Forming an LLC for your real estate career can feel like a big decision — especially when weighing the potential tax savings, liability protection, and administrative duties. Whether you're a seasoned broker or a new real estate agent, knowing the pros and cons of this popular business structure is key.

The main benefits of forming an LLC include personal liability protection, pass-through taxation, tax deductions, and stronger brand credibility. But the drawbacks include formation costs, annual state fees, employment taxes, and paperwork requirements.

In this guide, we break down everything you need to know about forming an LLC for real estate professionals. From asset protection and tax flexibility to legal risks and cost breakdowns, you’ll find every angle covered. If you’re deciding whether to structure your real estate business as an LLC — or simply want to understand the benefits and drawbacks — this article will help you make an informed choice.

Key Advantages of an LLC for Real Estate Agents

Forming an LLC for your real estate business can open up some serious strategic wins. From shielding your personal assets to cutting down your taxable income, it’s not just about checking a legal box, it’s about building a stronger, more secure future for your brand in the market.

Personal Liability Protection in Property Transactions

One of the most compelling reasons why you should form an LLC for your real estate business is personal liability protection. When you’re working as a real estate agent, even a small mistake during a property transaction may lead to a lawsuit. If you operate without an LLC, you can lose personal assets like your home or car.

When you form an LLC, your business is treated as a separate legal entity. Therefore, any legal issues that arise will not impact your personal finances. Having this liability protection is crucial in high-stakes property sales when issues involve contracts, disclosures, or earnest money. When you separate your real estate business from who you are, it protects your finances as well as legally separates your wealth from your work.

Pass-Through Taxation & Qualified Business Income Deduction

By forming an LLC, real estate agents can take advantage of one of the tax world’s most powerful weapons, pass-through taxation. Rather than paying corporate taxes, the business income flows right through to your personal income tax return. This prevents double taxation and provides you the opportunity to report profit on your individual 1040.

Real estate agents are allowed to take the benefit of Qualified Business Income (QBI) deduction. Because of which real estate agents can deduct almost 20% of the overall net income. This indicates significant tax savings, especially if you’re an agent making six figures in commission or rental income. When you add in payroll deductions for expenses like advertising, office space, and vehicle mileage, the LLC is one of the best structures for maximizing take-home profit as well as IRS compliance.

Flexible Profit Distribution & Retirement Planning

An LLC for real estate agents not only protects you legally, but it also gives you financial flexibility. One advantage is being able to allocate profits however you want as opposed to a corporation which has strict regulations. As an LLC owner, you get to divide your profits according to your operating agreement and not just the ownership percentage. This allows for creative and fair LLC profit distribution methods, especially useful for teams or partnerships who have similar input. If you want to dive deeper into how these distributions work, the full guide to LLC distributions covers profit-sharing structures, IRS compliance, and payout timing in detail.

This flexibility also extends to retirement planning. Having an LLC allows you to invest in tax-advantaged retirement plans such as a Solo 401(k). These types of options allow real estate agents to build wealth over the long-term while reducing taxable income annually. Real estate agents may have variable commission incomes. With this flexible structure, agents can learn how to create a more solid future. To better understand how to pay yourself from an LLC, including whether to use a salary or owner’s draw, check out this detailed guide on paying yourself from your LLC — it breaks down options based on income type and legal compliance. Most importantly, it complies with IRS tax rules.

Professional Credibility & Branding

Forming an LLC for your real estate business signals credibility and professionalism to both clients and industry peers. When you present yourself as a legal entity—not just an individual—it sets a tone of stability, commitment, and trust. This can be especially valuable when competing for listings or negotiating deals, where image and perception matter.

An LLC also allows you to brand under a formal company name, rather than using your personal identity. That’s a critical advantage for real estate agents looking to scale or work with investor clients. From custom signage to business cards, your LLC name builds authority while separating your personal life from your real estate business.

Asset Segregation for Investment Properties

If you are a real estate agent, then one of the smartest things you can do is to use an LLC for rental property ownership. Why? An LLC lets you legally create a wall between your investment properties and your assets and other parts of your real estate business. Separating your properties protects the lawyer catching your properties from any lawsuits or payments that arise from the property alone.

A lot of experienced real estate investors set up multiple LLCs (one per property) for better asset protection. This way, a lawsuit about one property won’t taint your whole portfolio. This makes it easier to do bookkeeping, insurance, and taxes for each property. If you’re real estate investing, it is necessary to separate your assets with LLCs for long-term risk management and financial security. You can also read this practical breakdown on LLCs for rental properties to learn how to set up the right structure for protection and control.

Form an LLC and Protect Your Real Estate Income

ZenBusiness helps real estate agents set up LLCs that shield personal assets, simplify taxes, and build client trust – without legal headaches.

Potential Drawbacks of an LLC for Real Estate Agents

While an LLC for real estate agents offers strong legal and tax benefits, it's not without its downsides. Understanding the drawbacks of an LLC is essential before forming one, especially when you're managing commissions, state regulations, and operational costs. This section covers the real financial and administrative burdens that come with maintaining a compliant LLC.

Formation Costs & Annual State Fees

The states charge an initial LLC filing fee and an ongoing annual fee for creating LLC for real estate. The costs for LLC formation depend on where you file, which ranges from $50 to $500 on average. Certain state governments like Massachusetts and California require organisations to pay annual fees and franchise taxes to remain compliant.

Apart from state fees, you may incur charges for the registered agent, business licenses, or expedited processing. The costs of LLC ownership can add up fast, especially for solo agents managing their own budget. While many of the real estate agents just absorb these costs as a part of doing business, I want you to understand that LLCs aren’t free. Always calculate the maintenance costs before registration. Also, remember to budget for the renewals and compliance paperwork from each year.

Administrative Formalities & Recordkeeping Requirements

Running an LLC for your real estate business definitely comes with more administrative requirements, especially if you’re a solo agent. Unlike a sole proprietorship, you’ll need to stay on top of things like operating agreements, financial reports, and even meeting notes (yep, even if it’s just you). Skipping these details might seem harmless, but it can actually weaken your legal protection and put your personal assets at risk by piercing the corporate veil.

Most states also ask that LLCs file annual reports, update their business info, and clearly separate personal and business finances. That usually means setting up a separate bank account, keeping all your contracts under the business name, and tracking every expense properly. It’s not overly complicated, but it does take some steady attention if you want to hold onto your limited liability protection and stay fully compliant.

Self-Employment Tax on Commissions

Even if you're running an LLC for real estate agents, your commission income usually doesn’t escape self-employment taxes. Basically, you’re still covering both the employer and employee share of Medicare and Social Security. That’s around 15.3% on whatever you earn after expenses—definitely something to plan for, especially if your real estate business brings in large checks.

Now, unless you elect to be taxed as an S-Corp, your LLC treats all of that net income as self-employment income. Sure, filing as an S-Corp might help lower the bill, but it also brings more complexity. If you stick with the default LLC structure, it’s smart to plan ahead: track your numbers, make those quarterly payments, and keep enough set aside to cover your employment tax when it’s due. It’s all part of keeping your business running smooth, and staying out of tax trouble.

Financing Challenges vs. Corporations

Setting up an LLC for your real estate business can be a smart move for flexibility and limited liability, but it may throw a wrench into your financing plans. Lenders don’t always love working with LLCs, especially single-member ones, because they tend to see them as less stable than traditional corporations.

That doesn’t mean you can’t get approved for a mortgage, business loan, or credit line, it just means the process might be more demanding. Think bigger down payments, more documentation, and often a personal guarantee to back it all up. Corporations usually have a clearer credit profiles, which banks are more comfortable with. So if expanding your real estate investment plans involves outside funding, it’s worth prepping strong financials. And yeah, sometimes applying in your own name instead of through the LLC makes the path smoother.

Do Real Estate Agents Need an LLC?

You don’t have to form an LLC for real estate agents, but honestly, it’s something a lot of folks eventually do. If you’re still learning the basics, here’s an introductory guide to LLCs that walks through how they work, who should form one, and what protections they offer. It helps with liability protection, keeps your personal assets separate from your real estate business, and can lead to some nice tax advantages along the way. If you're still operating as a sole proprietor, you're personally on the hook for any legal or financial fallout tied to your deals—which isn’t ideal.

Now, if you're working solo or starting to dabble in property investing, an LLC gives you formal legal entity. It adds credibility and gives you a little extra peace of mind. That said, not everyone needs one right away. If you’re just getting going or still under a broker’s license, it might be smarter to wait until your income (or risk), starts to grow.

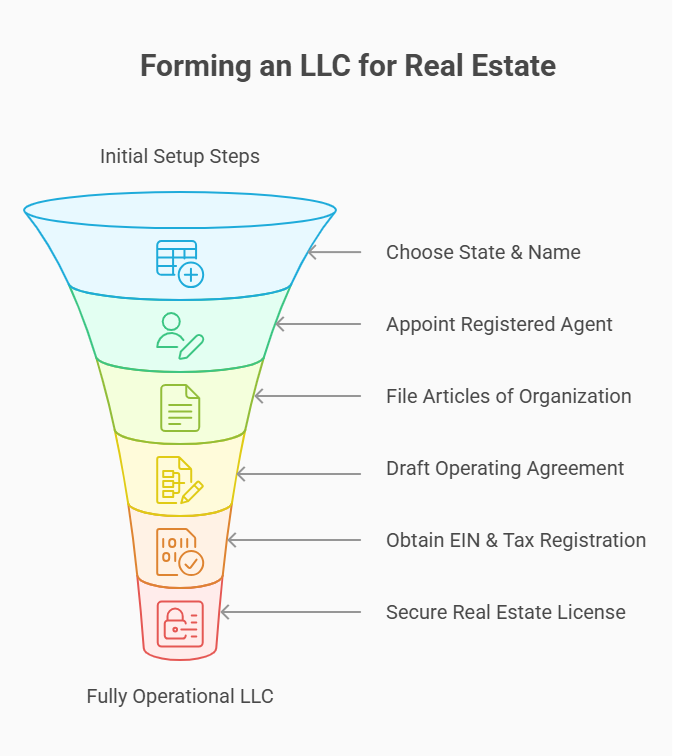

How to Form an LLC as a Real Estate Agent

It can be overwhelming to think about starting an LLC for your real estate business but when going through the process step by step it’s easy. If you need a full overview, this beginner’s guide to starting an LLC walks through the paperwork, fees, and legal choices involved in setup. Before you begin filing, it’s smart to know you don’t always need a formal business plan, this LLC formation without a business plan article explains when it's okay to skip it and still stay protected. This section explains what you need to do to form an LLC, starting off by naming your company, filing documents, and securing licenses. You’ll learn how to do all that the right way–legally, efficiently, and by state rules.

Step 1: Choose Your State & Business Name

The first step in forming an LLC is selecting the state where you will conduct your real estate business. The majority of real estate agents pick their home state, this is known as forming a domestic LLC, and it’s the most common route for new businesses. If you want to better understand the differences between state-formed and out-of-state LLCs, check out this guide to domestic LLCs which explains structure, registration, and benefits in detail. However, if you are investing in several states, you might consider registering in each or creating a series LLC in a business-friendly state such as Delaware or Wyoming.

Next, choose a compliant and memorable business name. State laws require an LLC name that is distinct from other entity names within the state. Moreover, it must contain “Limited Liability Company” or “LLC.” You can check your state’s online database for name availability. Think about getting a similar domain name and having it matches your brand. A well-chosen name can enhance the credibility of your business and aid in marketing, but it also helps to distance yourself from your legal entity.

Step 2: Appoint a Registered Agent

LLCs for real estate agents must designate a registered agent (individual or company) to receive legal papers and government mails on your behalf. For service of process (suit), tax form, notice and reminder, law needs your legal entity to be contactable. If you're new to LLC filings, it’s helpful to understand the difference between an LLC organizer and registered agent, they handle different roles in the formation process.

While you have the option to be your own registered agent, most professionals hire a third-party service to keep things private and avoid missing important documents. These are particularly helpful for anyone who has odd hours, frequent traveller or own investment properties in different states If you’re unsure who to trust, check out this expert-reviewed list of the most reliable registered agent options for small real estate businesses. Understanding exactly what a registered agent does, including how they handle legal notices, compliance deadlines, and privacy—can help you choose the right fit. When you stay on top of your official duties, you help maintain the limited liability status of your LLC.

Step 3: File Articles of Organization & Pay Filing Fee

To start your LLC for your real estate business, you must file Articles of Organization with your state’s business division, typically the Secretary of State. Going to this document, you will find basic information including your LLC name, business address and registered agent information.

The filing fee, which depends on the state, is often required for your application costing about $50 to $300. Some states offer online filing for faster processing. For example, the State of Minnesota provides a step-by-step breakdown of how to form an LLC including Articles of Organization, naming rules, and registered agent requirements. If your LLC is approved, it becomes a legal entity and you will receive a certificate. Keep a copy for your records; you need it to set up a bank account and apply for licenses to prove the business structure’s legal existence.

Step 4: Draft an Operating Agreement Tailored to Real Estate

An LLC operating agreement lays out how your real estate business functions on the inside, from how profits are shared and decisions are made to ownership shares and each member’s responsibilities. While not all states require it by law, having one is strongly advised, especially for real estate agents who share ownership or manage investment properties.

This internal agreement reinforces your limited liability by proving that your LLC operates as a legitimate business entity. You can tailor the document to fit your real estate setup, including how commissions are split, who handles what in terms of management, and how property purchases or sales will be handled through the LLC.

Step 5: Obtain an EIN & Register for State and Local Taxes

After the formation of your real estate LLC, an Employee Identification Number (EIN) is required from the IRS. Essentially, this is the Social Security Number of one’s business and is required for opening bank account, file tax returns and hiring of employees. You can apply online for an EIN through the IRS website without any charge.

After that, sign up for any state or local taxes that are applicable, including sales tax (in some states), state income tax and business privilege taxes. As each state has its own set of rules, you should check your state's Department of Revenue site for information. When you remain compliant right from the start, you stay out of trouble for penalties and ensure your real estate business is legal and operational.

Step 6: Secure Your Real Estate License & Local Permits

Before getting your real estate business LLC in order, you need to make sure that your real estate license is in alignment with the new entity. In many states, this means notifying your state’s real estate commission and providing proof of your license in your LLC’s legal name. Visit your state’s licensing board for the specific procedures and transfer forms.

Depending on where you work, you might also need local business permits, zoning approvals, or an occupancy certificate. Building permits are generally needed for construction or work on structures such as houses, bridges, etc. Having the proper licenses and permits adds professional credibility to your business. It helps ensure your LLC for real estate agents is running from day one.

Stay Protected with a Registered Agent Built for LLCs

Northwest will handle the paperwork and shield your address—perfect for agents who value privacy and focus.

Tax Implications of an LLC in Real Estate

The tax implications of running a real estate business through an LLC are one of its biggest advantages—but also a major area of confusion. From how commissions are taxed to deductions for depreciation and 1031 exchanges, it’s important to understand your responsibilities and opportunities. This section breaks down how real estate agents and investors report income and reduce their tax burden legally.

Reporting Commission Income & Rental Profits

As a real estate agent, you report the commissions your LLC earned on your personal income tax return, typically through IRS Schedule C for business income. It shows that an LLC is a pass-through entity whereby the business itself pays no income taxes. Rather, taxes are paid on the net profit according to the individual tax rate.

If you have rental properties as part of your real estate business, you will report that income on Schedule E. You can deduct expenses such as repairs, management fees, insurance, and mortgage interest from this income to lower your taxable income. By keeping clear records and keeping your commissions separate to your rental income – your tax return will be more accurate.

Depreciation, 1031 Exchanges & Deductible Expenses

One of the biggest tax benefits of forming an LLC for real estate investing is you get access to strategic deductions. It is possible to deduct depreciation on property, even if it increases in market value. This lowers your taxable income and increases your net income without affecting your cashflow.

Correctly structured real estate investment LLC further allows you to defer taxes on property swaps using 1031 exchanges. These enable you to sell one property and reinvest the cash from the sale into another, no immediate capital gains tax. You can also them deduct mortgage interest, repairs, office supplies, travel, and a home office, as long as you only use it for your real estate business. If you maximize these deductions, you can keep more money in your pocket year after year.

Quarterly Estimated Taxes & Withholding Rules

If you earn income through an LLC for your real estate business, you are required to pay quarterly estimated taxes, not simply file once a year. These payments are made for income tax as well as self-employment tax, due in April, June, September, and January. Missing deadlines can lead to interest and penalties.

If you are a real estate agents and receive commission income, you should estimate the tax you will owe based on your net commission earnings (net of expenses) – not your gross sales price. Use IRS Form 1040-ES to calculate and submit payments. Since no one is withholding taxes for you, it’s up to you to keep up and avoid surprises at year-end. Certain agents collaborate with tax experts in order to estimate and manage the payments.

Maximizing Liability Protection & Asset Safety

Real estate agents can benefit from LLCs as they do not just organize your business, but also protect your personal assets from your professional risk. Without that legal separation you face the threat of a lawsuit over a failed deal or a rental dispute that could endanger your home, savings, or investments. Forming an LLC gives you a separate legal entity that protects your liability.

Maximize your liability protections with these useful tips and strategies.

- Keep business finances separate with a dedicated bank account and credit card.

- Use your LLC’s name on contracts, leases, and marketing materials.

- Maintain proper documentation, such as an operating agreement and annual reports.

- Purchase adequate insurance to complement your legal protections.

- Avoid personal guarantees whenever possible in loans or rental agreements.

When combining these actions with your LLC, you bolster the corporate veil. This keeps the real estate business protected, even if disputes arise.

LLC vs. Other Business Structures for Real Estate Agents

Selecting the right business structure is just as important as generating leads. While working alone or with the team, the structure you choose has legal and tax ramifications. The structure also governs liability, profit-sharing and more. The Small Business Administration’s guide to choosing a business structure outlines three key factors—liability, taxation, and flexibility—that can help you make a more informed choice. Here’s how an LLC for real estate agents compares to sole proprietorships, partnerships, and corporations so you can make a savvy choice.

Sole Proprietorship vs. LLC: Risk & Tax Differences

A sole proprietorship is the simplest way of starting a real estate business. But it lacks a legal barrier between the firm and personal life. Your personal assets, such as your car and home, could be at risk if a client takes you to court or if you default on a business loan. An LLC for real estate agents, however, will offer liability protection due to it being a separate legal entity.

Both structures are subject to pass-through taxation from a tax perspective, so income gets included in your personal tax return. But LLCs are more flexible and allow you to elect S-Corp, which may afford some savings on self-employment taxes. It helps ease retirement planning processes, profit allocation and boosts credibility as you expand business.

Key differences at a glance:

| Feature | Sole Proprietorship | LLC |

|---|---|---|

| Liability Protection | None | Yes, shields personal assets |

| Legal Structure | Individual only | Separate legal entity |

| Taxation | Pass-through | Pass-through or S-Corp option |

| Business Credibility | Lower | Higher with formal structure |

| Startup & Compliance Cost | Minimal | Moderate to High |

LLC vs. S-Corp Election: When to Choose S-Corp

A real estate agent’s LLC is automatically taxed like a sole proprietor or partnership. However, the LLC can elect to be taxed like an S-Corp for self-employment tax savings. The arrangement lets you receive a fair compensation (payroll tax applicable) while enjoying supplementary earnings as distributions not exposed to employment taxes.

However, this strategy works well for agents who make over $75,000 a year. S-Corp election adds complexity, such as running payroll, filing extra tax forms, and compliant with strict rules. For those who earn a lot, tax savings generally outweigh the hassle.

Why choose S-Corp status as a real estate agent?

- Reduce self-employment tax burden

- Split income into salary + distributions

- Maximize tax efficiency for high earnings

- Still retain the liability protection of an LLC

Partnership & Corporation Options Explained

If you are starting your real estate novel business with one or more co-owners, a general partnership is the simplest structure, but shared liability comes with it. This means any partner can be held personally liable for business debts or litigation. An LLC with more than one member is safer as they provide limited liability and allow pass-through taxation too.

If, on the other hand, you plan to seek investors or reinvest profits, then a C-Corporation may be the entity type for you. C-Corporations (or C-corps) incur double taxation. This means that the corporation itself is taxed on its net income and then the shareholders are treated as separate entities that also get taxed on dividends. Often forming a corporation offers great credibility and growth. However, an independent real estate agent and small teams of investors do not need it. If you're weighing your options, this comprehensive comparison between LLCs and corporations can help clarify which entity type aligns best with your business goals. It details everything from legal structure and tax implications to ease of formation and investor appeal.

Frequently Asked Questions: LLCs for Real Estate Agents

When it comes to forming an LLC for real estate agents, common questions often revolve around cost, compliance, taxes, and bank accounts. Below are concise, expert-level answers to the most frequently searched queries—each crafted to help you make confident decisions and stay compliant.

How much does it cost to set up an LLC as a real estate agent?

The cost to form an LLC varies by state, typically ranging from $50 to $500 in filing fees. Some states also charge annual fees or require publication notices. You may also pay for registered agent services ($100–$300/year) and optional legal help. Always check your state’s Secretary of State website for exact costs.

Can I convert my sole proprietorship to an LLC mid-year?

Yes, you can convert a sole proprietorship to an LLC mid-year in most states. The process typically involves filing Articles of Organization, obtaining a new EIN, and updating licenses or permits. You may also need to close your sole proprietor tax account and notify your state tax agency. Mid-year conversions don’t retroactively apply, so your business income may be split between both structures on your tax return.

Do I need separate bank accounts for my LLC?

Yes, every LLC for real estate agents should use a separate bank account for business finances. Mixing personal and business funds can jeopardize your limited liability protection and make bookkeeping a nightmare. A dedicated account helps track income, pay expenses, and simplifies tax reporting. Most banks require your Articles of Organization and EIN to open a business account under your LLC’s name.

How does an LLC affect my real estate commissions?

Forming an LLC for your real estate business doesn’t change how commissions are earned but does affect how they’re reported and taxed. Commissions are paid to your LLC instead of you personally, then passed through to your personal income tax return. This setup can provide liability protection and allows you to deduct business expenses, reducing your taxable income. Be sure your broker and state licensing board approve the LLC as your payee.

What ongoing compliance do real estate LLCs face?

Real estate LLCs must meet annual compliance requirements, which vary by state. These typically include filing annual reports, paying state fees, maintaining a registered agent, and keeping your operating agreement up to date. You’ll also need to file federal and state tax returns and ensure all business records remain separate from personal ones. Failure to meet these rules can result in penalties or loss of your limited liability protection.

Resources for Real Estate Agents Forming an LLC

If you're considering forming an LLC for your real estate business, these trusted resources offer formation guidance, tax help, licensing tools, and ongoing compliance support.

- IRS – Apply for an EIN (irs.gov): Get your Employer Identification Number free online — required for taxes, banking, and hiring.

- National Association of Realtors (NAR) (nar.realtor): Offers legal and tax guidance for agents, including LLC best practices and structuring tips.

- Your State Real Estate Commission (varies by state): Required for updating license information when forming an LLC. Check your state agency for transfer forms and entity naming rules.

- SBA – Business Structure Guide (sba.gov): Breaks down key differences between sole proprietorships, LLCs, S-corps, and corporations.

- Local SBDC Office (Small Business Development Center) (americassbdc.org): Free one-on-one business consulting for formation, taxes, and strategy planning, with offices in every state.

Whether you’re launching a brand or protecting your assets, these tools can help make your real estate LLC legit, compliant, and built to last.

uild a Safer Business Foundation for Your Realty Practice

Harbor Compliance sets up your real estate LLC the right way – so you focus on sales, not legal forms.