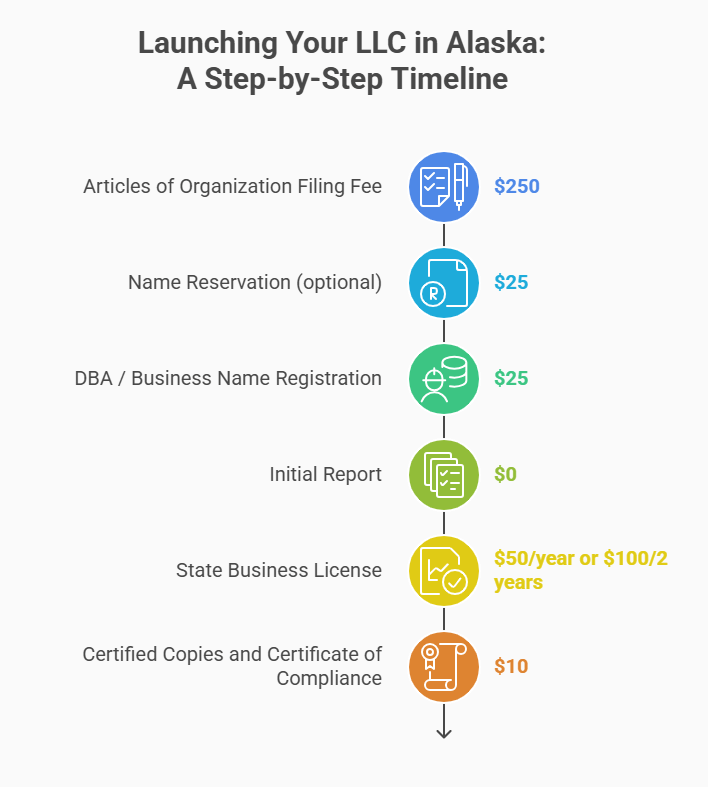

Looking for the real LLC cost in Alaska (2025)? It’s $250 to file Articles of Organization, most businesses also need a state Business License ($50/year or $100/2 years), and the Initial Report is $0 (due within six months). Ongoing, plan for a Biennial Report of $100 (domestic) or $200 (foreign); online filings post immediately while mailed filings take about 10–15 business days. Use the breakdown below to budget first-year vs. ongoing costs with confidence.

Alaska LLC Total Cost Summary for Formation (one-time & ongoing)

Here’s a quick glance at what you’ll likely pay to start and maintain an LLC in Alaska. The table separates one-time startup costs from recurring obligations so you can see your first-year vs. ongoing budget at a glance. If you’re gauging the business climate, our Alaska small business statistics give quick context.

Tip: Online filings post immediately; hard-copy filings take ~10–15 business days. There’s no separate state “expedite” fee listed for LLC formation.

| Cost item | Amount | When you pay it | Notes |

|---|---|---|---|

| Articles of Organization (LLC) | $250 | Once at formation | File online or by mail. Online posts immediately. |

| Alaska Business License | $50 / year or $100 / 2 years | At formation (most businesses) + renewals | Statewide license required for most businesses. Expires Dec 31. |

| Initial Report | $0 | Within 6 months after approval (domestic LLCs) | Free, file online. |

| Biennial Report (Domestic LLC) | $100 | Every 2 years (due Jan 2 in your cycle) | Late after Feb 2; total becomes $137.50. |

| Biennial Report (Foreign LLC) | $200 | Every 2 years (due Jan 2 in your cycle) | Late total $247.50. |

| Certificate of Compliance (Good Standing) | $10 | As needed | Ordered online. |

| Certified copies | Varies | As needed | $10 per document; $5 additional to certify; $30 for full file up to 50 pages. |

One-time Costs to Start an Alaska LLC

These are the upfront, pay-once items you’ll likely encounter when you launch an LLC in Alaska. For each, you’ll see what it costs, when to pay, where to file, and a quick “how to” so you can move fast and avoid surprises. Not sure what the “Articles/Certificate of Organization” actually is? This Certificate of Organization guide explains the document in plain English.

Articles of Organization Filing Fee – $250 (online or mail)

Forming your LLC costs $250. You can file online (fastest) or submit the PDF by mail. Online submissions post to the public database right away; hard-copy filings take longer.

Quick steps (2–3 mins online):

- Go to “Articles of Organization” under LLC forms (online/PDF 08-484).

- Enter your LLC name, Alaska registered agent, and principal address; submit payment.

- Save your receipt and confirmation page for your records.

If you want a step-by-step checklist, see our how to start an LLC in Alaska.

Name Search (free) and Name Reservation (optional) – $25

You can search names for free in the state’s Corporations Database (see our Alaska business entity search guide). If you’re not ready to file yet, you may reserve a name for 120 days for $25 (renewable, if needed).

How to do it:

- Run a free name check in the Corporations Database.

- File a New Business Name Reservation (form 08-559 online or PDF) to hold it. Fee: $25.

DBA / Business Name Registration – $25 for 5 years

If your LLC will publicly operate under a different name (a trade name/DBA), file a Business Name Registration for $25. It gives exclusive rights to that name for five years (requires an active Alaska business license).

When you might need this:

- You want to drop “LLC” in customer-facing branding, or use a distinct storefront name.

- File online or by mail (forms 08-557 new / 08-560 renewal).

Not sure when a DBA is enough versus forming an LLC? See our comparison: LLC vs DBA.

Initial Report – $0

Alaska requires a free Initial Report within 6 months after your LLC is approved. Domestic (Alaskan) entities file it online; foreign entities don’t. Filing on time keeps you compliant.

Where to file: Use the state’s Initial Report online page from the Corporations Section.

State Business License – $50/year or $100/2 years

Most Alaska businesses must hold a state business license. Fees are $50 for 1 year or $100 for 2 years; licenses expire December 31 of the licensing period. Online issuance is immediate.

Tip: Sole proprietor discounts don’t apply to LLCs. Keep your license current each year or every two years.

Certified Copies and Certificate of Compliance (Good Standing) – $10 (online)

Need proof your LLC is active? Order a Certificate of Compliance (Good Standing) online for $10. For documents, regular copies are $10 per document (or $30 for the full entity file up to 50 pages), plus $5 extra if you want them certified.

When it comes up: bank accounts, financing, leasing, or working with partners who require documented status.

Start your Alaska LLC for $0 + state fee with Bizee

Bizee makes it easy to launch your Alaska LLC with zero formation fee and tools to track biennial reports and state licenses.

Ongoing Alaska LLC Costs

Here’s what you’ll keep paying after formation. Each item includes timing, amounts, and the official place to handle it, so you can budget without surprises.

Biennial Report, $100 domestic / $200 foreign; due Jan 2 in your odd/even cycle; late fee brings total to $137.50 (domestic)

Every LLC files a Biennial Report in the January of its cycle (based on the year you formed or registered).

- Amounts: Domestic LLCs $100; Foreign LLCs $200. Late totals become $137.50 (domestic) or $247.50 (foreign).

- When due: If you created/registered in an even year, your report is due January 2 of every even year; if in an odd year, due January 2 of every odd year. Filing opens October 2 prior; late penalties apply to reports postmarked after February 1.

- How to file: Use the Alaska’s Biennial Report portal; you can’t change your registered agent here, use a Statement of Change instead.

Here’s how LLC annual reports work and what they cover.

Alaska Business License Renewal – $50/year or $100/2 years

Most businesses must maintain a state business license.

- Fee options: $50 per year or $100 for two years. Licenses expire December 31; online renewals post immediately to the public record.

- If you lapsed: Renewing less than 2 years late requires paying $50 for each lapsed year plus the new term; more than 2 years late, file a new license.

Unsure whether an LLC specifically needs one? Here’s a quick primer: do LLCs need a business license?

Registered Agent Renewal (if you hire one)

Alaska doesn’t charge an annual fee to have a registered agent; the ongoing cost is what your provider charges for bolded exactly: registered agent service.

- Typical range: Many reputable providers run ~$100–$150/year (industry guides commonly cite ~$100–$250). Examples: Harbor Compliance markets $99–$149/year; Northwest lists $125/year. For vetted picks, see our best registered agent in Alaska guide.

- Related state fee (one-off): If you change your agent, Alaska’s Statement of Change filing is $25 (not an annual charge).

Stay compliant in Alaska with Northwest Registered Agent

Get peace of mind with a trusted Registered Agent who keeps you updated on biennial filings and state notices in Alaska.

Local Licenses and Permit

Depending on where you operate, you may need a city license, sales tax registration, or industry‐specific permits (If you plan to hire staff soon, a PEO in Alaska can streamline payroll and HR while keeping costs predictable).

- Anchorage (example): Municipal licenses/permits by activity (food, vehicles, contractors, etc.); a state business license is still required.

- Juneau (example): Must register with the Sales Tax Office before making sales, providing services, or rentals.

- City of Fairbanks (example): Separate city business license (often $50 for new licenses), with its own deadlines.

Real-estate investors can also review our guide to an LLC for rental property for liability and compliance considerations.

Processing Costs and Timing

For an LLC in Alaska, what you pay is mostly the filing fee itself, timing depends on how you file.

- Online filings post immediately. The Corporations Section states that after payment, “your filing…will be filed for record and posted immediately,” and you can view/print it in the public database (for a step-by-step timeline, see how long it takes to get an Alaska LLC).

- Hard-copy filings take ~10–15 business days. The state’s Corporations page notes normal 10–15 business days for paper filings, with seasonal delays Oct–Feb; similar timing is repeated in specific instruction pages.

- No listed state expedite fee for LLC formation. Alaska doesn’t advertise a paid “expedite” option; instead, online filing is the instant route. (See the LLC Forms by Entity fee grid and online-filing guidance, no expedite tier is shown.)

At-a-glance

| Filing method | State turnaround | Extra “expedite” fee? | Notes |

|---|---|---|---|

| Online (Articles of Organization) | Posts immediately | No separate expedite shown | Confirmation & documents available right away. |

| Hard-copy (mail) | ~10–15 business days (longer Oct–Feb) | Not listed | Paper processing timeline from Corporations Section. |

Foreign (out-of-state) LLC Costs to Operate in Alaska

Formed your LLC in another state but plan to operate in Alaska? Here’s a quick, cost-first overview of what you’ll pay to register and stay compliant as a foreign (out-of-state) LLC. Expect a one-time registration filing, a recurring biennial report, and a state business license, plus, in some cases, a recent good-standing certificate from your home state. The breakdown below lists each fee and timing so you can budget confidently and file in the right order.

Certificate of Registration (foreign LLC filing) – $350

Register your out-of-state LLC by filing Certificate of Registration (Form 08-497). The state fee is $350; you can file online (instant posting) or by mail (paper takes ~10–15 business days).

Certificate of Good Standing from Home State

Alaska’s form asks you to attest your LLC “is active and in good standing” in its home state; it does not instruct you to attach a Certificate of Good Standing by default. If an examiner or third party requests proof, provide a good-standing certificate from your home state (costs and date-window vary by state, many request a document dated within 30–90 days). When in doubt, obtain a fresh certificate near filing.

Why the confusion online? Several reputable guides note Alaska typically doesn’t require attaching a home-state certificate for foreign LLC registration; the official form supports this (checkbox attestation, no upload field). Always follow any individualized request from the Corporations Section.

Biennial Report (foreign) – $200

After registration, foreign LLCs file a $200 Biennial Report on the same odd/even January cycle Alaska uses statewide. Reports postmarked after February 1 incur a late penalty, which adds to your fee.

Alaska Business License – $50/year or $100/2 years

Most businesses operating in Alaska must also maintain a state business license: $50 for 1 year or $100 for 2 years. All licenses expire December 31; online issuance/renewal is immediate.

Quick cost recap (foreign LLC)

| Item | Amount | Timing |

|---|---|---|

| Certificate of Registration (Foreign LLC) | $350 | One-time at registration |

| Biennial Report (Foreign) | $200 | Every two years (January of odd/even cycle) |

| State Business License | $50/year (or $100/2 years) | Annually or biennially, expires Dec 31 |

| Optional proof if requested: Home-state Good Standing | Varies by state | Obtain near filing if the examiner asks |

Taxes and Recurring Obligations that Affect Your Budget

Alaska keeps ongoing taxes simple. There’s no state personal income tax and no statewide sales tax, but many cities/boroughs do levy their own sales/use taxes (including special rules for remote sellers). Corporate income tax exists, but it generally applies to C corporations, not typical LLCs unless you elect corporate tax status. For a broader look at pass-through savings and elections, see LLC tax benefits.

No State Personal Income Tax

Alaska has no state personal income tax, so members of a typical pass-through LLC don’t owe Alaska income tax on their distributive shares (you’ll still handle federal tax).

No Statewide Sales Tax

While Alaska doesn’t impose a statewide sales tax, municipal sales/use taxes are common. Many jurisdictions participate in the Alaska Remote Seller Sales Tax Commission (ARSSTC), which standardizes remote-seller collection/filing under a uniform code, so if you sell into those jurisdictions and meet economic thresholds, you may need to register and collect.

Corporate Income Tax Applies to C-corps

Alaska imposes a graduated corporate income tax on corporations (top bracket 9.4%), codified at AS 43.20.011. This generally applies to C-corps. An LLC only falls under corporate income tax if it elects to be taxed as a corporation at the federal level (via Form 8832 for C-corp treatment or Form 2553 for S-corp election).

At-a-glance: taxes that may (or may not) hit your Alaska LLC

| Tax | Applies to most LLCs by default? | Who imposes it? | Notes |

|---|---|---|---|

| Personal income tax | No | State | Alaska has no individual income tax. |

| Sales/use tax | Maybe | City/borough | Check local rules and ARSSTC for remote-seller thresholds. |

| Corporate income tax | No (unless you elect corp status) | State | Corporations taxed under AS 43.20.011 (top 9.4%). |

Optional and Situational Costs

These aren’t part of every Alaska LLC budget, but they come up often. Each item is form-specific, so double-check fees on the official page before you file.

Name reservation renew/transfer, $25 each (if needed)

If you’re holding a name but aren’t ready to file, you can renew your Business Name Reservation for $25, or transfer it to someone else for $25. Both options are listed on the state’s Forms by Entity / Forms by Event pages. (Each reservation still holds the name for 120 days.)

Change of Registered Agent / Other Amendments

Routine corporate record updates are typically $25:

- Change of Registered Agent (Statement of Change) – $25.

- Notice of Change of Officials (LLC) – $25.

- Articles of Amendment (LLC) – $25.

Between biennial reports, many “notice of change” updates carry a $25 filing fee (the site flags this specifically).

Note: Some address-only changes in the Business Licensing system are no charge, but that’s separate from your Corporations record. Always use the correct form for the right division.

Professional Licensing

If you’re in a regulated field (e.g., healthcare, real estate, contractors), you may need a professional license under Title 8. Fees, renewals, and CE requirements vary by board, start with Alaska’s Professional Licensing portal and the Title 8 statutes.

FAQs: Alaska LLC Costs

Looking for the real Alaska LLC cost without the fluff? This FAQ delivers quick, price-first answers to what you’ll pay to form and maintain an LLC in Alaska: filing fees, state business license, biennial reports, local tax basics, and foreign registration. Each answer is current for 2025, so you can budget fast. Skim the questions, grab the numbers, and follow the official links when you’re ready to file.

How much does it cost to form an LLC in Alaska?

$250 to file Articles of Organization (online or by mail). Online filings post immediately; paper takes longer. The Initial Report is free (due within six months). Most businesses also need a state business license: $50 for one year or $100 for two years (licenses expire Dec 31). Name reservation is optional at $25. If you’re comparing requirements beyond costs, our Alaska LLC guide covers formation steps and choices end-to-end.

What’s the total first-year cost for an Alaska LLC (with business license and biennial/agent extras)?

Typical first-year budget: $250 (filing) + $50 (one-year business license) = $300. If you hire registered agent service, expect roughly $100–$150/year (market rate; the state doesn’t set this). Most LLCs won’t owe a Biennial Report in year one; that’s due the January 2 following your odd/even cycle. Optional documents (e.g., Certificate of Compliance) run $10.

Is there an annual LLC fee in Alaska? (biennial report vs business license)

There’s no annual “LLC tax.” Instead, you file a Biennial Report every two years: $100 (domestic) or $200 (foreign), due Jan 2 in your odd/even cycle. Separately, most businesses renew the state business license annually for $50 (or $100/2 years), expiring Dec 31. Online filings post immediately.

Do Alaska LLCs pay franchise tax?

No. Alaska doesn’t levy a state franchise (privilege) tax. The state’s business tax structure relies on corporate income tax (for C-corps and entities that elect corporate taxation) plus local taxes. Independent summaries confirm no corporate franchise tax in Alaska.

Does Alaska have state income tax on LLC profits?

No state personal income tax. Default pass-through LLC profits aren’t taxed by Alaska, though federal income/self-employment taxes still apply. If your LLC elects corporate treatment, Alaska’s corporate income tax (graduated, top bracket 9.4%) can apply.

Does Alaska have a statewide sales tax, and do local sales taxes apply to LLCs?

There’s no statewide sales tax. Many cities/boroughs impose local sales/use taxes. If you sell into participating jurisdictions as a remote seller, you may need to register/collect under the ARSSTC unified rules when thresholds are met. Check where you operate and sell.

How much does it cost to register a foreign LLC in Alaska?

$350 to file a Certificate of Registration (foreign LLC). After registering, budget $200 for the Biennial Report (every two years, Jan 2 cycle) and $50/year (or $100/2 years) for the state business license, expiring Dec 31. Online filings and license issuance post immediately.

What happens if I file the Biennial Report late?

If postmarked after Feb 1, the total becomes $137.50 (domestic) or $247.50 (foreign). Missed reports can push your entity to non-compliant status and lead to involuntary dissolution (domestic) or revocation (foreign). Domestic entities usually have up to two years to seek reinstatement; revoked foreign entities typically must re-register.

- Alaska DCCED – CBPL: Corporations, Forms by Entity Type

- Alaska DCCED – CBPL: Articles of Organization (Domestic LLC, Form 08-484)

- Alaska DCCED – CBPL: Online Filing Instructions, Form an Alaska LLC

- Alaska DCCED – CBPL: Certificate of Registration (Foreign LLC, Form 08-497)

- Alaska DCCED – CBPL: Online Filing Instructions, Register a Foreign LLC in Alaska

- Alaska DCCED – CBPL: Biennial Report, Online Filing Instructions (due & process)

- Alaska DCCED – CBPL: Forms by Event, Business Name Reservation & Registration

- Municipality of Anchorage: Licenses & Permits, industry-specific municipal licenses

Looking for an overview? See Alaska LLC Services

Form your Alaska LLC with Harbor Compliance

Get expert help with Alaska’s LLC formation, biennial reports, and licensing—Harbor Compliance handles it all for you.