Starting a business in 2025 and want strong liability protection, low fees, and real privacy? A Wyoming LLC checks all three boxes. This guide walks you step by step through choosing a name, appointing a Wyoming registered agent, filing your Articles of Organization, and setting up banking and tax basics. By the end, you’ll know exactly how to launch your Wyoming LLC with fewer delays and surprises.

Wyoming LLC Basics: Requirements, Costs, and What to Do Before You File

Before you actually submit anything to the state, it helps to understand what a Wyoming LLC is, what the state requires, and roughly what you’ll pay in 2025. This shapes your decisions about ownership, naming, addresses, and whether you’ll use a professional registered agent service or act as your own agent.

What a Wyoming LLC Is and How It Protects Your Personal Assets

A limited liability company (LLC) is a business structure that separates your personal assets from your business liabilities. In most situations, that means your house, car, and personal savings are not on the line if the business gets sued or can’t pay a debt. For a broader comparison of LLCs with sole proprietorships, corporations, and other options, see the SBA guide to choosing a business structure.

A Wyoming LLC gives you:

- A separate legal entity under Wyoming law

- “Limited liability” protection for its owners (called members)

- Flexible tax treatment (you can usually choose how the LLC is taxed)

In practical terms, that protection works only if you treat the LLC in Wyoming like a real business:

- Keep business and personal bank accounts separate

- Sign contracts in the LLC’s name, not your personal name

- Don’t use the LLC to commit fraud or hide personal debts

If you ignore those basics, a court can “pierce the veil” and go after your personal assets despite the LLC.

Wyoming is especially popular because it combines this standard LLC protection with:

- No state corporate income tax

- Strong privacy and asset-protection laws for LLCs

- Comparatively low filing and annual maintenance costs

Core Wyoming LLC requirements

Before you form a Wyoming LLC, you need to line up a few mandatory pieces so your filing isn’t rejected.

Here are the core requirements in 2025:

| Requirement | What Wyoming Requires | Practical Notes |

|---|---|---|

| Owner (Member) | At least one member. Individuals or business entities may own the LLC. | You don’t need multiple owners; a single-member Wyoming LLC is allowed. |

| LLC Name | Must be distinguishable from existing entities and include an LLC designator. | Acceptable endings include “LLC,” “L.L.C.,” “Limited Company,” etc. |

| Registered Agent | A registered agent with a physical address in Wyoming is required by statute. | Can be an individual resident or a commercial registered agent service. |

| Registered Office | A Wyoming street address (no P.O. box) where the agent is located. | This is where the state and courts send legal and official documents. |

| Principal Address | A business address for the LLC (can be in or out of Wyoming). | Many non-resident owners use their agent’s address as the principal office. |

Owner (member)

Wyoming does not require owners to live in Wyoming, and there’s no maximum number of members. Foreign owners and entity owners are allowed, as long as you follow federal tax rules.

Name rules

Your name must be unique in the state’s records and must include an LLC identifier such as “LLC,” “L.L.C.,” “Limited Liability Company,” or a permitted abbreviation. The Secretary of State can reject names that are misleading or too similar to existing companies.

Registered agent & address

Wyoming law requires every business entity to keep a registered agent with a physical Wyoming address to receive service of process and official notices. You can:

- Serve as your own registered agent if you live in Wyoming and are available during business hours, or

- Hire a commercial registered agent service that maintains a Wyoming office and accepts documents for you

Most out-of-state owners choose a professional service so they don’t need to be physically present in Wyoming.

Typical Wyoming LLC Costs

Before you file, it’s smart to understand what your Wyoming LLC will actually cost to start and keep active.

Core state and service costs in 2025

| Item | Typical Cost (2025) | How Often? |

|---|---|---|

| State filing fee – Articles of Organization | $100 to form an LLC with the Wyoming Secretary of State. | One-time at formation |

| Online processing / convenience fee | Around $2–$4 added to online card payments. | Per online transaction |

| Registered agent service | Usually $25–$150 per year, depending on provider and extras. | Every year |

| Wyoming LLC annual report (license tax) | Minimum $60 or $0.0002 per dollar (0.02%) of assets in Wyoming, whichever is higher. | Every year |

For a deeper, line-item breakdown (including examples at different asset levels), check our detailed guide to Wyoming LLC costs.

Start Your Wyoming LLC Easily with ZenBusiness

ZenBusiness streamlines every step of forming your Wyoming LLC: name reservation, articles of organization, and compliance – all handled quickly and affordably.

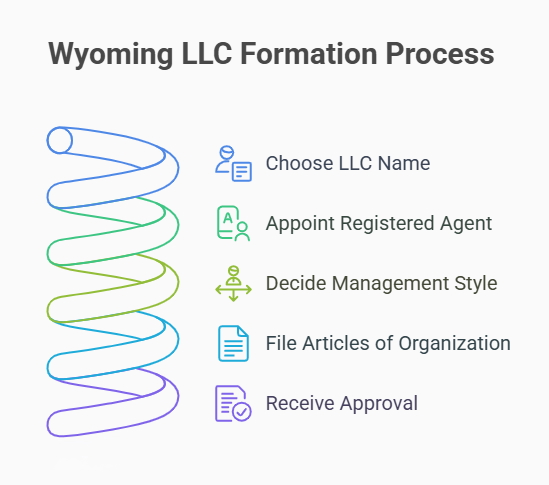

Step-by-Step How to Form Your Wyoming LLC

This is the “do it now” part. Below is the short, practical sequence to form a Wyoming LLC with the state without getting lost in legal jargon.

Step 1 – Choose a Wyoming-compliant LLC name and check availability

Your name has to follow Wyoming rules and be available in the state database.

Basic Wyoming LLC name rules

Your LLC name must:

- Be distinguishable from existing entities on file with the Wyoming Secretary of State

- End with “Limited Liability Company,” “Limited Company,” or an abbreviation like LLC, L.L.C., LC, L.C., or similar

- Avoid misleading terms or words that imply you’re a government agency (those can trigger rejections or extra approvals)

How to check name availability:

- Go to the Wyoming Business Filing Search on the Wyoming Secretary of State site.

- Search your desired name using the “Contains” option and omit “LLC” and punctuation for a cleaner search.

- If you see very similar names, tweak yours until it’s clearly different.

- (Optional) You can file a name reservation by mail if you want to hold the name for a period before forming the LLC.

Once you’ve got a unique, compliant name, you’re ready for the next step.

Step 2 – Appoint a Wyoming Registered Agent

Wyoming law requires every LLC to maintain a registered agent in the state. No agent = no approval.

Who can be a registered agent?

Your registered agent can be:

- An individual at least 18 years old with a physical street address in Wyoming (not just a P.O. box), or

- A business authorized to act as a Wyoming registered agent with a Wyoming office

The agent must be available during normal business hours to receive legal documents and official notices.

What address is used?

- The registered office address listed in your Articles of Organization must be a real Wyoming street address (a drop box or mail-forwarding-only address will be rejected).

- Your registered agent also signs a Consent to Appointment by Registered Agent form, confirming they agree to serve and keep required records on site.

If you live outside Wyoming, it’s usually easier to hire a professional registered agent service so you don’t have to maintain your own physical office in the state.

You can compare privacy practices, pricing, and support across leading providers in our Wyoming registered agent guide.

Step 3 – Decide Your Wyoming LLC Management Structure

Even though Wyoming’s basic Articles form doesn’t ask you to check a box for this, you should decide your management style before you draft your operating agreement and open a bank account.

Two options:

- Member-managed LLC

- All owners (members) run the business and can sign contracts for the LLC.

- This is the default and works best for small businesses where everyone is active.

- Manager-managed LLC

- One or more managers (who may or may not be members) handle daily operations and sign contracts.

- Good if you have passive investors or some members who don’t want day-to-day control.

Your Wyoming LLC operating agreement should clearly state whether you are member-managed or manager-managed and who has authority to act for the LLC.

Step 4 – File Wyoming Articles of Organization

You officially create your LLC in Wyoming by filing Articles of Organization with the Wyoming Secretary of State.

The most efficient way is to file online through the Wyoming Business Center.

Information you’ll need to provide (online form closely matches the state PDF):

- LLC name (with a proper LLC designator)

- Whether you’re electing “close LLC” status (most small LLCs leave this unchecked unless they know they want it)

- Registered agent’s name and physical Wyoming address

- LLC mailing address

- Principal office address

- Email address for the LLC (used for official notices and filing evidence)

- Organizer’s name, signature, and contact information

Filing method and fee

- Online: $100 filing fee, payable by credit/debit card; processing is usually very fast.

- By mail: $100 filing fee; processing can take up to about 15 business days after receipt.

To see current instructions straight from the state, you can review the latest Articles of Organization form and instructions on the Wyoming Secretary of State website.

If you’d rather have a specialist handle the filings for you, we compare the best Wyoming LLC services in a separate guide.

Step 5 – Get and Save Your Wyoming LLC Approval Papers

Once your filing is approved:

- The Secretary of State issues filed Articles of Organization (and, for online filings, sends electronic evidence and certificates to the email you provided).

- Your LLC appears as “Active” in the state’s Business Filing Search database.

If you ever need to confirm your status or look up another company, you can follow our step-by-step Wyoming LLC lookup guide.

What to save:

- Filed Articles of Organization (PDF or original mailed copy)

- Registered agent consent form

- Any confirmation or receipt from the Secretary of State

- Notes on your management choice (member-managed or manager-managed) for your operating agreement

You’ll need these documents when you:

- Apply for an EIN with the IRS (which you can do for free on IRS.gov)

- Open a business bank account

- Apply for state or local licenses

Keep digital and paper backups. If anything is lost, you can usually download copies from the Wyoming Business Center using the business search tool.

Create Your Wyoming LLC for Free with Bizee

Bizee helps you form your Wyoming LLC at $0 for the filing service, just pay the state fee and get guided tools to set up your business structure right.

After Approval – Set Up Your Wyoming LLC to Operate

Once your Wyoming LLC is approved, you’re not “done” yet. You still need a few key steps so banks, the IRS, and the state treat your company as a real, separate business.

Create a Wyoming LLC Operating Agreement

Wyoming doesn’t require you to file an operating agreement with the state, but every LLC should have one. It’s an internal contract that explains who owns the LLC, who runs it, and how decisions and money are handled.

(If you don’t want to draft this from scratch, several online legal service providers offer attorney-reviewed operating agreement templates and other core business documents).

Even for a single-member LLC in Wyoming, an operating agreement helps:

- Prove the LLC is separate from you (useful for banks and courts)

- Show how profits are distributed

- Clarify what happens if you add partners later or sell the business

Key items to include:

- LLC name, formation date, and principal address

- Member(s) and ownership percentages

- Member-managed vs. manager-managed structure

- Voting and decision-making rules

- How profits, losses, and distributions work

- What happens if a member leaves, dies, or sells their interest

You don’t send this to the state. Just sign it and keep it with your LLC records.

Apply for an EIN for Your Wyoming LLC with The IRS

An EIN (Employer Identification Number) is your LLC’s federal tax ID. You usually need it to open a business bank account, hire employees, or file certain tax forms.

You get an EIN directly from the IRS for free.

How to apply (most owners):

- Go to the IRS EIN application page and start the online application.

- Choose “Limited Liability Company (LLC)” as the entity type.

- Enter the responsible party’s name and SSN/ITIN.

- Enter your Wyoming LLC details (legal name exactly as on your Articles, address, formation state).

- Select how your LLC will be taxed (default is usually pass-through).

- Submit and download/save your EIN confirmation letter.

For non-U.S. owners without an SSN/ITIN, the IRS still allows EINs, but you’ll apply by fax or mail using Form SS-4 instead of the online system.

Open a Dedicated Business Bank Account

To protect your liability shield, you need separate business finances. Mixing personal and business money (commingling) is one of the quickest ways to weaken your LLC protection.

Most banks will ask for:

| Item | Where you get it |

|---|---|

| Filed Articles of Organization | Wyoming Secretary of State approval |

| EIN confirmation letter | IRS EIN application |

| Operating agreement | Your internal LLC records |

| Government-issued photo ID | Driver’s license or passport |

| Possibly your LLC’s mailing address proof | Utility bill, lease, or similar (depends on bank) |

Before you visit a branch, call ahead or check the bank’s website for its LLC checklist.

Once the account is open:

- Use it only for business income and expenses.

- Pay yourself with owner draws or payroll (depending on tax setup), not by swiping the debit card for personal stuff.

- Keep simple bookkeeping so transactions are clearly business-related.

Register for Required Wyoming Taxes and Licenses

Wyoming is attractive because it has no state personal income tax and no separate state corporate income tax, but you may still need to register for:

- Sales and use tax if you sell taxable goods or certain services

- Wyoming sales/use tax license through the Wyoming Internet Filing System for Business (WYIFS)

- Local city/county business licenses depending on where you operate

- Industry or professional licenses (for example, contractors, medical, legal, financial services, food service)

A simple way to check:

- Review the Wyoming Department of Revenue excise tax information for sales/use tax rules.

- Contact the Wyoming Small Business Development Center (SBDC) or your local city/county office to confirm local licensing needs.

Register early if you’ll be collecting sales tax or hiring employees so you can report and pay correctly from day one.

If you expect to build a team and want help with payroll, HR, and compliance, you can also look at Wyoming PEO companies that bundle many of these obligations into one service.

Keeping Your Wyoming LLC Compliant Each Year

After formation, staying compliant is simple as long as you file your annual report, keep a Wyoming registered agent, and update the state when key details change.

Once you start building a team, you can also outsource payroll, benefits, and HR compliance to a PEO for small businesses so your Wyoming LLC stays compliant even if you operate in multiple states.

Wyoming LLC Annual Report

Every Wyoming LLC must file an annual report and pay an annual license tax to stay in good standing.

Key points:

- Due date: Before the first day of your LLC’s anniversary month each year (starting the year after formation).

- Fee: Minimum $60, or $0.0002 per dollar of assets located in Wyoming, whichever is higher.

- How to file: Online through the Wyoming annual report wizard or by mail.

Quick overview:

| Annual report item | Detail (2025) |

|---|---|

| Who files? | Every active Wyoming LLC |

| Due when? | Before 1st day of anniversary month each year |

| Fee | $60 minimum or 0.0002 × WY-based assets |

| Where to file? | Wyoming Secretary of State annual report wizard or by mail |

| Risk if you ignore | Late fees and possible administrative dissolution |

Online filing steps (summary):

- Go to the Wyoming annual report area on the Secretary of State site.

- Look up your LLC by Filing ID or name.

- Confirm your LLC’s details and update asset information in Wyoming.

- Confirm the calculated fee and pay by card (small convenience fee applies).

- Download or print your receipt/confirmation for your records.

If you file by mail, you’ll print the form, sign it, and mail it with a check to the Secretary of State.

Maintaining a Wyoming Registered Agent

To remain active, your LLC in Wyoming must always have a valid registered agent with a current Wyoming street address.

That means:

- Your registered agent must be available during normal business hours.

- The registered office must be a physical address (no P.O. boxes only).

- If your agent or their address changes, you must update the state.

To change your registered agent, you typically:

- Choose a new Wyoming registered agent or registered agent service.

- Have the new agent sign a Consent to Appointment form.

- File the Appointment of New Registered Agent and Office (or similar “Statement of Change” form) with the Wyoming Secretary of State and pay the small state fee (currently $5).

If your agent’s contact information (but not the agent themself) changes, there is a separate Registered Agent Information Update form.

Failing to maintain a valid agent or address can lead to missed lawsuits and eventual administrative dissolution of your LLC. To lower that risk, many owners choose a privacy-focused provider like Northwest, and you can see how it stacks up in our Northwest Registered Agent review.

Keep Your Wyoming LLC Compliant with Northwest Registered Agent

Northwest provides a dependable Wyoming registered agent with real-address service and fast document alerts.

Updating Your LLC when Something Changes

When key information about your Wyoming LLC changes, you may need to update your records with:

- The Wyoming Secretary of State

- The IRS and any tax accounts

- Your bank and licensing agencies

Common updates and how they’re handled:

| Change type | Typical action |

|---|---|

| LLC name | File an LLC Amendment to Articles of Organization and pay the state fee. |

| Registered agent | File a change-of-agent form + new agent consent; pay $5 fee. |

| Principal office or mailing address | File an address update form or amendment, depending on the change. |

| Members/managers | Update your operating agreement; some changes may also require Articles amendment. |

Wyoming law requires filing Articles of Amendment when certain core details (like the LLC name or false/erroneous statements) change. For anything major, like name, ownership, management, assume you’ll need both:

- An internal update (operating agreement, membership records), and

- A state filing (amendment or change form), plus follow-up updates with the IRS, bank, and any license agencies.

Keeping your public record up to date helps avoid confusion, delays, and problems proving who is actually authorized to act for your LLC.

FAQs – Starting and Running a Wyoming LLC

Starting a Wyoming LLC comes with a few common questions about timing, residency, ownership, and naming rules. This FAQ section gives you quick, straightforward answers so you can move confidently through the formation process.

What is the first step to start a Wyoming LLC in 2025?

Confirm Wyoming is the right state for you, then choose a unique, compliant LLC name.

Before you file anything, make sure a Wyoming LLC matches your goals for liability protection, privacy, and taxes compared with your home state. Once that checks out, your real first step is picking a name that meets Wyoming’s naming rules and passes the state business-name search. With a solid name decided, you can line up your registered agent and complete the Articles of Organization in one smooth run.

How much does it cost to start and maintain a Wyoming LLC in 2025?

Expect about $100 to form your LLC, plus at least $60 per year, plus whatever you pay a registered agent.

The state charges $100 to file Articles of Organization for a new Wyoming LLC, with a small extra fee for online card payments. Each year, you’ll file an annual report and pay a license tax: a $60 minimum or $0.0002 per dollar of assets in Wyoming, whichever is higher. Most entrepreneurs also budget around $50–$150 per year for a professional registered agent.

How long does it take to form a Wyoming LLC online?

Often the same day or within 1–3 business days after you submit your online filing.

Wyoming’s online filing system processes Articles of Organization quickly compared with many other states. If you file during normal business hours with correct information and payment, your Wyoming LLC is often approved the same day or within a couple of days. Mailed filings can take longer because of mail time and manual processing, so online submission is usually the fastest option.

For more timing scenarios and real-world examples, see our full guide on how long it takes to get a Wyoming LLC.

Do I need to live in Wyoming to start a Wyoming LLC?

No, you can live anywhere, as long as you maintain a Wyoming registered agent.

Wyoming law does not require LLC owners (members) to live in the state. Non-residents and even foreign owners can form a Wyoming LLC, provided the LLC keeps a registered agent with a physical Wyoming address to receive legal documents. This is why many out-of-state entrepreneurs use a professional registered agent service, it satisfies the in-state address requirement without needing to relocate.

Can a Wyoming LLC have just one owner?

Yes, a Wyoming LLC can have a single member or multiple members.

Wyoming allows single-member LLCs, which are very common for freelancers, consultants, and small online businesses. Legally, they get the same liability protection as multi-member LLCs, as long as you treat the LLC as separate from your personal finances. For federal tax purposes, a single-member LLC is usually treated as a “disregarded entity” by default, unless you elect another tax classification with the IRS.

Do I need a DBA (trade name) in addition to my Wyoming LLC name?

Only if you want to operate under a different public name than your LLC’s legal name.

If you’re happy using your full Wyoming LLC name (including “LLC”) on your website, invoices, and contracts, you don’t need a DBA (also called a “trade name” or “doing business as”). If you want to market under a simpler brand, like “High Plains Designs” instead of “High Plains Designs LLC”, you’d register that trade name with the state while keeping your LLC name as your legal entity name.

- Wyoming Secretary of State – Business Division: Start a Business in Wyoming

- Wyoming Secretary of State – Business Division: Business Entity Search (name availability & records)

- Wyoming Secretary of State – Business Division: Business Division Filing Fee Schedule (PDF)

- Wyoming Secretary of State – Business Division: Annual Report Information & Online Filing

- Wyoming Secretary of State – Business Division: Registered Offices and Agents Act, Chapter 28 (PDF)

- Wyoming Department of Revenue: State Tax Information for Businesses

- Wyoming Internet Filing System (WYIFS): Sales, Use, Lodging & Other Excise Tax Filing

- Wyoming Business Council: Startup Resources, Licensing & Permitting Help

- U.S. Small Business Administration: Doing Business in the Wyoming District

Looking for an overview? See Wyoming LLC Services

Form a Professional Wyoming LLC with Harbor Compliance

Harbor Compliance assigns a dedicated specialist to handle your entire Wyoming LLC formation, ensuring accuracy and full regulatory compliance from day one.