Use Hawaii’s DCCA Search & Buy to check business name availability, pull official records, and order certificates in minutes. This guide shows exactly how to search entities, confirm a name under Hawaii’s distinguishability rules, read results correctly (status, good standing, registered agent), and handle trade names/trademarks. You’ll also see annual report due dates/fees and how to get a Certificate of Good Standing or certified copies online through Hawaii Business Express.

How to Search Hawaii Businesses Online

You’ll use the State’s Search & Buy portal inside Hawaii business express to locate entities, read their records, and purchase documents. The tool offers two search modes: Begins with and Contains, so you can cast a tight or wide net, then drill into each record for status, authority, and the listed registered agent. Note: Hawaii’s own page reminds you the search is informational and not a final name-availability determination.

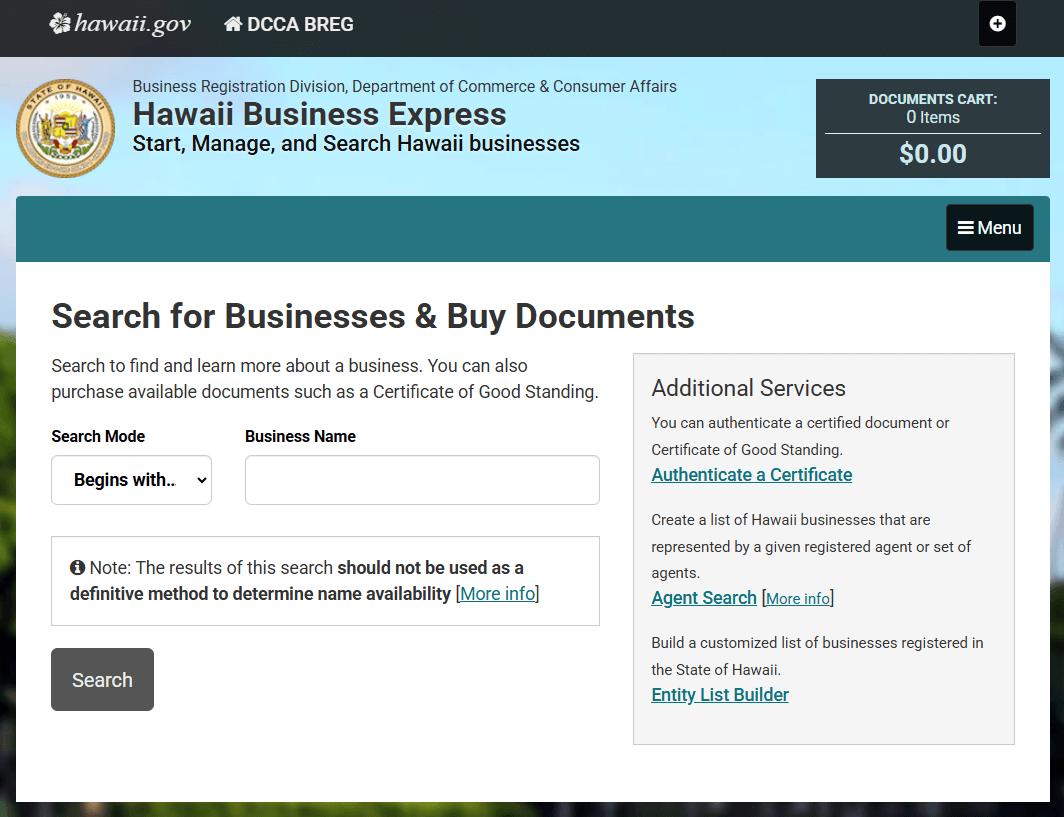

Open the Official “Search for Businesses & Buy Documents” Page

Start at the DCCA BREG hub inside Hawaii business express. You’ll see the page header “Search for Businesses & Buy Documents,” a Search Mode dropdown, a Business Name field, and an “Additional Services” panel (certificate authentication, Agent Search, and Entity List Builder).

What the screen shows:

- A reminder that the business name search is informational and not a final availability check.

- A documents cart (top-right) for any certificates or copies you add.

- Direct links to Authenticate a Certificate and Agent Search for deeper due diligence.

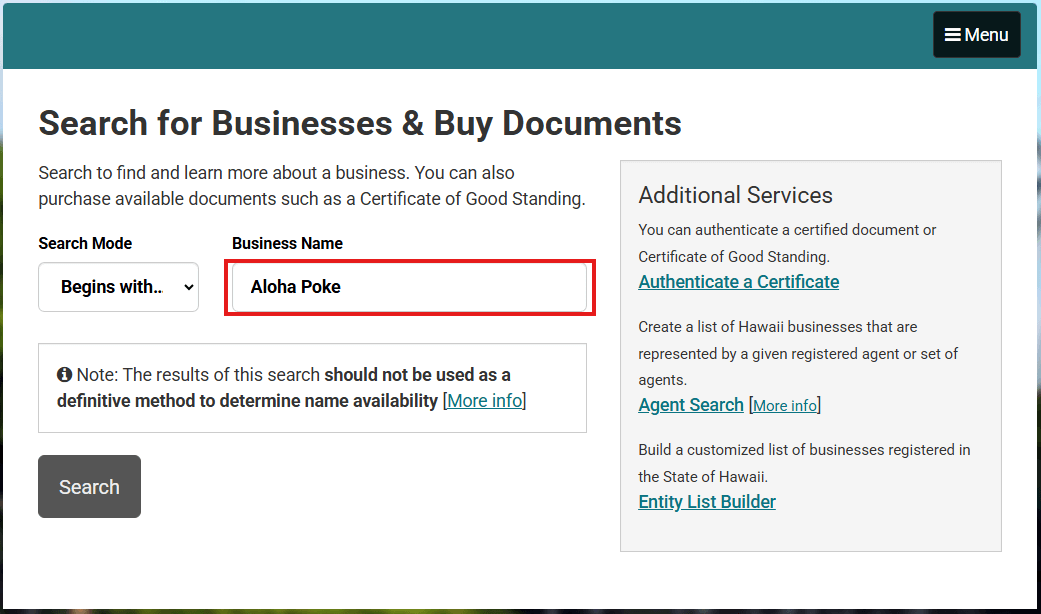

Select Begins With or Contains and Enter The Name

Use the Search Mode dropdown to control match scope:

- Begins with → tightest match; great for checking exact prefixes and brand stems.

- Contains → broader match; great for reversed word order, multi-word phrases, or partials.

Example input:

Choose Begins with, then type Aloha Poke in Business Name. This surfaces close variants such as “ALOHA POKE BAR LLC,” “ALOHA POKE LLC,” and similar strings so you can quickly spot direct conflicts.

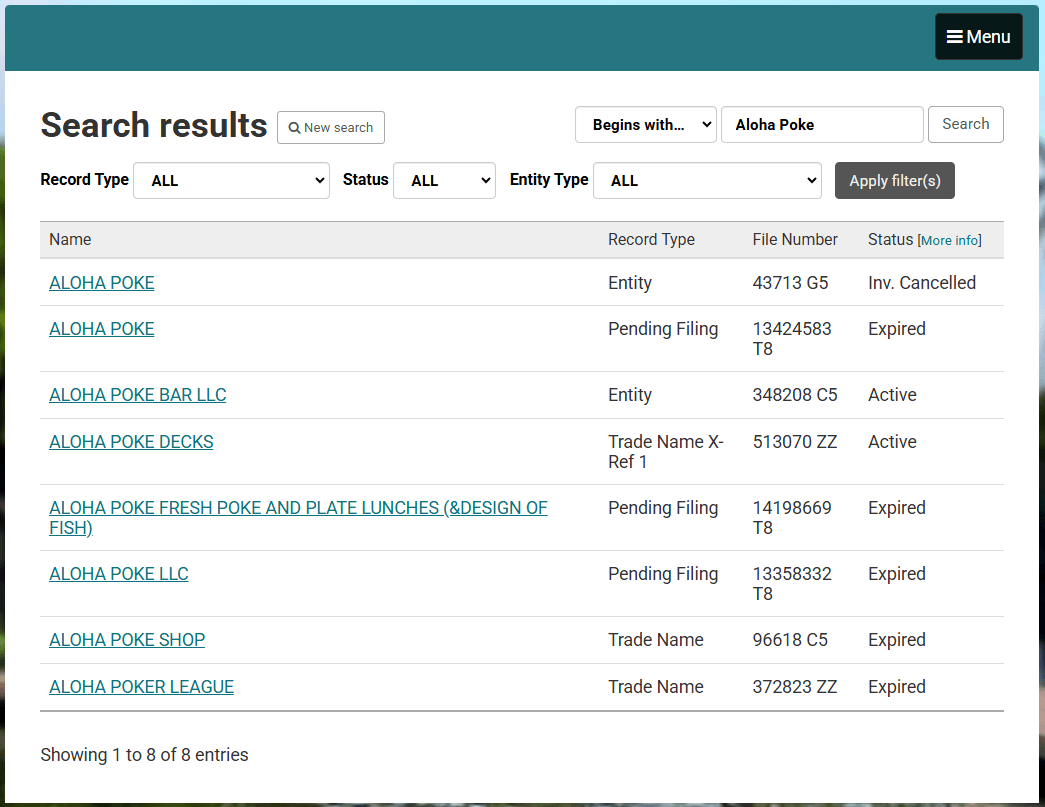

Refine Results With Additional Keywords And Variants

After you hit Search, the results table will show entries like ALOHA POKE BAR LLC (Entity – Active), ALOHA POKE DECKS (Entity), several Pending Filing items, plus Trade Name records such as ALOHA POKE SHOP and even near-misses like ALOHA POKER LEAGUE. Use this page to separate true conflicts from noise, then iterate your query.

How to tighten your list (start with filters, then iterate):

- Filter to the real competition.

Set Record Type = Entity, Status = Active, Entity Type = LLC to focus on live companies (e.g., ALOHA POKE BAR LLC). - Flip the match mode.

Re-run with Contains to catch reversed/partial strings and surface things like “BAR,” “DECKS,” or other descriptors attached to “Aloha Poke.” - Probe variants.

Try Aloha Poke Catering, Aloha Poke HI, Aloha-Poke, and Aloha Pokes to see how small changes affect the list (you’ll notice cosmetic tweaks don’t eliminate close hits). - Open promising records.

Click the name to confirm Status, File Number, Domestic/Foreign authority, principal/registered addresses, and registered agent so you can judge closeness and compliance details.

Using the live-style Aloha Poke sample, here’s a concise view of names Hawaii typically flags vs. options that usually clear distinguishability. Use this table while iterating queries in Begins with and Contains.

| Candidate name | Verdict | Why / How to fix |

|---|---|---|

| Aloha Poke LLC | ❌ Likely flagged | Identical stem to multiple results; add a truly distinctive lead word. |

| Aloha-Poke LLC | ❌ Cosmetic | Hyphen/spacing doesn’t create distinction. |

| Aloha Pokes LLC | ❌ Cosmetic | Plural/possessive changes don’t help. |

| The Aloha Poke LLC / Aloha Poke Company LLC / Aloha Poke Co., LLC | ❌ Cosmetic | “The,” “Company/Co.” are ignored for distinctiveness. |

| Aloha Poke Hawaii LLC / Aloha Poke of HI LLC | ❌ Too generic | Adding “Hawaii/HI/of” rarely distinguishes. |

| Kailua Reef Poke LLC | ✅ Often works | Distinct geographic + noun; new lead word. |

| Akamai Poke Kitchen LLC | ✅ Often works | Coined/less-common lead (“Akamai”) + specific descriptor. |

| Ko Olina Marine Poke LLC | ✅ Often works | Multi-word locale + specialty; clearly different stem. |

| MaunaKea Analytics LLC | ✅ Clear pass (different industry) | Entirely new coined brand + accurate industry term. |

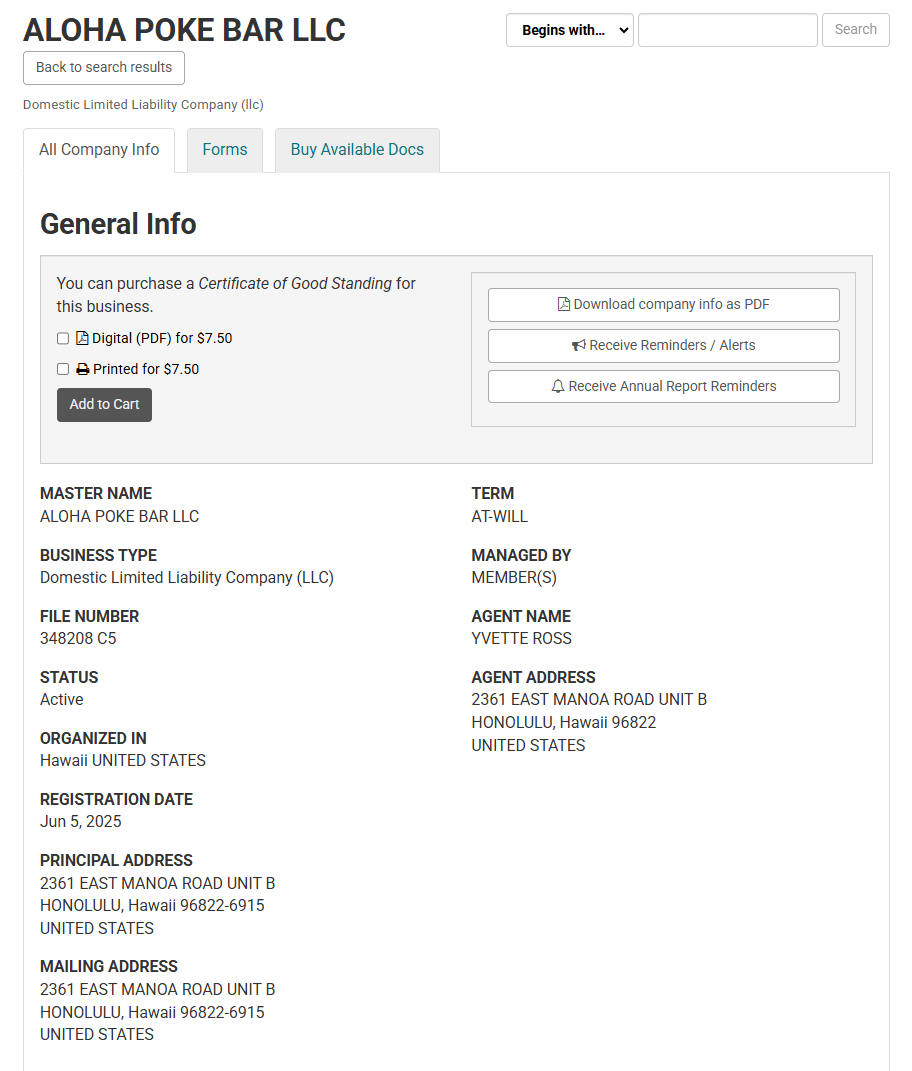

Open The Entity Page and Review It

Click any search result to open its profile. Use this page to quickly confirm you’ve got the right record and to grab the essentials you’ll need for banking, contracts, and follow-on filings.

- Status – e.g., Active. If a lender/vendor asks for proof, order a certificate of good standing from the same screen.

- File number & type – note the ID and whether it’s an LLC, corporation, etc.

- Authority – Domestic (formed in HI) or Foreign (authorized from another state).

- Addresses – verify principal and mailing address are current.

- **registered agent – confirm the agent’s name and Hawaiʻi street address.

Example: For “ALOHA POKE BAR LLC,” you’d check Status: Active, copy the File Number, confirm it’s Domestic, skim the addresses, and note the registered agent, then, if needed, grab a certificate of good standing or open “Buy Available Docs” for filings.

Open Filings and Download or Purchase Documents

From the entity page, use Buy Available Docs to obtain formation articles, annual reports, amendments, and more. The State lists most documents at $3 and certified copies +$10; Certificates of Good Standing are $7.50 (electronic or printed). You can order directly from Search & Buy.

Example: For “Aloha Poke Company LLC,” purchase the latest Annual Report to verify current managers/members and order a certificate of good standing if a bank needs proof.

Use Agent Search to Build a list by Registered Agent

If you’re mapping a market or doing due diligence, run the State’s Agent Search to pull all Hawaii businesses served by a given registered agent. Cost: $2.00 + $0.05 per business record. This is especially helpful when you see the same agent on a competitor’s profile and want to find related entities.

Example: Search for an agent like “ZenBusiness” or “Northwest Registered Agent” to see every associated Hawaii entity, then filter to “Active businesses” for a cleaner list.

Make Your Hawaii Business Name Official with ZenBusiness

Once you confirm your name is available, ZenBusiness can help you reserve it and handle all the filings, so you can secure your brand fast and hassle-free.

Confirm a Business Name

Before you file anything, confirm that your proposed business name won’t get rejected. This step has three parts: run a business name search in Hawaii’s system, check state and federal trademark conflicts, and apply Hawaii’s “distinguishable” rules (including the correct limited liability company designator if you’re forming an LLC). If you’re not ready to file today, you can reserve the name through Hawaii business express for a short period. For broader rules and examples, see our guide on checking LLC name availability (all states).

Check Conflicts in The Hawaii Trademark Search

Start with the State’s trade name/trademark portal. Hawaii registers trade names, trademarks, and service marks at the DCCA Business Registration Division. Use the State page to search exact and similar names, then review any active or recently filed marks that could block you. As of today, the State lists a $50 filing fee for a trade name, trademark, or service mark and an optional $20 expedited review (non-refundable).

It’s important to understand the difference between a registered entity name and a trade name/trademark. An entity name identifies the company on the public record; a trade name or mark is what you use in commerce. A name cannot be substantially identical to one already registered with the Department, and a trade name registration does not, by itself, grant full ownership of the name. For broader protection, search and (if needed) file at the federal level using the USPTO’s Trademark Search system.

Apply Hawaii Distinguishability and Designator Rules

Hawaii applies both statute and administrative rules when reviewing names. If you’re forming an LLC, HRS §428-105 requires that the name include “limited liability company,” “L.L.C.,” or “LLC” (with “Ltd.” and “Co.” permitted as abbreviations). The statute also allows the director to authorize a substantially identical name in limited situations (e.g., with written consent plus added words that make the name distinguishable).

Next, apply the “substantially identical” test in the Hawaii Administrative Rules. The State will reject names that differ only by small, cosmetic changes. Before the list below, note that these examples come directly from §16-36-15 and related State help pages.

Common pitfalls that usually do not make a name distinguishable (intro first, then the bullets):

- Swapping punctuation, spaces, symbols, or using a second entity suffix (e.g., “Company”).

- Changing to plural or possessive, or inserting articles or short words.

- Using “Hawaii,” “Hawaiian,” or “of HI” at the beginning or end.

- Using only a number or letter sequence to differentiate (e.g., “I” vs. “II”).

If your preferred name passes these filters, you can move forward. If it doesn’t, add distinctive words or re-order meaningful terms until the name is clearly different.

Reserve The Name for 120 Days or File Now

If you need time to prep your filing, you can reserve the business name for 120 days. Hawaii confirms the 120-day hold in its official FAQs, and the application (Form X-1) shows a $10 reservation fee; the fee tables also show an optional $25 expedited review. You can submit online through Hawaii business express.

Read Hawaii Results Correctly

When you open a result in the State’s search, don’t just skim. Read the profile like a due-diligence checklist: confirm status and whether the entity is in good standing, note whether it’s domestic or foreign (authorized to do business in Hawaii), and review the key filings before you make decisions or move forward with your own filing. The State’s portal is explicit that the search exists to confirm a company exists and to provide status/basic info; treat it as your first-pass verification.

Status Meanings And “Good Standing.”

The profile shows an overall Status (e.g., Active) and whether the entity is in “good standing.” If you need official proof, order a certificate of good standing (COGS) directly from the State (digital or printed for $7.50) or authenticate a certificate someone gives you using the same system. This is the definitive way to prove current compliance for banks, vendors, or registrations.

Domestic Vs. Foreign Authority.

“Domestic” means formed in Hawaii. “Foreign” means formed elsewhere but granted authority to transact business in Hawaii by filing a Certificate of Authority (for corporations: Form FC-1; for LLCs: Form FLLC-1). If the record shows “Foreign,” review the home-state jurisdiction and look for the authority filing in the entity’s documents.

Filings To Review First (What Actually Matters).

Before you start downloading everything, remember the sequence: the earliest filing creates or authorizes the business; amendments change what you can rely on; the latest annual report shows whether the record is current. Open these first (and download if needed).

| Filing (open first) | Purpose in due diligence | Why it matters | Priority |

|---|---|---|---|

| Articles of Organization/Incorporation (domestic) | Proves original creation and baseline details | Confirms legal existence, name, managers/directors at formation | ⭐⭐⭐ |

| Certificate of Authority (foreign) | Proves authorization to do business in HI | Verifies out-of-state entity is properly admitted | ⭐⭐⭐ |

| Most recent Annual Report | Confirms current officers/managers & status cadence | Shows the record is being maintained (good banking signal) | ⭐⭐ |

| Amendments / Name Changes / Conversions | Tracks changes after formation | Updates you on governance, name, or structure | ⭐⭐ |

| Merger / Dissolution / Termination | Indicates major events or wind-down | Can be a deal-stopper if recent | ⭐⭐⭐ |

You can purchase copies directly from the entity profile—regular copies are typically $3 per document and certified copies add +$10. The Search & Buy flow inside hawaii business express also links straight to certificate authentication if you need to verify documents later.

Registered Agents in Hawaii

A registered agent is the statutory contact for service of process and official notices. Hawaii’s Business Registration Division defines it plainly: an individual or entity authorized to transact business physically present in the State to accept legal documents and forward them to the company. You’ll see the AGENT NAME and AGENT ADDRESS on every entity profile. If you want recommendations, see best registered agent services in Hawaii.

Who Can Serve And Physical Address Rules

Hawaii follows the Registered Agents Act (HRS Ch. 425R). Practically, your agent can be: (1) a Hawaii resident individual, or (2) a domestic or foreign business entity authorized in Hawaii. The agent must provide a street address in Hawaii, the statute and State forms repeatedly require “the address of a place of business in the State” or “complete street address,” which means a physical location (not a mailing-only P.O. box). These rules ensure someone is actually available to receive delivery of legal papers. For eligibility details, review the registered agent requirement in Hawaii.

Find, Appoint, Or Change A Registered Agent

Before the numbered steps, a quick note: the State centralizes this in Search & Buy and the X-series change forms, so it’s predictable across entity types.

- Find the current agent.

Open the entity’s profile in Search & Buy; the AGENT NAME and AGENT ADDRESS appear with status and other details. If you’re doing research at scale, use Agent Search to build lists by agent (fee: $2 + 5¢/record). - Appoint an agent (new or foreign registrations).

You name your registered agent in the initial filing. For example, Domestic LLC (Form LLC-1) and Foreign LLC (Form FLLC-1) require agent details; foreign corporations use Form FC-1 with the same concept. File online or by email/mail/fax via BREG. - Change the agent (or the agent’s name/address).

Use the X-series forms: X-7 (Statement of Change of Registered Agent by Entity), X-8 (change non-commercial agent’s business address or name), X-14 (change by commercial registered agent), and X-9 (resignation of registered agent). The fee schedules for Hawaii entities list $25 for agent change or resignation filings (entity-specific schedules confirm the amount).

After any change, verify the update posted by pulling the public profile or purchasing a fresh certificate of good standing if a bank or counterparty needs official proof.

Need to Switch Your Hawaii Registered Agent? Choose Northwest

Whether you're forming a business or updating your agent info, Northwest handles filings with privacy-first service and reliable local presence in Hawaii.

Trade Names and State Trademarks

Choosing how you’ll “show up” in the market goes beyond your entity name. In Hawaii, trade names (DBAs) and trademarks/service marks are registered with the Business Registration Division and can be filed online through Hawaii business express. Securing these correctly helps you avoid conflicts, protect brand assets, and pass vendor/bank checks with less friction.

Search And Register A Hawaii Trade Name

Start with a quick state-level clearance, then register online.

Before the numbered steps, here’s the approach: you’ll search the State’s trade name database, run a broader “knock-out” check, and file via Hawaii business express if clear.

- Search the State’s trade name database.

Use the Trade Name/Trademark/Service Mark page to check identical and similar names. This is the canonical place to find active Hawaii trade names. - Run a broader conflict check (strongly recommended).

Cross-check your candidate in the business name search (entity database) and in the USPTO’s federal trademark search to catch marks that can block you beyond Hawaii. - Register the trade name online.

File through Hawaii Business Express. The State lists the trade name filing fee at $50 with an optional $20 expedited review; certified copies are $10 plus $0.25/page and there’s an additional $1 State Archives fee.

If you’d prefer a done-for-you option, compare the best DBA registration services (trade name filing) before you file.

Search and Register a Hawaii Trademark or Service Mark

Trademarks protect brand identifiers (names/logos) for goods, and service marks protect identifiers for services. Hawaii registers both at BREG; federal protection is handled by the USPTO.

- Search the State and file online.

Use the same DCCA page and hawaii business express flow; fees mirror trade names: $50 filing and optional $20 expedited. - Search federally (strongly recommended).

The USPTO’s search portal provides official guidance and tools; do a “knock-out” search, then expand to variants/similar marks. Filing federally is separate but often worth it for wider protection.

Annual Reports and Compliance

Hawaii annual reports keep your entity in good standing and visible to banks, vendors, and agencies. The State sets due dates by quarter of your registration date and publishes the online filing fees and late-fee rules. Filing on time is the simplest way to avoid penalties or administrative action.

Filing Window By Quarter Based On Registration Date

Your due date is tied to when your entity was approved/registered in Hawaii. The State’s rule is simple:

- Registered Jan 1-Mar 31 → due by Mar 31 each year

- Registered Apr 1-Jun 30 → due by Jun 30

- Registered Jul 1-Sep 30 → due by Sep 30

- Registered Oct 1-Dec 31 → due by Dec 31

The FAQ and BREG releases confirm these quarter windows. If you register late in the year, you generally won’t file in that same year, but confirm against your entity’s info sheet.

Fees, Late Penalties, And Reinstatement

Before you look up forms or click “pay,” keep this simple: online filing is a bit cheaper, late fees stack the longer you wait, prolonged delinquency can trigger separate penalties (and even revocation), and reinstatement is possible—but only for domestic entities and within a tight window.

| Item / Action | Amount | What to know |

|---|---|---|

| Annual report (online, LLC/Corp/LLP) | $12.50 | Due each year by your quarter; online price (paper base often $15). |

| Annual report (online, Nonprofit) | $2.50 | Same due-date rules via the portal. |

| Annual report (online, Partnership) | $5.00 | Same due-date rules via the portal. |

| Base annual report (paper/standard) | $15.00 | For LLCs/corporations if filing by paper. |

| Late fee (auto-added online) | $10 / year | Added at checkout when you file after the due date. |

| Ongoing penalty for non-filing | Up to $100 / 30 days | Continued failure can lead to revocation/authority loss. |

| Reinstatement (Form X-4) | Varies | Domestic entities only; apply within 2 years; bring reports current and pay all delinquencies. |

File everything online via Hawaii business express (Business Annual Report Filing). If you’re already late, submit through the same flow, the portal calculates and adds the correct late fee automatically.

Records and Certificates

When you need official proof or copies from the State, Hawaii makes it straightforward: order a certificate of good standing, verify it via the State’s authentication tool, and download regular or certified copies of filings from the same portal. Everything runs through Hawaii business express (Search & Buy).

Order a Certificate of Good Standing online

The State issues an official certificate of good standing (COGS) you can purchase and print in minutes.

Here’s the exact flow so you don’t miss a step:

- Open the State’s Search & Buy page, look up the entity, and select “Buy Certificate of Good Standing.”

- Complete checkout. Hawaii publishes the COGS fee as $7.50 (electronic or printed).

- Download the COGS immediately; keep a PDF on file for banks, vendors, and licensing. The BREG site also links COGS ordering directly from its Online Services page.

Authenticate a certificate

If a counterparty sends you a certificate, confirm it’s genuine before relying on it.

Use the State’s built-in validator:

- Go to the Authenticate a Certificate of Good Standing page and enter the Authentication Code or Document ID printed on the certificate. The system verifies the record instantly.

- You can access the same authentication tool from the Search & Buy page under “Additional Services.”

Order certified copies

Beyond the COGS, you can buy copies of individual filings from the entity’s profile.

Know your options and fees before you click:

- Regular copies: “Most documents are available for $3.” Select what you need from Buy Available Docs.

- Certified copies: add $10 per document (some fee tables also list +$0.25/page and a $1 State Archives fee, shown on various entity pages).

Register a Business in Hawaii

Once your name checks are done, you’ll choose an entity type, meet Hawaii’s naming rules, then file formation (domestic) or certificate of authority (foreign) in Hawaii business express. After the filing is approved, set up tax/employer accounts (GET, withholding, UI) and obtain a free federal EIN.

Choose an Entity Type and Clear The Name

Pick your structure (LLC, corporation, partnership, etc.), then apply Hawaii’s naming rules so you don’t get rejected. (For the full walkthrough, use our step-by-step Hawaii LLC formation guide).

- LLC designator required. HRS §428-105 requires “limited liability company,” “L.L.C.,” or “LLC” (with “Ltd.” and “Co.” permitted).

- Must be distinguishable. Hawaii rejects names “substantially identical” under HAR §16-36-15; cosmetic tweaks (punctuation, plurals, articles) usually won’t pass. Cross-check both the entity database and trade name/mark rules before filing.

If you’re not ready to file today, you can still proceed later via the same HBE portal; the Registration hub links all online forms in one place.

File Formation or Foreign Registration in Hawaii Business Express

You can file online or by email/mail/fax, but online is fastest.

- Domestic LLC (Form LLC-1).

File Articles of Organization; fee $50 (optional expedited +$25); State pages note certified copy fee $10 + $0.25/page and a $1 State Archives fee. The statute link and page confirm LLC formation under HRS Ch. 428. - Foreign LLC (Form FLLC-1).

File an Application for Certificate of Authority; fee $50 (optional expedited +$25). Attach a certificate of existence (a/k/a good standing) from your home state dated ≤ 60 days before filing (explicit in the instructions). - Registered agent is required.

The LLC forms require naming a registered agent with a Hawaii street address (no P.O. boxes). For mail, banking, and vendor records, set up a compliant business address for your LLC.

All of the above can be filed in Hawaii business express from the “Register a Business Online” link on BREG’s site. If you'd rather hire help, compare options in our Hawaii LLC formation service reviews.

Set Up Tax and Employer Accounts

Right after your approval email, handle tax IDs and employer registrations. Here’s the clean checklist with official sources:

- Hawaii Tax Online (GET & withholding).

Register via Form BB-1 (online). The General Excise Tax license has a one-time $20 fee; set up withholding if you’ll have employees. - Unemployment Insurance (DLIR).

New employers register with the Unemployment Insurance division; tax reports are quarterly. Many small teams streamline these tasks by partnering with Hawaii PEO providers (HR/payroll outsourcing). - Federal EIN (IRS).

Apply free and directly with the IRS online tool; EIN is issued immediately upon approval. (Avoid third-party sites that charge, IRS and SBA both emphasize it’s free). If you need to locate an existing number, here’s how to find a company’s EIN legally.

If you see search ads offering “EIN service,” skip them, credible reporting has documented paid middlemen charging for a free IRS service. Always use .gov domains.

Frequently Asked Questions About Hawaii Business Entity Search

Use this FAQ as your quick-reference when you’re double-checking name availability, buying proof, or figuring out what’s actually included in the State’s search tools. Each answer links to the official Hawaii Business Registration Division (BREG) pages inside Hawaii business express so you can act immediately.

How to confirm a name is available in Hawaii

Start with the State’s business name search to screen exact/similar entities. That’s only preliminary, the State warns search results are not a final availability decision; a name is confirmed only when your filing is accepted under Hawaii’s distinguishability rules. Use both “Begins with” and “Contains,” then clear trade names/trademarks separately to avoid conflicts. Final confirmation comes with acceptance/recording in the system.

Where to order a Certificate of Good Standing

Order a Certificate of Good Standing (COGS) via Search & Buy in Hawaii business express; the fee is $7.50. From your entity profile, open “Buy Available Docs,” select the certificate, and download the digital version immediately (printed available too). BREG’s FAQ confirms you can order directly from the profile page, perfect for banks, vendors, and licensing.

Can I search by registered agent in Hawaii

Yes, Use Agent Search to build a list of Hawaii businesses represented by a specific registered agent. Pricing is $2.00 per list + $0.05 per business record. Choose Active or All businesses, enter the agent’s name, and generate a due-diligence or competitor-mapping list. You’ll need an eHawaii.gov account with a linked subscriber service to purchase results. For a quick landscape view, skim our Hawaiʻi small business statistics (latest snapshot).

Are trade names and trademarks included with entity search

No, trade names and trademarks/service marks are separate from entity records. Search/register them on the Trade Name/Trademark pages and file online through hawaii business express. When clearing a brand, cross-check both the entity database and the trade name/mark database. State filing fees: $50 per trade name/mark, +$20 expedited; certified copies $10 + $0.25/page

How quickly new filings post online

Normal review is typically ~3–5 working days; expedited review is ~1–3 working days (some pages note 1 day for expedited). Online filing is faster and offers status visibility; email/mail/fax can introduce delays. If timing is critical, choose expedited service and file online through Hawaii Business Express. For timing specifics, see exactly how long it takes to form an LLC in Hawaii.

- Hawaii BREG: Form X-1 – Application for Reservation of Name (PDF)

- HRS: §428-105 – LLC Name Requirements (PDF)

- HAR: §16-36-15 – “Substantially Identical” Name Rule (PDF)

- DCCA BREG: Trade Name, Trademark & Service Mark Registration (overview)

- DCCA BREG: Trade Name / Trademark / Service Mark Forms (T-1, T-2, T-3)

- Hawaii Department of Taxation: General Excise Tax (GET) Info & Registration

- DCCA BREG: Contact (Phone, Email, Addresses)

Looking for an overview? See Hawaii LLC Services

Reserve Your Hawaii Business Name Before Someone Else Does

Harbor Compliance helps you check name availability and reserve your business name with the Hawaii DCCA, no paperwork stress.