How to start an LLC in 2025 — fast, legally, and on budget. This step-by-step guide shows the exact order: choose your state and name, appoint a registered agent, and file Articles of Organization. Most states approve in a few days and your IRS EIN is free. After formation, create an Operating Agreement, open a dedicated business bank account, and calendar ongoing filings to protect your liability shield.

What Is an LLC and Why Should You Start One?

An LLC (Limited Liability Company) is a business entity blending features of corporations and partnerships to shield personal assets from business liabilities. This company-law structure is popular among business owners who want a more straightforward process compared to corporations. Unlike a sole proprietorship, an LLC separates your personal financial assets from the business’s obligations, minimizing your personal liability. Beyond that, an LLC’s management can be tailored to your needs, member-managed or manager-managed, offering flexibility and control. If you’re serious about long-term growth and risk management, forming your LLC may be a strategic move for your type of business.

What are the benefits of LLCs?

Forming an LLC can offer multiple advantages:

- It provides a corporate veil, protecting your personal holdings if the business faces lawsuits or debts.

- Tax status is flexible: by default, a single-member llc taxed as a disregarded entity and multi-member LLCs are taxed as partnerships; you can also elect a different tax treatment or tax classification (e.g., S corp) if it better fits your goals.

- You can choose a member-managed structure or appoint managers—control and operations are up to you.

On top of that, if you’re looking to scale, the LLC structure can help you build business credit and accommodate investors (though some institutional investors prefer corporations). Once you establish your LLC, you’ll often find that routine compliance and federal tax filings are simpler than with a traditional corporate entity.

How to Create an LLC: The 8 Essential Steps

Forming an llc starts with a clear plan and an understanding of state rules. Whether you’re a single-member LLC or have multiple co-founders, follow a methodical approach to reduce administrative or legal hiccups. Below are eight essential steps covering everything from select a name and pick a name to obtaining your Employer Identification Number. Along the way, you’ll set up internal governance with an operating agreement, appoint a registered agent, and handle any unique local requirements. By meticulously tackling each stage, you’ll start an LLC that’s primed for compliance, offers limited liability, and meets your entrepreneurial goals, this is essentially how to start an LLC with confidence.

Step 1: Choose a State for Your LLC

Before jumping into paperwork, decide where you’ll form the LLC. Often, it’s your home state or the state where you’ll primarily operate, this helps you avoid extra fees for foreign registration. However, some entrepreneurs pick states like Delaware or Wyoming for business-friendly laws. For cost-effective options, explore our cheapest LLC formation services that can help you minimize expenses.

If you want to keep things local, simply file in your home jurisdiction. If you plan to scale or operate nationwide, weigh pros and cons carefully. For instance, Delaware’s company law and Court of Chancery are famously accommodating, but you might incur additional filing, franchise, or annual report fees if you’re physically based elsewhere. To manage these multi-state compliance needs efficiently, consider using a best registered agent service that can handle your registered agent requirements across different jurisdictions.

Here are five states commonly chosen and why:

- Delaware – Flexible statutes and well-established corporate law

- Wyoming – Low filing fees and robust privacy protections

- Nevada – No personal income tax, but watch out for business license and employer-related fees

- Texas – Large market and straightforward compliance for many industries

- North Carolina – Reasonable fees, stable economy, and a supportive small-business culture

Ultimately, evaluate ongoing requirements like franchise taxes, foreign qualification, or certificate-of-formation costs. If you’re simply setting up a local store, your state’s default rules might suffice. But if you sell goods nationally, consider how sales tax nexus and reporting will work. And if you have bigger ambitions or special privacy goals, exploring a more pro-business state could pay off.

Step 2: Select a Unique LLC Name

A standout name is vital for branding and legal clarity. Each jurisdiction restricts what you can call your LLC to avoid duplicating or closely resembling existing business entity names. Generally, your name must include an identifier like “LLC,” “L.L.C.,” or “Limited Liability Company” so the public understands the structure.

First, check the availability of your proposed moniker. Visit your chosen state’s database to confirm no identical or confusingly similar name is taken. For instance, if you’re launching in North Carolina, use their official site or a name-search tool to ensure no conflicts exist. For inspiration on naming, explore best LLC names. Keep an eye on state-specific rules—some might exclude certain words or require special approval for terms like “Bank,” “University,” or “Insurance.”

Securing a domain name that matches your LLC title is also wise. Even if you’re not ready for a website, consider reserving the URL to protect your online brand. If the domain isn’t free, weigh alternatives or slight variations that remain brand-consistent.

Tips for naming your LLC:

- Keep it short, memorable, and descriptive of your core activity.

- Avoid generic terms that can hamper SEO.

- Confirm it respects trademark rules—someone else’s brand name might be off-limits.

- Aim for a name that still resonates if you expand your product lines.

Finally, once you pick a name, lock it in by filing a name reservation (if your state allows it), so no one else can scoop it up while you finalize the rest of forming your LLC steps. If you haven’t decided yet, use the state’s search tool to select a name that complies with local rules.

Step 3: Choose a registered agent

Every LLC needs a registered agent, a person or service authorized to receive service of process, legal documents, and state correspondence. If you skip this or fail to maintain an agent, your LLC risks losing good standing or missing crucial lawsuits or official notices. The agent must have a physical business address in the formation state, no P.O. boxes allowed. Some business owners serve as their own agent to save money, but this can compromise privacy if your home address appears in public administration records.

Professional registered agent companies typically charge $100–$300 per year. If you’re operating in specific states like Florida, choosing best registered agent in Florida can enhance your compliance and operational efficiency. They’ll promptly forward vital mail to you, ensuring you never overlook something important. If your schedule is hectic or you travel frequently, outsourcing may be worth it for consistent coverage. For multi-state expansions, a registered agent service can handle each jurisdiction, simplifying overall compliance.

Look for these traits in a potential agent:

- Availability: Monday through Friday, during normal business hours.

- Experience with local rules: Familiarity with filings and forms speeds up processing.

- Solid reputation: Check reviews from other LLC owners.

With a trusted agent in place, your focus can shift from bureaucratic chores to scaling your brand.

Step 4: Define LLC's management structure

The next step is deciding how you’ll run the show. An LLC can be manager-managed or member-managed. In a member-managed setup, all owners share day-to-day decisions. For smaller teams or a single-member LLC, this typically works fine, everyone stays hands-on. But if your plan involves passive investors or a large membership group, a manager-managed format streamlines operations by delegating authority to one or a few managers.

Potential management structures to consider:

- Member-managed: All owners actively direct the LLC.

- Manager-managed: Selected individuals handle routine tasks; members remain more passive.

When picking, weigh factors like your skill set, each partner’s availability, and the complexity of daily tasks. Match the choice to your type of business: in a big operation, an experienced manager can maintain operational stability, leaving members free to address strategic concerns. Clarifying roles early avoids confusion over who’s authorized to sign contracts, hire staff, or handle other responsibilities.

Step 5: File Articles of Organization

With your name secured and a plan for oversight, it’s time to submit articles of organization — also known in some states as a certificate of formation — to the relevant government agency (often the Secretary of State). This filing is crucial for officially granting your LLC status under corporate law.

Here’s a quick checklist for your filing:

- LLC Name: The exact title, including “LLC,” “L.L.C.,” or “Limited Liability Company.”

- Registered Agent Details: Their name and physical business address in the state.

- Management Structure: Whether you’re manager-managed or member-managed.

- Purpose (Optional): Some states ask for the business’s main objective. Defining your business purpose clearly can streamline the filing process and clarify your operational goals.

- Organizer’s Signature: The person completing the form signs, verifying accuracy.

Once you pay the filing fee, it may take a few business days (longer without expedited service) for approval; your online status may show as pending during review. If your state offers e-filing, follow the instructions on the state administration portal to submit digitally and receive prompt updates. Keep confirmation documents in a safe spot, banks or future investors may request them to validate that your LLC is official.

Step 6: Draft an LLC Operating Agreement

Although not every jurisdiction mandates an operating agreement, the importance of drafting one is high, it clarifies management structure, ownership percentages, and how profits or losses are split. If you skip it, disputes can arise over voting rights or capital contributions, potentially undermining your newly formed LLC.

An operating agreement typically covers:

- Ownership Breakdown: Percentage of each member’s stake and initial financial contributions

- Voting and Decision-Making: How major calls get approved

- Profit Distribution: Whether payouts are based on ownership share, hours worked, or other metrics

- Dissolution Rules: Steps for winding down the LLC if that day comes

Also consider tax provisions — e.g., allocations, distributions, and your chosen tax classification or tax treatment (some owners later elect S corp status). Include provisions for special scenarios, like adding new members or transferring interests. Many owners seek brief legal or CPA advice to ensure the document aligns with local statutes and tax implications. Once complete, have all members sign and keep the agreement with your LLC records for easy reference if disagreements arise.

Step 7: Obtain an EIN (Employer Identification Number)

To handle payroll, open a business bank account, or file federal tax documents, you’ll likely need an EIN, your Employer Identification Number. It’s essentially your company’s ID with the IRS. For a free, official application, visit the IRS website and follow the online prompts; in most cases, the Internal Revenue Service issues an EIN almost instantly. If you’re not eligible to use the online system (e.g., foreign owners without an SSN/ITIN), apply with Form SS-4 by fax or mail — processing may remain pending for a short period.

Third parties sometimes charge a fee to “get” an EIN, but it’s straightforward to do yourself. You’ll provide basic details about your business entity, including legal name, business address, formation date, management structure, responsible party, and principal activity (type of business). Remember: obtaining an EIN doesn’t change how your llc taxed by default (single-member disregarded entity; multi-member partnership). If you want a different tax classification or tax treatment, such as electing S corp or C corporation status, you’ll file the appropriate election (separate from the EIN application). For unusual scenarios or cross-border ownership, consider professional advice to get it right.

Step 8: Ensure Compliance (business licenses and permits) with State Requirements

Finally, confirm you’re meeting every official standard, from local zoning permits to specialized certificates. Some industries—like food service or construction—require more than just LLC registration. You might need a general business license from your city, plus professional accreditation if you provide specialized services. Skipping these steps can lead to fines or forced closures.

Consider the following:

- Local permits: Check municipal rules for signage, operating hours, or safety compliance.

- Statewide regulations: Certain trades require state-level approval through the state administration portal; some licenses may show a pending status while under review.

- Sales & tax registrations: If you sell taxable goods or services, register for sales tax in states where you have nexus.

- Annual or periodic filings: File your annual/biennial report and pay franchise taxes on time; update your registered agent and business address when they change.

- Tax elections: If you’ve chosen a different tax classification/tax treatment (e.g., S corp), calendar payroll obligations and quarterly estimates accordingly.

Keep track of your obligations with a simple calendar system or through compliance service reminders. If you expand or shift into new product lines, re-check for any updated or additional licensing requirements. By proactively staying compliant, you avoid lapses that could erode your LLC’s legitimacy.deral level. Aim to maintain thorough records in case of audits—an organized approach spares you stress come tax season.

Start Your LLC Today

Form your LLC quickly and securely with Northwest. Get expert guidance every step of the way.

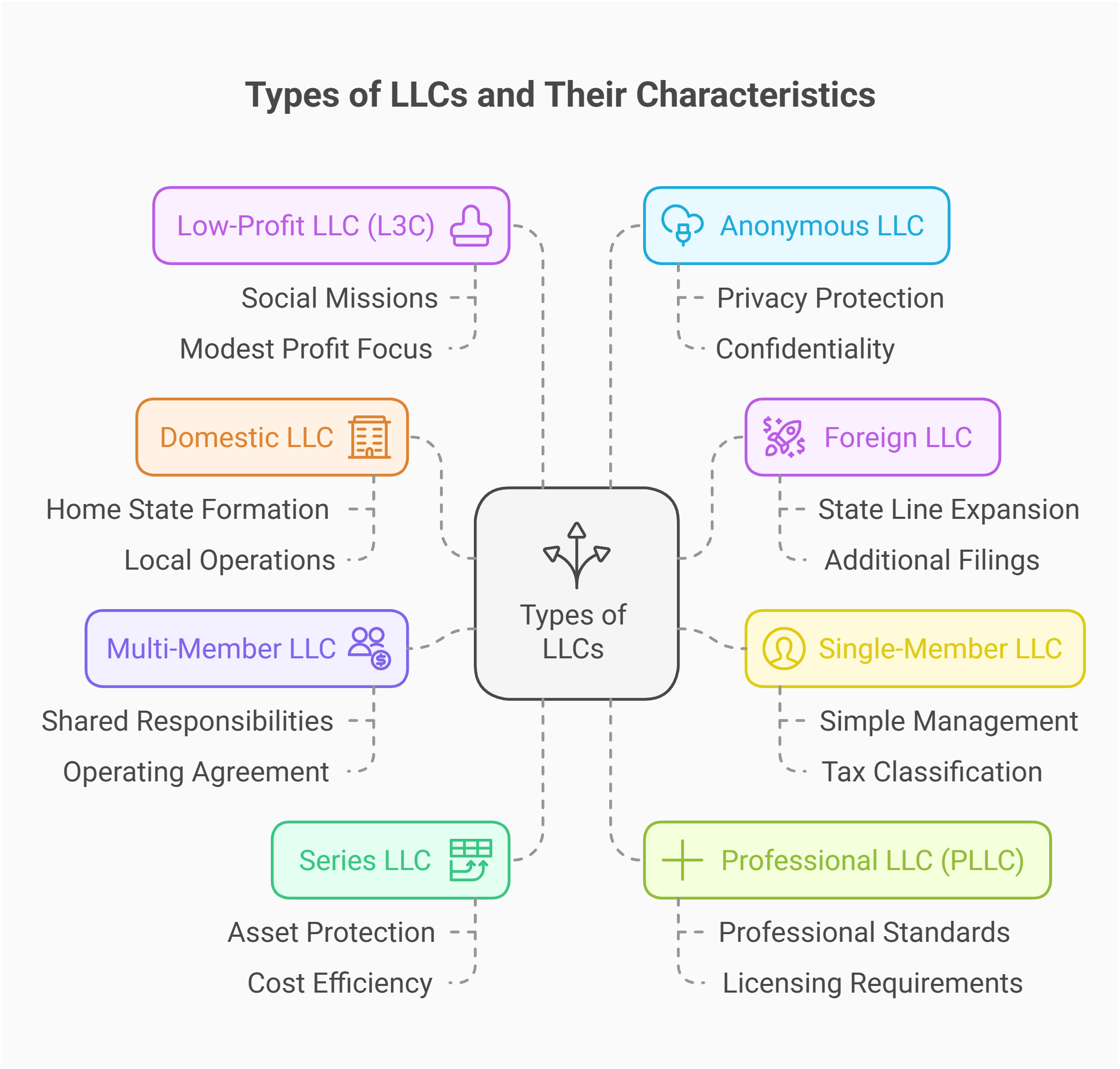

The 8 types of LLCs: how to choose the right form

In the U.S., limited liability companies come in various forms, each tailored to specific needs. From single-member setups to advanced series LLC structures, picking the right variant can shape your risk level and tax load. Below, we’ll briefly highlight eight popular LLC types and help you decide which suits your business goals.

1. Domestic LLC

A domestic LLC is an LLC formed under the laws of a given state and operating there. If you live and operate in Texas and file there, you’ve formed an LLC in Texas as “domestic.” It’s the simplest route for local entrepreneurs, with minimal extra registration. You’ll handle standard formation steps—filing the needed documents in your home jurisdiction. Because you won’t be subject to foreign qualification fees, domestic LLCs can keep compliance straightforward. Ideal for small-scale or community-based ventures.

2. Foreign LLC

A foreign LLC is simply an LLC formed in one state that registers to do business in another (often via a “foreign qualification”/certificate of authority). For instance, if you want to operate in Florida but originally formed the LLC in Delaware, you must register as a foreign LLC in Florida. Although “foreign” may sound international, it’s purely interstate. This structure is useful for expansions but often adds more annual report or filing obligations—and you may trigger sales tax or payroll registrations where you operate.

3. Single-Member LLC

A single-member LLC is owned by one individual or entity. It retains hallmark benefits—like personal liability protection—without requiring a partner’s involvement. Though simpler to manage, you still file the same initial documents (like Articles of Organization) and can elect the LLC’s tax classification/tax treatment. By default, a single-member llc taxed as a disregarded entity for federal income tax purposes unless it elects corporate status (including S corp).

4. Multi-Member LLC

A multi-member LLC includes two or more owners, each holding membership interests. This format can distribute responsibilities, capital, or expertise across the team. Your operating agreement typically outlines each member’s share of votes and earnings (the importance of a solid OA is high). For federal income tax, the default is to be taxed as a partnership unless an election is made to be taxed as a corporation (e.g., S corp/C corp).

5. Series LLC

A series LLC is available only in certain states and lets you form distinct “cells” under one umbrella LLC. Each series can hold separate assets or run distinct operations, with liability “silos” if state law recognizes them and you maintain proper separations. Recognition varies by state, and cross-border treatment isn’t uniform; banking and registrations can be more complex, professional advice is wise. (Example references: Texas and Delaware offer registered/protected series mechanics).

6. Professional LLC (PLLC)

A PLLC is designed for licensed professionals—like doctors, lawyers, or accountants—subject to additional licensing and board approvals. It offers liability protection for business obligations, though personal malpractice typically remains outside the shield. States may require owners to hold active professional credentials and obtain board sign-offs before filing.

7. Low-Profit LLC (L3C)

An L3C blends a business approach with a charitable mission. While not recognized in every state, it’s intended to facilitate mission-driven ventures and potential foundation program-related investments. Note there is no special federal tax status unique to L3Cs; your tax treatment follows standard LLC rules based on elections and operations.

8. Anonymous LLC

An anonymous LLC keeps owners off public state records (often via managers/agents), common in states like Wyoming or New Mexico. However, federal beneficial ownership reporting rules have been in flux. In March 2025, FinCEN issued an interim final rule removing BOI reporting requirements for most U.S. companies (foreign reporting companies may still have duties). Always check current FinCEN guidance before relying on anonymity for strategy or banking.

Cost Breakdown: How Much Does It Cost to Create an LLC?

Forming an LLC involves state fees, typically ranging from $50–$300 for your initial filing fee, plus optional charges for name reservations or expedited processing through the state administration portal. To get a detailed understanding of how much an LLC cost, refer to our comprehensive guide. A few states charge higher initial filing fees ($400–$500+), and some impose franchise or publication fees, so your total may vary by jurisdiction.

Many states also require an annual report or “renewal” fee — often $20–$100, though some can be higher. If you hire a registered agent service, budget $100–$300 yearly and ensure a physical business address is on file. For multi-state operations, remember to factor in foreign qualification fees in each state.

Additional expenses might include drafting a formal operating agreement, local business license fees, and specialized permits if you’re in regulated fields. If you sell taxable goods or services, plan for sales tax registrations in states where you have nexus (fees and rules vary). Online platforms or lawyers may charge $50–$500+ for setup help, plus any government costs.

While you can handle forming your LLC yourself to reduce expenses, targeted professional advice can prevent costly mistakes and keep your financial records and compliance organized. After you file, your online status may show pending until approval — save confirmations and receipts for banking and tax purposes.

What are the advantages and disadvantages of LLCs?

Limited Liability Companies combine the flexible features of partnerships with the protective legal framework of corporations. But they’re not a universal solution—certain pros can overshadow some cons, especially if your growth ambitions or compliance constraints differ. Below, we’ll detail key upsides and potential pitfalls, ensuring you can assess whether an LLC lines up with your unique goals and tolerance for complexity.

LLC Advantages

The LLC structure offers a host of tangible perks that many business owners find invaluable.

- Limited Liability: Your personal assets remain shielded if the LLC faces debts or lawsuits.

- Flexible Tax Setup: By default, LLCs use pass-through taxation, or you can elect a different tax classification (e.g., S corp) for tax purposes.

- Fewer Formalities: Compared to corporations, LLCs have lighter mandatory requirements like fewer annual meeting obligations.

- Multiple Management Options: Easily structure as manager-managed or let members share direct control.

- Credibility: Even a small operation can appear more established to clients or vendors.

By leveraging these advantages, many entrepreneurs feel confident that an LLC can help them scale responsibly. You’ll also find that such a setup tends to inspire trust among banks or potential collaborators, due to recognized stability and built-in liability protection.

LLC Disadvantages

Despite the flexible framework, LLCs aren’t always the perfect fit:

- Renewal and Filing Fees: Some states impose annual report costs, inflating overhead.

- Limited Case Law: Compared to corporations, LLC legal precedents can be less consistent, especially in newer or smaller states.

- Potential Self-Employment Taxes: With pass-through taxation, members might pay higher self-employment tax than they would under corporate wages.

- Complex Multi-State Rules: Operating in multiple states often triggers additional registrations and fees.

- Investment Hesitation: Some venture capital firms prefer corporations with stock structures, limiting large-scale fundraising options.

While these points might not be deal-breakers, it’s worth analyzing whether the cost-benefit ratio aligns with your ambitions. For certain expansions or advanced funding needs, you might weigh the pros of reclassifying or using a corporate approach.

Hassle-Free LLC Formation

ZenBusiness makes starting your LLC simple with fast filing and compliance support.

How to Maintain and Grow Your LLC After Formation

Once you have an official LLC, focusing on steady operations and timely filings keeps you in top shape. From annual compliance tasks to potential expansions, proactively managing your LLC ensures ongoing success. Here are key areas to master if you want your new business to flourish.

Filing Annual Reports and Avoiding Penalties

Most states require you to submit updates, either an annual report or biennial filing, to confirm your current business address, ownership structure, and registered agent details. Missing these deadlines triggers penalties, late fees, or even administrative dissolution. Fortunately, you can track the due dates using a simple calendar or a compliance service. If your LLC’s info changes mid-year, file an amendment or statement of change so state records stay accurate. By doing so, you guard against operational hiccups and preserve your legal good standing.

Managing Taxes and Accounting for Your LLC

LLC owners typically face pass-through taxation at the personal level (single-member as a disregarded entity; multi-member as a partnership by default), though you can elect a different tax classification/tax treatment, such as S corp, for planning purposes. Keep thorough books, separating business transactions from personal ones. A dedicated business bank account helps protect the liability shield and simplifies record-keeping. Track expenses and revenue carefully so you can file precise returns with the IRS and state agencies; if you sell taxable goods or services, register and file sales tax where you have nexus. If you’re uncertain, seek professional advice from a CPA familiar with LLCs to stay compliant at both federal and state levels.

Expanding or Converting Your LLC

As your enterprise grows, you might add new members, open offices out of state, or transition to a different business structure. For expansions, remember to complete a foreign qualification (register as a foreign LLC) in each target jurisdiction. If you need more robust funding or stock-based ownership, converting the LLC into a corporation may help. Consult legal counsel to handle a statutory conversion or re-formation so you don’t lose liability protection. Ultimately, remain adaptable while keeping up with required state-level updates and deadlines.

Specialized LLC Formation: Tailored for Your Business

Not every LLC is identical. The approach might differ if you’re freelancing solo, handling high-ticket real estate deals, or running an online storefront. Understanding unique LLC applications can refine your operations, reduce compliance burdens, and optimize tax outcomes. Below, we’ll examine how specific industries — freelance, real estate, and e-commerce — benefit from establishing an LLC.

How Freelancers Can Benefit from an LLC

Freelancers operating as a sole proprietorship risk personal liability if clients sue or disputes arise. With an LLC, you gain legal separation between personal finances and business dealings, plus potential brand credibility. Tax-wise, the LLC can be treated as a pass-through entity—ideal for straightforward tax purposes. You’ll file an annual or periodic update, but the administrative overhead is still minimal. If your freelancing expands or you add associates, the LLC structure helps you integrate them smoothly. Many creative pros appreciate this balance of formality and freedom.

Forming an LLC for Real Estate Investments

Property ventures often face major liabilities, like tenant disputes or property damage claims. Placing each building under a separate LLC can shield other holdings if one property faces legal trouble. You still must handle local business license or landlord permits, but the LLC perimeter keeps your personal assets safer. An LLC can also streamline partnerships when pooling capital for bigger deals. If you’re eyeing multiple properties, consider whether a Series LLC (if your state allows it) might centralize oversight while isolating risk among individual segments; confirm how your state treats series for banking and filings before proceeding.

E-Commerce and Online Businesses

E-commerce outfits often see customers from across the nation, making clarity in your legal structure essential. An LLC not only elevates brand trust—customers see a formal entity name instead of your personal identity—but also organizes finances, so your social security number remains private. Depending on your shipping footprint, you might face multi-state compliance. Yet once your LLC is official, obtaining a business license for certain product lines becomes more straightforward. The result? You can focus on perfecting digital marketing or supply chain operations while ensuring solid liability coverage.

How to Open an LLC in Any State

No matter where you call home, the core steps of forming an LLC stay consistent: choose a name, pick a registered agent, and file articles of organization. But each state carries unique quirks. Maybe some have steeper filing fee or rigorous publication requirements. If you’re curious which states rank high for simplicity or business perks, read on. We’ll also address multi-state expansions if your brand aims to cross borders.

State-Specific Requirements for Top 10 Popular States

Although the fundamental steps align, each state’s extra touches can influence your final decision. Here are 10 states that many entrepreneurs flock to, plus key highlights:

- Delaware: Corporate-friendly courts, easy to scale, moderate ongoing fees.

- Wyoming: Low cost to file, strong privacy laws, popular for single-member LLCs. To further benefit, consider using the best registered agent in Wyoming to maintain your LLC’s privacy and compliance.

- Nevada: No personal state income tax, but higher renewal costs and city business fees.

- Texas: Straightforward procedure, no personal state income tax, but watch the state franchise tax.

- Florida: Known for low fees and simpler annual report processes, large consumer market.

- California: Modest filing fee, $800 annual franchise tax (plus a gross receipts–based LLC fee), but access to a huge economy.

- New York: Publication requirement can raise costs, massive commercial potential.

- North Carolina: Competitive fees, robust local business environment, balanced regulations.

- Georgia: Mid-range fees, straightforward e-filing, expanding small-business base.

- Washington: No state-level personal income tax, but watch for the state B&O tax (and some cities also levy B&O taxes).

After picking a state, confirm if you need special business license or city permits. Also, read up on each state’s continuing compliance needs, from beneficial ownership rules to franchise tax obligations, so you’re never blindsided.

Multi-State LLC Formation

If you operate in more than one state—maybe you have employees in multiple locations or serve customers across lines—register as a foreign LLC in each relevant jurisdiction. This means paying extra state fees and possibly filing separate annual report forms, but it keeps you legally permitted to do business in those territories. The benefit: you maintain consistent liability protection everywhere. However, each state’s tax and compliance rules can differ, so stay organized with a tracking system or professional service to ensure multi-state success.

Common Pitfalls to Avoid When Creating an LLC

Starting an LLC can be straightforward, but certain oversights can derail your progress. Keep these in mind:

- Failing to Distinguish Funds: Mixing personal and LLC finances endangers the corporate veil.

- Using a Duplicate Name: Overlooking a prior usage can lead to trademark or state-level conflicts.

- Skipping the operating agreement: Even if optional, it’s vital for clarifying management structure.

- Forgetting State Compliance: Untimely annual report submissions lead to fees or dissolution.

- Neglecting Local Permits: Setting up an LLC doesn’t automatically secure all needed business license credentials.

Plan carefully, keep each element separate, and stay current on deadlines for a rock-solid LLC foundation.

How to Register an LLC Online

Filing from your desktop is simpler than ever — most states offer digital forms for Articles of Organization and fee payment. Before you begin, gather your proposed business name, operating agreement draft, and management structure decisions. Then visit your state’s official site (the state administration portal) to set up an account. Follow the prompts, upload or fill out each required field, pay the filing fee, and wait a few business days for approval (your online status may show pending during review). If you prefer an external platform to handle details, plenty of online LLC services exist. Choose carefully to avoid hidden charges.

Best Platforms for Online LLC Formation

Multiple providers promise seamless digital processes for forming an LLC. Below, we’ll compare three that commonly rank high in reliability, transparency, and support. Each offers a different approach, from minimal do-it-yourself help to full support. Evaluate their features and price tiers before deciding which platform best aligns with your timeline and budget.

Northwest Registered Agent

Northwest Registered Agent takes a privacy-first approach (“Privacy by Default®”) and, where permitted, lists their address on public filings instead of yours—useful if you don’t want your home listed. Packages commonly bundle the state filing with registered agent coverage, plus name-availability help and digital mail forwarding. Their registered agent service is widely advertised at $125/year, and they maintain offices in all 50 states. If you value human support over bare-bones automation, Northwest’s in-house team and privacy stance are the draw.

LegalZoom

LegalZoom pairs strong brand recognition with wide-ranging small-business content and tools. Formation plans start at $0 + state fees and include name search and basic filing; you can layer in services as needed. For ongoing coverage, LegalZoom’s Registered Agent service is listed at $249/year, which includes mail scanning/alerts, unlimited cloud storage, and a compliance calendar; they’ll also cover state fees to switch your RA to LegalZoom. Their broad library of “how-to” guides makes it beginner-friendly, and turnaround is generally a few business days depending on the state.

ZenBusiness

ZenBusiness emphasizes automation and budget-friendly entry points—formation plans often start at $0 + state fees, with higher tiers adding rush filing and extras. Its hallmark Worry-Free Compliance sends alerts and, when needed, files annual reports and amendments to help you stay in good standing. Registered agent service is an add-on: $99 for the first year, then $199/year on renewal (pricing subject to change). For founders who want a single dashboard to form, track deadlines, and keep state data current—without heavy phone time—ZenBusiness offers a streamlined path.

Harbor Compliance

Harbor Compliance is built for complex, multi-state, or heavily regulated scenarios. In addition to nationwide registered agent coverage, you get access to software like Entity Manager/License Manager to track where your entities are registered, organize licenses, and set annual-report reminders in one dashboard. Pricing for registered agent service typically starts at $99 for new customers and renews at $149/year, with volume discounts. If you want the team to file your annual reports for you, there’s a managed service for that. The combo of specialists + software shines when you expect fast expansion or diverse state rules.

For a broader selection of options, consider using best online legal services to find the platform that best fits your needs.

Frequently Asked Questions About LLC Formation

Below you’ll find concise, up-to-date answers to common LLC formation questions—each fine-tuned to appear in Google’s featured snippets. Whether you’re looking at paperwork timelines, lawyer requirements, or annual updates, these solutions aim to clear confusion so you can confidently proceed with creating your LLC in any state.

How Long Does It Take to Create an LLC?

Timing can vary based on state and filing method. Traditional paper submissions may require several business days to weeks before approval, especially during busy seasons. Online filing usually shortens wait times—some states process digital submissions in 1–2 days. If you pay an expedited filing fee, you might get same-day or 24-hour turnaround. After approval, factor in extra steps like scheduling local inspections if a business license is required. Overall, with correct documents and no backlog, you could receive official confirmation within a week. For states with heavier volume or stricter checks, expect up to three weeks.

Can I Create an LLC Without an Attorney?

You can absolutely create an llc independently by following your state’s instructions and preparing key documents (e.g., articles of organization, operating agreement). Many states have online portals with guides, plus there are reputable LLC formation platforms. However, consulting a lawyer is wise if your business structure is complex, or if you’re integrating unique ownership terms. A single-member LLC in a simple industry might manage fine without legal counsel. But for multi-member expansions, specialized tax purposes, or advanced corporate law queries, an attorney can ensure your documents align with best practices.

What Happens If I Don’t File My Annual Report?

Missing an annual report can lead to administrative dissolution—your LLC could lose its legal standing. Once that happens, the liability protection you rely on might vanish, putting your personal assets at risk if lawsuits arise. You’ll also owe late fees and potentially face difficulties reopening or re-registering. If you remain dissolved too long, the state might let someone else claim your LLC name. Not all jurisdictions require annual reports, but many do. Bottom line: stay alert to your deadlines, pay any state fees, and submit timely updates to remain in good standing.

Is It Necessary to Form an LLC in My Home State?

Most entrepreneurs form their LLC where they’ll actively operate. This avoids extra fees for registering as a “foreign” LLC. However, some states (like Delaware or Wyoming) are known for business-friendly rules, attracting out-of-state owners. If you pick a different state than your home base, you typically must also register in your home state as a foreign LLC, doubling compliance tasks. While certain high-growth or multi-state businesses find it beneficial, smaller local companies often keep it simple by forming at home. Evaluate costs, compliance complexities, and your expansion plans before deciding.

Can an LLC Have a Single Member?

Yes. A single member llc is perfectly valid and retains the same limited liability shield as multi-member versions. In this model, all ownership rests with one individual or entity—like a holding company. States often let you form a one-person LLC quickly with minimal filing fee. However, keep personal and business finances strictly separate—this helps maintain the personal liability protections. Also, your operating agreement can still define how you’ll manage finances or pass the business along, even if you’re the sole owner, ensuring clarity in any potential legal or estate matters.

- IRS: Form SS-4 (PDF)

- IRS: Instructions for Form SS-4 (PDF)

- IRS: Pub. 1635 (PDF): Understanding Your EIN

- FinCEN: BOI Reporting — current status

- Federal Register: BOI Interim Final Rule (Mar 26, 2025)

- USPTO: Search the federal trademark database

- U.S. SBA: 10 steps to start a business

- OSHA: Employer responsibilities (safe workplace)

- DOL/EBSA: COBRA continuation coverage overview

- NASS: Corporate registration directory (links to each state’s SOS)

Stay Compliant with Your LLC

Harbor Compliance helps you manage legal filings, annual reports, and business licenses with ease.

To read more about how to form a limited liability company in your state check out our catalog of LLC formation guides here: