving disputes and the position if one member leaves, or the business is dissolved.

Having a strong operating agreement helps protect your LLC’s legal standing as a separate business entity, especially in lawsuits or audits. It reduces internal conflict, clarifies expectations, and fosters long-term growth. Drafting your LLC operating agreement at the start will give you control and clarity for your Indiana business whether you have a single or multi-member LLC. It will also help bring peace of mind as the company grows.

State-Level Licenses & Permit Prerequisites

Starting an LLC in Indiana is just the first step, based on your industry, you may also require licenses or permits from the state where you will do business. Retail sales, construction, health services, transport, alcohol, and professional trades are commonly regulated activities. Each Indiana business license requirement varies according to the business and profession. Indiana does not have one generic license.

Log on to the Indiana Professional Licensing Agency or the INBiz portal to find out what you need. If you don’t register for the right license or permit, you can face fines, delayed operations, or legal issues. It is essential to be compliant at this stage to protect your limited liability company and provide your business with a proper legal foundation to operate confidently and continuously.

Still deciding if an LLC is the right entity for you? This LLC vs LLP comparison and LLC vs PLLC guide break down the key differences based on liability, structure, and professional requirements, helping you choose the best fit for your business.

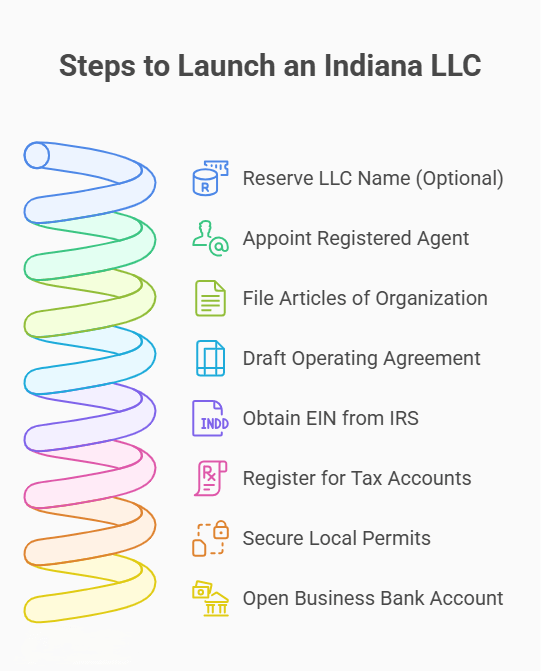

8 Steps to Launch Your Indiana LLC

Forming an llc in indiana requires more than just filling out a form — it's a step-by-step process that ensures your business is legally recognized, tax-ready, and fully compliant. From choosing a name and filing the articles of organization to securing permits and opening a bank account, following these eight essential steps will help you launch your limited liability company correctly and confidently.

Step 1: Reserve Your LLC Name (Optional)

Before you file your articles of organization, you should always check to ensure your LLC name is available in Indiana. You can run a free name check on the INBiz portal. If you are not prepared to establish your LLC in Indiana immediately, you may reserve your desired name for a period of 120 days. This stops others from registering it while you prepare the remaining paperwork.

To reserve a name you must file a form and pay the $10 filing fee and a $1 online fee. While it is optional, this step helps if you are still working on your operating agreement, choosing a registered agent, or any other paperwork. Make sure your name includes “Limited Liability Company” or its abbreviation and complies with state naming rules set by the Indiana Secretary.

Step 2: Appoint Your Registered Agent

Every llc in indiana must designate a registered agent, an individual or company responsible for receiving legal documents, government correspondence, and service of process. Your agent must have a physical address in Indiana and be available during regular business hours. You can appoint yourself, another member of the LLC, or use a commercial registered agent service.

Hiring a professional service, typically costing $100–$125 per year, ensures privacy and reliability — especially if your business operates in multiple states or lacks a fixed location. Self-appointment is free, but riskier if availability is inconsistent. Either way, this designation must be included in your articles of organization and is a key compliance requirement when you form a limited liability company in Indiana.

Step 3: File Articles of Organization – $95 Filing Fee

If you want to officially form your LLC in Indiana, you need to file your articles of organization with the Indiana Secretary of State. This document lists your business name, registered agent, where your principal office is located and management structure. Your limited liability company’s articles of organization are the legal basis for your LLC and need to be accurately completed.

The filing fee is $95 whether you submit online or by mail. Most businesses choose to file online through the INBiz portal to receive quicker processing and a digital confirmation. Once your LLC is accepted your business will be recognized as a registered business in Indiana, along with a stamped certificate confirming your business registration.

Online vs. Mail Filing & Expedited Option – $25

Indiana offers two options for filing your articles of organization. You can either file online through the INBiz portal, or submit by mail. The processing is done quicker through online filing and is done usually 1–2 days after your request, and provides instant confirmation. When you submit via mail, it can take 10 business days and there's no real-time tracking.

If you're in a rush, Indiana offers an expedited processing service for an additional $25. It applies only to the electronic filings and will substantially reduce turnaround time. No matter which method you decide to use, check to ensure your own documents are not incomplete. Also, ensure your registered agent principal address are listed correctly so there are no delays or rejection.

Step 4: Draft & Sign Your Operating Agreement

Though not required by Indiana, creating / drafting an operating agreement for an Indiana LLC is a best practice. This internal document sets out how your LLC will be managed, including the role of members, vote rights, contribution of capital, and addition and removal of members.

Having a signed operating agreement will help establish your limited liability company as a separate legal entity if there is ever a dispute or audit. It also protects business by preventing misconception and lends clarity to all stakeholders. If you are starting an Indiana LLC on your own or with partners, an operating agreement keeps your business on track.

Step 5: Obtain an EIN from the IRS (Free)

To file federal taxes, open a business bank account, or hire employees you will need an Employer Identification Number (EIN). After setting up your LLC in Indiana, you can apply for your EIN free of charge directly through the IRS EIN application portal. If you apply online, the process will take just minutes, and you’ll receive your EIN on submission.

Whether or not your LLC has employees, an EIN shows that your business is separate from you. This keeps your personal life and your company’s life distinct, they aren’t the same. This is also required for registration for state tax and licensing applications. Visit irs.gov to get started.

Step 6: Register for Tax Accounts via INBiz (Sales, Withholding, Unemployment)

After forming your llc in indiana, you may need to register for Indiana state tax accounts based on your business type. Common taxes include sales tax (for retail and product sellers), withholding tax (if you have employees), and unemployment tax. You can register for all of these through the INBiz portal — Indiana’s official business gateway.

The process is free and handled entirely online, and you’ll receive your account credentials upon approval. Make sure to register before you begin operating, as failure to do so can result in penalties or delays. For full details, visit the Indiana Department of Revenue website.

Step 7: Secure Local Permits & Zoning Clearances

Your Indiana LLC may also need licenses and permits at the city level or county level to operate. Depending on your industry and location, these may include health permits, sign-off on signage, fire inspection, or local business license. Zoning clearances are important to ensure that your business can legally operate at your address.

The city clerk's office or county planning department should be checked first. Each municipality has its own requirements, and your operations may be halted or fined if these permits are not obtained. For a national perspective on licensing needs, the SBA’s guide to registering your business provides a helpful checklist of what to expect across different sectors and jurisdictions. Always check the local rules before you sign an agreement or open your doors to your customers to protect your limited liability company.

Step 8: Open a Business Bank Account & Set Up Accounting

After your Indiana LLC is officially formed, it’s time to separate your personal and business finances. Setting up a business bank account is essential for protecting the limited liability status of your company and making tax reporting easier. To open the account, most banks require your EIN, articles of organization, and operating agreement.

As part of the bank setup, get bookkeeping software or an accountant to record your income and expenses and tax obligations. From day one, a strong financial system creates visibility, minimizes liability, and helps to scale your business more efficiently. To find money, many LLCs also consider getting a small business credit card or a loan from a lender approved by the SBA.

Start Your Indiana LLC the Easy Way with ZenBusiness

ZenBusiness streamlines the Indiana LLC process, filing paperwork, securing your name, and keeping you compliant from day one.

Indiana LLC Costs & Ongoing Fees

Starting and maintaining an llc in indiana is surprisingly affordable compared to other states. With a flat filing fee, low compliance costs, and no hidden state income tax, Indiana makes it easy to budget for both startup and long-term operations. If you want to dive deeper into exact startup fees, annual reports, and optional services, here’s a complete breakdown of LLC costs in Indiana. This section outlines every essential fee, from formation to renewal, so you can plan your business finances with confidence.

Articles of Organization – $95 One-Time

To officially form your llc in indiana, you must submit the articles of organization to the Indiana Secretary of State. This legal document includes your business name, registered agent info, and management structure. The filing fee is $95 whether you file online or by mail — and it's the only mandatory upfront cost to create your limited liability company.

Biennial Business Entity Report – $31 Online / $50 Mail

In Indiana, every LLC must file a business entity report every two years to maintain good standing with the state. This document verifies your business address, registered agent, as well as ownership. Filing online via the INBiz portal costs $31, while it costs $50 if filing via mail.

This step-by-step guide to renewing your Indiana LLC will give you information on when it is necessary, what details to include, and what happens if you don’t get it done on time. If you don’t file your limited liability company’s paperwork, the state will administratively dissolve it, so be sure to track due dates. The filing window opens 60 days before the anniversary month of your LLC, and you can complete the entire process online in minutes.

Certificate of Existence – $15 Online / $30 Mail

Certificate of existence (sometimes called a Certificate of Good Standing) is a document that proves your LLC in Indiana is registered and compliant and exists as required by law in the state of Indiana. When you apply for a loan, sign a contract, or expand to a new state this document is often needed.

You may ask through the Indiana Secretary of State’s site for $15 if it’s filed online or $30 if by mail. While not frequently necessary, many firms obtain good standing proactively for important transactions or financing applications to confirm their limited liability company status.

Registered Agent Service – $0 (Self) or $100–$125/Year

All llcs in indiana must maintain a registered agent to receive legal notices and official mail. You can serve as your own agent at no cost, but many entrepreneurs choose a professional registered agent service for greater privacy and reliability.

Commercial services typically cost between $100 and $125 per year and handle time-sensitive documents on your behalf. This option is especially useful for businesses without a fixed indiana office or for owners operating across multiple states. Regardless of who you appoint, the articles of organization must list your agent’s physical address in Indiana.

Name Reservation – $10 + $1 (Optional)

If you don’t want to form your LLC in Indiana just yet, you can reserve your business name for 120 days. This will prevent the other entity from claiming it while you finalize the operating agreement, select a registered agent or get papers done.

The filing fee for name reservation is $10, plus a $1 processing charge if submitted online. While optional, but it's a good idea if you're still forming your limited liability company or expect filing delays with your articles of organization.

Expedited Filing Fee – $25

If you need to form your llc in indiana quickly, the state offers expedited processing for an additional $25. This service is only available when you file online through the INBiz portal and can reduce turnaround time to as little as one business day.

The expedited filing fee is paid on top of the standard $95 articles of organization fee. While not required, it’s ideal for entrepreneurs on tight deadlines who want to launch their limited liability company as fast as possible without delays.

How to File Articles of Organization in Indiana

To form your LLC in Indiana legally, you must submit articles of organization to the Indiana Secretary of State. This document forms a limited liability company for your business as a recognized legal entity. It outlines your business name, registered agent, mailing address, and whether your LLC will be member-managed or manager-managed.

You can file either online via the INBiz portal or by mail. It is advised to complete the filing using online as it costs you $95 and is usually processed within 1 to 2 business days. Mail filings are slower and do not provide instant confirmation. If you're in a hurry, Indiana also offers an expedited processing option for an additional $25 (online only).

Upon acceptance, you will get a certificate for your LLC. Check that your information is complete and accurate before sending it in, mistakes could delay approval. Filing this document is the first step to starting a compliant and fully operational Indiana business.

Choosing & Working with a Registered Agent

Every LLC in Indiana is required to appoint a registered agent as per the law. Further, having the perfect one will also facilitate privacy, flexibility, and compliance. A registered agent receive important documents like tax forms, government correspondence, and even legal notice. Hence, they must be a professional business and reachable. In this section, we are going to see the pros and cons of doing it yourself versus hiring a professional and how to change agents if necessary.

DIY vs. Commercial Agent: Pros & Cons

When forming your llc in indiana, you must appoint a registered agent, but should you do it yourself or hire a professional? The table below outlines the key differences to help you decide.

| Feature | DIY Registered Agent | Commercial Registered Agent Service |

|---|---|---|

| Cost | $0 | $100–$125/year |

| Privacy | Your personal address is public | Keeps your personal address off public record |

| Availability | Must be available at business address | Always available during business hours |

| Compliance Risk | Higher if you miss a document | Lower — professionals handle time-sensitive docs |

| Best For | Solo owners with fixed hours | Remote owners, multi-state businesses |

Hiring a registered agent service offers privacy and reliability, while the DIY route saves money if you're consistently present at your Indiana office. For long-term peace of mind, many growing businesses opt for professional support, and this comparison of Indiana’s top registered agent services can help you find the right fit based on price, reliability, and features.

Changing Your Registered Agent: Process & Fees

To update the registered agent for your llc in indiana, you must file a Change of Registered Agent form with the Indiana Secretary of State. This can be completed online through the INBiz portal or submitted by mail. There is no state filing fee for this update, making it simple and affordable to switch agents as your business needs change.

Be sure to include your new agent’s name, physical address, and consent to serve. Once approved, the change is immediate, and your limited liability company remains in good standing, assuming your new agent meets Indiana’s legal requirements.

Permits & Licensing for Indiana LLCs

Forming an llc in indiana is only the first step, most businesses will need state or local licenses to operate legally. Depending on your industry, location, and structure, you may be required to register for tax accounts, obtain professional certifications, or secure zoning clearances. This section breaks down the key permit categories so your limited liability company can stay compliant from day one.

State Sales & Use Tax Account Registration

If your llc in indiana sells taxable goods or services, you must register for a state sales and use tax account. This is required by the Indiana Department of Revenue and allows your business to collect and remit sales tax properly. Common industries affected include retail, hospitality, online sales, and product-based service providers.

Registration is free and completed through the INBiz portal. Once approved, you'll receive a Registered Retail Merchant Certificate — which must be displayed at your place of business. Not registering can lead to penalties, audits, or revocation of your ability to operate legally. Make sure your limited liability company is fully registered before launching any sales activity in Indiana.

County & Municipal Business Licenses

Indiana does not offer a universal business license at the state level, however, your Indiana LLC will be subject to local permits by counties and cities. Restaurants, retail shops, contractors, daycare providers, or any business with a physical presence in a municipality may require these licenses.

Requirements vary widely by location. Locally, you will need to contact the office of your county recorder and city clerk to see if a license is required. Some areas also need fire or health inspection before approval. Check on compliance requirements within the area where you operate before you open for business, to protect your limited liability company from fines or shutdown.

Professional & Industry-Specific Permits (e.g., Alcohol, Trades)

Your LLC in Indiana may need more specialized permits that are dependent on your industry besides taxes or business licenses. These include professional certifications (for accountants, cosmetologists, real estate agents), environmental clearances, or regulated trade approvals like plumbing, electrical work, or HVAC. If you’ll be selling alcohol or tobacco, you will need special permits from the Indiana Alcohol & Tobacco Commission.

Verify requirements for your field by contacting Indiana Professional Licensing Agency. If you fail to obtain the right permits, operations could get delayed. You may be subject to fines that can impact your limited liability company. Always check if you have the state credentials before you advertise or offer a regulated service.

Indiana vs. Other LLC-Friendly States

Indiana is among the top states that are LLC-friendly due to their minimal cost of formation and maintenance, an all-inclusive liability protection, and so on. If you’re considering multiple options, a comparison of annual LLC fees for each state shows the cost advantages of Indiana Unlike Delaware or California, there’s no state-level income tax on pass-through profits, and ongoing fees like the business entity report are minimal. The online portal is easy to use, and processing is faster in Indiana.

When compared to popular states like Wyoming or Texas, Indiana remains competitive in affordability and simplicity — especially for businesses that operate locally or regionally in the Midwest. While it may not offer the anonymity of Wyoming, Indiana’s transparency, efficiency, and legal clarity make it a solid choice for entrepreneurs seeking long-term stability.

| State | Filing Fee | Annual/Biennial Fee | State Income Tax | Privacy Strength | Best For |

|---|---|---|---|---|---|

| Indiana | $95 | $31 (biennial) | None on pass-through | Moderate | Midwest/local businesses |

| Wyoming | $100 | $60 (annual) | None | High | Anonymity, remote businesses |

| Delaware | $90 | $300 (annual tax) | Yes | Moderate | Out-of-state corporations |

| Texas | $300 | No annual report | Franchise tax applies | Low | Large-scale operations |

| California | $70 | $800 minimum tax | Yes | Moderate | Tech/startup ecosystems |

Maintaining & Scaling Your Indiana LLC

Ongoing compliance and smart growth strategies are vital for the long-term success of your LLC in Indiana after formation. Every two years, submit your business entity report, have a valid registered agent, and keep your operating agreement up to date. Those simple but significant steps keep your LLC status intact and avoid costly penalties.

As your business grows, consider hiring employees, registering in other states (foreign qualification), or converting to a series LLC if your operations diversify. You might also want to consider bookkeeping tools, financing, or growing your digital presence. Curious how other entrepreneurs feel about forming here? These Indiana LLC reviews and founder stories show how actual companies function in the pro-business environment of the state. Growing locally or regionally? With Indiana’s low taxes, strong legal protections and stable economy, this is the place to be to grow your future.

Want to explore LLC formation beyond Indiana? This in-depth guide on how to start an LLC in any state discusses national-level best practices and legal requirements along with comparisons.

Frequently Asked Questions: Starting an Indiana LLC

Forming an llc in indiana can raise questions, especially if you're new to the process. Below are concise, trusted answers to the most common questions entrepreneurs ask. Each response is designed to give you accurate guidance and help you take the next step with clarity and confidence.

What documents are required to register an Indiana LLC?

To register an llc in indiana, you must file articles of organization with the Indiana Secretary of State. This document includes your business name, registered agent details, and management structure. While not required by law, it's also strongly recommended to create an operating agreement and obtain an EIN from the IRS to manage taxes and open a business bank account.

How long does the INBiz filing process take?

If you file online through the INBiz portal, most llc in indiana filings are processed within 1 to 2 business days. Mail submissions take longer, typically 7 to 10 business days, and don’t provide real-time confirmation. For faster results, you can pay a $25 expedited filing fee when filing online to potentially receive same-day approval from the Indiana Secretary of State. For a breakdown of each filing option and speed, check this Indiana LLC processing time chart.

Can non-residents form an Indiana LLC?

Yes, non-residents, including foreign nationals, can legally form an llc in indiana. You don’t need to live in the state or the U.S. to register. However, you must appoint a registered agent with a physical address in Indiana to receive legal notices. You’ll also need a U.S.-based business bank account and an EIN from the IRS to operate fully.

Do I need a physical Indiana business address?

No, your llc in indiana doesn’t need a physical business office in the state, but your registered agent must have a physical address in Indiana. This is where official documents and legal notices are delivered. You can run your business from another state or even internationally, as long as your agent’s address meets Indiana’s statutory requirements.

What ongoing fees and filings must I budget for?

Every llc in indiana must file a business entity report every two years, which costs $31 online or $50 by mail. You’ll also need to maintain a registered agent, which can be free if self-appointed or $100–$125/year if using a service. Optional costs may include a certificate of existence ($15–$30) or name reservation ($10 + $1). Indiana does not charge a recurring state income tax on LLC pass-through income.

Is an operating agreement legally required in Indiana?

No, Indiana does not legally require an operating agreement to form an llc in indiana, but having one is highly recommended. This internal document outlines ownership, management structure, and dispute resolution rules for your limited liability company. It also reinforces your business’s legal separation from its owners, which helps preserve liability protection in the event of a lawsuit or audit.

Resources for Starting and Managing an LLC in Indiana

Launching a limited liability company in Indiana is streamlined thanks to the state’s digital infrastructure and low compliance costs. These trusted resources will guide you through formation, tax registration, licensing, and long-term maintenance.

- INBiz – Indiana’s Official Business Portal

(inbiz.in.gov): File your Articles of Organization, register for taxes, manage renewals, and search for business names—all in one place. - Indiana Secretary of State – Business Services Division

(sos.in.gov): Access forms, file amendments, and request certificates of existence or name reservations. - Indiana Department of Revenue

(in.gov/dor): Register for sales, withholding, and unemployment taxes, and manage your state tax obligations via INtax. - Indiana Professional Licensing Agency (IPLA)

(in.gov/pla): Verify whether your industry or profession requires a state-issued license before operating. - IRS – EIN Application Portal

(irs.gov): Get your Employer Identification Number instantly and for free—required for banking, hiring, and taxes. - Wikipedia – Limited Liability Company

(en.wikipedia.org): Understand how LLCs function in the U.S. and abroad, including legal protections and tax structure. - Wikipedia – Operating Agreement (LLC)

(en.wikipedia.org): Learn why this internal agreement is essential for all Indiana LLCs, even when not legally required. - 2023 SBA Indiana Small Business Economic Profile

(advocacy.sba.gov): View key statistics about LLCs and small businesses shaping Indiana’s economy. - Indiana Small Business Development Center (ISBDC)

(isbdc.org): Offers free startup guidance, financial planning help, and training for entrepreneurs across the state.

These official links and tools help Indiana entrepreneurs form LLCs efficiently, stay compliant, and scale confidently.

Looking for an overview? See Indiana LLC Services

Get Your Indiana LLC Filed and Compliant

Harbor Compliance handles every formation detail so your Indiana LLC is built on a strong legal foundation.