Considering how to incorporate your business but uncertain about where to start? A company’s growth, liability and tax position can be impacted by the legal structure that you choose. Knowing how to incorporate your business will help you whether you are starting a small business or formalising a side hustle.

To incorporate your business, choose a legal structure (LLC, C Corp, or S Corp), register your business name, and file your articles of incorporation with the state. You’ll also need to appoint a registered agent, get an EIN from the IRS, and complete any required state-level compliance tasks.

This guide outlines the incorporation process from A to Z—choose between an LLC, C Corp, or S Corp, file your formation documents, and handle everything after you're officially set up. You'll also get important tips on required paperwork, registered agents, bylaws, taxes, and compliance so you can build a strong, reliable foundation for your business.

What Is a Corporate Entity?

A corporate entity is a type of business structure that exists separately from its owners. When you create your corporation or limited liability company (LLC), you’re creating a separate legal entity, as it were: a company that can own property, enter contracts, pay taxes, and be liable as a business, not the people in it (Wikipedia overview). This difference has many advantages, especially personal asset protection and legal continuity on a go-forward basis.

Core Traits of a Corporate Entity:

- It has a distinct name and operates under a registered legal identity.

- It can sue or be sued in its own name.

- It files its own tax return and must meet state and federal compliance standards.

- Ownership is represented through shares of stock (in corporations) or membership interests (in LLCs).

- It has structured leadership—typically a board of directors, officers, or managing members.

By incorporating a business, you are creating some separation of your personal finances and your business operations. In comparison to a sole proprietorship and a partnership, a corporation offers liability protection. In addition, it has long-term credibility. Finally, it gives you easy access to capital. Choosing the business structure early is important to find and protect your interests and enable your company to grow sustainably.

Key Benefits of Incorporation

If you incorporate your business, you can enjoy legal and financial benefits that are not available to sole proprietors and general partners. By forming a corporation, your company will be better positioned for long-term protection, funding and growth.

One of the biggest benefits is liability protection – your personal assets cannot be taken in order to satisfy business debts or liabilities. You also may receive some tax advantages by deducting business expenses and controlling how you generate income and when you take it.

Major Benefits of Incorporation:

- Protects personal assets from business liabilities and legal claims.

- Offers access to outside investment through shares of stock.

- Improves credibility with clients, vendors, and government agencies.

- Makes succession planning and ownership transfer easier.

- May result in lower tax rates depending on how you structure the entity.

Incorporation separates your business income from your personal income which is important to minimize risk and enhance compliance. A corporation can still function if the business owner retires or sells, unlike a sole proprietorship (see how it compares to a single-member LLC). Most bigger companies are incorporated because of this long-term stability.

Choosing the Right Business Structure

When you form your business, the choice of business structure is a fundamental step. Your choice matters in numerous ways. It affects their tax level, flexibility when changing owners, personal liability, and how much paperwork must be maintained. Many first-time founders wonder whether starting with an LLC is truly necessary, this guide explores when it's worth forming one and when a simpler setup might be enough. Learning the differences between corporations, LLCs and other entities helps you develop on the right legal and tax foundation.

C Corporation vs. S Corporation: Taxation & Ownership Rules

C Corporations and S Corporations are corporate entities. However, the two differ in their tax treatment, ownership structure as well as growth potential. A C Corporation pays a corporate income tax on its profits. In addition, shareholders pay tax on the dividends they receive with double taxation. This structure enables wider ownership and the ability to issue multiple classes of shares of stock.

On the contrary, an S Corporation avoids double taxation because it's a pass-through entity. The business does not pay any income tax, but the income is passed through to each shareholder’s tax return. S corps have a stricter set of requirements than C corps as its shareholders can only be 100 or fewer. The IRS outlines additional eligibility rules, including that all shareholders must be U.S. citizens or residents and only one class of stock is allowed.

Here’s a clear comparison of key differences between the two:

| Feature | C Corporation | S Corporation |

|---|---|---|

| Taxation | Corporate tax + shareholder tax on dividends | Pass-through taxation on shareholders' personal returns |

| Stock Structure | Multiple classes of stock allowed | Only one class of stock allowed |

| Ownership Restrictions | No ownership limits | Max 100 U.S. shareholders only |

| Investment Potential | Preferred by investors and VCs | Less ideal for outside investment |

| IRS Classification Rules | No special requirements | Must meet strict IRS eligibility |

Your choice between them should reflect your business goals, growth plans, and how you prefer to handle tax obligations.

Corporation vs. LLC: Formalities, Flexibility & Growth Plans

When comparing a corporation and an LLC, you are comparing two different legal entities that will have very different expectations and long-term consequences. Corporations have formalities, such as adopting the corporate bylaws, having annual meetings, means of enforcement and upon receipt of board of directors, and issuing shares of stock. If you're still weighing which legal structure fits your goals best, this breakdown of the key differences between an LLC and a corporation offers clear insight into taxes, liability, and investor appeal. These practices establish credibility, particularly with external investors and public companies.

An LLC, by contrast, is easier to manage. It does not have by laws but an operating agreement, requires less paperwork, and provides more flexible management. For tax treatment, the LLC is treated normally as a pass-through entity that avoids double taxation. This benefit is especially suited to small business owners.

Here’s how the two compare:

| Feature | Corporation | LLC |

|---|---|---|

| Legal Formalities | Requires bylaws, board, and annual meetings | Fewer formalities; uses an operating agreement |

| Management Flexibility | Structured hierarchy with board and officers | Flexible management; can be member- or manager-managed |

| Taxation | Subject to double taxation unless S corp election | Typically pass-through taxation |

| Investor Appeal | Preferred for raising capital and issuing stock | Less attractive to venture capital |

| Best For | High-growth companies and those seeking to go public | Small business owners wanting flexibility and simplicity |

For small business owners, an LLC is often the better option unless you plan to scale aggressively or go public (particularly if you prefer a simpler legal structure for solo owners).

When a Nonprofit or Benefit Corporation Fits

If your business purpose is something other than profit, such as doing good for a cause or fulfilling an educational mission or serving community needs, a nonprofit corporation or a benefit corporation might be the answer. An organization can apply to the internal revenue service for tax exempt status meaning the organization does not pay income tax on donations or mission related earnings.

A benefit corporation blends mission with profit. Although it functions like any regular business, it is legally bound to advance a positive social or environmental impact. Both structures can provide liability protection, increased public confidence, and funding advantages.

Set Up Your Bylaws or Operating Agreement with ZenBusiness

ZenBusiness provides ready-to-use, attorney-approved templates tailored to your business structure – LLC or Corporation.

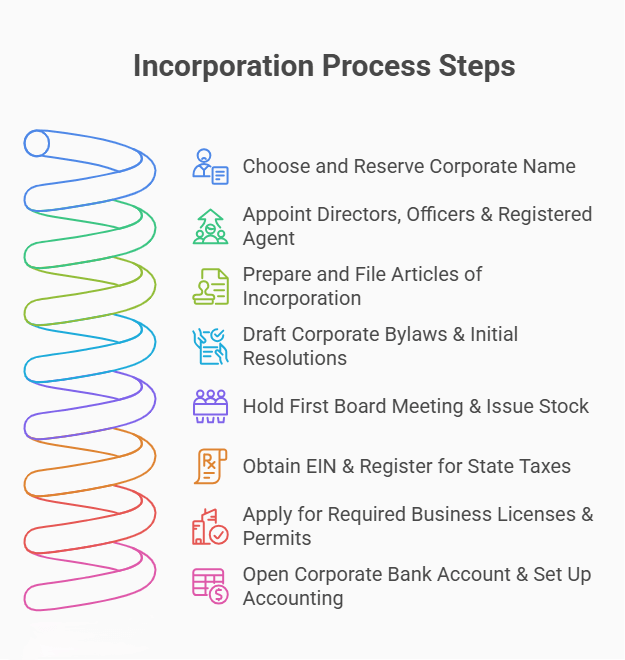

Step-by-Step Incorporation Process (8 Steps)

The steps to incorporating are straightforward; however, they each play a large part in forming a compliant and operable business entity. In order to avoid any delays or penalties, you need to follow a clear order, from reserving your business name, filing of documents and establishing the set tax accounts. If you need a hands-on breakdown, this step-by-step guide to starting a corporation covers naming, compliance, and strategies for growth in a clear, actionable format. This guide will help you with every step of the way so you can form your business yourself or with help with confidence.

Step 1: Choose and Reserve Your Corporate Name

The first thing you have to do when you incorporate your business is to choose a name. Every state requires that your name differs from any other registered entity in that state, and that it contains some corporate designator, either the word incorporated or an abbreviation thereof, such as Inc. or Corp. Most states will permit you to check the availability of your chosen name at their Secretary of State’s website and place a reservation for a small filing fee.

A name must match your brand and be easy to remember and line up with long-term strategy. Always check for domain name availability and trademark issues. If you want to use a trade name other than your incorporation name, you could also want to file a DBA (doing business as).

Reserving your name in advance avoids future legal tussles and helps in building a corporate identity. For sole proprietors making the switch, this step is one of several in the process of formally changing your business into an LLC.

Step 2: Appoint Directors, Officers & Registered Agent

After you have your business name, the next step is appointing your board of directors, corporate officers, and registered agent. Most corporate entities are legally required to fill these roles. They also help structure how your organization will operate and comply with the state.

Key business decisions are taken by directors and officers, and also the strategy making is done by them. They manage the day-to-day functioning of the business organization. A registered agent is a legal formal contact that receives government notices on behalf of the company. Your registered agent must have a physical address in the state you are incorporating.

Appointing the right people and documenting these early – helps establish authority, accountability, and transparency within your company from day one.

Step 3: Prepare and File Articles of Incorporation

To officially form your business, you must draft and file articles of incorporation with your state’s Secretary of State office. Your articles of incorporation are likely required for your startup. This is the document that officially creates your corporate entity. It contains certain information required by state law, such as your business name, registered agent, number of shares of stock authorized, and your business purpose.

Each states has its form and filing requirements, but most allow submission online for faster processing. A filing fee, which varies from state to state, must also be paid. After approval, the certificate of incorporation will be provided to you (for business).

It grants your business legal status, protects you from liability, and allows you to open a business bank account.

Step 4: Draft Corporate Bylaws & Initial Resolutions

After incorporation, your next legal requirement is drafting corporate bylaws, which are internal rules that govern how your business operates. Bylaws define what is expected of your board directors, how shareholders vote, what rights shareholders have, when meetings take place, and how decisions are made. Bylaws may or may not be filed with the state, however they should establish authority and avoid dispute.

Along with the bylaws, you will need initial resolutions, which officially memorialize the key actions of your directors and officers taken after incorporation. Typically, these are the things you will need to approve bylaws, appoint officers, issue shares of stock, and authorize to open bank accounts.

These internal documents are very vital documents that give your corporate structure. They help keep your company legal and organized.

Step 5: Hold Your First Board Meeting & Issue Stock

After creating yourcorporate bylaws and documenting initial decisions, it’s time to hold your first board of directors meeting. At this meeting, the directors and officers will officially adopt the bylaws, authorize the issuance of shares of stock, appoint officers if not already done, and approve other early-stage actions like setting the business bank account and the business’s fiscal year.

The meeting’s minutes need to be recorded and kept with your internal business records. When a firm issues stock at this point, it documents the ownership and lays down the framework for the shareholder’s rights and responsibilities.

Holding this all-important first meeting allows the company members to formalise their relationship and, specifically, create a framework for liability protection to protect the business. It is also a way to demonstrate necessary corporate governance.

Step 6: Obtain an EIN & Register for State Taxes

To do business as a corporation, you will need to apply to the Internal Revenue Service for an Employer Identification Number (EIN). The federal ID is used to open your business bank account, file tax returns, hire employees, and satisfy federal reporting requirement.

As a business owner, you may have to register for state taxes like sales tax, franchise tax, or state income tax aside from your EIN. As a business owner, you may have to register with your state or local revenue authority. The requirements vary depending by industry and area. You should check with your state’s department of revenue or department of business registration to ensure compliance.

Acquiring your EIN and registering with state agencies provides your establishment recognition with both the federal and state government.

Step 7: Apply for Required Business Licenses & Permits

In most cases, businesses require one or more licenses or permits to operate legally, depending on the industry and locality. These will include local business licenses, zoning permits, health department approvals, or other certifications. The requirements depend upon the type of business and place incorporated.

Local laws could require permits and inspections before starting your business. Look up your local government, state agency, and industry regulator to know what you’ll need. If you don’t get the right licenses, you’ll receive fines and penalties. What’s more, your operations may be suspended.

Filings the right filings early means you will remain compliant, your business entity is protected, and you’ll avoid legal issues later on.

Step 8: Open a Corporate Bank Account & Set Up Accounting

Once you have formed your corporation and registered it legally, you may now open a corporate bank account. It is vital to preserve your separate legal entity and personal asset protection by undertaking this step. A business account can also simplify bookkeeping, payroll, and tax returns.

You typically require your EIN, articles of incorporation, and board resolution that authorizes opening the account, to open it. In the meantime, set up an accounting system to track expenses and issue invoices. You’ll want it ready for tax filings or audits.

One of the simplest ways to maintain your liability protection and comply on an ongoing basis is to keep your finances organized from the beginning.

Incorporate Smart with Northwest

Whether it's an LLC or a corporation, Northwest files your documents and gets it done right – no gimmicks.

Essential Documents for Incorporation

To form your business successfully, you will need certain legal documents. By having a company agreement, it won’t just help you meet the requirements of your state, it will also define your corporate structure, outline ownership rights, and help maintain your liability protection. Keeping your documents compliant and investor-ready, right from the first day, is knowing what you require and what they include.

This section describes the key documents each corporate entity should have on record.

Articles of Incorporation/Certificate of Formation

Articles of incorporation, sometimes called certificate of incorporation in certain states, are the primary legal documents which officially formation of your corporation. These filings typically establish your business in your home state, which is why understanding the basics of local entity formation like a domestic LLC can be so useful for first-time founders. The papers you file with the Secretary of State typically include your business name, address, registered agent, the number of shares of stock authorized, and a statement of business purpose.

While different states may have slightly different formatting or filing requirements, the articles basically have the same purpose, which is to give your corporate entity legal standing. Once your organization is sanctioned, it is incorporated, and you will receive stamped or certified copies for your records.

Make sure to properly file articles of incorporation and continue to update them as your business grows.

Corporate Bylaws & Shareholder Agreements

Corporate bylaws serve as your company’s internal rulebook. Bylaws are the rules that govern the firm’s business. They outline the powers and responsibilities of the board of directors. They also outline how meetings will be held, how votes will be taken, which officers are to be appointed and the procedures to be followed in the event of a dispute. Although bylaws aren't state-filed documents, they are legally enforceable. Bylaws are required for maintaining corporate compliance.

Shareholder agreements among other things clarify the ownership rights, restrictions on transfer and dispute resolution, etc. Also, they clarify profit or loss-sharing. Ownership agreements and documents are particularly vital for businesses that have multiple owners, or hope to attract outside investors.

Combined, these core agreements work together to maintain liability protection, minimize internal quarrels, and keep your business entity from derailing.

Board Resolutions & Meeting Minutes

Board resolutions are official records of important business decisions by the board of directors. This includes passing the bylaws, issuing shares of stock, appointing officers, opening a bank account and entering contracts. Every resolution will set out a specific action and be placed on your internal company file.

Meeting minutes are a written record of what happened during board meetings. They help prove that your corporation has good governance and can be crucial in keeping your liability protection in place during audits or lawsuits.

Keeping accurate records of both ensures transparency, accountability, and ongoing corporate compliance.

Federal EIN Confirmation & State Tax Registrations

No sooner your entity formation is complete, you’ll get a letter from the IRS confirming you got an Employer Identification Number (EIN). In order to open a bank account, file tax returns, hire employees, and apply for licenses or financing, this document is required.

Depending on your operations, you may also need to register for state taxes, such as sales tax, use tax, or employment tax. The requirements vary between each state depending on what business you are doing and where.

Storing registration documents from the federal government as well as state authorities will make you fully tax compliant and avoid penalties.

DIY Incorporation vs. Professional Services

Whether you try and incorporate processss yourself or hire help depends on your comfort level with things like legal paperwork and your business goals. You can save money by doing it yourself. However, it will take time, attention to detail, and a good understanding of the filing requirements in your state.

Professional services, such as online formation platforms or business attorneys – provide comfort, help and accuracy. If your business has complicated needs and intends to scale quickly, then these are useful.

We’ll break down the pros and cons of each approach to help you choose the best fit.

Pros & Cons of Filing Yourself: Cost Savings vs. Complexity

Filing your own incorporation articles can save hundreds in legal or service fees. If your business structure is simple and you are confident you can deal with the paperwork, the DIY approach gives you the most control and the lowest startup costs.

However, running a business yourself isn’t without risk. You’ll handle all the filing requirements, draft internal documents, like your corporate bylaws, appoint your registered agent, and know all your ongoing compliance requirements. Filing mistakes can result in rejected filings, loss of liability protection or taxes issues.

Pros:

- Lower upfront costs

- Full control over the process

- Good fit for simple business models

Cons:

- Time-consuming and detail-sensitive

- Higher chance of errors or omissions

- Risk of noncompliance or delayed approval

Comparison Table: DIY vs. Professional Filing

| Aspect | DIY Filing | Professional Service |

|---|---|---|

| Legal Support | None — you’re on your own for compliance | Expert help with legal steps and filing requirements |

| Document Accuracy | Risk of error in forms or internal docs | Higher accuracy—documents reviewed or prepared by experts |

| Time Commitment | High — requires research and paperwork | Low — most tasks handled for you |

| Scalability Readiness | Less structured for long-term growth or investor readiness | Better suited for raising capital or complex ownership plans |

| Best Use Case | Solo founders, straightforward needs | Multi-owner firms, scaling ventures, or first-time founders |

If you're not confident navigating state-specific rules, consider hiring a professional service or attorney for peace of mind.

When to Use an Online Incorporation Service or Attorney

If your business has multiple owners, plans to raise money, or works in a tightly regulated industry, you may want to hire an online incorporation service or business attorney. Corporate lawyers can assist you to draft difficult documents like corporate bylaws, choose the right business structure, and comply with all state filing requirements.

When to seek professional help for your corporation you may want to get expert help in case you are confused about drafting a registered agent, structuring stock issuance, or managing legal risks. Expert help can save you time, reduce mistakes, and most of all, give you peace of mind. This is especially true during the first year of operations of your business.

Tax & Liability Impacts of Incorporation

When you incorporate a business, it can make a difference in the way in which you are taxed, how profit is reported and whether your personal assets are at risk. Making the choice in the right corporate entity can help in reducing your business tax burden, allowing you to take deductions and shielding you from being personally liable for business debts.

This part includes the ways that corporate taxes and pass-through options, and deductible expenses affect your business’s finances and practices to keep liability protection over the long run.

Corporate Taxation vs. Pass-Through Options

How your business is taxed depends on which structure you pick. C Corporations face corporate taxation, which means the business pays corporate income tax. Shareholders also pay income tax on dividends. According to the IRS, an LLC may be classified as a disregarded entity, partnership, or corporation, depending on the number of members and any tax elections filed. This is also known as double taxation. But the C Corps can retain profits and reinvest those dollars, which may decrease overall individual tax burdens.

On the other hand, S Corporations and LLCs are usually taxed as pass-through entities. As a result, business income passes through to the owners’ tax returns, avoiding the tax on the corporate level. Depending on how your LLC is structured, you may be subject to varying tax rates or qualify as a disregarded entity, a setup often used by single-member LLCs for simplified tax reporting (see tax overview, what is a disregarded entity). Taxation of pass-through structures is easier but they may not allow long-term reinvestment and stock options.

Which tax setup you choose depends on your planned growth, the number of owners, whether you prefer to reinvest or take profits. If you're currently operating as an LLC and considering the switch, this step-by-step guide to converting an LLC to an S Corporation explains why and how the transition could reduce your tax burden.

Deductible Business Expenses & Fringe Benefits

An incorporation of your business can lead to tax deductions. As a formal company, you can deduct many business expenses, including office rent, software subscriptions, marketing fees, professional fees, and travel related to your business operations. For LLCs in particular, these tax benefits and flexible classification options can significantly reduce overall tax burdens while maintaining legal protections. Your business’s tax bill can be much lower because of these deductions.

Corporations and some LLCs can also offer fringe benefits including health insurance, retirement benefits and education assistance. Depending on how these compensations are structured, the business may deduct the expenses, while the employee may not be taxable. For LLC owners, understanding the right method to pay yourself, via owner’s draw or salary is crucial for compliance and tax efficiency.

It is important to understand what is deductible and how to write off expenses properly. That same care should extend to how your company handles profit distributions and member payouts, which can carry major tax consequences if mishandled. This can help reduce your income tax and make your business attractive to top talent.

Preserving the Corporate Veil—Best Practices

If you form an LLC, you will get the liability protection. But not automatically. For you to preserve the corporate veil your business has to operate separately from you as an individual. In other words, you must keep things separate. This includes maintaining a dedicated business bank account. Don’t mix the funds and be sure to follow your internal rules. For example, if you hold board meetings, keep your corporate bylaws as up to date as possible.

You are to get stock certificates issued, documents major business decisions and make annual filings as required by your state. Not doing this will leave your personal assets exposed in a lawsuit or audit.

Consistently following best practices will ensure corporate compliance and reinforce your separate legal entity status and protection from personal liability.

Post-Incorporation Compliance & Ongoing Requirements

Forming a corporation is just the start, maintaining compliance is what protects your business entity over the long term. Many states have continuing requirements we must meet after we incorporate. If not satisfied, it can lead to severe consequences like the administrative dissolution of your business, costly fines, business license denial, or revocation, or even the loss of your liability protection. If you’re perceived as out of compliance, you may also damage your company’s reputation, or lose the ability to raise capital.

To stay in good standing, your company needs to comply with both internal governance rules and state filing requirements. This encompasses the revision of your company bylaws along with issuance and tracking of stock shares, annual board of directors and shareholders’ meetings, and detailed minutes of meetings. Every business decision made at the executive level should have a formal board resolution that becomes part of your permanent records.

It’s important to have these formalities because they illustrate that your business is not you but a separate entity. That distinction is what keeps your personal assets protected if the business is ever sued or audited.

Common Ongoing Requirements:

- File your annual report and pay all related state fees

- Keep your corporate bylaws and internal records up to date

- Hold scheduled board of directors and shareholder meetings

- Maintain an active and qualified registered agent

- Document major board resolutions and retain minutes

- Renew all required business licenses and local permits

- Keep finances clean with a separate business bank account

- File timely business tax returns and meet state-specific tax rules

Maintaining compliance reinforces your corporate entity’s credibility, protects your limited liability, and ensures uninterrupted operations.

Frequently Asked Questions About Incorporation

Still have questions about incorporating your business? You're not alone. Entrepreneurs often run into confusion about costs, legal documents, tax implications, and online filing options. This section answers the most common questions—clearly and concisely—so you can make informed decisions with confidence. Each answer below is tailored to give you reliable, easy-to-skim information that addresses real concerns faced by small business owners forming a corporate entity.

What are the legal steps to incorporate a business?

To legally incorporate a business, follow these essential steps:

1. Choose a unique business name that complies with state rules.

2. Appoint directors and a registered agent.

3. File articles of incorporation with your state’s Secretary of State.

4. Create corporate bylaws to govern internal operations.

5. Hold an initial board meeting and issue shares of stock.

6. Obtain an EIN from the IRS and register for state taxes.

7. Apply for licenses and permits as required.

Each step helps establish your corporate entity and maintain legal compliance.

How much does it cost to incorporate in my state?

The cost to incorporate varies by state but typically ranges from $50 to $500. The primary fee is for filing your articles of incorporation with the state. Some states also charge additional fees for name reservations, registered agent listings, or annual reporting requirements. Optional costs include hiring an attorney or using a professional service. Always check with your state’s Secretary of State website for the most accurate, up-to-date fee schedule.

What documents are required for incorporation?

To incorporate a business, you'll typically need the following documents:

1. Articles of Incorporation – Filed with the state to legally create your corporation.

2. Corporate Bylaws – Outline how your business will be governed internally.

3. Initial Board Resolutions – Approve bylaws, issue stock, and appoint officers.

4. Stock Certificates – Document ownership in the company.

5. EIN Confirmation Letter – Issued by the IRS after applying for an Employer Identification Number.

Some states may also require a name reservation or state-specific tax registrations.

Can I incorporate online without a lawyer?

Yes, you can incorporate online without hiring a lawyer. Most states allow businesses to file articles of incorporation directly through the Secretary of State’s website. Alternatively, you can use a reputable online incorporation service to handle the paperwork for you. These platforms guide you through each step, from name selection to choosing a registered agent. However, if your business involves complex ownership or legal risks, consulting a lawyer is still recommended.

How does incorporation affect my personal taxes?

Incorporation can limit your personal tax liability by separating your business income from your personal income. If you form a C Corporation, profits are taxed at the corporate level, and you only pay personal tax on dividends received. For S Corporations or LLCs, income typically passes through to your personal return, meaning you're taxed once on the company’s profits. Choosing the right structure affects how much tax you pay and whether you qualify for certain deductions or credits.

When should I elect S-Corp status?

You should elect S-Corp status if your business meets IRS requirements and you want to reduce self-employment taxes. S-Corps allow owners to split income between a reasonable salary (subject to payroll taxes) and distributions (which are not). This can lead to significant tax savings. It’s best for businesses that are profitable, have stable cash flow, and plan to reinvest less in the company. You must file IRS Form 2553 within 75 days of formation or the start of the next tax year.

Additional Resources for Incorporation & Structure Guidance

For more detailed support beyond this guide, here are official and trustworthy sources to help you make informed decisions:

- IRS – Limited Liability Company (LLC): Official information on how LLCs are classified and taxed.

- IRS – S Corporations: Eligibility rules, shareholder limits, and tax filing requirements for S Corps.

- SBA – Choose a business structure: Practical federal guidance on selecting between sole proprietorships, LLCs, and corporations.

- Wikipedia – Limited Liability Company: Concise overview of LLC fundamentals, including liability, taxation, and business structure options.

- Harvard University – Registering to Do Business: Insightful guide on when and how to register your business entity in different jurisdictions, including state and international considerations.

Harbor Compliance Has You Covered

Appoint Harbor Compliance to manage all legal notices and protect your business from missed filings.