Are you looking to form an LLC in Ohio and need to confirm your perfect business name is available? Do you want to avoid costly filing rejections and launch delays by running the right search first? Curious how to navigate the Secretary of State’s portal to secure your brand in 2025?

To look up and register a business in Ohio in 2025, start by visiting the Ohio Secretary of State’s Business Search portal and selecting “Business Name” to check availability. Once you confirm no identical or confusingly similar names are active, reserve your chosen name online for $39 or proceed to file your Articles of Organization for $99 via Ohio Business Central. After approval—often within minutes—download your stamped certificate, appoint your statutory agent, obtain an EIN from the IRS, and draft your operating agreement to complete registration.

In this guide, you’ll learn:

- Step-by-step instructions for using the Ohio Business Search tool

- How to interpret name-status results and avoid near-matches

- The reservation and filing process to secure your LLC name

- Post-filing essentials: agent appointment, EIN application, and operating agreement

Ready to register your Ohio LLC today? Let’s dive in and get your business off the ground!

What Is an Ohio LLC Search?

Conducting an business entity search in Ohio is more than a formality—it is the research step that keeps you from costly rebranding. By carefully verifying name availability, existing filings, and legal standing before you pay any fees, you protect your budget today and set up a smoother registration journey. For a step-by-step breakdown of how to check business names across all U.S. registries, see our guide on how to check business names.

Overview of the Ohio Secretary of State's Business Search Tool

The Ohio Secretary of State maintains a robust search tool that pulls live data from the business-filings database. If you’re weighing whether you really need an LLC to start a business, our article on do I need an llc to start a business lays out the key considerations. You can search by entity name, number, or agent details, and the portal returns every matching record in seconds. Because the system is updated throughout each work-day, entrepreneurs gain near-real-time insights that support informed decisions, competitive analysis, and faster filings.

- Filters results by active or canceled status.

- Links directly to Articles of Organization PDFs.

- Shows statutory-agent contact information.

- Displays a time stamp for the last update.

After reviewing the list, click any filing number to unlock expanded details, including amendments, past-agent changes, and certificates. This transparency lets founders confirm whether a name is truly free, identify potential infringement risks, and gauge a competitor’s growth trajectory. By mastering the intuitive ohio secretary portal early, you shorten the learning curve and avoid unnecessary professional-search fees later on.

Importance of Conducting an LLC Search Before Registration

Running an Ohio search before filing shields your fledgling limited liability company from three hidden but devastating pitfalls. First, it prevents an immediate name rejection that could push your launch back several weeks. Second, it uncovers look-alike trademarks that might trigger infringement demands, cease-and-desist letters, or a costly mid-year rebrand. Third, it exposes debts or tax liens linked to a legacy entity that could follow your new name into court. The same query also confirms that your chosen statutory agent is active, displays the agent’s current physical address, and reveals pending annual-report deadlines. Armed with this knowledge, you file with confidence, set realistic timelines, and budget only for the costs that truly move your enterprise forward. You can also explore strategies to start an LLC without business plan in our detailed resource on start an llc without business plan.

How to Perform an Ohio LLC Search

Navigating Ohio’s online portal may feel intimidating at first, but a structured approach turns the process into a quick five-minute task for any founder worldwide. Below you will find a clear, step-by-step walkthrough that confidently leverages the ohio business entity search platform so you can confirm name availability, gather legal documents, and move forward with registration without hiring an attorney.

Step 1: Navigate to the Ohio Secretary of State's Business Search Portal

Open your browser and visit the Ohio Secretary of State’s Business Services homepage, then click “Business Search” to launch the portal. This shortcut keeps you out of unrelated voter-services links and lands you directly on the form that powers the business name search function. For efficiency, bookmark the page for future compliance checks; you will use it to pull upcoming annual-report deadlines and historical statutory-agent changes long after your LLC is approved.

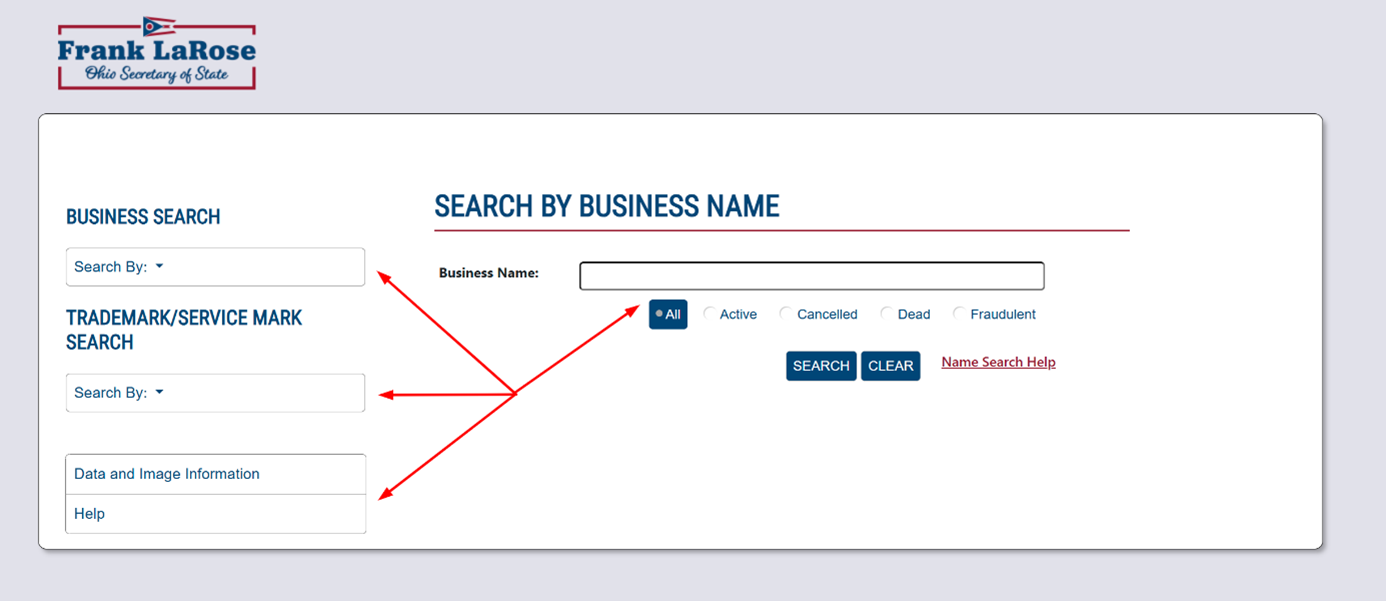

Step 2: Choose Your Search Criteria (Business Name, Entity Number, Agent Name)

Next, locate the drop-down field labeled “Search By.” You may filter results by Business Name, Exact Name, Registration Number, or Agent/Registrant. Unless you already have a filing number in hand, stick with “Business Name” so you can view variants, abbreviations, and potential spelling clashes. The system ignores punctuation and capitalization, yet subtle plural or possessive differences still matter when clearing future business names. If you want deeper assurance, run each variation separately and keep a spreadsheet of conflicts before choosing your final brand.

Step 3: Enter the Relevant Information and Execute the Search

Type the chosen name, agent, or number into the search bar, double-check spelling, and click “Search.” The portal processes whatever data you entered in their business registry almost instantly, returning a results table with status icons, entity numbers, and formation dates. If no record appears, run the search again with a shorter root word to catch hidden abbreviations or hyphenated entries. Pressing “Clear” between queries prevents cached terms from skewing subsequent searches.

Step 4: Review the Search Results for Business Details

Scroll through the results and click the hyper-linked entity number for each match. A detail panel expands, showing legal status, formation date, charter type, and the most recent filing submitted. Pay close attention to the “Status” field; only registered businesses marked Active raise a conflict. If you see “Cancelled,” check the cancellation date—an administratively-dissolved entity may still block your name for five years. Export the summary to PDF so you have a time-stamped record for your compliance files.

Step 5: Access and Download Available Business Documents

On the detail screen, select “Filings” and then click “Download” next to any certificate, amendment, or annual report you wish to keep. These PDFs act as primary evidence if a competitor disputes your claim later, and they reveal the filing habits of established rivals. Saving the file archive now streamlines future business registration renewals because you will already know each document’s form code, fee, and expected processing timeline, preventing last-minute scrambles.

ZenBusiness Takes Care of Your Ohio LLC, So You Can Focus on Growth

Smart filing, zero confusion, and fast results — in minutes, not weeks.

Checking Business Name Availability in Ohio

Clearing your desired llc name is slightly different from a broad entity search. Here the goal is exclusivity, not simply curiosity. Ohio’s database may show your spelling is free, yet the name could still violate trademark law or the Secretary’s distinctiveness rules. The steps below help you confirm availability, comply with state naming statutes, and secure reservation before you invest in branding assets.

Distinguishing Between Name Availability and Entity Search

An entity search returns every record that matches or resembles your phrase, but availability checks dig deeper into how Ohio protects different business entities. For example, “Buckeye Consulting LLC” may look inactive, yet “Buckeye Consulting Inc.” remains active and therefore blocks a similar LLC name under the state’s anti-confusion policy. The Secretary’s tool flags these cross-structure conflicts only when you compare results across status types, abbreviations, and legal suffixes. Gauging availability therefore means scanning not just exact duplicates but also homophones, creative spellings, and foreign-filed companies licensed to transact in Ohio. For inspiration from proven LLC name examples, visit our llc name examples.

Guidelines for Selecting a Compliant and Unique LLC Name

Ohio’s naming rules start with the ohio revised code, which requires every LLC to end with “Limited Liability Company,” “LLC,” or “L.L.C.” and forbids words that imply unlicensed professional services. Go further by avoiding generic geography-plus-industry formulas that blend into search results and trademarks. Aim for a three-word construction that is easy to spell, distinct in sound, and available across .com and social-media handles. Run your shortlist through the USPTO trademark database for conflicts, cross-check state listings, and ensure your domain registrar shows an available match before committing design dollars. For more insights on choosing between an LLC and a DBA, see our comparison of llc vs dba.

Reserving a Business Name Through the Secretary of State

Once you settle on a name, file Form 534B online through Ohio Business Central or mail the paper version with a $39 check. The reservation locks your name for 180 days and is processed immediately when submitted online. You will need the proposed name, applicant’s physical address, signature, and phone number. Print the confirmation page or save the email receipt; you must reference the reservation number when filing Articles of Organization. If the hold expires, you can renew once by resubmitting within thirty days, or the name becomes public again.

Understanding Ohio Business Records

Ohio’s online filing system does more than list formations—it preserves a living timeline for every entity. Think of it as a digital ledger curated jointly by the Secretary of State and the chamber of commerce, capturing each milestone that proves a company’s legal identity and operational health.

- Formation filings such as original Articles of Organization

- Amendments that reflect name changes or new members

- Biennial statements and the latest tax-clearance letters

- Certificates of Good Standing issued on demand

Reviewing these records before you sign a contract helps you verify ownership, spot looming compliance deadlines, and gauge how responsibly the principals manage paperwork. Pulling an annual report or amendment history takes seconds and can expose dormant entities, overdue fees, or lawsuits that never surface in quick credit checks—letting you negotiate from a position of fact rather than assumption.

Verifying an Existing Business in Ohio

Before signing contracts or wiring funds, take a minute to confirm the official profile behind the business name you see on marketing materials. Ohio’s database lets you run that check from any device, adding a vital layer of due diligence for suppliers, landlords, and investors.

Confirming Active Status and Registration Validity

Start by searching the entity number and looking at the Status line. Only an ohio llc marked “Active” enjoys the liability shield and tax standing promised on its website. If the status shows “Cancelled” or “Pending Reinstatement,” the company cannot legally enter new contracts until it satisfies back fees and regulatory filings—exposing you to collection delays if disputes arise.

Identifying the Registered Agent and Business Address

The detail screen also discloses the company’s current registered agent and principal place of business. Compare that address with the one on invoices: mismatches can signal a shell entity or a recent move not yet shared with vendors. Because agents must maintain normal business hours, you gain a reliable service address for subpoenas or legal notices—peace of mind that P.O. boxes and co-working spaces rarely provide.

Reviewing the Business’s Filing History and Compliance Status

Scroll to the Filings tab and download the original Articles of Organization alongside each amendment, resignation, and tax notice. A company that files on time every year usually treats payroll taxes and customer escrow with equal discipline. Conversely, gaps longer than two years, missing statutory-agent updates, or multiple name changes can hint at ownership disputes or creditor pressure. Use that timeline to adjust credit terms, require larger deposits, or walk away before problems become your own.

Secure Your Ohio LLC Name with Northwest’s Expert Support

Privacy-first filing, real-time search tools, and trusted registered agent service—done right from day one.

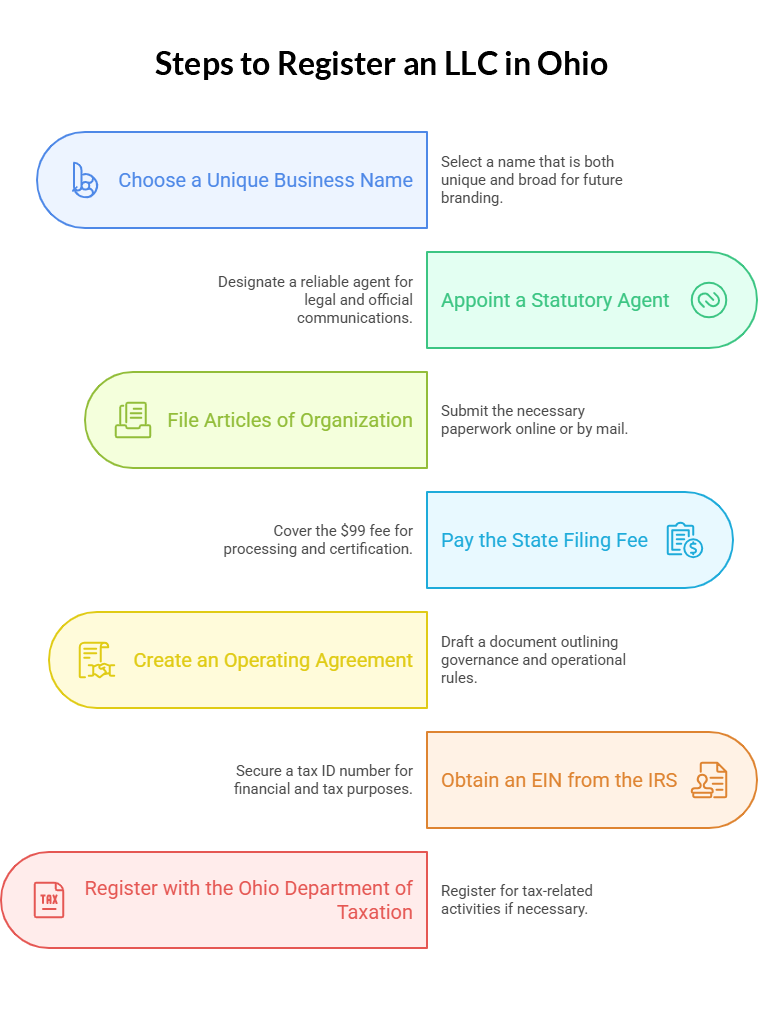

Steps to Register an LLC in Ohio

Registering an Ohio LLC involves seven deliberate moves, each grounded in state law and simple enough for do-it-yourself filers. By plotting them in order—name clearance, agent appointment, paperwork, payment, governance, tax IDs, and compliance—you sidestep rejections and late penalties. Budget time for the Secretary’s queue and the $99 formation fee, then follow the checklist below to unlock legal protections within a single afternoon. For tips on how to start an LLC without business plan, check out our guide on start an llc without business plan.

Step 1: Choose a Unique Business Name

Your legal title will anchor bank accounts, leases, and marketing, so treat selection like an asset purchase. Search the database twice—once for exact matches, again for phonetic cousins—and scan federal trademarks before locking the words in. If you envision multiple product lines, choose a broad umbrella title; you can file trade names later for niche branding. By steering clear of restricted terms such as “bank” and “insurance,” you avoid extra regulators and keep the pathway to a professional LLC uncomplicated for future expansions smoothly.

Step 2: Appoint a Statutory Agent

Ohio requires every domestic entity to designate a statutory agent with a street address inside the state. To find the best option, read our review of the best registered agent in Ohio. This individual or service company receives lawsuits and certified mail on your behalf, so reliability trumps familiarity. Confirm the agent forwards documents digitally, lists annual costs up front, and alerts you before changing location. Using a commercial agent also keeps your home off public records, giving online entrepreneurs valuable privacy and ensuring official notices never get lost in apartment mailrooms.

Step 3: File the Articles of Organization Online or by Mail

Log in to the online filing portal, choose “Form a For-Profit LLC,” and complete the prompted fields: entity name, duration, effective date, purpose clause, and agent details. If you prefer paper, fill Form 533A and mail it with a check—processing takes longer and you lose the instant receipt. Double-check spellings; typos become part of your permanent record and cost $50 to amend later. If you need more step-by-step instructions, our resource on how to form an llc in Ohio walks you through every click.

Step 4: Pay the $99 State Filing Fee

The $99 state filing fee covers examination, data entry, and the email delivery of your stamped certificate. Pay by card online or include a money order if mailing. Standard turnaround is three business days, but you can add $100 for same-day review when timing is critical, such as bidding on a contract. Keep the receipt; lenders and insurers sometimes demand proof that the fee cleared before extending credit or coverage, for crucial cash-flow forecasts and audits. For a detailed cost analysis, see our breakdown of llc Ohio cost.

Step 5: Create an Operating Agreement (Recommended)

Drafting an operating agreement is optional in Ohio, yet savvy owners treat it as their in-house constitution. Spell out voting rights, capital contributions, profit allocations, dissolution triggers, and the procedure for replacing managers. Banks may request a copy before opening accounts, and investors view a signed agreement as evidence of mature, long-term governance.

Step 6: Obtain an EIN from the IRS

Apply for an EIN online through the IRS in under ten minutes. The nine-digit tax ID number identifies your company when filing payroll returns, opening merchant accounts, or issuing 1099s. Sole owners can still use their Social Security number, but separating tax identifiers strengthens liability shields and limits identity-theft exposure. After downloading the confirmation letter, update payment gateways and state tax registrations with the new number immediately.

Step 7: Register with the Ohio Department of Taxation if Necessary

If you plan to sell goods, hire employees, or collect use tax, register through the ohio department of Taxation’s “Ohio Business Gateway.” The portal issues vendor’s licenses, employer-withholding accounts, and commercial-activity-tax numbers. Filing early prevents penalty bills that accrue from the first taxable dollar, not the registration date. Once approved, sync renewal reminders with your accounting calendar and re-verify data during each annual report to catch address or ownership changes.

Role of the Ohio Secretary of State in Business Operations

Ohio’s online filing system does more than list formations—it preserves a living timeline for every entity. Think of it as a digital ledger curated by the secretary of state’s office, capturing each milestone that proves a company’s legal identity and operational health.

- Receives and stamps all formation and amendment documents

- Issues certificates such as Good Standing and Name Reservation approvals

- Oversees the Business Search database and scanning of legacy records

- Collects and distributes state filing fees to fund compliance education

Because the office touches every stage of a company’s life cycle—from name approval to dissolution—it also sets many of the deadlines small-business owners must meet. Monitoring official compliance notices about annual reports, agent resignations, or charter amendments helps you anticipate fees, avoid administrative cancellation, and keep lenders satisfied with up-to-date legal proof.

FAQ About Ohio LLC Searches

Ohio’s online business database was designed to answer most ownership and compliance questions in minutes. The five quick FAQs below remove the final roadblocks entrepreneurs face when searching, verifying, or registering an LLC, letting you focus on strategy instead of paperwork. They condense agency guidelines into plain language, highlight insider tips, and provide the confidence every founder needs before filing.

Is the Ohio Business Search Tool Free to Use?

The Ohio business search portal is completely free for unlimited lookups. You can run searches by name, entity number, or agent without logging in or creating an account. Fees only arise when you order certified copies or file new documents. Browsing details, downloading plain-copy PDFs, and checking status updates cost nothing, so you can perform due-diligence checks or competitive research whenever you like.

How Often Is the Business Database Updated?

The system is typically database updated several times each business day. Filings submitted online appear within minutes, while paper submissions join the index after clerks scan and validate them—usually within forty-eight hours. Because updates roll out continuously, rerunning a search later in the afternoon can reveal new records. For the freshest data, check shortly after receiving email filing confirmations. Weekend submissions post first thing Monday, so plan reviews accordingly.

Can I Search for Inactive or Dissolved Businesses?

Yes. When you query the database, select the Status filter for Cancelled or Dead, and you will see inactive businesses including dissolved LLCs and lapsed corporations. Reviewing these files helps you gauge name conflicts that linger for five years and spot lingering liabilities. Downloading the final tax-clearance or agent-resignation documents offers proof of dissolution before purchasing assets or reviving a dormant brand. This safeguard prevents unpleasant surprises.

What Should I Do If My Desired Business Name Is Already Taken?

If your desired title fails due to a business name conflict, tweak non-distinctive words—swap Advisors for Consulting, add a geographic term, or rearrange the order—and rerun the search. Then review USPTO records to avoid federal clashes. Once a variant passes, reserve it immediately via Form 534B; the $39 fee is minor compared with rebranding after signage and checks are printed. Protect your momentum.

How Do I Obtain a Certificate of Good Standing in Ohio?

Request a certificate of good standing through Ohio Business Central. Locate your entity, click “Order Certificates,” and pay $5 for an electronic copy delivered by email within minutes. Mailed copies cost $10 plus postage. The document confirms active status and current filings—evidence lenders or foreign states require before extending credit or authorizing out-of-state registrations. Rush walk-in service remains available in Columbus for critical closings.

Looking for an overview? See Ohio LLC Services

Ohio LLC Filing Made Simple with Harbor Compliance

Skip the red tape, Harbor Compliance handles your Ohio LLC from name clearance to formation and beyond.