Are you weighing the benefits of forming an LLC versus electing S corporation status? Curious how each structure affects your taxes, ownership rules, and day-to-day formalities? Want to know which option will best protect your personal assets while maximizing your business’s growth potential?

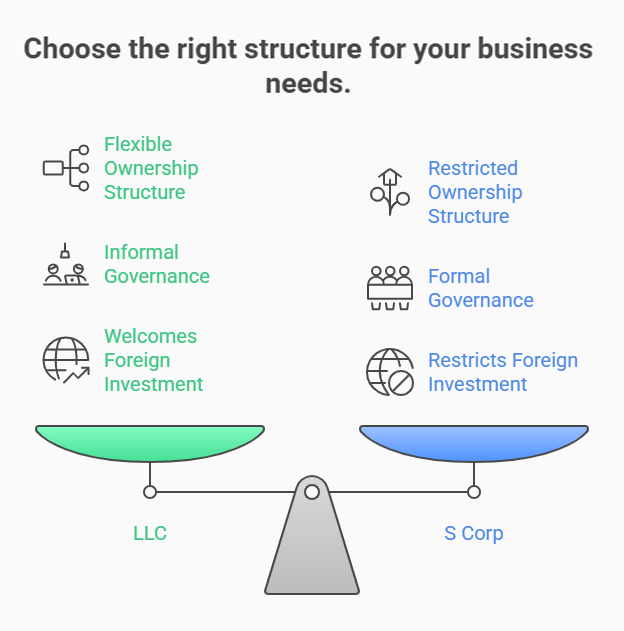

An LLC provides flexible management and pass-through taxation with minimal formalities, whereas an S corporation offers similar liability protection but adds shareholder restrictions and potential payroll-tax savings by splitting income into salary and distributions. LLC owners—members—enjoy simple setup and can allocate profits freely, but pay self-employment taxes on all earnings. S corps must adhere to IRS eligibility rules—100 shareholders max, U.S. persons only—and require reasonable salaries for owner-employees, enabling dividends to bypass self-employment tax. Your decision will impact your tax burden and administrative workload over the long term.

In this article, you’ll learn:

- How to form an LLC versus incorporating and electing S status

- Key tax differences and when to consider the S election

- Governance requirements, from operating agreements to corporate bylaws

- Ongoing compliance obligations and cost considerations

Ready to choose the right structure for your business? Let’s dive into the details!

What Is an LLC vs. an S Corporation?

Choosing the right business structure is the first legally significant decision any founder makes. While both a limited liability company (LLC) and an S corporation shield personal assets, they handle ownership, taxation, and formalities in very different ways. In the next sections you’ll see how each entity is built, what paperwork it takes to start, and how the upfront costs stack up. For a broader comparison of LLCs to traditional corporations, see our article on LLC vs Corporation.

LLC Definition and Structure Explained

An LLC is a flexible hybrid that blends the pass-through taxation of a partnership with the liability shield of a corporation. Under state statutes, limited liability companies are formed by filing articles of organization, appointing a registered agent, and paying a modest fee—typically under $200. Because requirements vary by state, check out how to start an LLC in Florida for a detailed example. Owners, called members, can be individuals, trusts, or even other companies, and there is no ceiling on their number. Profits and losses automatically flow to each member’s personal income-tax return, preventing double taxation, yet members retain insulation from most business debts and lawsuits. Governance stays simple: you may manage the company yourself or delegate day-to-day decisions to hired managers. Because the statutory framework is intentionally broad, start-ups, real-estate investors, and side-hustle consultants all use LLCs to test ideas without exposing household savings. For state-specific steps, see how to start an LLC in California and compare requirements.

S Corporation Meaning and Legal Setup

An S corporation isn’t a distinct charter—it is a tax election made under Subchapter S of the Internal Revenue Code. To walk through the exact incorporation steps, refer to our guide on how to form a corporation. After filing a state charter and adopting bylaws, shareholders file Form 2553 with the IRS within two months and fifteen days of incorporation. A compliant s corp must have one class of stock, no more than 100 shareholders, and none can be non-resident aliens or most entities. Like an LLC, it shields owners from business liabilities, but its signature benefit is tax: shareholders who work in the company draw a reasonable salary subject to payroll taxes, and remaining profits are distributed as dividends free of self-employment tax and corporate income tax. The model suits cash-generating professional firms where owners actively participate and retain only modest earnings for growth.

Key Differences in Formation Requirements

Although each entity delivers a liability shield, the way a legal entity comes to life—and the rules it must obey afterward—diverge sharply. Understanding these contrasts keeps paperwork on track and prevents costly re-filings.

- Founding document LLC files Articles of Organization; S corporation files Articles of Incorporation

- Owners LLC members unlimited; S corp shareholders capped at 100 U.S. persons

- Management LLC may be member- or manager-managed; S corp must install officers and hold director meetings

- Tax classification LLC is default pass-through but may elect S; S corp is pass-through once election is accepted

- Record-keeping LLC minutes optional; S corp must maintain bylaws, stock ledger, and annual minutes

Because the state clerk looks for articles of incorporation or organization to verify existence, choosing the right document on day one accelerates approval, speeds EIN issuance, and sets the tone for future compliance.

LLC vs. S Corp Formation Costs

Startup budgets vary by state, but most costs stem from government filing fees and optional professional help. For a complete breakdown of the cost to start an LLC across jurisdictions, see our resource on cost to start an LLC. Filing articles of organization for an LLC runs between $50 and $200, with expedited service adding $25 to $100. Drafting an operating agreement is free if you use a template but averages $150 when an attorney reviews it. Creating a corporation and later electing S status costs slightly more because you must file Articles of Incorporation, adopt bylaws, and issue stock certificates. Expect $50 to $350 in state fees plus legal drafting that can climb to $800 in large markets.

| Cost Item | LLC (Typical Range) | S Corp (Typical Range) |

|---|---|---|

| State filing fee | $50 – $200 | $50 – $350 |

| Name reservation (optional) | $20 – $30 | $20 – $30 |

| Expedited processing | $25 – $100 | $25 – $100 |

| Attorney/template docs | $0 – $500 | $0 – $800 |

| Initial report/statement | $0 – $100 | $0 – $125 |

LLC vs. S Corp Tax Differences

Taxation is where LLCs and S corporations truly part ways. For up-to-date figures on current LLC tax rates, check our analysis of LLC tax rate. Both avoid the corporate income tax imposed on C corporations, yet the mechanics of applying federal tax rules can move thousands of dollars in or out of your pocket. The comparison table below distills how salaries, dividends, and self-employment contributions differ so you can forecast cash flow before making the S-Election.

| Feature | LLC (Default) | S Corp |

|---|---|---|

| Profits subject to SE tax? | Yes—entire net income | No—only salary subject to payroll tax |

| IRS form filed | Schedule C/E or Form 1065 | Form 1120-S |

| Owner salary required | No | Yes—must be reasonable |

| Potential payroll-tax savings | None | High once net profit exceeds salary |

| State unemployment/paid-leave tax | Optional | Required if salary paid |

How LLCs Are Taxed by Default

By default, the IRS treats a single-member LLC as a disregarded entity. The business doesn’t file its own income-tax return; instead, the owner reports profits and losses on Schedule C or E of the personal Form 1040. Multi-member LLCs file an informational partnership return (Form 1065) and issue K-1s to each member. In both setups, the entire distributive share is subject to self-employment tax — 15.3 percent on the first $168,600 of combined wages and profits for 2025 and 2.9 percent above that ceiling. While this simplicity makes bookkeeping easier, it can become expensive for high-margin service firms because every extra dollar of profit also triggers the Medicare surtax once thresholds are met. Owners may deduct half of the self-employment tax, but cash flow still leaves the business. Learn more about the implications of a disregarded entity LLC in our detailed overview.

S Corp Salary and Dividend Taxation

An S corporation splits an owner’s compensation into two buckets: salary and profit distribution. The salary portion is subject to regular employment taxes—Social Security and Medicare—which the corporation withholds and remits just like any other employer. Net profits left after paying a reasonable salary flow to shareholders as dividends that bypass self-employment tax. This structure often saves thousands once annual profits exceed the salary the Internal Revenue Service considers reasonable for your role, industry, and region. The corporation files Form 1120-S and sends each shareholder a Schedule K-1 detailing salary and dividend amounts. Because under-payment penalties are steep, most owners benchmark salaries against Bureau of Labor Statistics data and document their rationale in meeting minutes.

Self-Employment Tax: LLC vs. S Corp

Self-employment tax is the hidden cost entrepreneurs overlook. For an LLC, the entire profit increases the member’s tax basis but is also hit with the 15.3 percent payroll levy. In an S corp, only the salary portion triggers Social Security and Medicare; dividends do not. However, pushing the salary too low invites an IRS reclassification audit that can impose back taxes and penalties. A practical rule is to tie salary to market pay for a comparable employee and distribute the balance as dividends. Once net earnings top roughly $80,000 per owner, the S election typically yields noticeable savings even after added payroll-service fees and state unemployment insurance.

Tax Filing Requirements for Each Structure

An LLC’s reporting load stays light. Single-member LLCs fold data into the owner’s personal tax return, while multi-member LLCs file Form 1065 and issue K-1s yet pay no entity-level tax. S corporations must prepare Form 1120-S, payroll-tax filings, state unemployment reports, and W-2 statements. Although the federal S return remains informational, many states levy separate franchise or filing fees regardless of profits. Bookkeeping must track reasonable salaries, shareholder distributions, and basis adjustments to avoid double taxation upon liquidation. Because penalties accrue quickly if any form arrives late, most S corps invest in payroll software or a CPA, adding roughly $600 to $1,200 in annual compliance cost versus the DIY-friendly LLC.

When to Elect S Corp Status for an LLC

Electing S status makes sense once the marginal tax savings outweigh extra payroll, accounting, and compliance costs. A common benchmark is $80,000 to $100,000 in net profit per active owner after salary. Below that, the complexity often erodes benefits. Timing matters: you must file Form 2553 within 75 days of formation or by March 15 of the year you want the election to take effect. Late relief is possible but burdensome. Before filing, confirm eligibility—no trusts, non-resident aliens, or multiple stock classes allowed. Also evaluate state taxes; some jurisdictions charge S corporations more than they save, which can flip the calculation.

Ownership Rules: LLC vs. S Corp

Control and profit sharing shape culture as much as taxation. LLCs cater to flexible business owners who want bespoke arrangements, whereas S corporations regulate equity to preserve pass-through status. The next subsections explain how many people can participate, what documents memorialize their rights, and why foreign investors often push founders toward an LLC even when the tax math seems neutral.

LLC Ownership Flexibility

An LLC can have a single member or hundreds, and they may be individuals, corporations, or foreign entities. Members receive percentage or unit interests defined in the operating agreement, which can assign voting, profit, and liquidation rights in almost any pattern the parties negotiate. This contract-driven model lets family enterprises gift non-voting stakes to children, venture funds receive preferred returns, or service partners earn sweat equity without endangering personal assets. Transfers require only an amendment to the operating agreement unless restricted by state law, and new members may enter without resetting tax basis for others, making LLCs attractive for joint ventures that plan several funding rounds.

S Corp Shareholder Restrictions

The upside of S status comes packaged with tight eligibility rules designed to keep the entity small and domestic. Shareholders must be U.S. citizens or residents, natural persons (with limited exceptions for certain trusts), and they cannot exceed 100 in total. The corporation may issue only one class of stock, though voting rights can vary. These constraints simplify allocation of earnings but complicate raising capital from venture funds or foreign investors. Governance also shifts: shareholders elect a board of directors that appoints officers who run day-to-day operations, introducing formalities absent in most member-managed LLCs. Minutes, bylaws, and stock ledgers become mandatory, and failure to maintain them can jeopardize liability protection or the cherished S election.

Foreign Ownership Rules Compared

Foreign participation highlights the fork in the road. S corporations categorically bar non-resident shareholders, so founders anticipating overseas investors or expansion should remain an LLC or convert to a C corporation later. LLCs, by contrast, welcome foreign individuals and legal entities, although withholding and treaty considerations apply. International members file Form W-8BEN and may owe U.S. tax on effectively connected income, but the structure itself remains intact. For cross-border real-estate deals or intellectual-property holding companies, the LLC’s flexibility often outweighs potential self-employment-tax costs. If foreign money enters after an S election, the corporation loses its status retroactively, triggering back taxes and penalties, so plan capitalization early.

Management and Legal Requirements

Legal paperwork may feel like overhead, yet it is the framework that keeps owners aligned and courts satisfied. An LLC lets you embed most rules in an corporate law operating agreement and then run informally, but an S corporation must follow formal rituals that protect creditors and minority investors. Knowing which chores appear on each calendar prevents last-minute scrambles and costly reinstatement petitions.

Member-Managed vs. Corporate Governance

In a member-managed LLC, every owner can bind the company, sign contracts, and approve expenditures without passing through formal votes. The model works well for close-knit teams because decisions are logged in minutes only when stakes are high. That informality never weakens the underlying liability protection—creditors still limit claims to business assets—but it does demand trust among participants. By contrast, an S corporation separates power into three layers: shareholders elect directors, directors set policy, officers carry it out. This hierarchy forces regular meetings, written consents, and recorded resolutions before major moves like buying real estate or admitting new investors. The added paperwork can slow rapid pivots, yet it gives outside partners confidence that no single founder will unilaterally drain cash or pivot strategy without oversight.

Required Formalities: LLC vs. S Corp

Formalities exist to create a paper trail rather than to satisfy bureaucrats. If you plan multi-state operations, explore our list of the best states to start an LLC for jurisdictional advantages. An LLC’s operating agreement may waive annual meetings altogether, but you still must update state records when members change or capital is raised. An S corporation, by contrast, files organizational minutes, adopts bylaws, issues stock, and records every shareholder vote. State clerks rarely police these items proactively, so founders must create their own checklist and tick tasks off immediately after filing.

- Draft initial bylaws or minutes within thirty days

- Issue stock certificates and log them in a ledger

- File a statement of information and list all officers

Failing to observe even one of these basics can pierce the liability veil, expose owners to personal suits, and jeopardize future funding rounds because auditors see incomplete books as a red flag.

Bylaws, Meetings, and Reporting Rules

Once an LLC or S corporation is up and running, record-keeping duties diverge further. LLC members generally document big decisions by signing consents, and banks rarely ask for more unless the company applies for a sizable credit line. S corporations, on the other hand, must keep bylaws on site, schedule annual meetings, and retain minutes showing directors approved salaries, dividends, and loans. Regulators care because sloppy minutes can cast doubt on the business tax status—if the entity looks like a sole proprietorship in practice, auditors may attempt reclassification and assess back taxes. The safest habit is to schedule one short board call per quarter and archive signed minutes in cloud storage for long-term compliance.

Profit Distribution and Payroll Rules

Paying yourself from an LLC or S corporation involves more than moving cash—the method you pick can tilt the IRS spotlight. For best practices on LLC distributions, see our dedicated guide. An LLC distributes profits and losses according to the operating agreement, and each member owes self-employment tax on every dollar withdrawn. By contrast, an S corporation forces working owners to take a reasonable salary processed through payroll. Only the leftover profit becomes a dividend exempt from Social Security and Medicare, which can shrink total employment tax once margins climb.

- Set payroll on a monthly cycle to simplify withholdings

- Recheck W-2 and K-1 totals before submitting tax returns

- Track shareholder loans separately to avoid deemed dividends

Regardless of entity type, keep distributions proportional to ownership unless an amended agreement or special allocation follows Internal Revenue Code § 704(b). Mixing personal and business transfers without documentation can trigger audits, reclassifications, and penalties that easily erase five years of tax savings. Document every payment with board or member consent minutes.

Compliance Requirements and Ongoing Costs

Launching an entity is exciting, but the true cost of ownership emerges over the years that follow. Each state bills an annual report fee, and the IRS expects timely elections and updates. Missing one deadline rarely means closure, yet late penalties snowball fast. A disciplined calendar and modest budget keep your business tax exempt from unnecessary fines.

Form Your LLC Easily with ZenBusiness

Avoid late fees and compliance headaches — ZenBusiness helps you form your LLC and provides reliable registered agent services in all 50 states.

Annual Reports and State Fees

Every jurisdiction imposes its own reporting rhythm, but most states require an annual or biennial statement that lists the principal office, registered agent, and current managers or directors. For LLCs, the filing runs $50 – $150; ignore it and the state will mark your company Delinquent in public databases, undermining credit applications. S corporations file the same report plus franchise taxes in states such as Delaware and Texas. While these levies are not an income tax, they can still exceed $400 a year for high-revenue companies. Budget extra for publication fees in Arizona and newspaper notices in Nebraska. The simplest hack is to enroll in automatic email reminders, pay the bill the day it arrives, and upload the stamped receipt to cloud storage where investors, lenders, and auditors can find it instantly.

S Corp IRS Election and Maintenance

Form 2553 is only the beginning. After the IRS accepts your S election, you must continue to meet every eligibility rule or the agency will terminate the status retroactively and impose double taxation for each affected year. The corporation must track shareholder count, verify that no owner is a non-resident alien, and maintain a single class of stock at all times. If you issue preferred shares, the election dies instantly. Each year you also file Form 1120-S, deliver K-1 statements by March 15, and ensure payroll-tax deposits reconcile with W-2 wages. When ownership changes, file Form 8940 for late unions or use an entity-classification letter to restore status. Assign these tasks to a dedicated officer to keep the checklist moving even when founders are busy scaling sales.

Pros and Cons of LLCs and S Corporations

Every entrepreneur eventually asks the same question: will flexible governance or tighter discipline move the company further? The snapshot below pairs real-world pain points—bank loans, payroll costs, investor perception—with each entity’s strengths, so you can judge the fit quickly and keep personal liability safely walled off without drowning in paperwork. Because formation documents are only the beginning, we also weigh what happens after year one, when cash flow rises and compliance reminders pile up.

Advantages and Disadvantages of an LLC

An LLC’s core appeal is simplicity. You can draft an operating agreement in a single afternoon, file online, and open a bank account days later. State law allows creative profit-splits, preferred returns, and sliding voting scales—ideal for friends, families, and real-estate syndicates where contributions differ. Because investors join through amendments rather than stock issuances, negotiations stay private and inexpensive.

- Flow-through taxation—no corporate layer

- Fewer formal meetings or minutes

- Flexible allocation of cash or losses

- Entire profit hit by self-employment tax

- Some investors view LLC units as unfamiliar securities

- Banks sometimes ask for personal guarantees

Annual upkeep is lean; most states charge under $150 to keep an LLC active and impose minimal disclosure. Still, appointing a knowledgeable registered agent and scheduling calendar reminders prevents silent dissolutions that can wipe websites from search results, void contracts, and stall funding rounds when diligence teams check status.

Pros and Cons of S Corporation Status

The S corporation shines once the business produces predictable excess cash. By carving income into salary and dividends, active owners can trim payroll taxes while still paying themselves W-2 wages that banks love. The entity’s corporate pedigree is familiar to lenders and vendors, and its bylaws reassure partners who expect formal governance and transparent cap tables.

- Payroll-tax savings on dividend portion

- One class of stock keeps voting straightforward

- W-2 income can boost mortgage approvals

- Strict shareholder cap and citizenship rules

- Must pay reasonable salary, adding payroll complexity

- Dividend misclassification risks IRS penalties

Because the internal revenue service rigorously polices reasonable compensation, founders must budget for payroll software, quarterly payroll-tax deposits, and annual W-2 preparation. The compliance cost is minor once net profit tops six figures, yet skipping it risks reclassification audits that could erase years of tax savings and trigger accuracy-related penalties.

How to Convert an LLC to an S Corporation

Switching from LLC to S corporation status is mostly a tax move, yet timing and paperwork matter. Treat it like upgrading your corp status rather than forming a brand-new entity.

- Verify eligibility: no more than 100 shareholders, all U.S. citizens or residents, one class of stock.

- Amend your operating agreement to reflect stock language and director authority.

- File Articles of Incorporation or a statutory conversion form with the state.

- Adopt bylaws, issue stock certificates, and record opening minutes.

- Submit Form 2553 to the IRS within 75 days of the conversion effective date.

- Update payroll to run W-2 wages and enroll in state unemployment programs.

- Notify banks, insurers, and vendors of the new classification.

File county, city, or taxable income registrations the same week so local agencies map your new EIN suffix correctly. From there, keep both your old LLC documents and new S-election letter on hand for lenders.

LLC vs. S Corp FAQs

Every founder has at least one lingering doubt after comparing LLCs and S corporations. The concise answers below tackle the most common sticking points—from payroll planning to future conversions—so you can pick the right business entity and move forward with confidence. Each reply is straight to the point, reliable in 2025, and easy to act upon today.

Which saves more on taxes—LLC or S Corp?

LLCs save on administration, but S corporations typically deliver greater tax savings once active owners earn at least $80,000 in net profit after salary. At that level, shifting excess income to dividend treatment bypasses 15.3 percent self-employment tax, often offsetting added payroll and state filing costs. Below that threshold, simplicity wins. For passive investors or real-estate ventures where members do not draw wages, the LLC’s default treatment usually produces the lighter total burden.

Can an LLC become an S Corp later?

Yes. File Form 2553 to elect S status. The LLC keeps its state charter while the IRS treats it under Subchapter S of the internal revenue code. Make sure you meet citizenship and stock-class rules, adopt bylaws, and start issuing W-2 wages. Most conversions finish in a week because bank accounts and contracts stay in place, though you must tell lenders and insurance carriers about the change.

Is an S Corp better for small businesses?

For many business owners, an S corporation is better if profits comfortably exceed a reasonable salary and everyone is a U.S. person. That mix delivers payroll-tax savings without violating shareholder caps. However, if you plan to court foreign investors, allocate profits unevenly, or reinvest heavily in growth, the LLC’s flexibility can save legal fees and prevent an early restructuring. Start-ups with tight margins often begin as LLCs and elect S status only when revenues prove consistent.

What’s the easiest structure to manage?

An LLC is generally the easiest to manage, while a sole proprietorship is simpler but offers no liability shield. LLCs skip mandatory director meetings and can waive annual minutes in most states, while S corporations must draft bylaws, hold board meetings, run payroll, and file Form 1120-S every year. If your schedule is packed and risk tolerance low, an LLC offers the best trade-off between protection and hassle. If you’re weighing even simpler alternatives, our comparison of LLC vs DBA can help.

Start Your Business Right with Harbor Compliance

Whether you're forming an LLC or electing S Corp status, Harbor Compliance handles your filings and keeps you compliant — so you can focus on growth.