Want a fast verdict on a Vermont LLC name? Start with a “Contains” search in the SOS Business Services Portal, scan DBAs for look-alikes, and run TESS for live federal marks in your class. If conflicts pop up, swap in a more unique root word and re-search; otherwise proceed to reserve or file. The bullets below summarize the path, and detailed steps follow.

Vermont LLC Search – Why It Matters in 2025

Launching a limited liability company is exciting—but if your business name conflicts with an existing vermont business entity, your application could be rejected on the spot. That’s why a vermont LLC search through the Secretary of State’s business entity search tool is a must-do before filing.

1. Avoid Rejection by the Secretary of State

The Vermont Secretary of State won’t approve any name that’s already taken or too similar to an existing legal entity. Filing fees aren’t refunded, so skipping this check could cost both time and money. Using the state’s search tool protects you from rejections and delays.

2. Spot Trademark Conflicts Early

Just because a name is available on the state level doesn’t mean it’s safe legally. Many businesses forget to check national trademarks through the USPTO database before filing. Running both state and federal checks gives you a clearer picture of what’s actually safe to use—and what’s off limits.

3. Gain Insight Into the Competition

A vermont business entity search is more than a name check—it’s a way to research competitors. You can view company types, filing statuses, registered agents, and even principal office locations. This visibility helps you understand what’s already out there and position your brand more effectively. For deeper market context, this Vermont small business statistics report shares key data on local industries, employment, tax rates, and economic trends that can influence your business strategy.

4. Stay Compliant and Informed

Keeping track of existing business entities also helps when forming partnerships, verifying legitimacy, or tracking dissolved companies whose names may soon become available again. If you’re still deciding whether an LLC is the right choice for your venture, this guide on whether you need an LLC to start a business breaks down the pros, cons, and alternatives.

Understanding Vermont’s Business Search Tools

Vermont offers a free, state-run business entity search platform where users can quickly investigate name availability, view company records, and confirm business status. Whether you're forming a limited liability company, sole proprietorship, or any other type of legal entity, this tool is your go-to resource.

Express vs. Advanced Search Options

The Vermont Secretary of State provides two types of search modes:

- Express Search: Ideal for quick checks, this mode scans for names that contain the keywords you enter. It's best when you're looking for broad results or variations of your desired name.

- Advanced Search: Offers more control, allowing users to search by entity type, status, filing date, or municipality. It’s perfect for legal due diligence or when narrowing down specific matches.

Both tools are accessible without creating an account. However, users who sign up can save filings and track application statuses over time.

What Information You’ll Find

Each vermont business entity result includes:

- Entity ID and full business name

- Status (e.g., active, dissolved, reserved)

- Type (LLC, corporation, etc.)

- Filing or formation date

- Principal office address

- Registered agent name and contact info

These records are pulled directly from the Secretary of State’s official business registry. The database is updated in real time and remains free to the public.

For help with searches, contact the Vermont SOS Corporations Division at 802-828-2386 or email SOS.Corporations@vermont.gov.

Secure Your Vermont LLC Name with ZenBusiness

From verifying availability to filing with the state, ZenBusiness helps you form your Vermont LLC quickly and keep it compliant.

Step-by-Step: Running an Accurate Vermont LLC Search

Performing a vermont LLC lookup isn’t just about typing a name and hitting “enter.” To get reliable results, and avoid conflicts, you need to use the business entity search the right way. The Vermont Secretary of State’s database includes thousands of registered business entities, so filtering your results properly matters.

This step-by-step guide shows exactly how to use the state’s search tool to confirm if your business name is truly available. You’ll learn how to choose the right search mode, enter smart keywords, interpret your results, and avoid common mistakes that can block your LLC approval.

Step 1 – Open the SOS Business Entity Search Portal

Start your vermont LLC search by visiting the official Vermont Secretary of State’s Business Entity Search Portal. Here's the direct link to access it: Vermont Business Search Portal

The updated portal is mobile-friendly and features a single-page layout for both basic and advanced search options. Once you're on the page, you'll see a clean interface with these main input areas:

- Business Name/Record Number field

- Radio buttons to choose search type: Starts With, Contains (default), or Exact Match

- Dropdowns to filter by Business Type, Business Status, and Date of Formation

- Optional Advanced Search section for filtering by:

- Principal Name

- Filing Number

- Registered Agent Name

This is the official Vermont SOS tool to check business name availability or view existing LLC records.

Tip: Bookmark the page now, you'll likely return to it several times during the LLC formation process.

Step 2 – Choose Search Type and Filters

Once on the vermont business entity search page, your first task is selecting a Search Type. These control how closely the search results match your input:

- Contains (default) – Returns any business names that include your keyword(s) anywhere in the name. Best for initial searches.

- Starts With – Limits results to names beginning with your entered phrase.

- Exact Match – Only shows names that match your input precisely (case-insensitive).

Next, use the additional filter options to narrow your results:

- Business Type – e.g., Limited Liability Company, Corporation, etc.

- Business Status – Choose from Active, Inactive, Terminated, etc.

- Date of Formation – Filter businesses formed within a specific date range using the built-in calendar picker.

You can stop here for a broad search, or click “Advance Search” to unlock more precise filters:

- Principal Name – The person associated with the LLC.

- Filing Number – Unique ID for filed documents.

- Registered Agent Name – Useful for locating businesses tied to a particular agent.

This flexibility makes Vermont’s portal one of the most efficient for pre-checking name availability.

Step 3 – Enter Smart Keywords

To get the most accurate results from your vermont business entity search, how you enter keywords matters. The goal is to uncover any potential conflicts before you form your limited liability company.

Skip Designators and Filler Words

When typing your business name into the search tool, leave out terms like:

- “LLC” or “L.L.C.”

- “the,” “and,” or “a”

- Punctuation marks (like commas or periods)

These elements don’t affect name availability in Vermont. The state ignores them when evaluating business entity names, so including them may cause false negatives.

Use the Two-Pass Technique

- First pass: Enter a partial root of your name using the “Contains” search type. This gives you the broadest view of possible conflicts.

- Second pass: Refine your search using alternative spellings, plural/singular forms, or synonyms. This step helps confirm no close matches exist.

You can enter names in uppercase or lowercase, Vermont’s system is case-insensitive.

Step 4 – Interpret the Results Grid

After clicking “Search,” you’ll land on a results page similar to what’s shown here. Let’s break down what each part means so you can confidently decide whether your desired LLC name is available:

Key Columns Explained:

- Business Name – Clickable link. Opens detailed business info, including filing history and agent.

- Record Number – Unique ID assigned by the state. Helpful for official tracking or referencing.

- Business Type – Indicates entity type. Look for “Limited Liability Company” to compare accurately.

- Physical Address – Registered principal business address. Can help you check for location overlap.

- Status – Active/Inactive. “Active – In Good Standing” means the name is in full use.

If you see a direct match (like in this example):

- The name Green Mountain Bakery LLC is already taken and cannot be used again as-is.

- You’ll need to modify your proposed name enough to make it distinguishable (per Vermont’s name rules).

- Consider variations like:

- Green Mountain Baked Goods

- The Green Mountain Bakehouse

- Green Mountain Artisan Bakery

Remember: Minor changes like punctuation, spacing, or adding “LLC” don’t make a name unique in Vermont’s eyes.

Step 5 – Open the Entity Detail Page

If you click on a business name in the results list, you’ll open a detailed entity profile like the one shown here. This page gives you a complete overview of the business, including:

- Formation Date

- Business Status

- Physical Address

- Registered Agent & Principal Owner

- NAICS Code (Business Purpose)

- Filing History (e.g., Articles of Organization)

This is valuable when:

- You want to verify how recently a name was used (e.g., 2025 = still restricted).

- You need to avoid names used by similar businesses (same NAICS or city).

- You want to check if the owner or registered agent is linked to other entities (useful for legal, competitive, or compliance research).

Step 6 – Troubleshoot Edge Cases

Sometimes, even after multiple searches, you’re still unsure if your desired business name is safe to use. That’s when troubleshooting techniques, and human assistance, become essential.

Try Alternate Spellings and Variations

If your search returns no results, don’t assume your name is clear. Rerun your search using:

- Synonyms or root words

- Plural and singular forms

- Alternate spellings or abbreviations

- The Sound-Alike search filter (in Advanced Search) to catch names that sound similar

These steps ensure you don’t accidentally infringe on another vermont business entity with a confusingly similar name.

Still Not Sure? Contact the Secretary of State

If you’re unsure whether a business name is too close to an existing filing, especially a terminated one, contact the Vermont Secretary of State:

- Phone: 802-828-2386

- Email: SOS.Corporations@vermont.gov

Response time is typically under 24 hours, and getting written confirmation is worth the peace of mind before filing your vermont LLC paperwork.

Vermont Naming Guidelines & Distinguishability Rules

Choosing a business name in Vermont isn’t just about creativity, it must meet legal and structural requirements set by the Secretary of State. If your proposed name fails these guidelines, your vermont LLC filing will be rejected, even if no identical match appears in the business entity search.

Required Designators

Your name must include one of the following acceptable endings (designators) to indicate it’s a limited liability company:

- Limited Liability Company

- L.L.C.

- LLC

This signals your entity type and is required under Vermont law.

Prohibited & Restricted Terms

Some terms are not allowed in LLC names unless you have specific regulatory approval. These include:

- Prohibited Words: “Corporation,” “Incorporated,” or misleading words implying government affiliation.

- Restricted Words: “Bank,” “Trust,” “Insurance,” or similar terms that require additional licensure or review.

What Doesn’t Make a Name Unique?

Certain elements don’t count toward making your name distinguishable:

- Punctuation or spacing differences

- Use of articles like “a,” “an,” or “the”

- Plural versus singular (e.g., “Mountain” vs. “Mountains”)

To pass Vermont’s distinguishability rules, your business name must be truly unique in substance, not just appearance. If you’d like broader strategies for verifying LLC names across states, check out these steps to verify your LLC name.

What If Your Preferred Name Is Taken?

If your desired business name is already registered, or too similar to an existing vermont business entity,you still have options. Don’t give up on your idea just yet.

Modify the Name Strategically

To create a distinguishable version of your name, consider adding:

- A geographic term (e.g., “Green Mountain,” “South,” or “West”)

- A descriptive word (“Consulting,” “Solutions,” “Group”)

- A unique brand element (a made-up word or acronym)

These additions can help your vermont LLC stand apart while preserving your core identity.

Check for Recently Terminated Entities

Vermont protects the names of terminated businesses for up to two years. If a name you want is tied to a recently dissolved company, it might become available soon. Use the business entity search to monitor its status, or call the Secretary of State for updates.

Conduct a Trademark & DBA Search

Your name might also be registered as a trademark, DBA, or assumed business name, even if it doesn’t appear in the state registry. To confirm, search the following resources:

Additional Due Diligence – Trademarks, Trade Names, Domains

Before finalizing your vermont LLC, go beyond the state registry. A name that’s clear in the business entity search might still be protected by a federal trademark, local DBA, or even an active website domain.

Federal Trademark Check (USPTO)

Make sure to check the USPTO Trademark Database (TESS) to see if any existing trademarks are already using your business’ name or a variation of it. It’s an important move to protect your ideas and avoid an expensive rebrand.

Vermont Trade Name Lookup

In Vermont, businesses can register alternative names which are often known as DBA (doing business as) or assumed name. Check to see if your desired name is available using the Vermont Trade Name Lookup Tool.

If the legal entity is not the same, then a conflicting trade name could create legal risk or confusion in relation to your brand.

Domain Availability Search

Before finalizing your business name, check domain availability on websites like :

Secure the domain name that’s as similar to your LLC name as possible. When you’re consistent, you build trust and grow your online presence. Consider buying many domain extensions (.com.net.org) to protect a brand.

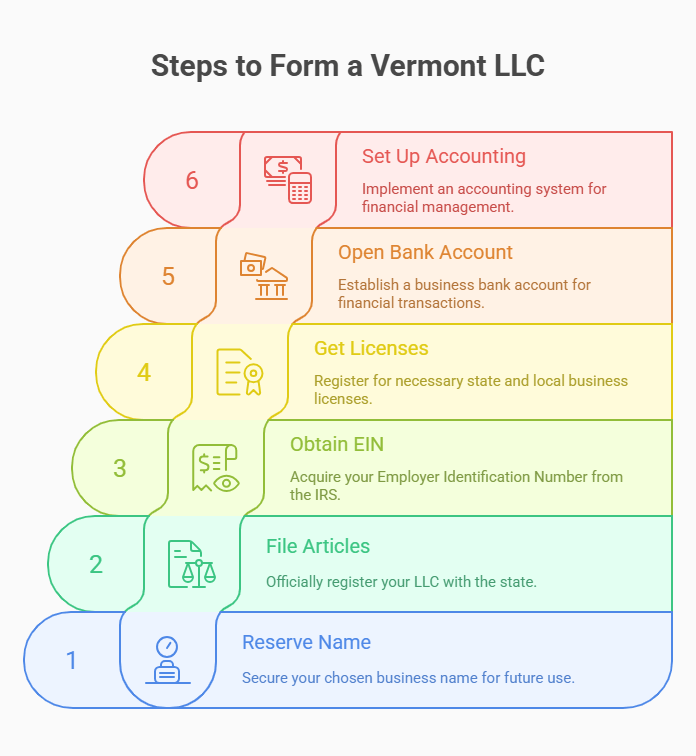

Next Steps After Name Availability

Once your vermont LLC name is confirmed as available, it’s time to move forward with formation. Vermont makes the process fairly simple, but knowing what to file—and when—can save you time and money.

Reserve the Name (Optional)

If you're not ready to file immediately, you can reserve your business name for $20. This holds the name for 120 days, and you can renew the reservation twice. It’s a smart move if you're still preparing documents, coordinating with partners, or waiting for approvals.

Submit your reservation online through Vermont’s Business Services Portal or by mail using Form CORP-1.

File the Articles of Organization

To officially form your limited liability company, file the Articles of Organization online or by mail:

- Filing Fee: $125

- Processing Time: 1–2 business days online, or 7–10 days by mail

- You’ll appoint a registered agent and provide a principal office address. If you’re looking for recommendations, this guide to the best registered agent services in Vermont compares top providers and pricing.

Online filing is done via Vermont’s BizFile Portal. Once approved, you’ll receive a certificate of formation.

Get Your EIN and Licenses

After your LLC is approved:

- Apply for an EIN (free) from the IRS website – see this EIN lookup guide if you need help

- Register for any state or local business licenses

- Open a business bank account

- Set up your accounting system and file for taxes if applicable

For a complete overview of the process, this full step-by-step guide to forming an LLC in Vermont covers everything from name reservation to filing your first reports. If you’d rather have professionals handle the paperwork, this review of the 10 best LLC services in Vermont rates top providers based on cost, speed, and reliability.

Northwest: Vermont Registered Agent You Can Count On

Protect your privacy and stay compliant with Northwest’s dependable registered agent service in Vermont.

Annual Reports & Ongoing Compliance

Forming a vermont LLC is just the beginning. To keep your business entity in good standing with the Secretary of State, you must meet Vermont’s ongoing compliance requirements, starting with the annual report.

Annual Report Filing Requirements

All Vermont LLCs must file an Annual Report every year between January 1 and March 31.

- Filing Fee: $35

- Where to File: Vermont Business Services Portal

- Details Required: Principal office address, registered agent information, and confirmation of current status

If the deadline is not met, there will be a late fee and you may lose your Good Standing status. Your limited liability company may get administratively dissolved if a report is not filed within six months.

Stay Organized Year-Round

To avoid missed filings:

- Set calendar reminders for January 1

- Keep your mailing address and agent details up to date

- Store copies of submitted reports in your digital records

If you stay compliant, it protects your legality, confirms your financiers and bankers, and avoids reinstatement hassles.

Frequently Asked Questions – Vermont LLC Search

If you are about to start the formation process or just want to clarify something before filing, the answers below cover the most common Vermont LLC search questions. Whether name reservation to annual reports, we’ve curated what you need to know – quickly.

How do I perform a Vermont business search to confirm name availability?

To confirm if your business name is available, visit the Vermont Business Entity Search Portal.

Choose “Business Name” as your search type and use the “Contains” option for broader results.

Omit terms like “LLC,” “L.L.C.,” and filler words like “the” or “and.”

Scan for active or reserved names that are identical or too similar.

If none appear, your vermont LLC name is likely available.

Is a Vermont name reservation required before filing an LLC?

No, reserving your business name is not required in Vermont. It’s completely optional, but helpful in some cases.

A name reservation costs $20 and holds your name for 120 days. You can renew it twice.

This option is ideal if you’re not ready to file your vermont LLC immediately but want to secure the name while preparing your documents or business plan.

What naming restrictions should I know?

Your Vermont LLC name must include a proper designator like “LLC,” “L.L.C.,” or “Limited Liability Company.”

You may not use the terms “Corporation,” “Bank” or “Insurance” without a license.

Names must be clearly distinguishable from one another (i.e., more than just different punctuation, addition of “the” or making the name plural must not make it distinguishable).

Your name will be rejected if it is too closely related to an existing Vermont business entity.

How long does Vermont take to approve an LLC?

Vermont typically processes online LLC filings within 1–2 business days.

Mail-in submissions usually take 7 to 10 business days.

At this time, Vermont doesn’t have expedited service, so plan accordingly.

Seasonal delays may occur, especially at year-end.

Check the Secretary of State’s website for real-time processing updates before you submit your paperwork.

To learn more about processing times, seasonal trends and tips for filing, see this guide on how long it takes to get an LLC in Vermont.

Does Vermont require annual or biennial reports?

Vermont requires all LLCs to file an Annual Report, not biennial.

The report is due every year between January 1 and March 31, and it costs $35.

If you miss the deadline, your vermont LLC could lose its Good Standing and face administrative dissolution after six months.

Filing is done online through the Vermont Business Services Portal.

- Vermont Legislature: 11 V.S.A. § 4005 — LLC Name Rules & Designators

- Vermont Secretary of State: Assumed Business Name (DBA) Filing

- Vermont Secretary of State: UCC Liens

- Vermont Secretary of State: Records Officer — Links to Business Search & UCC

- Vermont Department of Taxes: myVTax

- USPTO: Federal Trademark Search

- NASS: UCC Filings — State Portals Directory

- Vermont SBDC: Starting a Business

- U.S. Small Business Administration — Vermont District: Doing Business in Vermont

Looking for an overview? See Vermont LLC Services

Check & Claim Your Vermont LLC Name with Harbor Compliance

Harbor Compliance verifies your desired LLC name, files your paperwork, and manages compliance for your Vermont business.