Are you weighing the benefits of an LLC versus a C corporation for your business?

Want to know which structure offers the best tax treatment and liability protection?

Curious how compliance requirements and fundraising potential differ between the two?

An LLC provides simple pass-through taxation—profits and losses flow directly to members—flexible management via an operating agreement, and lighter annual reporting, making it ideal for small businesses and service providers. A C corporation, by contrast, is taxed at the corporate level (21%) and again on shareholder dividends, but it supports multiple stock classes, easy transferability of shares, and strong appeal to institutional investors and venture capital. While C corps demand stricter formalities—annual meetings, bylaws, and detailed minutes—their structure unlocks broader equity incentives and Section 1202 gain exclusions for founders.

In this guide, you’ll explore:

- Key tax differences, including pass-through vs. double taxation

- Ownership and management structures for each entity

- Compliance formalities and ongoing reporting requirements

- Fundraising advantages and equity incentives

Ready to choose the right structure for your goals? Let’s dive in!

Start Your Business the Smart Way with ZenBusiness

Form your LLC or corporation with expert help, fast filing, and full compliance support — so you can focus on growth.

What Is the Difference Between an LLC and a C Corporation?

Choosing between an LLC and a C corporation starts with understanding how each business structure controls ownership, governance, and taxes. While both protect owners from the debts of the company, they diverge on paperwork, funding options, and how profits land on your personal return. The next sections break down definitions, formation steps, and compliance demands so you can match the entity to your growth goals. Not sure if you even need an LLC? Check out our guide on do you need an LLC?

Definition of an LLC (Limited Liability Company)

A limited liability company, often shortened to LLC, blends the contractual freedom of a partnership with the asset wall of a corporation. Learn exactly what does LLC mean and why it matters for your structure. Like other limited liability companies, it is created under state statute by filing articles of organization and paying a modest fee. Owners, called members, may be individuals, trusts, or even other entities, and they decide whether the company will be taxed as a sole proprietorship, partnership, or corporation. Curious how it works with just one owner? See our explanation of what is a single member LLC. Profits and losses generally flow directly to members, avoiding entity-level tax, yet the structure still shields personal cars, homes, and savings from business lawsuits. There is no cap on the number of members, foreign ownership is allowed, and internal rules live in an operating agreement that can be as simple or complex as the venture demands. Because management can be member-managed or manager-managed, startups get flexibility without the rigid ladder of corporate titles.

What Is a C Corporation and How Does It Work?

By contrast, a c corp is a separate legal person under both state corporate statutes and federal tax law. It comes to life when incorporators file articles of incorporation, issue stock, and adopt bylaws overseen by a board of directors. Shareholders own freely transferable shares, and ownership can scale from a single founder to millions of public investors. Because the corporation, not its shareholders, earns the income, it pays corporate income tax at a flat 21 % rate, then distributes dividends that shareholders report again on their individual returns. This double layer is the price of perpetual life, unlimited fundraising potential, and familiar governance for venture capital and institutional funds. Standardized record-keeping, formal meetings, and strict fiduciary duties create predictability, making the structure ideal for businesses planning to reinvest profits, raise multiple rounds, or eventually list on a major exchange. Ready to incorporate? Here’s how to start a corporation and meet all requirements.

Formation Process and Filing Requirements for Both

Forming either legal entity starts with state filings but the paperwork depth differs. For step-by-step instructions, read our complete guide on how to form an LLC. An LLC generally submits short articles of organization listing the name, registered agent, and management choice, then drafts a private operating agreement. A C corporation files articles of incorporation, creates bylaws, appoints initial directors, and issues share certificates. Both must obtain an EIN from the IRS, register for state taxes, and secure any local licenses before opening bank accounts. Where corporations must hold an organizational meeting and record minutes, LLCs can skip formal meetings unless members want them. Average state filing fees range from $50 to $150 for LLCs and $80 to $300 for corporations, but professional help or expedited services add to the budget.

Ownership and Management Structures Compared

Ownership and authority shape daily decision-making, so understanding who holds power—and how they use it—matters as much as taxes. The following comparison clarifies how each entity classification allocates equity, votes, and responsibility, giving you a realistic preview of board meetings, member resolutions, and the paperwork that backs every signature.

Who Owns an LLC vs. a C Corp?

In an LLC, the business owners are its members, and membership units can be split in any ratio the operating agreement allows—down to fractions of a percent. There is no stock, so new investors receive membership interests that combine voting, profit share, and liquidation rights in a single bundle. A C corporation’s equity is stock, divided into common or preferred classes that can be issued in unlimited tranches. Shareholders may include individuals, funds, or even other corporations, and rights attach to the shares, not the people. Because shares are freely transferable, corporations can run employee option plans and court public markets, advantages that LLC units, bound by contract, rarely match without complex amendments.

How Are LLCs and C Corporations Managed?

LLCs offer a choose-your-own-adventure management structure. Member-managed companies operate much like partnerships, with every owner acting as an agent of the firm. Manager-managed models hand day-to-day control to one or more appointed managers—who can be members, outsiders, or a blend—while reserving big-picture decisions for member votes. Annual meetings are optional, minutes informal, and resolutions often circulate electronically. A C corporation, by statute, separates ownership and control. Shareholders elect a board of directors, the board sets strategy and appoints officers, and officers run operations. Regular board and shareholder meetings with recorded minutes are mandatory, and certain actions—like issuing new shares—require formal resolutions. That hierarchy reassures investors by clearly mapping authority but adds paperwork startups must schedule and archive.

LLC vs. C Corp Taxes Explained (2025)

Taxes influence cash flow more than any filing fee. To understand the after-tax dollars you keep, you need more than a headline rate—you must see how each entity handles taxable income from operations, salaries, and dividends. The next four sections translate complex code sections into plain English so you know what the IRS and states will claim in 2025. For a broader overview, dive into our detailed comparison of LLC vs corporation.

Pass-Through Taxation for LLCs

By default, the IRS treats single-member LLCs as disregarded entities and multi-member LLCs as partnerships, granting them pass-through taxation. Business income, deductions, and credits appear on Schedule C or K-1, then roll onto each member’s Form 1040. The entity itself files an informational return—Form 1065 for partnerships—but pays no federal income tax. Members pay individual tax on their share whether or not cash is distributed, and they owe self-employment tax on active earnings unless the LLC elects corporate treatment. Many states mirror the federal rule, though a few impose small entity-level franchise or gross-receipts taxes. Overall, pass-through status simplifies profit withdrawals and allows owners to use losses against other income, but it can complicate multi-state allocations.

Double Taxation in C Corporations

C corporations face double taxation: first on the company’s earnings at the 21 percent federal corporate income tax rate (plus state surcharges), and again when profits are distributed as dividends. Shareholders pay individual rates on those dividends, typically 15 % to 23.8 % when qualified. While the second layer sounds punitive, corporations can retain earnings for growth without triggering shareholder tax, deduct officer salaries, and benefit from broader deductions unavailable to pass-throughs. Additionally, dividends to tax-exempt investors or foreign shareholders may be taxed at reduced treaty rates or not at all, mitigating the burden. Companies planning to reinvest heavily often tolerate the structure because retained funds compound internally without owner-level tax.

S Corporation Election: Is It an Option for LLCs?

Both LLCs and C corporations can ask the internal revenue service for S corporation treatment, creating a hybrid: pass-through income but corporate formalities. For LLCs, the election is filed on Form 2553 after first choosing corporate status via Form 8832, effectively layering S rules onto an LLC wrapper. The reward is payroll savings; active owners split compensation between reasonable wages, subject to employment tax, and profit distributions, exempt from self-employment tax. Eligibility limits exist: no more than 100 shareholders, all U.S. persons, and only one class of stock. Multi-state LLCs must also track apportionment because some jurisdictions ignore the election for franchise-tax purposes. While paperwork heightens, many service businesses hit the breakeven point where FICA savings outweigh compliance costs.

LLC vs. C Corp: Which Has Lower Taxes in 2025?

Which entity pays the lower tax rate in 2025 depends on profit level and owner plans. Up to roughly $200,000 of annual profit, an S-elected LLC often wins, because owners avoid the 21 % corporate tax and qualify for the 20 % Qualified Business Income deduction. Mid-sized firms reinvesting earnings may favor the flat 21 % corporate rate, especially in states without their own corporate income tax. High-growth tech companies planning to chase venture rounds accept C-corp double taxation in exchange for Section 1202 qualified small-business stock, which can shield $10 million of gain at exit. Calculating the crossover point requires modeling salary, dividends, state rates, and future sale scenarios, but most SMEs see the LLC edge erode once profits and capital needs soar.

Lower Your Tax Burden with Northwest LLC Services

Form your LLC with Northwest and stay in control of your income with pass-through taxation and privacy-first support.

Liability Protection and Legal Requirements

Both LLCs and C corporations wall off owners from company debts, but the strength of that shield—and the paperwork behind it—differs. Before you sign contracts or take investor money, compare how each framework handles lawsuits, state reporting, and record-keeping so your limited liability protection actually holds up under pressure.

Do Both Structures Offer Limited Liability Protection?

An LLC and a C corporation both create a statutory barrier that keeps personal assets like your house, car, and savings beyond the reach of most business creditors. Courts treat the entity—not its owners—as the defendant, meaning judgments are paid only from company property or insurance. Banks and enterprise customers often perceive corporate protection as more time-tested, yet modern LLC statutes are equally strong in most states. Either structure blocks contract claims, slip-and-fall suits, and regulatory fines when you separate finances, sign in the entity’s name, maintain adequate insurance, and record capital contributions. In practice, good habits—not the filing label—preserve the shield. Need naming inspiration? Browse our list of the best LLC names.

Legal Formalities: LLC Operating Agreement vs. C Corp Bylaws

Paperwork is the backbone of any shield. An LLC relies on its operating agreement to define voting thresholds, capital calls, and dissolution steps, whereas a corporation turns to bylaws passed by its board of directors. Below are the core formalities:

- LLC: Sign operating agreement; issue membership certificates if desired; keep income and expenses in a dedicated bank account.

- C Corp: Adopt bylaws; hold initial board meeting; record share issuances and maintain a stock ledger.

- Both: Renew registered agent, file annual or biennial reports, and maintain meeting minutes or written consents.

Corporations also need written consent for option grants and major contracts, whereas LLCs can authorize deals with a quick member resolution or even an email thread.

Corporate Veil: When Can You Be Personally Liable?

Piercing the corporate veil happens when courts disregard the entity and tap owners for company debts because of fraud or sloppy governance—think commingled funds or missing minutes. Both structures are vulnerable, but judges apply a tougher standard to LLCs that operate with minimal capitalization. To keep personal liability off the table, follow your bylaws or operating agreement, sign documents in the entity’s name, fund the business to appear solvent, and keep detailed records. Courts look for undercapitalization, fraud, or alter-ego behavior. Keeping state fees current, using business credit cards, and maintaining consistency year after year further harden the barrier.

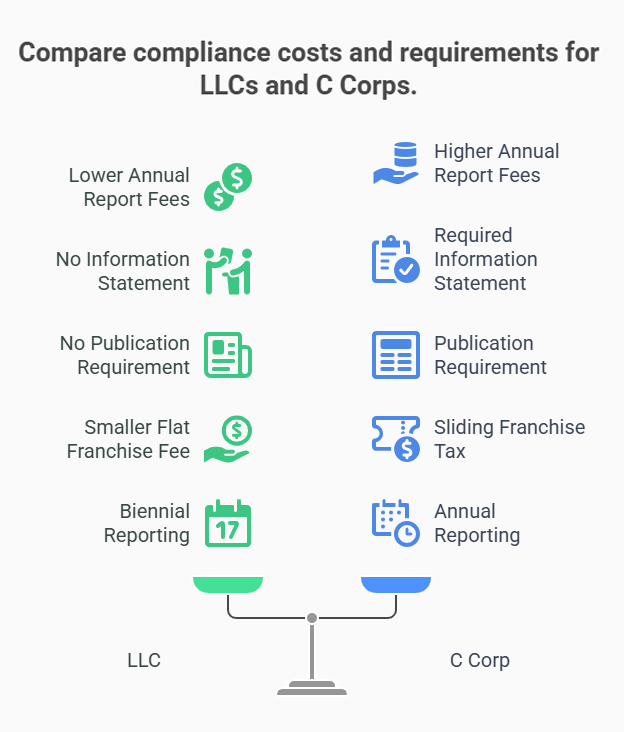

State Compliance Differences Between LLC and C Corp

States set different maintenance rules, and missing them can dissolve your legal requirements overnight. Key variances include:

- Annual Reports: Many states charge LLCs under $100; corporate reports can exceed $300 with franchise taxes.

- Information Statements: Some jurisdictions ask only corporations to list directors and officers each year.

- Publication: A few states still demand corporation announcements in newspapers, while LLCs skip this step.

- Franchise Taxes: Corporations in places like Delaware pay a sliding franchise tax; LLCs often face a smaller flat fee.

- Reporting Frequency: Several states let LLCs file biennially but require corporations to report annually.

Before choosing a state of formation, price out these recurring tasks; what looks cheap up front can cost thousands over a decade. Consult each secretary of state site or a compliance service to map deadlines, forms, and penalties in advance.

Raising Capital: LLC or C Corporation for Investors?

Growth often outpaces personal savings, forcing founders to tap outside cash. Structure affects how willing investors are to write checks, the paperwork they expect, and the tax consequences of exit events. The next sections weigh those issues so your venture capital pitch deck matches your legal footing and avoids costly surprises down the line. Understanding these nuances can accelerate funding rounds.

Is It Easier to Raise Funding as a C Corporation?

Institutional investors prefer the predictability of a corporation. A board of directors holds management accountable, stock classes allow preferred rights, and corporate law offers clear remedies for disputes. While an LLC can raise money, each new member needs a bespoke agreement amendment, slowing closings. For that reason, raising Series A or later rounds is business entity friendly in a C corp—especially if you plan to list on an exchange. Corporations can also grant stock options that align with standard venture term sheets, speeding negotiations and reducing legal fees. Familiarity alone can shave weeks off diligence timelines and bolster valuation confidence.

LLC Equity vs. C Corp Shares and Stock Options

LLC units bundle voting, profits, and liquidation in one contract, complicating option pricing and cap-table math. By contrast, C corp equity divides rights neatly: common shares for founders, preferred for investors, and ISO or NSO options for employees. The model syncs with 409A valuations and term sheets, making board of directors approvals routine. LLCs can mimic options through profits interests, but recruits often prefer share counts over capital-percentage language. Corporations also support option pools that automatically refresh after each financing, letting you hire aggressively without constant amendments. Separate share classes allow liquidation preferences, anti-dilution clauses, and tailored voting thresholds that reassure institutional money while preserving founder control.

Why Venture Capital Prefers C Corporations

VC funds raise money from tax-exempt partners that dislike pass-through K-1s, so they gravitate toward the corporate form. corporate law in Delaware and other startup hubs gives investors predictable fiduciary standards and swift injunctions when deals sour. Section 1202 qualified small-business stock offers up to $10 million in capital-gain exclusion—an incentive unavailable to LLC interests. Preferred stock also carries liquidation preferences and voting blocks that protect investors if growth stalls. Combined, these factors make C corps the default pick for venture-backed scaling.

Administrative Burden and Ongoing Costs

Record-keeping seldom excites founders, yet ignoring it dissolves protection and spooks investors. An LLC faces fewer formalities: no mandatory annual meeting and simplified minutes. A corporation files two tax returns, drafts bylaws, and logs every board resolution. Ongoing costs include:

- State reports: $50–$500 annually, plus franchise taxes where applicable

- Registered-agent service: $100–$300 per year

- Licenses and permits: renewals vary by industry and location

- Accounting and legal reviews: more frequent for corporations

Corporations also face quarterly estimated payments at both federal and some state levels, whereas many LLC owners remit only individual estimates. If you operate in multiple states, each foreign qualification adds another report and fee. Map compliance into cash-flow forecasts early so administrative costs don’t ambush your runway.

LLC vs. C Corp: Which Is Better for Your Business Model?

Selecting the right entity is about more than taxes; it shapes fundraising, ownership control, and exit paths. A service firm, a SaaS startup, and a holding company need different tools. The guide below compares both structures across growth stages so you see which legal entities truly fit your vision.

Best Option for Startups and High-Growth Companies

High-growth outfits chasing accelerators or institutional money almost always adopt the C corporation. Preferred stock, option pools, and Delaware case law give investors predictable governance while founders lock in Section 1202 stock perks. Because a corporation pays corporate income tax at 21 percent, retained earnings can compound internally until dividends are declared—ideal for capital-hungry R&D. In an LLC, each dollar flows to members immediately, making large reinvestments harder. Add board oversight, easy share transfers, and global employee equity programs, and the C corp remains the default for tech, biotech, and fintech ventures that aim for IPO readiness and seamless acquisition deals.

Ideal Choice for Freelancers, Consultants, and Small Business Owners

Consultants, solo developers, and lifestyle e-commerce brands value simplicity over complex charters. An LLC treated as a sole proprietorship removes double taxation, keeps bookkeeping light, and lets profits move straight into the owner’s pocket. Flexible ownership allows you to add a spouse or silent partner without rewriting bylaws, and you can elect S-corp treatment later to trim self-employment tax. Annual reports are shorter, franchise fees lower, and your CPA can finish year-end books in hours. The IRS disregards single-member LLCs for separate filings, and anonymity options in states like New Mexico add privacy without extra tax burden.

Scalability, Exit Strategy, and IPO Readiness

Scaling past eight-figure revenue forces founders to weigh governance friction against public-market eligibility. C corps integrate smoothly with underwriters, auditors, and share-based roadshows, while LLCs struggle with multi-state allocations and double-check income taxes when foreign investors arrive. If acquisition is your exit plan, most buyers favor merging with a corporation to sidestep entity-classification hiccups. Private-equity firms also insist on corporate form to leverage recap tools that assume a share-based cap table. Converting to a C corp two years before an S-1 cushions audit timelines and shareholder holding-period clocks.

How to Convert Between LLC and C Corporation

Business plans evolve; sometimes your LLC must become a corporation, or vice versa. Understanding the filings and tax ripples ahead of time prevents penalties. The steps below walk through mechanics under federal tax law and state codes. Some jurisdictions call it a statutory conversion, others use merger documents, but the logic stays consistent.

Steps to Change an LLC to a C Corp

Converting an LLC into a corporation follows a predictable roadmap in most states:

- Draft a plan of conversion approved by all members.

- File articles of conversion and a new corporate charter with the secretary of state.

- Obtain a new EIN—or confirm the IRS will let you keep the old one.

- Adopt bylaws, appoint directors, and issue shares proportional to prior interests.

- Update contracts, licensing, and bank accounts to reflect the new name.

- File final LLC state tax returns and start corporate filings going forward.

- Issue new stock certificates and cancel membership certificates to match ownership.

- File a final state LLC dissolution, if required, to prevent duplicate notices.

Each step protects continuity while satisfying limited liability partnership statutes. Finally, notify payroll providers so W-2s and 1099s print under the new corporate EIN, avoiding mismatches at year-end.

Pros and Cons of Converting Your Business Structure

Switching alters cap tables, tax obligations, and paperwork loads. Below are key points to weigh:

- Pros: unlock venture funding, issue incentive stock options, qualify for Section 1202 gains exclusion.

- Pros: centralize equity under one ledger, simplifying audits and due diligence.

- Cons: loss of pass-through status means the entity files its own tax return and may trigger double taxation.

- Cons: state franchise taxes and added formalities raise annual costs versus an LLC.

Remember that conversions can trigger real-property transfer taxes if title changes hands, and some banks demand fresh diligence before extending credit. Factor these one-time expenses into both timeline and budget.

Pros and Cons of an LLC vs. C Corp (Quick Comparison)

Need a fast verdict? The matrix below spotlights headline advantages and drawbacks so you can match risk tolerance to business income projections. Check the boxes that matter today: growth strategy, tax outlook, compliance appetite, and investor expectations. The best choice for a boutique agency may cripple a biotech sprinting toward FDA trials.

Advantages and Disadvantages of an LLC

An LLC’s biggest win is flexibility balanced against protection. Members share profits however they wish, elect S status, or convert later. Day-to-day paperwork stays light and filing fees low. But investor skepticism lingers, and co-mingling funds can pierce the shield, exposing unlimited liability similar to a partnership.

- Pass-through taxation cuts double tax.

- Operating agreement tailors governance.

- Venture funds rarely invest directly.

- Self-employment tax applies to active income.

On the tax side, LLCs may capture the 20 % Qualified Business Income deduction for active earnings, and losses can offset rental gains—flexibility corporations cannot match.

Advantages and Disadvantages of a C Corporation

C corporations shine in capital markets. They scale share classes, adopt option pools, and enjoy predictable case law. Limited liability is solid, retained earnings grow internally, and retirement plans can be layered. Yet corporate layers introduce administrative heft, and dividends can face double tax. Officer salaries must survive IRS reasonableness tests, and high employment taxes on payroll may offset some planning wins.

- Easier to raise VC and go public.

- Section 1202 stock can exclude gains.

- Requires annual director and shareholder meetings.

- Franchise and corporate income taxes raise costs.

Corporations also sponsor multiple benefit plans, deduct health insurance for owner-employees, and time dividends or buybacks to fine-tune overall tax exposure.

Frequently Asked Questions About LLCs and C Corporations

Choosing the right entity raises inevitable questions about filings, finance, and tax purposes. Below you’ll find concise answers to the five issues readers search most, each crafted to deliver a decisive takeaway without wading through statutory jargon. Whether you’re debating stock classes, tax elections, or audit triggers, these bite-sized explanations put practical numbers and deadlines at your fingertips.

Can an LLC Elect to Be Taxed as a C Corporation?

Yes. An LLC can elect corporate taxation by filing IRS Form 8832 to adopt C-corp classification, then Form 2553 if it later wants S status. Once effective, the LLC files Form 1120 and pays corporate income tax directly; members report only wages and dividends. This change also shifts employment taxes—owners become W-2 employees, subject to FICA on reasonable salaries rather than self-employment tax on the entire profit share.

Which Structure Is Better for Going Public?

C corporations remain the preferred vehicle for IPOs because federal securities rules assume a share-based tax law framework. Corporations can issue multiple stock classes, satisfy exchange-listing standards, and align with investment-bank underwriting models. Delaware LLCs can theoretically go public, but the novelty adds legal cost and investor uncertainty. Corporations also meet state blue-sky laws more smoothly and simplify investor-relations reporting once shares begin trading.

How Do Distributions and Dividends Differ?

LLC distributions pass earnings through to members, who pay individual tax on their share whether or not cash is disbursed. Corporate dividends are paid only after the entity covers its own tax and the board declares a payout; shareholders then owe tax on the dividend itself. In short, distributions are single-layer and flexible, while dividends carry a second tax layer and must follow formal corporate protocols.

What Are the Ongoing Costs for Each Structure?

Expect recurring costs of $50 – $300 for state reports, plus about $150 for a registered agent. LLC owners include profits on personal filings and dodge a separate return, while corporations must prepare Form 1120, pay state levies, and often remit quarterly estimates. Insurance, licensing, and bookkeeping scale with revenue, yet freelancers typically spend under 1 % of revenue versus 2 % or more for corporations tracking personal income and retained earnings separately.

Can You Switch from LLC to C Corp Later?

Absolutely. Most states allow statutory conversion or a merger that transfers assets and liabilities into a new corporation without dissolving your LLC. Federally, the IRS treats the move as a Section 351 transfer, usually tax-free when shareholders receive stock proportional to prior interests. After conversion, the company files federal income tax returns, issues shares, and adopts bylaws. Plan ahead for fees, updated contracts, and any required clearance certificates.

Harbor Compliance Offers Reliable Registered Agent Services

Get professional, dependable Registered Agent service from Harbor Compliance — stay legally protected and fully informed.