Are you torn between forming an LLC or incorporating as a corporation? Do you need to know which structure offers the best tax treatment and liability protection for your goals? Curious how governance requirements and fundraising options differ between the two?

An LLC (Limited Liability Company) offers pass-through taxation, flexible management via an operating agreement, and minimal annual formalities, making it ideal for small businesses and single-owner ventures. A corporation (Inc.) provides perpetual existence, ability to issue multiple classes of stock, and strong appeal to investors—but it faces double taxation (corporate and dividend levels) and requires strict compliance with bylaws, board meetings, and detailed record-keeping.

In this guide, you’ll explore:

- Key tax differences and filing requirements

- Management structures: operating agreements vs. corporate bylaws

- Liability protection and formalities for each entity

- Fundraising and equity-incentive considerations

Ready to choose the right structure for your business? Let’s dive in!

LLC vs. Inc: Legal Definition and Formation Basics

Choosing between an LLC and a corporation starts with understanding how each legal framework works under state statutes. At its core, an business entity label dictates tax treatment, paperwork burden, and the strength of your liability shield. This section lays a clear foundation so you can match structure to budget, risk tolerance, and growth trajectory. If you’re ready to compare steps, check our detailed guide on how to form an LLC.

What Is a Limited Liability Company (LLC)?

A Limited Liability Company blends partnership flexibility with corporate shields. Because limited liability companies are creatures of state law, the exact rules vary, but most jurisdictions view the LLC as a contractual shell whose inner workings live in a private agreement instead of public bylaws. Owners—called members—enjoy pass-through tax status by default and can choose almost any management setup they like. For a quick explainer on what LLC really stands for, see our page on abbreviation LLC.

- Offers limited liability protection that shields savings and homes from business debts

- Defaults to pass-through taxation that avoids entity-level income taxes

- Relies on an operating agreement to spell out profit splits and voting rights

Combined, these traits let entrepreneurs protect their personal assets while keeping paperwork light. That simplicity explains why single-member LLCs dominate local service industries, yet the model also scales to complex real-estate syndicates and multi-state e-commerce operations without losing agility.

Simplify Your LLC Formation with Northwest

Northwest handles everything from name search to filing and compliance, making LLC formation effortless and affordable.

What Is a Corporation (Inc.)?

A corporation is a separate legal entity created by filing Articles of Incorporation with the state and issuing stock to its owners. Because it exists apart from the people who run it, the corporation can own property, sue, and be sued in its own name. This permanence attracts investors who want clearly defined rights, a court-tested playbook, and unlimited life even if founders depart. In exchange, owners accept formalities that an LLC can often skip.

- Strategic oversight rests with a board of directors elected annually

- Profits retained inside pay a federal corporate income tax before dividends

- Equity sales unlock venture capital and public-market liquidity

These design choices give shareholders strong voice yet protect them from unlimited liability. The trade-off is double-layer taxation and a rulebook that demands minutes, bylaws, and strict separation between personal and company funds. To see the exact steps, visit our walkthrough on how to start a corporation.

How They’re Formed and Registered

Forming either structure begins with state filings, but the documents differ in tone. LLC promoters submit Articles of Organization, list a registered agent, and declare the company’s entity classification as default pass-through unless they opt out later. Corporations file Articles of Incorporation, authorize share classes, and adopt bylaws at the first board meeting. Both entities must pay a formation fee and publish notices if required. Processing times range from instant online approval to several weeks by mail, but entrepreneurs can reserve names in advance to avoid delays. After acceptance, each receives a stamped certificate—proof of existence for the LLC and a charter for the corporation—which banks and vendors will ask to see. If you’d like to skip the formal plan, see whether you can start an LLC without a business.

Ownership and Management Structures Compared

Control defines culture and determines how quickly a business can pivot. While an LLC may rewrite rules overnight, a corporation must navigate board resolutions and formal votes, often under securities regulations. Grasping that underlying management structure helps you anticipate bottlenecks long before they stall growth.

LLC Members vs. Corporation Shareholders

In an LLC, business owners are called members and may be individuals, trusts, or even other entities. Learn best practices for setting roles and voting weights in our guide to managing members. Each member’s stake is measured in percentage interest rather than shares, which means income, losses, and voting weight can be assigned in any ratio the operating agreement allows. Corporations, by contrast, issue stock certificates that divide ownership into uniform units. Those shares can be freely sold unless restricted by buy-sell agreements, making equity easier to value and collateralize. Because stock is property, shareholders can pledge it for loans or transfer it through estates without dissolving the enterprise, while LLC interests often need unanimous consent—preserving close-knit control but slowing exits.

How LLCs Are Managed vs. Corporate Boards

LLCs choose between member-managed and manager-managed setups, a fork that lets hands-on founders keep the wheel or appoint outsiders for day-to-day operations. Either way, statutes impose minimal scripted duties, giving teams freedom to react in real time and update roles without external filings. In a corporation, governance flows downward from the board, whose fiduciary duties are hard-wired into corporate law and enforced through shareholder derivative suits. Directors hire officers, ratify budgets, approve option pools, and must record minutes for every material decision. That hierarchy reassures auditors and institutional investors who crave predictable checkpoints for risk, yet it can slow emergent pivots when unanimous director approval—or even super-majority shareholder consent—is required. Seasoned founders weigh that trade-off carefully before selecting a charter.

Decision-Making Flexibility: LLCs vs. Inc.

Flexibility isn’t just cultural—it affects exit timelines and audit risk. When an LLC wants to add investors, members can draft an amendment overnight, change waterfall provisions, and email signatures for approval. Because the entity is contract-driven, those shifts rarely trigger public filings unless the tax law status changes from disregarded to partnership or corporation. A corporation must file amended charters, restated bylaws, and sometimes proxy statements before any tweak takes effect. These extra steps preserve transparency but require founders to budget legal fees and time whenever strategy evolves. Entrepreneurs therefore weigh agility against paperwork, asking whether rapid pivots or premium valuations matter more to long-term vision. Many founders speed this up through online legal services that automate document updates.

How LLCs and Corporations Are Taxed in 2025

Even the strongest liability shield falls apart if taxes drain cash. Understanding how each structure reports income, pays levies, and treats owner draws is essential for planning. The next sections unpack the latest rules so you can model cash flow, investor returns, and audit exposure, then choose the vehicle that best aligns with expansion budgets and long-term tax purposes.

Form Your LLC with ZenBusiness

Choosing LLC over a Corporation? ZenBusiness helps you register your LLC quickly and stay on top of taxes and compliance.

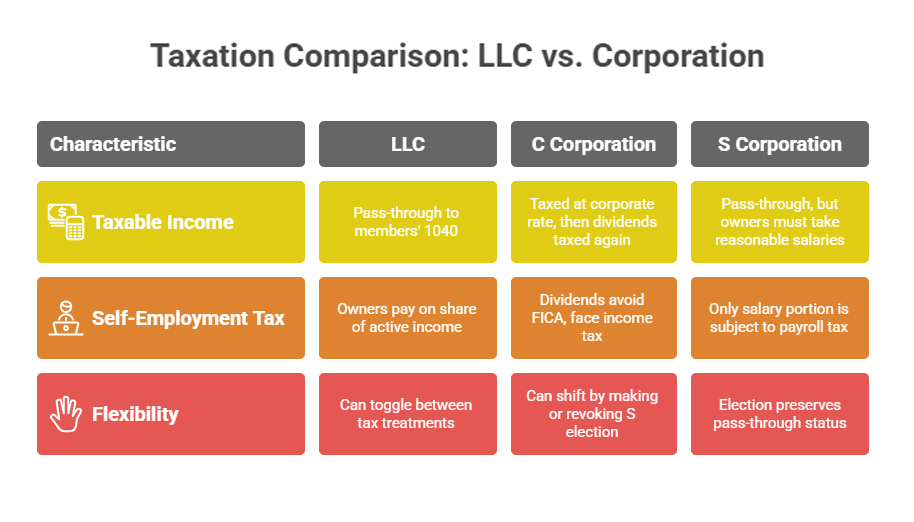

Pass-Through Taxation for LLCs

By default an LLC is a pass-through entity, meaning the company itself never pays federal income tax. Instead, the business calculates taxable income on Schedule K-1 and pushes the numbers to each member’s 1040. Members then pay at individual marginal rates, even if cash stays inside. This arrangement avoids entity-level tax and lets owners use losses to offset outside wages or portfolio dividends (subject to basis and at-risk limits). States generally follow the same model, though a few levy minimum franchise fees. Because payments ride on personal returns, owners must plan quarterly estimates, yet they also bypass double taxation and may claim the qualified business-income deduction when thresholds are met.

Double Taxation in C Corporations

A C corporation faces double taxation because profits are taxed twice—first at the corporate rate when earned, then again at the shareholder’s rate when distributed as dividends. The current federal corporate income tax is 21 percent, and states add zero to twelve percent on top. Qualified dividends then flow to Form 1040 and attract capital-gains or ordinary rates depending on holding period. Retaining earnings defers the second hit but may trigger an accumulated-earnings tax if totals exceed reasonable business needs. On the upside, reinvested profits compound inside the entity without hitting owners’ quarterly estimates, a feature high-growth teams use to fund R & D, marketing, and equipment.

S Corporation Election for LLCs and Corps

Both structures can ask the internal revenue service to treat them as S corporations. The election preserves pass-through status but limits owners to 100 U.S. shareholders and one class of stock. Working owners must draw reasonable salaries subject to payroll tax, while leftover profit passes free of self-employment tax. The election is due within two months and 15 days of formation—or anytime with late-relief—and is revocable if the company later prefers C-corp optics.

Self-Employment Taxes and Owner-Salary Rules

In a default multi-member LLC, owners owe self-employment taxes—15.3 percent combined Social Security and Medicare—on their share of active income up to annual wage caps. Electing S-corp status can cut that bill because only the salary portion is subject to payroll tax, but the IRS watches for artificially low wages. Corporate dividends avoid FICA entirely yet face corporate and personal income tax layers. Solo founders typically switch to S-corp treatment once net profits top roughly $80,000, when payroll-tax savings exceed accountant and software costs.

Which Structure Offers the Best Tax Flexibility?

True flexibility depends on your profit margin, reinvestment horizon, and personal tax rate. An LLC can toggle among disregarded, partnership, S-corp, or even C-corp treatment without changing its charter, allowing founders to retool as income grows. A corporation can only shift by making or revoking an S election, but it gains easier access to foreign-tax credits, qualified small-business-stock exclusions, and public listings. Model both scenarios over five years; if most earnings stay inside, the C-corp may win, whereas frequent distributions usually favor the LLC path.

Personal Liability and Asset Protection

Entrepreneurs often fixate on taxes, yet overlooking personal liability can sink a company faster than any IRS bill. This primer shows how each entity shields—or exposes—your savings, home, and retirement funds. Master the rules now so you can sign contracts, hire staff, and scale with full knowledge of what’s truly at stake.

What Kind of Liability Protection Each Structure Offers

Both an LLC and a corporation create statutory walls, but the thickness differs. An LLC’s shield is contractual and hinges on solid books, while a corporation’s barrier rests on century-old precedent. Grasping the nuances of each liability protection helps founders choose the right armor before vendor disputes escalate.

- An LLC treats members as separate legal entities, so most creditors stop at the company bank account.

- Corporate formalities and legal requirements add paperwork, yet those layers deter plaintiffs because officers rarely end up personally named.

- A sole proprietorship has no barrier at all—every business debt instantly reaches the owner’s entire net worth.

Choose wisely, because switching structures after litigation begins is virtually impossible.

When the Corporate Veil Can Be Pierced

The statutory wall is not magical. Courts can ignore it if founders blur accounts, under-capitalize the venture, or commit fraud. Knowing the triggers lets you preserve the shield and protect future business income.

- Failing to file annual tax returns or pay franchise fees signals neglect and invites judges to treat the entity as a sham.

- Mixing payroll and household bills shows disrespect for separateness, exposing owners to individual tax assessments and personal judgments.

- Signing contracts under your own name, not the entity’s, creates implied guarantees that can bankrupt diligent founders.

Treat the entity as a distinct legal persona every day, and the veil stays intact.

Ongoing Compliance and Legal Obligations

Forming an entity is the prologue; staying compliant is the real story. Each business structure carries its own calendar of reports, fees, and legally mandated signatures. Map those obligations early, or face late-payment penalties that dwarf the original filing cost.

Annual Reports, Fees, and Filings by Entity Type

States monetize oversight through predictable paperwork. LLCs often submit lean statements, while corporations deliver fuller disclosures. Missing a deadline triggers fines, suspension, or forced dissolution, so tracking due dates for employment taxes and related levies keeps the company legally alive and credit-worthy.

- LLCs file short forms and pay modest state filings fees—often under $100—unless they opt for series or foreign registrations.

- Corporations remit franchise levies, submit balance-sheet snapshots, and attach a signed tax return summary in states like California and Illinois.

- Both structures maintain agent addresses, but only corporations disclose directors and list new-issue registration fees.

Automated calendar alerts prevent tiny oversights from ballooning into administrative cancellations.

Required Meetings and Formal Documentation

Internal governance matters as much as state filings. LLCs log decisions flexibly, while corporations memorialize every vote in corporate minutes that withstand audits and M&A scrutiny.

- LLCs track shifting capital accounts to record member contributions, reallocations, and buy-sell events.

- Corporations store signed board resolutions to validate option pools, loans, or major contracts.

- Both entities archive timestamped meeting agendas and signature pages in encrypted vaults for investor inspections.

Keep PDFs sortable and e-signed; regulators accept digital records as long as timestamps remain intact.

Differences in State-by-State Requirements

Beyond federal oversight, each jurisdiction adds quirks. Nexus thresholds, publication mandates, and privacy laws vary, changing how entities interact with federal income tax rules and local collectors.

- Delaware welcomes all business entities but charges steep franchise taxes on high share counts. If you’re considering the West Coast, our step-by-step on start an LLC in California covers Golden State specifics.

- Nevada values confidentiality; however, its strict foreign qualification rules still demand annual officer lists and license renewals.

- Texas lets a single-member disregarded entity skip state income tax yet insists on public-information reports and a franchise fee.

Before expanding, price every state’s hidden levies, agent costs, and compliance hurdles so distant branches don’t siphon profits unexpectedly. To compare top jurisdictions, check our analysis of the best state to form an LLC.

Raising Capital and Attracting Investors

Bootstrapping works until growth goals outpace cash. Whether you need seed money or a nine-figure IPO, entity choice shapes terms, valuations, and the perceived risk of outside investment. This section shows how structure steers the funding pipeline so paperwork never blocks your financing roadmap.

Can LLCs Issue Stock?

LLCs cannot issue stock in the corporate sense, but they can sell membership units that mimic equity and offer profit-interest bonuses. Because units lack statutory clarity, each agreement must define rights in detail, slowing diligence. Investors still gravitate toward c corp shares that fit standard cap-table software and Delaware precedent. An LLC aiming for big checks can form a holding corporation or convert via statutory merger—re-calculating basis, honoring capital accounts, and filing fresh certificates with the state and SEC. A well-timed conversion instantly unlocks SAFEs, warrants, and option pools.

Why Venture Capital Favors Corporations

Institutional funds chase scale and liquidity, both easier inside corporations engineered for preferred stock classes, drag-along rights, and ratchets. Limited partners also value Delaware’s chancery precedents, which clarify fiduciary duties and expedite disputes. Because standard charters spell out participation caps, liquidation waterfalls, and voting thresholds, lawyers can model returns quickly, slashing diligence costs. These legal comforts support the multi-round funding ladders that high-growth SaaS startups need before profitability, making the corporate form the default on Sand Hill Road.

Investor Perception and Scalability Factors

Angel groups weigh control rights, growth horizons, and resale appetite. A corporation’s linear share tree maps neatly onto option pools and IPO waterfalls, boosting exit strategy clarity. LLCs can woo capital by issuing preferred units or convertible notes, yet every tweak adds tax complexity and legal bills. Founders must decide whether savings on franchise taxes now outweigh friction later when courting mezzanine debt, crowdfunding, or underwriters. Whatever the choice, a transparent capital roadmap reassures backers that the vehicle matches the journey ahead.

Can You Convert Between an LLC and a Corporation?

Switching structures isn’t just paperwork; it rewires cash flow, control, and income taxes in one filing. Most states now allow statutory conversions that shift assets and liabilities in a single step, sparing founders from dissolving the old entity and re-issuing contracts.

- A limited liability partnership can merge into an LLC first, then convert, trimming stamp-tax exposure for professional firms.

- Filing fees range from $0 in Colorado to $500 in Texas, plus any employment tax clearance letters the comptroller demands.

- Post-conversion, shareholders receive stock for units, triggering a capital-gain calculation on their personal income unless treated as tax-free under IRC §368.

Because conversions reset charter dates, lenders may require updated opinions and lien searches. Vet every real estate deed, software license, and insurance policy so counterparties recognize the successor without renegotiation. When timed before a financing round, the move lets founders align governance with investor expectations.

Pros and Cons of LLCs vs. Corporations

Choosing a wrapper is easier when you see both sides of the ledger. This comparison highlights operational friction, fundraising potential, and pass-through taxation benefits so you can rank what matters most right now.

LLC: Advantages and Limitations

LLCs thrive on contractual freedom, letting members draft bespoke rules that would give securities lawyers heartburn in a public company. That flexibility can slash legal bills during pivots and keep decision cycles brisk.

- No cap on flexible ownership classes, enabling sweat-equity deals with contractors.

- States like Wyoming waive the series LLC publication cost, lowering barriers for property investors.

- Many jurisdictions levy only a trivial franchise tax, freeing cash for marketing rather than compliance.

Still, banks may hesitate to extend large credit lines without audited statements, and some investors demand a corporate parent before wiring funds. A single-member LLC can feel too closely tied to the owner, raising continuity questions if illness or divorce intervenes.

Corporation: Strengths and Weaknesses

C-corps shine when the game plan involves institutional money, stock-option pools, or an eventual NYSE listing. Their governance script reassures outsiders who want predictable veto rights and airtight fiduciary standards.

- Formal corporate governance separates board oversight from daily management, reducing key-person risk.

- Employees prize liquid stock options they can track in brokerage accounts and exercise on clear tax timetables.

- The promise of public listing supports higher valuations because shares can reach global markets.

Downsides include two layers of tax and statute-driven rigidity. Founders must maintain minutes, officer rosters, and audit trails even when juggling holiday-season sales. Yet disciplined record-keeping often lifts shareholder value, especially in M&A talks where clean books trim due-diligence time.

FAQs – Understanding LLC vs. Inc. in Practice

Pros get tripped up by details, and rookies don’t know what to ask. These quick answers tackle the most common misconceptions so your registered agent never forwards an unwelcome surprise.

What’s Better for a Small Business: LLC or Inc.?

The best choice hinges on growth plans. An LLC fits most service firms because setup is cheap and profits flow straight to owners’ 1040s. Corporations excel when equity financing is essential or when founders foresee going public. If your firm will stay family-owned and local, the LLC’s simplicity beats a corporate stack designed for small business unicorn hunting.

Can an LLC Become a Corporation Later On?

Yes. All 50 states allow statutory conversion or a merger into a new corporation. Both shift assets and liabilities without dissolving the original entity, though each triggers filing fees and possible tax events. Electing S-corp status first can soften the sting for pass-through owners, but you’ll still need an attorney to draft the entity conversion plan and update bank accounts.

Which Is Better for Tax Purposes?

If owners want salary plus dividends, a corporation may lower overall tax advantages once profits top roughly $300K. Below that, LLC pass-through rules often save money by avoiding double tax and enabling the qualified business-income deduction. Model five-year projections—including self-employment levies and Section 1202 stock gains—before locking into one path.

Do Both Structures Require a Registered Agent?

Absolutely. States mandate a domestic address where lawsuits and compliance mail can land. Many founders hire a commercial service for privacy and guaranteed business-hour availability. Pick a provider that scans documents the same day, forwards originals weekly, and renews automatically so a missed invoice never jeopardizes your entity’s compliance agent status.

Reliable Registered Agent Services from Harbor Compliance

Keep your business compliant with professional Registered Agent services you can count on from Harbor Compliance.