Use Kentucky’s Secretary of State FastTrack Business Records to search entities and verify status, filings, officers/managers, and registered agent details in minutes. For naming, run both the Name Availability check (preliminary only) and the broader Business Entity Search to spot conflicts, final clearance happens when your filing is accepted. To confirm legitimacy, look for Active status, review the filing history, order a Certificate of Existence/Authorization, and validate it with the SOS Validate Certificate tool; remember Annual Reports are due by June 30 each year and missing them can trigger dissolution/revocation. A DBA/assumed name doesn’t grant exclusive rights, pair state and USPTO trademark searches if brand protection matters.

How to Conduct a Kentucky Business Entity Search

Conducting a Kentucky business entity search starts with understanding the four-step verification process that ensures thorough due diligence and compliance verification. The Kentucky Secretary of State maintains a comprehensive database containing just over 355,000 registered business entities, making it the primary resource for business research and verification activities. Learn exactly how to start an LLC in Kentucky with our dedicated guide.

Step 1: Access the Kentucky Secretary of State's FastTrack Business Search Portal

The FastTrack Business Search portal provides 24-hour access to Kentucky's comprehensive business database through an intuitive user interface. This free system offers multiple search capabilities including entity lookup, officer searches, and registered agent verification without requiring account creation. The portal's streamlined design enables both basic name searches and advanced filtering options for professional researchers and business owners.

Step 2: Search by Business Name, Organization Number, or Registered Agent

Kentucky's search system accommodates various research approaches depending on available information and verification needs. Start with broad searches using partial business names, then narrow results using advanced filters for precision targeting.

The system supports four primary search methodologies:

- Business name searches using full or partial entity names

- Organization number lookups for direct entity identification

- Registered businesses searches by authorized agent information

- Officer and director name searches across all active entities

After entering search criteria, review all results carefully since business names may contain variations in punctuation, capitalization, or legal designators that affect search outcomes.

Step 3: Interpret Search Results: Status, Type, and Filing History

Search results display essential entity information including business status, formation type, and comprehensive filing history. Active entities appear with “GOOD STANDING” status, while dissolved or revoked business entities show corresponding inactive designations.

Each result provides the organization number, entity type (LLC, Corporation, limited liability partnership), formation date, and current compliance status. Click individual entity names to access detailed records including physical address information, officer listings, and complete filing chronology. Make sure you have a compliant physical business address for LLC.

Step 4: Use Advanced Search Options and Filters

Advanced filtering capabilities enable targeted searches by entity type, formation date ranges, and status parameters for refined results. Specify legal entity types like corporations, LLCs, or partnerships to eliminate irrelevant entries from search outcomes. Date range filters help locate recently formed entities or track historical business formations within specific timeframes for market research purposes.

Secure your Kentucky LLC name with ZenBusiness

ZenBusiness helps you lock down your Kentucky LLC name, handle the FastTrack search, and complete your filings – all with expert support and zero guesswork.

Read Kentucky Results Correctly

When you open Kentucky’s FastTrack search, you’ll land on Business Entity Search with “Show active entities only” pre-checked and quick links to Name Availability, Registered Agent Search, Current/Founding Representative Search, and Validate Certificate of Existence/Authorization. Uncheck “active” to see dissolved or revoked records.

What each field means, and why it matters:

| Field on the profile | Where you see it | How to use it |

|---|---|---|

| Organization number | Header of the entity profile | Unique ID for ordering records or certificates. |

| Status (Active/Inactive) | Header/overview | “Inactive” often ties to missed annual reports or dissolution, confirm before contracting. |

| Entity type | Header/overview | Confirms LLC vs corporation vs nonprofit for the right compliance playbook. |

| Formation/qualification date | Header | Helps verify operating history. |

| Principal office | Overview | Mailing hub for official notices, make sure it matches your contract. |

| Registered agent & registered office | Overview | Must be a Kentucky address; agent can be an in-state individual or business. |

| Officers/Managers (current/founding) | Links on search hub | Cross-check names against contracts or due-diligence reports. |

| Filings & scanned documents | Profile links | Download articles, amendments, annual reports, assumed names, etc. |

| Certificates | “Validate certificate” link | After purchasing a Certificate of Existence/Authorization, validate it here. |

Read status the right way:

- Active with recent filings usually means good standing. Kentucky requires an Annual Report every year (due by June 30) and domestic entities that miss it are administratively dissolved until reinstated.

- Inactive/Revoked: dig into the filings list to see if the cause was non-filing, name issue, or voluntary dissolution. Then decide if reinstatement or requalification changes your risk.

Registered Agents in Kentucky

Every Kentucky entity must continuously maintain (1) a registered office in Kentucky and (2) a registered agent. The agent may be an in-state individual or a business entity whose business address is the same as the registered office.

Who Can Serve and What They Do

Kentucky expects every business to keep a real, in-state street address on file and appoint a registered agent at that address. That agent can be a Kentucky resident or a business entity authorized to do business in Kentucky, many companies choose a commercial registered agent service so legal papers never miss a beat. By law, the agent is the default recipient for lawsuits and official notices and must promptly forward them to the company. If there’s no agent on file (or the agent can’t be served with reasonable diligence), Kentucky allows service by registered or certified mail to the company’s principal office.

Finding, Changing, or Resigning an Agent

You can handle most registered-agent housekeeping online. Start in FastTrack to view the current agent and registered office. If you need to switch agents or update the registered office, file a Statement of Change through the Secretary of State’s Online Services (changes take effect upon filing). If an agent wants to step down, they file a resignation with the SOS; the appointment ends when a new agent is appointed or on the 31st day after the filing, and the SOS mails notice to both the registered office and the entity’s principal office.

Trade Names and State Trademarks

Think of this section as “DBA vs. brand protection.” A Kentucky trade name (assumed name/DBA) is your public-facing alias, filed with the state (and recorded with the appropriate county) so you can operate under something other than the legal entity name. It lasts five years and must be renewed on schedule. A trademark or service mark, by contrast, protects your brand identifiers (name, logo, tagline) and can be registered at the state level for five years at a time, or federally for broader protection. The smart move is to file the DBA for compliance and run trademark searches before you invest in signage, packaging, or ads. We’ll walk both paths below.

Search And Register a Kentucky Trade Name

A “trade name” in Kentucky is your assumed name/DBA, the name you use in the marketplace when it’s different from your entity’s legal name. Here’s how to handle it the right way.

- Search first (avoid conflicts).

Use the Secretary of State’s Business Entity Search to spot obvious conflicts and the Name Availability tool to check basic distinguishability. (Availability checks are helpful but don’t grant rights). - Know who files where.

- Individuals/sole proprietors: file the Certificate of Assumed Name with the county clerk where you do business.

- LLCs, corporations, partnerships, trusts, etc.: file with the Kentucky Secretary of State (SOS) and then record the SOS file-stamped copy with the county clerk where your registered agent is located (or, if no registered agent is required, in the county of your principal office).

- Mind the KY rules (and limits).

- You must file a separate certificate for each assumed name.

- Names filed with the SOS must be distinguishable from names already on record.

- A DBA does not by itself give exclusive rights to the name or block others statewide, that’s a trademark issue.

- Term, renewal, and fees.

- A Kentucky assumed name lasts 5 years and can be renewed by filing within 6 months prior to expiration (same filing destinations as the original).

- The SOS filing fee is $20; county clerk fees are set by statute and vary by county.

- You can file most business forms online from the SOS hub.

Search and Register a Kentucky Trademark or Service Mark

If you want brand protection, look at marks (state and/or federal). Kentucky offers state registration; the USPTO covers federal protection.

- Search before you file.

Kentucky marks: check the SOS trademark/service mark database.

Federal marks: search the USPTO’s trademark search system (successor to TESS). - File in Kentucky (state-level).

File a Trademark/Service Mark Application with original signatures by mail or in person, and include three specimens showing actual use (one specimen for renewals). Forms and directions are on the SOS site. State registrations are effective 5 years and renewable within 6 months prior to expiration. - Consider filing federally (nationwide scope).

For broader protection, file through the USPTO’s Trademark Center and manage ongoing filings in TEAS/TSDR as directed. (Trade names/DBAs and trademarks are different; trademarks protect brand identifiers.)

Annual Reports and Compliance

Staying in good standing in Kentucky is simple: file your Annual Report every year between January 1 and June 30 and keep your public info (principal office, officers/managers, and registered agent/office) current. The filing fee is $15, and you can submit online for instant confirmation. Miss the deadline and you risk bad standing and, for domestic entities, administrative dissolution (foreign entities face revocation of authority).

At-a-glance:

- Window: Jan 1 → Jun 30 (every year after formation/qualification).

- Fee: $15 (same for most entities).

- Where to file: SOS Online Services (fastest) or by mail/in person.

What the report does (and doesn’t):

- Does: Confirms/updates principal office, registered agent/office, and officers/directors/members/managers.

- Doesn’t: The postcard itself can’t change your principal office or registered agent, those require a Statement of Change filing.

Deadlines, penalties, and fixes:

- Deadline: June 30 every year.

- If you miss it:

- Domestic entities → administrative dissolution (inactive/bad standing until reinstated).

- Foreign entities → revocation of authority (must requalify).

- Reinstatement (domestic): File the Reinstatement application and required supporting documents/fees as directed by the SOS.

5-step compliance checklist:

- Calendar it: set recurring reminders for Jan 1 (open window) and June 15 (buffer).

- Verify your registered agent: confirm a Kentucky street address; if switching to a professional registered agent service, file the Statement of Change first ($10).

- Confirm leadership info: officers/directors (corps) or members/managers (LLCs) match reality.

- File online: use Online Services for the Annual Report; save the receipt.

- Spot-check public records: look up your entity in Business Records to verify status updates correctly.

Checking Kentucky LLC Name Availability

Before you file, run a real Kentucky-specific name check. This avoids “not distinguishable” rejections, wasted filing fees, and delays with bank accounts or licenses. In Kentucky, your LLC’s real name must be distinguishable from names of record with the Secretary of State and use an approved LLC designator.

Understanding Kentucky's Naming Requirements

Kentucky’s reviewer really checks two things:

- That your name is distinguishable from names of record, and

- That you’ve used an approved designator (LLC/LC or the spelled-out versions).

If you’re a professional practice, use PLLC/PLC. The statute even permits foreign-language equivalents, there’s no English-only rule, so focus your energy on distinguishability and the correct ending.

| Rule (what KY law requires) | What you do in practice |

|---|---|

| Name must be distinguishable from any name on file. | Run both searches (Business Entity & Name Availability). If a result looks close, plan a backup name. |

| Use an approved LLC designator: “limited liability company,” “limited company,” or LLC/LC. For professional practices, PLLC/PLC. | Add the ending to every version of your name (website footer, invoices). Abbreviations “Ltd.” and “Co.” are allowed within the phrase. |

| No English-only mandate. | If you need a non-English word, you can use one; the test is still distinguishability + designator. |

| Extra rules for licensed professions may apply. | If you’re in medicine, law, engineering, etc., check your board’s naming rules before filing. |

| Filing a name ≠ trademark rights. | Treat the entity name as a compliance box; run trademark searches if you want brand exclusivity. |

Quick Kentucky examples:

- Derby City Pediatrics PLLC – professional practice with the right designator.

- Bourbon Barrel Logistics LLC – clear LLC ending.

- Bluegrass Roofing LLC when “Bluegrass Roofing & Restoration, LLC” exists – likely not distinguishable; try “Bluegrass Roof Pros LC” or add a unique word.

Designator snapshot (for fast scanning):

| Entity flavor | Allowed endings (examples) |

|---|---|

| Standard Kentucky LLC | “limited liability company”, “limited company”, LLC, LC, with “Ltd.”/“Co.” allowed within the phrase. |

| Professional LLC | “professional limited liability company”, “professional limited company”, PLLC, PLC. |

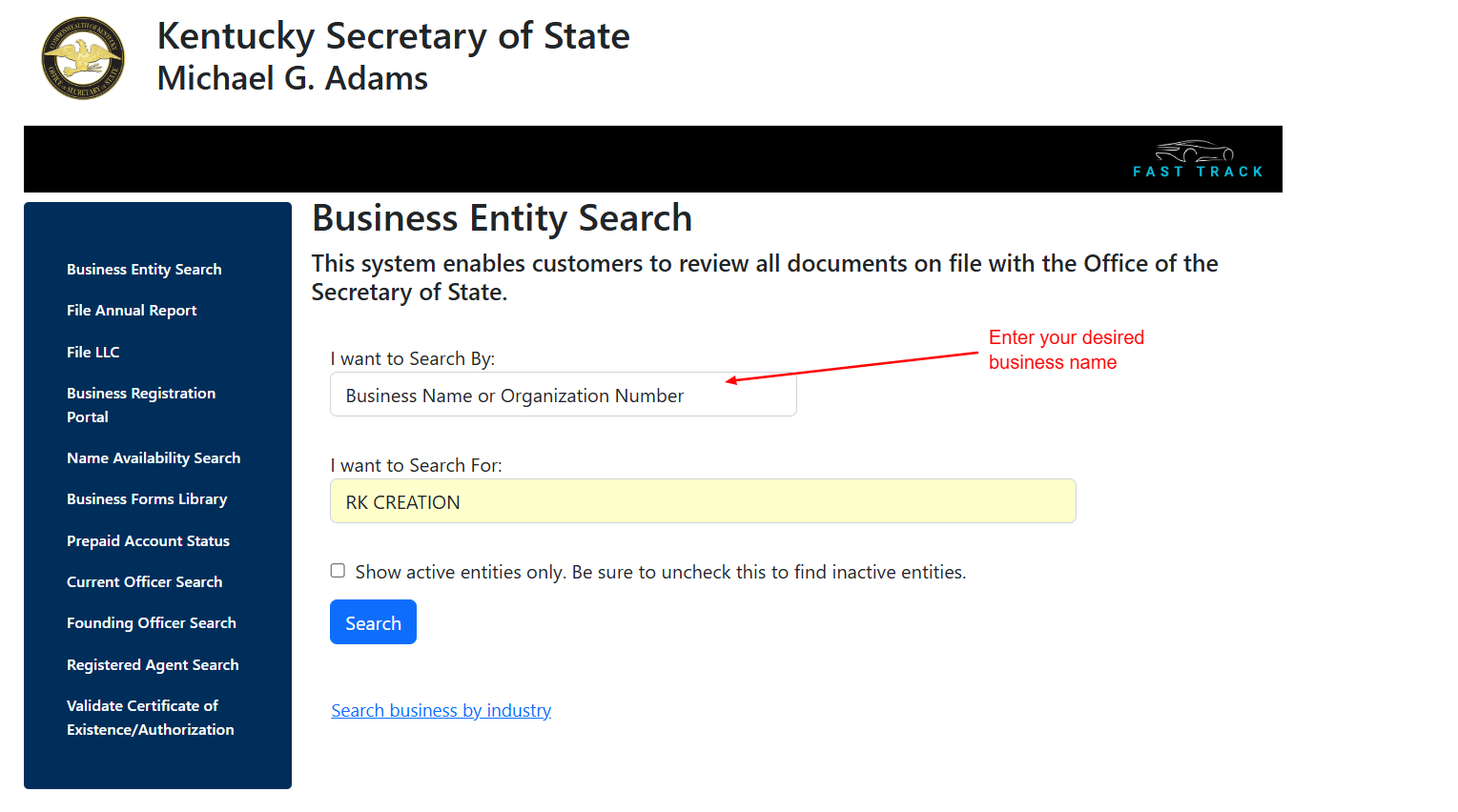

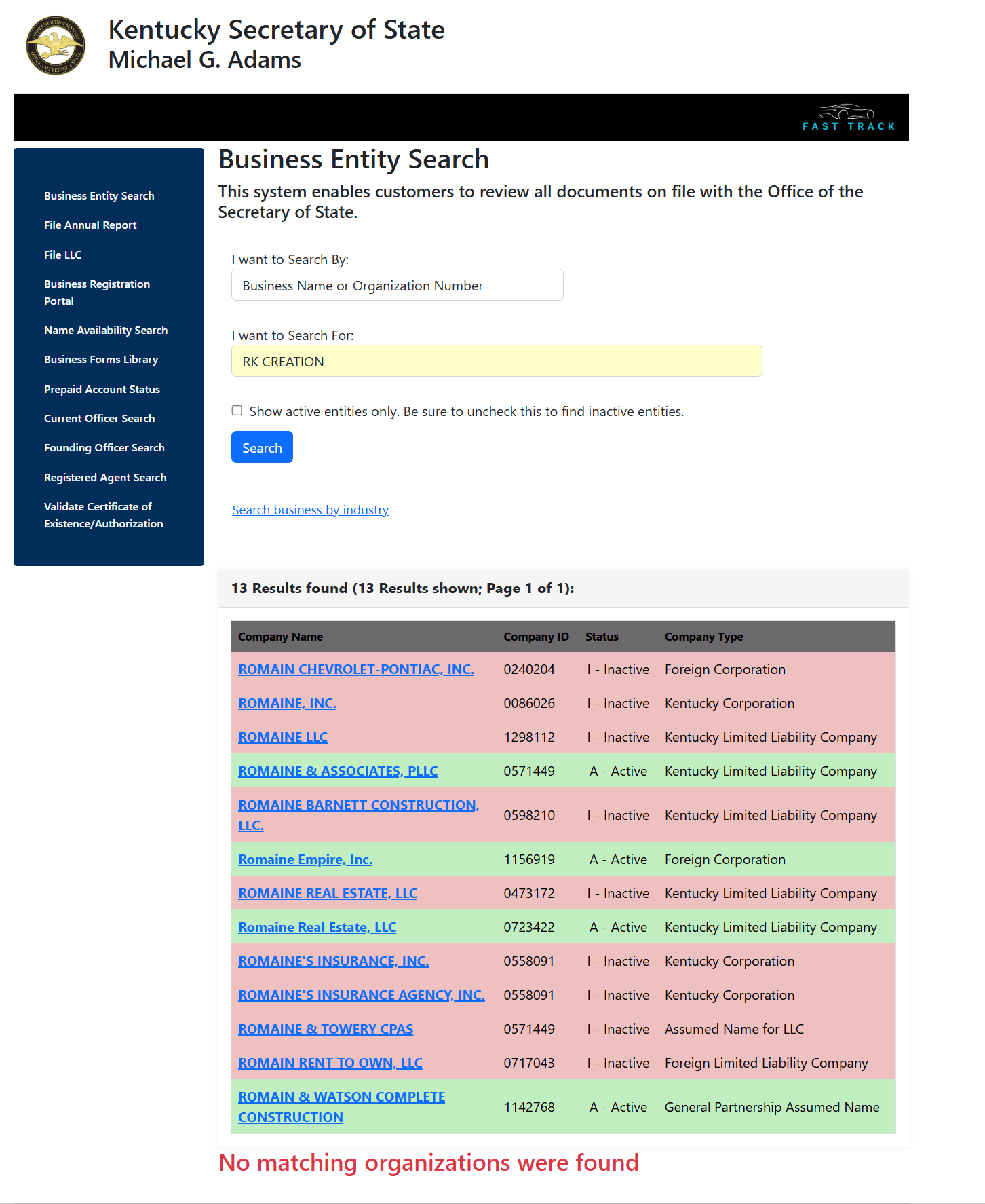

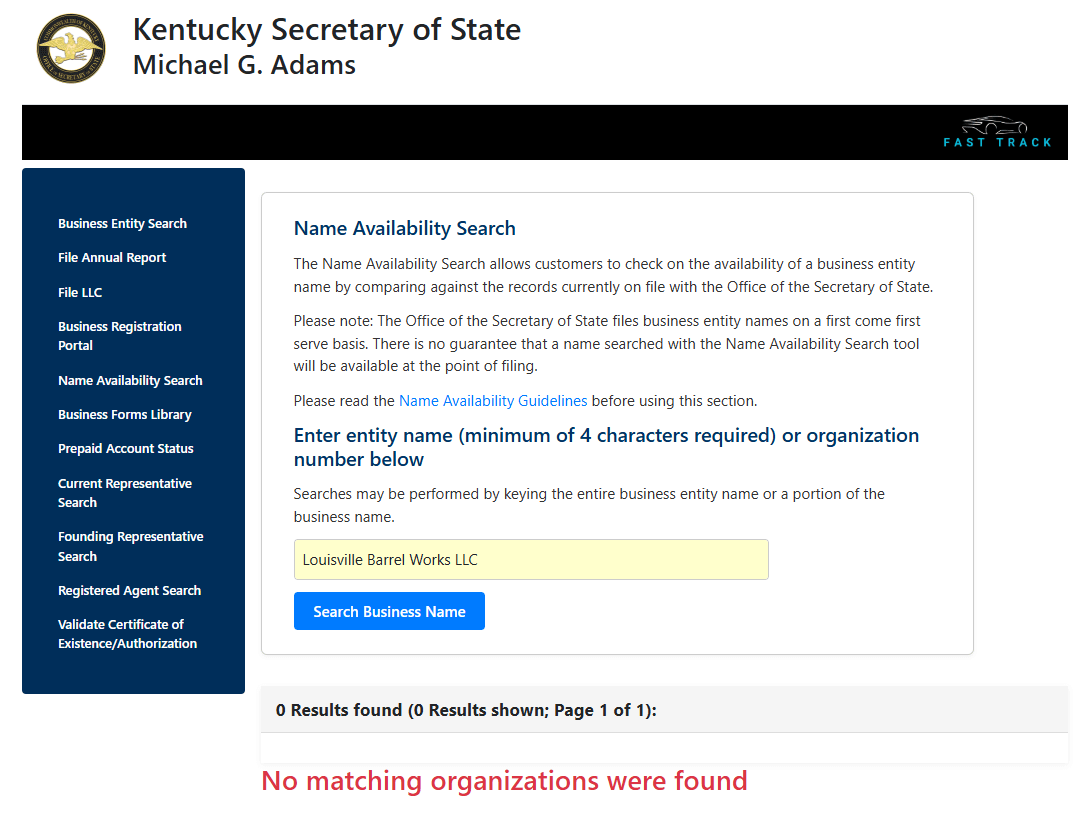

Using the Name Availability Search Tool

The dedicated Name Availability Search tool provides instant feedback on proposed business name availability through direct database queries. This specialized search requires minimum four-character entries and displays all similar existing registrations.

Follow these verification steps:

- Access the Name Availability Search portal

- Enter your complete proposed business name

- Review all returned similar business registrations

- Analyze distinguishability against existing entered in their business database entries

- Confirm compliance with state naming requirements

Results showing “No matching organizations were found” indicate name clearance, while existing similar registrations require alternative name selection or modification strategies. Before you lock in your choice, be sure to check LLC name availability to avoid filing rejections.

Reserving a Business Name Before Registration

Not ready to file this week? Reserve the name for 120 days. Anyone can reserve a name (you don’t need an entity formed yet). Renew once for another 120 days by applying in the last 30 days before expiration. Reservations can also be transferred or canceled. (You can’t reserve by phone.)

How it works: Submit an Application for Reserved Name to the Kentucky SOS. The name must meet KRS 14A.3-010 (designators + distinguishability).

When to use it:

- You need time to align partners, leases, or licensing.

- Your bank or franchisor wants a guaranteed name before you file.

- You’re coordinating multi-state launches and want to lock the Kentucky name early.

When to skip it: You’re ready to file now, just file online and get the real clearance upon acceptance.

Example timeline:

- Monday: Reserve “Bluegrass Mobile Vet PLLC.”

- Next 6–8 weeks: finalize operating agreement, city license, and domain.

- By Day 110: file Articles of Organization (PLLC) online. No renewal needed.

Remember to plan your LLC renewal to keep your business in good standing.

Verifying Business Legitimacy and Compliance

When you’re about to sign a contract, open a vendor account, or wire a deposit, Kentucky’s FastTrack tools let you verify who you’re dealing with – fast. You can confirm status, see who runs the company, view filing history, order a Certificate of Existence/Authorization, and even validate that certificate online. Think of this as your quick, Kentucky-specific due-diligence loop.

Confirming Good Standing and Legal Status

What “good standing” means here. In Kentucky, entities maintain good standing by filing the Annual Report every year by June 30 and keeping a continuous registered office/agent on file. If they miss the report, they’ll show bad standing and can be administratively dissolved (domestic) or revoked (foreign).

How to check it in under 2 minutes:

- Open the SOS Business Records / Business Entity Search and look up the company. Status appears at the top of the profile.

- If you need proof for a bank or a new vendor file, order a Certificate of Existence/Authorization (state fee $10).

- After you download it, use the SOS Validate Certificate feature to confirm it’s genuine.

Example:

Before awarding a subcontract, you pull up “Ashland Industrial Services, LLC.” The profile shows Active; last Annual Report filed in April; registered agent: a Lexington street address. You order a Certificate of Existence (downloaded PDF) and paste its code into Validate Certificate, it checks out. This is the level of documentation most lenders and procurement teams want to see.

Reviewing Key Business Records and Filings

Kentucky keeps a surprisingly complete digital trail. Use it to confirm the story the other side is telling you.

| What to check | Where to find it in FastTrack | Why it matters |

|---|---|---|

| Articles + amendments | Filing history | Confirms formation date, name changes, mergers. |

| Annual Reports | Filing history | Shows continuous compliance (watch for gaps before June 30). |

| Registered agent & office | Entity header | Confirms KY street address and service channel. |

| Officers / managers | “Current/Founding Representative” | Match names to contracts, resolutions, or signers. |

| Assumed names (DBAs) | Filing history | Reveals market names you’ll see on invoices. |

| Certificates | “Order / Validate certificate” links | Generate and validate proof of status for your files. |

If you’re extending credit or buying assets, add a UCC lien search at the SOS UCC portal to spot secured creditors. Search by debtor name for active filings.

Mini-case:

You’re vetting “Bluegrass Equipment Rentals, LLC.” The entity shows Active, but the Annual Report history skips last year. That’s a red flag, ask them to file immediately and send a fresh Certificate of Existence before you release funds.

Using Registered Agent Details for Verification

Every entity must continuously maintain (1) a registered office in Kentucky and (2) a registered agent (either a Kentucky resident or a business entity authorized in Kentucky) at that address. This agent is the statutory recipient for service of process; if the agent is missing or can’t be served, Kentucky law allows certified-mail service to the principal office.

How to use RA data smartly:

- Does the RA street address look real and in Kentucky? If the company is sizable, an RA that’s a reputable registered agent service is normal.

- Cross-check the RA name/address against the entity profile and your contract documents; discrepancies suggest the file is stale or the counterparty is careless.

- For tax onboarding, request a completed IRS Form W-9 from the vendor. If you’re an authorized payer, you can use IRS TIN Matching (e-Services) to validate the name/TIN combo before filing information returns.

Applying Due Diligence with Business Information

Pull everything into one quick, Kentucky-specific pass before you sign, extend credit, or wire funds.

Kentucky due-diligence checklist:

| What to verify | How to check & what “pass” looks like (plus next step if not OK) |

|---|---|

| Good standing |

Check SOS Business Entity Search. Order a Certificate of Existence/Authorization and validate it. Pass: Status shows Active and the certificate validates. If not: Have them file the Annual Report (due June 30), then send a new validated certificate. |

| Authority to sign |

Open the entity’s Officers/Managers/Directors list. Pass: Signer appears with the right title. If not: Request a board/member resolution or updated filing before you accept signatures. |

| Assumed names (DBAs) |

Review filing history for assumed name records. Pass: The name on invoices/signage matches a current DBA. If not: Ask them to renew/file the DBA or invoice under the legal name. |

| Registered agent & office |

Confirm an in-state registered office and current registered agent. Pass: Kentucky street address on file; reliable agent (often a professional registered agent service). If not: Require a Statement of Change before closing. |

| Liens (credit risk) |

Run a UCC search under the debtor’s legal name. Pass: No unexpected active filings. If not: Require payoffs/releases or adjust pricing/collateral. |

| Tax onboarding |

Collect IRS Form W-9; if eligible, use IRS TIN Matching. Pass: Name/TIN combo verifies. If not: Fix mismatches before payment or 1099 reporting. |

Why Registered-Agent details matter

By statute, every Kentucky entity must keep a registered office and registered agent on file. The agent is the default recipient for lawsuits and official notices; if none is available, service can be sent by registered/certified mail to the principal office. Stale or missing RA info = service-of-process risk.

Form your Kentucky LLC with Northwest

Northwest Registered Agent guides you through Kentucky’s entity search, ensures your name is unique, and files your LLC with built-in privacy protections and expert compliance help.

Additional Resources for Kentucky Business Searches

Kentucky offers supplementary research tools beyond the primary database for comprehensive business intelligence gathering. These resources provide additional verification layers and expanded business information access. Compare inter-state procedures via our guide on Kansas business entity search for a complete overview.

Kentucky Business One Stop Portal

The Kentucky Business One Stop Portal centralizes business formation resources, licensing information, and regulatory guidance for entrepreneurs and researchers. This integrated platform connects users with multiple state agencies including taxation, licensing, and regulatory departments for streamlined business research.

Accessing Online Business Filings and Records

Digital access systems provide immediate document retrieval for registered entities through secure online portals. Kentucky maintains electronic copies of essential business documents for quick reference and verification purposes. You can also perform a quick NH business lookup for New Hampshire entities.

Available document types include:

- Articles of Incorporation and Organization

- Annual reports and compliance filings

- Amendment records and name changes

- LLC operating agreements are internal records and are not filed with the Kentucky Secretary of State

- Professional license verifications

- Tax registration and compliance records

Electronic document access eliminates traditional mail delays while providing immediate verification capabilities. Most documents display within minutes of online requests, enabling real-time due diligence and compliance verification. You can also run a quick California business license search for West Coast filings.

Utilizing Local Chambers of Commerce and Directories

Local chambers provide community-based business intelligence and membership verification for enhanced due diligence processes. Chamber membership often indicates established business operations and community involvement. To expand your research in the Southeast, try our North Carolina business name search.

Contact regional chambers for membership verification and business reputation information. The Small Business Administration Kentucky office maintains additional business resources and verification databases for federal program participants and loan recipients.

Frequently Asked Questions About Kentucky Business Entity Search

Common questions about Kentucky's business entity search system address procedural concerns and user guidance for effective database utilization. Similar features are accessible via our Iowa business entity search..

How Long Does a Name Reservation Last in Kentucky?

Kentucky business name reservations remain valid for 120 days from filing date with renewal options available before expiration. Reservation applications require entity type specification and appropriate fees paid to the Secretary of State. Expired reservations return names to general availability, requiring new applications for continued protection. To plan effectively, see how long does it take to get an LLC in Kentucky.

Is There a Fee for Conducting a Business Entity Search?

Basic business name search functions remain completely free through the Kentucky Secretary of State's online portal. Premium services including expedited processing, certified document copies, and bulk data access may require additional fees. Standard searches, name availability verification, and basic record viewing incur no charges for public users.

How Often Is the Kentucky Business Database Updated?

Kentucky's business database receives real-time updates for new filings, amendments, and status changes throughout business days. Most filing updates appear within hours of processing, ensuring current information availability for time-sensitive research and verification activities.

Can I Search for Dissolved or Inactive Businesses?

Kentucky's search system maintains comprehensive historical records for dissolved and inactive legal entities with full filing histories available. Advanced search filters enable specific status targeting including dissolved, revoked, and withdrawn entities. Historical searches help track business succession, asset transfers, and compliance histories for legal research purposes.

What's the Difference Between the SOS Search and the UCC Search?

Secretary of State research focuses on entity formation and compliance records, while UCC searches target secured transaction filings and business asset documentation. Business entity searches reveal corporate structure and compliance status, whereas UCC databases show financial obligations and secured interests affecting business assets.

- Kentucky Legislature (Statutes): KRS 14A.3-010 Entity Name

- Kentucky Secretary of State: Annual Reports

- Kentucky Secretary of State: Business Records

- Kentucky Secretary of State: Business Forms Library

- Kentucky Secretary of State: UCC Online Services (Search & File)

- Justia: KRS 14A.3-010 (Entity Name)

- FindLaw: KRS 14A.3-050 (Assumed Name)

Looking for an overview? See Kentucky LLC Services

Register your Kentucky LLC with Harbor Compliance

Harbor Compliance provides precision-driven Kentucky LLC formation, including full name availability checks and fast, compliant filings handled by professionals.