Ready to launch your Indiana LLC but need to check if your perfect business name is still available?

Worried about filing delays or having your formation rejected due to a conflicting name?

Curious which official tool helps you confirm real-time status, standing, and ownership of registered companies in Indiana?

To check name availability in Indiana, visit the INBiz business entity search portal and enter your proposed entity name, number, or registered agent to generate real-time results. If no exact or similar active matches appear and inline availability is confirmed, you can reserve the name for 120 days with an $11 fee or proceed directly to filing your Articles of Organization.

In this guide, you'll learn:

- How to navigate the INBiz portal and use the business entity search tool effectively

- How to interpret results like formation date, registered agent, and standing

- Steps to reserve your business name and file your Indiana LLC

- Tips to avoid common mistakes and ensure your name is legally available

Whether you're forming a new company or researching an existing limited liability company, this tutorial gives you the tools to search smart, stay compliant, and move forward with confidence.

What Is the Indiana Business Entity Search & INBiz Portal?

The Indiana Business Entity Search is a free, public tool provided by the INBiz portal, Indiana’s official online gateway for business services. Managed by the Secretary of State, this database allows anyone to access up-to-date records of business entities registered in the state — including corporations, limited liability companies, and limited partnerships.

You can use the tool to:

- Check if a business name is already taken

- Find information about a specific legal entity such as its registered agent, formation date, and standing

- Review filings, status updates, or dissolution records for any Indiana company

INBiz consolidates multiple government functions into one platform. It streamlines everything from searching existing entities to filing formation documents and managing compliance tasks. Whether you’re researching a potential partner, forming a new Indiana LLC, or just confirming your own company’s status, this platform provides all the essential tools in one place.

Beyond the search tool, INBiz offers:

- Access to annual report filings and amendment submissions

- Trademark and intellectual property filings

- Online applications for certifications like a Certificate of Good Standing

Thanks to its comprehensive scope, INBiz is a go-to resource for managing business entities in Indiana.

7 Steps to Conduct an Indiana LLC Search

Before forming or doing business with any Indiana LLC, it’s crucial to run a full business entity search using the INBiz portal. This not only confirms name availability, but also lets you view a company’s status, filing history, and registered agent details. Below are the seven steps to search effectively and confidently on Indiana’s official site.

ZenBusiness Makes Your Indiana LLC Happen – Fast

ou bring the business idea, ZenBusiness brings the tools. We’ll handle the paperwork so you can focus on building something great in Indiana.

Step 1: Navigate to the INBiz Portal (inbiz.in.gov)

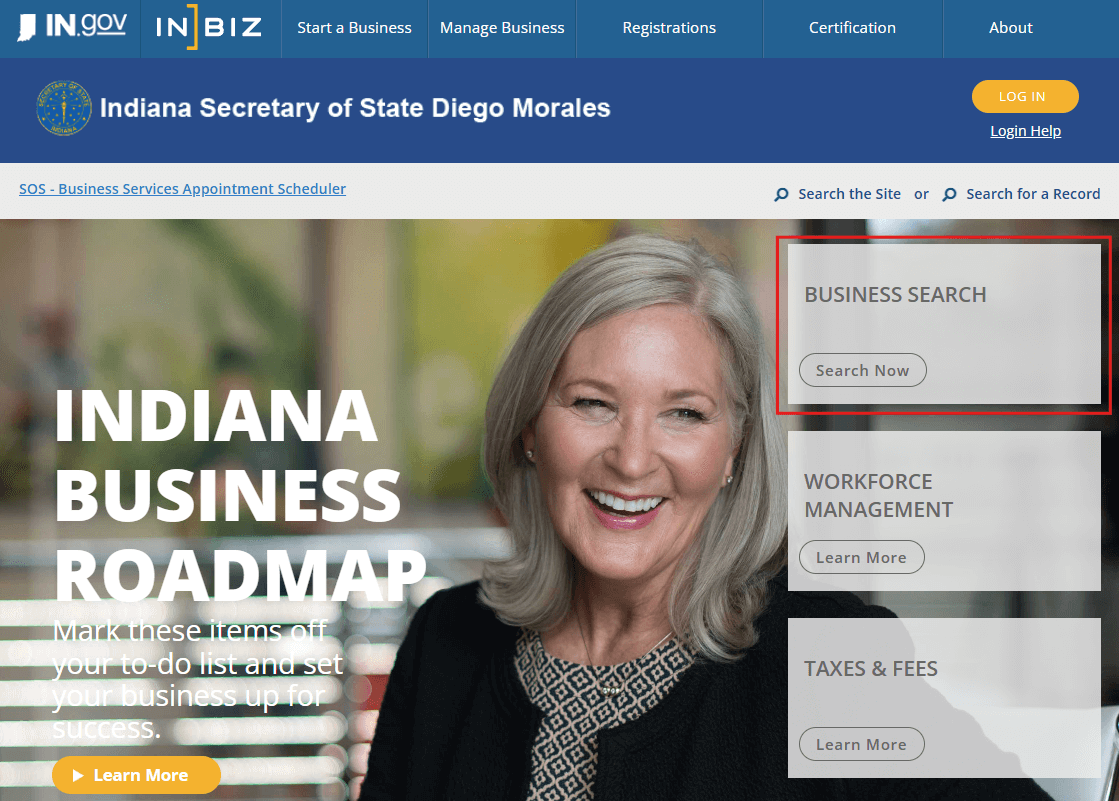

Start by visiting INBiz.in.gov, Indiana’s official one-stop portal for business services, maintained by the Secretary of State. From the homepage, locate the large gray box labeled “Business Search” on the right, then click “Search Now” button.

This will take you to Indiana’s public business entity search system — your access point to LLCs, corporations, nonprofits, and other registered entities in the state. The portal is:

- Free to use

- Publicly accessible (no login required)

- Updated in real time with official state records

If you plan to perform multiple lookups or file documents in the future, it’s a good idea to bookmark this portal.

Step 2: Select “Business Entities” from the Search Menu

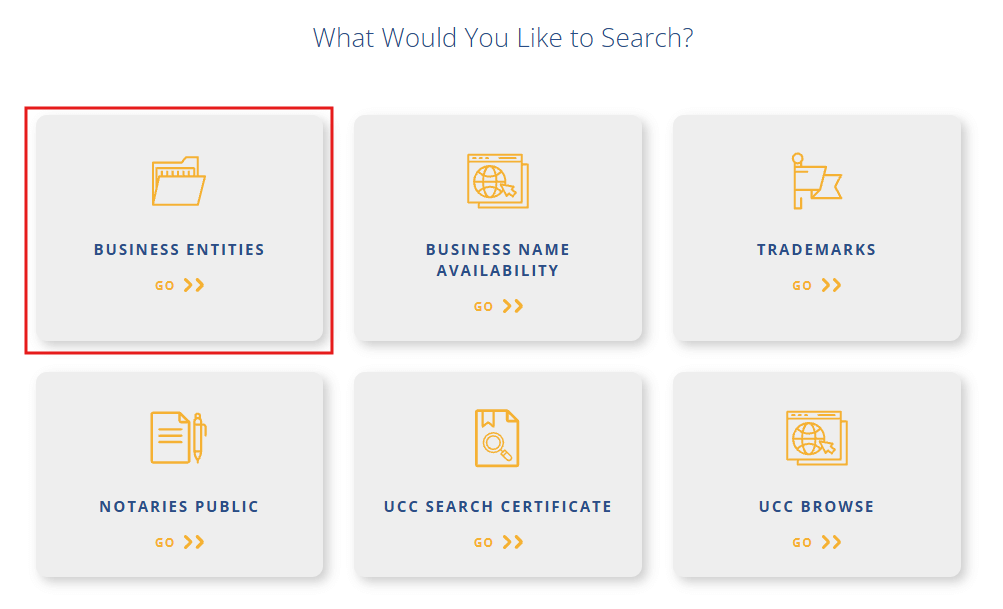

After clicking “Search Now” from the homepage, you’ll land on a page titled “What Would You Like to Search?”.

Here, you’ll see several boxes representing different search categories.

Click the box labeled “Business Entities”

(Look for the yellow folder icon and “GO »” link)

This is the correct choice for searching Indiana’s registered business database. It allows you to look up:

- LLCs (Domestic and Foreign)

- Corporations

- Nonprofits

- Limited Partnerships

- Other registered business types

Important: Don’t choose “Business Name Availability”, that’s only for checking name availability, not existing business records.

After selecting “Business Entities,” you’ll be taken to the entity search form — that’s where you’ll enter your criteria like business name or ID number.

Step 3: Enter Search Criteria and Run the Lookup

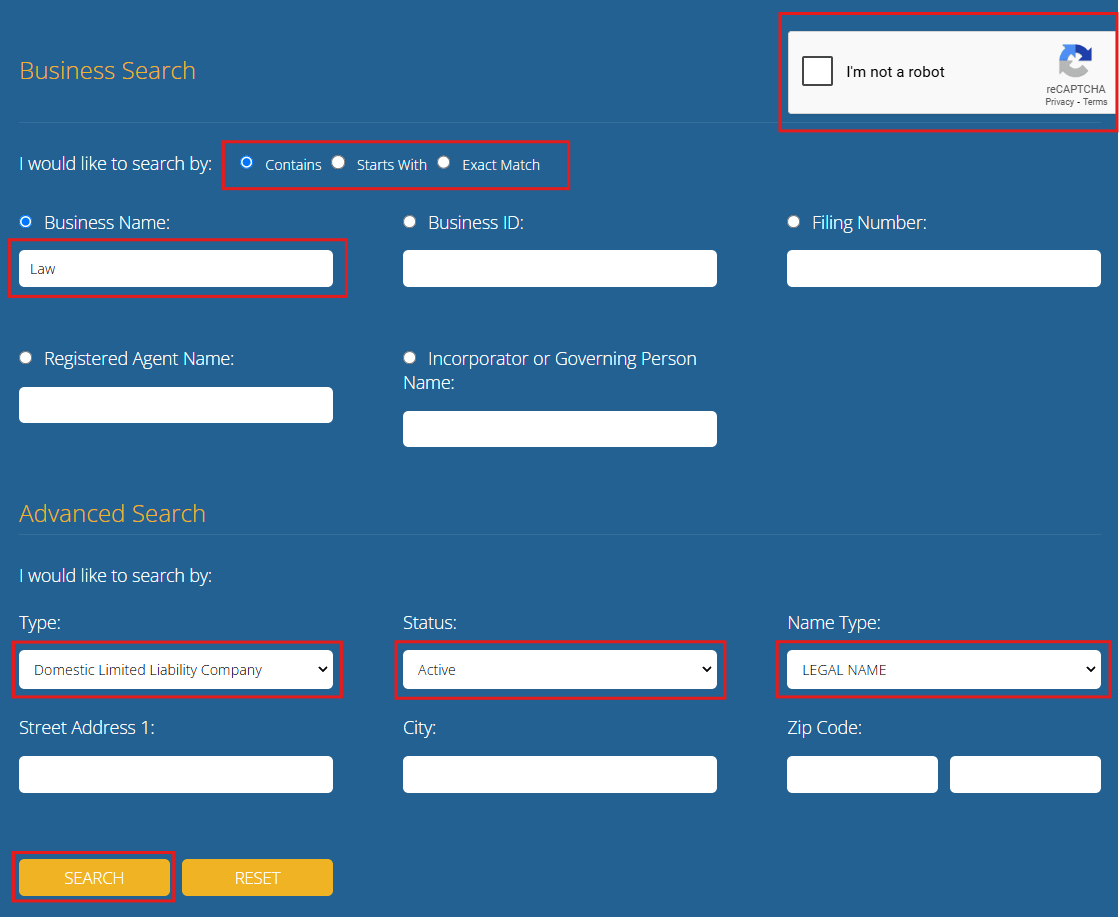

After selecting “Business Entities,” you’ll arrive at the main Business Search form. This page lets you search using several types of information. At the top, choose how you want the system to match your query:

Search Method:

- Contains (default) – finds names that include your term anywhere

- Starts With – useful for prefix-based searches

- Exact Match – only returns results that exactly match your input

Search Options (choose one):

- Business Name – Enter the legal name or partial name of the LLC or company

- Business ID – 9-digit Indiana registry number (most precise)

- Filing Number – If known from state documents

- Registered Agent Name – Search based on the name of the filing agent

- Incorporator or Governing Person Name – Search by individual involved with the company

Advanced Search Filters (Optional):

- Entity Type – Filter for LLCs, corporations, nonprofits, etc.

- Status – Choose from Active, Inactive, Revoked, etc.

- Name Type – Such as Legal Name or Assumed Name

- Street Address / City / Zip Code – Narrow results by business location

After entering your information, complete the CAPTCHA and click the “SEARCH” button at the bottom of the page.

Tip: Use Business ID for the most accurate, one-result match. For broader research, start with “Contains” + Business Name.

Step 4: Review Search Results and Select a Business

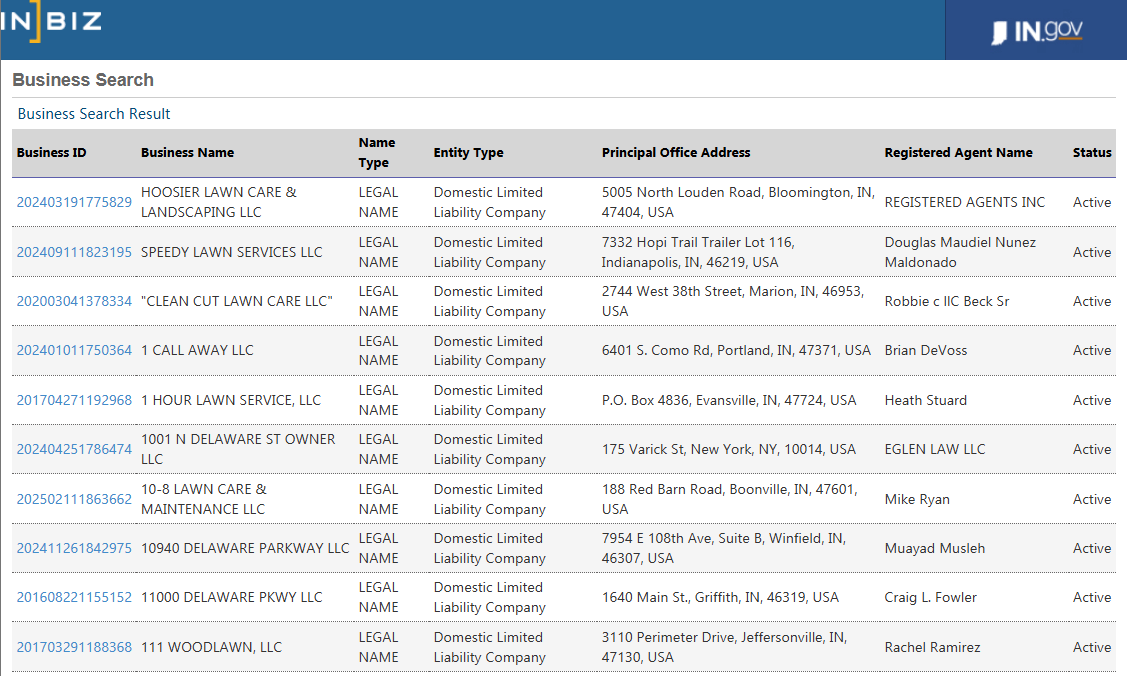

After clicking Search, the system will display a list of matching business entities. Each row in the table provides essential details to help you identify the correct business.

Here’s how to read the results:

Key Columns in the Results Table:

- Business ID – A clickable ID number that links to the full business record

- Business Name – The legal name of the company

- Name Type – Usually labeled as “LEGAL NAME”

- Entity Type – Such as Domestic Limited Liability Company (LLC)

- Principal Office Address – The business’s primary registered location

- Registered Agent Name – The individual or firm responsible for legal service

- Status – Indicates if the business is Active, Inactive, Admin Dissolved, etc.

Tip: Always confirm that:

- The status is “Active”

- The Business Name matches exactly

- The Registered Agent is someone you recognize (for vendor due diligence or legal checks)

What to do next? Click on the Business ID link to open the full business profile

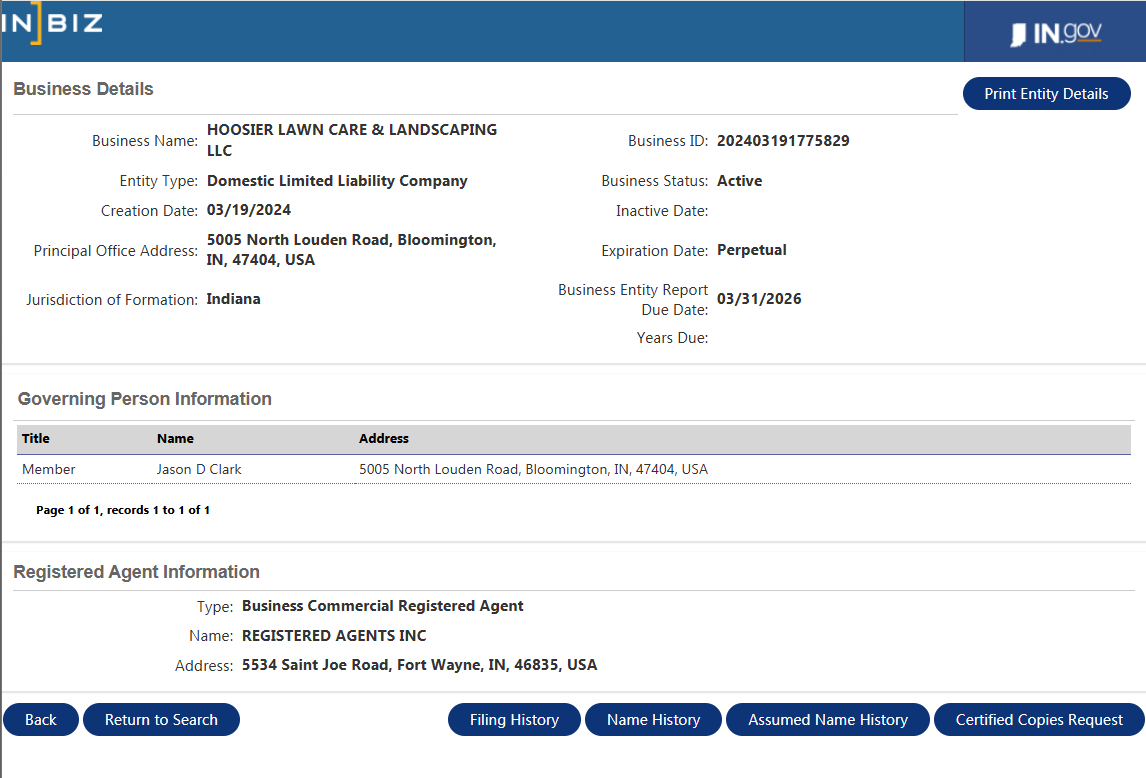

Step 5: Review and Print the Full Business Record

After selecting a Business ID from the search results, you’ll arrive at the Business Details page. This record provides the official, state-verified profile for the selected Indiana entity.

Key Information to Review:

- Business Name – The legal name as registered with the state

- Entity Type – Example: Domestic Limited Liability Company

- Business Status – Should show Active if the company is in good standing

- Creation Date – The official date the business was formed

- Expiration Date – Often listed as “Perpetual” for LLCs with ongoing status

- Business Entity Report Due Date – When the next report is due (e.g., 03/31/2026)

- Principal Office Address – The business’s main operating location

- Jurisdiction of Formation – Typically “Indiana” for in-state LLCs

Governing Person Information:

- Title – Such as “Member” or “Manager”

- Name & Address – The official representative or owner on file

Registered Agent Information:

- Type – Usually a Business Commercial Registered Agent

- Name & Address – Who receives legal correspondence on behalf of the LLC

To Save or Print the Record:

- Click the “Print Entity Details” button at the top right

- Or use your browser’s Print / Save as PDF option for a clean copy

You can also explore:

- Filing History

- Name History

- Assumed Name History

- Certified Copies Request

These buttons at the bottom of the screen let you dig deeper into the company’s past filings or request official documentation.

Tip: Save this page as a PDF for your internal records, especially if you're conducting vendor due diligence, verifying legal status, or documenting a partnership.

Need help keeping your business compliant? This top-rated Indiana LLC service list can point you to providers that handle filings and registered agent tasks reliably.

Reserving & Registering an LLC Name in Indiana

It's smart to reserve the name for your Indiana LLC before you form it officially. Entrepreneurs in Indiana can hold a name for 120 days to prevent others from registering the name before them. But if you're still unsure whether forming an LLC is necessary at all, this guide on whether you need an LLC to start a business helps you evaluate your options and avoid unnecessary filings. This is particularly beneficial if you are still working on the necessary steps such as writing the operating agreement, applying for the EIN or gathering the ownership documents.

If you reserve your name early, it can protect your branding. It can also make it easier to file your company later. This helps to ensure that the name you want stays available while you finalize your limited liability company.

Preliminary Name Availability Check via INBiz

Before reserving your Indiana LLC name, you need to confirm that it’s actually available. The most reliable way to do this is by using the business entity search feature on the INBiz portal. This tool taps into Indiana’s official business registration database maintained by the Secretary of State, ensuring you’re working with accurate, up-to-date results.

When checking availability, look for:

- Exact matches – if the name already exists, it can’t be reserved

- Similar names – names that are deceptively alike may also be rejected

- Proper designators – include “LLC” or “Limited Liability Company” as required

Take a screenshot or save a copy of your results for reference. A successful name check doesn’t guarantee reservation approval, but it drastically reduces the chance of rejection and helps you move forward with more confidence.

File a Name Reservation Request—$10 + $1 Processing Fee

Once your name passes the availability check, you can file a reservation request directly through INBiz. Indiana charges a $10 fee, plus a $1 processing fee, to temporarily hold your business name for up to 120 days.

To complete the reservation:

- Log in or create an INBiz account

- Select “Name Reservation” from the available services

- Enter your desired business name with the proper designator (e.g., “LLC” or “Limited Liability Company”)

- Pay the fee via credit card or bank transfer

This step doesn’t officially form your Indiana LLC, but it does secure your name during the planning stage. If the reservation expires before you file, the name becomes available to the public again. For a full breakdown of what you'll spend to form and maintain your LLC, this state fees and ongoing costs for Indiana LLCs outlines all state fees, optional services, and ongoing requirements.

Transitioning from Reservation to Filing Articles of Organization

After successfully reserving your name, you are ready to form an Indiana LLC. To do so, you’ll file your Articles of Organization through INBiz, using the exact name you reserved. For a broader view of how the process works across different states and what to prepare beforehand, this guide to starting an LLC the right way breaks down everything from structure selection to compliance. INBiz connects your reservation directly to the filing, so you won’t need to re-enter the name.

File your formation documents before your reservation expires in 120 days. Missing that deadline makes the name available to others and you will require to re-reserve it or choose a new name.

Once your filing is complete, your limited liability company will be a legally recognized business entity in Indiana and will appear in the business entity search system. Your business will be assigned a unique entity number and will indicate an active status.

Indiana Business Entity Types & When to Use Them

Choosing the right business entity for your goals is essential before registering your company. Indiana has different types of legal entities which get various benefits in terms of ownership, taxation, and liability. If you're trying to decide which is best for your situation, this guide helps you compare LLP and LLC structures based on liability, taxes, and management. The decisions you make at the beginning affect everything from how you pay taxes to how your business is managed and protected.

Here we will break down the most common business entities in Indiana:

- Limited Liability Company (LLC) – The most flexible and popular option for small business owners. Offers liability protection and pass-through taxation.

- Corporation – Best for businesses with shareholders, boards, or growth plans that involve outside investment.

- Limited Partnership – Designed for companies with silent investors or unequal ownership/control roles.

- Sole Proprietorship & General Partnership – Quick to start but lack legal separation between the business and its owner(s).

- Nonprofit Corporation – Created for charitable or public service purposes, with special filing requirements.

Indiana’s business entity search lists each type of entity, each of which has its own filing forms and ongoing requirements. When forming your company in the same state where it will operate, it is worth learning the basics of domestic LLCs, this article on domestic LLCs explains how they work, it also shows why they are great for in-state operations. Consider evaluating which business structure fits your operational and financial needs and consult to a lawyer or tax adviser if unsure. If you’re a licensed professional (like a doctor, lawyer, or architect), it's worth reading up on choosing between LLC and PLLC, since your profession may require a more specialized entity that aligns with state licensing laws.

Start Your Indiana LLC the Smart Way with Northwest

Looking for privacy and support with zero fluff? Northwest helps you form an Indiana LLC without the usual nonsense.

INBiz & Secretary of State Services for LLCs

With INBiz, you do not just run a business entity search. It also serves as your central place to manage your Indiana LLC following formation. Through INBiz, the Secretary of State offers a variety of services designed to help you stay in good standing, legally file updates and access useful business tools. INBiz makes it easy to follow Indiana law when changing your company information or requesting a Certificate of Good Standing. If you’re still wondering whether you should choose an LLC or corporation for your business, this LLC versus corporation overview can help clear things up.

Biennial Report Filing & Certificate of Good Standing

Every LLC in Indiana must submit a biennial report to the Secretary of State. This filing is to inform the government that your information is up to date and that your LLC is still operating. Every two years, your LLC must submit reports on the anniversary month of its formation.

If you fail to file, you could incur late fees or worse: administrative dissolution; meaning your business is no longer legal. You can file the report quickly through your INBiz account.

When your filings are up to date, you can request a Certificate of Good Standing. This document shows your LLC is compliant with the law. Many banks, investors and licensing agencies will require one. For single-member LLCs, it's also helpful to understand how disregarded entity status can affect your tax filings—especially at the federal level.

UCC, Trademark, and Notary Public Services

In addition to LLC filings, the Secretary of State offers access to several other vital business services through INBiz. These include Uniform Commercial Code (UCC) filings, which are often required when securing loans or registering liens on business assets. UCC filings protect lenders and clarify rights in a secured transaction.

You can also register a trademark with the state to protect your intellectual property — such as a brand name, logo, or slogan — from being used by competitors in Indiana. While a federal trademark offers broader protection, state-level registration is faster and more affordable for local companies.

Lastly, the portal allows access to Notary Public services. You can apply to become a notary or update your credentials online, making it easier to support internal business documentation and client agreements. Once you’ve established your LLC and are generating income, it’s important to understand how to pay yourself properly, choosing the right method impacts taxes and compliance.

Online Amendments, Mergers & Dissolutions

Your Indiana LLC may need to evolve over time — and INBiz makes that process simple. Through the platform, you can file amendments to update your business name, address, registered agent, or other key details. These changes are processed directly through the Secretary of State and are reflected in your public business entity record.

INBiz also supports online merger filings if you're combining entities, as well as dissolution filings when you need to formally close your business. Each form includes instructions and built-in validation checks to prevent filing errors.

Timely updates ensure your company remains in compliance and that your public record accurately reflects your operational status. For entrepreneurs looking to centralize ownership or manage multiple businesses under one structure, forming a holdings LLC can provide simplified control and enhanced asset protection.

Best Practices & Common Pitfalls in Indiana LLC Search

Running an accurate Indiana LLC search is more than typing a name into a search bar. To avoid errors and maximize results, follow these proven strategies, especially if you're preparing to register a new limited liability company or researching an existing legal entity. You may also want to compare formal entities with simpler alternatives, this guide to DBA vs LLC structures outlines the practical differences in cost, protection, and registration.

Best Practices:

- Use Exact Match First: Always start with the full entity name before trying partial searches.

- Apply Advanced Filters: Narrow by status, county, and filing date to eliminate unrelated results.

- Check Name Variants: Look for abbreviations, plurals, misspellings, or swapped word orders.

- Export Your Results: Save a copy or screenshot for your records and future reference.

- Cross-Check Registered Agent: Use the agent name field to verify who represents the business.

Common Pitfalls:

- Assuming Availability Means Approval: Just because a name isn’t in the system doesn’t mean it will be accepted — it still must meet Indiana’s naming requirements.

- Skipping Status Filters: Without filtering by “Active,” you may waste time reviewing dissolved or forfeited businesses.

- Overlooking Similar Matches: Indiana can reject names that are deceptively similar, even if they’re not exact matches.

- Not Verifying the Entity Number: For official documents or filings, always rely on the unique entity number, not just the business name.

Following these tips ensures your business entity search yields reliable, actionable results and helps you avoid delays in registration or legal errors down the road. Once you’re confident your desired name is available and you understand the business entity status, you’re ready to move forward. This Indiana LLC step-by-step guide walks you through every stage—making the entire process easier, from paperwork to compliance.

Frequently Asked Questions: Indiana LLC Search

Whether you're forming a new Indiana LLC, researching an existing business entity, or checking compliance details, INBiz’s tools can help. Below are the most common questions people ask — along with clear, concise answers to help you move forward confidently.

How do I perform an Indiana LLC search on INBiz?

Go to inbiz.in.gov and select “Business Search” from the homepage. Use the search tool to enter the entity name, entity number, or registered agent name. You can also apply filters like status, county, and filing date to narrow results. INBiz will display a list of matching business entities, including formation dates, standing, and registered agents — all updated by the Secretary of State.

What does it cost to reserve an LLC name in Indiana?

It costs $10 to reserve an LLC name in Indiana, plus a $1 online processing fee if you file through the INBiz portal. This reservation holds your desired business name for 120 days, giving you time to prepare your Articles of Organization and other setup documents. You can file the name reservation request directly through your INBiz account using a credit card or bank transfer.

Can I search for foreign LLCs registered in Indiana?

Yes, Indiana’s business entity search tool allows you to look up foreign LLCs — companies formed in other states but registered to do business in Indiana. Just enter the entity name, number, or registered agent, and the system will display all matching results, including foreign registrations. You can view key details like formation state, registration date in Indiana, and whether the entity is currently active.

How do I verify my LLC’s good standing?

To verify your LLC’s good standing in Indiana, visit inbiz.in.gov and search for your business using the entity name or entity number. In the results, check the status field — it should show “Active” if your company is in good standing. For official verification, you can also request a Certificate of Good Standing through your INBiz account for legal or financial use.

Where can I find local business license information?

Local business licenses in Indiana are issued by city or county governments — not the state. To find the right information, contact your city hall, county clerk, or local chamber of commerce. You can also visit in.gov business portal for state-level resources and links to local agencies. Requirements vary by location and business type, so check with your local office before operating.

Resources for Indiana Business Owners

Looking for additional help beyond the INBiz portal? Here are trusted state and national resources that support business owners with name checks, legal filings, compliance, and business growth in Indiana.

- INBiz Portal (inbiz.in.gov): Indiana’s official business services gateway. Offers entity search, name reservation, LLC filing, annual reports, and compliance tools.

- Indiana Secretary of State – Business Services Division (sos.in.gov/business): The regulatory authority overseeing business entity filings, registered agents, and good standing status. Includes legal forms, FAQs, and filing guidance.

- U.S. Small Business Administration (SBA) Indiana District Office (sba.gov): Offers funding programs, business plan resources, and mentorship for Indiana entrepreneurs.

- Indiana Small Business Development Center (Indiana SBDC) (isbdc.org): Provides free guidance on business formation, market research, and scaling operations. Offices statewide.

- IRS – Employer Identification Number (EIN) (irs.gov): Essential if you’re forming an LLC with employees or opening a business bank account.

Don’t navigate the LLC process alone — these services offer guidance, tools, and professional support at every stage.

Looking for an overview? See Indiana LLC Services

Harbor Compliance Gets Your Indiana LLC Off the Ground

Don’t get stuck in legal limbo – Harbor Compliance walks you through every form, deadline, and detail. Start right, stay right.