Starting an LLC in Massachusetts in 2025 involves a clear sequence: filing a Certificate of Organization, appointing a registered agent, setting up tax accounts, and staying compliant with annual reports. While the state’s $500 filing fee is higher than most, the process is straightforward if you know what to expect. This guide walks you through each step: naming your LLC, handling filings, and managing ongoing obligations — so you can launch with confidence and avoid costly mistakes.

Why Form an LLC in Massachusetts?

Forming an LLC in Massachusetts gives you the practical mix most owners want: liability protection, tax flexibility, and a clean compliance rhythm—without the complexity of a full corporation.

- Limited liability, by design. Your personal assets are generally shielded from business debts and lawsuits when you keep finances separate and follow operating formalities.

- Simple, flexible taxation. A Massachusetts LLC is pass-through by default (profits/losses flow to your return). If it fits your numbers, you can elect S-corp taxation later to optimize self-employment taxes.

- Management your way. Choose member-managed for hands-on control or manager-managed if investors or silent partners prefer a separation of duties.

- Credibility & banking. Vendors, marketplaces, and banks tend to prefer registered entities. Your LLC name is protected statewide once approved, and opening a business bank account is straightforward with your filings in hand.

- Professional use cases. Licensed fields can form a Massachusetts professional llc (PLLC), aligning liability protection with board/insurance rules.

- Clear ongoing cadence. One state Annual Report on your anniversary date and standard tax accounts (e.g., sales tax via DOR) make the maintenance predictable.

- Local execution help. You can act as your own agent or hire a registered agent service for privacy, mail scanning, and compliance reminders.

For readers who want a broader introduction before diving into state-specific details, we’ve also created a complete guide on what an LLC is and how it works.

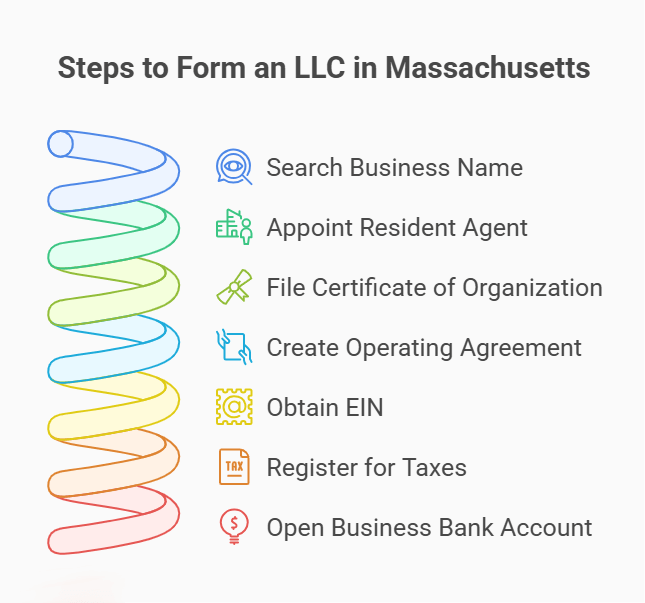

Steps to Form an LLC in Massachusetts

Use this section as your practical roadmap. In the next few steps, you’ll see exactly what to file, where to file it, and what to prepare beforehand, so your LLC in Massachusetts is formed correctly the first time. If you’re wondering how to start an llc in massachusetts, begin at Step 1 and move straight through; each step is short, action-oriented, and aligned with 2025 requirements.

Step 1 – Search Your Business Name

Before you file, make sure your name is available and compliant. Massachusetts requires that an LLC in Massachusetts include “Limited Liability Company,” “Limited Company,” or an approved abbreviation (LLC, L.L.C., LC, L.C.), and the name must be distinguishable from existing entities on record.

Do three quick checks:

- State database (availability). Search the Corporations Division database by entity name and variations (singular/plural, punctuation, word order). If it’s close to another company, tweak now to avoid rejection.

You can follow our step-by-step tutorial on the Massachusetts business entity search tool to make sure your name is truly available. corp.sec.state.ma.us - Trademarks (conflicts). Run a federal trademark search to avoid stepping on someone’s protected brand—even if the state shows your name as available (visit: USPTO)

- Local DBA records (if using a trade name). If you’ll operate under a public name different from your LLC’s legal name, check your city/town clerk’s DBA listings and requirements.

Step 2 – Appoint a Resident/Registered Agent

Massachusetts uses the term resident agent (you’ll also see “registered agent”). Every LLC in Massachusetts must continuously maintain an agent with a Massachusetts street address (no P.O. boxes) who’s available during normal business hours to receive legal documents (service of process) and state mail. If you’re unsure why this role is legally required or what options you have, our guide on registered agent requirements in Massachusetts explains it in plain detail.

Who can be the agent?

You (or another individual) with a physical Massachusetts address, or a business entity authorized to do business in MA. The agent must consent to the appointment—there’s a signature line on the Certificate of Organization for this consent.

Why many owners choose a registered agent service?

Most owners pick a registered agent service to protect privacy, ensure 9–5 availability for legal notices, and avoid missed deadlines.

- Privacy: keeps your home/office address off the public record.

- Always available (9–5): someone is there to accept service of process and state mail.

- Compliance reminders: alerts for annual reports, tax filings, and changes.

- Address stability: you can move or work remotely without updating state records.

- Professional handling of lawsuits: immediate, documented delivery—no surprises at your storefront.

- Mail scanning & online vault: fast access and audit trails.

- Multi-state coverage: one provider can handle several states as you expand.

- Out-of-state owners: satisfies the in-state address requirement.

- Time savings: no front-desk interruptions; fewer filing mistakes.

For a deeper comparison of top providers, see our guide to the best registered agent services in Massachusetts. Many entrepreneurs prefer working with providers like this detailed review of Northwest’s registered agent service, while others go for ZenBusiness as a bundled formation + agent solution because of its affordability.

Step 3 – File the Certificate of Organization

File your Certificate of Organization with the Secretary of the Commonwealth (Corporations Division). this is what legally creates your LLC in Massachusetts. The state filing fee is $500. When you file online or by fax, Massachusetts adds an expedited/service fee, which makes a $500 filing show $520 at checkout (the fee schedule explicitly lists a $20 add-on for $500 subtotals). You can file online via the Corporations Division portal or by mail.

What you’ll need on the form (core items):

- LLC name and (if available) your FEIN.

- Street address where company records are kept (Massachusetts address).

- Resident (registered) agent name and MA street address, plus the agent’s written consent (there’s a consent line on the form).

- General character of the business.

- Manager/member information (as applicable).

- Effective date and authorized signer.

How to file:

- Online: Use the Corporations Division’s e-filing system (often searched as “massachusetts secretary of state llc”). You’ll see the service/expedite fee applied before payment.

- Mail/in person: Submit the paper Certificate of Organization to the Boston office; base fee remains $500 (no electronic service fee).

Step 4 – Create an Operating Agreement (Internal)

This is an internal contract that governs how your LLC in Massachusetts is owned and run. Massachusetts doesn’t file your operating agreement, but the state explicitly expects certain company records to exist, and if they’re not in a written operating agreement, you must keep them in a separate written record (e.g., contributions, distribution rights, and other core terms). That’s why a short, written agreement is strongly recommended.

What to include (essentials):

- Ownership (member list and percentages) and capital contributions.

- Management structure (member-managed or manager-managed) and decision-making rules.

- Voting thresholds, profit/loss allocations, and distribution policies.

- Admission/exit of members, buy-sell triggers, and dispute procedures.

- Record-keeping location (your Massachusetts records office) and signatories.

Single-member LLCs: You still benefit from a written agreement—it documents separateness and the rules you want (otherwise the default statute fills the gaps).

Where to keep it: Do not file it with the Secretary. Keep the signed copy with your LLC records in Massachusetts and update it when ownership or management changes.

Step 5 – Get an EIN

Your EIN is the federal tax ID the bank and tax agencies will ask for. It’s free and you get it directly from the IRS, avoid sites that try to charge. Apply online and you’ll receive the number immediately after approval.

What you’ll need (key items):

- Responsible party details (a real person who controls the company). If the responsible party has an SSN/ITIN, include it. If they don’t have and aren’t eligible for an SSN/ITIN (common with non-U.S. owners), the IRS instructions say to leave the field blank or enter “foreign.” You’ll also provide member count and whether your LLC in Massachusetts was organized in the U.S. (yes).

How to apply:

- Online (fastest): Use the IRS EIN application to apply and receive your EIN immediately, at no cost.

- Fax or mail (backup options): Send Form SS-4 to the IRS: Fax 855-641-6935 or Mail Attn: EIN Operation, Cincinnati, OH 45999. Fax applications typically get a response in about 4 business days; mail takes about 4 weeks.

- International applicants: If your principal place of business is outside the U.S., you can apply by phone at +1-267-941-1099 (Mon–Fri, 6 a.m.–11 p.m. ET).

After you receive it: Keep the IRS confirmation letter with your records, and remember to file Form 8822-B within 60 days if your responsible party or address changes.

Step 6 – Register for Massachusetts Taxes & Permits

If your LLC in Massachusetts will sell taxable goods/services or hire employees, you must register with the Department of Revenue (DOR) through MassTaxConnect before you start collecting or remitting taxes. Registration is online and quick.

When you must register (common cases):

- Sales & Use Tax (6.25%) — selling taxable goods/services or making taxable rentals in MA. Register, collect, and file via MassTaxConnect.

- Meals — restaurants/food vendors must charge 6.25% state sales tax plus any local option meals excise (0.75%) adopted by the city/town (effective rate 7% where adopted).

- Employer payroll — if you have employees, register for withholding tax (state income tax withheld from wages).

- Unemployment insurance (UI) — employers must also register with the Department of Unemployment Assistance (DUA) to report wages and pay UI contributions.

- Use tax (purchases with no MA sales tax paid) — remit 6.25% use tax on taxable items you use in MA if the seller didn’t collect MA tax.

How to register:

- Go to MassTaxConnect and choose Register Your Business (a separate account from the Secretary’s filing system). Once approved, you’ll file and pay returns in the portal.

Local licenses/permits:

- Depending on your activity, you may also need city/town approvals (e.g., food permits). Massachusetts’ “Starting a business” guide links out to local DBA/Business Certificate and licensing steps.

Set your filing frequency reminders in MassTaxConnect (monthly/quarterly/annual, as assigned) to keep Massachusetts LLC taxes on schedule.

Step 7 – Open a Business Bank Account

Separate finances are essential to preserve liability protection for your LLC in Massachusetts. Open a dedicated business checking account (and, if needed, a savings/merchant account) before you start taking payments.

What banks typically ask for:

- Your approved Certificate of Organization (or state receipt/printout showing active status).

- EIN confirmation letter from the IRS.

- Operating Agreement (even for single-member LLCs).

- Personal ID for authorized signers (driver’s license/passport).

- Company address and contact details (match your records).

Tips for a smooth appointment:

- Bring a second form of ID and proof of business address (e.g., lease or utility bill).

- If multiple members will be signers, have them attend or use the bank’s remote authorization process.

- Some banks may also ask for a Certificate of Good Standing, you can order one from the state if requested.

- After opening, use the account exclusively for business income and expenses; keep receipts and reconcile monthly.

Form your Massachusetts LLC with ZenBusiness

enBusiness makes starting your Massachusetts LLC stress-free by handling your filings, business name registration, and ongoing compliance—all at a low cost.

Massachusetts LLC Costs & Fees (2025)

Here’s a clean, state-sourced breakdown of what it costs to form and maintain an LLC in Massachusetts in 2025. Core amounts are published by the Secretary of the Commonwealth; online or fax filings typically include an added processing/expedite charge that shows at checkout (many filers see a $20 add-on, so totals display as $520).

Fee Table (2025):

| Cost item | Amount (USD) | When / Notes |

|---|---|---|

| Certificate of Organization (domestic LLC) | $500 | Creates the LLC upon approval; online/fax submissions commonly reflect an added $20 processing/expedite at checkout (total $520). |

| Annual Report (LLC) | $500 | Due each anniversary date of formation; online submissions often show a $20 add-on (total $520). |

| Name Reservation (60 days) | $30 | Optional; may extend once for an additional 60 days for another $30. |

| Change of Resident/Registered Agent or Office | $25 (paper/fax) / $0 (online) | File a “Statement of Change of Resident Agent/Office.” |

| Certificate of Amendment (LLC) | $100 | Updates the Certificate of Organization. |

| Restated Certificate of Organization | $100 | Restates and optionally amends the certificate. |

| Foreign LLC Registration | $500 | Registers an out-of-state LLC to do business in MA. |

| Certificate of Good Standing / Legal Existence | $25 / $12 | Often requested by banks or for foreign registration. |

How much does it cost to form an LLC in Massachusetts?

By mail, the state filing fee is $500 for the Certificate of Organization. If you file online or by fax, the checkout total commonly shows $520 due to an added processing/expedite charge. The Annual Report is $500 each anniversary (often $520 online).

For a more detailed breakdown of Massachusetts LLC costs, see our dedicated state guide.

Why is Massachusetts more expensive than many states?

Relative to peers, Massachusetts sits on the high end for base formation and annual report fees. For comparison, official state sources show: Florida $125 to form an LLC, Texas $300, Delaware $90, and Kentucky $40—all below Massachusetts’ $500 base.

The difference is a policy choice by each state; fees fund each filing office’s operations and service model. If you’d like a state-by-state comparison beyond Massachusetts, see our complete breakdown of LLC costs across the U.S.

Maintaining Your Massachusetts LLC

Keywords: massachusetts llc annual fee, massachusetts llc annual report, MA llc annual report fee, file annual report online massachusetts, massachusetts llc taxes, massachusetts llc forms.

Annual Report Requirements

File an Annual Report with the Corporations Division each year by your formation anniversary. The massachusetts llc annual fee is $500. You can file online or by mail through the Secretary of the Commonwealth.

Massachusetts LLC Taxes

- Sales & Use Tax (6.25%): If you sell taxable goods/services or owe use tax, register and file via MassTaxConnect.

- Withholding/payroll: If you have employees, register for employer withholding with DOR (via MassTaxConnect) and set up a DOR account.

- Unemployment Insurance (DUA): Employers register with the Department of Unemployment Assistance and submit quarterly wage reports and UI contributions.

BOI / Corporate Transparency Act (2025 update)

Per FinCEN’s updated guidance (March 26, 2025): U.S. domestic entities are exempt from BOI reporting. Foreign entities registered to do business in the U.S. still must report under revised deadlines (e.g., companies registered before March 26, 2025 must file by April 25, 2025; those registered on/after March 26 have 30 days). Always reconfirm at FinCEN before you file.

Keep a Registered Agent Current

You must continuously maintain a Massachusetts resident (registered) agent and street address. If you switch agents (for example, to a registered agent service), file a Statement of Change. The fee is $25 for paper/fax and $0 if filed electronically.

Hire a Trusted Massachusetts Registered Agent from Northwest

Northwest’s Registered Agent service keeps your personal info off public records and ensures you never miss a critical delivery in Massachusetts.

Local DBA and licenses

If you operate under a trade name, file a Business Certificate (DBA) with your city/town clerk. Local licensing may also apply based on industry.

Alternatives to an LLC in Massachusetts

If an LLC isn’t the perfect fit, you still have solid options. Below is a quick, owner-friendly look at Massachusetts corporation formation, Professional LLC (PLLC) rules, and when a sole proprietorship or partnership makes sense (and when it doesn’t).

Corporation (C-Corp, S-Corp): Filing fee $275 (Mass SOS).

If you’re focused on venture funding, stock plans, or building a company with formal governance, a corporation may be better than an LLC. To get started, you’ll file Articles of Organization with the Secretary of the Commonwealth. The fee is $275 minimum (covers up to 275,000 authorized shares) and increases by $100 per additional 100,000 shares—that’s the state’s official schedule for how to form a corporation in Massachusetts.

- Tax treatment: “C-corp” and “S-corp” are tax statuses, not different state filings. A C-corp is the default; to be taxed as an S-corp, an eligible corporation (or eligible LLC taxed as a corporation) files IRS Form 2553 by the deadline. This is the practical core of starting a corporation in Massachusetts if you plan to elect S-corp treatment.

- When it shines: Raising capital, issuing equity broadly, or scaling with formal boards and bylaws.

If you need broader support beyond LLC or corporate filings—like contracts, compliance, or custom agreements—you can also check out our guide to the best online legal services available today.

Professional LLC (PLLC): Required for doctors, lawyers, CPAs.

Certain licensed fields (e.g., physicians, attorneys, CPAs) are expected to use a Massachusetts professional llc (or a Professional Corporation) to comply with board and insurance rules. Massachusetts provides a dedicated Professional LLC Certificate of Organization form, and state legal resources point practitioners to profession-specific regulations (e.g., SJC Rule 3:06 for law firms; Division of Insurance and Board of Accountancy rules). Check your board’s rules before you file.

- Why choose a PLLC: Liability separation for business obligations while respecting licensing/ownership rules unique to your profession.

- Note: A PLLC is still an LLC under Chapter 156C; tax treatment remains flexible (default pass-through, with optional corporate/S-corp elections if eligible).

Sole Proprietor/Partnership: Cheaper but no liability protection.

These are the least expensive paths to start operating, but they don’t provide liability protection the way corporations and LLCs do. The U.S. SBA explains that sole proprietors’ business and personal assets are not separate; owners can be personally liable for business debts. For partnerships, Massachusetts notes that general partners are legally responsible for the business’s debts (jointly and, in key cases, jointly and severally), unless you register a limited-liability variant like an LLP.

- Good fit when: You’re testing a concept with minimal risk and cost, and you understand the personal liability trade-off.

- DBA reminder: If you’ll operate under a trade name, file a local Business Certificate (DBA) with your city or town clerk.

Conclusion

A well-structured LLC in Massachusetts gives you what most owners want—limited liability protection, clean credibility with banks and vendors, and flexible tax treatment—while keeping management simple. The trade-off is cost: Massachusetts sits on the expensive end of the spectrum. Plan for the $500 filing fee to launch and the $500 annual report fee every anniversary to stay compliant. With those two numbers on your calendar, the rest of the workload is mostly routine record-keeping and timely tax filings.

Ready to move? You can file directly through the Massachusetts Secretary of the Commonwealth for maximum control, or use a trusted formation provider (ideally one that bundles a registered agent service and compliance reminders) if speed and convenience are your priority. To help you decide, we’ve put together detailed reviews of the best LLC services in Massachusetts. Either way, follow the steps you’ve seen here, name check, agent, Certificate of Organization, operating agreement, EIN, and tax setup, and your Massachusetts LLC will be formed correctly from day one.

FAQs About Massachusetts LLCs

Have questions about forming and maintaining an LLC in Massachusetts? Start here, we cover costs, timelines, registered agent service requirements, operating agreements, Annual Reports, foreign registration, and the 2025 BOI update — so you can act fast without digging through statutes.

How much does it cost to start an LLC in Massachusetts?

$500 by mail; most online/fax filings total $520 because Massachusetts adds a $20 expedited/service fee at checkout. That $500 base applies to the Certificate of Organization; the same $20 tier shows up on the state’s expedited fee table for $500 subtotals. Always confirm your cart total in the Corporations Division portal before paying.

How long does it take to form an LLC in Massachusetts?

Typically 1–2 business days online/fax; mail adds several business days plus transit. The LLC legally exists when the Certificate of Organization is filed/accepted—there’s no guaranteed timeline, but the Corporations Division notes fax filings are often processed the same business day (or next day if after hours). Practitioner guides commonly report ~1–2 business days for online approvals.

You can also check our breakdown of the Massachusetts LLC approval timeline for a clearer idea of what to expect

What is the Massachusetts LLC annual fee and due date?

The Annual Report costs $500 and is due every year on your anniversary date. You can file online or by mail; online checkouts often reflect the same $20 expedited/service fee tier. Put the anniversary on a recurring calendar to avoid late surprises.

Do I need a registered (resident) agent in Massachusetts?

Yes, every LLC must continuously maintain a resident/registered agent at a Massachusetts street address (no P.O. boxes). The requirement is baked into the regulations; you can be your own agent or use a registered agent service. If you change agents later, the state charges $25 on paper/fax and $0 if filed electronically.

Do Massachusetts LLCs have to file BOI reports in 2025?

Domestic U.S. companies do not file BOI under FinCEN’s March 2025 interim final rule. However, foreign companies registered to do business in the U.S. still have BOI obligations on adjusted deadlines. Always check FinCEN’s BOI page before filing anything, as federal guidance can evolve.

Do I need an operating agreement in Massachusetts?

No, the Commonwealth doesn’t require you to file an operating agreement, but it’s strongly recommended. State law recognizes operating agreements (even oral ones) and separately requires LLCs to keep key records at their Massachusetts records office, having a short written agreement makes compliance and banking easier. Many agencies and banks may ask to see it during onboarding or certification. Keep the signed copy with your LLC records.

I formed elsewhere—when must I register as a foreign LLC in MA?

Within 10 days after you commence doing business in Massachusetts. File the Foreign LLC Application for Registration and attach a recent Certificate of Good Standing from your home state; the filing fee is $500. Missing the deadline can trigger penalties, so plan before hiring, leasing, or opening.

- MA Secretary of the Commonwealth: LLC Information

- MA Corporations Division: Fee Schedule (PDF)

- MA Secretary of State: LLC Annual Reports – How & When to File

- Mass.gov: Starting a Business in Massachusetts – Overview

- M.G.L. c.156C §12: Certificate of Organization Contents

- Massachusetts DOR: Sales & Use Tax (6.25%) Overview

- Mass.gov: Register Your Business with MassTaxConnect

- USPTO: Search the Federal Trademark Database

- IRS: Instructions for Form SS-4 (PDF)

- FinCEN: BOI Reporting Interim Rule – News Release

Looking for an overview? See Massachusetts LLC Services

Form Your Massachusetts LLC with Harbor Compliance

Harbor Compliance offers fast, personalized LLC formation services with full compliance support tailored to Massachusetts requirements.