Planning to start a business and researching the Alabama LLC cost? Forming a limited liability company gives you the best of both worlds: personal asset protection and simplified tax treatment, but it’s important to first understand every required filing fee, ongoing tax, and optional service under Alabama law – whether you're forming a domestic LLC or registering as a foreign LLC.

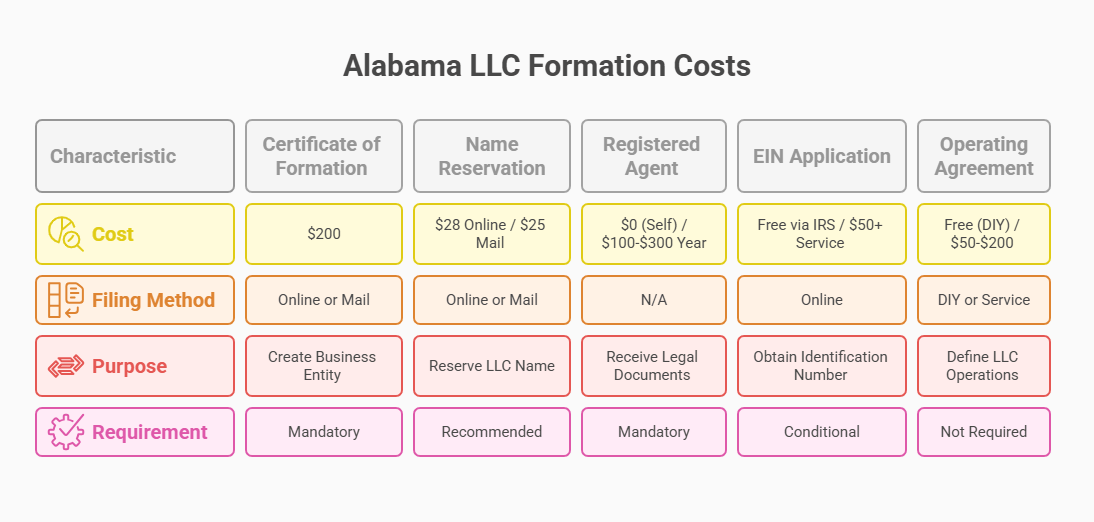

The total cost to form an LLC in Alabama in 2025 is $228 if filed online, this includes the $200 certificate of formation and a $28 name reservation. To maintain your LLC, you’ll pay a minimum annual fee of $50 for the Business Privilege Tax and a $10 annual report, with optional expenses like registered agent service, business licenses, EIN application, or expedited filing potentially raising your total to $300–$800 or more depending on your structure, industry, and whether you're forming a domestic or foreign LLC.

This guide breaks down every official filing fee, license, tax, and optional service you might encounter. Keep reading to avoid surprises and make the smartest choice for your business entity in 2025.

| Expense Type | Cost (USD) | Required? | Details & Notes |

|---|---|---|---|

| Certificate of Formation | $200 | ✅ Yes | Mandatory one-time filing fee paid to the Alabama Secretary of State when you form your LLC. |

| Name Reservation | $28 online / $25 by mail | ✅ Yes | Alabama requires reserving your LLC name before formation. Included if you file online. |

| Registered Agent Service | $0 (self) or $100–$300/year | ⚠️ Optional | You must list an Alabama registered agent. Using a registered agent service is optional. |

| EIN Application | Free via IRS / $50–$100 | ⚠️ Optional | Get it free from the Internal Revenue Service or pay a provider to do it for you. |

| Operating Agreement | Free (DIY) or $50–$200 | ⚠️ Optional | Strongly recommended. Defines your LLC operating agreement structure and rights. |

| Business Privilege Tax & Annual Report | $50 minimum | ✅ Yes | Filed yearly with Alabama Department of Revenue. Amount increases based on income. |

| Annual Report Filing (SOS) | $10 | ✅ Yes | Filed alongside BPT. Penalty for late file an annual report: up to $100. |

| Professional/Trade Licenses | $50–$150 | ⚠️ Depends | Required if your business in Alabama falls under regulated professions. |

| County/Municipal Business Licenses | $25–$300+ | ⚠️ Depends | Local license rules vary by city or county. Often required. |

| Foreign LLC Registration | $150 | ⚠️ Only if out-of-state | Required to register as a foreign LLC if you’re operating from another state. |

| Expedited Filing (SOS) | $25 (next day) | ⚠️ Optional | Faster processing for formation or amendments. |

| Amendment / Restatement Filing | $100 per event | ⚠️ Optional | Required only if you update LLC name, members, or structure. |

| Certificate of Existence / Compliance | $14–$28 | ⚠️ Optional | Often requested by banks or vendors. Proves your LLC is in good standing. |

| Premium Formation Package (3rd Party) | $99–$299 | ⚠️ Optional | Includes filing, agent service, EIN setup, and more – pricing varies. |

Initial Formation Costs in Alabama

Forming an LLC in Alabama starts with a few essential steps that are each connected to a specific state-mandated filing fee. Whether you’re just starting out or refining your business setup, knowing these basic startup costs will help you form your LLC effectively and avoid delays.

Certificate of Formation – $200 State Filing Fee

You need to file a Certificate of Formation with Alabama Secretary of State to create a business entity officially. The filing fee of $200 is non-refundable and must be paid for domestic and foreign LLCs. You can submit your application through the Secretary's online portal or by mail via your local probate judge. When you file online, it’s much faster, which is usually processed within 3–5 business days. If you file by mail, it may take longer. Your LLC’s name, address, registered agent and purpose are in this document. The Alabama Secretary of State’s LLC page has the official forms and filing instructions you’ll need.

Name Reservation – $28 Online / $25 by Mail

Before submitting your formation documents, you need to reserve your LLC’s name in Alabama. You can reserve your name online for $28 or by mail for $25 using the certificate of name reservation system. The reservation of name is valid for a period of 12 months and must be unique that is not identical to other business entities. Using the state’s official portal streamlines the formation process with a reservation of online. Search the state database for name availability before paying the filing fee.

Registered Agent Service – $0 (Self-Service) or $100–$300/Year

Every Limited Liability Company (LLC) based in Alabama must appoint a registered agent to receive important documents and service of process on their behalf. While you can represent yourself as your own agent without any cost, your name and address will get featured as part of the public record. This raises privacy concerns for some business owners. Typically, a professionalregistered agent service costs $100 and $300 a year. Furthermore, they help with compliance reminders, secure mail handling, and document scanning. This guide explains why you need a registered agent for Alabama businesses if you are on the fence about it. Many people believe it's worth an annual fee for the extra layer of security and convenience.

EIN Application – Free via IRS vs. $50+ Through Service Providers

Your LLC will need an Employer Identification Number (EIN) if you plan to open a business bank account, hire employees, or submit federal income tax returns. You can do it directly through IRS website for free. It is a free process and you can do it online in just a few minutes. Many formation providers charge anywhere from $50 to $100 to register you for an EIN. You’re better off filing the application yourself through the IRS website if you don’t want convenience. You can go straight to the IRS EIN and LLC information page, which features clear guidelines and an online form.

Operating Agreement – Free (DIY) or $50–$200

Operating agreements are not required by Alabama law but, nevertheless, are an important internal document that explains how your Alabama LLC operates, such as member roles, decision-making processes, and profit distribution. By creating an operating agreement for your LLC, you can prevent in-house fights in your business. Most banks and investors expect a plan during account opening or due diligence. You can use free templates to create one yourself, or get one from a service for $50–$200. The SBA explains why this document is vital and what it should include.

Form Your Alabama LLC Without Breaking the Bank

ZenBusiness offers simple, all-in-one packages to form your Alabama LLC—covering state fees, paperwork, and ongoing compliance.

Annual & Ongoing Compliance Fees

Once an LLC is formed in Alabama, the business owes annual fees and state filings to remain in good standing. These costs help you maintain your legal status, avoid penalties, and comply with Alabama law. Here’s a rundown of what you’ll need to budget for each year to keep your business entity compliant.

Business Privilege Tax Return – $50 Minimum Annually

In Alabama, all LLCs have to submit a Business Privilege Tax Return to the Alabama Department of Revenue each year. The state’s minimum fee is $50, although, it increases based on your net worth, taxable income, and actual amount. The report, which is required to be filed annually by every company, is due April 15. Late fees and interest charges can accrue if you do not file on time. Should you be wondering exactly how Alabama compares to other states, this 2025 guide to LLC annual fees by state shows what businesses pay across the nation. The Business Personal Property Tax (BPT) keeps your LLC compliant with state law and keeps it active.

Certificate of Amendment/Restatement – $100 per Filing

Alabama requires you to file a Certificate of Amendment or Restatement if you change your LLC’s name, registered agent, business address, or structure. Alabama’s Secretary of State charges $100 for filing each document. Do keep in mind to thought of this though this may not be a recurring charge if there are changes in ownership or management. You can file either online or by mail, but make sure that you provide all required information is accurate, otherwise, it will delay approval and will be required to resubmission.

Late-Filing Penalty – Up to $100

If you do not file an annual report or business privilege tax return on time, you could be penalized up to $100 (in addition to interest). To maintain compliance with state law, the Alabama Department of Revenue enforces these penalties on businesses. After the April 15 due date, penalties begin accruing immediately and can compound. To prevent unneeded costs, be sure to note your due dates for compliance and consider using a registered agent service that offers reminders for those filings. To avoid unnecessary spending, be mindful of when you need to be compliant and consider hiring a registered agent service that reminds you of filings. To simplify your decision process when selecting the best option, feel free to take a look at the following list of the best registered agent services in Alabama which we have vetted out based on features, pricing, and reliability.

Annual Report (SOS) – $10

Each LLC in Alabama must submit an annual report to the Alabama Secretary of State with its Business Privilege Tax Return. The state fee charged is $10, to confirm that the business is active and legally compliant, as well as up to date with information such as your registered agent, and business address. This small but essential step will keep your business entity in good standing. Submit your return online or by mail by April 15 to avoid late penalties.

State & Local Licensing & Permit Fees

Depending on their location and industry, many businesses in Alabama must obtain further licenses or permits other than core formation costs. The costs vary by county, municipality, and type of business. Knowing which requirements influence your LLC helps it stay compliant and operational.

Alabama Professional/Trade Licenses – $50–$150

Certain professions and regulated industries in Alabama require a state-level professional or trade license to legally operate. Example : Real estate agents, contractors, barbers, and accountants. The average application fee for a license falls within the $50 to $150 range. You will send an application to appropriate state licensing boards your own state and its requirements to get your license. It's important to understand that forming an LLC doesn't replace this requirement, an LLC is not the same as a business license, and most businesses will need both to operate legally. Before starting your LLC, check with the Alabama Department of Revenue or whichever state board is most relevant to your particular business activities are required to file for one of these licenses.

County & Municipal Business Licenses – $25–$300+

Aside from state requirements, a business license is required by several cities and counties in Alabama in order to operate. The fees usually go from $25 to $300+ depending on your business type, size, and location. A shop in Birmingham may pay different rates than a service in Montgomery County, for instance. These licenses are usually renewed once a year and are enforced by local authorities. We suggest contacting your local business licensing office before forming, starting or operating an LLC if you want to avoid a fine or shutdown.

Industry-Specific Regulatory Fees (Alcohol, Construction, etc.)

Some sectors of Alabama are heavily regulated and require another layer of state or federal oversight, often at a great cost. Your LLC is likely to pay industry-specific permit and application fees if it operates in agriculture, alcohol sales, construction, cannabis, firearms, or food service. Fees range from $100 to well over $1,000.

For example, an ABC license for alcohol distribution involves multiple layers of filing, documentation, and approval. These business licenses are often subject to detailed compliance checks, renewals, and inspections. Always consult with your licensing board or legal advisor to understand what’s required to file for your specific sector.

Expedited Filing & Professional Add-Ons

If you’re in a hurry or want to streamline the paperwork, Alabama offers optional upgrades during the LLC formation process. From faster filing to bundled business formation services, these extras can save time, reduce mistakes, and simplify compliance, though they do come at an added cost.

SOS Expedited Filing – $25 for Next-Day Service

Alabama gives you immediate processing through the Secretary of State for just $25. By paying this filing fee, you can get next-business-day service for the submission of your certificate of formation, amendments, or other important documents. Even if you don’t have to, it’s great if you have a time-sensitive deadline like closing on your lease or onboarding clients. Paying extra for expedited service requires you to tick the expedited box in your online registration and add the additional state fee to your payment, usually credit card or e-check.

Premium Formation Packages – $99–$299 (Bundled Services)

If you want everything in one package, many third-party providers offer premium LLC formation packages. These generally consist of the reservation of name, registered agent service, EIN application, template of operating agreement, and compliance alerts. Prices may vary. These generator prices may range from $99 to $299. Although not mandatory, these services can ease the process for novice entrepreneurs and minimize mistakes. To assist you in selecting the most trustworthy one, take a look at this list of the best LLC services in Alabama, each of which has been reviewed and ranked so you’ll get real value for money. Before you book a service, make sure you compare what’s included. You don’t want to pay for more services than what you need, or more importantly, services you can do by yourself.

Domestic vs. Foreign LLC Fees

The cost to operate an LLC in Alabama depends on whether you’re creating a domestic LLC or registering as a foreign LLC from another state. By knowing the different variations and associated fees, you can prevent delay or duplicate filing of your application. If you're still unsure about where to form your LLC, this state-by-state guide to the best states for LLC formation will compare taxes, privacy, filing costs and more. A comparison of main fees include filing and annual fees of both entities.

Domestic Formation – $200 vs. Foreign Qualification – $150

The fee to form a domestic LLC in Alabama is $200, while registering a foreign LLC to operate in Alabama costs $150. Here’s how the two options compare:

| Type of LLC | Filing Fee | Filed In | Used For |

|---|---|---|---|

| Domestic LLC | $200 | Alabama | Forming a new LLC directly in Alabama |

| Foreign LLC | $150 | Another state | Authorizing an out-of-state LLC to do business in Alabama |

If your business entity is legally formed in another state but plans to operate in Alabama, you're required to file as a foreign LLC to remain compliant.

Annual Privilege Tax for Foreign LLCs – $50 Minimum

If you are a foreign LLC operating in Alabama, you must file a business privilege tax return like a domestic LLC. The minimum fee charged every year is $50 although it can be higher depending on the net worth and earning of the company. You must file the tax each year with the Alabama Department of Revenue no later than April 15. Failure to file the tax can lead to a fine, while your right to do business in Alabama may be revoked. Stay compliant to keep your registration in good standing with the authority.

Stay Compliant in Alabama with a Registered Agent You Trust

Northwest ensures your Alabama LLC meets ongoing requirements with professional registered agent services.

Cost Comparison: Alabama LLC vs. Other Structures

Before starting an Alabama LLC, it’s a good idea to compare its costs to other common business types. The state fee to register an LLC is higher than for a sole proprietorship. However, the liability protection and flexibility of tax treatment make creating an LLC worthwhile in the long run. This simple guide will explain what LLC means in a clear and concise manner, so you can understand what makes an LLC unique. Here’s a comparison of LLCs to other types of entities.

LLC vs. Sole Proprietorship – $200 vs. No State Fee

The primary cost to form an LLC in Alabama is a $200 filing fee, while a sole proprietorship has no state formation cost. Definitely, the price difference has a huge trade-off. An LLC provides liability protection, separating your personal assets from business debts. On the other side, a sole proprietor is personally liable for all obligations. Are you still trying to figure out if an LLC is required for your business? This guide explains if you need an LLC to get started, outlining the pros, cons and use cases of each structure. LLCs above all can have access to more tax planning and bank funding and ownership structures. LLC State Fee Worth it. If protecting your personal finances is important to you, the state fee upfront for an LLC is often more than worth it.

LLC vs. Corporation – $200 vs. $100 Filing Fee

Forming an LLC in Alabama costs $200 and forming a corporation will only require a $100 filing fee. At first glance, corporations seem more affordable. Nonetheless, corporations are required to follow stricter formalities like shareholder meetings, bylaws, and annual reports. To better understand what incorporation really involves, and how it compares to other structures, check out this comprehensive guide to incorporating your business, covering legal entities, tax implications, and paperwork. On the other hand, LLCs offer flexible management, fewer administrative duties, and pass-through taxation. For most business owners, the compliance costs and the structure of a corporation are not worth the savings. Entrepreneurs wishing for liability protection without the hassle of corporate governance should choose an LLC.

LLC vs. General Partnership – Licensing & Tax Differences

While a general partnership doesn't require a state filing fee, it also offers no liability protection. In contrast, forming an LLC in Alabama costs $200 but separates your personal assets from the company’s debts and obligations. LLCs are also more credible with banks, vendors, and clients – and can opt for flexible taxation methods. Meanwhile, partnerships may face complications when ownership changes or disputes arise. If long-term stability and asset security matter, the state fee for an LLC is a small price for greater control. You can dive deeper into the pros and cons of LLCs in this expert analysis.

How to Form an LLC in Alabama (High-Level Overview)

Setting up an LLC in Alabama is a simple process, however, if you don’t pay attention to the detail at every step, it can cause delays. In selecting a name and filing your documents, you’ll need to follow state requirements and local nuances. To learn about everything from reserving your name to filing for tax, read this step-by-step guide to starting an LLC in Alabama. Below is a simplified overview of the key steps to start your business entity legally and efficiently.

Steps to Start an LLC in Alabama:

- Reserve your business name through the state’s online portal.

- Designate a registered agent service or serve as your own agent.

- File the Certificate of Formation and pay the $200 filing fee.

- Create an LLC operating agreement (not required by law but highly recommended).

- Apply for an EIN through the Internal Revenue Service.

- Register for any required business licenses or permits.

- Open a business bank account to separate personal and company finances.

These steps to start your LLC give you both legal structure and liability protection. If you’re still in the planning phase and asking yourself if it’s too early to form a company, don’t worry, you can still start an LLC without an active business. This is a great way to secure your business name, protect your assets and prepare your brand for future business moves. And if you’re an international founder, this guide on how to open a U.S. LLC as a non-resident walks you through everything — from forming your company to getting an EIN without a Social Security number. If you are not comfortable dealing with everything, use a trusted professional formation service to handle reminders and compliance documents.

Frequently Asked Questions About Alabama LLC Costs

If you’re looking for quick, direct answers about the cost to form and maintain an LLC in Alabama, this section has you covered. We’ve compiled the most common questions business owners ask, with clear and up-to-date responses designed to save you time and help you plan confidently.

What is the total cost to form an LLC in Alabama in 2025?

The total cost to form an LLC in Alabama in 2025 is typically $228 if filed online. This includes the $200 filing fee for the certificate of formation and a $28 name reservation fee. If you file by mail, the cost drops slightly to $225 due to a lower reservation fee. Optional services like a registered agent service, EIN application, or legal assistance may raise your overall startup expenses to $300–$600+, depending on what you choose. The U.S. Small Business Administration also provides guidance on choosing the right legal structure based on your long-term business goals.

How much is the annual Business Privilege Tax?

The annual Business Privilege Tax in Alabama starts at $50 but can increase based on your LLC’s net worth and taxable income. This tax must be filed each year with the Alabama Department of Revenue, along with your annual report, by April 15. Failure to file on time can lead to penalties or suspension of your LLC’s good standing. Most small LLCs with minimal assets will only owe the $50 minimum.

Are publication fees mandatory?

No, Alabama does not require publication fees when forming an LLC. Unlike states like New York or Arizona that mandate newspaper notices during formation, Alabama imposes no such requirement. You can form an Alabama LLC without publishing your intent in a newspaper or paying any related fees. This helps keep your initial filing costs lower and simplifies the registration process for new business owners.

Can I act as my own registered agent to save costs?

Yes, you can serve as your own registered agent in Alabama and save between $100 and $300 per year. However, you must have a physical address in Alabama and be available during normal business hours to receive service of process. Acting as your own agent keeps costs low but may compromise your privacy, since your name and address become part of the public record. Many business owners choose a registered agent service for added convenience and discretion.

What additional fees apply if registering as a foreign LLC?

If you’re registering as a foreign LLC in Alabama, you’ll pay a $150 filing fee for the Certificate of Authority. In addition, you're required to file an annual Business Privilege Tax Return, with a minimum fee of $50. Depending on your industry, you may also need business licenses or permits. While you won’t pay the $200 domestic formation fee, staying compliant with Alabama law means budgeting for yearly taxes and any local registration costs tied to operating your business in Alabama.

Resources for Alabama LLC Owners

From filing fees to ongoing compliance, these trusted resources will help you manage every part of forming and maintaining your LLC in Alabama.

- Alabama Secretary of State – Business Services Division

(sos.alabama.gov): Access formation documents, name reservation tools, and online filing for Alabama LLCs. - My Alabama Taxes (MAT) – Business Privilege Tax Portal

(myalabamataxes.alabama.gov): File your Business Privilege Tax return and annual reports online through this state portal. - Alabama Department of Revenue – Business Taxes

(revenue.alabama.gov): Get details on license requirements, compliance deadlines, and industry-specific tax obligations. - IRS – Apply for an EIN

(irs.gov): Apply online for your free EIN — required for opening business bank accounts and filing taxes. - Alabama Small Business Development Center (ASBDC)

(asbdc.org): Offers free training, consulting, and business planning assistance to new and existing LLC owners in Alabama. - Wikipedia – Limited Liability Company

(en.wikipedia.org): Learn the structure, tax treatment, and legal framework of LLCs in a broader context. - 2023 SBA Alabama Small Business Economic Profile

(advocacy.sba.gov): Access economic data and trends that affect small businesses and LLCs across Alabama.

Bookmark these pages to simplify formation, avoid penalties, and keep your Alabama LLC compliant year after year.

Looking for an overview? See Alabama LLC Services

Transparent LLC Formation for Alabama Entrepreneurs

Harbor Compliance helps you navigate Alabama’s filing fees and keeps your LLC compliant—no surprise charges or confusing steps.