Are you curious about the exact fees involved in launching and sustaining an LLC in Maryland? Do you know which state-mandated filings you can’t skip and which optional services might add to your budget? Wondering how annual reports, registered agents, and local permits all factor into your year-one and ongoing costs?

Forming an LLC in Maryland costs $100 by mail or $150 online for the Articles of Organization, with optional expedited processing from $50 to $425. You’ll file a $300 Annual Report and Personal Property Return every April 15 to keep your company in good standing. Registered agent services range from $0 if you serve yourself to $99–$300 per year for a commercial provider. Additional optional fees include a $25 name reservation, $25 DBA registration, and local business license or permit costs that vary by county.

In this guide, you’ll learn:

- The breakdown of one-time formation and annual report fees

- Registered agent options and pricing

- Optional services like name reservations, DBAs, and expedited filing

- Local licensing and compliance expenses you shouldn’t overlook

Ready to plan every dollar for your Maryland LLC? Let’s dive in!

| Maryland LLC Cost Snapshot | Fee | Timing |

|---|---|---|

| Articles of Organization (mail) | $100 | One-time, at formation |

| Articles of Organization (online) | $150 | One-time, at formation |

| Expedited Processing | $50 standard / $425 two-hour rush | Optional, when filing |

| Name Reservation (30 days) | $25 | Optional, before filing |

| Trade Name (DBA) | $25 (good for 5 years) | Optional, any time |

| Certificate of Status | $20 | When third parties request proof |

| Annual Report & Personal Property Return | $300 | Every 15 April |

| Registered Agent Service | $0 self / $99–$300 yr | Yearly |

| Other Licenses & Permits | Varies | Case-specific |

Maryland LLC Formation Filing Fees

Before launching your Maryland LLC, it’s essential to understand the mandatory and optional filing fees involved in the process. Ready to get started? Follow our step-by-step guide on how to start an LLC in Maryland for formation details and tips. From the core Articles of Organization to optional services like expedited processing or trade name registration, each filing has its own cost and purpose. The sections below break down these expenses so you can plan your LLC formation budget with clarity.

Articles of Organization – $100 by Mail / $150 Online

Your company becomes real once the State Department of Assessments and Taxation (SDAT) accepts the articles of organization. Mailed paper forms cost $100 and may linger four-to-six weeks. Filing through Maryland Business Express runs $150, reflecting the same state charge plus a $50 portal fee, and usually produces approval in two-to-four business days. That charter number is your key to an EIN, dedicated bank account, and limited-liability contracts. To see exactly what goes into the paperwork, check out our breakdown of the certificate organization for LLC.

Expedited Processing – $50 Extra for Faster Approval

When standard processing feels glacial, SDAT’s upgrades help. A $50 filing fee cuts review to about seven business days; a two-hour rush tier costs $425 and requires hand-delivery before 2:30 p.m. Both surcharges stack on the base Articles fee. For closings, franchise deadlines, or government bids, that modest surcharge can preserve deposits and lock in loan rates. Curious about every line item? Review the cost for launch an LLC to budget comprehensively.

Name Reservation (Optional) – $25 for 30 Days

Maryland doesn’t force you to reserve a name to start an llc, yet a $25 online filing can hold branding while you gather signatures or clear trademarks. The reservation freezes your chosen name for 30 days and is renewable if more time is needed. For a complete walkthrough of each step, see our full guide on how to form an LLC.

Trade Name (DBA) – $25 Filing Fee

A DBA lets a business entity sell under a storefront label. The $25 online form takes minutes and lasts five years. Once approved, notify your bank so payments clear and update marketing materials for consistency.

Certificate of Status – $20 (When You Need It)

Third parties sometimes demand proof your legal entity is active. SDAT issues a Certificate of Status online for $20; the PDF lists your charter number, formation date, and real-time standing, so order only when specifically requested.

Annual Report and Property Tax Requirements

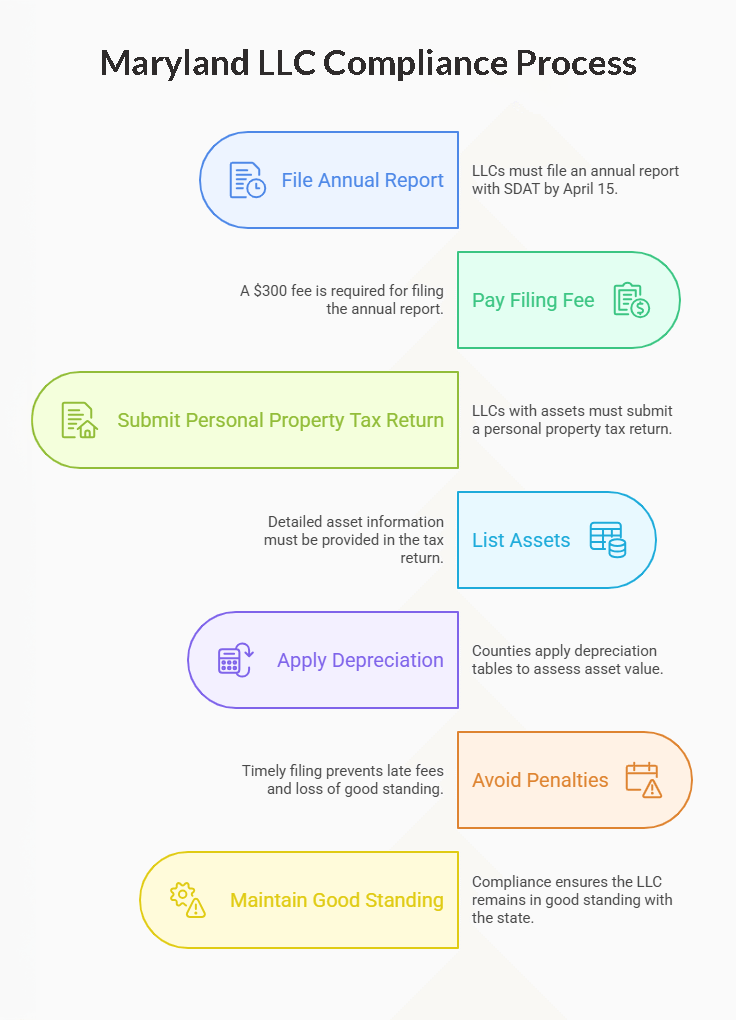

Every Maryland LLC must file an annual report with SDAT—even those with no revenue. To compare Maryland’s rates with other states, check out our overview of LLC annual fees state. The filing verifies addresses, managers, and assets so state records stay current and taxes are assessed fairly.

Maryland LLC Annual Report – Flat $300 Due by April 15

Form 1 costs $300 and is due each April 15 to the department of assessments. Online filing accepts cards, issues instant receipts, and pre-populates last year’s data, shrinking the task to minutes. Provide EIN, principal office, members, NAICS code, and asset totals. Tick the $20,000-certification box if eligible to bypass depreciation schedules. Timely filing shields your charter from penalties, bank freezes, and lost state-contract eligibility.

Personal Property Tax Return – Required for Asset-Holding LLCs

Owning equipment, inventory, or furniture triggers the personal property tax return embedded in Form 1. List each asset’s cost, purchase year, and location; counties then apply depreciation tables. LLCs below the $20,000 threshold can certify and skip line-items. Keep invoices and schedules: they streamline audits and future asset sales.

Penalties for Late Filing or Non-Compliance

Miss April 15 and Maryland adds a $30 minimum late fee plus monthly interest at county tax rates. After 60 days SDAT marks the LLC “not in good standing,” blocking loans and certificates; after 90 days the charter can be forfeited. Reinstatement means paying every back fee plus a $100 revival filing, so calendar alerts are cheap insurance.

Registered Agent Costs in Maryland

Maryland law demands a registered agent with a physical state address. You can serve as your own agent or outsource for privacy and reliability. If you’d rather outsource, explore top options for LLC service in Maryland that handle registered-agent duties and more.

Appointing Yourself – Free and Legal

Acting as resident agent costs nothing, but someone must be present 9–5 on weekdays at the listed street address. A missed summons risks default judgments, and the published address invites marketers—costs that grow as your LLC scales.

Using a Commercial Registered Agent – $99 to $300 Per Year

A professional agent service charges $99–$149 for mail scanning and deadline reminders; premium law firms reach $300. The fee buys a staffed office, same-day document scans, and privacy protection. Many services integrate with accounting apps, store documents for life, and remind you of annual-report deadlines—benefits that often outweigh the subscription cost. Compare features and pricing of the best registered agent in Maryland to find the right fit.

Get a Reliable Maryland Registered Agent With Northwest

Northwest prioritizes your privacy with secure mail handling, fast uploads, and real-time alerts—backed by friendly in-house support.

Licenses and Permits for Maryland LLCs

Before a Maryland limited liability company can open its doors, it must confirm whether its work triggers state- or county-level licensing. Most approvals are quick and inexpensive, yet missing even a minor permit can halt sales on day one. The guide below separates statewide professional credentials from local paperwork so you can plan, budget, and launch without compliance surprises.

Statewide Professional Licensing – Case-by-Case Requirements

Certain trades—accounting, construction, health care, and more—require professionals to hold a Maryland license in their own name, even when they operate through an LLC. Filing fees vary by board, but plan for $20 – $150 plus any exam costs. Typical statewide credentials include:

- Certified Public Accountant permit via the Board of assessments and taxation (application $75, renewal $56)

- Home Improvement Contractor license from DLLR (application $370, renewal $250)

- Registered Nurse license through the Board of Nursing (application $100, renewal $136)

Elevating an LLC’s credibility often hinges on showcasing these hard-earned credentials. Keep digital copies in a compliance folder, calendar renewals 60 days ahead, and make sure at least one licensee stays active at the firm.

Local Licenses – Check County/Municipality Rules

Each maryland business must verify county or municipal requirements. Baltimore City issues trader’s licenses for retail storefronts, while Montgomery County demands extra permits for food trucks and home-based bakeries. Fees start at $15 but climb with square footage or expected revenue. Research should also cover home-based zoning limits, resale certificates, and fire-marshal approvals for venues hosting more than 50 patrons. A small spreadsheet tracking requirements, costs, expiration dates, and renewal contacts now prevents frantic phone calls later.

Trader’s License – Cost Based on Inventory ($15 – $800)

Retailers, wholesalers, and repair shops storing inventory must buy a trader’s license priced on January stock: $15 for less than $1,000; $103 for $20,001 – $30,000; up to $800 above $750,000. Clerks collect payment with sales taxes, often at the same counter where DBAs are filed. The license must hang conspicuously and travel with mobile vendors. Inventory estimates should be realistic—under-reporting invites audits. When growth pushes you into a higher tier, pay the difference proactively to avoid penalties.

Other LLC-Related Administrative Costs

Beyond formation filings, every LLC should budget for extras—small costs that protect the business bank account and reduce future legal friction. Think of them as maintenance items: minor compared with formation fees, but critical for keeping the LLC’s legal armor intact as operations expand.

Operating Agreement – $0 DIY, Up to $500 Attorney-Drafted

Drafting an llc operating agreement costs nothing with a trusted template, yet many owners invest $150 – $500 for attorney-tailored language. For benchmarks on legal review costs, see our analysis of attorney fees for LLC. A custom document clarifies decision-making, capital calls, and profit splits. Key clauses to include:

- Initial contributions and ownership percentages

- Voting thresholds for major actions

- Admission procedures for new members

- Dissolution triggers and asset distribution rules

A well-drafted agreement also outlines dispute-resolution methods, indemnification, and accounting policies. Revisit it annually—and add valuation language if outside investors may join—to keep legal terms aligned with reality.

Certified Copies or Amendments – $20 Per Document

Whenever LLC data changes, SDAT charges $20 for each amendment or certified copy. These documents prove alterations—like new managers or address changes—to lenders and other business entities. Order online for instant PDFs or pay extra for embossed originals. Missing an amendment before a loan closing can derail financing, so savvy owners grab fresh certificates whenever they sign major contracts and file them in a compliance binder.

Taxes Maryland LLCs May Owe

Forming an LLC doesn’t exempt profits from income tax. If you’re weighing jurisdictions, explore our ranking of the best state to start an LLC for fee, tax, and compliance comparisons. Maryland and the IRS still expect their share, although the exact bill hinges on classification, location, and sales footprint. Understanding the landscape preserves cash flow and positions your company for cleaner audits.

Maryland Income Tax – Brackets from 2 % to 5.75 %

LLC income usually passes through to members, but single-member entities may elect C-corporation treatment to manage corporate income. Maryland’s individual brackets run 2 % – 5.75 %, plus county surtaxes up to 3.20 %; C-corps pay 8.25 % flat on net profit. Review local add-ons too: combined rates can exceed 9 % in Baltimore City. Corporate status can defer payouts and fund expansion, especially when fringe-benefit deductions enter play.

Sales and Use Tax – 6 % State Rate

Selling goods or taxable services means collecting Maryland’s 6 % sales and use tax. Register with the Comptroller and display the permit at each site. File monthly if receipts top $1,200; otherwise, quarterly works. Digital products and many software subscriptions are taxable, and sellers hit nexus once they reach $100,000 or 200 Maryland transactions. Keep exemption certificates for resale clients and schedule periodic nexus reviews as laws evolve.

Employer Payroll Taxes – If Hiring Workers

Hiring staff triggers withholding, FICA, and state unemployment. The internal revenue service sets federal tables, while Maryland’s UI tax starts at 2.6 % of the first $8,500 in wages and adjusts with claims history. Register promptly, file wage reports quarterly, and use payroll software that auto-remits taxes to avoid late-payment interest.

Federal Tax Obligations – Based on IRS LLC Classification

The IRS taxes LLCs according to their election—sole proprietorship, partnership, S-corp, C-corp, or limited liability partnership for certain professionals. Partnerships file Form 1065; S-corps use 1120-S; C-corps file 1120. Electing or changing status requires timely filing (Form 2553 or 8832). Proper classification also affects SBA-loan access and research credits, so consult a CPA before revenue spikes.

Costs for Registering a Foreign LLC in Maryland

Doing business in Maryland without forming a brand-new entity is perfectly legal when you qualify your existing company as a foreign llc. The process is simpler than first-time formation, yet you still have to budget for state filings and ongoing compliance. Below we walk through the flat registration fee and the annual obligations that keep your out-of-state company in good standing.

Certificate of Registration – $100 Flat Fee

Maryland’s certificate of registration is the single form that legalizes your out-of-state company’s operations here. File online through Maryland Business Express, attach a certified copy of your home-state charter dated within 60 days, and pay the $100 filing fee. Payment by credit card or PayPal posts instantly, and most approvals arrive in three-to-five business days. Unlike some states, Maryland requires no county filing or newspaper notice, so the certificate alone places your enterprise on record with the State Department of Assessments and Taxation.

Annual Report Compliance for Foreign Entities

Once approved, the ongoing obligations mirror those of a domestic firm. A llc in maryland that operates as a foreign entity must submit the $300 Form 1 Annual Report every April 15 and complete the personal-property schedule if equipment or inventory sits in the state. You can file online with your foreign charter number, and the due date matches domestic LLCs. Missing the deadline triggers the same late fees, interest, and potential charter forfeiture, so calendar Maryland alongside your home-state reports to stay loan- and contract-ready.

Maryland LLC Cost Comparison – DIY vs Professional Services

Starting an LLC doesn’t have to break the bank, but the cheapest path isn’t always the wisest. The snapshot below compares do-it-yourself filing with popular formation bundles. By weighing time, mandatory fees, and optional upgrades, even a sole proprietorship owner can see when paying a little more up front saves money and stress later.

| Approach | State Fees | Service Fees | Extras Included | Total Year 1 |

|---|---|---|---|---|

| DIY (online) | $150 | $0 | None | $150 |

| DIY + Expedited | $200 | $0 | 24-h review | $200 |

| Formation Service – Basic | $150 | $0 | Registered agent 1 yr | $150 |

| Formation Service – Plus | $150 | $299 | Reg. agent, OA template, EIN | $449 |

| Law Firm Package | $150 | $800 | Custom docs, legal advice | $950 |

Filing by Yourself – Budget Overview and Time Commitment

Handling the paperwork on your own keeps hard costs minimal. You finish the online articles, pay with credit card or paypal, and wait a few days for approval. The real expense is your time: researching naming rules, drafting an operating agreement, and confirming your registered-agent address meets state standards. Expect at least two hours for SDAT forms plus another hour or two for IRS EIN registration and banking visits. DIY works when cash is tight and your structure is simple, but if equity investors are on the horizon, professional templates may pay for themselves.

LLC Formation Services – What’s Included at $0 to $300

Budget platforms such as ZenBusiness and Northwest file your paperwork for free or a nominal fee, then upsell add-ons like registered-agent service and compliance alerts. Mid-tier bundles (about $199–$299) include templates, expedited filing, and one year of privacy. The price is still far below a single hour of attorney time. Dashboards store documents and track deadlines, but they don’t offer tailored corporate tax advice, so you may still need a CPA. For founders who want speed and structure without bespoke counselling, these services hit the sweet spot.

When Paying More Adds Value (Compliance, Templates, Support)

Full-service law firms and premium providers charge $600 to $1,200 but bundle deep legal reviews, custom clauses, and post-formation guidance. Ventures holding significant real estate or outside capital gain peace of mind against lawsuits and tax audits. Attorneys tailor governance to investor rights, vesting schedules, or buy-sell triggers that off-the-shelf kits miss. They also research industry licensing and draft employment agreements in one engagement. If your time is worth more than the price gap—and you need immediate human answers—premium help usually nets out cheaper.

FAQs – Maryland LLC Formation and Maintenance Fees

Even seasoned founders have lingering questions about Maryland’s cost structure. This quick FAQ clears up common misunderstandings so you spend less time searching and more time growing—whether that means launching products or securing a business license.

What’s the total cost to start a Maryland LLC?

The total cost to launch online is $150 for Articles of Organization plus any extras you choose. Add $50 for expedited processing and remember the $300 Annual Report each April 15. A registered agent averages $125 per year, and a custom operating agreement can run $500. Most owners budget about $600 for year one and $425 for each year after.

Is the $300 annual report required for all LLCs?

Yes. Every domestic or foreign LLC must file Form 1 and pay the flat fee of $300 by April 15—even with zero income. If your company owns no Maryland property, you simply certify that fact, but the filing and payment remain mandatory. Skipping the report triggers late fees, interest, and eventual charter forfeiture.

Do I need a license to operate a small business in Maryland?

Most service-only firms can operate without a statewide permit, but retailers or inventory holders generally need a trader’s license from the circuit-court clerk. Fees range from $15 to $800 based on stock levels, and many counties process the license alongside sales-tax registration. Professionals like contractors or CPAs must also secure their personal credentials.

Can I avoid using a registered agent service?

Maryland lets you name yourself or another adult resident, so a paid commercial agent isn’t required. Going DIY saves money but posts your address on SDAT’s public record and obliges weekday availability. Many owners start as their own agent, then switch to a service when mail volume rises or privacy matters more.

Are there additional hidden costs to be aware of?

Beyond obvious state charges, watch for compliance fees like local permits, certified amendments, and trade-name renewals. Banks may bill for cashier’s checks, and payment processors often demand a certificate of status, adding $20 per request. Scam compliance letters can also trick the unwary into paying unnecessary service bills. Smart calendaring and bundled packages curb these surprises.

Looking for an overview? See Maryland LLC Services

Start Your Maryland Business Fast with Harbor Compliance

Avoid red tape, missed deadlines, and rejected filings. Harbor Compliance makes forming an LLC smooth and secure.