Forming an LLC online is the fastest and most efficient way to establish your business legally, offering liability protection and tax benefits. By using online filing services, entrepreneurs can complete the entire registration process in just a few business days, avoiding paperwork delays and unnecessary costs.

To start an LLC online, select your state, file the Articles of Organization, pay the state fees, and obtain an EIN. Digital platforms streamline the process, making it easier to secure liability protection, manage compliance, and launch your business with confidence.

In this guide, we’ll cover:

- The benefits of online LLC formation over traditional methods.

- A step-by-step process to register your LLC online.

- Comparison of the best online LLC formation services.

Follow these essential steps to form your LLC efficiently and legally.

Understanding Online LLC Formation

Starting a limited liability company online has become a practical solution for business owners looking to streamline their registration process. By leveraging digital platforms, you can form an LLC in just a few business days, enjoying features like pass through taxation and liability protection. Whether you’re a sole proprietorship transitioning to a more robust business structure, or a busy entrepreneur seeking faster company registration, online LLC formation can be a time-saving and cost-effective path to officially launching your new venture.

Definition and Benefits of Forming an LLC Online

Forming an LLC online involves using digital services or state portals to register a domestic or foreign entity under your chosen jurisdiction. Compared to traditional paper filings, the online route reduces bureaucratic hurdles and speeds up registration timelines. Another advantage is centralized access to vital documents, including articles of organization, operating agreement, and federal identification details for income tax filing. Ultimately, establishing an LLC through online platforms offers professional convenience, cost savings, and simpler compliance, helping entrepreneurs quickly secure liability protection and solidify their legal entity status.-positioned you are to handle the transition.

Form Your LLC Online Fast

ZenBusiness streamlines the LLC formation process, helping you register quickly and hassle-free.

Advantages Over Traditional LLC Formation Methods

With the emergence of llc online platforms, forming your domestic entity has never been easier. Unlike the paper-heavy processes of old, online methods simplify tasks for both the state’s corporations division and individual business owners.

- Faster review time and fewer in-person visits

- Lower filing fees in some states

- Convenient tracking of business registration status

- Streamlined submission of all supporting documents

Overall, the digital process grants you greater control, making it more efficient to start an llc while keeping your personal assets shielded from potential liabilities.

Why Choose Online LLC Formation Services

Online LLC formation services specialize in guiding business entities through the entire process, from drafting your articles of incorporation to providing a registered agent service. They offer handy features like automated document preparation, compliance alerts, and state-specific guidance, making each business day productive. With this support, entrepreneurs can focus on growth areas like real estate investments or eCommerce while leaving compliance and administrative tasks to trained professionals.

How to Start an LLC Online

For many modern entrepreneurs, moving from concept to a legally recognized company is less daunting when using digital solutions. By tapping into streamlined websites and e-filing tools, business owners can avoid lengthy queues and mountains of paperwork. Additionally, platforms that accept credit card payments let you settle filing fees or formation filing fees swiftly, ensuring you meet deadlines without stress.

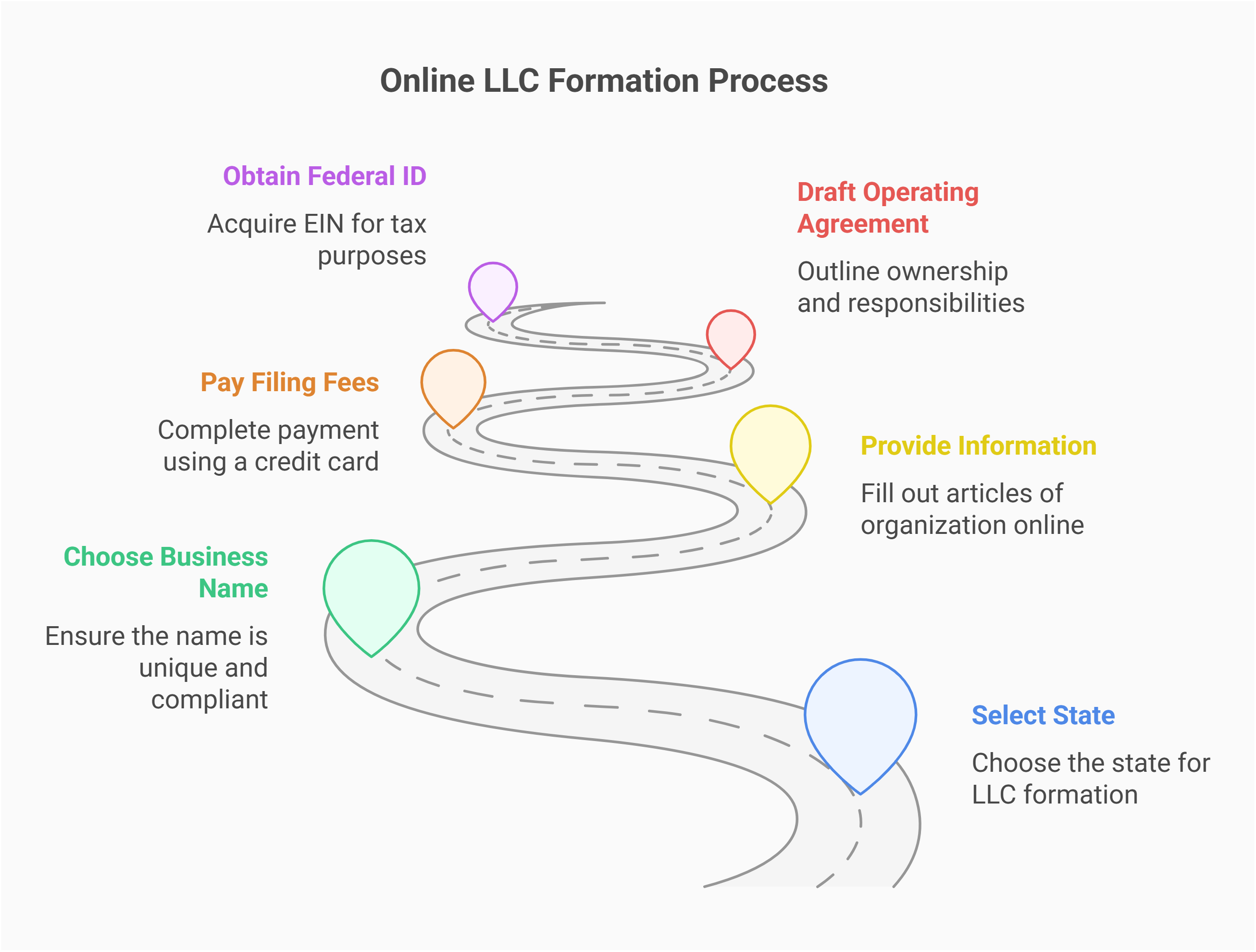

Step-by-Step Process for Online LLC Formation

Forming an LLC online can seem complex, but breaking it into clear steps helps. Below is the best approach to ensure a smooth experience:

- Select Your State: Begin by deciding where to establish your limited liability companies. If you’re looking to register a domestic entity, check local laws on filing fee and processing times.

- Choose a Business Name: Ensure it’s unique and compliant with state rules. Many states have name search tools on their corporations division sites.

- Provide Required Information: Fill out your articles (like articles of organization) through an online form. Have details like business structure and your registered agent service ready.

- Pay Filing Fees: Complete the payment with a credit card. Fees can range widely by state, so budget accordingly.

- Draft an Operating Agreement: This optional but recommended document outlines ownership, responsibilities, and how taxes (e.g., pass through taxation) are handled.

- Obtain Federal Identification: Visit the internal revenue service portal to get an EIN for your tax returns.

- Await Confirmation: After submission, states generally process your LLC in a few business days. You’ll receive an approval notice or certificate.

Once confirmed, remember to track renewal timelines, especially if your state imposes annual registration or ongoing compliance requirements.

Required Documents and Cost Considerations

When forming an LLC, you’ll need certain documentation and must plan for any associated filing fees:

- Articles of Organization: Legal paperwork detailing the LLC’s name, purpose, and members

- Operating Agreement: Outlines ownership, management, and responsibilities

- Federal Identification (EIN): Required for income tax reporting and opening a bank account

- Registered Agent Information: The person or service that receives official documents

Costs vary by state, so always check for state filing fees, potential publication expenses, and any costs an additional to expedited filings.

Filing Procedures and Best Practices

Different states have unique company registration rules, but standard steps can keep you on track:

- Check Name Availability: Before you start, ensure your chosen LLC name is free to use

- Review State Requirements: Confirm whether you must file articles of incorporation or a specialized LLC form

- Submit Early in the Week: This strategy often reduces wait times in state systems

- Use a Reliable Registered Agent Service: They handle legal notices to protect your personal assets. To compare top-rated options, explore the best registered agent services and choose one that fits your needs.

Adhering to these basics helps streamline the entire llc formation process.

How Long Does LLC Registration Take?

Depending on the state, most online LLC registrations finalize within 2–14 business days, although some states offer expedited processing for an extra fee. Factors such as high-volume business day filings or holiday schedules can affect this timeline. If you need a quick turnaround, pay close attention to each state’s business entities queue and consider optional rush services to speed things up.

Register Your LLC with Confidence

Northwest Registered Agent ensures a smooth online filing process while keeping your business compliant.

Comparing the Best Online LLC Formation Services

Choosing the right platform can make or break the efficiency of your online llc launch. To ensure a smooth process, check out reviews of the best LLC service before making your decision. Many popular service providers streamline the process, help handle compliance, and offer step-by-step guidance. Below is a concise comparison table of four reputable services—LegalZoom, Northwest Registered Agent, ZenBusiness, and Rocket Lawyer—to help you make an informed decision.

| Service | Pricing Range | Turnaround | Key Features | Overall Rating |

|---|---|---|---|---|

| LegalZoom | $0–$399 + fees | 7–30 business days | Brand recognition, add-on legal help | 4/5 |

| Northwest Registered Agent | $39–$179 + fees | 5–10 business days | Premium support, privacy focus | 4.5/5 |

| ZenBusiness | $0–$299 + fees | 5–14 business days | Flexible plans, worry-free compliance | 4.5/5 |

| Rocket Lawyer | $0–$349 + fees | 7–20 business days | Legal docs & advice, monthly membership | 4/5 |

Reviews and Ratings of Online LLC Formation Services

Below, you’ll find a comprehensive overview of top LLC formation services, updated for 2025. Learn about their strengths, user feedback, and how they might fit your real estate or consulting business model.

LegalZoom

A household name in the digital legal space, LegalZoom offers a streamlined process for forming an llc. Though base packages can start at $0 (plus state filing fees), add-ons for compliance alerts or faster processing may push costs higher. Users praise its brand familiarity and robust suite of extra legal products—from wills to business trademarks. Customer service, while dependable, sometimes faces volume spikes causing wait times. If you prioritize a well-known provider, LegalZoom remains a compelling choice for limited liability companies looking for proven track records and widely recognized support.

Northwest Registered Agent

Renowned for personalized customer care, Northwest Registered Agent stands out with its “Corporate Guides,” who assist with compliance and operating agreement queries. Packages begin at $39 plus state charges, covering essential steps like file articles of organization and providing a registered agent service at no extra cost for the first year. The platform emphasizes privacy, ensuring your personal assets remain separate from public records. While the pricing is mid-range, the level of one-on-one help is a major draw. If first-rate customer support and dedicated assistance matter, Northwest may be your top pick.

ZenBusiness

ZenBusiness’s tiered packages, starting at $0 plus formation filing fees, cater to a wide range of business owners. They offer basic features like EIN assistance and annual compliance monitoring, with more robust options available at higher tiers. Users appreciate the intuitive interface, transparent pricing, and quick turnaround—often within 5–14 days depending on your state’s volume. The company also focuses on socially responsible initiatives, drawing entrepreneurs who value ethical business practices. For a balanced approach combining affordability and feature-rich solutions, ZenBusiness is a strong contender in the online LLC space.

Rocket Lawyer

Rocket Lawyer differs slightly by bundling legal services with membership plans, making it cost-efficient if you need ongoing counsel. For entrepreneurs needing continuous support, exploring the best online legal services can provide comprehensive assistance. While they offer basic LLC formation starting at $0 plus state costs, advanced features—like extended lawyer consultations—require a paid monthly subscription. Users highlight the convenience of storing all documents (like articles of organization) in a single portal. Customer reviews note the advantage of having quick access to legal advice, especially for complicated business setups. For those seeking a year-round support system beyond just company registration, Rocket Lawyer might be worth the investment.

Free vs. Paid LLC Formation Services

By 2025, several platforms have begun offering “free” LLC setup, though you’ll still pay state filing fees. For those looking for cheap LLC formation, some platforms offer basic services with minimal costs, covering essential registration steps. This approach covers essential actions like drafting documents and verifying business names. Meanwhile, paid options bundle perks like priority processing, compliance notifications, and robust customer support. Balancing upfront savings with ongoing needs can guide your decision.

Below is a quick cost comparison chart:

| Service Type | Base Cost | Additional Features |

|---|---|---|

| Free | $0 + state fees | Basic filing, name check |

| Paid | $39–$300+ | Speedier filing, year-round support |

| Premium | $300+ | Legal advice, complex documentation |

How to Choose the Best Online LLC Formation Service

Selecting the perfect service depends on your budget, time constraints, and willingness to handle certain tasks yourself. For 2025, follow these guidelines to decide:

- Review Package Options: Compare base offerings and add-ons

- Check Turnaround Times: Ensure the timeline suits your needs

- Assess Customer Feedback: Look for testimonials highlighting reliability and support

- Evaluate Extra Features: Registered agent, compliance alerts, and more

This blend of factors helps you pick a service aligned with your specific priorities, whether that’s swift processing or comprehensive legal guidance.

State-Specific Online LLC Formation

While the general steps for llc formation remain similar nationwide, each state has unique requirements and filing fees. Before clicking submit on your e-application, review local laws to avoid rejections or hidden costs. Some states also provide helpful resources, streamlining tasks like drafting articles of organization or verifying your business entity name.

Texas LLC Formation Online

Forming an LLC in Texas is popular thanks to a robust economy and business-friendly climate. By 2025, most tasks can be done digitally with minimal business day delays.

- Choose a Name: Use the Texas Secretary of State website to check availability

- File the Certificate of Formation: Submit details online, pay the $300 filing fee

- Appoint a Registered Agent: Can be an individual or a registered agent service

- Draft an Operating Agreement: Not mandatory, but highly recommended

This process ensures your legal entity gains official recognition quickly.

California LLC Formation Online

In California, forming an LLC online requires meeting annual registration standards and paying attention to specific regulations. The typical steps in 2025 include:

- Select a Unique Business Name: Confirm name availability using the Secretary of State portal

- File Articles of Organization: Pay the standard $70 filing fees plus a $20 statement of information fee

- Appoint a Registered Agent: Must be available during standard business days

- Create an Operating Agreement: An official document detailing management structure

Keeping up with annual franchise taxes is also vital for ongoing compliance.

Delaware and New York LLC Formation Online

Delaware remains a global hub for private limited company setups, while New York has distinctive publication mandates. By 2025, the online processes for both states have become more streamlined:

- Delaware:

- Pay $90 to file with the Division of Corporations

- Consider additional maintenance fees for franchise taxes

- Typically used by tech or high-growth companies seeking strong legal precedents

- New York:

- Requires a notice publication in two newspapers

- Filing the Certificate of Publication costs $50

- Perfect for entrepreneurs focusing on local or international markets

Other States: Florida, Arizona, NJ, PA, and More

States like Florida, Arizona, New Jersey, and Pennsylvania also offer user-friendly e-portals. By 2025, each region has simplified tasks like verifying your business structure or paying minimal formation filing fees. General steps include:

- Florida: $125 filing cost, no major annual franchise tax

- Arizona: Publication requirement in some counties, $50–$85 filing

- New Jersey: Online services for $125–$150, annual report due every year

- Pennsylvania: $125 fee, add-ons for expedited processing

Regardless of location, always verify your legal entities remain compliant with local law.

LLC Formation Costs and Documentation

By 2025, online LLC formation fees can vary significantly. In many states, you’ll need to pay state filing fees (ranging from $50 to $500) plus any operating agreement drafting or expedited services you select. If you're operating in Louisiana, it's crucial to select the best registered agent in Louisiana to stay compliant with state regulations. Some states charge extra for name reservation or annual registration renewals. Also, note that real-time e-filing services often have convenience surcharges, so you might see a slight bump in filing fee costs.

When forming your LLC, expect to gather:

- Articles of Organization or equivalent state form

- Operating Agreement (optional, but recommended)

- Federal Identification details (EIN)

- Credit Card for paying any required business registration expenses

Below is a quick cost breakdown reference:

| Item | Estimated Range |

|---|---|

| State Filing Fee | $50–$500 |

| Registered Agent Service | $0–$150/year |

| Optional Name Reservation | $10–$50 |

| Operating Agreement Drafting | $0–$100+ |

| EIN Application (IRS) | $0 (DIY) |

Ensuring all documents are in order and fees are budgeted helps avoid delays and unexpected charges during llc formation.

Benefits and Advantages of Online LLC Formation

Opting to form an llc online can transform a traditionally slow process into a swift, user-friendly endeavor. Beyond speed, entrepreneurs gain clarity on each step, from paying state filing fees to finalizing articles of incorporation. This transparency allows them to focus on core tasks like building product lines or expanding a real estate portfolio.

Cost Savings and Operational Efficiency

Creating an LLC through digital services often leads to lower overhead expenses. With fewer manual filings and no need for physical trips to state offices, you cut out many hidden costs. This combination of remote accessibility and user-friendly portals boosts productivity, allowing you to finalize your LLC in a fraction of the time, saving you on both labor and resource allocation. As a result, you gain immediate relief from tedious paperwork and can pivot quickly into operational growth.

Tax Advantages and Liability Protection

By forming your LLC, you establish an official legal entity separate from personal finances, preventing business debts from spilling into your personal assets. For tax returns, the pass through taxation mechanism helps owners report profits and losses directly on their personal forms, avoiding double taxation common in some legal entities. You also maintain a strong protective barrier against lawsuits or creditors, ensuring your private finances remain safeguarded. Coupled with potential income tax deductions (like business-related expenses), an LLC structure bolsters financial confidence and fosters better wealth management over time.

Ease of Management with Digital Tools

Modern e-filing systems and compliance apps empower you to handle tasks like annual registration, certificate renewal, or operating agreement revisions all from one centralized hub. Some states even offer direct integration between their corporations division and private software, enabling real-time updates on status changes. This synergy decreases the likelihood of missing deadlines, encourages better record-keeping, and grants immediate access to documents on any business day. Overall, digital solutions simplify the administrative side of operations, boosting efficiency and helping you maintain a professional edge.

Tips and Best Practices for Successful Online LLC Formation

Launching an LLC online can be straightforward, but there are crucial steps to ensure everything goes smoothly. First, always confirm your chosen name complies with state guidelines. Second, gather essential documents—like your state’s required forms, proof of identity, and basic operating agreement details—well before you begin. This proactive approach helps avoid delays and unexpected fees.

- Assign a specific email account for all LLC-related correspondence

- Monitor your business days carefully to understand typical approval times

- Budget for any expedited or priority services, especially if you have tight deadlines

Lastly, consider using a registered agent service to guarantee you never miss important paperwork. By adhering to these best practices, you create a stable foundation for your private limited company or other legal entity type, paving the way for smooth growth and minimized liability.

FAQ: Frequently Asked Questions about Online LLC Formation

Below is a quick-reference FAQ to help you navigate the most common inquiries about forming an LLC digitally. These answers are optimized for direct, clear responses that align with the top search queries on online llc formation.

Forming an LLC online typically reduces administrative complexity and expedites the registration process. You can submit essential documents in a few clicks and often track status updates in real time. Many states offer secure e-filing systems that limit manual errors. Additionally, online services integrate features such as compliance alerts and draft templates for articles of organization or operating agreement. Overall, you save on travel, reduce paperwork, and enjoy faster processing while maintaining robust liability protection for your business.

Costs vary widely depending on state filing fees and optional extras like registered agent service or expedited processing. For a full breakdown of LLC cost across different states, review updated pricing structures before filing. Base expenses can start at around $50 in more affordable states, while pricier regions may charge $300 or more. Beyond the state fee, you might pay for name reservation, formation filing fees, or subscription-based help from legal platforms. It’s wise to budget for at least $200–$500, allowing you to manage potential add-ons without surprise costs and ensuring a smooth registration journey.

In most states, the online process can finalize within 2–14 business days, though states with higher filing loads might require more time. If you opt for rush handling, your approval could arrive in just a few business days—even the same day in rare cases. Keep in mind that holidays and weekends can extend the timeline. Planning ahead and submitting early in the week can help minimize delays, ensuring a swifter path to official LLC status and immediate liability protection.

In 2025, top contenders include Northwest Registered Agent and ZenBusiness, both praised for streamlined setups and strong customer support. LegalZoom remains popular due to brand recognition and expansive legal product offerings. Rocket Lawyer excels when you want ongoing legal advice through membership plans. Your choice ultimately depends on factors like budget, speed, and specialized features—such as compliance alerts or foreign qualification guidance. Reviewing user testimonials and third-party ratings will help you pinpoint the best service for your legal entity needs.

While specific rules differ by state, core documents typically include articles of organization or similar forms. You’ll also need details for your operating agreement, which outlines roles and responsibilities. Many states require basic information like your LLC’s name, registered agent contact, and membership structure. If relevant, keep payment methods (such as credit card) on hand to cover state filing fees. Obtaining a federal identification number (EIN) from the internal revenue service is also essential for opening bank accounts and managing tax returns.

When selecting a state, weigh factors like formation filing fees, ongoing annual registration costs, and local regulations. Some entrepreneurs prefer states with business-friendly statutes—such as Delaware for advanced corporate laws or Nevada for minimal income tax. If you operate primarily in one location, forming your LLC there can streamline compliance. Ultimately, you should consider filing in the state where your main activities occur to avoid extra reporting. Research each jurisdiction’s climate for private limited company or limited liability companies to ensure the best fit for your business goals.

Simplify Your LLC Formation Process

Harbor Compliance provides expert guidance for online LLC registration and compliance.