| Cost item | Amount (June 2025) | Frequency | Notes |

|---|---|---|---|

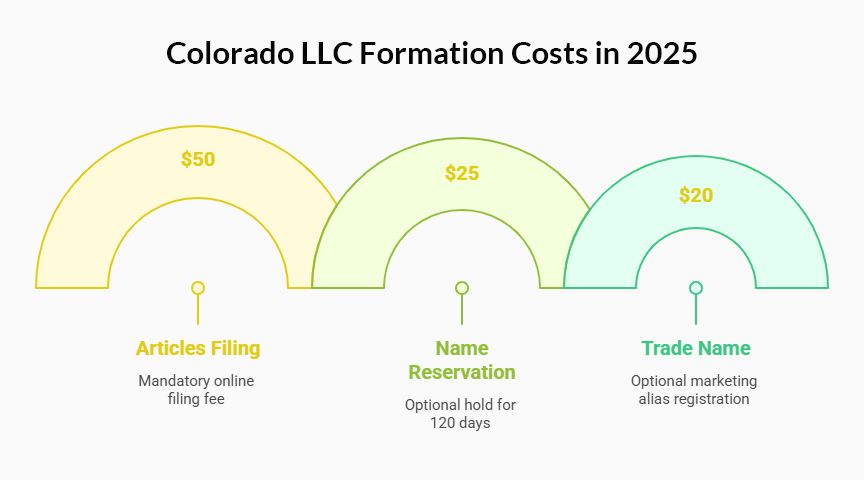

| Articles of Organization | $50 (online) | One-time | Flat fee creates LLC |

| Name reservation (opt.) | $25 | One-time | Holds name 120 days |

| Trade name/DBA (opt.) | $20 | One-time | Required to brand differently |

| Registered agent (pro) | $99 – $149 | Annual | Privacy & mail scanning |

| Periodic report | $25 | Annual | Due within 3-month window |

| Certificate of Good Standing | Free PDF | On demand | Certified copy $5 |

| Late report penalty | $50 | Per missed filing | Starts day after due date |

| Reinstatement | $100 | As needed | Plus past reports |

Colorado LLC Formation Costs in 2025

Creating a Colorado LLC is refreshingly affordable. The state collects just one mandatory payment—the $50 Articles filing—yet optional steps like locking a name or marketing under a trade name can raise the cost to form. Knowing each possible charge helps you choose only what drives value for your startup.

Articles of Organization Filing Fee – $50 Flat Online Rate

Launching starts with the articles of organization, a two-page form you file through the Secretary of State’s MyBiz portal. Payment is by card and approval is immediate. Once stamped, your LLC gets an ID number, satisfying banks and vendors.

- Flat $50 online fee—no paper option

- Real-time approval and downloadable PDF

- Control number used for taxes, amendments, and foreign filings

Because Colorado went all-digital, there’s no expedited tier or hidden filing fee. Uploading a custom operating agreement is free, and you can delay the effective date up to 90 days without added cost.

Optional Name Reservation – When It’s Needed and How Much It Costs

Most founders file instantly, but if investors insist on brand clearance first, you can reserve a name for 120 days at $25. Submit a Statement of Reservation and note the reservation number on the later formation. The colorado secretary of State will not extend the hold, so complete the LLC filing or lose the claim. Reservation isn’t required for domestic LLCs—only for those wanting extra time before they officially appear in the registry.

Trade Name (DBA) Registration – Required Cases and $20 Fee

If your LLC will market under anything besides its legal name—say, “Front Range Renovations” instead of “Smith Holdings LLC”—Colorado treats that alias as a trade name. File online for $20 and renew every five years. The record makes your llc filing discoverable in public searches and banks often ask for it when you open merchant accounts or sign leases. Skip it and you could face contract disputes over name mismatches.

Annual Fees and Ongoing Costs for Colorado LLCs

One-time paperwork is only half the story. Colorado’s compliance cycle features predictable annual fees that keep your good-standing status, plus low-cost extras when creditors or buyers need proof of legitimacy. Budgeting now prevents deadline scrambles later.

Periodic Report Filing – $25 Each Year, Mandatory

Colorado replaces the typical annual report with a lean periodic report. The form confirms your principal address, owners, and registered agent; no financials are disclosed. It costs $25 and is due within the three-month window that starts on your LLC’s anniversary date. File online—there’s no mail-in option—and you’ll get an instant “Accepted” receipt. Missing the window triggers a $50 late fee and flips your status to Noncompliant, which banks can treat like a credit red flag.

Cost of Maintaining a Registered Agent – Free or Paid Options

Colorado lets any adult resident or business entity act as agent, so using your office address keeps the cost at $0. A professional registered agent service runs $99 – $149 per year and shields your personal details from the public database. It also forwards legal mail, time-stamps service of process, and sends deadline reminders. This added layer is invaluable if you plan a move, travel often, or expand as a foreign llc in other states—situations where missing a sheriff’s summons could default a lawsuit.

Certificate of Good Standing – When You Need It and What It Costs

Whether you’re refinancing real-estate deals or bidding on city contracts, lenders and agencies may ask for proof your colorado business is active. The Secretary of State issues an instant PDF certificate free of charge, and a certified paper version costs just $5. Because the document auto-updates with each filing, download a fresh copy on the day you deliver it—third-party “service” sites charging $79 for the same file offer zero added value.

Late Filing Penalties and Reinstatement Fees

Miss your Periodic Report and Colorado moves fast. Status flips to Noncompliant the next day, locking you out of new contracts, and a annual report late fee of $50 appears. Fail to cure within 60 days and the entity is Administratively Dissolved; reinstatement costs $100 plus all past reports. Credit lines can freeze and vendors may declare breach, so a calendar reminder—or your agent’s alert—is the cheapest insurance you’ll buy.

Form your Colorado LLC with ZenBusiness

Get fast filings, EIN assistance, and a year of registered agent service — all bundled for Colorado entrepreneurs who want simplicity and speed.

Additional Costs LLC Owners in Colorado Might Face

Beyond state filings, local rules, industry mandates, and legal paperwork can add additional costs. Planning for them early stops sticker shock and keeps working capital intact.

Local Licenses and Permits – City and County-Based Fees

Colorado is home-rule, meaning municipalities set their own permitting schedules. A Boulder food cart pays different fees than a colorado springs boutique. Expect the following ranges:

- City business license: $15 – $50 initial, similar renewal

- Building or fire inspection: $50 – $200 per site

- Home-occupation permit (if you run the LLC from a residence): $25 flat

- Sales-tax license: free statewide but some cities add $10

Because enforcement officers can issue stop-work orders for missing permits, confirm requirements with both county and city clerks before opening day. Factor these line items into cash-flow models alongside rent and utilities.

Business Insurance – Required for Some Industries

General liability policies start around $42 per month, but Colorado mandates workers’ comp for any W-2 employee—even part-timers. Regulated trades like roofing or cannabis may need higher limits or bonds, driving premiums north of $200 monthly. Smart business owners compare quotes early and bundle coverages to qualify for multi-policy discounts.

Costs for Legal Documents and Contract Templates

Free templates abound, yet a bespoke operating agreement or lease review typically runs $250 – $700 via flat-fee legal marketplaces. Multimember LLCs, real-estate holdings, or equity-sharing deals benefit from attorney-drafted clauses that avert six-figure disputes later. Consider the document’s lifespan: dividing the one-time fee by years of use often justifies the outlay.

Foreign LLC Registration Costs in Colorado

Cross-border expansion is easy here, but the rules—and the foreign entities fees—differ from domestic filings. This section walks you through every mandatory charge so your out-of-state company can transact legally on day one.

Filing a Statement of Foreign Entity Authority – $100 Fee

The document that authorizes a foreign llc to operate in Colorado is the Statement of Foreign Entity Authority. You file it online only, pay $100 by card, and receive a stamped PDF in minutes. Key requirements include the true name in home jurisdiction, a Colorado registered agent, and a principal office address. If your LLC’s legal name is taken here, add an assumed name in the same filing at no extra cost. Because the SOS validates home-state good standing automatically, you rarely need extra certificates, making Colorado faster than most states for foreign qualification.

Other Required Documents and Associated Costs

After the authority statement, you may still need ancillary filings:

- Registered-agent acceptance—free if appointed during the main filing

- Statement of correction ($100) if you mistype the name or jurisdiction later

- Periodic Report ($25) due each subsequent year, mirroring domestic LLCs

- Withdrawal ($10) if you leave the state

Budget $25–$50 for certified copies if lenders demand paper seals and $5 for each Certificate of Good Standing when bidding on local contracts. Keep receipts—these charges are deductible business expenses under IRS rules. Thorough record-keeping now prevents scrambling when opening a Colorado bank account or signing long-term leases.

Colorado LLC Taxes vs Administrative Fees

Colorado distinguishes compliance fees from true taxes. Knowing that split saves founders from conflating the $25 report with corporate income tax liabilities and over-budgeting. Below is your quick guide to what’s a tax, what’s a filing fee, and how each affects cash flow.

Does Colorado Charge an Annual Franchise or LLC Tax?

Good news: Colorado imposes no recurring franchise tax or state-level LLC income tax. Members report profits on personal returns, and entities taxed as partnerships owe nothing at the entity level. C-corp-elected LLCs do pay the 4.4 % state corporate rate, but that choice is optional. Your only statewide recurring payment is the $25 Periodic Report. Because lenders sometimes mislabel this fee as “annual tax,” clarify the distinction to avoid double accrual on budgeting spreadsheets.

Sales Tax Registration and Collection Costs (If Applicable)

Colorado’s base sales tax is 2.9 %, yet home-rule cities layer local rates pushing totals past 11 % in spots like Denver and Castle Rock. Register for free through the Colorado Department of Revenue’s MyBizColorado portal; permits arrive instantly by email. Marketplaces and SaaS sellers may qualify for the state’s destination-sourcing simplification, but physical retailers must collect every local add-on. Expect $0.01-per-return electronic filing fees once you surpass quarterly thresholds. Non-compliance triggers 10 % penalties plus 0.5 % monthly interest, so automate calculations in your POS or subscribe to an API that syncs the ever-shifting local rates nightly.

DIY vs Using a Service: What’s the Real Cost Difference in Colorado?

Most founders start online in under an hour, yet service bundles claim to “save time” for an online fee. To decide, compare the raw numbers below then weigh them against your personal tolerance for paperwork.

| Method | Up-front Spend | Year-1 Total | Key Extras |

|---|---|---|---|

| Pure DIY | $50 filing + $25 report | $75 | Your time, public address |

| DIY + pro agent | $50 + $25 + $129 | $204 | Privacy, compliance alerts |

| Formation service | $50 + $199 package + $129 agent | $378 | EIN help, templates |

| Premium bundle | $50 + $349 package + $129 agent | $528 | Expedited filings, domain |

Total Cost Breakdown for DIY Formation in Colorado

Doing everything yourself means you form your llc through the SOS portal, draft the operating agreement, and serve as registered agent. Cash outlay:

- $50 Articles filing

- $25 first Periodic Report (due within three-month window)

- $15–$50 local license if required

- $0 EIN through IRS.gov

At roughly $90–$125, DIY is unbeatable for single-member LLCs comfortable with public addresses. Just remember to update agent info if you move; the change costs $10 online and resets your compliance calendar.

Pricing and Features of LLC Formation Services

Most companies price Colorado llc formation packages at $199–$349. Baseline tiers include the Articles filing, name check, and generic operating agreement. Mid-level plans add EIN procurement and expedited processing, while top tiers bundle website domains, compliance dashboards, and trademark search vouchers. The actual state fees still pass through at cost, so evaluate whether each perk—like same-day approval—truly advances your launch timeline.

Are Online Filing Services Worth the Extra Fees?

Paying extra makes sense when speed, privacy, and bandwidth matter. Firms juggling multiple ventures can offload filings and avoid clerical errors that spawn fee schedule corrections. Services also queue your Periodic Report automatically, preventing late penalties. Yet if your venture is a side gig and you’re confident with forms, stick to DIY—reinvest the $200 saved into marketing or prototype upgrades instead of paperwork middlemen.

Hidden or Recurring Costs With Filing Providers

Read the fine print. Some providers auto-renew registered-agent subscriptions at $199 after the first-year promo or bill for compliance alerts that Colorado emails free. Transferring the agent to your own address requires a $10 SOS filing and may trigger a $25 exit fee. Watch for up-selling of “premium” bank account openings or tax-consult calls billed at hourly rates. Check renewal notices 30 days out and cancel add-ons you can handle in-house.

FAQ – Colorado LLC Fees and Payment Requirements

Colorado business owners love the state’s transparent fee schedule, yet questions keep popping up when launch day approaches. This FAQ demystifies every common concern—from first-year totals to online payment clicks—so you can budget with confidence and avoid surprises. Scan the quick answers below and keep them handy the next time a lender or partner asks about LLC costs.

What is the total cost to form an LLC in Colorado in 2025?

Filing online in 2025 costs a flat $50 for the Articles plus $25 for the first Periodic Report, bringing the statutory total to $75. A single member llc that acts as its own registered agent and skips optional name reservations can stay within that figure. Add $20 for a trade name and $15–$50 if local licensing applies. Professional agent service pushes year-one cash outlay to roughly $204, but nothing else is required by the state.

Are there annual maintenance fees for a Colorado LLC?

Beyond the $25 Periodic Report, most LLCs pay nothing else to remain in good standing because Colorado has no entity-level franchise tax. However, if your company elects C-corp treatment, profits face the 4.4 percent state tax rate collected on a separate return. Budget $99–$149 if you hire a commercial registered agent, and remember local sales-tax licenses may renew annually for $15–$50. For pass-through LLCs, those sums usually represent the full yearly cost of compliance.

Is the $50 filing fee still in effect in 2025?

Yes. The Secretary of State confirmed the $50 online filing remains unchanged for 2025, making it one of the cheapest ways to start an llc in colorado. The fee covers the entire Articles submission—there are no per-member surcharges or hidden tiers. Because the state digitized all formations, mail filings are unavailable, and the system won’t accept a lower payment. If the legislature adjusts fees, the SOS posts an advance notice on its dashboard.

What happens if I don’t file the periodic report on time?

Missing the three-month filing window flips your entity to Noncompliant and triggers a $50 late fee. The colorado department of State then starts a 60-day countdown: if the report still isn’t filed, the LLC becomes Administratively Dissolved, losing legal capacity to enter contracts. Reinstatement costs $100 plus the overdue report and must be completed online. During the lapse, banks may freeze credit lines and vendors can void agreements, so calendar alerts or registered-agent reminders are essential.

Can I form a Colorado LLC for free?

Not entirely. You can start an llc without hiring a lawyer, reserving a name, or buying templates, but the state still requires the $50 Articles fee. Fortunately, Colorado waives separate business-license charges for many low-risk home-based ventures, and the IRS issues EINs for free. If you serve as your own registered agent and handle filings yourself, the initial out-of-pocket cost stops at $75 once the first Periodic Report posts.

How do I pay Colorado LLC fees online?

All fees route through the Secretary of State’s MyBizColorado portal. Create an account, select “Existing Record Search,” and locate your LLC by ID or name. Click the pending task—formation, report, or agent update—and the system guides you to checkout. Payments accept major cards or ACH; receipts email instantly. To form a colorado entity from scratch, choose “File a Form” and follow the three-step wizard. Save PDFs of confirmations because banks and insurers often request them later.

Resources for Launching Your Colorado LLC

Ready to set up your Colorado LLC with confidence? These official resources and expert guides offer seamless access to fee details, filing tools, and compliance support – helping you navigate each step like a pro.

- Colorado Secretary of State – LLC Filing & Fee Information (sos.colorado.gov)

Official source for filing your Articles of Organization: $50 one‑time fee, plus optional name reservation and trade name registration. - Start Colorado Business (coloradosbdc.org)

A helpful portal offering checklists, legal considerations, tax planning, helpful workshops, and local Small Business Development Center support. - Colorado LLC Filing Guide – Northwest Registered Agent (northwestregisteredagent.com)

Walks you through state filings, registered agent requirements, processing timelines, and optional services to simplify your startup. - Colorado Business Tax & Sales License Info – DOR (colorado.gov)

Guides you through state-level tax registration, business tax IDs, and compliance for sales and use tax, income tax, and employer withholdings.

From filing your initial documents to managing state taxes and annual updates, these resources will empower you to build and maintain your Colorado LLC with clarity and ease.

Looking for an overview? See Colorado LLC Services

Use Harbor Compliance as Your Colorado Registered Agent

Stay compliant and never miss a notice with Harbor Compliance’s professional Registered Agent service in Colorado.