Are you considering launching an LLC in Tennessee and wondering what it will cost you?

Do you need to budget for both initial filings and ongoing maintenance fees?

Curious which expenses are mandatory and which are optional for your new business?

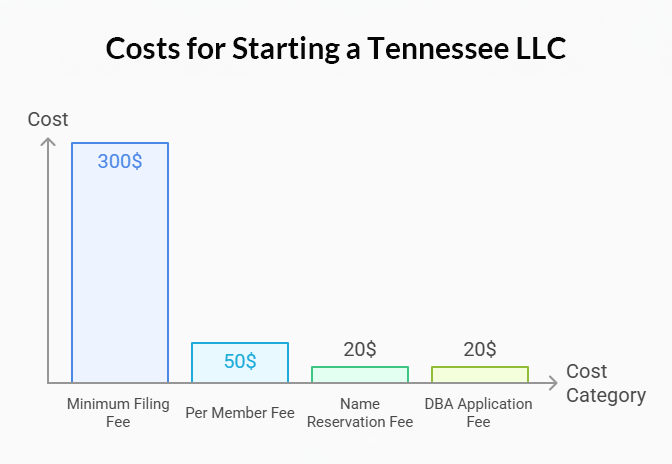

Forming an LLC in Tennessee starts with a state filing fee of $50 per member (minimum $300, maximum $3,000), plus an optional $20 name reservation. You’ll also need a registered agent—either yourself for free or a professional service for $99–$149 per year. Each April 1, you’ll file an annual report using the same per-member formula and pay franchise tax (0.25% of net worth, $100 minimum) and potentially excise tax if you elect corporate status. Don’t forget local business licenses (around $15) and any industry-specific fees that can add to your budget.

In this guide, you’ll learn:

- How to calculate and pay Tennessee’s one-time formation fees

- Which recurring state and local taxes apply each year

- Optional costs—registered agent services, legal agreements, EIN assistance

- Strategies to minimize expenses and avoid surprise penalties

Ready to map out every dollar you’ll need? Let’s dive in and break down Tennessee LLC costs!

| Cost item | Amount (June 2025) | Frequency | Notes |

|---|---|---|---|

| State filing fee | $50 per member (min $300, max $3,000) | One-time | Articles of Organization filing |

| Name reservation (opt.) | $20 | One-time | 120-day hold |

| DBA/Assumed-name filing (opt.) | ≈ $20 | One-time | County clerk; varies slightly |

| Professional registered agent | $99 – $149 | Annual | Privacy & compliance reminders |

| Annual report | $50 per member (min $300) | Annual | Due 4 months after fiscal year-end |

| Franchise tax | 0.25% TN net worth (min $100) | Annual | Department of Revenue |

| Excise tax (if corp-elected) | 6.5% of taxable income | Annual | Applies only if LLC elects C-corp tax status |

| County business license | $15 | Annual | Separate city fees possible |

To compare Tennessee’s charges with other jurisdictions, check out our overview of LLC annual fees for every state.

What Is the Total Cost to Start a Tennessee LLC Today?

Launching your Tennessee limited liability company comes down to two numbers: the cash you need today and the cash you must budget every year. In 2025 the baseline state charge starts at $300, but optional filings, extra members, and local permits can push your initial outlay higher. This section breaks down every mandatory and discretionary dollar so you can start an llc with confidence before you file. If you’re ready to get started, follow our step-by-step guide on how to start an LLC in Tennessee.

Understanding the $50 per member filing fee (min $300)

Every Tennessee LLC begins with the state’s filing fee, officially listed on the formation screen as “Initial Filing.” That filing fee is locked at $50 per member, yet state law sets a $300 floor and a $3,000 ceiling. For a detailed breakdown of every line item, see our full article on LLC cost. A single-member company therefore pays the same $300 as a six-member firm, while a 40-member venture tops out at the statutory maximum. The Secretary of State collects the fee when you submit Form SS-4270 online or by mail, and processing doesn’t begin until payment clears. Because the fee is tied to member count, some founders wait to admit new partners until after formation to keep launch costs predictable.

Cost examples for single vs. multi-member LLCs

To see how Tennessee’s per-member rule shapes real budgets, picture two common scenarios for an llc in tennessee. Small teams generally hit the $300 minimum, but larger partnerships must tack on $50 for every member above six, a difference that quickly compounds as equity spreads. Remember: “member” means anyone named in the operating agreement the day you file—manager or not.

Optional pre-filing costs (name reservation, DBA)

Before the state sees a dollar of your formal llc filing fee, you can spend a small amount to secure your brand. Tennessee lets you reserve a desired business name for 120 days at $20, giving you time to refine paperwork without losing the label to a competitor. If you plan to market under a different trade name, most counties require an assumed-name (DBA) application, typically $20 through the clerk. Neither step is mandatory, but both prevent costly reprints and customer confusion later—an inexpensive hedge compared with redesigning signage.

Required One-Time Fees for Tennessee LLC Formation

Up-front costs end as soon as your charter clears, so this section isolates the cash you pay only once while forming an llc. Know these figures and you’ll budget accurately instead of scrambling when the first renewal notice lands.

Articles of Organization: Filing process and fee

Think of the Articles of Organization as the birth certificate for Tennessee business entities. Learn what must go into that document with our guide to the certificate organization for LLC. The state’s online wizard asks for your LLC’s name, office address, management style, and member count; it then calculates the $50-per-member charge with its $300 floor and $3,000 ceiling. You’ll also provide registered-agent details and may delay the effective date up to 90 days to mesh with contracts or funding. Providing accurate data speeds approval and avoids costly rejections.

- Create or sign in to your SOS account.

- Enter company details and upload any optional provisions.

- Review, pay, and submit the filing.

- Download your stamped receipt instantly.

Once approved, the state emails a certificate—the legal proof your limited liability company exists. Save that PDF; banks, insurers, and vendors will ask for it, and you’ll need its control number for every future amendment or report.

Registered Agent: Free vs. professional services

Someone must always be present at a Tennessee street address to accept lawsuits and state mail. Many founders outsource to a professional registered agent service for privacy and compliance alerts. Using a commercial provider (about $99 – $149 per year) keeps your home address private, forwards documents, and sends deadline alerts. If you later expand and register as a foreign llc elsewhere, nationwide agents streamline multistate compliance. Switching from self-representation to a paid service is a $20 amendment, reflected online within two days, and the fee is tax-deductible for entrepreneurs.

Appoint ZenBusiness as Your Tennessee Registered Agent

ZenBusiness offers reliable Tennessee Registered Agent services to help you stay compliant and receive legal documents securely.

Annual & Recurring Costs Every Tennessee LLC Must Pay

After the ink dries, Tennessee sends yearly invoices that keep your charter alive. For an all-in-one solution, explore our top-recommended LLC service providers. Whether you run a boutique shop or a complex series llc, predictable state and local charges hit on the same calendar-marked dates, letting you plan cash flow instead of scrambling.

| Recurring cost | Base Rate | Frequency | Notes |

|---|---|---|---|

| Annual report | $50 per member (min $300) | Yearly (Apr 1) | Same formula as formation |

| Franchise tax | 0.25% of net worth (min $100) | Yearly | Statewide rate |

| Excise tax | 6.5% of net earnings | Yearly | Applies when LLC elects C-corp taxation |

| County license | $15 | Yearly | Separate city fee possible |

Annual Report fee: How it’s calculated and when it’s due

Every active LLC files an annual report by April 1 and pays the same per-member formula used at formation. For busy business owners, the online form auto-loads last year’s data, so verifying addresses and member totals takes minutes. Card payment posts instantly, creating a timestamped receipt banks treat as proof of good standing. If ownership changes mid-year, double-check the member count—under-reporting triggers rejection and voided payments, delaying financing, bids, or critical vendor approvals.

Franchise and excise taxes: Obligations for active vs. inactive LLCs

Tennessee’s franchise-excise pair replaces the familiar corporate income tax seen elsewhere. Franchise equals 0.25 % of net worth or Tennessee property value (whichever is higher) with a $100 minimum. Excise is 6.5 % of net income but applies only if the LLC elects C-corp status or earns non-pass-through income. Partner-taxed LLCs owning little property usually owe only the $100 floor, yet they must file to avoid penalties. Deadlines mirror federal returns—April 15 for calendar firms—while extensions merely delay late fees, not accruing interest.

Local license renewals: What varies by city and industry

Most counties require a general business license once receipts exceed $3,000. The laminated card costs $15, and many lenders demand it before opening a bank account or granting credit. Cities such as Nashville add their own $15 fee and may layer inspections for food, alcohol, or lodging. Because both county and city thresholds hinge on gross sales tiers, forecast revenue realistically to avoid mid-year upgrades, extra forms, and surprise processing fees.

Penalties for late reports or tax non-compliance

Miss a due date and the Secretary of State can dissolve your LLC after 60 days; reinstatement costs $70 plus every back report. The Department of Revenue levies 5 % monthly penalties (up to 25 %) and daily interest on unpaid balances. Because Tennessee shares data with the internal revenue service, chronic delinquency risks audits, frozen bank accounts, and voided leases—costs that dwarf a calendar reminder or your registered agent’s compliance alerts.

Hidden or Optional LLC Costs Most Entrepreneurs Overlook

Even after paying state fees, founders often face surprise bills that hide beneath initial llc formation expenses. By spotting them early—EIN upsells, contract drafting, and convenience subscriptions—you’ll keep cash in the business instead of feeding service providers.

EIN registration: Why it’s free but often monetized

An EIN is essential for hiring, banking, and reporting taxable income, yet the IRS issues it online in minutes for $0. If you’re curious how quickly you’ll be up and running, learn how long it takes to get an LLC in Tennessee. Third-party sites market “same-day” numbers for $79–$199, delivering the identical confirmation page you can print yourself. Skip the markup by applying directly through the IRS portal, which processes U.S. requests instantly and international calls within one business day.

Legal and banking costs: What to expect beyond formation

Opening a bank account, drafting an llc operating agreement, and ordering starter checks can add $250 – $1,200 to your launch budget. A lawyer-crafted operating agreement averages $760 nationwide, while banks may charge a $100 deposit plus $10–$25 monthly unless you maintain a minimum balance. Attorney help is optional but valuable if multiple members, outside investors, or complex profit splits are involved—situations where boilerplate language fails.

Optional services that offer value (or not)

Domain privacy, virtual mailboxes, and a registered agent service often appear in checkout carts. Privacy-focused founders appreciate a commercial agent’s $99–$199 annual shield, yet many other upsells—certificate frames, compliance binders, “expedited EINs”—deliver little utility once you download your stamped formation PDF. Evaluate each add-on by asking whether it saves more time or risk than its recurring fee.

Should You Form Your LLC Yourself or Use a Service?

Setting up a business in tennessee is straightforward online, but time, confidence, and future growth plans dictate whether DIY or paid help wins.

DIY cost: State fees and what you’ll handle alone

Tackling paperwork yourself means you must form an llc through the Secretary of State portal, pay the $50-per-member filing fee, and track every compliance date. For a complete walkthrough of each step, see our guide on how to form an LLC. Expect to:

- Draft or customize the operating agreement

- Apply for a free EIN at IRS.gov

- List a physical Tennessee address for service of process

- File the initial articles and future annual reports

Add $20 if you reserve the name first and $15 for the county license once revenue tops $3,000. In exchange, you keep control, learn the rules firsthand, and save $100–$400 that many services charge for the same clicks.

When paying for formation services makes sense

If you dread government forms, plan to expand nationwide, or need same-day approval before signing leases, hiring a provider linked directly to the tennessee secretary of State’s API is worth the $0 – $199 premium. Bundled compliance alerts, free operating-agreement templates, and discounted registered-agent renewals can offset the fee, especially for multi-member teams that value speed over learning each statute citation.

Tennessee LLC Taxes Explained (Franchise, Excise & More)

Beyond formation, Tennessee collects both franchise tax and excise tax from LLCs—unique levies that surprise newcomers used to pass-through states.

Franchise tax: Calculation formula and recent updates

The franchise levy equals 0.25 % of the greater of net worth or Tennessee property value, with a $100 floor. A May 2024 law repealed the alternative tangible-property measure for most filers, but every LLC still submits Form FAE-170 to the tennessee department of Revenue. Calendar-year entities pay by April 15, matching federal returns; extensions avoid late-file penalties yet accrue interest at the federal short-term rate plus 7 %. Inactive but undissolved LLCs must file zero-dollar returns to dodge the minimum assessment.

Excise tax: Who it applies to and deduction opportunities

Unlike a sole proprietorship, an LLC can choose corporate taxation, triggering a 6.5 % excise rate on net earnings. Pass-through filers generally owe zero unless they hold installment-sale interest or portfolio income excluded from member K-1s. The same FAE-170 form reports excise, and NOL carryforwards plus state R&D credits can offset 100 % of liability, making informed elections key before your CPA transmits the return.

Federal and state-level taxes beyond LLC obligations

Members pay federal income and self-employment tax on distributed profits, while certain industries require sales-tax permits or a specialized business license at both county and municipal levels. LLCs selling physical goods collect 7 % state sales tax plus local add-ons up to 2.75 %. Employment taxes, 1099 filings, and city gross-receipts levies add complexity, so coordinate due dates to leverage overlapping data—your payroll provider can often file local returns automatically, bundling costs into one platform fee.

Cost Differences Based on Business Type or Location

Location and line of work can change your Tennessee LLC’s budget faster than you can finish the online llc filing. From physician-specific privilege taxes to rural property-tax holidays, the true price goes far beyond the state filing fee. The chart and sections below compare regulated professions, big-city storefronts, and small-town workshops so you can pin down realistic numbers before signing a lease.

| Scenario | Start-Up Add-On | Extra Cost | Source |

|---|---|---|---|

| Medical practice privilege tax | Annual state levy | $400 | tn.gov |

| Engineer firm license | Initial/renewal | $140 biennial | support.commerce.tn.gov |

| City business tax surcharge | Added to state rate | 0.1 – 0.3% of gross | tn.gov |

| Rural property-tax holiday | Job-creation incentive | Up to 100% for 5 yrs | tnecd.com |

Costs specific to professional and regulated industries

Doctors, architects, and CPAs pay more than entrepreneurs selling T-shirts. Health-care providers owe Tennessee’s $400 professional privilege tax each June 1, regardless of profit or payroll. Engineers and architects must also renew their state licenses biennially at $140, plus continuing-education costs and board late fees that start at $200. If your practice is organized as a professional limited liability company or limited liability partnership, you still file the standard LLC annual report—yet malpractice insurance riders and extra firm registrations can push first-year outlays near $2 000. Because these discipline-specific expenses sit outside Secretary of State records, many founders overlook them until invoices arrive. Research your board’s schedule now so your cash-flow forecast reflects every testing, fingerprinting, and privilege-tax line item.

Urban vs. rural: Where LLCs cost more to operate

Rent and local taxes differ sharply between downtown Nashville and counties like Perry or Fentress. City business-tax rates stack on top of the state levy, while rural areas charge only the statewide schedule detailed by the Department of Revenue. Filing your articles of organization with an urban mailing address also means higher utility deposits and, often, zoning-permit fees of $50 – $300. Conversely, many rural counties waive development impact fees and offer property-tax freezes for job-creating ventures. Transportation costs rise outside metro hubs, but cheaper real estate and utility rates can offset franchise liabilities tied to asset values. Compare both sets of costs before locking in your registered-agent address.

Local government fees and incentives

Beyond taxes, municipalities court entrepreneurs with cash grants, sales-tax credits, and reduced permit fees. Tennessee’s Department of Economic and Community Development offers up to 6.5 % state-sales-tax rebates on qualified capital purchases, while rural counties stack cash grants worth $4 500 per job created. Some cities even discount building-inspection charges if you file your annual report on time and enroll in their mentoring program. Remember: these carrots usually require head-count or investment thresholds and come with multi-year reporting duties, so read the fine print.

Sector-specific licensing costs (e.g., food, health, construction)

Industries regulated for health or safety bring their own price tags. Food trucks must pass a $300 health inspection and pay $70 for a mobile-vendor decal each year, while construction firms post $400 contractor bonds before bidding on state projects. For a tailored solution, compare the best LLC service in Tennessee to handle formation and ongoing compliance. Cosmetology salons need a $60 shop license plus individual technician permits. If your LLC imports alcohol or sells insurance, expect federal licenses on top of state approvals. Failing to attach these certificates can bar a foreign llc from obtaining local occupancy permits, so verify every agency’s checklist long before opening day.

How to Reduce Tennessee LLC Costs Legally and Effectively

Smart planning yields serious cost savings without flirting with non-compliance. Discover which platform is the best LLC to form an LLC if speed and ease are your top priorities. By mastering free government portals, matching fiscal calendars to state deadlines, and batching amendments, first-time founders routinely shave hundreds off Tennessee launch budgets—money far better spent on inventory, marketing, or that first hire.

Free alternatives to paid services (EIN, filings, compliance)

Skip the checkout-cart upsells and look for genuine freebies first. The IRS issues an employer identification number in minutes online at no charge. Tennessee’s TNTAP portal registers your business for sales and franchise tax without a fee, and the Secretary of State publishes blank operating-agreement templates you can tailor yourself. Acting as your own registered agent is legal if you keep a Tennessee street address staffed during business hours; you can change it later for $20 when privacy becomes a concern. Finally, export calendar reminders from TNTAP and the SOS RSS feed—eliminating the $120-per-year “compliance monitoring” subscriptions many services push.

Filing tips to avoid unnecessary penalties or rejections

Prevent headaches by mastering Tennessee’s state fees before clicking “Submit.” Small mistakes—like listing seven members but paying the six-member minimum—bounce your filing and can force you to re-pay the $300 floor plus a $25 expedite upgrade when deadlines loom.

- Match the member count on the annual report to the formation filing.

- Use a physical Tennessee street for the registered agent—no P.O. boxes.

- Upload the operating agreement as a PDF under 10 MB to avoid system time-outs.

After approval, log every requirement into a personal compliance calendar. Free tools such as Google Calendar or Microsoft To Do surface reminders weeks ahead, giving you time to add members or update addresses without incurring interest or the $70 reinstatement fee if the LLC is dissolved.

FAQ: Tennessee LLC Costs Answered

Even with the detail above, certain topics surface in every consultation. The fast answers below tackle the most-searched tn llc costs questions, giving you a concise reference you can quote to partners, investors, or your CPA.

Is the $300 filing fee paid every year?

The one-time state filing fee of $300—calculated at $50 per member but never less than the statutory floor—is due only when you submit your Articles of Organization. After that, Tennessee charges an annual report at the same per-member rate, yet this payment is legally distinct from formation. Unless you dissolve and re-form the entity, the initial $300 never repeats.

What’s the lowest possible cost to start an LLC?

File online with one member, skip the name reservation, and act as your own registered agent. Doing so limits spending to $300 for formation and, once revenue tops $3 000, a $15 county business-license application. Drafting a free operating agreement and postponing DBAs keeps the minimum cost under $320 until cash flow improves.

Are LLC costs deductible on my business taxes?

Yes. Formation, licensing, and maintenance expenses are usually tax deductible as ordinary and necessary business costs. IRS Publication 334 allows you to deduct—or amortize—up to $5 000 in start-up costs plus $5 000 of organizational charges if total expenses stay below $50 000.

How much does it cost to dissolve an LLC in Tennessee?

Voluntary shutdown is cheap. Filing the Certificate of Cancellation online or by mail costs a $20 dissolution fee. Submit final franchise-excise returns, and if no assets remain the $100 franchise minimum is typically waived.

What happens if I miss the annual report deadline?

Tennessee imposes no immediate cash late filing penalties, but 60 days after the Secretary of State issues a non-compliance notice your LLC is administratively dissolved. Reinstatement costs $70 plus every missed report, and franchise-excise interest continues to accrue during the gap.

Resources for Starting a Tennessee LLC

Explore official and expert resources that guide you through Tennessee LLC formation, from filing fees and annual report obligations to legal and tax rules, so you can start with confidence.

- Shopify Guide: How to Start a Tennessee LLC (shopify.com)

Covers $300–$3,000 filing fee based on members, timeline expectations, and the franchise tax plus excise tax overview. - Pay.com Blog: Forming an LLC in Tennessee (pay.com)

Straightforward guide to Articles of Organization requirements, $50 per member base fee, operating agreement advice, and licensing requirements. - Tennessee Business Tax Essentials (vintti.com)

Detailed summary of annual franchise tax, excise tax, local licenses, and startup compliance steps. - One IBC: Registering an LLC in Tennessee (oneibc.com)

Includes filing fee logic, member-based fee structure, operating agreement tips, and ongoing compliance reminders.

These resources combine state-specific cost details, smart budgeting guidance, and filing best practices to help you confidently form and maintain your Tennessee LLC.

Looking for an overview? See Tennessee LLC Services

Tennessee Compliance Made Easy with Harbor’s Agent Service

From lawsuits to state notices, Harbor Compliance handles sensitive documents securely — so you stay in good standing.