Have you ever wondered how to confirm your perfect business name is still available in Washington? Unsure which filters to use in the state’s official search portal? Want to avoid costly delays or rejections when you’re ready to register?

Conducting a Washington LLC search and registration is straightforward: first, access the state’s official Corporations and Charities Filing System to verify your desired name’s availability; next, reserve or confirm your name, then complete and submit the Certificate of Formation online with the required fee; finally, appoint a registered agent, obtain your EIN from the IRS, and file your initial report within 120 days. This entire process can be completed in just a few clicks—often in a single afternoon—giving you official confirmation of your LLC status and legal protections so you can start operating with confidence from day one.

In this guide, you’ll discover:

- How to navigate the CCFS portal to search and reserve your LLC name

- Step-by-step instructions for drafting and filing your Certificate of Formation

- Best practices for appointing a registered agent and obtaining your EIN

- Tips to maintain compliance, including initial reports and annual filings

Ready to get started? Let’s dive in and explore the Washington LLC search process now!

What Is a Washington LLC Search?

Before you invest time or money in branding, you need to confirm that your future company name is truly yours. A quick washington business entity search eliminates hidden duplicates, protects you from costly rejections, and gives you an early glimpse of potential competitors. In under a minute you can know whether it is safe to move forward. For a complete walkthrough of how to start an LLC in Washington, check our step-by-step guide.

Purpose and Importance of Conducting an LLC Search

Entrepreneurs launch thousands of companies in Washington every month, yet many overlook a simple preliminary step: a thorough business name search. This check prevents you from filing paperwork that will bounce, dissolving dreams and budgets alike. If you’re eager to launch fast, you can even form an LLC without business plan requirements. It also shields you from trademark skirmishes, equips your banker with clearer records, and reassures suppliers that you understand compliance and positions your brand for long-term credibility.

- Confirms no other LLC or corporation uses a deceptively similar name

- Flags suspended entities that still owe taxes or annual reports to the state

- Identifies active trademarks that could block your web domain or brand logo

Running this search before drafting articles of organization saves you filing fees, accelerates approval, and puts your limited liability company on solid legal footing from day one, reducing risk when you negotiate leases, open bank accounts, or court investors. To compare top services, see our roundup of the best registered agent providers.

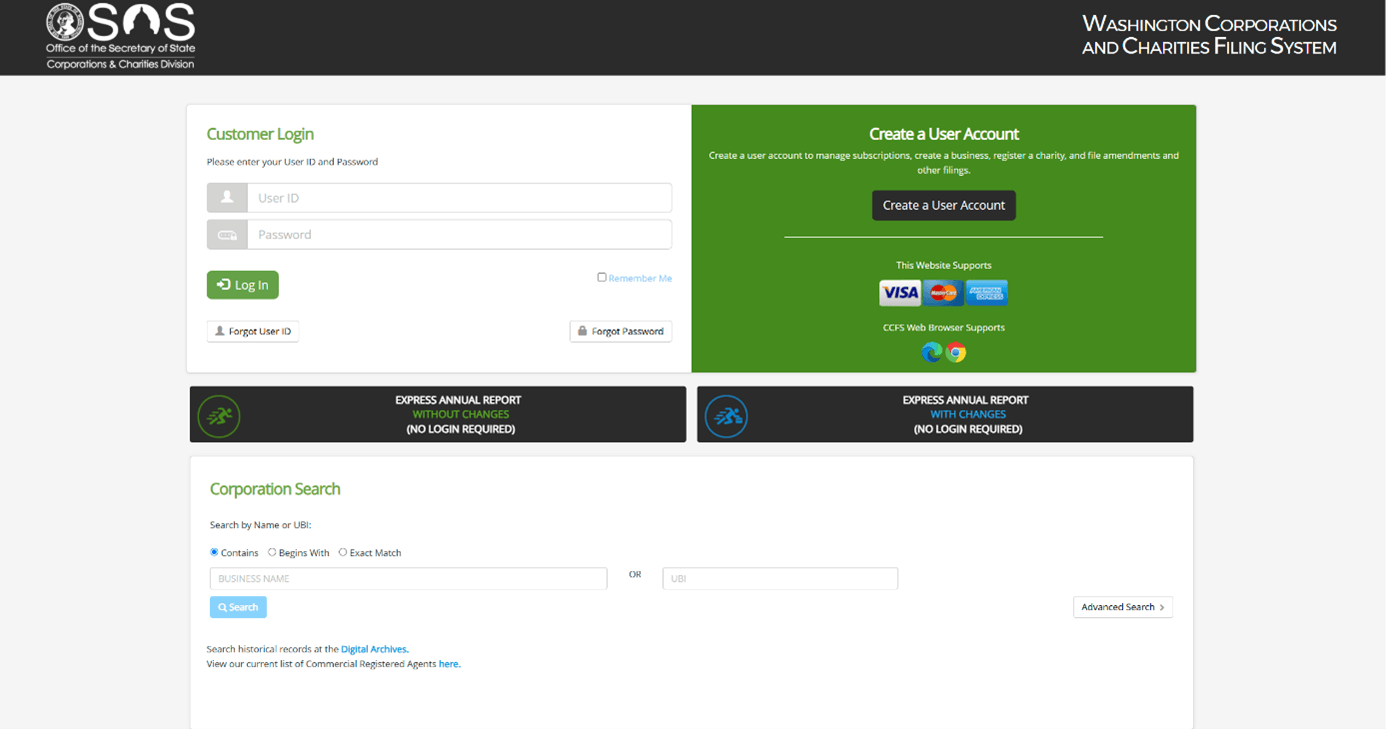

Overview of the Washington Corporations and Charities Filing System (CCFS)

The state hosts all business records inside the online Corporations and Charities Filing System, known as CCFS. Think of it as an ever-updated ledger where clerks post new formations, amendments, and annual reports the moment they clear payment. Because the portal ties every record to a unique business identifier, you can trace an entity’s history in seconds without visiting Olympia.

- Search by entity name, Unified Business Identifier (UBI), or registered agent

- Switch between card and grid views to copy filing numbers cleanly

- Download stamped certificates, formation documents, and annual reports in PDF

Unlike third-party directories that refresh intermittently, the state’s official search tool updates each night, so the data you see matches exactly what examiners rely on when deciding whether to approve your filing without delay.

ZenBusiness Makes Forming a Washington LLC Effortless

One platform to secure your name, register your company, and stay compliant.

How to Perform a Washington LLC Search

Executing a Washington LLC lookup is straightforward once you know where to click. In the guide below, we walk you through each screen so you spend less time guessing and more time launching. By following the steps recommended by the secretary of state, you will gather every fact lenders and partners expect before they green-light your venture.

Step 1: Access the Washington Corporations and Charities Filing System (CCFS)

Start by opening the CCFS homepage and selecting the Search option at the top of the dashboard. If you run into a pop-up about system maintenance, simply hit continue—maintenance rarely blocks lookups. The Washington secretary keeps the portal public so that entrepreneurs can verify names even after hours. Bookmark the URL in your browser’s favorites bar; returning later is common when your attorney requests an entity number and prevents you from typing the address each time you run due diligence. A direct link also saves you from phishing pages that mimic the state site and charge unnecessary fees.

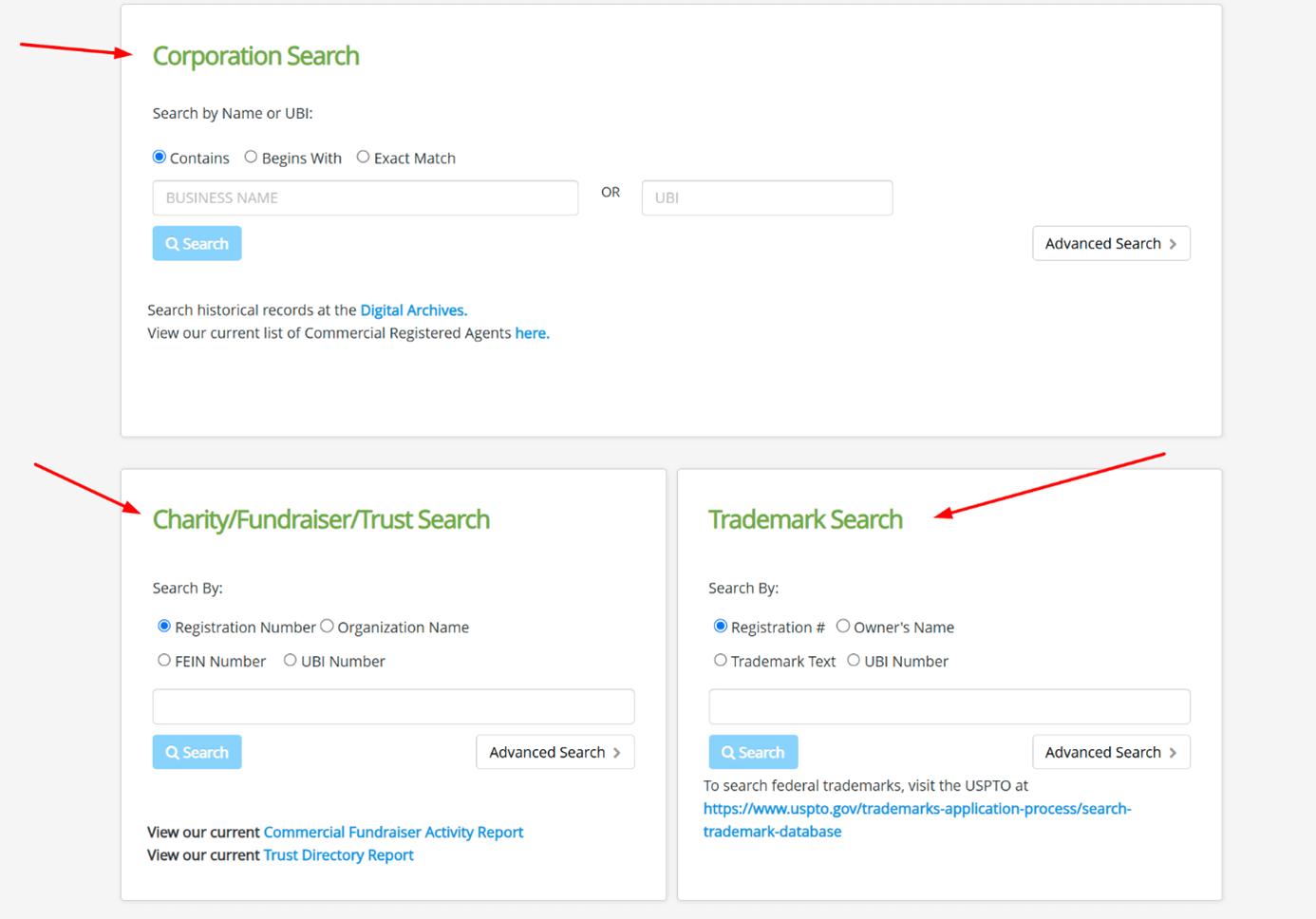

Step 2: Choose Your Search Criteria (Entity Name, UBI Number, Registered Agent)

When the search bar appears, decide which filter best isolates your desired llc. Name queries work for early brainstorming, but they can overlook abbreviations and punctuation. Entering the nine-digit Unified Business Identifier pulls an exact record—ideal when you need a certificate of good standing. If you only know who handles mail, choose the registered-agent filter; it lists every entity that person represents. Remember that results include active, inactive, and merged companies, so scan the Status column carefully before continuing. For tight deadlines, combine multiple filters in one session; the portal remembers each constraint, shortening future searches. Each filter offers wildcard support, letting you test variations quickly without retyping the entire phrase.

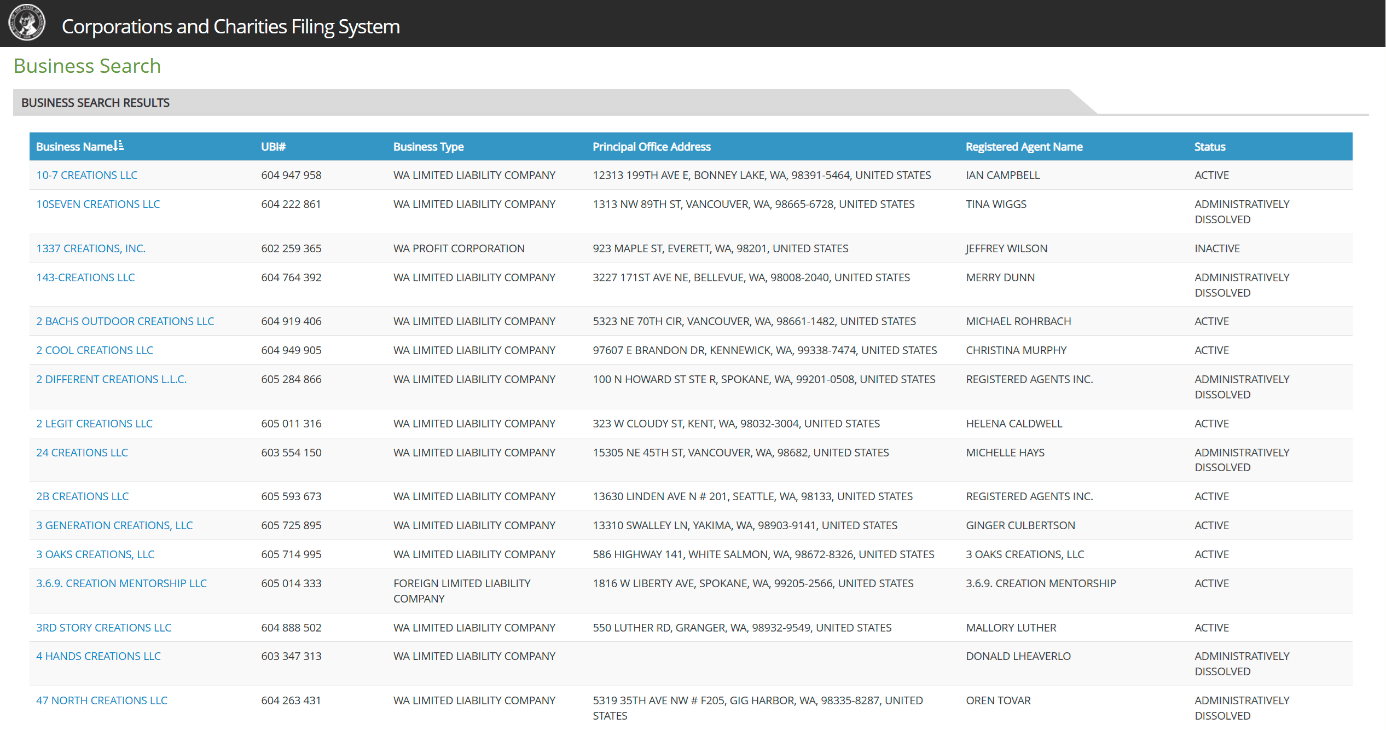

Step 3: Review Search Results for Business Details

Search results populate in a sortable table. Click the hyperlinked entity name to open its detail page, where you will find core business records such as formation date, expiration date, and registered-agent address. Review the Entity Status first; only Active and Delinquent statuses can generally be revived, while Administratively Dissolved names return to the pool after 120 days. Use the Filings tab to confirm whether an annual report is overdue—a missed report could delay bank onboarding or trigger penalties if you purchase the company.

Step 4: Access and Download Available Business Documents

From the detail page, select the “Print Certificate” or “View PDF” buttons to download official copies. Saving these files in a due-diligence folder will make it easier when you later register a business license with the Department of Revenue or apply for a commercial lease. Certificates open in a new tab; double-check that the state seal appears crisp and date-stamped. If the link fails, clear your browser cache and retry, as large filings sometimes take an extra moment to render.

Checking Business Name Availability in Washington

Even the most creative founders discover that many business names are already spoken for in Washington’s crowded marketplace. A targeted availability check lets you refine your shortlist early, ensuring the logo you sketch tonight still looks fresh on tomorrow’s paperwork and marketing collateral. That five-minute search can spare you months of rebranding expense.

Difference Between Business Entity Search and Name Availability Check

An entity search and a name availability check seem identical but serve different goals. The first is a broad business lookup that pulls every public record, including dissolved LLCs and revoked corporations. It is perfect for competitive intelligence yet can mislead new owners who assume an inactive listing frees the name instantly. The availability function, by contrast, queries a narrower database used by filing clerks. It screens for conflicts under Washington’s deceptively similar standard and blocks names reserved by pending applications. Use both tools together—run the entity search for background, then confirm availability to ensure no unseen hold prevents immediate filing. This two-step approach also saves attorney review time, cutting your legal bill and accelerating contract signatures.

Guidelines for Choosing a Compliant and Unique LLC Name

Your chosen name must satisfy more than branding taste—it also has to meet legal and tax rules enforced by the department of revenue and the Secretary of State. Ignoring these guidelines can delay approvals or force mid-course rebranding just as you start marketing to investors, partners, and early customers. Careful vetting now protects your credit line, web domain, hiring ads, and customer trust later.

- Include “LLC” or “L.L.C.” and place it at the end of the name

- Avoid restricted words like “bank” or “insurance” unless you obtain regulatory consent first

- Make the name distinguishable from existing records by at least one unique word or letter sequence

Finally, ask your registered agent to review the draft list; they encounter rejections daily and can warn you of subtle conflicts that would escape automated screens. That quick consultation may spare weeks of delay and redesign.

Reserving a Business Name Through the Secretary of State

If your perfect moniker is available but you are not ready to file articles, reserve it online through the CCFS portal. The reservation locks the Washington LLC name for 180 days and costs just $30, payable by credit card. Submit the form before 5 p.m. Pacific to secure same-day processing. You will receive a confirmation email—keep it with your formation checklist in case a third party challenges your claim. If the hold expires, you can renew once, but only after the initial reservation lapses at the standard renewal fee.

Information Available in Washington Business Records

Washington’s public filings reveal far more than a yes-or-no on name availability. With a single click you can open every formative and ongoing document behind an LLC, giving investors, lenders, and co-founders instant clarity. Learning to read those screens will turn a quick business registration check into a full-scale health audit.

Entity Status, Formation Date, and Expiration Date

Start your review by focusing on the line labeled entity status. This single field signals whether the company is Active, Delinquent, Administratively Dissolved, or Terminated, and each label carries different legal and financial consequences. Just below, the portal lists the original formation date, showing how long the business has enjoyed limited-liability protection, and the current expiration date, which indicates when annual fees and reports are next due. If the expiration date is less than thirty days away, factor the pending renewal into your acquisition budget or loan schedule. Seasoned investors pair this timeline with bank statements to verify continual operation and avoid shell entities that reactivate only when inspections loom. A long track record often translates into lower insurance premiums and easier credit approvals.

Registered Agent and Principal Office Address

The next items to confirm are the registered agent and the principal office address. Washington requires every LLC to list a human or company with a physical street location that can accept legal papers during normal business hours. Compare the registered agent’s name to your operating agreement; mismatches can void service of process and derail lawsuits in your favor. The principal office, meanwhile, is where tax notices and lender correspondence arrive, so make sure it is not an outdated coworking space. If you plan to relocate, file the address change before signing leases so that banks, vendors, and the Department of Commerce do not send critical mail to the wrong doorstep.

Filing History and Certificate Access

Scroll to the filings tab to examine amendments, mergers, and annual reports. Pay particular attention to any missed deadlines; a single late report can trigger penalties and revoke the LLC’s authority to transact. If everything looks current, generate a certificate of good standing — lenders and marketplaces often require it before releasing funds or activating seller accounts. The PDF opens instantly and shows the issuance timestamp plus the signature of the Washington Secretary. Save the file in cloud storage so you can share it with investors at a moment’s notice.

Common Mistakes to Avoid in Washington LLC Searches

New founders often assume a quick business entity search is a mere formality, yet small oversights in this stage can snowball into rejected filings, trademark disputes, and even personal liability. Understanding the most frequent errors will help you interpret results accurately and keep your timeline — and budget — intact.

- duplicate names : failing to notice a dissolved but not yet released LLC can block your filing for 120 days or more

- Misreading status codes : confusing “Inactive” with “Available” leads to costly reprints of branded material

- Skipping agent cross-check : overlooking an outdated agent address results in missed lawsuits and default judgments

Take an extra five minutes to photograph each results page, verify UBI numbers against tax receipts, and store the PDFs in a shared folder. That small layer of due diligence provides a paper trail when bankers, investors, or auditors challenge the history of your LLC, and it prevents last-minute scrambles that can delay your launch by weeks.

Want Peace of Mind for Your LLC? Choose Northwest

Washington filings handled by real experts—no upsells, no surprises.

How to Register an LLC in Washington

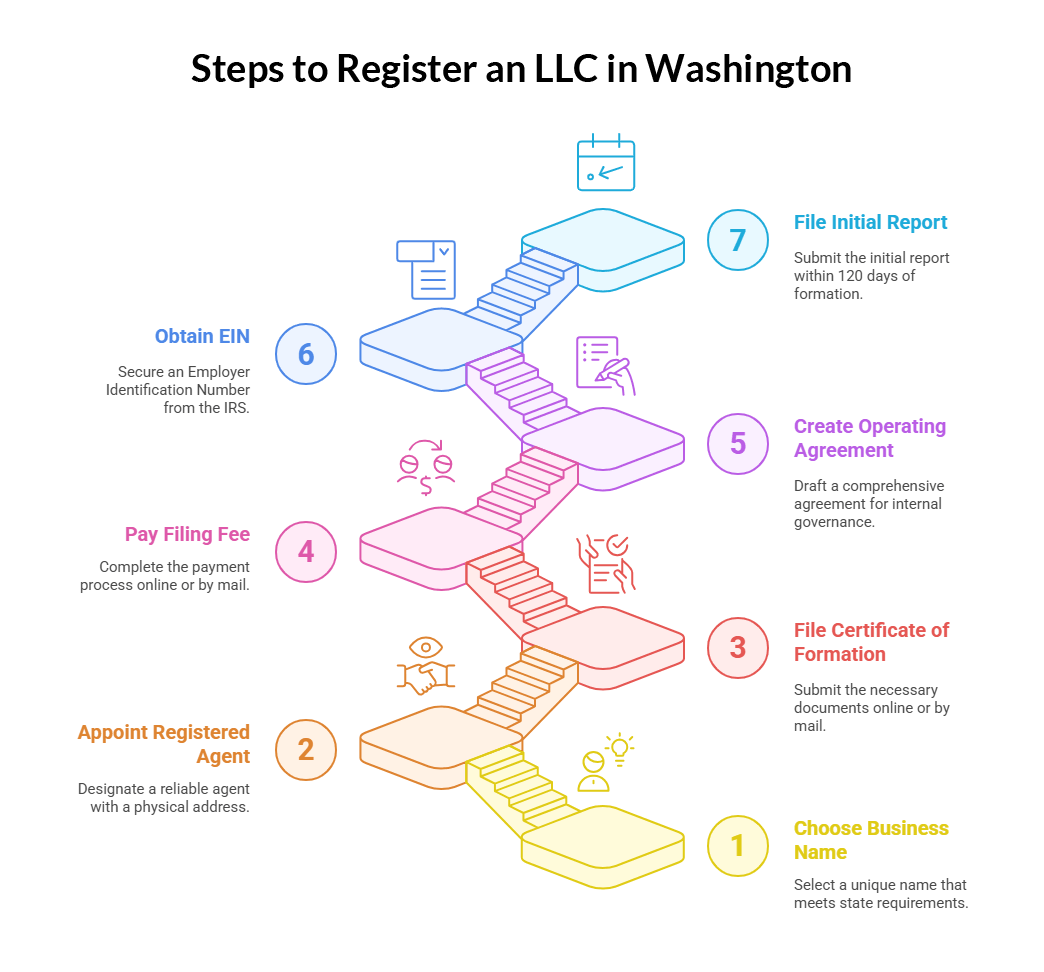

Filing your LLC in Washington is far simpler than most founders expect. By following the checklist below and leveraging the online tools provided by the Washington state department of Revenue and the Secretary of State, you can reserve your name, create legal separation from personal assets, and start collecting revenue in as little as two business days — all without hiring an expensive attorney. To understand typical processing times, check our overview of how long does it take to form an LLC in Washington.

Step 1 : Choose a Unique Business Name

Brainstorm at least three variations before you open the search page, then test each candidate until one passes all conflict screens. Your unique business name must end with “LLC,” avoid restricted terms like “bank,” and differ from existing filings by more than punctuation. Once cleared, secure matching domains and social media handles immediately; Washington does not grant trademark rights, so early digital branding discourages imitators and reassures investors that you intend to operate nationwide.

Step 2 : Appoint a Registered Agent with a Physical Washington Address

Washington law insists that every LLC maintain an in-state adult or professional firm authorized to accept service of process Monday through Friday. Choose someone reliable; a missed lawsuit can morph into a default judgment, piercing your liability shield. If you operate remotely, hire a commercial agent; their downtown address looks credible to banks and keeps personal details off the public record. Confirm that the agent agrees to forward government mail within 24 hours, and list both their name and street address exactly as provided. Mark the renewal date on your calendar to avoid lapses. To compare top providers, see our review of the best registered agent services in Washington.

Step 3 : File the Certificate of Formation Online or by Mail

Log back into CCFS, click “Start New,” and select Limited Liability Company. The system guides you through eight screens and auto-checks your certificate of formation for missing fields. Expect to enter your LLC name, business purpose, duration, and agent details. Online submissions receive immediate acknowledgment; mailed packets take up to two weeks. If you need a stamped form for a loan closing, opt for expedited online filing and download the acceptance letter the same afternoon.

Step 4 : Pay the $200 Online Filing Fee or $180 for Mail-In Applications

Most founders choose online filing because the $200 charge includes instant confirmation, whereas the $180 mail option adds postage, printing costs, and waiting time. Payments go through SecureAccess Washington, which accepts major credit cards, e-checks, or saved e-wallets. Keep the emailed receipt with your tax documents; auditors occasionally request proof of payment. Veterans and nonprofit organizers may qualify for discounted fees, so check the current waiver policies before submitting. For a full breakdown of fees and timing, see how Much Does It Cost to Start an LLC in Washington.

Step 5 : Create an Operating Agreement (Recommended)

Washington does not require an operating agreement, yet banks and investors almost always ask for one. Draft clauses covering member contributions, voting rights, profit allocations, withdrawal procedures, and dissolution triggers. A clear document prevents stalemates, demonstrates professionalism, and can override default state rules that may not suit your management style. Digital templates work as a starting point, but have an attorney customize terms involving intellectual-property ownership or mandatory capital calls.

Step 6 : Obtain an EIN from the IRS

Within minutes of receiving state approval, head to IRS.gov and complete Form SS-4 online to secure an Employer Identification Number. The EIN functions like a Social Security number for your company, allowing you to open business bank accounts, hire employees, and file federal taxes. Download the confirmation letter immediately; some banks refuse screenshots. If you are forming a multi-member LLC, give a copy to each owner so they can report K-1 income correctly at tax time. For troubleshooting tips and alternatives, see how to find a company EIN.

Step 7 : File the Initial Report Within 120 Days of Formation

Mark a reminder: Washington expects an initial report within 120 days after the formation date. File online through CCFS and verify that ownership percentages and addresses match the Certificate of Formation. Late reports trigger a $25 penalty and may place the LLC in delinquent status, alarming creditors. Submitting on time also registers your company for email alerts, making future annual renewals nearly effortless.

Role of the Washington Secretary of State in Business Operations

The Washington Secretary of State is far more than a ceremonial role. Its office safeguards every filing inside the corporations and charities system, certifies compliance, and gives banks, vendors, and courts confidence that the public record they consult is up-to-date. When you understand how these duties intersect with daily operations, you can anticipate deadlines instead of scrambling to fix oversights.

- Registers new entities and records amendments within hours of approval

- Issues stamped certificates that lenders treat as primary proof of existence

- Enforces annual-report rules and administratively dissolves non-compliant LLCs

Because the office holds ultimate authority over public filings, its notices carry legal weight. Responding promptly to delinquency emails, address-change confirmations, or name-reservation expirations keeps your LLC in good standing and prevents costly reinstatement fees. Many founders set calendar alerts keyed to Secretary emails, ensuring no compliance step gets lost in spam folders.

FAQ About Washington LLC Searches

Below you’ll find quick answers to the questions most founders type into the business database search bar.

Is the Washington Business Search Tool Free to Use?

Yes. Washington’s online portal offers a totally free search for business entities. You can query by name, UBI number, or registered agent without creating an account or entering a credit-card number. Fees only arise if you decide to download a certified document, reserve a name, or file a formation. The state funds the lookup service through filing revenues, so the core database remains open to entrepreneurs at no cost.

How Often Is the Business Database Updated?

The CCFS portal undergoes nightly updates. Each business filing approved before 5 p.m. Pacific typically appears in the database by the next morning. Weekend submissions may post on Monday, while expedited filings can surface within minutes. Because the schedule is predictable, checking the database the day after you submit paperwork is usually enough to confirm acceptance.

Can I Search for Inactive or Dissolved Businesses?

Absolutely. The search tool displays inactive filings such as dissolved, revoked, or merged entities. These records help you gauge name conflicts and assess a seller’s history during acquisitions. Note, however, that an administratively dissolved name remains restricted for 120 days, and voluntary dissolutions can take up to two weeks to clear. Always verify the status date before assuming the name is reclaimable.

What Should I Do If My Desired Business Name Is Already Taken?

First, tweak your shortlist by adding a distinctive word, then rerun the search. If everything close to your idea is taken, file a name reservation online. The $30 fee locks your revised name for 180 days, buying time to draft marketing collateral and legal documents. You can renew once if needed, but most founders proceed to formation well before the hold expires.

How Do I Obtain a Certificate of Good Standing in Washington?

Log into CCFS, locate your entity page, and click “Certificate of Existence.” After paying the $20 fee, the system generates a digital status certificate bearing the state seal and today’s date. Download and forward it to your bank or marketplace immediately; most recipients treat electronic copies as valid. If the PDF fails to load, clear your browser cache and retry or contact the certifications desk for manual processing.

Looking for an overview? See Washington LLC Services

Serious About Compliance? Harbor Will Get Your Washington LLC Right

Name search, filings, and lifetime support from real specialists.