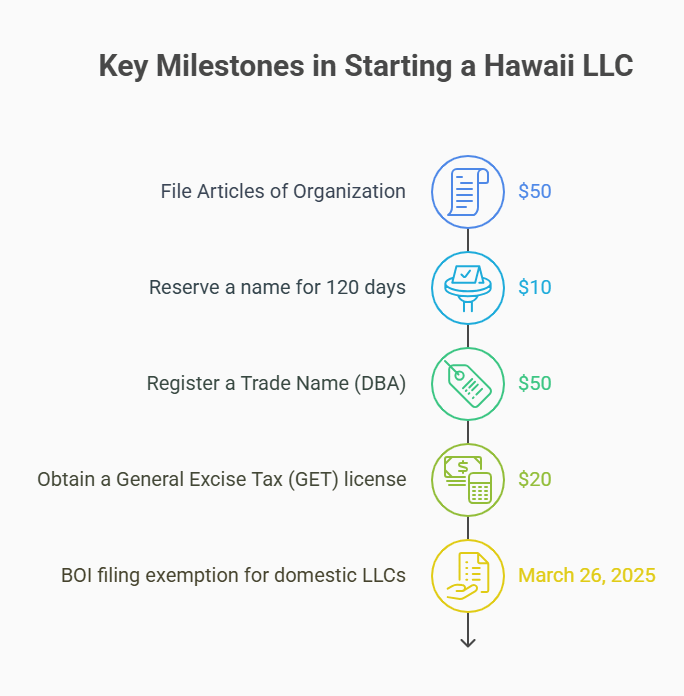

The real Hawaii LLC cost in 2025 is straightforward: $51 to file Articles of Organization ($50 plus a mandatory $1 State Archives fee). Most businesses also budget a one-time $20 General Excise Tax (GET) license before operating. Your ongoing Hawaii LLC cost is the $12.50 online annual report (or $15 by mail), with an optional $25 expedite if you need faster processing (often ~1 business day vs. ~3–5 standard). Everything else (name reservation, DBA/trade name, certified copies, registered agent service) is optional or “as needed.”

Total Cost to Form a Hawaii LLC (one-time & ongoing)

If you’re comparing the LLC cost in Hawaii, start by separating must-pay formation charges from recurring obligations. The snapshot below groups both in one place and flags the optional add-ons, so you can plan your first year (and every year after) without guesswork.

Below is a quick table of the most common state-level costs you’ll encounter. (Optional third-party services aren’t included, since those vary by provider).

| Cost item | Amount | When you pay |

|---|---|---|

| Articles of Organization (Form LLC-1) | $50 + $1 State Archives fee (total $51) | One-time at formation |

| Expedited review (optional) | +$25 | With your filing |

| Name reservation (optional) | $10 (holds name up to 120 days) | Before filing (if needed) |

| Annual report (online / mail) | $12.50 online / $15 mail | Each year, in your anniversary quarter |

| Late fee (annual report) | $10 per year delinquent | Only if you miss the deadline |

| GET license (Form BB-1) | $20 one-time | After formation / before operating |

| Certificate of Compliance (Good Standing) | $5 (expedite +$10) | As needed (banks, deals, etc.) |

| Certified copy | $10 + $0.25/page | As needed |

One-time Costs to Start a Hawaii LLC

When you map out the up-front Hawaii LLC cost, you’re mainly looking at the state filing fee, optional name tools, any assumed-name (DBA) you’ll use for branding, and a one-time state tax license. Below, each item explains what it covers, how to file, and how to avoid paying for extras you don’t need. If you prefer an all-in-one filing package, see our Hawaii LLC service reviews for costs and pros/cons.

Articles of Organization Filing Fee

Hawaii charges $50 to file Articles of Organization for a domestic LLC. You can add $25 for expedited review. Submissions are accepted online, email, mail, fax, or in person, and standard review typically runs about 3–5 business days, with expedite often ~1–3 business days depending on volume. Expect a separate $1 State Archives fee on many filings and copies. Core details in this filing include the LLC’s legal name, mailing and principal addresses, registered agent, and management structure.

Quick compare (filing methods):

- Online (Hawaii Business Express): Fastest queue, instant submission + receipt; add $25 to expedite.

- Email / Fax / Mail: Accepted, but processing and transit can add time.

For a step-by-step checklist, use our Hawaii LLC formation guide.

Hawaii LLC Name Search & Reservation

Before you file, run a Hawaii business entity search to spot conflicts. If you’re not ready to form yet, you can reserve a name for 120 days for a $10 fee using Form X-1 (online or paper). This is optional, skip it if you’re filing your Articles right away.

Trade Name (DBA) Registration with DCCA BREG

If you’ll operate under a public-facing brand that’s different from your LLC’s legal name, register a Trade Name (DBA) with DCCA BREG. The filing fee is $50 (optional $20 expedite). You can file online via Hawaii Business Express or by paper form. A DBA doesn’t create a new entity; it simply lets your LLC transact under that name.

For naming strategy basics, see our LLC vs DBA comparison.

Certified copies & Certificate of Good Standing (use cases and fees)

Banks, investors, or out-of-state filings may ask for proof that your LLC exists and is compliant. Hawaii offers:

- Certificate of Good Standing (a.k.a. Certificate of Compliance): $5 (optional +$10 expedite).

- Certified copy of a filing: $10 + $0.25/page.

You can order these online or at the BREG counter.

GET License (Form BB-1)

Most Hawaii LLCs that sell goods or services need a General Excise Tax (GET) license before operating. The license is a one-time $20 fee. Apply online at Hawaii Tax Online or submit Form BB-1 (Basic Business Application) by mail. (The same BB-1 packet covers other tax permits if you need them.)

How to register (fast path):

- Create/Log in to Hawaii Tax Online → “Register a New Business.”

- Complete Form BB-1 → pay the $20 fee.

- Receive your Hawaii Tax ID and GET license confirmation.

Local/County Licenses & Professional Permits

There’s no statewide “general” business license, but many activities are regulated. If you’re in a licensed trade (e.g., contractors, real estate, healthcare), check DCCA’s Professional & Vocational Licensing (PVL), which oversees 52 professions. For food businesses, the Department of Health’s Food Safety Branch issues county-specific Food Establishment or Special Event permits. If you’ll build out a space or add signage, especially on Oahu (City & County of Honolulu), expect zoning/building/sign permits through the Department of Planning & Permitting (DPP).

For a broader view of fees elsewhere, compare business license costs by state.

Registered agent (free DIY vs. paid service)

Hawaii requires every LLC to keep a registered agent with a physical Hawaii address who is available during normal business hours to accept legal documents. This can be you or another individual, or a commercial provider. DIY is free (if you have a reliable street address and daytime availability). Many owners hire a registered agent service in Hawaii for privacy, stability, and mail handling. See HRS § 428-107 and DCCA guidance for the exact rules.

Beneficial Ownership Information (BOI) filing with FinCEN

Important 2025 update: As of March 26, 2025, FinCEN’s interim final rule revised who counts as a “reporting company.” Entities formed in the U.S. (domestic LLCs) are now exempt from BOI reporting under the Corporate Transparency Act. Only foreign entities that register to do business in a U.S. state (and aren’t otherwise exempt) must file, and there is no filing fee. Key deadlines for foreign reporting companies: those registered before March 26, 2025 had to file by April 25, 2025; those registered on/after March 26, 2025 have 30 days after registration becomes effective. Always check FinCEN’s page for any future changes.

Form your Hawaii LLC with ZenBusiness

ZenBusiness helps you handle Hawaii’s unique requirements like GET registration, annual reports, and state filings, quickly and affordably.

Ongoing Hawaii LLC Costs (every year)

Your ongoing budget after formation boils down to four things: the Hawaii LLC annual report, routine state taxes for owners, General Excise Tax (GET) filings, and employer taxes if you hire. Add provider renewals (like a registered agent service) and any industry or local permit renewals as needed. The sections below keep it simple and cite the exact state rules so you can plan with confidence.

Hawaii LLC Annual Report

Hawaii LLCs file an annual report during the quarter of their original registration anniversary. File online for $12.50 (or $15 by mail/paper). If you miss the window, the state adds a $10 late fee per year delinquent. If an LLC is administratively terminated, you can generally reinstate within 2 years by filing an application and paying $25 plus all past-due reports/fees.

When is your report due? (by anniversary quarter)

| If your LLC formed between… | Due by… |

|---|---|

| Jan 1–Mar 31 | Mar 31 each year |

| Apr 1–Jun 30 | Jun 30 each year |

| Jul 1–Sep 30 | Sep 30 each year |

| Oct 1–Dec 31 | Dec 31 each year |

Source: DCCA BREG.

Hawaii Taxes that Affect LLC Budgets

Most LLCs are “pass-through” by default, Hawaii follows the federal “check-the-box” classification, so profits/losses typically flow to the owners’ personal returns (unless you elect corporate taxation). Owners file Form N-11 (residents) or N-15 (nonresidents/part-year) and should check the state’s annual calendar, individual returns are generally due around April 20 (or the next business day). Hawaii also offers an elective PTE tax for partnerships and S corps (useful SALT-cap workaround); see DOTAX’s PTE page for eligibility and add-back rules starting with tax years after Dec 31, 2024.

General Excise Tax (GET)

Hawaii’s GET applies broadly to business receipts. The base rate is 4%, and each county currently adds a 0.5% surcharge (Honolulu since 2007; Kaua‘i since 2019; Hawai‘i County 0.5% since 2020; Maui since 2024). The surcharge applies only to activities taxed at 4%, not to wholesale (0.5%) or insurance commissions (0.15%). File periodic Form G-45 (monthly/quarterly/semiannual as assigned) by the 20th day after the period ends, and file the annual G-49 reconciliation by the 20th day of the 4th month after year-end (April 20 for calendar-year filers).

Quick GET filing cadence

| Return | What it covers | Typical due date |

|---|---|---|

| G-45 (periodic) | Monthly/Quarterly/Semiannual gross receipts | 20th day after period end |

| G-49 (annual) | Year-end reconciliation of GET | 20th day of 4th month after year-end |

Source: DOTAX G-45 instructions.

Payroll Taxes if You Hire

- State income tax withholding. Register via Hawaii Tax Online. Hawaii currently instructs employers to file Form HW-14 quarterly (due Apr 15, Jul 15, Oct 15, Jan 15). The official instructions also note periodic returns are due on/before the 15th day after the period closes; check your assigned frequency on your account. See the DOTAX 2025 due-date calendar for specific dates. The annual reconciliation (historically HW-3) and W-2 submissions follow DOTAX guidance. If you want to outsource payroll/HR, consider vetted Hawaii PEO options.

- Unemployment insurance (SUTA). Register with the DLIR Unemployment Insurance Division; UI reports and contributions are due quarterly.

Registered Agent Renewal (if using a service)

There’s no state “renewal” fee for your registered agent. If you switch agents, Hawaii charges $25 to file a Statement of Change/Resignation of Registered Agent for an LLC. If you use a commercial registered agent service, budget their annual subscription (provider-set, not a state fee).

Reliable Registered Agent Service in Hawaii – Northwest

Northwest provides discreet, dependable Registered Agent services, keeping your Hawaii LLC in good standing all year long.

License Renewals (industry or locality specific)

Renewals vary by industry and county. Start with DCCA Professional & Vocational Licensing (PVL) for any board-regulated occupation (52 professions) and use MyPVL for online renewals. Food businesses renew through the Department of Health – Food Safety Branch (permits are location-specific). If you maintain premises or signage in Honolulu, track DPP permit timelines and renewal/extension procedures.

If you’re in a licensed profession, compare structures in our LLC vs PLLC guide.

Foreign (out-of-state) LLC costs to operate in Hawaii

If your company was formed outside Hawaii, you’ll “foreign qualify” before doing business here. That means filing for a Certificate of Authority with DCCA BREG, keeping up with the annual report, and registering for taxes like GET if you have Hawaii-sourced revenue. Below you’ll find the exact fees, documents, and when a DBA (trade name) becomes necessary.

Certificate of Authority Filing

To register a foreign LLC, file Form FLLC-1 (Application for Certificate of Authority) with DCCA. The state fee is $50, expedite is +$25, and most filings include a $1 State Archives fee. Hawaii accepts filings online (Hawaii Business Express) or by email, mail, or fax. You must also attach a Certificate of Good Standing from your home state dated within 60 days of filing. A Hawaii registered agent with a physical HI address is required.

Common up-front costs for foreign LLCs

| Item | Amount | Notes |

|---|---|---|

| Certificate of Authority (Form FLLC-1) | $50 | Required to transact business in HI. |

| Expedited review (optional) | +$25 | Add to speed up review. |

| State Archives fee | $1 | Added to many filings/copies. |

| Certificate of Good Standing (home state) | Varies | Must be issued ≤ 60 days before filing. |

Ongoing Filings for Foreign LLCs

Annual report. Foreign LLCs file the same annual report as domestic LLCs during the anniversary quarter. Online fee $12.50 (or $15 by mail/paper). Late filings add $10 per year delinquent.

GET (General Excise Tax). If you have Hawaii receipts, obtain a GET license (one-time $20) and file periodic returns: G-45 (monthly/quarterly/semiannual as assigned) by the 20th day after each period, plus the annual G-49 by the 20th day of the 4th month after year-end. Base rate 4%; each county currently adds a 0.5% surcharge on transactions taxed at 4%.

Local taxes (industry-specific). If you provide lodging (hotels, STRs, etc.), Hawaii imposes State TAT 10.25% (scheduled to increase to 11% on Jan. 1, 2026 under Act 96), plus county TAT (3% in each county). Check your county’s site for payment portals and forms. For landlords and hosts weighing liability and banking, see our primer on LLCs for rental properties.

When a DBA is Required for a Foreign Name Conflict

If your true LLC name isn’t available in Hawaii (e.g., it’s “substantially identical” to an existing HI entity or registered trade name), you may still qualify by registering a different name as a Hawaii trade name and then doing business under that name. Statute HRS §428-1005.5(c) authorizes this fix; DCCA’s guidance confirms the process. The Trade Name (Form T-1) fee is $50 (+$20 expedite) and typically carries a $1 archives fee. You can also reserve a fictitious name in advance under HRS §428-106.

Hawaii LLC Processing Time & Expedite Fees

Hawaii keeps filings simple: the Articles of Organization cost $50 plus a $1 State Archives fee, and you can add +$25 for expedited review. Standard turnaround is about 3–5 working days; expedited filings are typically processed in 1 business day (see Hawaii LLC processing time guide). Filing online moves you to the front of the queue and lets you pay by card; paper/email/fax are accepted but slower. Note that filing fees are not refundable, so mistakes can cost you a second fee.

Standard vs. Expedited

The math is straightforward: add $25 for expedite on top of the base fee (e.g., $50 + $1 + $25 = $76 for Articles). Pay for expedited review if you’re:

- chasing a launch date (lease signing, bank account, contract start);

- resolving a name conflict before a competitor files; or

- fixing a rejected filing quickly to avoid downstream delays.

Hawaii advertises “3–5 working days” for normal processing and “1 day” for expedited, so the upgrade is cost-effective whenever a day or two impacts revenue or compliance.

Online vs. Paper

The state fee is the same online or by paper for formations, but online filing gets faster routing and an instant receipt. Paper/email/fax are allowed, yet the division cautions processing may be delayed when filed by those channels. For ongoing compliance, the annual report is cheaper online ($12.50) vs. $15 by mail, and you can enable free email reminders when you file online (otherwise the reminder service is $2.50/year).

Expedited Service Levels

Hawaii offers a single expedite tier: +$25 per filing. In practice, expedited submissions are typically handled in about one business day, but the state does not guarantee hour-by-hour turnaround. Treat expedite as a next-business-day queue upgrade—useful when timing affects contracts, bank onboarding, or launch milestones.

Timing Risks that Add Costs

Even small delays can snowball into extra fees and administrative headaches. Build a simple calendar for filings, keep your registered agent current, and double-check forms before you submit. The items below are the most common (and avoidable) cost traps:

- Annual report late fee: $10 per year delinquent; miss too long and you risk administrative termination.

- Reinstatement: If administratively terminated, you can reinstate within 2 years; Application of Reinstatement fee is $25 (expedite +$25).

- Nonrefundable filings / dishonored checks: BREG states filing fees are NOT REFUNDABLE; a $25 dishonored-check fee applies. Errors that force a re-file can mean paying the state fee again.

Cost-saving tips

You can keep your Hawaii LLC budget tight without cutting corners by filing smart, preventing rejections, and tracking deadlines proactively. Start with these quick wins:

- File online (Hawaii Business Express) to speed review, get receipts, and enable free reminders on future annual reports.

- Use BREG’s “Filing Tips” (current forms, don’t modify PDFs, complete every field) to prevent rejects and re-filing costs.

- Monitor due dates from your HBE dashboard (Overdue/Due Soon) and subscribe to MyBusiness Notifications.

Cost Optimizations & Practical Tips (without risking compliance)

These are simple, low-risk ways to lower your total Hawaii LLC cost without cutting corners. Each tip links to the state rule so you can move fast, and stay compliant.

When to Reserve a Name

Only reserve if you’re not ready to file in the next few weeks but want to lock the name. Hawaii reservations hold the name 120 days and cost $10 (Form X-1). If you’re forming now, skip the reservation and file the Articles directly.

Quick rule of thumb: Reserve if you need time for banking, investors, or branding; otherwise file the Articles and save the extra step.

File Online to Save Time and Lower Fees

For most filings the fee is the same online or paper, but online is faster and the annual report is $12.50 online vs. $15 by mail, a small but automatic savings every year. Online annual filers also get free reminder emails (vs. $2.50/year if you subscribe separately).

Keep the Registered Agent DIY or Switch Later

Hawaii lets you name any individual with a Hawaii street address as your registered agent, so you can start DIY at $0 and switch to a commercial provider later if privacy or availability becomes an issue. If you change agents, the Statement of Change fee is $25. Use a registered agent service if you want mail scanning, privacy, or multi-state coverage from day one.

Plan GET Filings to Match Cash Flow

DOTAX assigns or allows filing frequencies based on annual liability. In short:

- Semiannual if your annual GET ≤ $2,000;

- Quarterly if around $2,000–$4,000;

- Monthly if > $4,000, and e-filing is mandatory above the $4,000 threshold. Periodic returns (G-45) are due by the 20th day after the period; the annual G-49 is due by the 20th day of the 4th month after year-end. If you over-elect frequent filing, DOTAX may change you to monthly. Choose the least frequent option that fits your projections to smooth cash outlay, then adjust if revenue changes.

FAQs: Hawaii LLC Costs

Starting fresh in Hawaii? Here are quick, plain-English answers about the real LLC cost in Hawaii, from day-one fees to annual obligations and timing. Each answer is short, practical, and sourced so you can budget with confidence.

How much does it cost to start a Hawaii LLC?

Your core formation cost is $51 ($50 to file Articles of Organization plus a $1 State Archives fee). Many owners also budget $20 for the one-time GET license after formation. Need speed? Add $25 for expedited review. You can file online (fastest) or by email, mail, or fax. That’s the true “day-one” LLC cost in Hawaii.

How much do I pay every year in Hawaii?

Expect the annual report: $12.50 online (or $15 by mail) during your anniversary quarter; late filings add $10 per year delinquent. Most businesses also make ongoing GET filings on revenue (separate from the state filing fee). File online to save time and track due dates.

Here’s a plain-English LLC annual report guide.

Does Hawaii have an LLC franchise tax?

Not for typical LLCs. Hawaii doesn’t impose a general “LLC franchise tax” like some states. Most LLCs handle GET on gross receipts and owners pay Hawaii income tax on profits (unless the entity elects corporate taxation). A franchise tax does exist for banks/financial institutions, but that’s a specialized regime.

Is there a newspaper publication requirement in Hawaii?

No, Hawaii does not require newspaper publication to form an LLC. You simply file Articles of Organization with DCCA BREG (online (fastest) or by email, mail, or fax) and pay the standard fee (optionally add expedite). No extra publication steps or costs.

What happens if I miss the annual report deadline?

File late and the state adds a $10 late fee per year delinquent. Prolonged non-filing can lead to administrative termination. You generally have up to two years to reinstate by submitting missing reports and paying all delinquent fees (BREG’s reinstatement filing is $25, expedite optional), then you’re restored to good standing.

Do I need a Hawaii address or registered agent in-state?

Yes. Every LLC must maintain a registered agent with a physical Hawaii address who is available during normal business hours. This can be an individual resident or an authorized company. It’s fine to DIY if you meet the requirements; many choose a provider for privacy and reliability.

How fast can I form a Hawaii LLC?

Standard filings are typically processed in 3–5 business days; expedited can be ~1 business day for an extra $25. If a faster approval affects revenue (leases, contracts, banking), expedite is usually worth it. Filing online also moves you through faster queues and gives instant confirmations.

What extra costs apply if I register an out-of-state (foreign) LLC?

To operate in Hawaii, file Form FLLC-1 (Certificate of Authority): $50 (+ $25 expedite; $1 archives). You must attach a Certificate of Good Standing from your home state dated within 60 days and appoint a Hawaii registered agent. If you have Hawaii receipts, obtain the GET license ($20) and file periodic GET returns; foreign LLCs also file the same annual report ($12.50 online).

- DCCA BREG: Domestic LLC: overview, filing methods & fees

- DCCA BREG: LLC fee table (domestic)

- DCCA BREG: LLC Info (PDF)

- DCCA BREG: Trade Name (DBA) registration (Form T-1)

- DCCA BREG: Statement of Change of Registered Agent (Form X-7)

- HRS §428-107: Registered agent requirement

- Hawaii Business Express: Start, manage & search businesses

- Hawaii Dept. of Taxation: General Excise Tax (GET)

- City & County of Honolulu: Department of Planning & Permitting

Looking for an overview? See Hawaii LLC Services

Form a Hawaii LLC with Harbor Compliance

Harbor Compliance takes care of everything—from Articles of Organization to GET and annual report filings—for your Hawaii LLC.