Are you an international entrepreneur looking to tap into the U.S. market by forming an LLC from abroad? Wondering how to navigate state filings without a Social Security number? Curious which steps you must complete to legally own and operate a U.S. business entity as a non-resident?

To open an LLC in the USA as a non-resident, start by choosing your state of formation and a unique business name, then appoint a U.S.-based registered agent to accept official mail. File the Articles of Organization online or by mail and pay the state fee. Next, secure an EIN from the IRS using Form SS-4 (no SSN required) so you can open a U.S. business bank account. Finally, draft an operating agreement and, if necessary, register for state and federal taxes to maintain compliance without ever setting foot in the States.

In this guide, you’ll discover:

- How to select the best state and reserve your LLC name

- Steps to appoint a registered agent and file formation documents

- The process to obtain your EIN and open a U.S. bank account

- Key tax registrations and ongoing compliance must-dos

Ready to make your U.S. business dream a reality? Let’s dive into how to open an LLC in the USA as a non-resident!

Can a Non-Resident Open an LLC in the U.S.?

Yes—non-U.S. citizens can open llc entities in any state. Need a full walkthrough? Read our guide on how to start an LLC from anywhere in the world. You don’t need a Social Security number or American residency, only a compliant filing package and a U.S.-based registered agent. Because the LLC is a separate legal person, it may own assets, sign contracts, and sue or be sued in its own name, giving international founders an immediate gateway to the world’s largest consumer market while shielding personal wealth.

Legal Eligibility for Foreign Entrepreneurs

U.S. company law welcomes global founders, but you must clear identity checks and appoint domestic contacts. Key eligibility factors include:

- Passport or government-issued ID for KYC verification

- U.S. foreign ownership box checked on state forms

- Registered agent with a street address in the chosen state

- Form SS-4 to secure an EIN after approval

U.S. sanctions screening also applies; avoid ties to blocked countries. Most states approve filings in two to ten business days. After formation, open a bank account, maintain clean books, and file annual reports to keep the shield intact.

U.S. Residency vs. Citizenship Requirements

Immigration status differs from tax status. No visa is required to join an LLC; any individual taxpayer worldwide may own units. Tax residency begins when you have effectively connected income or lengthy U.S. stays. Non-resident owners file Form 1040-NR and, if single-member, attach Form 5472 each year. Double-check treaty provisions—some countries cut withholding on dividends and income taxes, improving cash flow. If you later gain a U.S. visa, your personal filings change, but the LLC’s non-resident history stays on record for audits.

Best States to Form an LLC as a Non-Resident (Full Comparison)

State choice shapes fees, privacy, and tax exposure. To compare all your options, see our ranking of the best states to form an LLC for fee, privacy, and banking ease. While you can form anywhere, three jurisdictions dominate for remote founders, and two others suit companies with staff or warehouses. The snapshot below ranks best states on cost, compliance, and international banking acceptance.

Open Your U.S. LLC from Abroad with ZenBusiness

ZenBusiness makes it easy for non-U.S. residents to form an LLC in any state—no U.S. address or citizenship required.

Delaware – The Legal Standard for International Investors

Delaware’s Court of Chancery and flexible statutes make it the gold standard for cross-border deals. If you want step-by-step help, follow our guide to start an LLC in Delaware. Benefits include:

- business friendly case law with quick injunctions

- Flat $90 filing fee and predictable $300 franchise tax

- Anonymous ownership via third-party agents

- Easy conversion to C-corp for venture funding or IPO

- International banks often whitelist Delaware LLCs for correspondent accounts

The state also supports series LLCs, letting e-commerce sellers silo risk without extra filings. Delaware agreements remain enforceable even when all members live abroad.

Wyoming – Maximum Privacy and No State Income Tax

Wyoming offers rock-bottom fees and unmatched confidentiality. For details on Wyoming’s process, check out how to launch an LLC in Wyoming. Highlights:

- $100 formation and $60 annual report—no franchise tax

- Nominee managers permitted, shielding owners’ names

- Charging-order protection for single-member LLCs

- Lifetime proxy options to mask day-to-day control

- No requirement to list a physical address for members

The legislature updates statutes yearly for digital-asset and DAO trends. You may later domesticate into Delaware without triggering capital-gain tax, but some East-Coast banks still require an in-person visit.

New Mexico – Anonymous LLCs with No Annual Reports

New Mexico excels for owners seeking true anonymity at minimal cost:

- $50 filing fee and zero annual reports or franchise taxes

- No member or manager names on public record

- Foreign qualification rarely required unless assets move into other states

- Secretary of State processing in under three days

- No annual fees while you maintain compliance

Banking is improving: several fintechs now whitelist New Mexico LLCs, though institutional investors may prefer Delaware precedent. To understand the differences between foreign and domestic LLC filings, read our comparison.

Florida & Texas – Popular Alternatives for Active Businesses

Florida and Texas attract founders with staff, warehouses, or frequent U.S. travel:

- Florida: $125 formation, tourism economy, and Latin-American trade links

- Texas: $300 filing, flexible business address, and no income tax under $2 million revenue

- Texas margins tax kicks in above that at a 0.375 % tax rate

- Both states host major airports and talent pools

Both jurisdictions offer grants and foreign-qualification paths if you keep a Delaware holding company. If Texas fits your model, see our step-by-step on how to form an LLC in Texas.

How to Choose the Right State Based on Your Business Model

Digital-only brands gravitate to Wyoming or New Mexico for low friction, while VC-bound startups default to Delaware. Inventory or staff usually dictate formation in the fulfillment state to avoid dual filings. Always map privacy, banking, and tax advantages to your five-year plan. Seasoned founders build a matrix scoring each jurisdiction on fees, banking ease, and legal predictability before pulling the trigger.

Step-by-Step Process to Register a U.S. LLC from Abroad

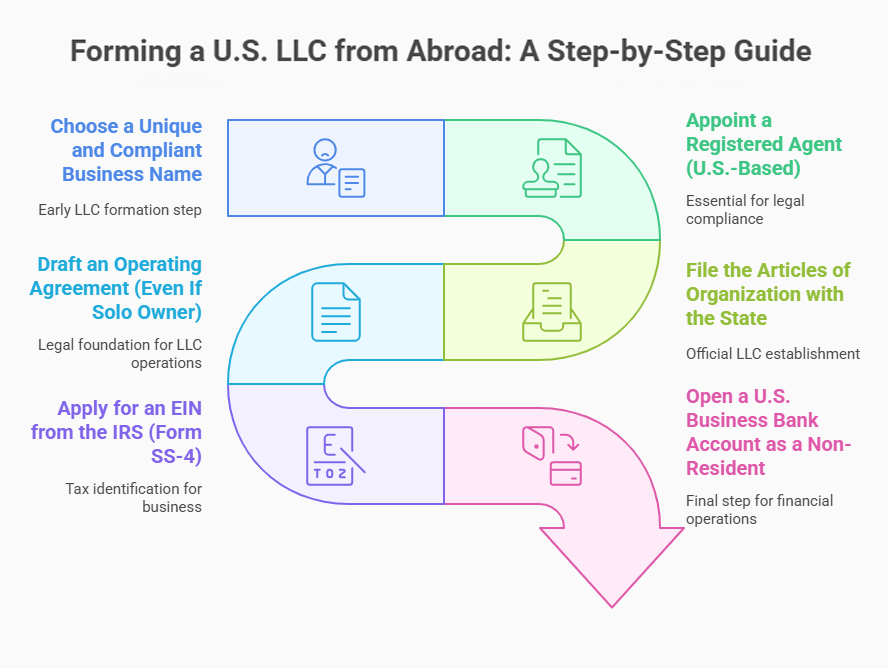

Forming remotely involves six clear steps. Follow them in order to lock down name rights, pass state reviews, and open accounts without a flight. Each action below ticks standard form an llc checklists; save PDFs for later bank and processor audits.

Step 1 – Choose a Unique and Compliant Business Name

Search state databases and USPTO records; your name must include “LLC” and avoid restricted terms. Reserving early costs $10–$50 and blocks imitators. Use tools like Namechk for domain checks and double-check social profiles. Doing so protects branding and shields your business entity from cybersquatters. Need help defining goals? Check our advice on crafting your business purpose for LLC.

Step 2 – Appoint a Registered Agent (U.S.-Based)

Every LLC needs a registered agent with a street address in its state of formation. Commercial agents charge $99–$149 yearly, forward legal mail, and supply compliance calendars. Some bundle scanning and U.S. mailing addresses, easing KYC for payment processors and smoothing tax obligations deadlines.

Step 3 – File the Articles of Organization with the State

Submit the state’s online form, pay $50–$300 in fees, and list your agent plus management mode. For a full breakdown of every fee, read our guide to LLC cost. Many portals accept cards and issue certificates instantly. Provide a physical address for public record; correct nexus data prevents tax misallocation. Some states offer same-day service for a surcharge—handy when you need an EIN fast. Keep stamped PDFs for Stripe or PayPal onboarding.

Step 4 – Draft an Operating Agreement (Even If Solo Owner)

Banks and partners expect a signed operating agreement outlining capital, voting, and dissolution terms. Include indemnification and dispute-resolution clauses to reinforce liability protection. International co-founders can sign via e-signature with notarized apostilles, validating the document abroad.

Step 5 – Apply for an EIN from the IRS (Form SS-4)

Fax Form SS-4 or call the IRS’s international line to obtain your employer identification number. An EIN unlocks banking, payroll, and payment gateways. Use a courier-friendly address or authorize your agent via Form 2848, and remember that this number doubles as your taxpayer identification for state filings.

Step 6 – Open a U.S. Business Bank Account as a Non-Resident

Traditional banks often require an in-person visit plus two IDs and proof of the business bank account owners. Fintechs like Mercury or Wise accept video calls and passports. Bring the certificate of formation, EIN letter, and operating agreement. Some institutions also ask for a U.S. address or utility bill—confirm requirements before boarding a flight. In a hurry? Learn how to launch an LLC without a business plan and get started fast.

Tax Requirements for Non-Resident LLC Owners

Navigating U.S. tax laws can feel daunting, yet the rules are clear once you split federal from state duties. The table below shows the typical annual costs a non-resident faces—from IRS disclosures to franchise levies—so you can budget confidently before revenue lands.

| Compliance Item | Due Date | Typical Cost |

|---|---|---|

| Form 5472 + pro-forma 1120 | Apr-15 | $0 filing, $25k late penalty |

| Form 1065 + K-1s (multi-member) | Mar-15 | CPA $500–$1,200 |

| State annual report | Varies | $0–$500 |

| Franchise tax (e.g., DE) | Jun-01 | $300 flat |

| Registered-agent renewal | Anniversary | $99–$149 |

Federal Tax Responsibilities (Form 5472, 1040-NR)

Every foreign-owned single-member LLC must file Form 5472 with a pro-forma 1120, while multi-member entities submit an informational tax return on Form 1065 and issue K-1s to each owner. If the LLC has U.S.-sourced income, owners also file Form 1040-NR and pay any withholding. Form 5472 is due April 15; Form 1065 by March 15. Penalties start at $25 000 for late 5472s, and interest accrues on unpaid balances. Foreign owners without withholding agents can pay electronically via the IRS EFTPS portal to avoid paper delays.

State Taxes – Income, Franchise, and Sales Tax

States impose their own tax rates on income, franchise, and sometimes gross receipts. Delaware charges a flat $300 franchise tax; Wyoming asks $60 based on in-state assets. California adds an $800 LLC fee plus income tax on California-sourced revenue. Register with each state’s Department of Revenue early—penalties can exceed the tax when you delay. Registering for sales tax may trigger income-tax nexus even without a warehouse. Use software like TaxJar or Avalara to monitor thresholds—especially after $100 k in revenue or 200 transactions. Some states levy gross receipts taxes when margins are slim, so model those costs before choosing fulfillment hubs.

Tax Treaty Benefits and Withholding Rules

Tax treaties curb double taxation by capping withholding on dividends, interest, and royalties—often to 0 % or 5 %. Claim benefits via Form W-8BEN and note treaty articles on your 1040-NR. Treaties rarely override Form 5472, but they can eliminate branch-profits tax if the LLC elects corporate status. Treaties also influence portfolio-interest exemptions, possibly erasing withholding on cross-border loans. Keep residency certificates on file; many states require them to honor reduced rates. If your country lacks a treaty, consider a holding entity in a treaty jurisdiction and document substance to preserve relief.

When You Need to Hire a U.S. Tax Professional

Multi-state sales, U.S. real estate, or payroll signal time to seek guidance on complex tax implications. A cross-border CPA can obtain ITINs, e-file Form 5472 attachments, and prepare composite state returns. Expect annual fees of $800–$2 500—small compared with five-figure penalties or frozen bank wires. Their insight often pays for itself by uncovering deductions and avoiding nexus traps.

U.S. Compliance Rules for Foreign-Owned LLCs

Forming the company is only step one; staying compliant keeps banking channels and visas open. This section outlines the documents, due dates, and filing fees non-resident owners must track. Missing even one filing can freeze merchant accounts or block future visa applications.

Annual Reports, Franchise Taxes, and Due Dates

Most states require an annual or biennial report listing managers, a mailing address, and the registered agent. Fees range from $20 in Colorado to $500 in Massachusetts, plus any state tax return for franchise or margin tax. Key tasks include:

- File the state report by the anniversary month

- Pay franchise or margin taxes, even at break-even

- Renew the registered-agent contract

- Update BOI if ownership changes 25 %+

Spam filters swallow state reminders—use calendar alerts. Two missed reports can place the LLC in delinquency, blocking bank wires and Amazon seller accounts. Reinstatement means catching up fees, filing multiple years, and waiting weeks for good-standing certificates.

BOI Reporting Requirements Under the Corporate Transparency Act

Beginning 2024, every legal entity must file a Beneficial Ownership Information report within 30 days of formation. Provide passport data, residential address, and control percentage for each owner; updates follow any change in 30 days. FinCEN keeps data private, but fines reach $500 per day for lateness. Non-compliance can include criminal liability. FinCEN allows batch XML uploads—ideal for cap-table software—so automate filings and store the receipt PDF for audits.

Keeping Your LLC in Good Standing Year-Round

Create a compliance calendar covering state reports, IRS forms, and BOI updates. A cloud folder with stamped certificates and EIN letters helps a resident llc sail through bank reviews. Each quarter, confirm agent renewals and reconcile fees. Maintain separate books to avoid fund commingling, store digital minutes for big decisions, and update Amazon or FBA accounts with fresh report numbers. Back up critical docs in multiple clouds; replacing an EIN letter can take hours on the IRS line.

Key Benefits of Starting an LLC in the U.S. as a Foreigner

Launching a U.S. LLC unlocks advantages unmatched elsewhere. For global business owners the blend of credibility, flexibility, and protection is compelling:

- Limited liability shields personal assets from U.S. claims

- Dollar bank accounts accelerate Stripe and PayPal payouts

- A domestic address reassures North-American customers

- Flexible tax elections optimize pass-through or corporate rates

- Treaty network trims withholding and supports cross-border loans

- Early formation builds a record for future visa petitions

U.S. buyers trust domestic entities more than offshore corporations, boosting conversions. Stripe Atlas, Mercury, and Brex integrate with Delaware, Wyoming, and Florida registries, speeding approvals. LLCs can later elect corporate taxation to retain earnings for R&D, and holding IP in a U.S. LLC simplifies licensing with American partners. Combined, modest start-up costs turn into a launchpad for global scaling.

Common Pitfalls to Avoid When Opening a U.S. LLC from Abroad

Even seasoned founders stumble on U.S. logistics—wrong state, missing tax forms, or rejected bank KYC. Catching these errors early protects cash flow, secures merchant accounts, and keeps immigration options open. Use the checklist below to sidestep delays and launch smoothly.

Using the Wrong State Based on Business Type

Choosing Delaware by default feels safe, but if your SaaS runs servers in Oregon or you store inventory in California, you’ll pay to qualify twice. Filing articles of organization in a “cheap” state, then registering as a foreign entity where you actually operate, means double fees and extra annual reports. Match state law to your footprint: Wyoming or New Mexico for digital brands, the fulfillment state for e-commerce, and Delaware only when investors insist. Always confirm sales-tax nexus and shipping zones before you click “file.”

Issues with Bank Account Verification or Address

U.S. banks follow strict AML rules and often reject applications that list a PO Box or co-working space as the primary address. Bring a utility bill for the registered agent’s office and a government ID—no social security number required. Fintechs like Mercury accept passports via video call, but traditional banks still want an in-person visit and two forms of photo ID. Make sure the LLC name exactly matches paperwork, or automated systems will freeze onboarding. Budget a week for compliance checks before launching ads.

Missing IRS Reporting Deadlines for Foreign-Owned LLCs

Form 5472, Form 1065, and sometimes Form 1040-NR land sooner than you think. The IRS assesses $25 000 penalties for late filings, and the fine repeats each month until fixed. Mark March 15 for partnerships and April 15 for disregarded entities on your calendar, and send certified mail if e-filing fails. Pay estimated taxes on federal income tax quarterly if you have U.S.-sourced earnings—waiting for year-end can trigger interest and underpayment penalties. A $300 CPA review now beats a five-figure bill later.

Frequently Asked Questions – U.S. LLC for Non-Residents

Launching a company from overseas raises recurring questions about visas, costs, and paperwork. The concise answers below focus on practical steps and current regulations so you can move from idea to invoice without detours.

Can I form an LLC without visiting the United States?

Yes. A fully online process lets a foreign owned founder file in any state, appoint a registered agent, sign the operating agreement electronically, and request an EIN by fax or phone. Banks remain the sticking point: traditional institutions usually demand a U.S. branch visit, but fintechs such as Mercury, Relay, and Wise open accounts remotely after a video KYC. Expect to courier notarized passports for final verification and keep digital copies of all formation certificates for auditors.

Do I need a U.S. mailing address or phone number?

States require a registered agent’s street address, not yours. Formation services provide that, forward mail, and scan documents. Many online applications accept foreign phone numbers if they support SMS authentication. For commerce platforms or payment gateways that insist on U.S. contact details, virtual numbers from reputable business entities services (e.g., OpenPhone) work, provided you answer compliance calls promptly. Never use unverifiable VoIP numbers—banks will flag them as high-risk.

What’s the total cost to form and maintain a U.S. LLC as a non-resident?

Budget $50–$300 in state filing fees, $99–$149 for a registered agent, and $0 for the EIN if you apply directly. Annual upkeep ranges from $60 in Wyoming to $300 in Delaware, plus accountant fees for treaty claims and state filings. Add mailbox or virtual office costs if you need a public address for tax purposes. Plan on roughly $600–$900 the first year and $400–$700 thereafter.

Can a foreign-owned LLC hire U.S. employees or contractors?

Yes. Once the LLC has an EIN, it can register with federal and state labor agencies, issue W-2s or 1099s, and set up payroll withholding. Hiring staff may create nexus for real estate and income-tax purposes in that state, so register for unemployment insurance and withhold state income tax where employees reside. Use compliant onboarding platforms like Gusto or Deel to avoid I-9 and E-Verify pitfalls.

Is it better to use a lawyer or an online service for formation?

For straightforward e-commerce or consulting ventures, formation platforms handle filings in two days and cost a fraction of legal rates. However, if you’ll raise capital, issue preferred shares, or navigate industry licensing, a lawyer is worth the premium. Attorneys draft bespoke clauses, advise on franchise tax traps, and coordinate multi-state registrations. Many founders start with an online kit and engage counsel later for conversions or funding rounds.

U.S. Registered Agent for Non-Residents by Harbor Compliance

Harbor Compliance provides dependable Registered Agent service across the U.S. — a legal requirement for non-resident LLC owners.