Forming a Connecticut LLC costs $120 (Certificate of Organization, filed online). Most first-year budgets land around $200–$600, mainly driven by whether you pay for a statutory agent service and any add-ons (like a DBA/trade name or sales tax registration), but the deadline you can’t ignore is the $80 annual report, filed each year Jan 1–Mar 31. Use the quick table below to budget the essentials.

| Cost item | What you’ll pay | When / notes |

|---|---|---|

| State filing fee (formation) | $120 | Certificate of Organization (includes appointing a statutory agent). |

| Annual report (maintenance) | $80 / year | Filed online every year Jan 1 – Mar 31. |

| Name reservation (optional) | $60 | Useful if you’re not ready to file yet but want to lock the name. |

| Statutory agent (DIY vs service) | $0 DIY or ~$99–$125 / yr | DIY is possible if you have a qualifying CT address and availability; services typically charge an annual fee. |

| Late / reinstatement risk trigger | $120 reinstatement (if dissolved) | Failure to file the annual report may lead to administrative dissolution; overdue entities can’t obtain a Certificate of Legal Existence. |

Watch for “annual report” solicitations that overcharge. Connecticut has issued official warnings about mailers/emails that look government-issued but try to charge an inflated “filing” or “processing” fee. The real state annual report fee is $80, and you can file directly through the official CT portal, if a notice tells you to pay a third party, treat it as a red flag and verify before paying.

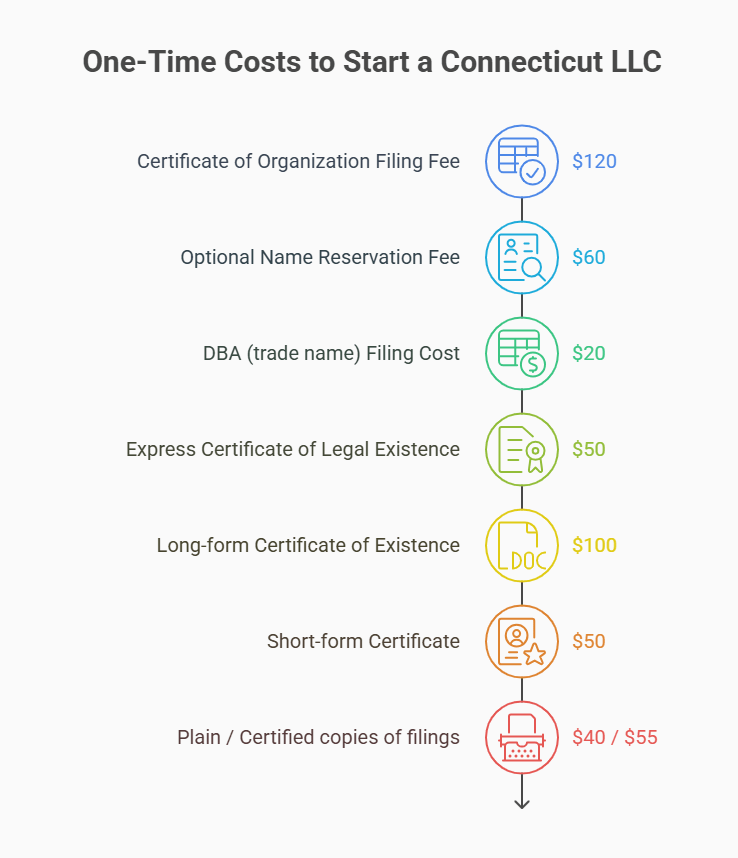

One-time Costs to Start a Connecticut LLC

Before you launch, there are a handful of one-time fees you can predict with confidence: the Certificate of Organization filing ($120), optional name reservation ($60), and any documents you might need later (like certified copies or a Certificate of Legal Existence). If you’ll operate under a different public name, most towns require a local trade name (DBA) filing (now $20 statewide). Licensing is industry-specific and handled through CT’s eLicense system. For step-by-step filing, see how to start an LLC in Connecticut so your cost plan matches the actual workflow. Everything below is straight from state sources so you can budget precisely.

Certificate of Organization Filing Fee

The state filing to create your LLC is $120. File online through your Business.CT.gov dashboard for the fastest acceptance and fewer errors. (Expedite is optional and offered at checkout when available).

Aaron Kra has filed Connecticut LLC paperwork both online and by mail, and recommends using the official form’s listed mailing and delivery addresses for paper submissions. In his experience, Connecticut’s online portal is usually faster, while paper filings tend to take longer to process and offer more limited expedited handling options.

What you’ll need (from the official form/statute):

- LLC name with “LLC” (or similar) designator

- Principal office street address (no P.O. box) and mailing address

- Registered agent in Connecticut who accepts/consents

- At least one manager or member’s name and business/residence addresses

- Company email and NAICS code

- Organizer’s signature (the LLC can’t be its own organizer)

Tip: Many owners use a registered agent service for privacy and reliability, but it’s optional and not a state fee. If you want help choosing one, see our Best LLC Services in Connecticut guide.

Name Search and Reservation (optional)

You can check availability free using the state Business Records Search (see our Connecticut business entity search). If you’re not ready to file yet, reserve your name for 120 days for $60, entirely optional. You can file the reservation online.

Quick steps (1–2 minutes):

- Search for your exact or similar names in the Business Records Search.

- If the name looks clear, submit the Application for Reservation of Name from your account.

DBA (trade name) Filing Cost

If you’ll operate publicly under a name different from your LLC’s legal name, file a trade name (DBA) with the town clerk where you primarily do business. The statewide fee is $20 (effective January 1, 2025). Forms must be hand-signed and notarized (town clerk or another notary). If you’re weighing branding options, read LLC vs DBA (what’s the difference?) before you choose.

Certified Copies and Certificate of Status

Banks, vendors, or partners may ask for proof your LLC exists and is compliant. Here’s what Connecticut charges:

| Document | CT fee | Notes |

|---|---|---|

| Express Certificate of Legal Existence (LLC) | $50 | Instant online certificate for most needs. |

| Long-form Certificate of Existence (LLC) | $100 | Detailed, domestic LLCs only; cannot be expedited. |

| Short-form Certificate (LLC) | $50 | Shows name history. |

| Plain / Certified copies of filings | $40 / $55 | Add $50 if you choose online expedite. |

Local Licenses and Permits

Licensing is industry-specific (e.g., trades, food/health, childcare, banking). Use eLicense (Connecticut’s official portal) to look up, apply, renew, or verify credentials; the Business.CT.gov licensing hub also links you to agency requirements. Fees vary by license type and agency.

Common agencies you might touch:

- Department of Consumer Protection (DCP) – many professional and trade licenses

- Department of Public Health, DEEP, Department of Banking, DRS, etc. (all searchable in eLicense)

If you’re unsure whether you need one at all, see does an LLC need a business license? for a quick overview before you file.

Publication Requirement (if any)

None, Connecticut does not require newspaper publication to form an LLC. You won’t find any publication step in the Secretary of the State’s formation pages or in the formation statute, only the filing itself and required data (name, addresses, registered agent, manager/member info, email, NAICS).

Launch your Connecticut LLC with ZenBusiness

ZenBusiness simplifies the Connecticut LLC process by handling filings, name checks, and compliance – so you can focus on growing your business.

Ongoing Connecticut LLC Costs

Once your LLC is formed, your predictable, recurring costs are simple: the $80 annual report you file each winter, plus any taxes tied to how you operate (sales tax, payroll, or optional pass-through entity tax). If you hire a third-party registered agent service, budget a modest annual fee as well. The sections below keep it practical, with official sources for every number so you can plan your cash flow confidently. If you’re adding employees and want one provider for payroll, benefits, and HR filings, compare best PEOs in Connecticut.

Annual Report

Every Connecticut LLC files an annual report online for $80 each year. The filing window is January 1–March 31; file from your Business.CT.gov dashboard (the system walks you through updating company info, agent, and NAICS).

What to have ready

- Business.CT.gov login and your company name/ALEI

- Current registered agent details and principal office address

- Basic company contacts and NAICS code (the form prompts you)

For a broader primer, see LLC annual report (how it works)

Taxes (overview)

By default, the IRS treats a single-member LLC as a disregarded entity and a multi-member LLC as a partnership, but you can elect corporate tax treatment if it fits your situation (for example, by filing IRS Form 8832).

In Connecticut, pass-through entities with Connecticut-source income may have state filing obligations, including the composite return for nonresident members and, optionally, the Connecticut Pass-Through Entity Tax (PET) election, which is generally due March 15 for calendar-year entities and can generate a PET credit for members. Because these rules depend on ownership, residency, and how your LLC earns income, confirm the right filings and elections with a tax professional and the latest Connecticut DRS guidance.

If you’re a licensed professional (law, medicine, accounting, etc.), compare structures in LLC vs PLLC (for licensed professionals) before filing.

Sales and Use Tax

If you sell taxable goods or services, register with DRS for a Sales & Use Tax Permit ($100 one-time). You can usually print the permit the next day in myconneCT. Connecticut’s statewide rate is 6.35% (some items have special rates); there are no local sales taxes.

Quick checklist

- Register in myconneCT for Sales & Use Tax

- Display the permit at your place of business/events

- File and pay on the schedule assigned in myconneCT

Employer Payroll and Unemployment Taxes (if you have staff)

Hiring in CT triggers three recurring items:

- CT income-tax withholding: Register in myconneCT (no fee) and file CT-941 quarterly plus CT-W3 annually; give employees CT-W4.

- Unemployment insurance (UI): Register with CT DOL. For 2025, the UI taxable wage base is $26,100 and the new-employer rate is 2.2% (fund solvency and other adjustments may apply per DOL notices).

- CT Paid Leave payroll deduction: Withhold and remit 0.5% of employee wages up to the Social Security wage base; employers do not contribute a match.

Statutory Agent (if you hire a service)

Connecticut lets you serve as your own statutory agent if you have a CT street address. You may also see this role labeled as a “registered agent” on some forms and as a “business agent” in the annual report flow, but in this guide we use statutory agent for consistency. You can also hire a statutory agent service (see our best Statutory Agent in Connecticut). Market rates typically run about $100–$150/year (examples: Northwest $125/yr; Harbor Compliance $99 intro, then $149/yr). If you change agents later, the state filing fee is $50 (file online).

When a paid agent makes sense

- You want privacy (their address on public records)

- You travel or keep irregular hours and need reliable service of process

- You operate in multiple states and want centralized compliance

Protect your privacy with a Connecticut Registered Agent from Northwest

Northwest keeps your personal info off public records while ensuring you never miss a legal notice in Connecticut.

Foreign LLC Costs in Connecticut

If you’re bringing an existing company into Connecticut, budget for the Foreign Registration Statement ($120), the same $80 annual report as domestic LLCs, and, if your exact name isn’t available, an optional name registration ($60) or an alternate name on the filing. You’ll also attach a recent certificate of legal existence/good standing from your home state and list a Connecticut registered agent. The quick details below keep you compliant on day one.

Registration Fee & Required Documents

To expand a home-state LLC into Connecticut, file the Foreign Registration Statement and pay the $120 state fee. Your filing must include a certificate of legal existence/good standing from your formation state issued within 90 days, plus Connecticut registered agent details and your NAICS code. The Secretary of the State’s form also allows you to appoint an individual or business agent in CT (or, in limited cases, the Secretary of the State) directly on the application.

Annual Report & Tax Obligations for Foreign LLCs

Once registered, foreign LLCs file the Connecticut annual report online each year for $80, due January 1–March 31. The same window and fee apply to both domestic and foreign LLCs.

For taxes, Connecticut treats foreign pass-throughs like in-state ones. If you have CT-source income or nexus, you’ll generally file the Composite Income Tax return and (optionally) elect the Pass-Through Entity Tax (PET) on Form CT-PET, Connecticut made PET elective starting with 2024 tax years and it’s computed at 6.99% under current instructions. Always confirm current-year deadlines and election rules on the DRS site.

Name Issues if Your Home-state Name Isn’t Available

If your exact LLC name is taken in Connecticut, you have two official options:

- Use an alternate name on the Foreign Registration Statement (there’s a built-in field for “Alternate Name to be used in Connecticut”).

- Register your name ahead of time for $60 using the Application for Registration of Name (holds a name for one year; renewable).

Changing or Fixing Your LLC Later

Things change, names, addresses, ownership, or even your whole entity structure. Connecticut makes most updates easy to file online, but the fee (and the right form) depends on what you’re changing. Below is a quick, plain-English guide with exact costs and links to the official pages so you can pick the fastest, least-expensive route.

Amendment (name, address, members/managers)

Use a Certificate of Amendment when you need to change core formation details (like the LLC name). The filing fee is $120. File online from your Business.CT.gov account.

Often, you can make cheaper, targeted updates instead of a full amendment:

- Change of Business Address – $50 (can also be updated on the annual report).

- Interim Notice of Change of Manager/Member – $20 (updates principals between annual reports).

Articles of Correction

If a filed record has an error, submit a Statement of Correction (Connecticut’s term for “articles of correction”). The fee is $100; there’s no standard form, your statement must identify the record, explain the inaccuracy, and provide the corrected text. File it online from your dashboard.

Registered Agent/Office Change

To switch agents, file Change of Agent ($50; $20 for non-stock nonprofits). There’s also a separate Change of Agent’s Address filing ($50). The official PDF confirms the fee and acceptance signature requirement from the new agent. Many owners hire a registered agent service for convenience, but it’s optional.

Reinstatement after Administrative Dissolution

If the state administratively dissolves your LLC (e.g., for missed reports), you can file a Certificate of Reinstatement. The fee is $120 and includes one annual report; your company keeps its original formation date once reinstated.

Merger, Conversion / Domestication

Connecticut handles these under Entity Transactions with clear, fixed fees:

- Merger – $60.

- Conversion – add the formation fee for the resulting CT entity (for an LLC converting into CT, add $120).

- Domestication (inbound) – likewise, add the CT formation fee for the domesticated entity.

All are filed through Business.CT.gov.

Penalties, Late Fees and Common Mistakes

Missed deadlines or bad data can quietly knock your LLC out of good standing. Connecticut doesn’t usually add a “late fee” for an overdue annual report, but the state can restrict services (like issuing a Certificate of Legal Existence), send a Notice of Intent giving you a short cure window, and ultimately dissolve the company by forfeiture if you don’t fix things. Filing online (and accurately) avoids most headaches.

Missed Annual Report

If you miss the January 1–March 31 filing window, your business drops out of good standing and you can’t obtain a Certificate of Legal Existence. If you stay delinquent more than one year, the Secretary of the State may start administrative dissolution (dissolution by forfeiture). Before that happens, the state issues a Notice of Intent; you then have 90 days to file and have the missing reports accepted to avoid forfeiture.

How to fix it fast

- Log into Business.CT.gov and file your overdue annual report online.

- If you received a Notice of Intent, make sure the overdue filing is accepted within 90 days of the notice date.

- Once accepted, your status returns to good standing; you can then request a Certificate of Legal Existence if needed.

No Registered Agent on Record

Connecticut law requires every LLC (domestic or foreign) to designate and maintain a registered agent; appointing one affirms the agent’s consent. If you fail to maintain an agent, the Secretary can email a forfeiture notice and, if you don’t appoint an agent within three months, dissolve the LLC by forfeiture.

Quick checklist

- Verify your agent info during each annual report filing.

- If an agent resigns, appoint a new one immediately (the Change of Agent form requires the new agent’s acceptance signature).

Rejected Filings & re-submission Tips

Most rejections stem from name or ID mismatches, missing agent acceptance, or using slower channels that have a higher rejection rate. Connecticut explicitly recommends filing through the Business.CT.gov online flows for faster processing and fewer rejections, and it publishes an optional $50 online expedite (often unnecessary because many filings are auto-accepted).

Prevent rejection

- Match your business name and ALEI/Business ID exactly to the state’s record before submitting.

- Ensure your registered agent acceptance/signature is included on agent-change filings.

- Prefer the online flow over paper; it’s built to reduce errors and rejections.

- If timing is critical, consider the $50 expedite at checkout (online filings only).

FAQs: Connecticut LLC Costs

Looking for a straight-to-the-point guide to Connecticut LLC costs? You’re in the right place. This FAQ collects the most common money questions: formation fees, annual obligations, optional add-ons, and typical services, so you can budget confidently for 2025 and beyond. Each answer is concise, plain English, and written to match real search intent (not legalese). Whether you’re starting fresh, expanding from another state, or tuning up an existing company, use this section as your quick reference before you file, pay, or hire a registered agent service.

How much does it cost to start an LLC in Connecticut?

$120 to file the Certificate of Organization online. That’s the core, statewide cost. Optional add-ons: name reservation ($60) if you’re not ready to file, and a $50 expedite that sometimes appears at checkout (often unnecessary because most filings are auto-accepted). If you’ll operate under a different public name, a town-level trade name filing costs $20 (from Jan 1, 2025).

How much are the yearly fees for a Connecticut LLC?

$80 for the annual report, due Jan 1–Mar 31. Beyond that, costs depend on activity: sales & use tax returns if you registered for a $100 permit; employer payroll items (UI based on a $26,100 wage base in 2025 + 0.5% employee CT Paid Leave withholding). Using a paid agent adds about $99–$149/year.

Is there a Connecticut franchise tax?

No separate “franchise tax” for LLCs. Connecticut repealed its old $250 Business Entity Tax for periods beginning after 12/31/2018. You still file the $80 annual report and handle taxes applicable to operations (Composite Income Tax return; optional Pass-Through Entity Tax election at 6.99% per current guidance).

Do I need a registered agent in Connecticut?

Yes, every LLC must maintain a registered agent in CT. It can be you (with a CT street address) or a company; the agent must consent, and changes cost $50 to file online. Many owners choose a registered agent service for privacy and reliability, typically $99–$149/year.

How long does it take to form a Connecticut LLC?

Often very fast online, many filings are automatically accepted (see Connecticut LLC processing times). CT also offers an optional $50 expedite at checkout, but the state says it’s usually unnecessary. If a bank or partner needs proof after approval, you can order an Express Certificate of Legal Existence for $50 online the same day.

Are fees refundable if my filing is rejected?

Generally, state filing fees aren’t refundable, refunds are for overpayments. CT provides a “Refund Claim for Overpaid Fees” form; it’s not a mechanism to reverse a valid filing charge. Best move is to correct the issue and resubmit; expedited fees are per-transaction if you choose them.

What if my desired LLC name is taken?

Search the Business Records first. If the exact name is unavailable, you can reserve another name for 120 days for $60 while you prepare, or (for foreign LLCs) register with an alternate name on the Foreign Registration Statement. A town-level trade name (DBA) is separate and costs $20.

- CT Secretary of the State: Domestic LLC: forms & fees

- CT Secretary of the State: Foreign LLC: forms & fees

- CT Secretary of the State: Reserve a business name

- CT Secretary of the State: Trade name / DBA in Connecticut

- CT Secretary of the State: Certificate of Legal Existence / Good Standing

- CT Secretary of the State: Update (change) your business agent / registered agent

- CT Department of Revenue Services: Sales & Use Tax

- IRS: Apply for an EIN

- CT Department of Revenue Services: Pass-Through Entity Tax (PET)

Looking for an overview? See Connecticut LLC Services

Set up your Connecticut LLC with Harbor Compliance

Harbor Compliance offers concierge-level LLC services with personalized support and fast processing for Connecticut businesses.