Choosing the best Wyoming LLC service in 2025 comes down to predictable year-two registered-agent renewals, real Wyoming address practices on public filings, and honest timelines. We reviewed the top Wyoming LLC services on transparent pricing, privacy, support quality, and refund terms, so you see what you’ll actually pay after the first year. This guide cuts through the “$0 formation” noise to highlight providers that keep your home address off the record and your costs stable. Start with the quick picks below, then dive into unbiased, line-item comparisons.

Top 10 Wyoming LLC Services – Unbiased Reviews & Rankings

This 2025 list ranks the top providers for forming an LLC in Wyoming based on real-world factors that impact your wallet and privacy: clear upfront pricing, year-two registered agent service renewals, whether a real Wyoming business address can appear on public filings, turnaround transparency, and overall support quality. Use the table to scan starting costs, renewal rates, address policy, and “best for” at a glance – so you can match the right partner to your use case (budget, privacy, multi-state growth, legal ecosystem, or truly local expertise) without guesswork or upsells.

| Provider | WY formation price | Year-2 RA renewal | WY Address | Best For |

|---|---|---|---|---|

| Northwest Registered Agent | $39 + state fee | $125/yr | Business address allowed on public filings | Privacy-first, flat pricing |

| Bizee (Incfile) | $0 + state fee | $119/yr | RA line only | Lowest upfront cost |

| LegalZoom | $0 + state fee | $249/yr | RA line only | Big brand + legal add-ons |

| ZenBusiness | $0 + state fee | $199/yr (first year $99) | RA line only | Guided workflows |

| Harbor Compliance | From $99 + state fee | $99 first year; then $149/yr | RA line only | Multi-state compliance |

| InCorp | $99 + state fee | $129/yr (as low as $87 multi-year) | RA line only | Long-term RA savings |

| Swyft Filings | $0 + state fee (current promo) | $149/yr | RA line only | Quick setup + à-la-carte |

| Rocket Lawyer | $0 + state fee (with membership) | $124.99/yr with membership; $249.99 full price | RA line only | Ongoing legal membership |

| Wyoming Registered Agent (Cheyenne) | From ~$203 total incl. state (formation bundle) | $99/yr | Business address included (use on public filings) | Local WY specialist & privacy |

| Wyoming Corporate Services Inc. | Custom (call) | $145/yr | Business address + mail options | Bespoke address/mail extras |

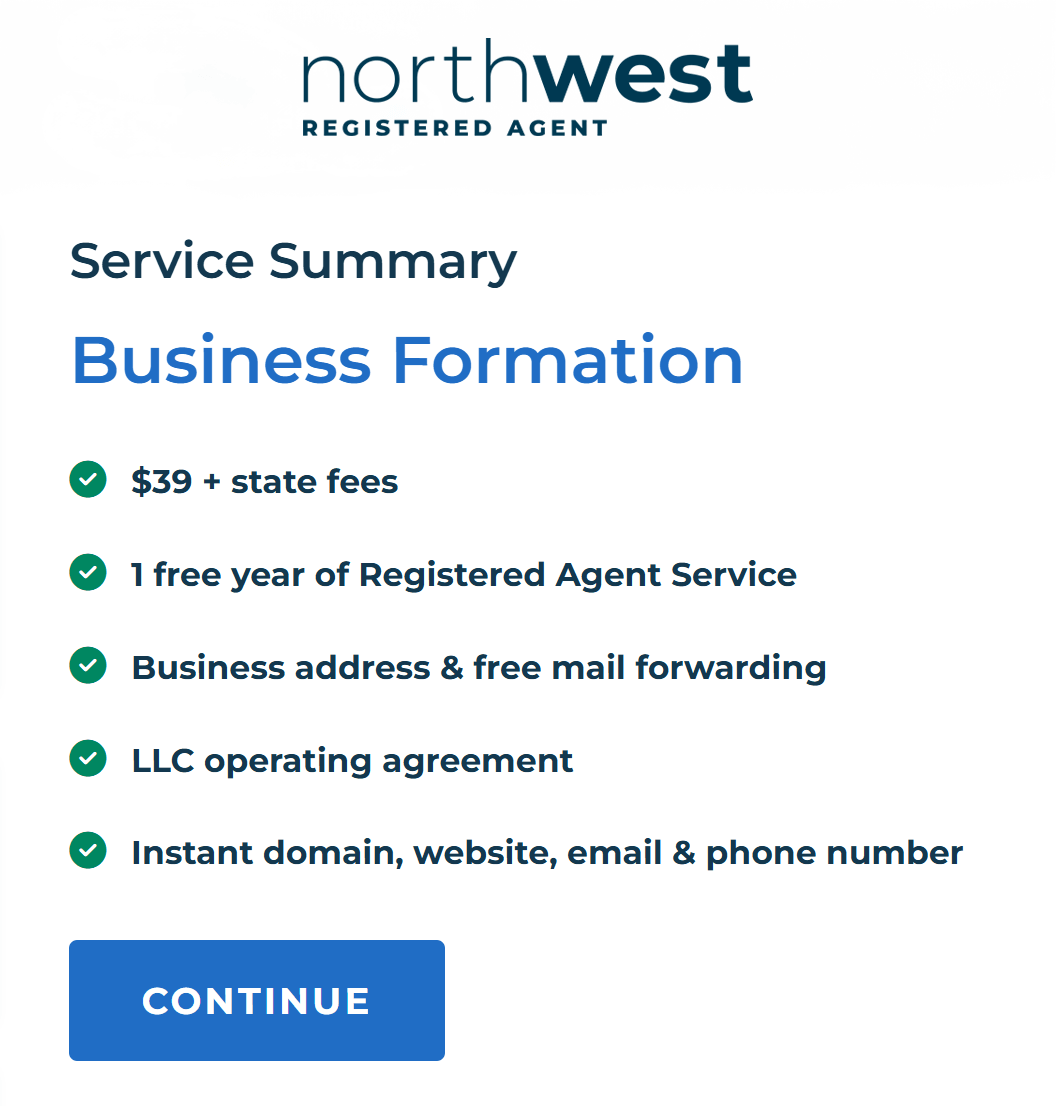

1. Northwest Registered Agent

Northwest leads with a simple offer: $39 + state fee to form your LLC and a flat registered agent service price of $125/year that they explicitly say they don’t raise (See our Northwest Registered Agent review for details). Their “privacy by default” policy means they use their address wherever allowed on public filings, a real perk for Wyoming founders who value discretion.

Pros:

- Flat RA renewal of $125/year; “never raise that rate.”

- Uses their business address on filings where permitted (keeps your home off public records).

- Clear, low formation fee ($39 + state), with first year of RA included.

- Published Wyoming guidance (fees and basics) for quick context.

Cons:

- Up-front formation fee is higher than $0 providers.

- Refunds limited after 90 days.

Overall: Best for privacy-first Wyoming founders who want predictable renewals and minimal public exposure of personal info. If you can afford the $39 formation fee, the long-term RA savings and privacy policy are hard to beat.

Form Your Wyoming LLC with Northwest’s Expert Support

Northwest offers premium, privacy-focused LLC formation services to help you build your Wyoming business the right way from day one.

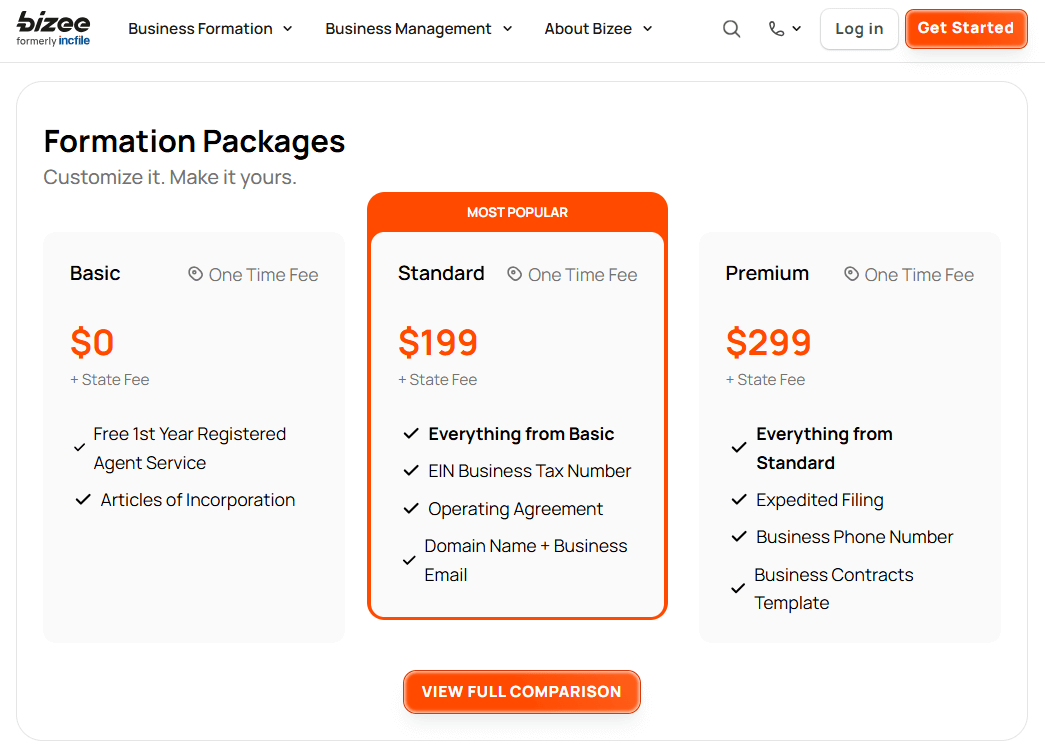

2. Bizee (Incfile)

Bizee’s hook is $0 + state fee formation and a free first year of registered agent, then $119/year after. Refunds are limited: before funds are sent to the state and subject to a $30 cancellation fee (Full breakdown in our Bizee review).

Pros:

- $0 + state fee formation keeps startup costs minimal.

- RA renewal clearly listed at $119/year after the free first year.

- Wyoming-specific pages that outline fees and basics.

Cons:

- Refund policy is narrow and deducts $30 even if you cancel quickly (before filing).

- Doesn’t market broad “use our address everywhere” privacy like some rivals. (Bizee focuses on statutory RA; no claim of full-address substitution across filings.)

Overall: Ideal if you want the lowest up-front cost and are fine with a basic RA setup at $119/year later. Read the refund fine print and capture screenshots at checkout to avoid surprises.

Create Your Wyoming LLC for Free with Bizee

Bizee offers $0 LLC formation, just pay the state fee. A fast, easy start for your Wyoming business.

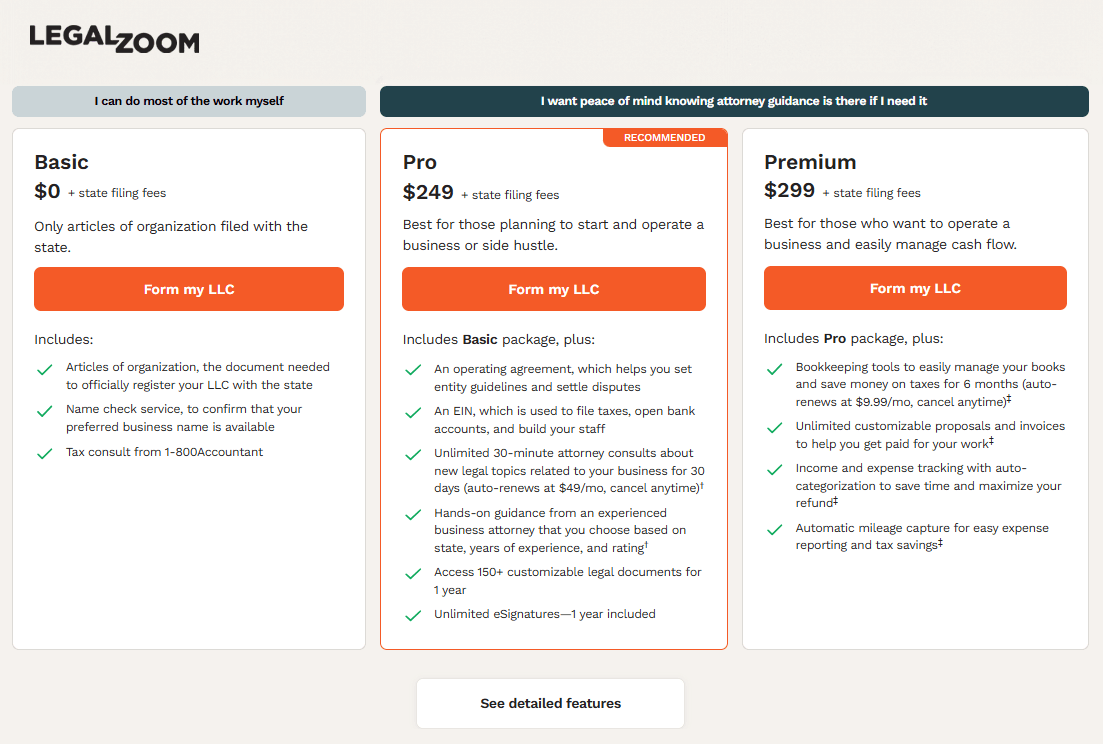

3. LegalZoom

LegalZoom pairs a $0 + state fee formation option with an extensive add-on catalog and brand support. Its registered agent runs $249/year, and most products come with a 60-day satisfaction guarantee (limitations once a filing is submitted).

Pros:

- $0 + state fee entry point with broad legal ecosystem (contracts, IP, etc.).

- 60-day satisfaction guarantee (see terms and exclusions).

- Clear product pages and strong brand recognition.

Cons:

- Higher RA renewal at $249/year versus peers.

- Turnaround often tied to paid tiers/expedites; read the fine print.

Overall: Best if you want one vendor for formation plus legal templates and ongoing advice, and you’re comfortable paying premium RA pricing for the convenience/brand.

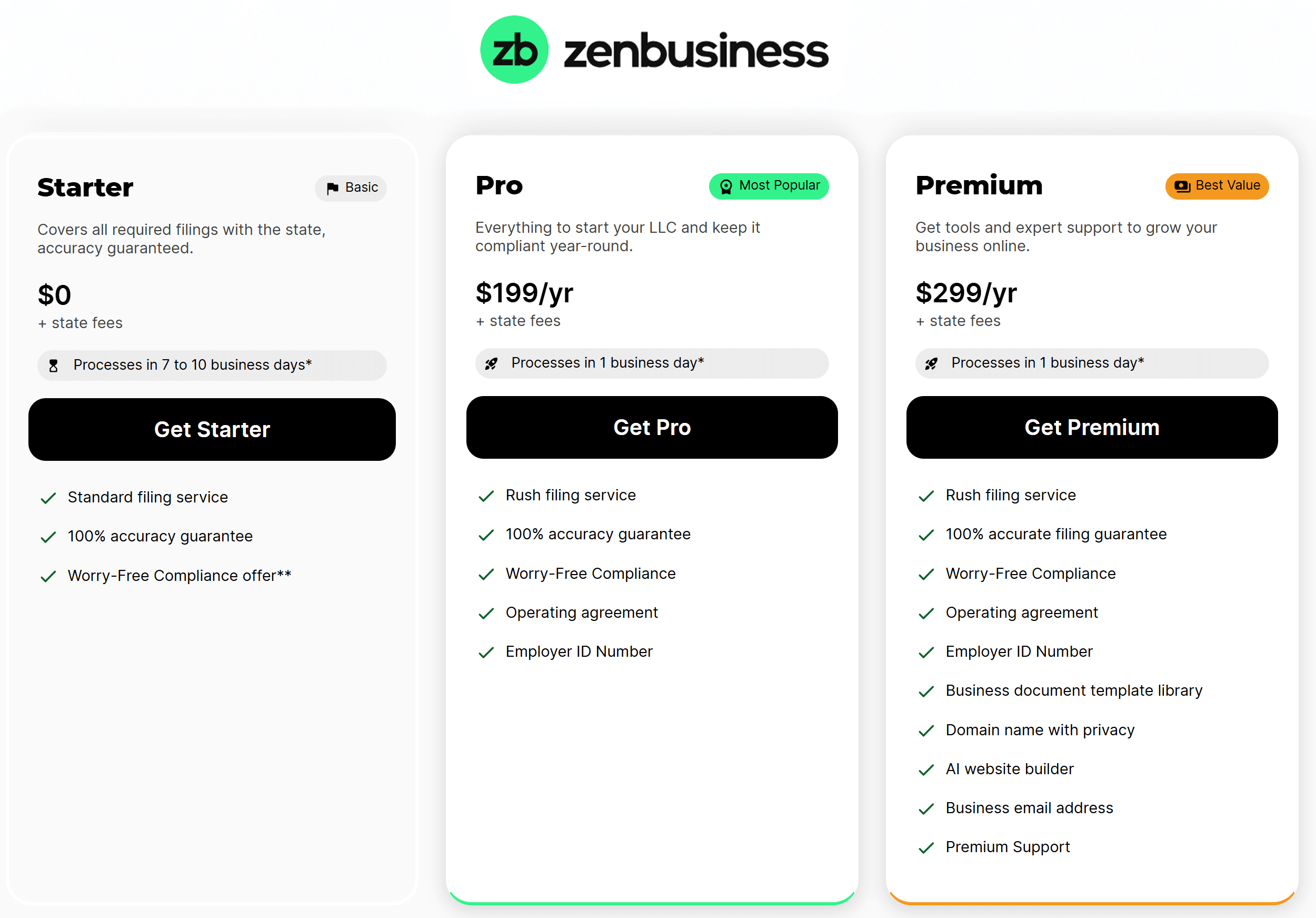

4. ZenBusiness

ZenBusiness emphasizes guided workflows and clear plan pages: Starter from $0 + state fees, optional registered agent at $199/year, and a straightforward 60-day money-back guarantee.

Pros:

- Beginner-friendly dashboard and step-by-step formation.

- 60-day refund window on most services (state/third-party fees excluded).

- Clear RA pricing; Worry-Free Compliance renews at $199/year (distinct from RA but often bundled in tiers).

Cons:

- RA isn’t built into the $0 Starter; it’s an extra $199/year.

- Add-ons (EIN, OA templates, etc.) can raise the total.

Overall: Great for founders who want a polished interface and hand-holding through Wyoming steps, and who don’t mind paying more for RA and bundled compliance in year two.

See our ZenBusiness detailed review for pros, cons, and pricing.

5. Harbor Compliance

Harbor Compliance is a compliance-heavy alternative with national coverage. Registered agent is $99 for the first year and $149/year thereafter, and its portal, policies, and documentation speak to multi-state needs (including SOC 2 Type II controls).

Pros:

- Transparent RA pricing ($99 year one, then $149/year).

- Enterprise-grade compliance posture (SOC 2 Type II; same-day electronic delivery).

- Clear rate cards and cost explainers across pages.

Cons:

- No $0 formation; package pricing typically higher than budget rivals.

- RA renewal at $149 is higher than Northwest and some local Wyoming options.

Overall: Best for founders who expect to operate in multiple states or want stricter compliance tooling and documented controls, even if it means paying more than $0-plan competitors.

For a deeper look at strengths, trade-offs, and pricing, see our LegalZoom review.

6. InCorp

InCorp is a straight-shooter for founders who care about long-term cost control: Wyoming LLC formation is $99 + state fee, and its registered agent renews at $129/year, with deep multi-year discounts down to $87/year if you prepay 5 years.

Pros:

- Clear, published pricing: $129/year RA with multi-year tiers to $87/year.

- Affordable formation at $99 + state fee.

- National coverage if you expand beyond Wyoming.

Cons:

- Dashboard and UX feel more “enterprise” than beginner-friendly. (Observation; compare during checkout.)

- Address use is the statutory line, no broad “use our address everywhere” promise. (Check filing forms and disclosures.)

Overall: A solid pick if you want predictable renewals and the best registered agent service price by committing to multi-year terms. The $99 filing fee keeps upfronts reasonable.

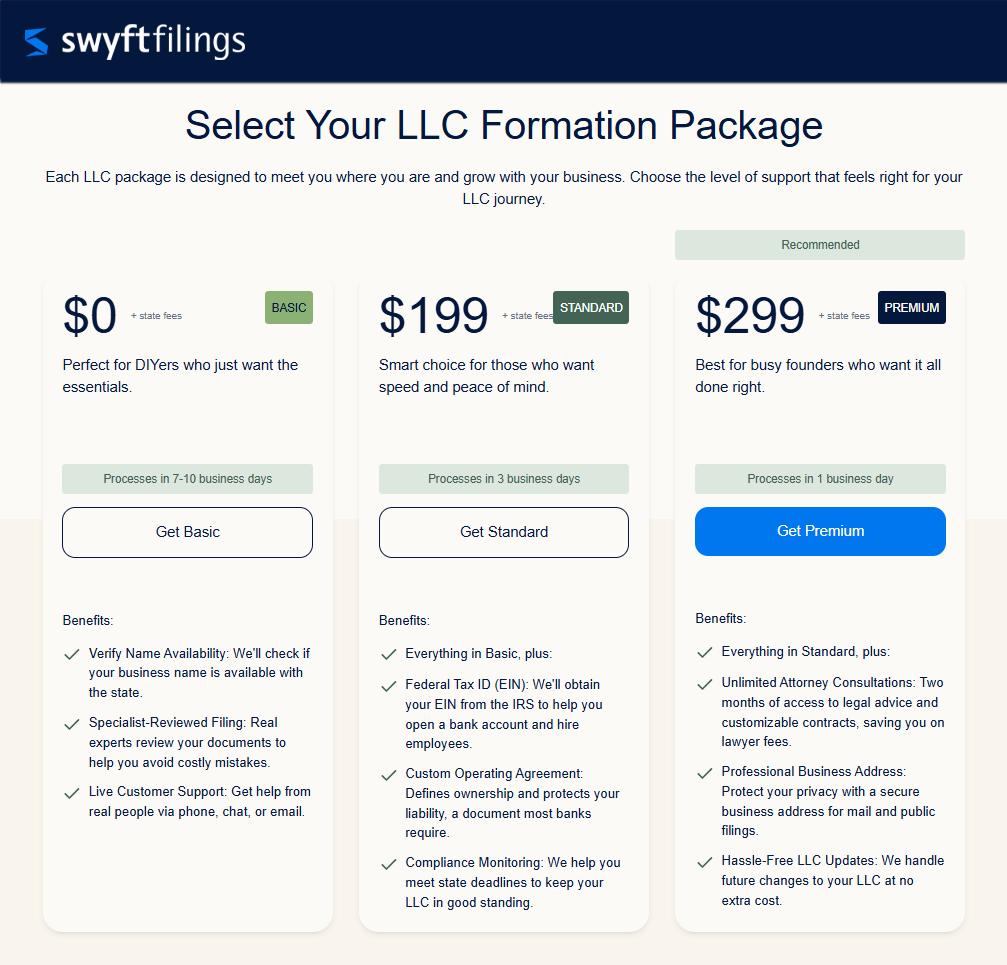

7. Swyft Filings

Swyft is known for fast setups and frequent promos, but it doesn’t clearly publish its registered agent price on product pages. Third-party sources commonly list RA at $149/year, while others cite $199–$299; either way, confirm the actual number at checkout. Refund requests must be made within 60 days.

Pros:

- Fast, guided filing flows with Wyoming page explaining state fees ($100 filing; $60+ annual report).

- Widely available support and status updates.

- 60-day refund window (terms apply).

Cons:

- RA pricing isn’t plainly posted; reliable third-party ranges vary ($149–$299).

- Add-ons can raise the total vs. $0-plan rivals. (Compare Bizee’s free first-year RA.)

Overall: Choose Swyft for speed and hand-holding, but capture screenshots and verify RA renewal during checkout to avoid surprises. The 60-day policy helps, but it has limits once filings are submitted.

8. Rocket Lawyer

Rocket Lawyer shines if you want legal docs and attorney Q&A bundled with formation. With a Rocket Legal+ membership, your first LLC filing is $0 + state fees, and registered agent is $124.99/year (otherwise $249.99). Membership runs $239.88/year (Compare the details in our full Rocket Lawyer review).

Pros:

- $0 first filing with membership; discounted RA at $124.99/year.

- Big library of legal templates and member perks.

Cons:

- True cost depends on keeping the membership active.

- RA is $249.99/year without membership, pricey vs. peers.

Overall: Best if you want an all-in-one legal ecosystem and will actually use the membership; otherwise, you may pay more over time for RA than with specialized agents.

9. Wyoming Registered Agent (Cheyenne)

This Cheyenne-based firm keeps it local: registered agent is $99/year and includes a business address you can use on public filings. Their formation bundle is a transparent $203 total (includes the state’s $104 online filing fee and first-year RA).

Pros:

- $99/year RA with mail scanning (5 docs/year) and stable downtown address.

- Lets you use their address on public documents (privacy win).

- Clear “all-in” formation price that already includes state fees.

Cons:

- Smaller team than national providers (fewer multi-state tools).

- Feature set is lean by design, great for WY, less so if you expand quickly.

Overall: A no-nonsense Wyoming registered agent choice if you prioritize a real in-state address on your filings and a simple, all-in formation price.

10. Wyoming Corporate Services Inc

WCS is an old-guard Cheyenne provider focused on formation, mail, and privacy extras. Their packages include the first year of RA; the second-year registered agent fee is listed at $145 (auto-billed). They also offer virtual office/mail forwarding for clients who want a Wyoming presence.

Pros:

- Clear indication that year-two RA runs $145.

- Local team with mail/virtual office options for a Wyoming address.

- Longtime presence in Cheyenne.

Cons:

- Site materials look dated; verify current pricing before checkout.

- Fewer software bells-and-whistles than national platforms.

Overall: A practical local route if you want formation plus mail handling in one place, and you’re comfortable confirming legacy-site pricing details directly before you pay.

Best Wyoming LLC Services by Use Case (2025) – Quick Picks

Pick the service that matches how you’ll actually operate, not just the cheapest headline price. These “quick picks” focus on recurring costs, privacy, and workflow fit for an LLC in Wyoming, so you can launch fast and avoid surprises later.

Northwest Registered Agent – Best overall for most founders

If you want predictable renewals and maximum privacy, Northwest is hard to beat: $39 formation, flat registered agent service at $125/year (they state they don’t raise that rate), and “Privacy by Default,” including use of their business address on public documents. That combination delivers low noise and fewer upsells while keeping your home address off the record.

Bizee (Incfile) – Best budget “$0-formation” pairing

The go-to if upfront cash is tight: $0 + state fees to form, free first year of registered agent, then $119/year after. It’s a lean, no-frills path to a running Wyoming LLC, with clear RA renewal pricing published on Bizee’s Wyoming page.

LegalZoom – Best legal-ecosystem add-ons

Choose LegalZoom when you want formation plus a broad library of legal docs and support. Plans start at $0 + state fees, registered agent is $249/year, and there’s a 60-day satisfaction guarantee (with limits after state filing). It’s the “one login” route for ongoing legal needs.

ZenBusiness – Smoothest EIN & filing handoff

ZenBusiness excels at hand-holding: clean dashboards, transparent timelines for Wyoming filings, and a simple EIN add-on for $99 if you don’t want to deal with the IRS yourself. The 60-day money-back policy adds peace of mind.

Harbor Compliance – Best compliance dashboard at scale (multi-state)

If you expect to expand beyond Wyoming or you want stricter governance, Harbor Compliance offers a compliance-first platform, same-day document delivery, and SOC 2 Type II controls. RA runs $99 for year one and $149/year after, transparent and built for multi-state growth.

Wyoming Registered Agent (Cheyenne) – Best local Wyoming registered agent

A local, no-nonsense option: $99/year registered agent with a Cheyenne business address you can use on public filings, plus a simple formation bundle advertised at $203 total (includes the state’s online fee and first-year RA). Ideal if you want a genuine in-state presence and quick mail handling.

How We Score & Rank Providers

Our scoring system is built for LLC in Wyoming buyers who want predictable costs, real privacy, and clean workflows. Each provider earns a composite score across six factors. We verify claims by checking pricing pages, terms, checkout screens, and support responses, then weight what matters most for your long-term bill and compliance, not just launch-day hype. We also record screenshots and dates so every call is auditable.

How we score (weights & what we measure):

| Factor | Weight | What we check | How we measure |

|---|---|---|---|

| Transparent pricing & renewals | 30% | Formation base price, year-two registered agent service renewal, add-on clarity (EIN, OA, mail), refund window/fees, auto-renew terms | Price sheet + checkout verification; refund/ToS review; hidden-fee checks |

| Wyoming expertise & RA quality | 25% | RA practices, ability to use a WY business address on public filings, mail scanning speed/limits, compliance alerts | Address policy testing; test mail timing; alert settings & logs |

| Turnaround clarity & document quality | 15% | WY SOS handoff transparency, EIN guidance, accuracy of delivered docs (articles, OA templates, minutes) | Timeline disclosures vs. reality; doc spot-checks for correctness |

| Support & reputation (volume-weighted) | 15% | Response time (chat/email/phone), first-contact resolution, Google/BBB/Trustpilot recency & pattern analysis | Time-to-first-reply tests; rolling 6–12-month review sampling |

| Security, data handling & terms | 10% | Privacy posture, 2FA, data minimization, cancellation/auto-renew fairness, DPA/CCPA/GDPR statements | ToS/Privacy audit; account security settings; cancellation path test |

| Evidence & update cadence | 5% | Test orders/receipts, dated screenshots, change logs, monthly+ rechecks | Source-of-truth archive; cadence checklist completion |

Transparent pricing & renewals – 30%

We reward providers that publish all core costs up front and keep renewals stable. We check: (1) formation price versus what’s charged at checkout; (2) year-two RA renewal; (3) clarity on EIN, operating agreement, mail, and compliance add-ons; (4) refund window and any processing fees; (5) auto-renew defaults and cancellation steps. Providers lose points for buried fees, vague “from” pricing, or refund terms that change after checkout.

Wyoming expertise & RA quality – 25%

Wyoming founders care about address privacy and clean mail handling. We verify whether a provider allows a Wyoming business address on public filings (beyond the statutory RA line), how many mail items they scan/forward, and how quickly they deliver service-of-process. Bonus points for configurable compliance alerts and clear Wyoming-specific guidance.

Turnaround clarity & document quality – 15%

Speed claims must separate provider prep time from the state’s processing time. We compare stated timelines to our test orders and look for honest caveats. We also inspect delivered documents (articles, EIN instructions, operating-agreement templates) for accuracy, correct entity names, signatures, and tidy PDF output.

Support & reputation (volume-weighted) – 15%

We run timed outreach via chat, email, and phone, rating tone, accuracy, and first-contact resolution. For public reviews (Google/BBB/Trustpilot), we weight recency and volume, down-weighting suspicious spikes and templated responses. Consistency across months matters more than one viral complaint or one glowing testimonial.

Security, data handling & terms – 10%

We audit privacy posture (address exposure, data minimization), account security (2FA, device/email alerts), and fairness in terms (auto-renew notice, prorations, easy cancellations). Extra credit for plain-English policies and data-processing disclosures; penalties for dark-pattern upsells or surprise auto-bills.

Evidence & update cadence – 5%

Scores are only as good as the audit trail. We keep dated screenshots of prices and ToS pages, store receipts from test orders, and recheck provider pages on a monthly (or faster) cadence. If something changes, we log it and adjust rankings transparently.

Wyoming LLC Costs, Timelines & Ongoing Fees

Launching a Wyoming LLC is affordable, but the “real” cost is a mix of state fees, small online convenience fees, and ongoing filings. Here’s what to expect at a glance, then we’ll unpack each line so you can budget accurately and avoid surprise renewals. (For a deeper dive, see our Wyoming LLC cost breakdown.

State Filing Basics

The items below are the recurring questions founders ask during setup. Amounts come from the Wyoming Secretary of State (and the IRS for EIN).

| Item | Typical amount | Notes / source |

|---|---|---|

| Articles of Organization (LLC formation) | $100 | Official filing fee. |

| Online convenience fee (formation) | $3.75 | Added to most online filings (“all other entity types”). |

| Approval speed (online) | Often immediate | Online filings are commonly approved instantly; mail takes longer. |

| Change registered agent filing | $5 | You can switch agents anytime for a $5 state filing. |

| Annual report / license tax (minimum) | $60 | Or $0.0002 × WY assets (greater of the two). |

| Annual report e-file convenience fee | $2.25–$8.95 | Based on the tax due; e-filings under $500 only. |

| EIN from the IRS | $0 (free) | Apply online (Mon–Fri, 7 a.m.–10 p.m. ET). |

Processing windows. Online filings are typically approved right away; by mail, expect several business days (or longer). Always differentiate the provider’s prep time from the state’s processing.

Annual Report / License Tax Overview

Wyoming’s annual report is due the first day of your anniversary month every year (e.g., formed May 15 → due May 1). The license tax is $60 minimum or $0.0002 × assets located and employed in Wyoming, whichever is greater. Examples:

- $200,000 of WY assets → $60 (minimum applies).

- $1,210,000 of WY assets → $242 (1,210,000 × 0.0002).

If you e-file the report, the portal adds a small convenience fee based on the tax due.

Common Extras:

- Registered agent service. Most services fall around $100–$250/year (Northwest publicly lists $125; LegalZoom lists $249). Prioritize transparent year-two pricing. If you’re still comparing options, start with our guide to registered agent services in Wyoming.

- Mail scanning / virtual office. Useful if you want a professional Wyoming address beyond the statutory RA line. Pricing and features vary, check scan limits and forwarding fees on the provider’s page.

- EIN. Always free directly from the IRS; many providers charge to obtain it for you. If eligible, apply online during IRS hours. Non-US filers can apply by fax/mail.

- Operating Agreement (OA). An OA is internal (not filed with the state) and strongly recommended to define ownership/management, even for single-member LLCs.

“Same-day” Claims vs Realistic Turnaround

“Same-day filing” usually means the provider submits your forms the day you check out; Wyoming’s state approval still controls when your LLC exists. In practice, Wyoming’s online portal often approves instantly; mail filings take longer. For EIN, online issuance can be immediate during IRS hours; fax/mail routes take days to weeks. Screenshot any expedited promises and confirm whether they’re provider prep or state approval.

Wyoming Attorney vs Online Formation Service

Most founders don’t need a law firm to file Articles, but some situations do benefit from counsel. Below is a clear split so you can choose confidently (and avoid paying for services you don’t need).

When to Hire an Attorney

Use a lawyer when your structure, ownership, or risk isn’t “standard.” The list below flags common triggers, trusts/layered entities, Series LLC “cells,” complex investor terms, high-risk industries, cross-border issues, and custom Operating Agreements.

- Holding/Trust structures (LLC owned by a trust or layered entities), Series LLC planning, or specialized entity types. Wyoming has formal Series LLC rules, use counsel if you’ll create multiple liability “cells.”

- Complex ownership (vesting, buy-sell provisions, investors, profit interests), or industry-specific compliance.

- High litigation exposure (real estate with multiple properties, medical, regulated services).

- Cross-border founders (non-US owners, treaty/tax issues) or when negotiating bespoke contracts.

- Custom Operating Agreement terms (deadlocks, drag/tag, class voting). A lawyer-drafted OA can prevent costly disputes.

When an Online Service is Sufficient

For a straightforward setup: file Articles, appoint a compliant Wyoming registered agent, and get an EIN – an online service (or DIY) is usually enough. The list shows simple scenarios where templates and a clean workflow work well.

- Straightforward formations where you just need Articles filed, a compliant Wyoming registered agent, and an EIN. (Remember: the EIN is free at IRS.gov, many providers charge for convenience.)

- Simple ownership with no unusual capital structures. You can still use a solid OA template and upgrade later if needs change.

If you prefer to DIY, follow our step-by-step Wyoming LLC formation guide.

How to vet “Wyoming LLC Attorney”

Apply the checklist below: prioritize recent reviews and clear scope/pricing, read BBB context, watch Trustpilot flagging patterns, and be wary of paid EIN upsells. Focus on who actually does the work.

- Favor recency and volume. Recent reviews (last 6–12 months) matter more than decade-old praise.

- Understand BBB vs “accreditation.” BBB grades A+–F and offers optional accreditation; look for response patterns to complaints, not just the badge.

- Watch for review flagging games. On Trustpilot, businesses can flag reviews; check transparency/flagging disclosures for context.

- Be skeptical of “paid EIN” upsells. The IRS EIN is free; a firm charging for EIN may be selling convenience, not a special approval.

Red Flags from Crowdsourced Reports

Scan the red flags below (vague scopes, rushed “same-day” promises without state caveats, auto-renew traps), and then follow the protection steps to lock deliverables, capture evidence, and control billing.

- Red flags: vague flat-fee scopes, rushed “same-day guarantee” without state caveats, auto-renew traps, or refusal to provide a written fee cap.

- Protect yourself:

- Get scope + deliverables in writing (OA length, EIN handling, number of revisions).

- Screenshot checkout pages/ToS and save dated PDFs of pricing and refund terms.

- Use a virtual card or spending limit for auto-renewals; calendar dispute windows (card network + firm’s refund window).

- Keep a single email thread for all instructions/approvals to simplify any chargeback or complaint file.

Wyoming vs New Mexico (and Texas)

If you’re choosing between LLC in Wyoming, New Mexico, or Texas, focus on what you’ll actually do and where. Wyoming and New Mexico emphasize privacy and low ongoing costs, while Texas optimizes for operating in-state with clear (but public) business disclosures tied to its franchise tax system. Below is a quick, practical comparison, then deeper guidance on privacy, reporting, taxes, and how “operating vs. registering” affects your obligations.

At-a-glance comparison (formation & ongoing)

The table highlights only the factors most founders weigh first: fee to form, what you’ll owe each year, how public your ownership is, and whether an extra recurring state report exists.

| State | Formation fee (LLC) | Annual/ongoing state filing | Public owner/manager names on state filings? | Extra recurring report? |

|---|---|---|---|---|

| Wyoming | $100 (online) | Annual report/license tax: $60 minimum or $0.0002 per WY assets, due each anniversary month | No owner/manager list in Articles; RA + addresses only | No extra report beyond annual license tax |

| New Mexico | $50 | No annual LLC report with SOS (tax accounts still required if you do business in NM) | Generally not listed in basic public filings; RA required | No SOS annual LLC report |

| Texas | $300 | Annual Franchise Tax: report due May 15 (many small entities owe $0 but still must file an information report) | Yes, PIR lists officers/managers annually | Yes, Public Information Report (or OIR) each year |

Privacy, annual fees, reporting differences

Here’s the quick lens that matters: what’s public (owners/managers), what you owe each year, and which recurring reports each state requires. Use this to spot true privacy vs. ongoing compliance.

Privacy:

- Wyoming keeps member/manager names off the Articles; you’ll publicly list a Wyoming registered agent and addresses. (Banks and some counterparties still ask for beneficial owners)

- New Mexico similarly does not impose an annual owner-listing requirement for LLCs with the Secretary of State.

- Texas requires a Public Information Report (PIR) each year that publicly lists officers/directors/managers (for LLCs and corporations), even when no franchise tax is due.

Annual/ongoing state costs:

- Wyoming: $60 minimum annual report/license tax (or $0.0002 per in-state assets, whichever is greater). Due each anniversary month.

- New Mexico: No SOS annual report for LLCs. (You still register for NM tax if you’re doing business there.)

- Texas: Annual franchise tax report due May 15; many small entities owe no tax but must still file a PIR/OIR information report.

Formation speed:

- Wyoming notes processing in filing order; no expedited service.

- Texas & New Mexico speeds vary by queue and method (online/paper), but actual timelines hinge more on state processing than on a provider’s “same-day” claims.

Banking, payroll, sales tax nexus

Where you operate drives registration, payroll accounts, and tax collection—not where you formed. If you sell, hire, or store inventory in a state, expect to register and comply there.

- Operate where you sell or hire? Register there. If you form in Wyoming but do business in Texas (or NM), you’ll typically foreign-register in that state – e.g., Texas requires foreign LLCs to file Form 304 (fee $750) before transacting business. Failing to register can block lawsuits and trigger penalties.

- Payroll: Hiring in TX or NM creates employer duties locally (state unemployment, withholding accounts). Each state’s workforce/tax agencies will onboard you after registration (links provided in those portals). If you prefer to outsource payroll and compliance, these Wyoming PEO companies are a practical option.

- Sales tax / GRT (economic nexus):

- Texas: remote sellers with >$500,000 Texas receipts must collect/remit; a single local use tax rate option exists for remote sellers.

- New Mexico: Gross Receipts Tax regime; remote sellers meet economic nexus at $100,000 in prior-year NM receipts.

- Wyoming: standard sales/use tax administered by the Department of Revenue; remote-seller rules apply (confirm with DOR guidance).

Non-residents & foreigners: EIN, address, mail, compliance realities

For non-U.S. founders, focus on the essentials: EIN (free via IRS), bank KYC/beneficial-owner checks, BOI rules, a real in-state registered agent service, and reliable mail scanning so you never miss deadlines.

- EIN: You get it from the IRS (free). Online hours apply if the responsible party has a U.S. TIN; otherwise use Form SS-4 via fax/mail.

- Banking/KYC: Even with privacy-friendly states, banks must verify beneficial owners under FinCEN’s Customer Due Diligence Rule (generally 25% ownership and control persons; banks may set lower thresholds). Expect to show passports/IDs.

- Corporate Transparency Act (BOI): As of March 26, 2025, FinCEN’s new rule ended BOI reporting for U.S. (domestic) companies; foreign reporting companies still have BOI duties. Always check the latest FinCEN pages if your situation is edge-case.

- Address & mail: All three states require a registered agent service with a physical in-state address for service of process. Wyoming’s form makes the RA consent and physical address explicit.

- Mail handling: If you’re non-U.S. or nomadic, choose a provider that scans mail quickly and forwards government notices reliably (saves you from missed deadlines in any state).

Wyoming-Specific Gotchas & Ethics

Wyoming’s privacy and low costs are attractive, but don’t let marketing hype trip you up. Most risks boil down to (1) over-promising “anonymity,” (2) poor provider practices (addresses, mail, billing), and (3) misunderstanding what banks and federal rules still require. The notes below help you stay compliant and ethical while preserving legitimate privacy.

Nominee / “privacy” marketing

Wyoming allows public-record privacy, but “nominee” pitches often blur privacy with anonymity. Use the points below to see what’s permitted, what’s risky, and how BOI/KYC realities still reveal beneficial owners.

- What’s legal: Using an organizer or manager-of-record and keeping member names off Wyoming’s Articles is permitted; the state’s form doesn’t ask for owners, only the registered agent and addresses.

- What’s risky:

- False filings (fake offices, sham managers) can lead to administrative dissolution or worse; Wyoming has emphasized action against fraudulent business filings.

- BOI confusion: Domestic companies currently don’t report BOI to FinCEN, but banks still collect BOI under the separate CDD Rule whenever you open accounts. If a provider claims “no one will ever know the owners,” that’s misleading, your bank will.

Bottom line: Privacy in public records is fine; deception on government forms or to financial institutions is not.

Shell-company / opacity concerns

Major investigations (Pandora Papers) showcased how certain U.S. structures (Wyoming included) were used in opaque arrangements (“cowboy cocktail”). That doesn’t make ordinary Wyoming businesses suspect, but it does put a spotlight on provider quality: real offices, verifiable staff, and responsive support. Reviewers noted storefront-style addresses linked to huge volumes of companies; Reuters profiled one such Cheyenne address years ago. Choose providers that publish a physical office you can verify.

Misleading mailers, autopay defaults, and unverifiable offices

Scams and sloppy practices can cost more than your state fees. Use the quick checks below to spot fake “official” mail, avoid unwanted auto-renewals, and confirm a real in-state office before you buy; the final checklist locks down receipts, billing controls, and deadlines.

- Misleading mailers: States warn about “official-looking” solicitations for annual reports, certificates, or minutes kits. Verify deadlines on the state site before paying anything. Wyoming’s SOS has publicly coordinated with county officials on fraudulent filings and reporting.

- Auto-renew (negative-option) traps: Many services default to autopay. The FTC’s Negative Option rules (and 2024 click-to-cancel update) emphasize clear consent and easy cancellation. Insist on written terms explaining renewal dates and refund windows, and cancel in writing.

- Office you can’t verify: Cross-check the provider’s street address on Maps and state filings. Wyoming requires a physical RA address (no drop boxes as the RA office); if you can’t verify it, skip.

Quick self-protect checklist:

- Screenshot pricing and ToS before buying.

- Use a virtual card or card controls to cap charges.

- Keep state deadlines in your own calendar (not just the provider’s portal).

- If a mailer looks “official,” look up your entity directly on the SOS site.

FAQs: Wyoming LLC Services

Looking for fast, factual answers about Wyoming LLC services? Start here. Each FAQ gives a direct answer first, then a short expansion with what actually matters for cost, timing, and compliance – so you can choose a provider with confidence and avoid upsells you don’t need.

What is the best Wyoming LLC service?

For most founders, Northwest Registered Agent is the best overall; by use case, choose Bizee (Incfile) for $0-formation, LegalZoom for legal add-ons, or Wyoming Registered Agent (Cheyenne) if you want a local address-first option.

Our top pick balances price predictability, privacy, and clear timelines. Northwest stands out for privacy-friendly address practices and steady renewals. If your priority is the lowest upfront cost, Bizee’s $0-formation bundle is hard to beat (trade-off: year-two RA renewal). LegalZoom is ideal when you’ll use its broader legal ecosystem post-formation. Prefer a truly local setup? The Cheyenne-based Wyoming Registered Agent includes a usable Wyoming business address and straightforward bundles, great for a simple, in-state presence.

How much do Wyoming LLC services cost?

Expect $0–$399 + state fees to form, then $99–$249/year for registered agent service. Ongoing state cost: $60+ (annual report/license tax).

“$0 formation” offers still require Wyoming’s $100 filing fee (the portal adds a small online fee). Year one is often cheapest because RA is bundled; year two is where renewals hit (commonly $119–$199; some brands $249). Optional add-ons: EIN ($0 at IRS.gov or ~$70–$99 via provider), operating agreement templates ($0–$99), and mail/virtual address ($10–$50/month). Budget roughly $150–$400 for a lean year-one setup and $160–$320+ in later years, plus any add-ons you choose.

Can a provider form my Wyoming LLC the same day?

They can submit it the same day; state approval often happens immediately online. Mail takes longer.

“Same-day” usually refers to the provider’s submission speed, not guaranteed state approval. Wyoming’s portal commonly issues approvals right after online filing, while paper filings depend on mail/queue time. Always separate provider prep time from the Secretary of State’s processing, and confirm which one a marketing claim refers to. If timing is critical, file online yourself or choose a provider that explicitly states “we file today” (and still plan for bank/EIN steps).

For typical filing windows, see our explainer on how long it takes to get an LLC in Wyoming.

What’s included in a Wyoming LLC service package?

Typically Articles prep/filing, first-year registered agent service, and basic documents; state fees are extra.

Most packages handle the Articles of Organization and the first year of a Wyoming registered agent. Add-ons (EIN, operating agreement, mail scanning, compliance alerts) vary by provider and price. Wyoming requires a registered agent who formally consents and lists a physical WY address, so this is the one add-on you’ll always need (first year is often bundled). EIN is optional to buy through a service because the IRS issues it free.

Do I still need a registered agent if I buy a package?

Yes, Wyoming requires an in-state registered agent with a physical address; most packages include year one.

The agent receives service of process and certain state notices. Wyoming’s rules make the agent’s physical Wyoming address and written consent explicit requirements. If you switch later, the state filing fee is low, so you’re not locked in. Verify whether your package includes year-two renewal pricing and how much mail scanning/forwarding is included to avoid add-on surprises.

Will the service get my EIN (and what if I don’t have an SSN)?

Many providers will obtain an EIN for a fee, but it’s free at IRS.gov. Without an SSN/ITIN, file Form SS-4 by fax or mail.

The online IRS EIN application (free) works for applicants with an SSN/ITIN and issues an EIN immediately during IRS hours. If the responsible party doesn’t have an SSN/ITIN, you can still get an EIN by submitting Form SS-4 via fax/mail (or by phone if you’re an international applicant, per IRS instructions). Services charge for convenience, use them only if the time savings are worth it.

Should I use a Wyoming attorney or an online service?

Use an attorney for complex ownership, trusts/Series structures, or industry-specific risks; online services are fine for straightforward setups.

If you’re bringing in investors, drafting bespoke buy-sell terms, or layering entities/Trusts (including Series LLC planning), legal counsel prevents costly rewrites later. For standard single- or multi-member LLCs, a reputable provider handles the filing, Wyoming registered agent, and documents efficiently; you can upgrade to legal help as your needs grow. The SBA’s overview explains where an LLC helps and what decisions still need tailored advice.

Are Wyoming “privacy” or nominee add-ons worth it?

They can keep your home address off public filings, but they don’t hide owners from banks or federal checks. Weigh the benefit against cost.

Banks must collect beneficial ownership under FinCEN’s Customer Due Diligence Rule when you open accounts, regardless of public state records. In 2025, FinCEN issued an interim rule removing BOI reporting for U.S. companies under the CTA, but banks still gather owner data for KYC. Choose address-privacy tools for public-record hygiene; avoid any service implying true anonymity. Verify that the provider’s office and mail handling are real and reliable.

- Wyoming Secretary of State: LLC Articles of Organization (PDF)

- Wyoming Secretary of State: Business Registration Fees & Online Convenience Fee

- Wyoming Secretary of State: Annual Report Online Filing & Due Dates

- Wyoming Secretary of State: Registered Agents & Offices FAQs ($5 change fee)

- Taxpayer Advocate (IRS): Online EIN hours (7:00 a.m.–10:00 p.m. ET)

- Texas Comptroller: Franchise Tax – Reports due May 15

- Texas Comptroller: Remote Sellers — $500,000 safe-harbor & registration guidance

- New Mexico Taxation & Revenue: Gross Receipts Tax overview (economic nexus, $100k)

- FTC: Final “Click-to-Cancel” / Negative Option Rule (official release)

Looking for an overview? See Wyoming LLC Services

Professional Wyoming LLC Setup with Harbor Compliance

Harbor Compliance offers hands-on service and personalized guidance for forming your Wyoming LLC, ideal for regulated industries or complex needs.