Are you debating between forming an LLP or an LLC for your business in 2025? Do you wonder which structure better suits your professional or entrepreneurial needs? Understanding the key differences can help you choose wisely.

LLPs are best for professional partnerships where individual accountability is key, while LLCs provide robust, flexible liability protection for a wider range of businesses. Choose based on your industry, ownership style, and desired tax treatment.

In this guide, you'll learn:

- Key differences in formation, management, and liability

- Tax implications and compliance requirements

- Pros and cons for various business types

- Expert tips for making the right choice in 2025

Ready to decide which structure aligns with your goals? Read on to unlock the secrets of LLP vs. LLC!

What Is an LLP vs. an LLC? (Quick Overview)

A limited liability partnership (LLP) and a limited liability company (LLC) are two business entities that offer flexibility, ownership protection, and operational benefits. Both separate owners from the organization to some degree, yet each one carries unique formation rules, liability provisions, and tax treatments. Understanding llc vs llp is crucial when designing a structure that aligns with your growth strategy, risk tolerance, and professional needs. In 2025, entrepreneurs typically weigh factors like management flexibility, legal requirements, and how each model impacts personal finances. Below, we dive into definitions and core distinctions to help you decide.

Definition of an LLP (Limited Liability Partnership)

An LLP is a specialized legal entity often favored by professionals—think accountants, architects, or attorneys—who operate under a collaborative business model. When you form an llp, each partner contributes resources while retaining some personal control over daily decisions. However, there’s a layer of limited liability protection that shields you from another partner’s malpractice or negligence. In many states, limited partners enjoy a distinct boundary that prevents them from paying out of pocket for the partnership’s liabilities or lawsuits. Yet, not all states permit an LLP for just any venture; some restrict it to professional services. Key to an LLP’s function is a clear partnership agreement, which stipulates how disputes, profits and losses, and management duties are divided. Generally, LLPs combine the simpler structure of a partnership with a partial liability safeguard.

Definition of an LLC (Limited Liability Company)

An LLC is a flexible business structure that blends aspects of corporate protection with partnership-level tax advantages. Once you form an llc, the company becomes a separate legal entity, meaning owners aren’t personally on the hook for the firm’s business debts. Whether you have one member or multiple, the LLC’s design typically includes an llc operating agreement detailing voting rights, distributions, and standard processes. It’s also recognized nationwide, making it accessible to a wide array of industries—from e-commerce startups to brick-and-mortar shops. In most jurisdictions, you file articles of organization with the state and designate a registered agent. This grants you corporate-like protection while maintaining pass-through taxation—much like a sole proprietorship—so your earnings remain simplified for tax purposes. As a result, LLCs are highly sought after by business owners looking for moderate complexity but robust asset protection.

Key Differences at a Glance

While both structures reduce exposure to unlimited liability, they differ in who can use them and how they operate:

- Who Can Benefit: LLPs are frequently reserved for professional services, while LLCs suit diverse endeavors, from local shops to online startups.

- Ownership: An LLP typically requires multiple partners, whereas an LLC can have just one member.

- Formality: LLCs often face uniform rules across states; LLP regulations can be more specialized.

- Management: In an LLP, each partner shares control; an LLC’s management structure can be member-managed or manager-managed.

LLP or LLC? Make the Right Choice

ZenBusiness helps you compare and form the best structure for your business needs.

Legal & Structural Differences

Selecting the right entity means understanding how state laws define each structure. For those uncertain about their long-term strategy, it is possible to form an LLC without a business plan, though careful planning is still recommended. LLPs and LLCs might sound similar, but they have varying formation processes, compliance norms, and liability rules. Below, we dig into each area.

Formation & Registration Requirements

In most jurisdictions, limited liability partnerships are established by filing a short form—often called a Certificate of LLP status—and then drafting a partnership agreement. Not all business types qualify for an LLP; states may restrict them to regulated fields. Conversely, creating an LLC typically involves articles of organization with your Secretary of State, plus designating a registered agent. This step transforms it into a recognized legal entities separate from the members. Certain states impose higher filing fees for LLCs, although this varies widely. Ensure you confirm local guidelines before finalizing your choice. If you plan to open a business in a different state, check jurisdictional rules to avoid compliance issues.

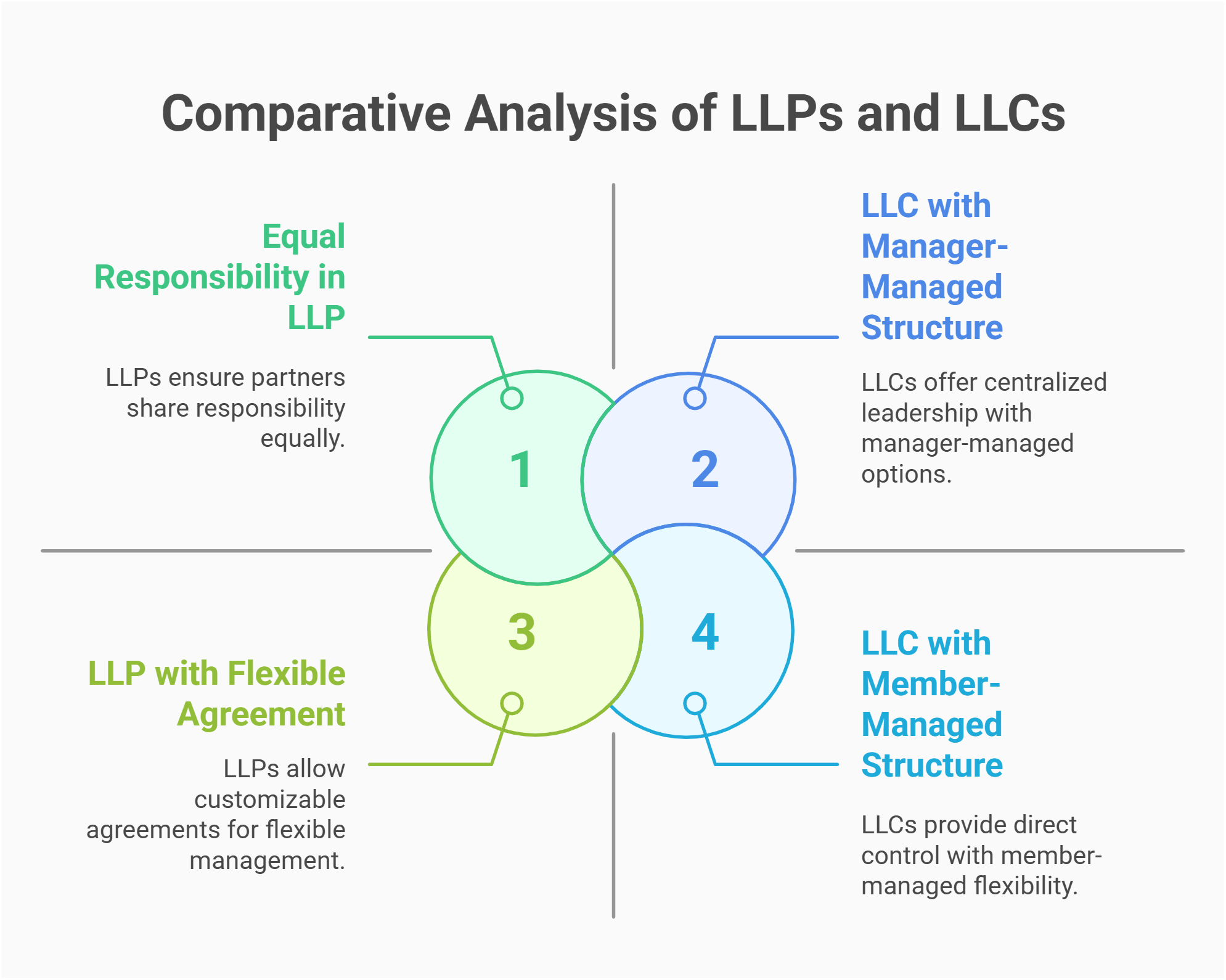

Ownership & Management Structure

LLP partners generally share responsibility equally, though you can tweak the arrangement through your agreement. Each partner can be hands-on daily or more passive, but the group collectively oversees operations. LLC members, by contrast, often adopt a flexible management structure. You can choose member-managed (all owners have direct control) or manager-managed (select individuals handle day-to-day tasks). This distinction can matter if you prefer centralized leadership. Another differentiator is that LLP partners remain collectively responsible for governance, whereas LLC members can delegate tasks more formally. The result is an environment well-suited for different leadership styles.

Ongoing Compliance & State Regulations

LLPs typically face fewer mandatory reporting rules, yet states can still require annual or biennial renewals. By contrast, an LLC must submit periodic updates like an annual report, pay any franchise taxes (where applicable), and maintain a valid registered agent. Noncompliance can trigger dissolution or revocation of the entity’s status. Each jurisdiction has specific LLC annual fees by state, so be sure to account for recurring costs. Because state laws vary, research local demands—some states impose more paperwork on LLCs, while others treat both entity types similarly. Regardless, schedule reminders for critical deadlines so you don’t accidentally lose your formation status.

Liability Protection – Who Is Personally Liable?

An LLP’s greatest perk is that no single partner is responsible for another partner’s wrongdoing—like malpractice—protecting personal finances if a colleague faces a lawsuit. Yet, the protection for each partner’s direct negligence can be more limited. On the other hand, an LLC typically shields all members from the entity’s obligations, unless they personally guarantee loans or commit wrongful acts. This robust barrier ensures personal houses, cars, or bank accounts are usually insulated from the company’s issues. While each state’s laws differ, an LLC’s liability shield is widely regarded as more thorough than that in an LLP.

Taxation: LLP vs. LLC

Tax implications can greatly influence whether you pick an LLP or LLC. Both can offer pass-through taxation, but there are nuances in self-employment taxes, income tax filings, and how the internal revenue service categorizes each entity.

Pass-Through Taxation & How It Works

For both structures, revenue typically passes directly to owners, who then pay personal tax on those earnings. Instead of the business paying a corporate rate, each owner reports their portion of profits and losses on their tax returns. This setup often appeals to smaller operations aiming to avoid double taxation. If you’re set up as an LLP, each partner is taxed on their share, while an LLC can opt for default pass-through or an S Corp election. Remember, “pass-through” doesn’t mean zero taxes; it just ensures that the entity itself usually doesn’t pay federal tax under standard circumstances.

Self-Employment Taxes & IRS Treatment

Partners in an LLP or members of an LLC may owe self-employment tax on their portion of net earnings. For an LLC, especially those filing as partnerships, all active members typically face this. However, some LLCs choose corporate tax classification (C Corp or S Corp) to lower self-employment burdens if the structure suits them. In an LLP, each partner is usually considered self-employed, subjecting them to Social Security and Medicare taxes. Ensuring you follow the correct classification and pay quarterly estimates to the IRS helps you stay in good standing with federal rules. Understanding the LLC tax rate is crucial for planning your financial obligations, as different classifications can impact overall liabilities.

Which Business Structure Offers the Best Tax Benefits?

Optimal tax strategies depend on your individual circumstances, but consider:

- LLC Advantage: Freedom to select an S Corp or C Corp status if it trims tax liabilities

- LLP Flexibility: Straightforward pass-through typically suits professional alliances

- Varying State Rules: Some states levy more on LLCs or partnerships

Neither entity type is universally superior for tax purposes; it truly depends on your revenue streams, the number of owners, and the complexity of your finances. Consulting a tax professional can pinpoint the best approach for your unique situation.

Expert Guidance for LLP vs. LLC

Northwest Registered Agent simplifies business formation with tailored advice on liability and compliance.

LLP vs. LLC: Pros and Cons

Choosing the right structure can shape your firm’s growth, legal safety, and daily operations. Below is a quick reference table on the upsides and downsides of each.

Advantages & Disadvantages of an LLP

A limited liability partnership often suits collaborative ventures, especially if each partner provides a specialized service. You enjoy partial protection that stops lawsuits tied to a co-partner’s negligence from jeopardizing your personal finances.

- Advantages:

- Minimal formalities compared to corporations

- Strong protection against your partner’s personal wrongdoing

- Typically less complex than an LLC for regulated fields

Yet the coverage might not be universal. Depending on the state, an LLP might not shield you from all acts—particularly if you’re the one at fault. Moreover, certain jurisdictions only allow forming an llc or a corporation for general businesses, limiting the use of LLP status. If you’re outside a licensed profession, you might find an LLP unavailable or cumbersome. Choosing the best state for an LLC can impact tax rates, regulatory burdens, and overall ease of operation.

Advantages & Disadvantages of an LLC

LLCs boast robust limited liability protections for their owners, ensuring that your personal assets typically remain safe from company debt or legal claims. Paired with the pass-through approach for tax return filings, it’s a favorite among entrepreneurs looking for a mix of easy compliance and risk minimization.

- Advantages:

- Adaptable structure (member-managed or manager-managed)

- Typically recognized in all 50 states, covering any industry

- Offers a crisp boundary between personal and business finances

On the downside, some states demand annual or semiannual fees, plus franchise taxes if your profits exceed a threshold. The complexity can be higher than an LLP in certain niches, especially if your business must maintain multiple licensures or operates across states. However, for broad usage, an LLC remains among the most popular picks in the U.S.

LLP vs. LLC: Which One Is Right for You?

Deciding between llc or llp isn’t a one-size-fits-all matter. Each has unique perks, from cost savings to extensive protective measures, so choose based on your field, liability concerns, and operational style. Below is a quick table summarizing suitable matches:

| Business Type | Ideal Entity | Key Reason |

|---|---|---|

| Freelance Professionals | LLP | Shared control, suits professional groups |

| E-Commerce & Online Startups | LLC | Strong liability barrier & easy compliance |

| Regulated Services (Medical etc.) | LLP (State permitting) | Typical requirement for licensed collaborations |

| Brick-and-Mortar Retail | LLC | Pass-through tax & straightforward name recognition |

Best Choice for Small Businesses & Startups

Most small shops or budding online ventures flourish under an LLC’s protective umbrella. This business entity is flexible about ownership, offering as few as one member or as many as you like. You can keep overhead low by structuring management yourself. Additionally, pass-through taxation means you’re not double-taxed if you maintain a single-member approach. For expansions, it’s easy to add members or transfer interest without rewriting everything from scratch. Considering these perks, an LLC often stands out as the simpler route for smaller outfits wanting moderate liability shielding.

Best Choice for Professional Services (Lawyers, Accountants, etc.)

For attorneys, CPAs, and licensed consultants, an LLP may be a better fit, assuming your state endorses it. Because it’s geared toward professional services, each partner shares control while limiting exposure to another’s mistakes. The structure is specifically tailored for synergy among specialized practitioners. However, keep in mind that certain states restrict who can register an LLP, so confirm your local rules. If legal complexities arise, consider reviewing attorney fees for creating an LLC to determine if professional assistance is necessary. If your profession or region bars LLPs, you might explore a professional LLC (PLLC) or similar alternative that grants comparable coverage and ease.

Best Choice for Real Estate & Investment Firms

Real estate partnerships often revolve around raising funds, distributing returns, and managing liability exposures. An LLC typically triumphs here, providing robust separation between personal finances and property-related hazards—like mortgage defaults or slip-and-fall cases. If you plan to hold multiple properties, forming multiple LLCs can help isolate risk. Still, in some cases—like certain hedge or private equity groups—an LLP structure might be used if you have numerous limited partners. The prime factor is whether you value simplified pass-through taxes, streamlined membership changes, and the capacity to adapt to shifting investor rosters.

Key Questions to Ask Before Making a Decision

Before finalizing your choice, evaluate these crucial points:

- Do state regulations limit your ability to pick one structure over another?

- Are you comfortable with pass-through taxes, or do you desire corporate taxation options?

- Is your industry heavily regulated, pushing you toward an LLP or PLLC?

- How many owners do you have, and do they want equal control or delegated roles?

By tackling these questions upfront, you clarify how each framework aligns with your operational style, financial outlook, and future ambitions.

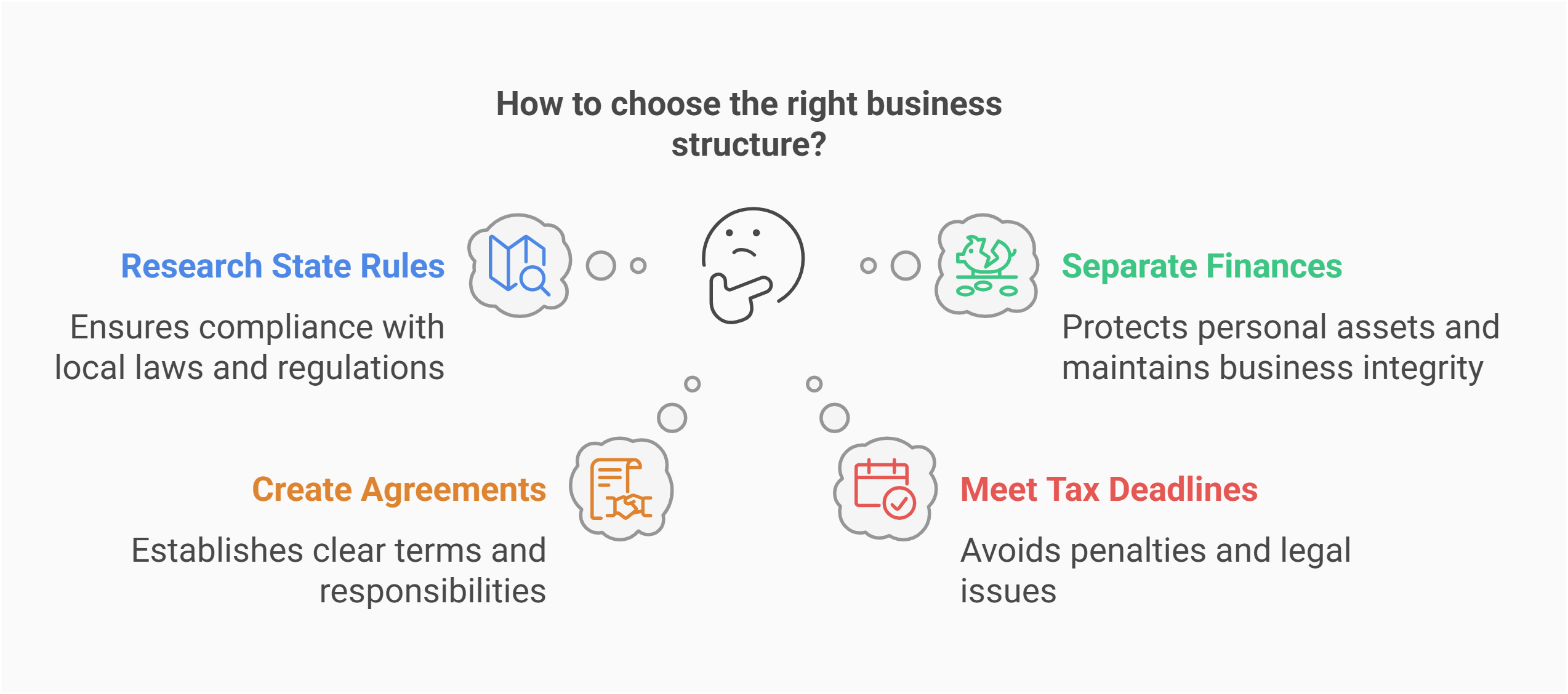

Common Mistakes to Avoid When Choosing LLP vs. LLC

Setting up a new enterprise can be overwhelming, and it’s easy to skip important steps or misunderstand rules. Below are pitfalls to steer clear of as you weigh your options:

- Failing to research state-specific rules before deciding on one structure

- Mixing personal finances with business transactions, undermining asset protection

- Overlooking the need for a comprehensive partnership agreement or llc operating agreement

- Missing deadlines for tax returns or franchise taxes in states that impose them

- Selecting an LLP in a field that doesn’t permit it under local laws

Ultimately, a thoughtful approach and good counsel help you form the right entity minus the headaches.markets.

How to Form an LLP or LLC (Step-by-Step Guide)

Whether you choose an LLP or an LLC, establishing your framework involves multiple filings and compliance steps. Below, we lay out the essential actions so you can sidestep confusion and begin operations swiftly.

Steps to Register an LLP

Forming a limited liability partnership requires meeting state demands, typically designed for professional services.

- Check Eligibility: Ensure your state allows your profession to register as an LLP.

- File Paperwork: Submit your application (often called an LLP Certificate) to the relevant agency.

- Draft a Partnership Agreement: Outline responsibilities, profits and losses distribution, and partner exit clauses.

- Name Registration: Comply with naming guidelines, often requiring “LLP” in the title.

- Obtain Licenses: Confirm specialized or local permits if your field demands them.

Once approved, keep detailed records, including any modifications to your partner roster or changes in core business operations.

Steps to Register an LLC

Opting for an LLC demands a different approach.

- Select a Unique Name: Incorprate “LLC” into the official title per state mandates.

- File Articles of Organization: Deliver these to the Secretary of State along with any mandated fees.

- Designate a Registered Agent: Provide an in-state address and contact details for official notices.

- Craft an LLC Operating Agreement: Clarify management structure, ownership percentages, and dissolution conditions.

- Fulfill Initial State Requirements: Some states require a notice or initial report soon after formation.

After obtaining approval, you can start focusing on everyday tasks like opening accounts and hiring your team. To ensure a smooth setup, follow this step-by-step guide on how to start an LLC based on your state’s requirements.

Cost Comparison: LLP vs. LLC Formation Fees

Formation expenses vary by location. Generally, an LLP can be cheaper in certain states, particularly for regulated professions. However, LLC filing often:

- Involves a set fee for articles of organization

- Requires ongoing charges like annual renewals

- May impose local taxes or assessments for business structure maintenance

An LLP might save you on front-end paperwork if your state has fewer demands. But if you’ll operate across multiple regions, an LLC might face fewer discrepancies in the overall process. Always confirm local statutes to avoid sticker shock. The overall LLC cost varies by state, making it essential to compare expenses before choosing a business structure.

FAQs – Everything You Need to Know About LLP vs. LLC

Curious about picking the right structure in 2025? Below are quick, concise answers to frequent questions entrepreneurs have regarding these two entity types, from liability coverage to potential conversions.

An LLP is typically geared toward partners in professional services, such as accounting or legal work, where each partner holds partial liability for their own actions. An LLC, on the other hand, provides more robust limited liability coverage for all members, regardless of profession. LLPs often require multiple owners, while an LLC can be formed by a single individual. Although both are legal entities offering pass-through tax benefits, they differ in state-level regulations and the degree of personal liability shielded.

from liabilities incurred by others, an LLC’s coverage frequently extends to lawsuits and debts against the company, preventing creditors from seizing your personal assets. Still, local laws influence exact coverage, making an LLC especially popular among those seeking a clear boundary between personal finances and business obligations. If you’re wary of personal exposure, leaning toward an LLC is often a safer bet.

Both setups typically qualify for pass-through taxation, meaning profits and losses are reported on individual owners’ tax returns. However, an LLP is usually locked into partnership tax treatment, while an LLC can elect corporate or S Corp status for different benefits. Under default pass-through rules, the internal revenue service treats each partner/member as self-employed, requiring them to handle Social Security and Medicare taxes. In contrast, an LLC opting for S Corp classification can sometimes reduce self-employment tax on certain distributions, but that adds complexity and stricter compliance.

Yes. Many states let you file a conversion form or reclassification documents with the appropriate agency, effectively rebranding the entity as an LLC. The process may involve additional fees, amending your management structure, and modifying the business’s official name. Additionally, you might need to notify clients and creditors of the change. Conversions can streamline liability coverage and open the door for more flexible ownership structures. If you’re in a strictly regulated profession, check whether your field’s rules accommodate such a transition before proceeding.

Your optimal choice hinges on your industry, ownership style, and risk profile. If you run a regulated, professional partnership, an LLP might suffice—particularly if you need to limit cross-liability among co-partners. For broader protection and potential growth, an LLC offers a stronger shield against lawsuits and business debts, with flexible tax options. Compare factors like cost, operational control, state requirements, and whether multiple owners will be equally active. When in doubt, seek counsel from a legal or financial adviser to ensure your strategy suits your future ambitions.

Stay Compliant with Your Business Structure

Harbor Compliance ensures you meet legal requirements whether you choose an LLP or LLC.