Forming an LLC in Louisiana is one of the most effective ways to protect your personal assets, reduce liability risk, and establish a legally recognized business. If you're wondering about the actual Louisiana LLC cost, this guide gives you everything you need to know — including required fees, optional services, and recurring expenses.

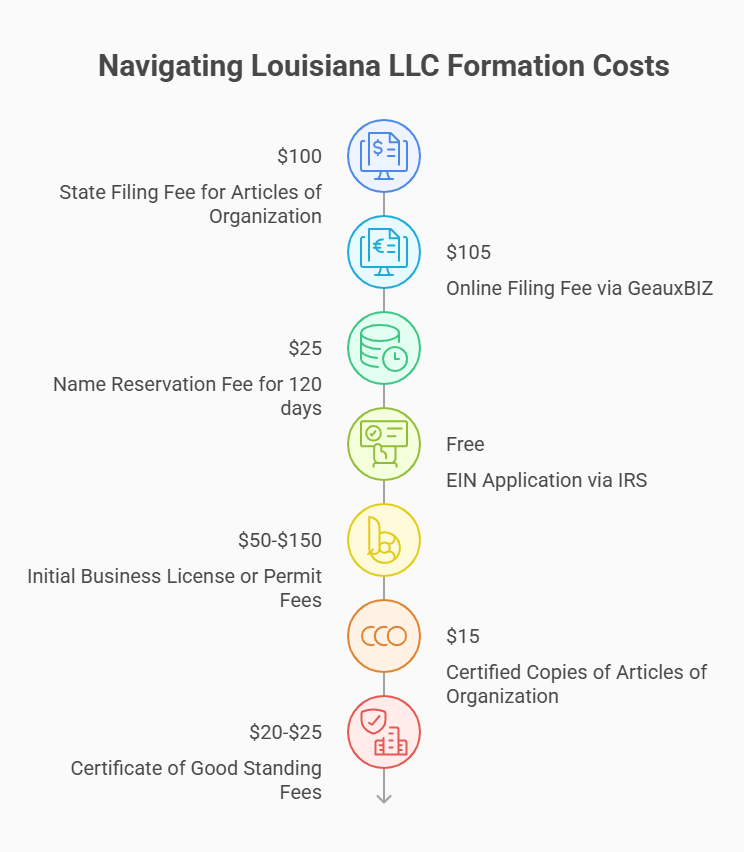

The total cost to form an LLC in Louisiana starts with a $100 state filing fee by mail or $105 online (including a $5 processing charge). Optional expenses include a $25 name reservation, registered agent service ($100–$300/year), certified documents ($15–$25), and local business licenses or permits, which vary by parish and industry; most first-year totals range from $105 to $450, depending on the services you use.

In this guide, you’ll get a complete cost breakdown of every fee required to form and maintain an LLC in Louisiana. We’ll cover initial filing costs, optional services like registered agent providers, required documents, ongoing compliance fees, and local licensing requirements. All data is verified and current as of July 2025, using official sources like the Louisiana Secretary of State and Department of Revenue.

| Cost Item | Amount | Frequency |

|---|---|---|

| Articles of Organization filing fee | $100 (mail) / $105 (online incl. $5 processing fee) | One-time |

| Initial Report (must be included at filing) | Included in Articles filing fee | One-time |

| Annual Report fee | $30 (online) / $35 (mail) | Annual |

| Name Reservation (optional) | $25 | One-time |

| Trade Name / DBA (varies by parish) | $75 | One-time (10-year term) |

| Registered Agent Change Filing | $25 | As needed |

| Certified Copies / Certificates | $15 per doc / $20–$25 additional | As needed |

| Certificate of Good Standing | $15 (single doc) / $25 (multi-doc) | As needed |

| Registered Agent Service (optional) | $100–$300+ per year | Annual |

| Expedited Filing (via SOS) | $30 (24-hour) / $50 (same day) | Optional add-on |

Breaking Down the Costs to Start Your Louisiana LLC

Forming an LLC in Louisiana is not very expensive, however, keep in mind the bigger picture before you file. Whether they are optional or mandatory, extra expenses beyond the filing fee could affect your total startup costs. We explain each fee so you know exactly what they mean and what to expect.

State Filing Fee

In Louisiana, an LLC is formed by filing the Articles of Organization with the Louisiana Secretary of State. The state fees to file a Louisiana Articles of Organization are $100 to file it on paper, and $105 online via GeauxBIZ (the extra $5 is for the online filing fee). Filing online is faster – typically within 1–2 business days – while filing with paper may take up to a week. Making submissions online automatically includes the Initial Report.

Name Reservation Fee (optional)

While you do not have to reserve your business name before you form an LLC in Louisiana, it is helpful to do so, especially if it is unique or in demand. To reserve a name for a time period of 120 days, the Louisiana Secretary of State charges a fee of $25. You can do this online through GeauxBIZ or by mail using Form 398. While not required, it buys you time to prepare your formation documents without someone else claiming your name.

Registered Agent Fees

In Louisiana, every LLC has to appoint a registered agent — one who accepts legal documents for you. If you act as your own agent, there’s no cost. When you opt for registered agent services, you will generally have to pay around $100 to $300 a year. These services add additional benefits such as privacy and compliance reminders. A registered agent is ideal if you don’t have a physical address in the state. Or, if you want to avoid missing important legal notices.

To understand the legal requirements and practical reasons behind this role, check out this guide on whether you need a registered agent in Louisiana.

EIN Application Fee

Your Louisiana LLC will require an Employer Identification Number or EIN if it plans to hire employees, file federal taxes, or open a business bank account. The Internal Revenue Service (IRS) offers a free application for the EIN. You may apply online at irs.gov and get instant approval. Don't use a service that charges a fee unless you have a reason for needing additional support or bundling and have done your research. If you're applying from abroad, this guide to opening a U.S. LLC as a non-resident walks you through the process without needing a Social Security number.

Initial Business License or Permit Fees

Louisiana does not require a general statewide business license, however specific categories of businesses operated in the state will require licenses. The price may vary depending on your business type and location of your business from $50 to $150. Also, a local permit or registration may be required by the parish or city to do business in their jurisdiction. You can use the GeauxBIZ portal to verify your particular requirements and licensing fees through either the Louisiana Department of Revenue or your local clerk’s office.

If you’re unsure how licenses differ from legal entities, this LLC vs. business license comparison clears up what each does — and why most businesses need both.

Certified Copies & Documentation Fees

You might need certified copies of your Articles of Organization or a Certificate of Good Standing to obtain a bank account, enter contracts or gain licensure. In Louisiana, certified copies of documents cost $15 each and official certificates range from $20 to $25 based on delivery and documents. These documents are optional but mostly required in order to prove your business entity is registered and compliant. You may request these from the Louisiana Secretary of State online or by mail.

Start Your Louisiana LLC Without the Guesswork

ZenBusiness breaks down every cost and handles the paperwork, so you can launch your Louisiana LLC with full clarity and confidence.

Annual and Ongoing Maintenance Fees

After you form your LLC in Louisiana, compliance involves a few ongoing costs. It is important that you adhere to your legal deadlines. Failure to do so can result in negative consequences for the business. To ensure you comply with your obligations and avoid any extra fines, we cover the main yearly fees and compliance costs. It is important that you adhere to your legal deadlines. Failure to do so can result in negative consequences for the business. To ensure you comply with your obligations and avoid any extra fines, we cover the main yearly fees and compliance costs.

For a broader comparison of annual LLC costs in all 50 states, this LLC annual fees guide by state highlights where your business might save – or spend – more in the long run.

Annual Report Fee

Louisiana LLCs must file an Annual Report with the Louisiana Secretary of State to maintain good standing. If you file online through GeauxBIZ, the fee is $30. If you file by mail, the fee is $35. The report verifies your LLC’s business address, registered agent and members. It’s due each year by your anniversary date. If you file late, you may face penalties or even administrative dissolution, so it’s important to make a note and file on time.

Louisiana Franchise Tax

Contrary to many states, Louisiana does not impose state-level franchise taxes on typical LLCs. Your LLC might owe Louisiana’s corporate franchise tax if your LLC elects federal taxation as a C corporation or S corporation. The capital used by your LLC in the state determines this tax. Before making any tax elections, please verify your status and taxes with the Louisiana Department of Revenue or your tax professional.

Registered Agent Renewal Fee

If you have an LLC in Louisiana and you hire a registered agent service, you’ll need to renew that service every year. Typically, costs range from $100 to $300 per year, depending on the provider. Renewal fees are billed by the service directly, and these fees are not tied to filings with the state. To formalize a registered agent change, you must notify the Louisiana Secretary of State and pay a $25 fee. Always ensure your agent info is current to stay compliant.

Need help finding a reliable one? Here’s a review of the top-rated registered agent services in Louisiana to help you compare providers with confidence.

Articles of Amendment & Certificate of Good Standing Fees

You must file an Articles of Amendment form if there are changes to your Louisiana LLC name, address, or members. The fee is $100 whether you file online or by mail. You may also require a Certificate of Good Standing to show that your LLC is compliant, if a bank or government asks for one. A standard edition of this certificate costs $15, while an expanded edition will cost $25. The Louisiana Secretary of State may be requested for both documents via GeauxBIZ.

Expedited Service Fees and Professional Add-Ons

While Louisiana’s LLC filing process is already quick, some business owners desire even quicker turnaround or additional assistance with paperwork. Whether you need same-day processing or LLC formation done for you, the optional services simplify the process. Based on the information we gathered, it turns out that all of the manufacturers mention the availability of add-ons on their official websites, but only few use them.

Expedited Filing Fees

Need to quickly form an LLC in Louisiana? In this case, you may choose expedited service from the Louisiana Secretary of State. When filing an LLC, you can pay an extra $30 for a 24-hour handling period, or $50 for same-day delivery if submitted before noon. These fees apply on top of the regular filing fee. Clearly mark expedited requests and submit them online or in person. If you have a deadline or business to launch then this is a good option.

Professional Formation Service Packages

You can hire third-party companies to form an LLC on your behalf if you want to make it easy. Often, you can find professional services between the price of $0 to $300+. Basic packages usually include filing the Articles of Organization. Premium packages, however, may have a registered agent service, an EIN application, and operating agreement templates. Zen Business, Northwest, and Legal Zoom are all available in Louisiana. Before choosing a service that best suits your needs and budget, always compare features.

Other Associated Licensing and Permit Costs

In Louisiana, a number of business expenses do not stem from the state. They stem from your city or parish. Based on the industry you are in, you may need to get local permits, zoning clearances, or business licenses. Jurisdictive fees vary tremendously, thus, a bit of research is required. Aside from your LLC filing, there are two types of licensing costs you may come across. If you’re curious how Louisiana’s local business landscape compares, these small business statistics from the state highlight where small businesses are thriving, and where local permits might be more common or costly.

For a broader economic snapshot, the U.S. Small Business Administration’s 2023 Louisiana Profile offers valuable insights into the state’s business environment, including employment, industry distribution, and regional licensing impact.

State-Level Business License Fees

Louisiana does not have a single business license for LLCs. Certain professions and industries must receive licensing from specific state agencies. Contractors, Real Estate brokers, healthcare providers, and food-related businesses need state-level approval, for instance. Depending on license type and agency, the fees generally run from $50 to $300. If your business needs a license, either visit the Louisiana Department of Revenue or go to the GeauxBIZ portal for instructions and requirements.

Parish & Municipal Permit Costs

Besides state-level licenses, your Louisiana LLC may be required to obtain local business permits based on your parish or city. Licenses and approvals such as zoning, health department and signage permits. Prices are quite widespread but usually shine anywhere from $25 to $150 some must get renewed every year or so. Get in touch with your parish clerk or take a look at your municipality’s website for specifics. Make sure you have the proper permits, not having them could result in penalties and/or shutting down.

Cost Comparison: Louisiana LLC vs. Other Business Structures

The type of entity you choose affects your liability, ongoing costs and tax obligations going forward. Forming an LLC in Louisiana can be cheaper than other popular structures. Here's a breakdown of the costs involved. This section covers how to assess one-time and annual expenses so you can choose which works for you and your pocket (If you're still deciding where to launch your business, this best states to form an LLC guide compares top choices like Delaware, Wyoming, and more).

LLC vs. Sole Proprietorship Costs

The cheapest and easiest way to start a business in Louisiana is through a sole proprietorship, but it does not provide liability protection. Although forming an LLC typically costs more, it can save your personal assets and provide legal credibility.

Cost & Feature Comparison:

| Feature | Sole Proprietorship | LLC in Louisiana |

|---|---|---|

| Formation Cost | $0 | $100 (mail) / $105 (online) |

| Annual Report Requirement | ❌ None | ✅ Required – $30 to $35/year |

| Liability Protection | ❌ No | ✅ Yes (protects personal assets) |

| Legal Status | Informal business structure | Formal legal entity |

| Ideal For | Freelancers, hobbyists | Growing businesses, risk-based work |

Bottom Line: An LLC costs more upfront but offers stronger protection and long-term flexibility.

Still unsure whether you actually need an LLC? This essential guide can help you weigh your options and decide the best fit for your business.

LLC vs. Corporation (C Corp & S Corp) Costs

Setting up either a C Corp or an S Corp in Louisiana has a similar filing fee as that of an LLC. However, corporations come with stricter requirements. An LLC is generally less hassle for small businesses not needing venture funding.

Cost & Feature Comparison:

| Feature | LLC in Louisiana | C Corp / S Corp in Louisiana |

|---|---|---|

| Formation Cost | $100 (mail) / $105 (online) | $75 to $100 (Articles of Incorporation) |

| Annual Report | $30–$35 | $30–$35 + other compliance requirements |

| Franchise Tax | Generally No | ✅ May Apply (based on capital) |

| Formal Requirements | Minimal | Shareholders, bylaws, board meetings |

| Default Tax Treatment | Pass-through | Corporate tax / optional S Corp election |

| Best For | Flexibility, single-member setups | Scaling businesses or venture-backed |

Bottom Line: Choose an LLC for simplicity and lower maintenance. Opt for a corporation if you're planning to issue shares or seek outside investment.

LLC vs. Partnership Costs

LLCs and partnerships are both pass-through entities, meaning that business income passes through to the owners directly. But that’s where the similarities end. A Louisiana LLC offers more legal protection, formal registration, and long-term robustness, though at a slightly higher cost. A general partnership is easier to start but involved will be responsible for the debts of a business personally.

Cost & Feature Comparison:

| Feature | General Partnership | LLC in Louisiana |

|---|---|---|

| Formation Filing Requirement | ❌ Not required | ✅ Required – $100 (mail) / $105 (online) |

| Personal Liability Protection | ❌ No | ✅ Yes – limited liability |

| Annual Report | ❌ None | ✅ Required – $30–$35/year |

| Legal Status | Informal agreement | Registered legal entity |

| Tax Treatment | Pass-through | Pass-through (by default) |

| Best For | Low-risk businesses, co-owned | Asset protection, flexible growth |

Bottom Line: If you want simplicity and don’t need legal shielding, a partnership is fine. But for stronger protection and legitimacy, an LLC is worth the cost.

How to Form an LLC in Louisiana (Brief Overview)

Setting up an LLC in Louisiana is an easy task, especially if you prepare your documents ahead of time. No matter if you file online through GeauxBIZ or via mail, each step is to ensure that your business is officially registered and protected under the law.

We’ve outlined the key steps below, but if you prefer a more detailed walkthrough, this complete guide to starting an LLC in Louisiana breaks it all down with examples and tips.

Steps to Form an LLC in Louisiana:

- Choose a business name – Must be unique and comply with Louisiana naming rules.

- Designate a registered agent – Can be an individual or a registered agent service with a Louisiana address.

- File Articles of Organization – Submit online ($105) or by mail ($100) to the Louisiana Secretary of State via the official geauxBIZ portal, where you can find all required forms and instructions.

- Include your Initial Report – Required when filing your Articles.

- Get an EIN – Apply for free at the IRS website to handle hiring, banking, and tax purposes.

- Create an Operating Agreement – Recommended for multi-member LLCs to define roles and responsibilities.

- Check for business licenses – Use GeauxBIZ to find out local and industry-specific requirements.

Once approved, your LLC becomes a legal entity that protects your personal assets and provides operational flexibility.

Want a broader overview beyond Louisiana? This national guide to forming an LLC walks through every step, benefit, and state-by-state option.

Forming an LLC in Louisiana doesn’t just offer liability protection — the state also provides numerous support programs to help small businesses thrive. Through its economic development agency, Louisiana offers grants, business counseling, and training to entrepreneurs. You can explore these options on the Louisiana Economic Development Small Business Programs page.

Frequently Asked Questions About Louisiana LLC Costs

Curious about the real costs of starting and maintaining an LLC in Louisiana? These quick answers will help you understand the exact fees, avoid hidden charges, and keep your business in good standing. All information is based on the most recent guidelines from Louisiana’s official agencies and trusted business resources.

What is the total cost to form an LLC in Louisiana?

The total cost to form an LLC in Louisiana is $100 for paper filing or $105 for online filing through GeauxBIZ. This includes the Articles of Organization and Initial Report. Optional costs may include a name reservation ($25), a registered agent service ($100–$300/year), and certified documents if needed. Most LLCs can be formed for under $200 if self-filed, though add-ons and professional services may increase total costs.

Are there any hidden fees when starting an LLC in Louisiana?

Louisiana’s official LLC costs are transparent, but there are optional and situational fees you should be aware of. These may include a name reservation fee ($25), certified copies ($15–$25), and local business licenses or permits, which vary by parish or city. If you hire a registered agent service, expect $100–$300 annually. These aren’t hidden, but they’re often overlooked during planning — so it’s important to account for them when estimating your total startup costs.

Not planning to launch right away? You can still form an LLC before your business is active to secure your name and get a head start on legal protections.

How much does it cost annually to keep my Louisiana LLC active?

To keep your LLC in Louisiana active, you must file an Annual Report each year with the Louisiana Secretary of State. The cost is $30 if filed online or $35 by mail. If you use a registered agent service, add another $100 to $300 annually. Depending on your parish and industry, you may also need to renew local business licenses or permits. Most LLCs can expect to pay between $30 and $350 per year, depending on their compliance needs.

Can I reduce LLC formation costs by filing myself?

Yes, filing your LLC in Louisiana yourself is the most cost-effective option. The state charges $100 for paper filings or $105 online through GeauxBIZ, and that includes your Initial Report. By handling the process directly, you avoid paying third-party service fees, which typically range from $50 to $300. Just make sure to follow the official instructions carefully and prepare all required documents to avoid delays or rejections.

What factors can increase my Louisiana LLC’s overall costs?

Several factors can raise the total cost of maintaining your LLC in Louisiana. These include hiring a registered agent service ($100–$300/year), ordering certified documents, or paying for expedited filing ($30–$50). You may also need local business licenses, permits, or industry-specific registrations. If your LLC elects corporate tax status, franchise taxes may apply. Lastly, missing deadlines can result in late fees or reinstatement costs. Careful planning and compliance help avoid unexpected expenses.

- Louisiana Secretary of State — Commercial Division: Forms & Fee Schedule (Articles #365 $100; Annual Report $30; Registered Agent change $25)

- Louisiana Secretary of State — Commercial Division: Articles of Organization — Louisiana LLC (Form #365)

- Louisiana Secretary of State — Commercial Division: Name Reservation (Form #398) — $25 / 120 days (PDF)

- Louisiana Secretary of State — Commercial Division: Trade Name / Trademark / Service Mark Registration (Form #309) — $75 per class (PDF)

- Louisiana Secretary of State — Commercial Division: Filing & Expedite Options ($30/24-hour; $50 same-day walk-in)

- Louisiana Secretary of State — Commercial Division: Order Documents & Certificates (certified copies $15; complete file $25)

- geauxBIZ (Louisiana Secretary of State): Online Business Filings & Annual Reports Portal

- Louisiana Department of Revenue: Corporation Income & Franchise Taxes (LLC franchise-tax treatment when taxed as a corporation)

- Louisiana Department of Revenue: How are LLCs taxed for Louisiana income & franchise tax purposes?

- Internal Revenue Service: Get an Employer Identification Number (EIN) — Free

- Financial Crimes Enforcement Network (FinCEN): Beneficial Ownership Information — Current Guidance

- Harbor Compliance: Louisiana Annual Report — $30 + $5 online card convenience fee

- Northwest Registered Agent: Louisiana LLC Filing — $100 by mail / ~$105 online (card fee)

Looking for an overview? See Louisiana LLC Services

Stay Compliant in Louisiana with a Trusted Agent

Harbor Compliance acts as your registered agent, so you never miss a notice, filing, or deadline required by the state of Louisiana.