An LLC’s “purpose” is the single sentence in your Articles of Organization that legally authorizes what your company may do. Keep it short, lawful, and—unless a lender or regulator requires detail—broad enough (“any lawful business”) so you can pivot without amendments. This line speeds banking, licensing, and insurance because reviewers can verify your scope at a glance. Below is the quick version and the wording choices that work in the real world.

Understanding the Purpose of an LLC

The purpose of an LLC is the single sentence that authorizes what your business may do. Think of it as your scope of work — short, clear, and easy to verify — so banks, insurers, and vendors quickly understand your business activities. If you’re still weighing whether you even need an LLC to begin with, this guide on starting a business without forming an LLC breaks down when it’s essential and when a simpler setup might work. And even if you haven’t finalized your business strategy yet, you can still move forward — here’s a resource on forming an LLC without a business plan that explains when starting lean is possible.

You’ll place this line in your state’s articles of organization. Because an LLC is a separate business entity, an owner’s personal assets are generally protected by liability protection at the entity level (when you follow the rules and keep good records). A well-phrased purpose also reduces back-and-forth during account opening and licensing, and — if you choose flexible wording — gives the company room to grow without constant edits.

What Does an LLC Do for Your Business?

If you’re new to the concept and wondering what LLC really means, here’s a clear explanation of what an LLC stands for and how it works. Once you understand the basics, it’s easier to see how an LLC supports your venture in four practical ways that beginners actually feel day-to-day:

- Liability protection – The LLC separates the owner from the company. If the business is sued or owes a debt, claims generally stop at the entity level, unless you misuse the LLC (often called piercing the corporate veil).

- Tax flexibility – By default, most LLCs are pass-throughs, no income tax at the entity level. If it fits your plan, you can elect corporation tax treatment later for different rates or benefits.

- Operational credibility – Banks, insurers, and vendors can see your scope in the state-filed articles of organization, which speeds onboarding and reduces paperwork questions.

- Room to grow – A well-worded purpose lets you add new business activities without rewriting your whole setup, as long as you stay within the law and your filings.

Why States Require a Business Purpose Statement

States collect your purpose at LLC formation to make your scope part of the public document and to keep records consistent across agencies. In practice, that purpose line helps with:

- Compliance: Establishes the legal basis for the activities your LLC is authorized to perform and supports legal reviews.

- Public notice: Lets partners, vendors, and lenders see what you do at a glance.

- Licensing & banking: Aligns your filings with permits, insurance, and underwriting questions.

- Risk control: Gives regulators a simple way to flag activities that need special approvals.

Most states accept a broad “any lawful business” clause. Regulated industries (and some lenders) may ask for something more specific. Keep your business purpose statement short, plain, and accurate. If you use a registered agent service, they’ll paste this line into your filing and make sure it meets legal requirements in your state.

The Business Purpose Statement (What It Is and What It Isn’t)

The business purpose statement is the one-sentence authorization for what your LLC is allowed to do. It explains the “why” behind your business activities — not your marketing pitch — and it should be short, clear, and lawful. If you’re wondering what is a business purpose statement, it’s the line you file in your state’s articles of organization so banks, insurers, and vendors can quickly see your scope. Think of it as your concise statement of purpose for the company.

General vs. Specific Purpose—Which Should You Choose?

Before you write your purpose, decide how much flexibility your LLC needs. This single choice shapes banking, licensing, and your ability to grow without refiling.

- General (“any lawful business”) — Maximum flexibility to pivot, test offers, and add revenue lines without new filings. A smart default for most startups and small businesses. Use a generic business purpose for LLC when you want room to expand products, locations, or partnerships as your company evolves.

- Specific — Clearer for lenders, insurers, or regulators (e.g., healthcare, construction, financial services). Helpful when an underwriter wants your scope spelled out in your articles of organization or loan documents, or when a license requires precise activity language.

Keep your wording accurate and simple. Choose general unless a lender, license, contract, or regulator requires specific wording.

Business Purpose Examples You Can Adapt

Here are business purpose examples for LLC you can copy and tailor:

- Consulting — “To provide management consulting and related personal services in [State].”

- E-commerce — “To engage in online retail sales, warehousing, and fulfillment in [State].”

- Retail — “To operate a retail store and related business activities in [State].”

- Real Estate — “To acquire, hold, lease, manage, and sell real estate properties in [State].”

- SaaS — “To develop, license, and support software and intellectual property for customers in [State].”

- Marketing Agency — “To provide advertising, content, and brand strategy services to businesses in [State].”

- Professional Services — “To provide accounting and bookkeeping services in [State].”

- Light Manufacturing — “To manufacture and distribute consumer goods and related activities in [State].”

If you’d like to see a broader collection of ready-to-use samples, check out this detailed guide on LLC business purpose examples that expands on different industries and use cases.

LLC Purpose Clauses (With State-Specific Notes)

Your purpose clause is the exact sentence you paste into the form. Keep it short, lawful, and easy for bankers and regulators to read. Most filers use one of the two options below—pick the one that matches how much flexibility you need.

Sample Wording You Can Copy

Start by choosing whether you want maximum flexibility or a tightly defined scope. Then drop one of these into your articles of organization:

General (flexible):

“To engage in any lawful business for which limited liability companies may be organized in [State].”

Specific (narrow):

“To acquire, hold, lease, manage, improve, finance, and sell real estate in [State].”

What “Any Lawful (Legal) Purpose” Really Means

This phrase authorizes a wide range of business activities without filing amendments every time you pivot. Banks and insurers usually accept it for unregulated industries. If you’re in healthcare, financial services, construction, or other regulated fields, expect requests for a more specific scope. Keep wording accurate, avoid buzzwords, and mirror how you actually operate.

State Variations: Texas, Florida, Ohio, Missouri (Quick Notes)

Before you file, check how your state’s form handles “Purpose” or “Nature of Business.” Here’s how four common states treat the language:

- Texas — Form 205 (Certificate of Formation) includes a general-purpose default; many filers keep it broad unless a lender asks for specifics.

- Florida — Sunbiz forms accept a general clause and usually include a “Nature of Business/NAICS” line for a short description.

- Ohio — General language is common; some banks still ask for a descriptive sentence on the application.

- Missouri — Broad clauses work for most filers; add specificity for licensed trades or when underwriting requires it.

Ready to protect your business? Form your LLC with ZenBusiness

Now that you understand the purpose of an LLC — like liability protection and tax benefits — ZenBusiness makes it easy to turn that knowledge into action with simple, affordable formation services.

Describing the Nature of Your Business in Formation Forms

When you file, most states ask two things: a purpose (the authorization) and a short description/nature of business (what you actually do). Getting both right keeps banking, licensing, and insurance simple—and avoids avoidable back-and-forth later.

Purpose vs. Description vs. General Character—Key Differences

To prevent confusion, align your wording with what each field really means:

- Purpose (authorization / “why”) — A one-line clause in your articles of organization that authorizes your business activities (e.g., “any lawful business”). Keep it lawful and flexible.

- Description or Nature of Business (operations / “what”) — A short plain-English line or NAICS code that says what you do day-to-day (e.g., “online retail of home goods”).

- General character of business (category) — A broad label some forms or insurers use to bucket risk (e.g., “retail trade” or “professional services”).

If the form gives both “Purpose” and “Nature of Business,” use purpose for the legal authorization and description for daily operations. Don’t swap them.

For more clarity, remember that having an LLC and holding a business license are two different things—one creates your legal entity, while the other authorizes you to operate in your locality. Likewise, it’s worth knowing that an LLC and a DBA are not the same: the first forms a separate company, while the second is just a trade name. You can read more about the difference between forming an LLC and getting a license as well as the key differences between LLCs and DBAs.

Examples of Business Descriptions by Industry

Use clear, concrete language. Start with a verb, mention the channel, and add 1–2 activities:

- E-commerce — “Online retail of home goods; order fulfillment and customer support.”

- Retail — “Brick-and-mortar apparel shop; inventory purchasing and sales.”

- Consulting — “Management consulting services in operations and strategy.”

- Real estate — “Acquisition and management of residential rentals.”

- SaaS — “Cloud software development, licensing, and support.”

- Home services — “Residential cleaning and routine maintenance services.”

Tip: If a bank or license reviewer wants more clarity, add one sentence to the description—not the purpose. Keep the purpose broad unless a lender or regulator requires specific wording.

Operating Agreements and Your LLC’s Purpose

Your LLC operating agreement is the internal rulebook for how the company runs. Placing a clear purpose inside it keeps every owner aligned on which business activities are authorized, who can approve new lines of work, and how risk is managed. It should mirror the scope in your state-filed articles of organization so banks and partners see consistent language across documents.

Why the Purpose Appears in the Operating Agreement

Think of the purpose clause as a guardrail. It sets expectations for members, makes approvals faster, and reduces disputes because everyone can point to the same sentence. Externally, it helps with legal compliance and underwriting: lenders and insurers compare your operating agreement to your public filing, so matching language speeds reviews. It also supports tax planning—if you elect corporation tax treatment later, advisors rely on this clause to confirm your scope. Even your CPA, insurer, and registered agent service use it to prepare filings, policies, and renewals. Keep the wording slightly broader than a loan covenant so the business can grow without constant amendments.

Real Estate LLC: Operating Agreement Purpose Examples

For a property venture, plain language works best. One option is: “To acquire, hold, lease, manage, improve, finance, and sell real estate assets and related activities.” Another is: “To operate as a real estate holding company for the acquisition, management, and disposition of residential and commercial properties.” Choose the one that best matches how you actually operate, then keep records consistent across all documents.

Can You Change the Purpose of Your LLC?

You can revise your LLC’s purpose without starting over. When your business model evolves, updating the purpose keeps public records, banking, and insurance aligned with how the company actually operates. The core idea is simple: file the change with the state, then mirror that language in internal documents (like your LLC operating agreement) and with third parties so your paper trail is consistent.

When It Makes Sense to Amend

An amendment is worthwhile when clarity unlocks smoother compliance or access to capital. Consider amending if any of the following apply to your business:

- You’re adding new business activities (e.g., moving from retail only to retail and wholesale).

- You’re entering a regulated area that needs specific wording (healthcare, financial services, construction).

- A lender, insurer, or large customer requires a tighter purpose statement in your documents.

How to Amend Your Articles (Step-by-Step)

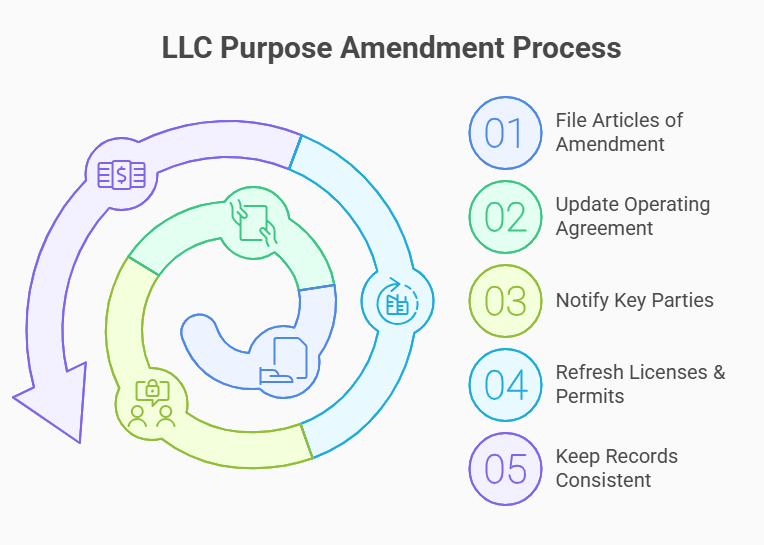

This is the LLC purpose amendment process you file with your state. Follow the steps in order so your public records, internal documents, and third-party accounts all match.

- File Articles of Amendment with the Secretary of State. List the company name, the current purpose, the new purpose, and an authorized signature; pay the state filing fee.

- Update your operating agreement. Revise the LLC operating agreement so the internal scope mirrors the public Articles; record member approval and the effective date.

- Notify key parties. Tell your bank, insurer, CPA, and registered agent service so accounts, policies, and renewals use the same wording.

- Refresh licenses & permits. If any agency or locality keys off your purpose/NAICS, submit the update. Do the same in any foreign-qualified states.

- Keep records consistent. Store the file-stamped amendment, updated agreement, and minutes; align proposals, major contracts, and your website if they reference scope.

Processing times and fees vary by state; expedited options are often available. When funding or a closing depends on the change, submit early and confirm state requirements before you sign. For most limited liability companies, a broadly written purpose remains the default – use specific wording only when a regulator, license, or contract truly requires it.

Turn LLC theory into action with Northwest

Understanding the purpose of an LLC is just step one. Northwest helps you form your LLC while protecting your privacy and guiding you through each legal step with expert support.

Common Mistakes to Avoid

Even a strong filing can stumble if your wording or follow-through is sloppy. Use this section to spot (and fix) the issues that most often slow down banking, licensing, and underwriting.

Before the list, remember the rule of thumb: keep your purpose lawful, plain, and consistent across your articles of organization, LLC operating agreement, and anything a lender will read.

- Writing only “any lawful business” when reviewers expect specifics. If you’re in healthcare, construction, or financial services, add a short, precise scope line to satisfy regulators or underwriters.

- Getting overly narrow and boxing the business in. If the company pivots, you’ll need amendments; prefer flexible phrasing unless a contract or license requires detail.

- Mixing up “purpose” with “description/nature of business.” The purpose statement is authorization (the “why”); the description is operations (the “what”). Don’t swap them on forms.

- Inconsistency across documents. The articles of organization, operating agreement, and bank package must match; mismatches trigger delays.

- Ignoring corporate-style formalities entirely. While an LLC is not a corporation, you still need clean records, separate accounts, and signatures—otherwise you risk piercing the corporate veil arguments.

- Forgetting to update third parties after changes. When you amend the purpose, notify your bank, insurer, CPA, and registered agent service so everything stays aligned.

- Using jargon or marketing copy. Regulators prefer clear, legal phrasing—skip buzzwords and keep verbs concrete (e.g., “acquire, lease, manage, sell”).

Conclusion

A clear business purpose sets your LLC up for smooth banking, licensing, and growth. Start with one plain sentence in your state’s articles of organization, pick general wording for flexibility (unless a lender, license, or regulator requires specific language), and keep every document — especially your LLC operating agreement — consistent with that line. When your business evolves, you can amend the purpose and move forward without rebuilding the company.

The playbook is simple: write a lawful, accurate purpose statement, confirm your state’s form fields, and make sure banks, insurers, and vendors see the same wording everywhere. Use the “Nature of Business” or description field (not the purpose) for today’s activities, and reserve amendments for real pivots. This balanced approach protects credibility now while leaving room to scale later. For a broader look at the full process, check out this step-by-step guide on how to start an LLC.

Frequently Asked Questions About Business Purpose

Have questions about your business purpose statement? This FAQ gives direct, copy-ready answers — takeaway first, brief expansion second — so you can draft clean language, file it in your state articles of organization, and mirror it in your LLC operating agreement. Use it to keep your business wording lawful, consistent, and bank-friendly across filings, contracts, and work with your registered agent service.

What Should I Put for My LLC’s Purpose?

Use one plain sentence: “To engage in any lawful business for which limited liability companies may be organized in [State].” That line is flexible, bank-friendly, and accepted on most state forms. If a lender or license needs detail, add a short second sentence describing today’s business activities. Put the purpose in your articles of organization, and keep your internal documents consistent with the same wording.

What Does “Any Lawful Business” Mean in an LLC Purpose Clause?

It’s a broad legal authorization to operate within state and federal law. The clause lets your company pivot — add products, channels, or services — without refiling each time. Regulators and banks usually accept it for unregulated industries. If you’re in healthcare, finance, or construction, a reviewer may request a more specific scope. Start broad, then tailor only when a contract, license, or insurer formally asks for precision.

Do I Need a Specific Business Purpose for a Real Estate LLC?

Often yes when financing or insurance is involved. Lenders prefer clear verbs like “acquire, hold, lease, manage, improve, finance, and sell real estate.” That language reduces underwriting questions and aligns with property management operations. If you’re cash-only and low-risk, a general clause may still work, but expect banks to ask for a sentence describing your activities. Mirror the final wording in your LLC operating agreement.

Can I Change My LLC’s Purpose After Formation?

Yes, file Articles of Amendment with your Secretary of State. After it’s approved, update your LLC operating agreement, notify your bank and insurer, and have your registered agent service reflect the change on future filings. Some agencies tie licenses to your purpose, so refresh those too. Fees and timelines vary by state; if funding depends on the change, submit early and keep all records aligned.

Is the Business Purpose the Same as the “Nature of Business”?

No, Purpose is the authorization (“why”) that goes in your articles of organization; nature/description of business is the operations summary (“what”) — often a plain sentence or NAICS code. Keep the purpose broad for flexibility and use the description to explain day-to-day activity. Mixing them up triggers bank and licensing delays, so label each field correctly and use consistent wording across documents.

- U.S. Small Business Administration (SBA): Choose a Business Structure

- IRS: Limited liability company (LLC)

- Texas Secretary of State: Certificate of Formation – Form 205 (PDF)

- Texas Legislature: Business Organizations Code § 2.001 — General scope of permissible purposes

- Florida Department of State: Articles of Organization – CR2E047 (PDF)

- Florida Department of State: Articles of Amendment – CR2E049 (PDF)

- Ohio Revised Code: § 1706.05 — Scope of authority

- Missouri Revisor of Statutes: § 347.039 — Lawful business purpose

Build legal protection for your business with Harbor Compliance

Now that you know why forming an LLC matters, Harbor Compliance helps you apply that knowledge—offering hands-on support to form your LLC the right way.