If you’ve launched a single-member LLC and you additionally own a small business, you might have encountered the term disregarded entity. But what does this mean? How does it affect your taxes compliance and legal standing?

A disregarded entity is a business structure that is treated as a separate legal entity under state law but is not considered separate by the IRS for federal income tax purposes. It allows a single owner to report all business income, losses, and deductions on their personal tax return, avoiding corporate-level taxation while still meeting specific IRS reporting and compliance requirements.

This guide will teach you what a disregarded entity is, how the IRS classifies one, and how a disregarded entity is not a partnership, S-Corp, or C-Corp. We will clarify how taxation is treated in this status, when to file Form 8832, how to comply with regulations, and the main pros and cons. Whether you are just starting your Limited Liability Company (LLC) or are thinking about changing your status, this article will help get you clear and confident.

What Is a Disregarded Entity?

A disregarded entity is a kind of business entity that the Internal Revenue Service (IRS) considers for federal income tax purposes. According to the law, it is separate from you legally but for filing purposes it is as if it is you and you are the business. This simplifies reporting and eliminates double taxation. If you're new to the concept, this full breakdown of disregarded entity LLCs provides helpful context on how this classification works in real-world settings. For additional clarity, the IRS also outlines how LLCs are treated for tax purposes on its official website.

The most common instance is a single-member LLC which a default is treated as a sole proprietorship unless an entity classification election is made to be treated as a corporation.

Key Features of a Disregarded Entity:

| Feature | Description |

|---|---|

| Single owner | Only one individual or entity owns the business |

| Tax treatment | Ignored for federal income tax; taxed as a sole proprietorship |

| Reporting | No separate income tax return; files via Schedule C, E, or F |

| Legal standing | Remains a separate legal entity under state law |

| EIN & banking | Can obtain its own EIN and open a bank account |

Since the federal government doesn’t recognize it, the owner directly reports its profits, losses, and other information on their personal tax return. But an entity exists under state law which can own property, enter contracts, and manage its own operations.

A disregarded smllc may be a smart choice for business owners that desire simplicity, pass-through taxation, and less paperwork.

IRS Classification Rules & Default Treatment

The Internal Revenue Service (IRS) uses default rules to determine how a business entity is treated for federal income tax purposes. If no entity classification election is filed using Form 8832, the IRS automatically assigns a default status based on ownership structure. These classifications directly affect how income, losses, and taxes are reported.

The following sub-sections explain how the IRS handles default and elective classifications for LLCs, QSSSs, and multi-member entities.

Single-Member LLCs Automatically Disregarded

According to the IRS, by default, they treat a single member LLC as a disregarded entity unless the owner of that LLC files Form 8832. If the owner files Form 8832, then they will elect corporate status. The LLC is not a separate entity from its owner for tax filing purposes, meaning the same tax is filed as the owner’s.

Rather than submitting a separate income tax return, the individual reports all business income, losses, and expenses on the income tax return they normally file, most commonly on Schedule C (for general business activity), Schedule E (for rental real estate), or Schedule F (for farming operations).

This default categorization simplifies compliance and transactions free from double taxation. Nevertheless, you must realize that the LLC is not disregarded by the state and, thus, a legal entity. Also, despite being a single member LLC, the series offers limited liability protection to its single owner.

Set Up a Disregarded Entity the Easy Way

ZenBusiness helps you form a single-member LLC, fully compliant, IRS-recognized, and ready to operate as a disregarded entity.

Default vs. Elective Classification Explained

The IRS assigned a tax classification to every legal entity automatically based on the ownership. This is known as default classification. For example, a single-member LLC is treated as a disregarded entity by default, while a multi-member LLC is treated as a partnership by default. Business owners can opt-out of this default status by filing an entity classification election via Form 8832.

By choosing to elect a classification, you allow your entity to be treated as a corporation, which can either be a C-Corp or an S-Corp if Form 2553 is also filed. This determination alters the treatment of income, self-employment taxes and benefits.

Elective classifications offer their owners tax flexible nature. On the flip side, it comes with additional formalities like separate tax returns and payrolls. When owners have knowledge of both, they are able to make decisions based on their business goals and tax plan.

Qualified Subchapter S Subsidiaries (QSSS)

A Qualified Subchapter S Subsidiary (QSSS) is a corporation owned 100% by an S-Corp and eligible to be treated as a disregarded entity for federal income tax purposes. For this classification, the parent S-Corp must file an election under IRS regulations.

Upon acceptance, the QSSS is disregarded for tax purposes and is consolidated with the parent S-Corporation’s income tax return along with the QSSS’s assets, liabilities and income. Despite being disregarded for tax purposes, the QSSS remains a separate legal status for state law purposes.

It is useful for tax consolidation, easy filings and an effective entity structure for a business operating multiple units.

When an LLC Defaults to Partnership or Corporation

Any LLC with two or more members that does not file an entity classification election will automatically be treated by the IRS as a partnership for federal income tax purposes. This status requires the business to file a partnership tax return (Form 1065). Also, issue Schedule K-1 to each owner regarding their share of income, losses, and deductions.

An LLC can also elect to be treated as a corporation by filing Form 8832 (C-Corp) or Form 2553 (S-Corp). The election is going to change the tax treatment of the entity in question, usually in relation to employment taxes, profit distributions, compliance obligations, etc.

The default vs elective classification system permits the IRS to classify entities properly, while still allowing for flexibility irrespective of their business’ classification. It is important to know the default rule in order to select most favorable tax structure that suits your company’s size, income, and operations.

Tax Treatment & Reporting Requirements for Disregarded Entities

Owners of disregarded entities get simplified tax treatment. But, they must still meet certain filing and payment requirements. Because the entity is not separately recognized for federal income tax purposes, all income, deductions and taxes pass through to the owner.

A single-member LLC must report its income on the owner’s personal tax return, as per IRS guidelines. However, the entity is generally required to obtain its own EIN for employment tax or excise taxes. Depending on the activities of the organization, the reporting requirements will differ.

The next sections explain how these parties report income, calculate self-employment taxes, and comply with state-level tax rules.

Flow-Through Income on Schedule C, E & F

A single-member LLC or other disregarded entity does not file a separate income tax return. An owner reports all business income, losses, and deductions on the owner’s return and the applicable IRS schedules.

Schedule Usage for Disregarded Entities:

| Schedule | Used For | Examples |

|---|---|---|

| Schedule C | Standard business activities | Freelance work, consulting, online sales |

| Schedule E | Rental real estate and pass-through income | Rentals, S-Corp or partnership earnings |

| Schedule F | Farming and agricultural operations | Crop sales, livestock farming |

A flow-through structure ensures all taxable income appears on the individual’s tax return and is not taxed twice. Even though it is easier than a business filing, careful documentation is still essential. For deeper insight, this breakdown of rules and tax risks behind LLC cash distributions helps clarify how profits should be allocated and reported—especially in a disregarded entity setup.

However, recordkeeping must be done properly as the IRS will want complete documentation of expenses, losses, and revenue sources on these schedules.

Self-Employment Tax Calculation & Estimated Payments

A disregarded entity passes income directly to its owner, which makes the individual responsible for self-employment tax payments. This refers to both the employer and the employee piece of Social Security and Medicare at 15.3% of net earnings. To understand how much you'll actually owe, and how classification changes can reduce that, check out this LLC tax rate breakdown with examples and planning strategies.

You must pay quarterly estimated tax payments to the Internal Revenue Service (IRS) if you expect to owe $1,000 in tax or more for the year. The projected income, deductions, and credits help in filing Form 1040-ES. The IRS provides full instructions and tools for calculating estimated taxes on its Estimated Tax resource page.

Business owners should monitor their earnings closely and be in touch with a tax professional so that they do not incur penalties for underpayment. Even if no salary is taken, as long as there is taxable income, the self-employment tax applies.

Those looking to better understand compensation options—like owner’s draw versus salary—can check out this complete guide to paying yourself from an LLC for practical strategies and tax tips.

State & Local Tax Nuances (e.g., CA LLC Fees, NY Filing Requirements)

Disregarded entities are not recognized for federal income tax purposes; however, they are still fully recognized under state law. This indicates that single-member LLCs may have to pay annual fees, file state-specific forms, and satisfy licensing as well as publication requirements, even when the federal level imposes no requirement for a separate tax return.

Sample State-Level Obligations for Disregarded Entities:

| State | Annual Fee or Filing | Special Notes |

|---|---|---|

| California | $800 LLC tax + Gross receipts fee (if >$250K) | Required regardless of business income |

| New York | Filing fee $25–$4,500 + publication requirement | Based on income; must publish in two local newspapers |

| Texas | Franchise tax (based on margin) | No LLC fee, but annual report required |

Numerous other states require a registered agent, payment of franchise taxes, or city-wide business permits. Some localities even impose excise taxes or gross receipts taxes.

Since rules differ from state to state, owners must research the requirements of their state to stay compliant. California-based entrepreneurs can use this California LLC tax guide to better understand state fees, gross receipts thresholds, and how to stay compliant locally. It could incur fines, suspend your legal entity or lead to the loss of your limited liability protection if you miss a filing or payment.

Pros & Cons of Disregarded Entity Status

The option of operating as a disregarded entity offers major tax benefits in terms of simplicity, reporting ease, and legal structuring especially for single-member LLCs. But it's not without trade-offs. The pros and cons like self-employment tax and lack of outside capital must be weighed by business owners.

The following two sections will discuss the pros and cons in detail so that you can determine if this entity classification is right for you.

Advantages: Simplified Filings, Pass-Through Benefits & Cost Savings

One of the biggest advantages of making a disregarded entity, especially a single-member LLC, is administrative and tax simplicity. The structure is flexible and cost-effective and qualifies as a separate legal entity under state law.

In fact, LLCs offer a range of tax benefits that help maximize savings and reduce compliance burdens, from deductible expenses to strategic classification elections.

Here are the key benefits:

- Pass-through taxation: All income and losses are reported on the owner’s personal tax return. Thus, there is no need for a separate business tax return or corporate filings.

- Less burden of compliance: No board meetings, minutes, and no double taxation, only regular Schedule C, E or F filings

- Reduced startup and maintenance costs: Compared to a corporation, forming a limited liability company as a disregarded entity generally requires less paperwork and fewer legal formalities.

- Limited liability protection: Despite being ignored for federal income tax purposes, the entity protects the owner’s personal assets from the business’s creditors and lawsuits.

This structure would work well for freelancers, consultants and solo entrepreneurs who want legal protection while staying tax-efficient.

Drawbacks: Self-Employment Tax Exposure & Financing Challenges

Consider whether a disregarded entity is the proper fit for your business even if it’s a simple option. Many restrictions are there that business owners should know before opting this tax classification.

Here are the primary downsides:

- Self-employment tax liability: Since the business income flows directly to the owner, they must pay both the employer and employee portions of Social Security and Medicare, increasing their tax burden.

- Limited access to investors: A disregarded smllc can't issue stock, making it harder to raise outside capital or attract equity investors — unlike a corporation.

- Less formal structure: While appealing to some, the lack of formal corporate governance may be viewed negatively by lenders or partners.

- No income splitting: Unlike partnerships or S-Corps, a single-owner entity cannot divide taxable income to reduce overall taxes.

A company ready for growth or looking for venture funding may opt to be treated as a corporation for better flexibility and financial opportunity.

Ready to Be a Disregarded Entity? Start with Northwest

Northwest forms your single-member LLC fast, keeps your info private, and ensures it’s treated right for tax purposes.

Eligibility Criteria & Compliance Requirements

To qualify as a disregarded entity, a business must meet specific criteria related to its ownership structure and compliance with IRS and state-level rules. While the setup is simpler than corporate formation, maintaining legal entity status still requires the right filings and documentation.

The next sections break down which entities qualify, how ownership must be structured, and what compliance steps are essential to keep your disregarded smllc in good standing.

Qualifying Entities: SM-LLCs & QSSSs

The IRS rules allow disregarded status only for specific legal entities. The ones most often chosen are single-member LLCs (SM-LLCs) and Qualified Subchapter S Subsidiaries (QSSSs), both of which meet the ownership and structure’s requirements for this tax classification:

- Single-member LLC: Must be wholly owned by one individual or entity. It defaults to a disregarded entity unless an election is made to be taxed as a corporation.

- QSSS: Must be 100% owned by an S-Corp and filed with a proper entity classification election.

- Sole ownership requirement: Only entities with one owner can be disregarded — multi-member LLCs are treated as partnerships by default.

These structures allow for pass-through taxation while keeping limited liability under state law. Nevertheless, entities remain required to follow all local laws and federal filing rules to continue eligibility. For sole proprietors planning to restructure, this step-by-step guide to switching from sole proprietor to LLC explains what’s required to gain LLC protections and comply with IRS expectations.

Ownership Structure & Single-Member Limits

To be classified as a disregarded entity, the business must have a single owner. This individual or entity must maintain 100% ownership of the LLC or QSSS — even temporarily adding a second member will shift its status to a partnership for federal income tax purposes.

This strict single-member rule is enforced by the IRS under default classification guidelines. However, some exceptions exist in community property states where a spouse may co-own the business without changing its disregarded status — if treated as a joint venture.

Key ownership rules:

- Only one legal owner permitted

- Co-ownership in most states defaults to partnership

- Spouses in community property states may qualify as a single owner

- Must remain consistent with IRS records and prior tax return filings

Violating these structure limits without filing the proper election can lead to unexpected reclassification and additional tax liabilities.

Essential Compliance: EIN, Operating Agreement & Recordkeeping

Although a disregarded entity doesn’t exist as a separate taxpayer for purposes of federal law, it must still satisfy formal compliance requirements to keep its status and avoid penalties.

Key compliance obligations include:

- Employer Identification Number (EIN): Required if the business has employees, pays excise taxes, or opens a bank account — even if not filing a separate income tax return.

- Operating agreement: Highly recommended for all LLCs, including single-member ones, to establish business operations, ownership roles, and liability provisions.

- Recordkeeping: Maintain detailed records of income, expenses, contracts, and tax filings — especially when pass-through taxation applies.

If you don’t follow these procedures, your company could be audited, lose its limited liability protection, or change its entity classification by default. Maintaining compliance ensures that your business entity is in good standing with the IRS and your state.

How to Elect or Change Disregarded Status

The IRS assigns a default classification that reflects the structure of any eligible entity. If you do not like this, you can file an entity classification election using the proper form. Following the guidelines and deadlines are important for anyone switching to a disregarded entity or electing to be treated as a corporation.

The upcoming sections provide a complete overview of how to file, select effective dates, make retroactive elections, and revoke disregarded status.

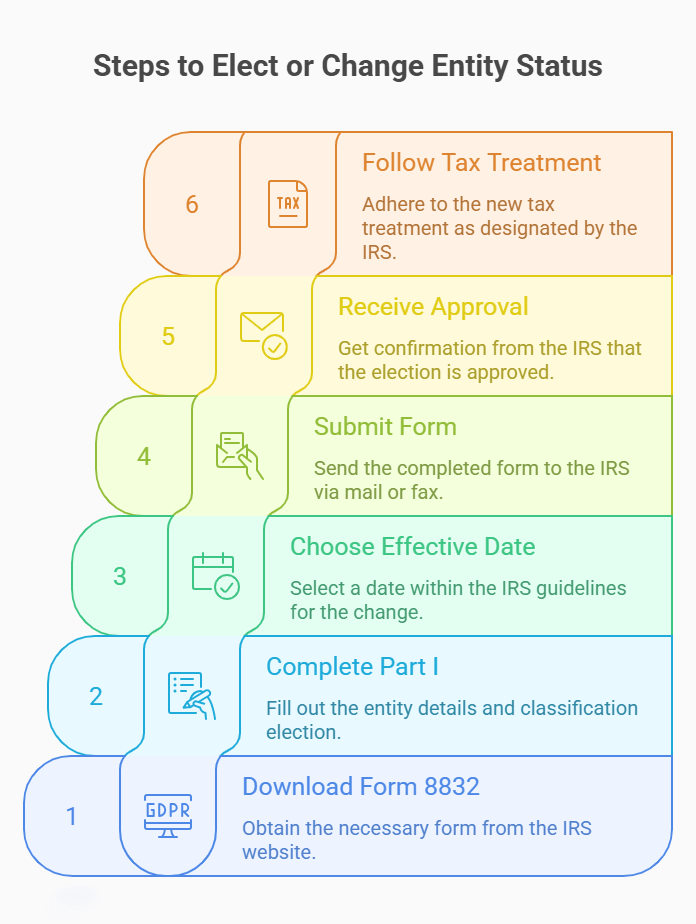

Filing IRS Form 8832: Exact Steps

You must file Form 8832 with the IRS to elect or change your entity classification. This document allows an LLC, or other eligible entity, to elect corporate classification or revert to disregarded status.

Steps to file:

- Download Form 8832 from IRS.gov.

- Complete Part I with entity details and classification election.

- Choose an effective date (if not retroactive).

- Sign and submit the form by mail or fax to the designated IRS office.

Once approved, the business entity is designated as elected, and from that date on, related tax treatment must be followed.

Completing Part II & Choosing Effective Dates

With Part II of Form 8832, you can choose your effective date for entity classification. The date you choose must be 75 days before filing or no more than 12 months after filing but it must be a start date of a tax period.

Choose your effective date wisely, as it can alter your tax return, liability, and the IRS’s treatment of your business going forward. The classification will be effective the date the form is filed when no date is given.

Make sure to keep a copy for your records and get confirmation from the IRS.

Retroactive Elections & Timing Constraints

Under IRS regulations, a business can request retroactive election of its entity but only if it meets strict timing rules. To backdate your change, you must.

- You must submit Form 8832 no more than 75 days after the requested effective date.

- If applicable, give a valid reason for filing late.

- Make sure the entity has complied with all filing requirements during the retroactive period.

Retroactive elections affect the tax liability of the business entity, the forms that are necessary and the reporting of income. If you make a mistake or miss a deadline, this could mean technical default classification, sanctions or loss of disregarded status.

To ensure there are no complications, speak to a tax professional and review the full instructions at IRS.gov.

Revoking Status & Electing Form 2553 for S-Corp

A disregarded entity can revoke its status and elect to be treated as an S-Corporation by filing Form 2553 with the IRS. Usually, this happens when the business grows and the tax benefits, such as income splitting and a lower self-employment tax obligation.

To better evaluate whether this switch aligns with your goals, take a look at this LLC vs. S Corp guide which unpacks the pros, limits, and tax structure of each option.

To qualify, the entity must:

- Be an entity that qualifies under the IRS rules.

- Within 75 days from the effective date: Submit Form 2553

- Get permission from all shareholders (if any).

Once it is approved, the business is taxed as full S-Corp with different reporting and payroll, and no longer as sole proprietorship or disregarded entity.

Disregarded Entity vs. Other Entity Classifications

When choosing the right tax classification, it is important to compare a disregarded entity with other business structures. From partnerships to C-Corps and S-Corps, each type will have different rules regarding liability, taxation, ownership, and administrative burden. The U.S. Small Business Administration also provides a useful overview of common business structures, including their pros, cons, and compliance requirements.

In the following two sections, we will outline the major differences between disregarded entities and other significant legal entities. This will allow you to consider which one is best for you operation-wise and financially.

Disregarded Entity vs. Partnership: Reporting & Liability

A disregarded entity and a partnership are both pass-through entities, which means they don’t pay business-level taxes. However, their structure and reporting is essentially different from each other.

| Feature | Disregarded Entity | Partnership |

|---|---|---|

| Ownership | Single owner | Two or more partners |

| Filing | Uses Schedule C, E, or F on personal tax return | Files Form 1065 and issues Schedule K-1s |

| Liability Protection | Yes, if formed as an LLC | Yes, but depends on state laws and structure |

| Income Splitting | Not allowed | Allowed based on agreement |

| Administrative Burden | Lower (simplified filings, fewer forms) | Higher (more complex compliance and documentation) |

Even if both types of organizations offer limited liability protection, only partnerships can divide profits and losses among several owners. A disregarded entity simplifies operations but is best for single ownership. To better understand how a sole proprietorship stacks up against a single-member LLC, explore this practical comparison of tax, liability, and setup requirements.

Disregarded Entity vs. C-Corp & S-Corp: Tax Rates & Formalities

Choosing between a disregarded entity, C-Corporation, or S-Corporation involves major differences in tax rates, filing requirements, and ownership flexibility.

| Feature | Disregarded Entity | S-Corporation | C-Corporation |

|---|---|---|---|

| Taxation | Pass-through to owner | Pass-through to shareholders | Entity taxed separately; risk of double taxation |

| Filing Requirements | Uses Schedule C, E, or F | Files Form 1120-S, issues Schedule K-1s | Files Form 1120; separate tax return |

| Self-Employment Tax | Full rate applies | Can reduce exposure via reasonable salary | Not applicable; owners paid as employees |

| Ownership Limits | Single owner only | Limited to 100 U.S. shareholders | No ownership restrictions |

| Formalities | Minimal | Requires meetings, bylaws, payroll | Most formal: board, bylaws, minutes, corporate compliance |

A disregarded entity is great because it is simple and there are not a lot of legal requirements. However, when starting to scale, hire employees, or do tax planning or investment, an S-Corp or C-Corp might be better suited for you.

To make a more informed decision, this deep dive into LLC vs. C-Corporation taxation and ownership highlights key trade-offs worth evaluating, while this overview comparing LLCs and traditional corporations walks through structure, governance, and investor appeal in plain terms.

For broader context, the U.S. Department of the Treasury also explains how tax policies apply to businesses, including pass-through entities and corporations at the federal level.

Common Pitfalls & Best Practices

Creating a disregarded entity can simplify your tax and business operations – just don’t make these common mistakes. Many single-member LLCs lose a lot of their tax advantages or become subject to penalties because they don't follow important rules and best-practices.

Common Pitfalls:

- Mixing personal and business finances: Failing to maintain a separate bank account can jeopardize limited liability protection.

- Not obtaining an EIN: Even if you’re the only owner, having employees or paying excise taxes requires an Employer Identification Number.

- Poor recordkeeping: Without detailed logs of income, expenses, and contracts, you risk triggering an IRS audit.

- Assuming no state-level obligations: Even if federally disregarded, your state may still require annual reports, fees, or local tax filings.

Best Practices:

- Keep finances separate and formalize all agreements with an operating agreement.

- File on time and use the correct IRS schedule or form.

- Consult a tax advisor annually to stay current on changing tax laws and eligibility rules.

- Review your entity classification regularly — especially if ownership changes.

By applying these strategies, your disregarded smllc will stay compliant and secure, while enjoying enhanced simplified tax treatment.

Frequently Asked Questions About Disregarded Entities

Operating a disregarded entity can cause some confusion regarding tax filings, ownership changes, compliance, and more! We compiled real business owners and entrepreneurs’ most asked questions to help you quickly retrieve accurate answers. Every response is straightforward and actionable to help in maintaining compliance and making the right choices for your entity, LLC and overall tax treatment.

Can any single-member LLC be a disregarded entity?

Yes. By default, the IRS treats every single-member LLC as a disregarded entity for federal income tax purposes, unless the owner files an entity classification election to be treated as a corporation. This implies that the business has been overlooked for federal tax filing and the owner's personal tax return includes all income, losses and expenses. However, the LLC exists as a separate legal entity under state law and has to meet the state-specific formation and compliance requirements.

How do I report disregarded entity income on my personal return?

If you own a disregarded entity, you will report all business income, expenses, and deductions on your personal income tax return, not as a separate business. Use :

Schedule C deals with income for business.

Schedule E for rental of a real estate or pass-through investments.

Schedule F is for farm or agricultural activity.

This method allows for pass-through taxation, so the income is taxed only once. Simply ensure that you maintain accurate records and comply with any relevant state filing requirements.

Do I need a separate EIN or bank account for my LLC?

Yes. Even though a disregarded entity is ignored for federal tax filing, it’s still a legal entity under state law. If your LLC hires employees, pays excise taxes, or opens a business bank account, you’ll need a separate Employer Identification Number (EIN). Keeping your business finances separate also protects your limited liability status. It helps prevent “piercing the veil” — a legal situation where personal and business assets are treated as one.

What happens if I add another member mid-year?

If you add a second owner to a single-member LLC mid-year, the business automatically becomes a multi-member LLC and is treated as a partnership for federal tax purposes from the date of the ownership change. You have to prepare Form 1065 and issue Schedule K-1 forms for the part of the year after the change. Due to this mid-year update, your entity classification changes, so please make sure to update your EIN, operating agreement, and state registrations.

When should I consider converting to an S-Corp or C-Corp?

You should consider about converting or changing your disregarded entity to an S-Corporation or C-Corporation depending on whether your business is generating consistent profits and you wish to lower your self-employment tax or attract outside investors.

Choose an S-Corp and pay yourself as much as is reasonable and take the rest in distributions that are not self-employment taxes.

Choose a C-Corp, If you require flexibility on ownership, plan to own or issue stocks, or looking for profit reinvestment.

Use Form 2553 (S-Corp) or Form 8832 (C-Corp) to elect.

Resources for Disregarded Entities and Single-Member LLCs

Forming a disregarded entity involves more than just picking a structure — it requires ongoing IRS compliance, tax planning, and state-level responsibilities. These official resources can help clarify your obligations and assist with setup, classification, and maintenance.

- IRS – Entity Classification Overview (irs.gov): Official IRS page explaining how single-member LLCs are treated for tax purposes, including disregarded status rules and filing guidance.

- IRS Form 8832 – Entity Classification Election (irs.gov): Use this form to elect or change your entity’s federal tax classification, including switching to or from disregarded status.

- IRS Form 1040-ES – Estimated Tax for Individuals (irs.gov): Required if your disregarded entity income leads to self-employment taxes or quarterly tax payments.

- U.S. Small Business Administration (SBA) – Business Structures Guide (sba.gov): Compares entity types including LLCs, sole proprietorships, partnerships, and corporations.

- U.S. Department of the Treasury – Tax Policy Resources (https://home.treasury.gov/): Offers federal-level guidance on how tax policies apply to pass-through entities, LLCs, and corporate structures — useful for high-level tax planning or policy interpretation.

- State Business Portals (varies by location): Your state’s Secretary of State or Department of Revenue may require LLC annual reports, business license renewals, or franchise taxes — even for disregarded entities.

Bookmark these links to stay ahead of deadlines, file the right forms, and maintain both federal and state compliance with confidence.

Make Your Business IRS-Recognized as a Disregarded Entity

Harbor Compliance takes care of the legal setup so your single-member LLC is properly formed and tax-classified from day one.