Are you looking to verify a company's details in Connecticut? Wondering how to confirm business status and registered agent info quickly? A thorough entity search is key to making informed decisions.

A Connecticut Business Entity Search is the definitive method to verify company legitimacy and compliance. It provides accurate, up-to-date records on business status, formation dates, and registered agents—essential for avoiding fraud and ensuring reliability.

In this guide, you'll learn:

- How to access Connecticut's online business registry

- Step-by-step procedures for effective name searches

- Tips for analyzing and verifying business data

- Best practices for using additional resources

Ready to secure reliable business insights in Connecticut? Read on to master the process!

What Is the Connecticut Business Entity Search?

The official connecticut business entity platform is the state’s central business registry for verifying details about local companies. When you run a search here, you can see official records, check corporate standings, and confirm contact information. It’s especially handy for those who want to verify business name availability, avoid potential fraud, or gather insights about firms operating in Connecticut. The system is user-friendly, ensuring quick lookups with minimal effort.

The Role of the Connecticut Secretary of State in Business Registration

In Connecticut, the connecticut secretary of State’s office is in charge of secretary of state business filings. They oversee registered businesses and manage all records related to business entities—including corporations, partnerships, and any llc in connecticut. By handling everything from new formations to annual reporting, this office ensures businesses remain compliant with state regulations. Similarly, if you need to verify a company outside Connecticut, you can also check the California business entity search for businesses registered in that state. Whether you plan to form a new company or amend existing documentation, you’ll interact with this department at various stages of your entity’s lifecycle. It acts as a centralized hub for official filings, name reservations, and corporate status checks.

Why Conduct a Connecticut Business Lookup?

Running a llc lookup or corporation check helps you stay informed about any desired business in the state. Common reasons include:

- Verifying if a company is active or dissolved

- Checking for a physical address and correct registered agent details. If your business research extends beyond Connecticut, consider looking into the North Carolina business registry for additional verification

- Confirming the exact name before entering contracts

- Ensuring no conflicts with other business names you might use

From small business owners doing competitive research to larger companies assessing potential partners, a thorough search gives you confidence in the terms you entered. It also helps reduce risks associated with fraudulent entities or expired registrations.

ZenBusiness Start Your Connecticut LLC

ZenBusiness helps you file formation documents and maintain compliance with Connecticut state regulations.

Key Business Information You Can Find in the Registry

Whether you’re finalizing a deal or scoping out opportunities, the Connecticut database can reveal pivotal facts about an entity’s standing. You’ll often see:

- Status of each business (active, dissolved, or pending)

- Official formation date and ID numbers

- Contact data for the company’s registered agent

- Historical filings like amendments or name changes

Armed with these insights, you can evaluate an entity’s stability, track changes over time, and gauge if the firm meets state compliance rules. For businesses operating in multiple states, it may be useful to check their status in other jurisdictions, such as with the Florida business entity search. This transparency fosters trust between business owners and the public.

How to Contact the Connecticut Department of State

If you have questions or need clarification on your business records search, the connecticut department of State is there to help. They can address concerns about filings, fees, or the overall search tool:

- Address: 30 Trinity Street, Hartford, CT 06106

- Phone: (860) 509-6200

- Email: send email

- Official Website: https://portal.ct.gov/SOTS

How to Conduct a Business Entity Search in Connecticut

Performing a business entity search in Connecticut gives you crucial details about a company’s legal and financial standing. Whether you’re doing due diligence or checking on your own filings, mastering these steps can simplify your process. Below is a concise guide to ensure you find the right information without confusion.

Step 1: Access the Connecticut Secretary of State Business Search Tool

Begin by visiting the state’s official website, where you’ll find the dedicated search tool for business records. This resource allows you to search by business name, ID number, or owner details. Once on the portal, review any instructions provided, as they’ll clarify how to refine your results. Enter as many fields as possible for accuracy—if you only supply partial data, you might end up with numerous irrelevant listings.

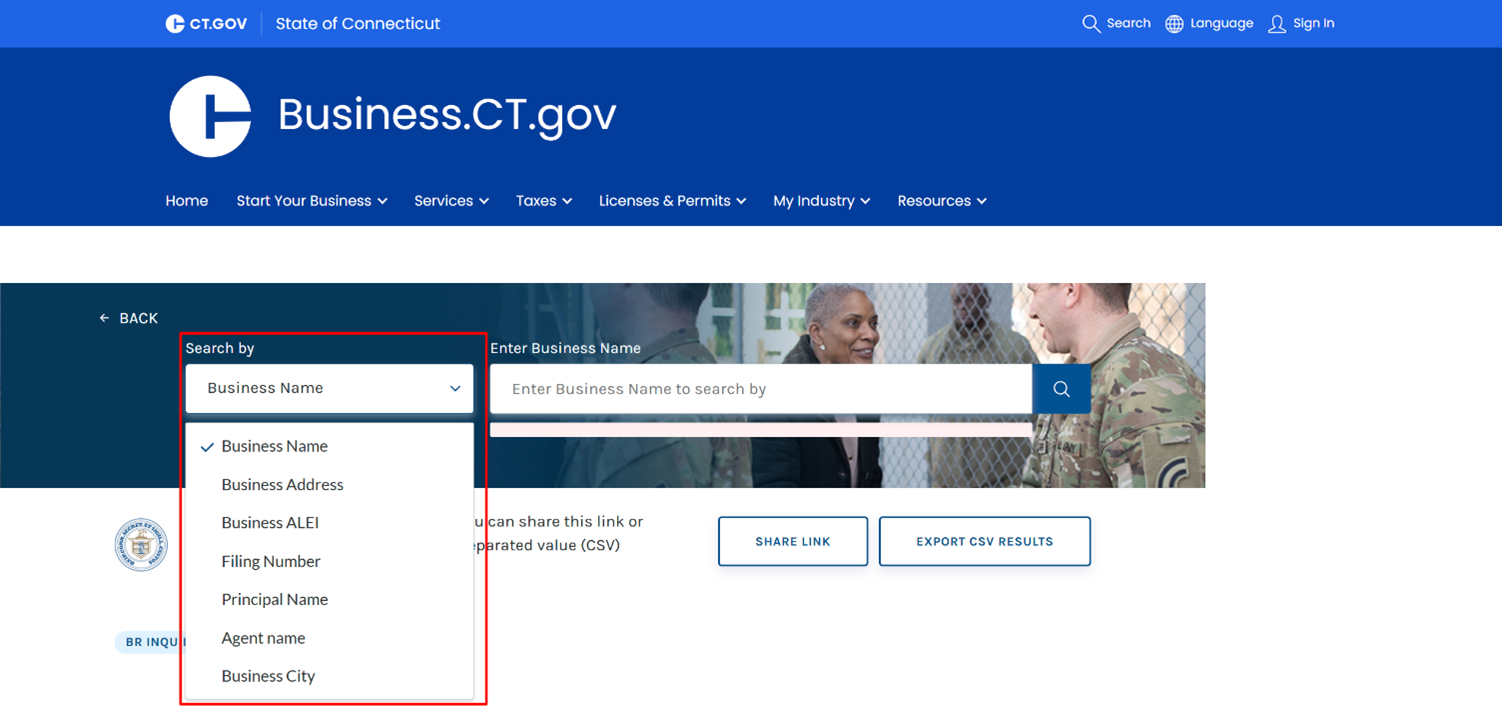

Step 2: Choose a Search Method (Business Name, Filing Number, or Owner Name)

Connecticut’s system offers multiple ways to filter your query. Decide which route suits your goal:

- Business Name Search: Ideal if you have a specific entity name in mind. Searching by full name or partial can yield either an exact match or a broader list of companies.

- Filing Number: If you already have the official entity ID from prior documentation, this is the most direct way to find your desired llc or corporation.

- Owner or Principal Name: Useful when the entity’s name is unknown, but you know who is involved.

Regardless of approach, ensure the terms you entered match the company’s official listing. Minor typos or extra punctuation can affect your results.

Step 3: Analyzing the Search Results (Business Status, Registered Agent, etc.)

Once you click “Search,” the site provides a list of companies matching your input. For each entry, you’ll typically see:

- Entity type (e.g., llc and corporation)

- Current standing or status of each business

- The official business name on record

- Details about the registered agent and physical address

Review these listings to confirm you have the right entity. If you need further verification, you might also want to find a company with an EIN to confirm its tax identification details. Pay close attention to the “Active” or “Inactive” label, as that can influence how you interact with the organization.nsure due diligence, or verify a competitor’s operational status.

Step 4: Getting Certified Copies or Additional Business Records

If you need to validate a company’s background more thoroughly, you can request official paperwork from the state. These business services might include:

- Certified copies of formation documents

- Historical annual reports

- Amendments or name-change filings

Obtaining such records helps you confirm that the legal entities in question meet regulatory requirements. The Connecticut Secretary of State typically charges fees for these add-ons, so check the website for current pricing and processing times.

Checking Business Name Availability in Connecticut

Making sure a name is free to use is critical before you fully commit to your desired business concept. To ensure uniqueness, you can follow these steps on how to check LLC names before finalizing your registration. The state’s connecticut business entity search lets you confirm if anyone already registered a name that’s too similar. Start by running a standard search with possible variations. If you don’t see any conflicts, you can usually proceed to reserve or register the name.

- Double-check any llc search for partial matches that might cause confusion.

- Look for an exact match in the system to ensure you’re not duplicating.

- Consider slight rewording if your initial choice is taken.

Once you find a unique name, follow the official steps for business registration. If you’re ready to take the next step, here’s how to start an LLC in Connecticut and complete the formation process. This might involve completing formation paperwork, designating a registered agent, and paying the required fees. Securing a distinct name is essential, both to maintain brand identity and to comply with state rules. It also prevents future disputes over naming rights or trademark violations.

Trademark and Legal Considerations for Connecticut Business Names

Protecting a name in Connecticut involves more than just listing it on the registry. You’ll need to confirm no one else holds a trademark and possibly secure additional legal safeguards. Below are key points to keep in mind as you proceed with your selection.

How to Check If a Business Name Is Trademarked in Connecticut

Use the state’s business data platforms and federal resources to confirm no existing marks conflict with your chosen name. Searching the USPTO database helps you uncover any national registrations. Likewise, a connecticut llc might have trademark protection beyond just the typical business name search. If you spot a mark similar to yours, consult legal advice before you finalize your naming strategy to avoid costly disputes or forced rebranding later.

Reserving vs. Trademarking a Business Name

Reserving a name with the connecticut department ensures that no other entity can register it for a specified time. However, trademarking is a separate process that provides broader legal coverage, potentially even at a national level. A reservation is typically short-term—helpful if you plan to form a new company soon. Meanwhile, a trademark can last indefinitely if you maintain it properly. Evaluate which route supports your business goals, noting that both might be useful if you operate across different states or rely heavily on brand recognition.

Legal Requirements for Business Naming in Connecticut

When choosing a moniker, adhere to state regulations on naming. For instance, a limited liability company must include “LLC” or “L.L.C.” in its title, while certain words (like “Bank” or “Insurance”) may require special permissions. Additionally, avoid implying state endorsement or using language that misleads the public. Always review the rules around expansions or relocations, especially if your business crosses borders. Compliance with naming guidelines keeps your venture aligned with local laws, minimizing bureaucratic hurdles in the future.

Northwest Registered Agent CT Business Registration

Northwest Registered Agent provides expert registered agent services and guidance on Connecticut entity formation.

Next Steps After Conducting a Connecticut Business Search

Once you’ve confirmed an entity’s status or discovered an available name, you might wonder what comes next. Below is a step by step guide to ensure you move forward effectively:

- Evaluate your findings: Decide if the results confirm your proposed venture’s name viability or if you need adjustments.

- Secure registration: If no conflicts arise, proceed with official business registration forms.

- Designate a registered agent: This professional (or company) is crucial for legal notifications.

- File necessary documents: Articles of organization (for an LLC) or incorporation (for corporations).

- Arrange any additional permits: Depending on your industry, check local or federal guidelines.

Whether you plan to start a new project or verify existing records, each action should align with Connecticut’s requirements. To ensure you’re working with the most reliable service, check out reviews of the best LLC services in Connecticut before proceeding. That way, you maintain compliance and lay a solid foundation for successful operations.

How to Maintain and Update Your Connecticut Business Information

Once your connecticut business is established, staying compliant involves keeping your filings and data current. Neglecting updates can lead to penalties or even administrative dissolution. The good news is, Connecticut offers clear guidelines to keep your organization in good standing.

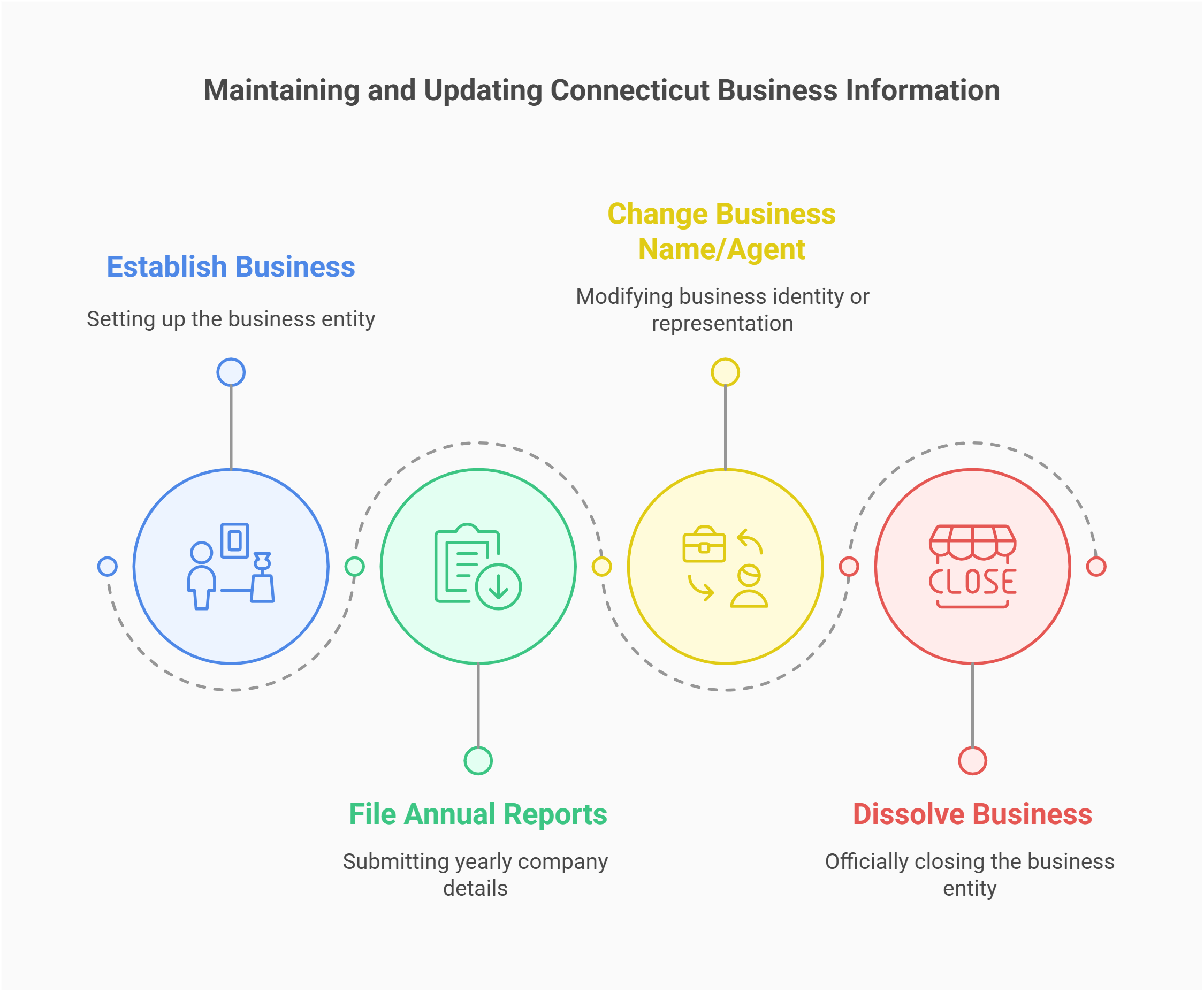

Filing Annual Reports and Maintaining Good Standing

All business owners must submit an annual report summarizing company details. This ensures the state has up-to-date information about your business entity structure, physical address, and contact data. Missing the deadline often results in fines or, in extreme cases, the state labeling you as inactive. By regularly reviewing your official records, you confirm the details are correct, which helps the public and other companies trust your credibility. For those starting a new venture, understanding how long it takes to get an LLC in Connecticut ensures better planning.

Changing Your Business Name or Registered Agent

You may decide to switch out your registered agent or adopt a new name as your enterprise evolves. If you’re unsure which service to choose, explore options for the best registered agent in Connecticut to ensure compliance and efficiency. In either case, you’ll typically file an amendment with the secretary’s office. For a name change, do a business name search first to ensure it’s not already taken. Then, complete the necessary forms and pay associated fees. When you replace the agent, provide the new agent’s physical address and contact details. Keeping such changes official prevents confusion and ensures legal notices arrive on time.

How to Dissolve a Business in Connecticut

If the time comes to close operations, you’ll file dissolution paperwork to remove your entity from the official business records. This involves clearing any debts, notifying creditors, and settling taxes with the department of revenue. Once approved, your business name becomes available again for others to use unless you trademarked it or took additional measures. Proper dissolution also protects you from ongoing obligations or surprise liabilities.

Additional Business Search Alternatives and Resources

Besides the connecticut business entity search maintained by the secretary’s office, other avenues exist for deeper or complementary insights:

- Local Chambers of Commerce: Helpful for verifying membership and local standing

- Industry Databases: Sector-specific listings for specialized checks

- Professional Licensing Boards: Useful if the entity operates in regulated fields

- Social media channels: Platforms where some organizations highlight official credentials

Exploring these supplemental resources can fill in gaps the basic registry might not cover. For instance, if you need a list of companies in a certain region or niche, local associations or licensing boards may provide valuable additional context and details. This combined approach ensures you’re fully informed before making partnership or investment decisions.

Connecticut Business Entity Search FAQ

Below are brief yet thorough answers to common questions about verifying Connecticut companies. Each response aims to address your concerns directly, helping you navigate the process with confidence and clarity.

Yes. Accessing the state’s online platform to review registered businesses or conduct an llc search is generally free of charge. You can explore the system to confirm a company’s standing, gather basic information, and ensure the name is unique. However, if you want certified documents or specialized business services—like expedited processing—there may be associated fees. These extras come into play if you need official records for court proceedings, financing, or other legal matters. The standard lookup, though, remains cost-free.

Start by using the state’s business entity search and look for ownership or principal details. Some filings, like Articles of Organization or amendments, list member names for an llc in connecticut. If the info isn’t publicly shown, you can request official paperwork from the secretary’s office, which might reveal additional data. If owners chose minimal disclosure, you may not see every detail. In that case, try searching external databases or ask for the company’s official disclosures. In some instances, contacting the firm directly is your best bet.

After entering the company’s name or ID, the search results should indicate whether the entity is in good standing, inactive, or dissolved. Look for terms like “Active,” “Dissolved,” or “Revoked” to gauge the status of each business. If the listing shows “Inactive” or “Dissolved,” confirm the effective date. Businesses that operate across state lines may also require a Tennessee Secretary of State business search to check their status in that region. Some companies might be in the process of reinstatement, so check the notes section for further details. Should you need proof of status, you can usually request a formal certificate from the state for a small fee.

If you operate under a name that another entity officially registered, you risk legal conflicts and potential lawsuits. Competitors or existing businesses might claim trademark infringement or unfair competition. Beyond the legal disputes, confusion can arise among customers, vendors, and partners who might think your organization is affiliated with someone else. The Connecticut Secretary of State’s office could also reject your business registration application, forcing you to pick a new name altogether. Researching thoroughly helps avoid these complications.

The business data in the registry is typically refreshed as new or updated filings arrive. For most changes—like annual reports, amendments, or agent switches—you’ll see updates within a few business services days after the state processes the paperwork. Peak times, such as tax deadlines, can lead to brief delays. Generally, the system remains an accurate reflection of current status, but if you need the most immediate info, contacting the secretary’s office directly is your best option.

Looking for an overview? See Connecticut LLC Services

Harbor Compliance Connecticut LLC Solutions

Harbor Compliance ensures your Connecticut business meets all filing requirements and maintains good standing.